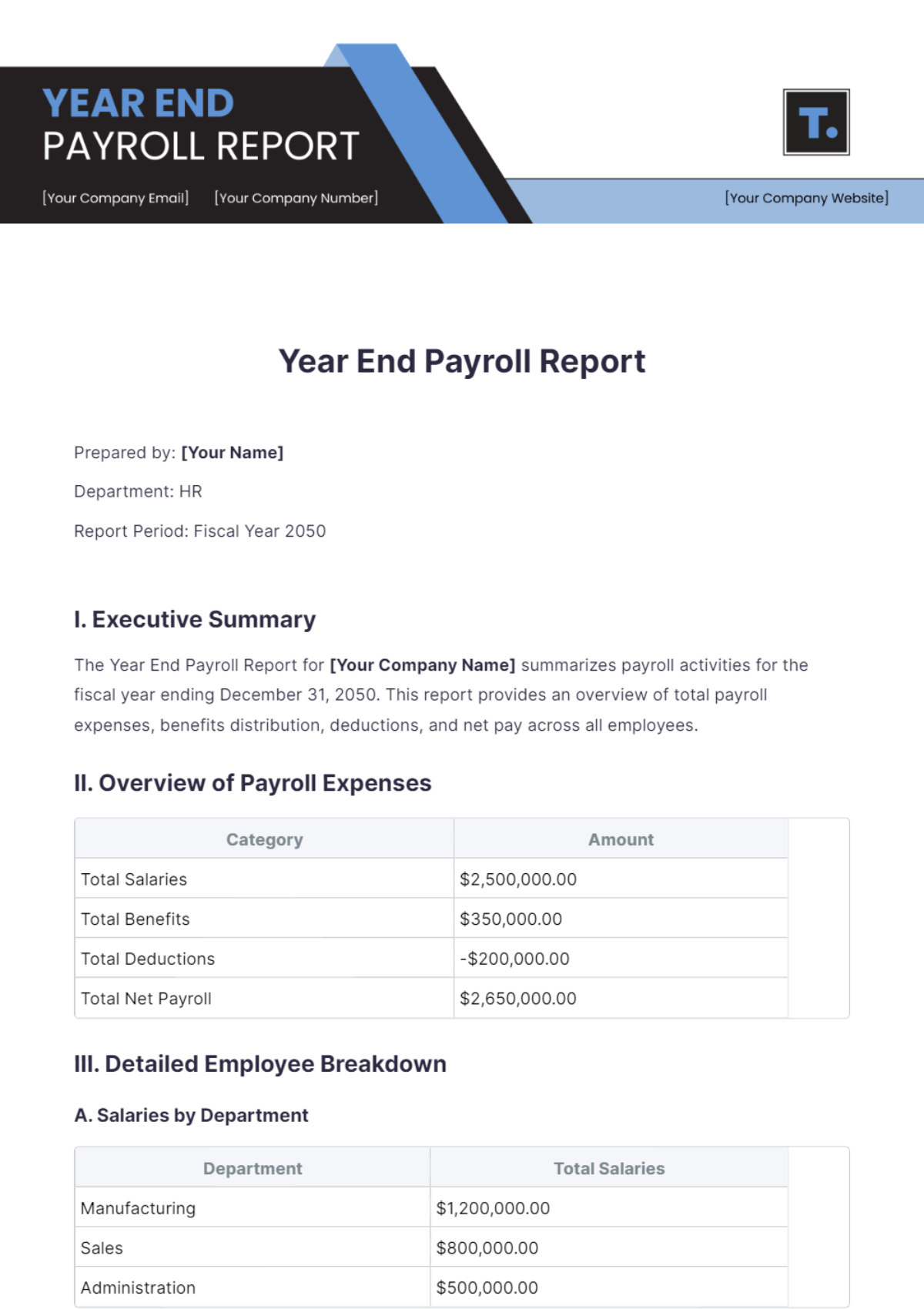

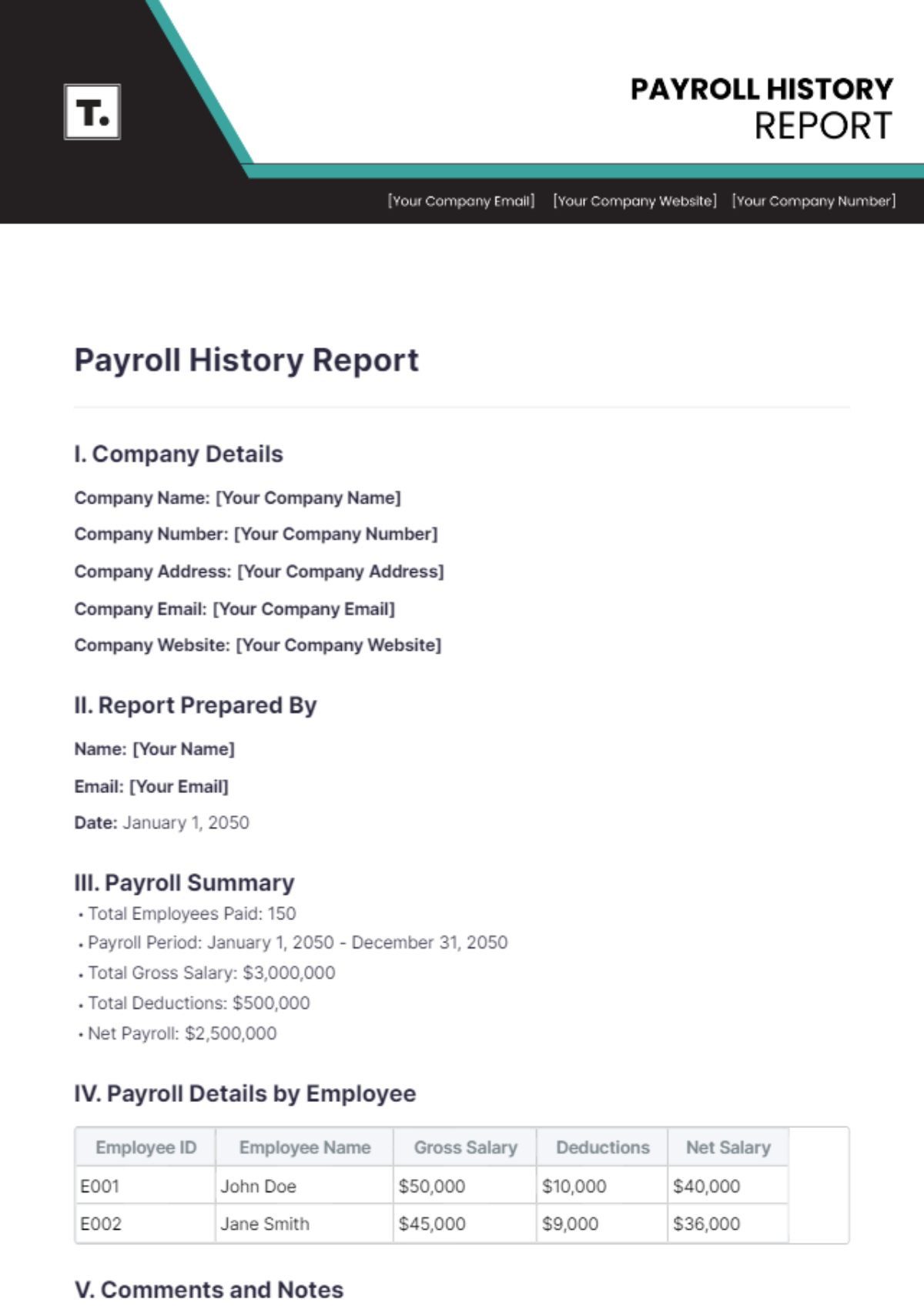

Year End Payroll Report

Prepared by: [Your Name]

Department: HR

Report Period: Fiscal Year 2050

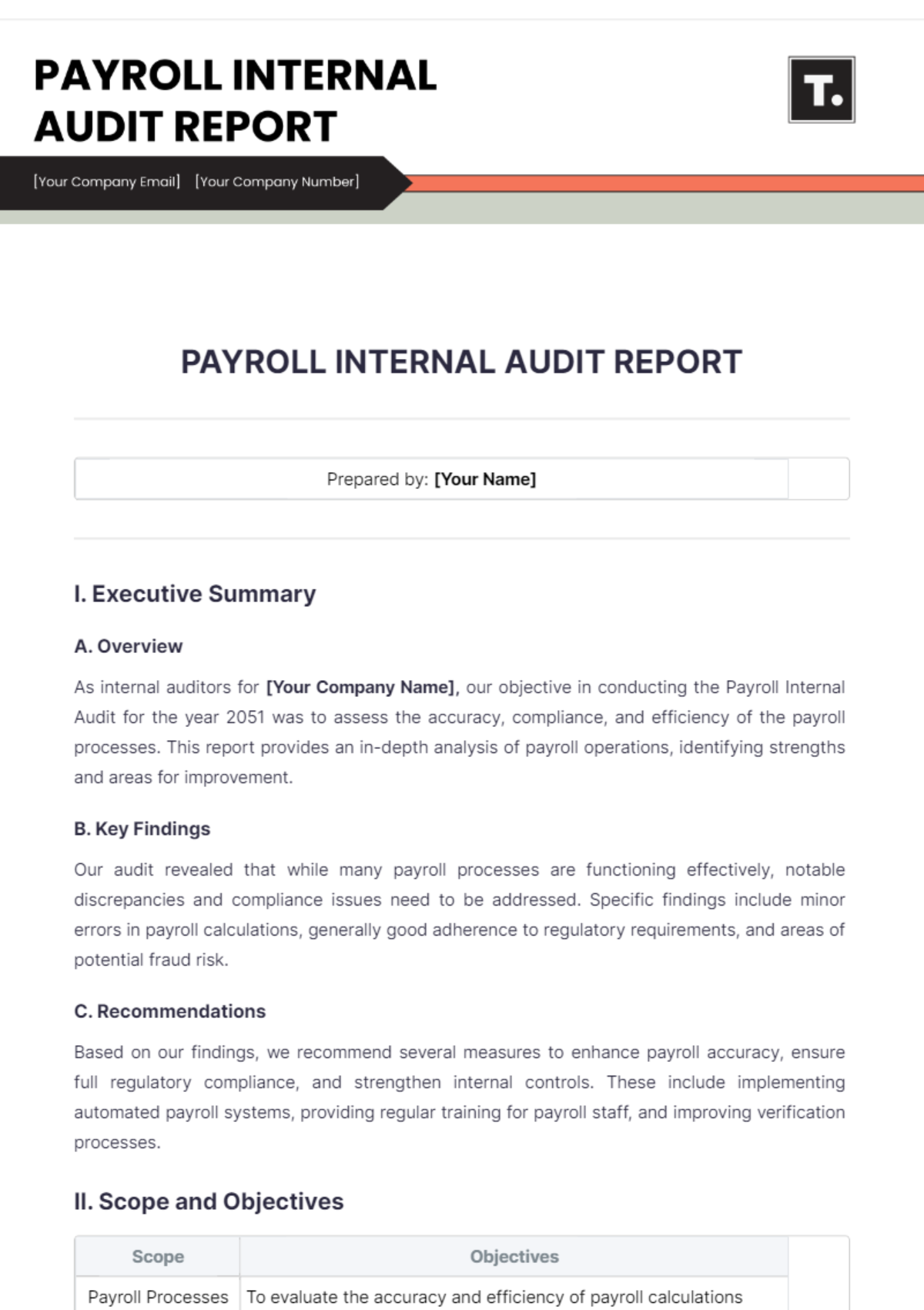

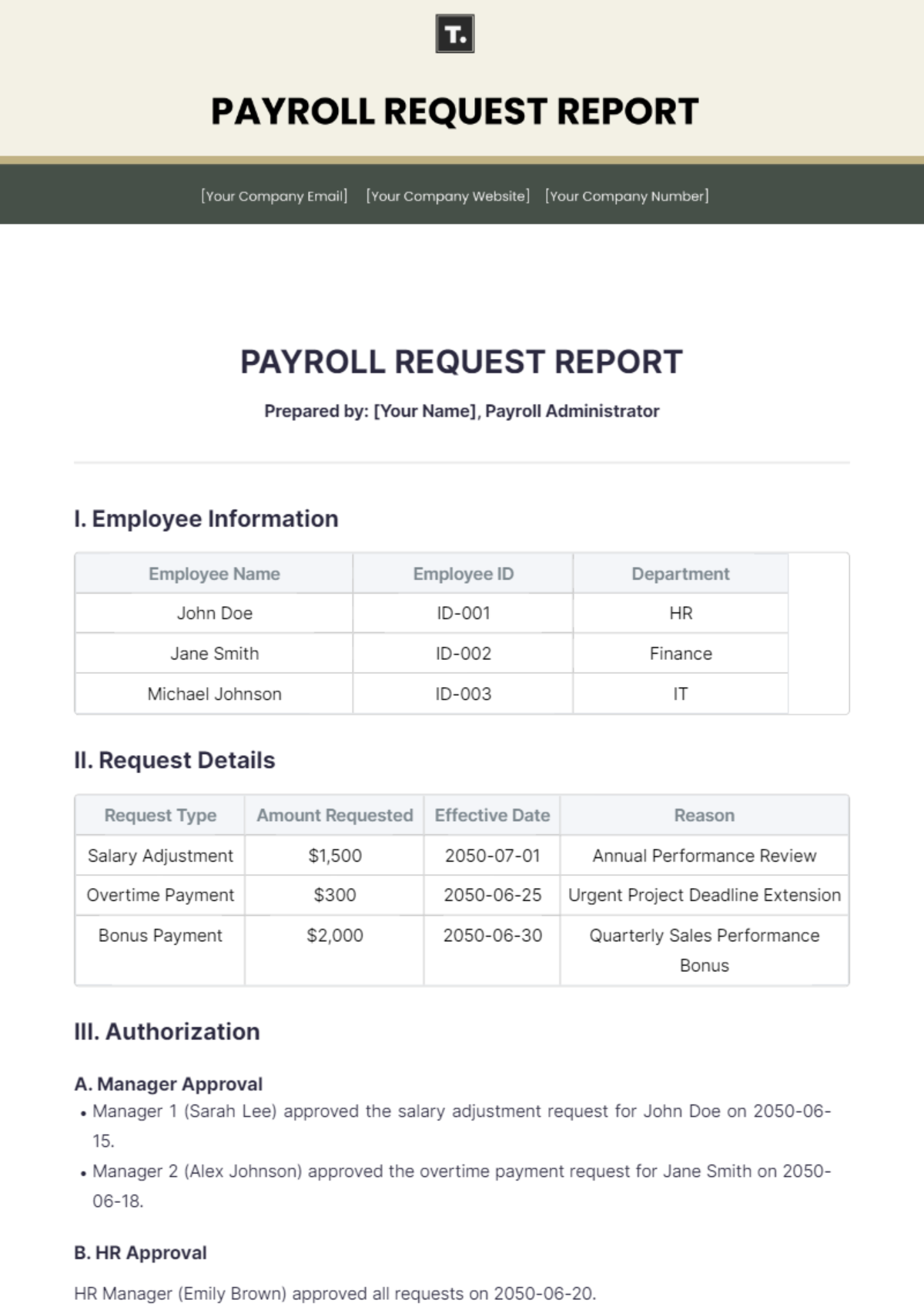

I. Executive Summary

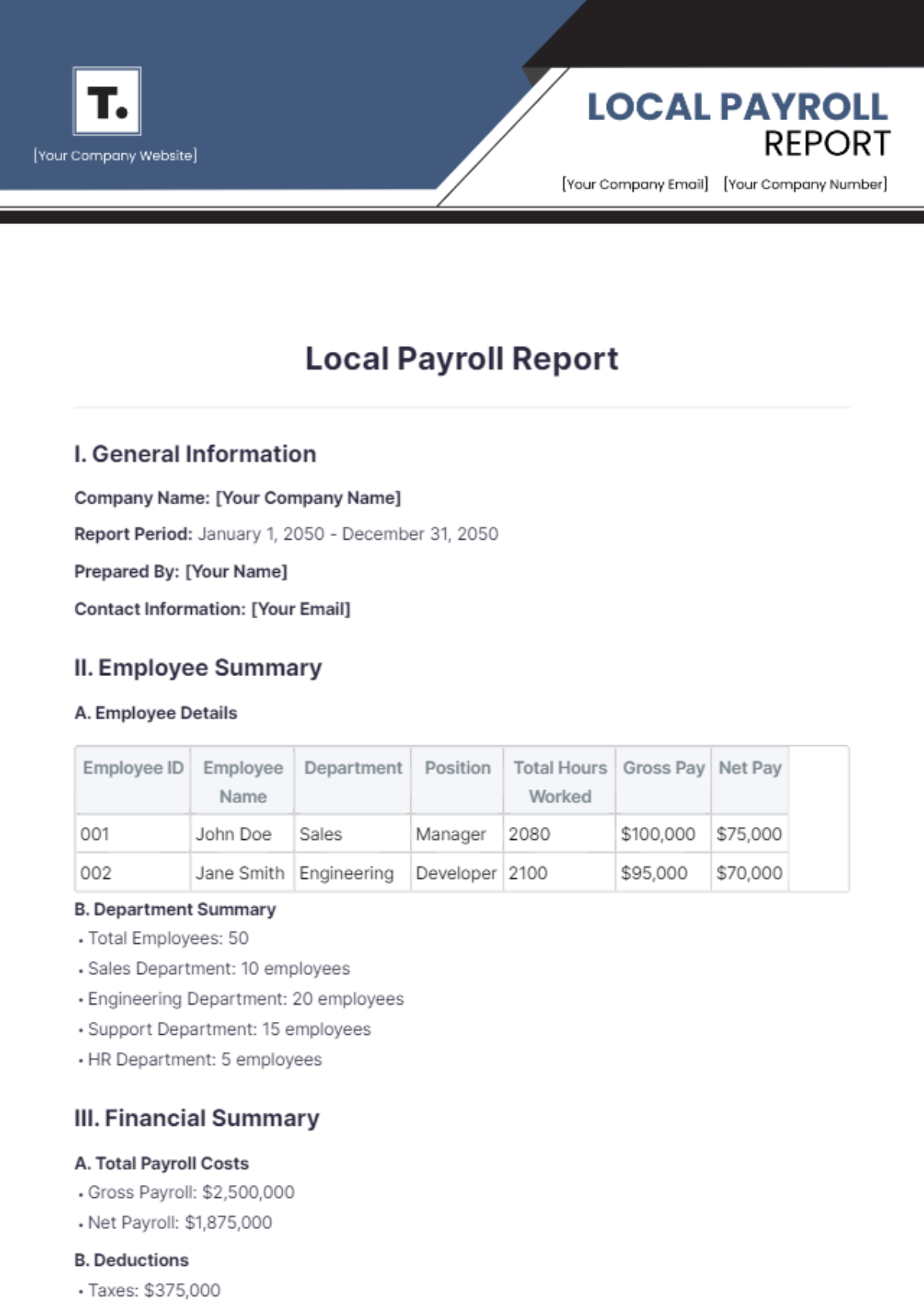

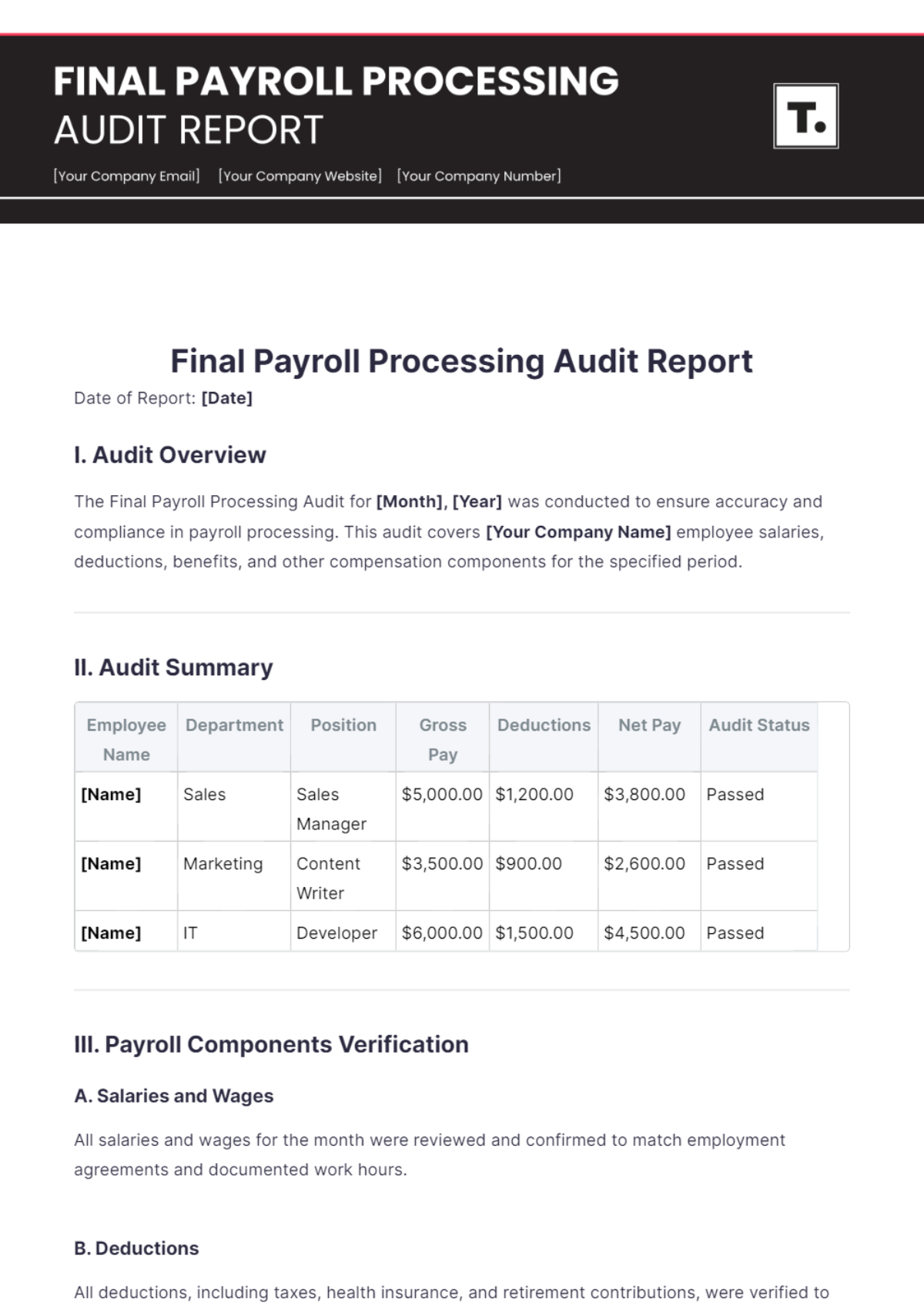

The Year End Payroll Report for [Your Company Name] summarizes payroll activities for the fiscal year ending December 31, 2050. This report provides an overview of total payroll expenses, benefits distribution, deductions, and net pay across all employees.

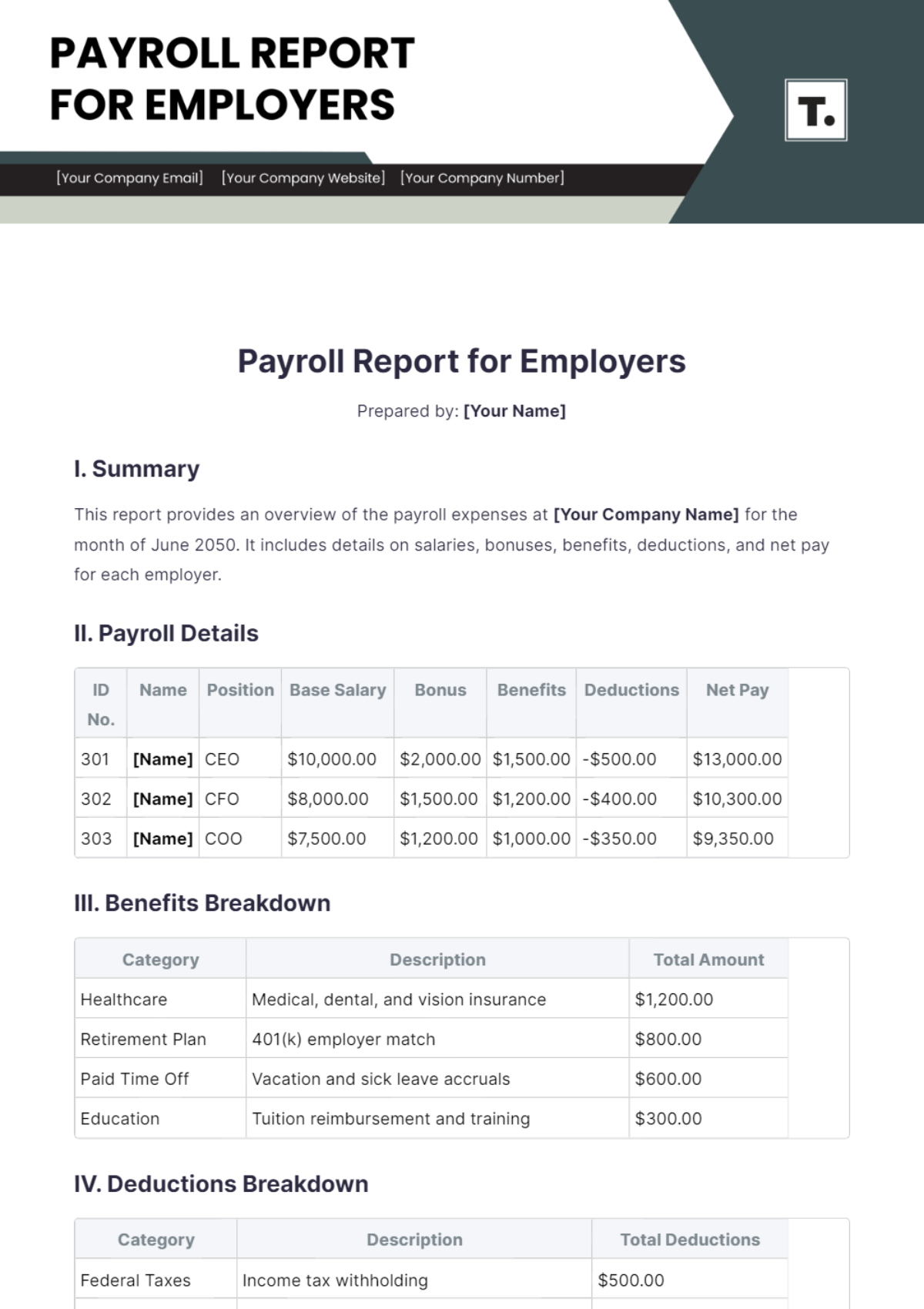

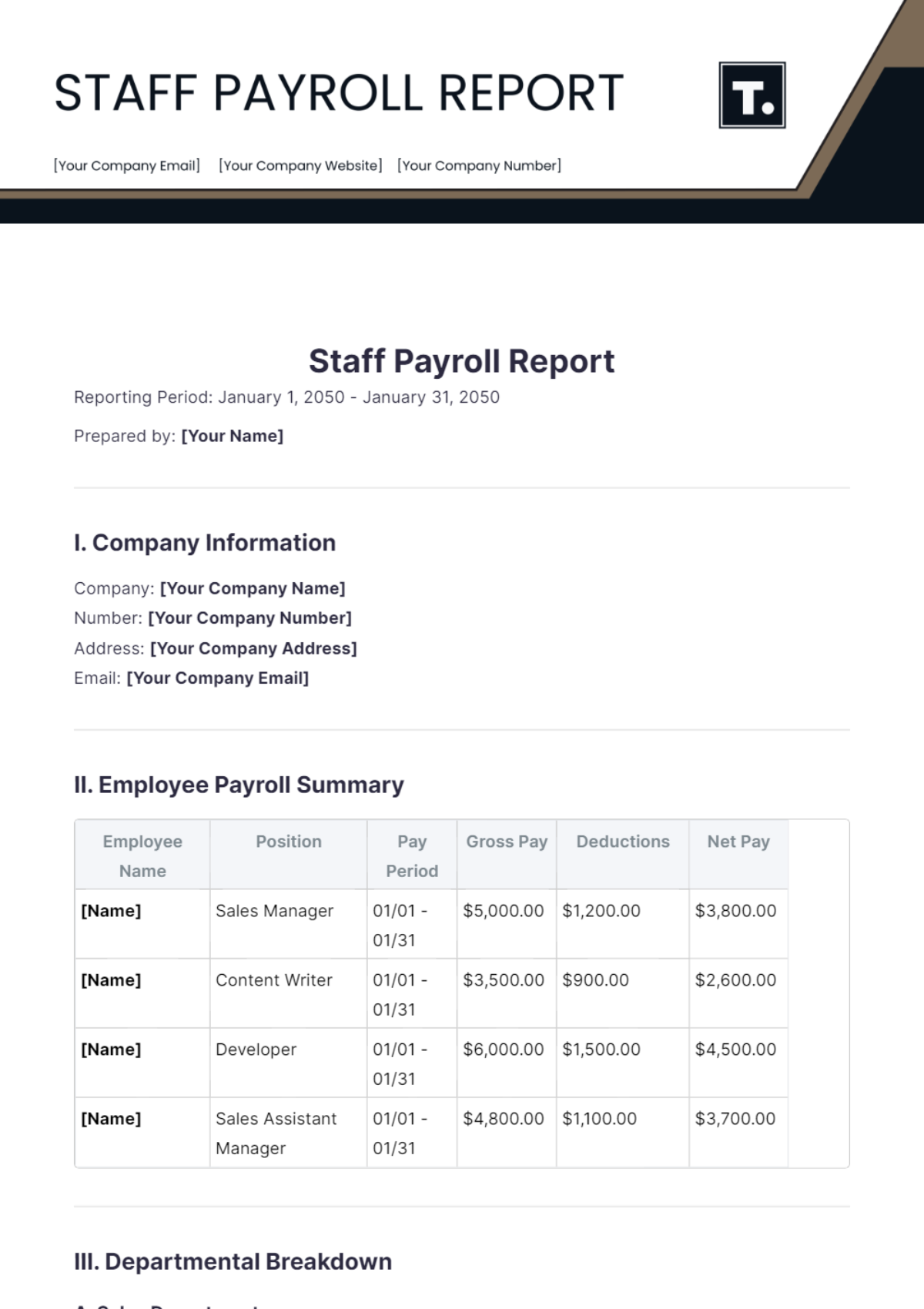

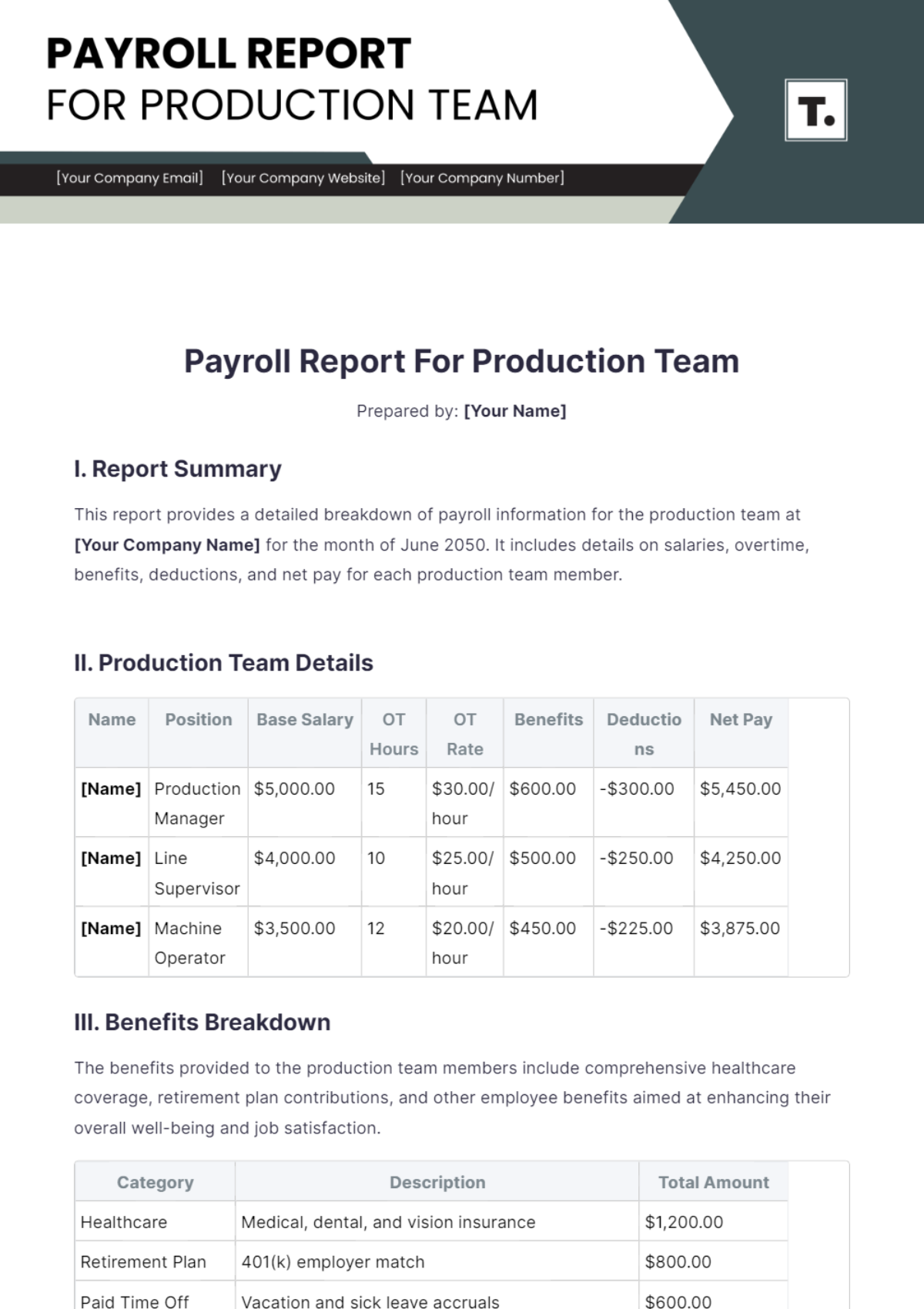

II. Overview of Payroll Expenses

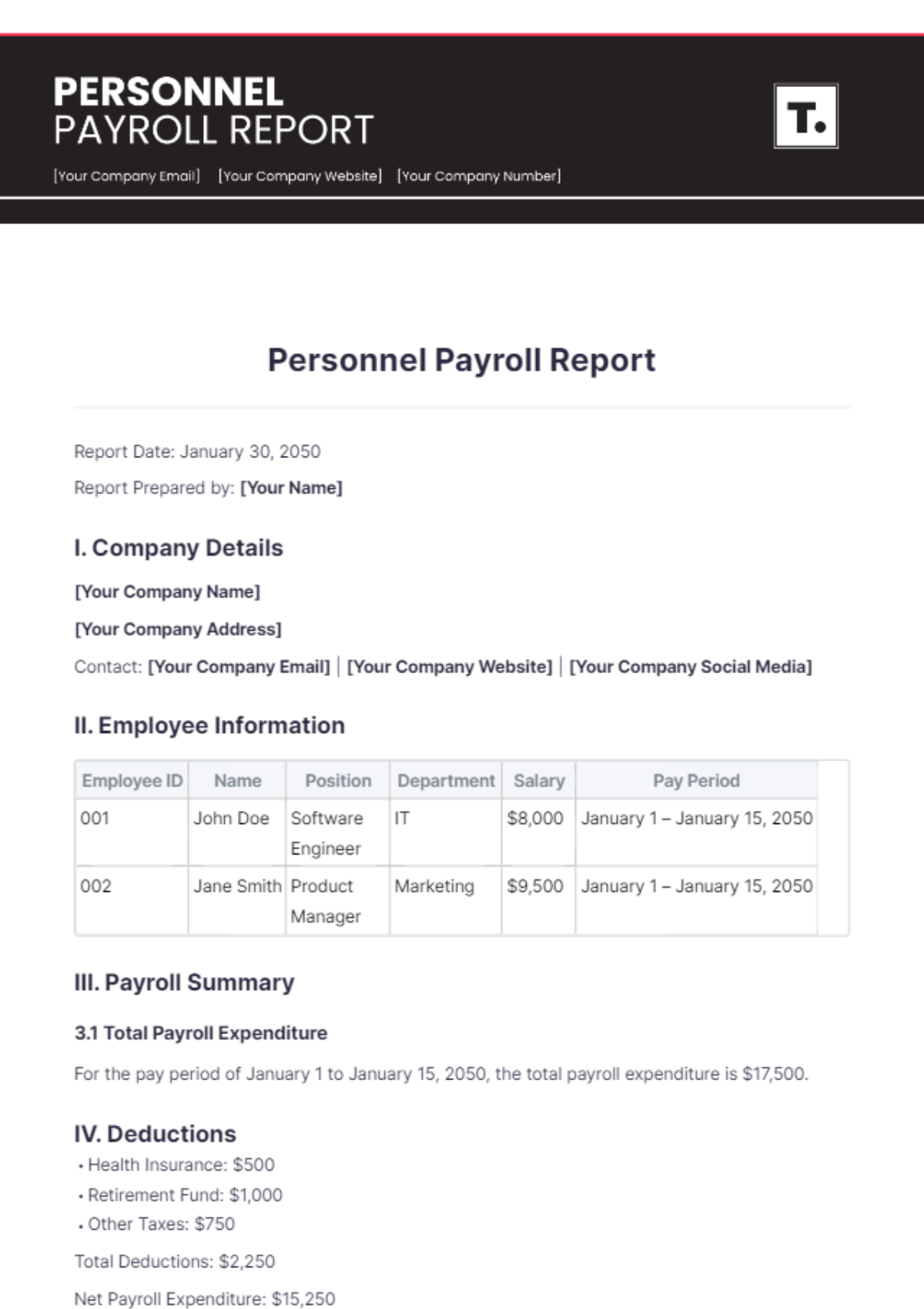

Category | Amount |

|---|---|

Total Salaries | $2,500,000.00 |

Total Benefits | $350,000.00 |

Total Deductions | -$200,000.00 |

Total Net Payroll | $2,650,000.00 |

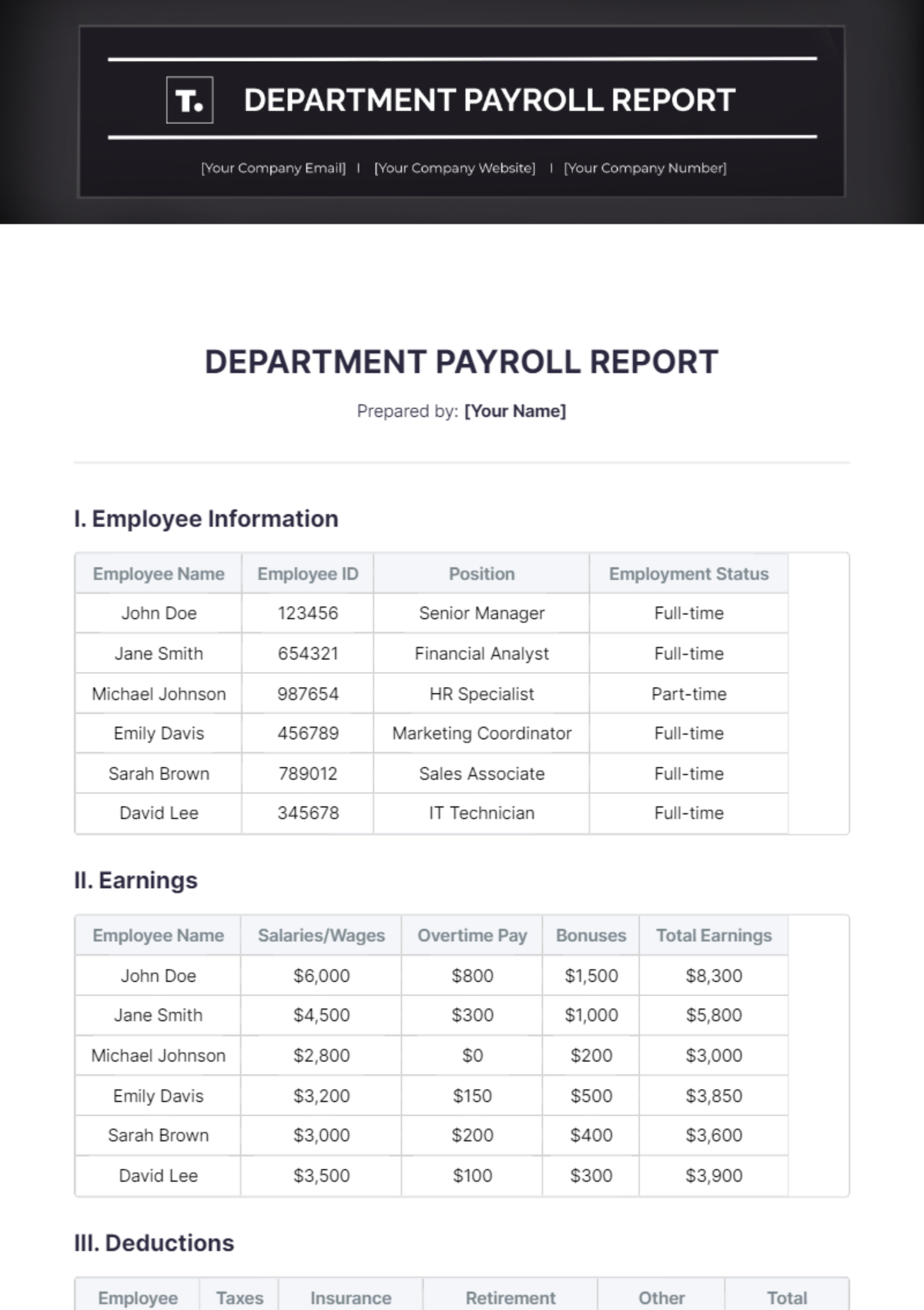

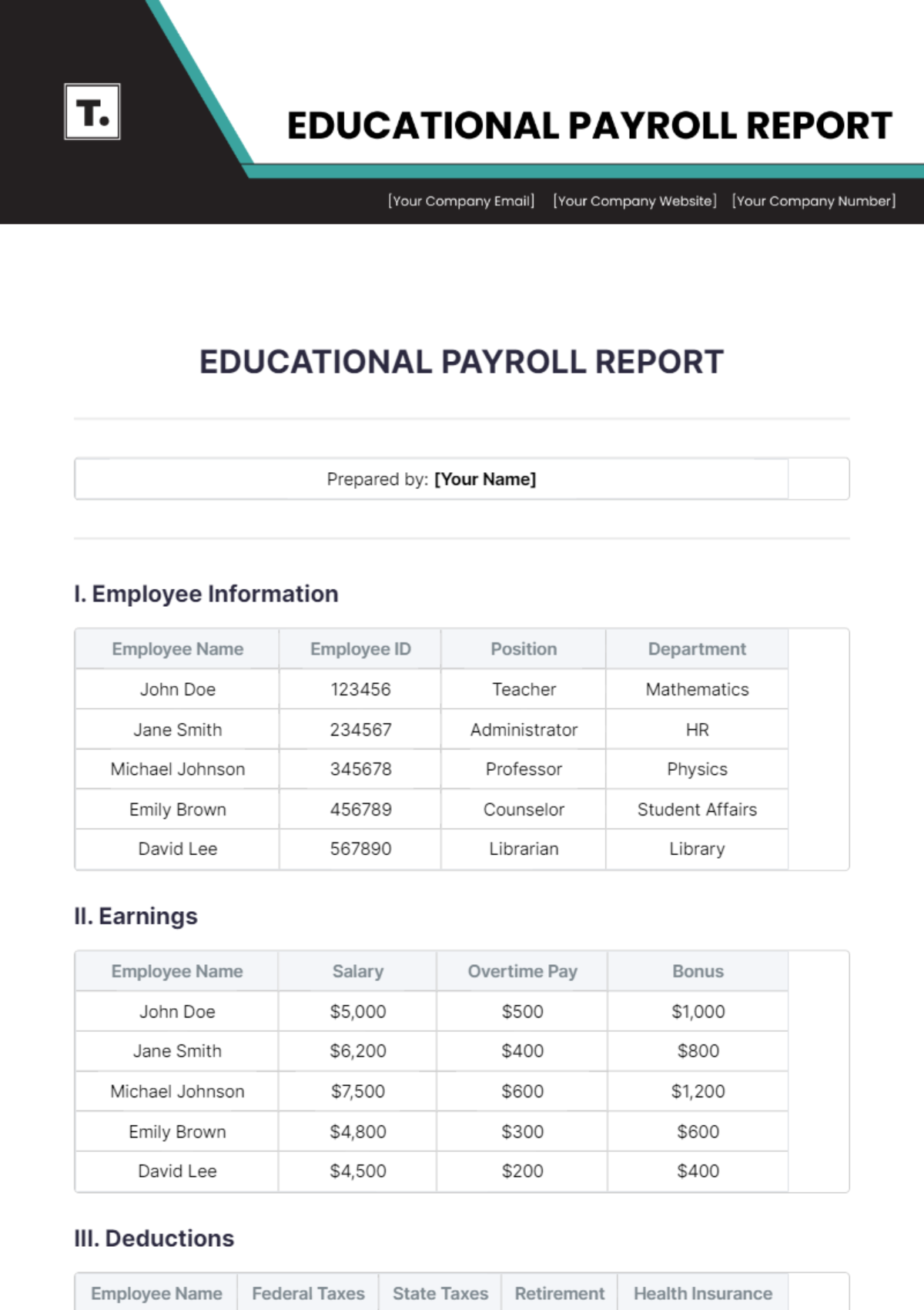

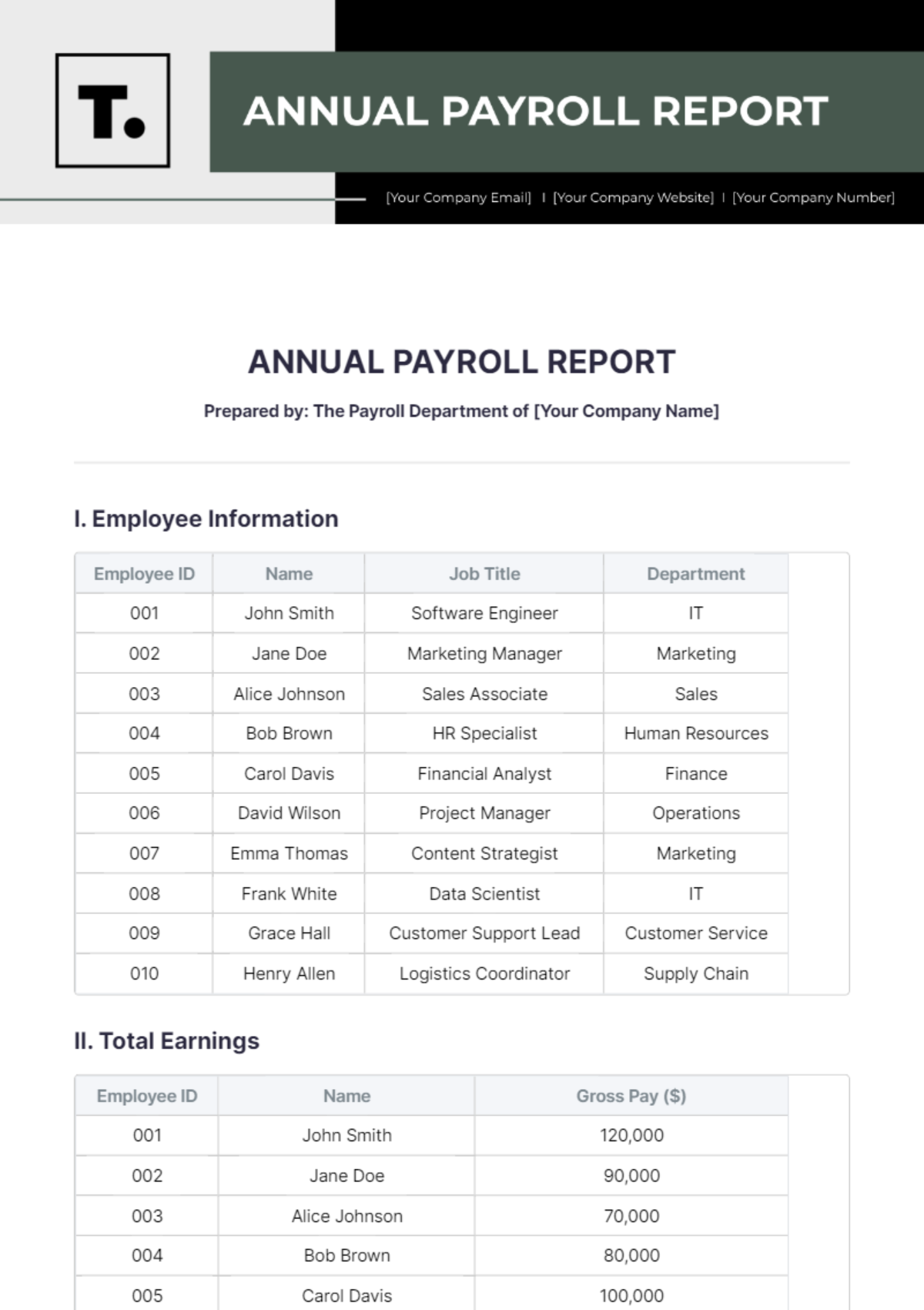

III. Detailed Employee Breakdown

A. Salaries by Department

Department | Total Salaries |

|---|---|

Manufacturing | $1,200,000.00 |

Sales | $800,000.00 |

Administration | $500,000.00 |

B. Benefits Breakdown

Category | Total Amount |

|---|---|

Healthcare | $200,000.00 |

Retirement Plans | $100,000.00 |

Other Benefits | $50,000.00 |

C. Deductions Analysis

Category | Total Deductions |

|---|---|

Taxes | $150,000.00 |

Insurance Premiums | $30,000.00 |

Other Deductions | $20,000.00 |

IV. Employee Performance Bonuses

Top Performers | Department | Bonus Amount |

|---|---|---|

[Name] | Manufacturing | $5,000.00 |

[Name] | Sales | $4,000.00 |

[Name] | Administration | $3,500.00 |

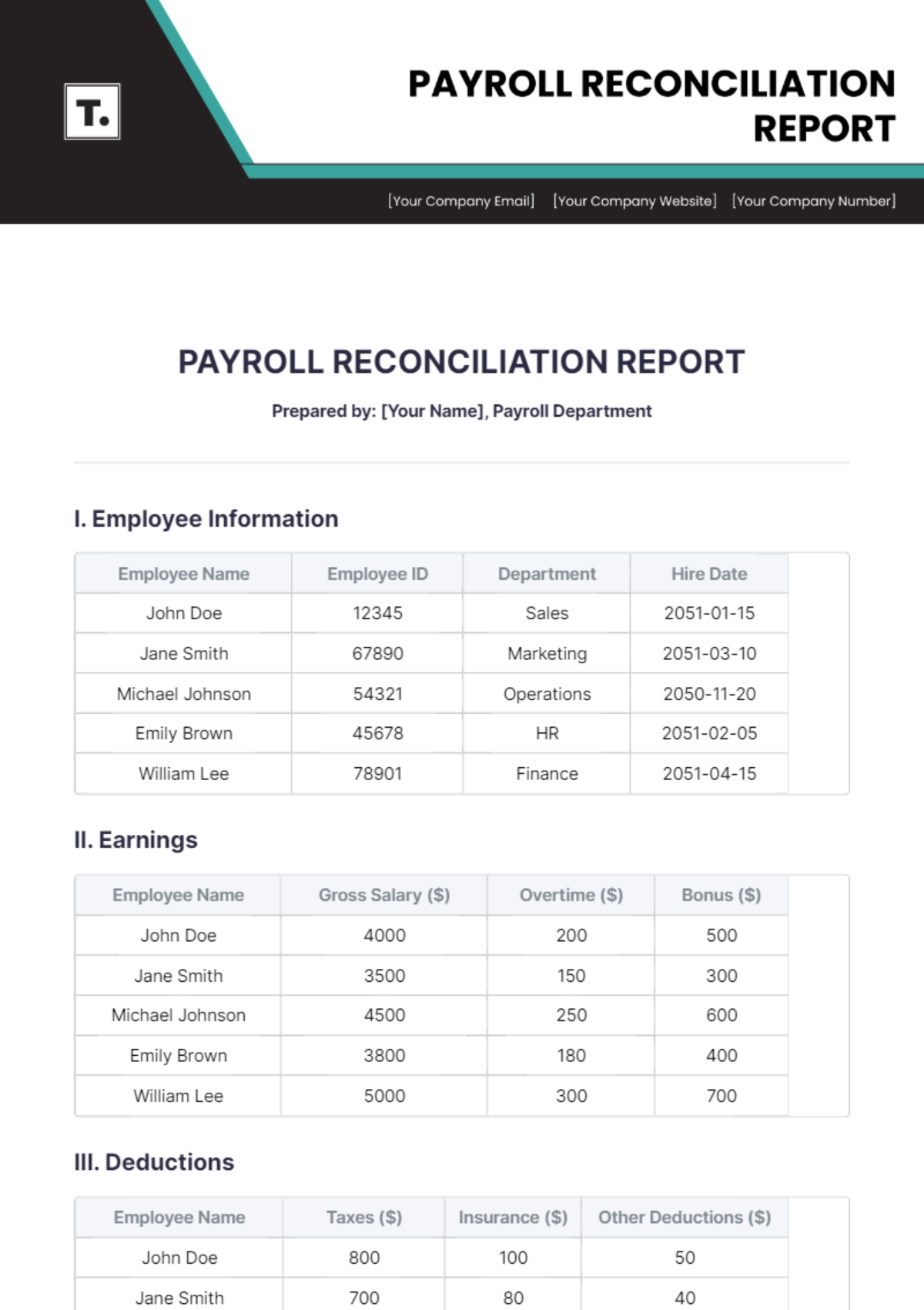

V. Conclusion and Strategic Insights

The Year End Payroll Report for [Your Company Name] showcases a total payroll expenditure of $2,500,000.00 in salaries, reflecting the company's commitment to compensating its workforce competitively. Benefits totaling $350,000.00, including healthcare and retirement contributions, further illustrate the company's dedication to employee welfare.

Deductions amounting to -$200,000.00 primarily consist of taxes, insurance premiums, and other withholdings, ensuring compliance with regulatory requirements and financial responsibility. Employee performance bonuses, totaling $12,500.00, recognize top performers across departments, fostering a culture of meritocracy and motivation.

This report not only provides a comprehensive overview of payroll expenses but also offers strategic insights into resource allocation and employee compensation strategies for future planning and operational excellence at [Your Company Name].