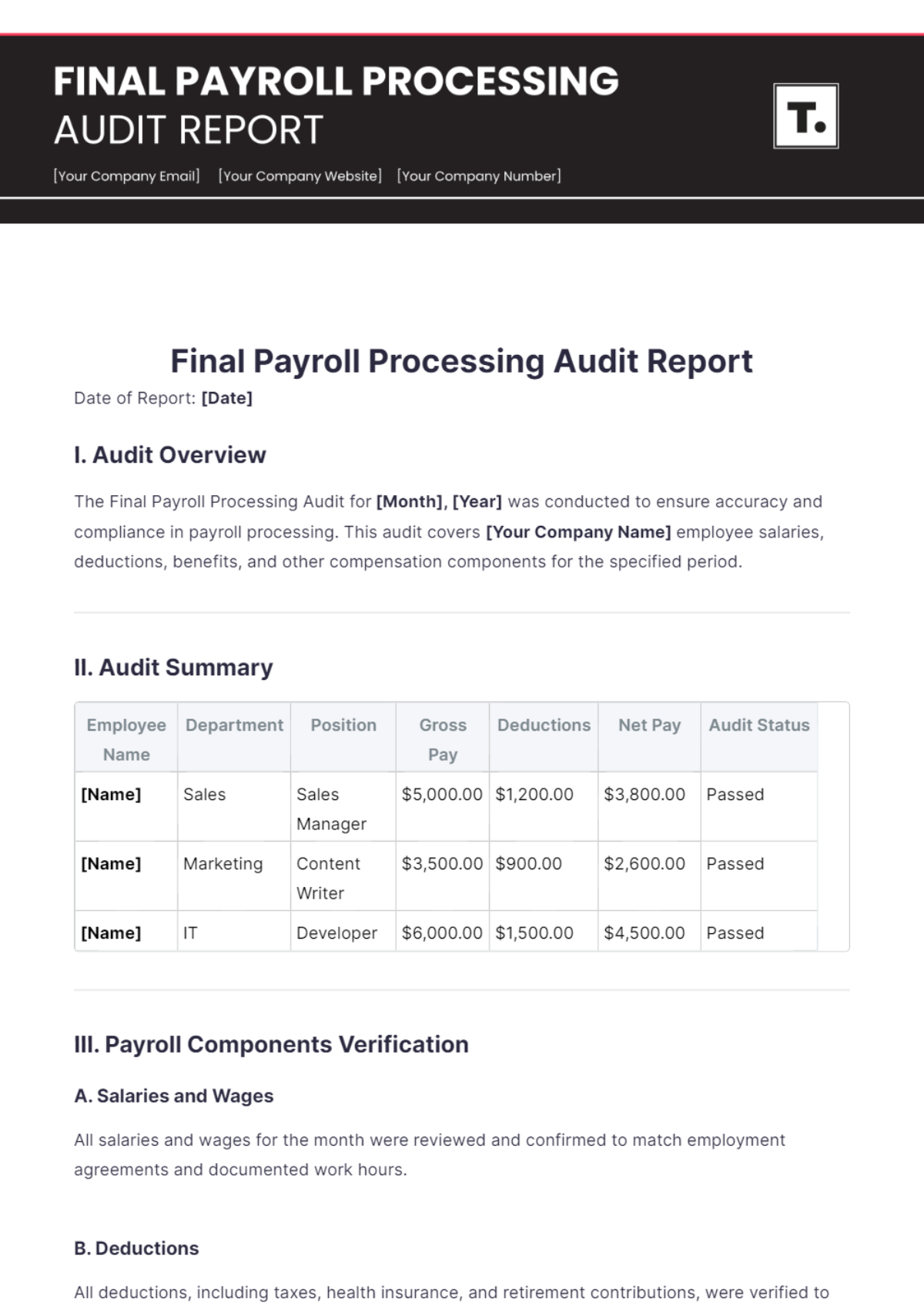

Final Payroll Processing Audit Report

Date of Report: [Date]

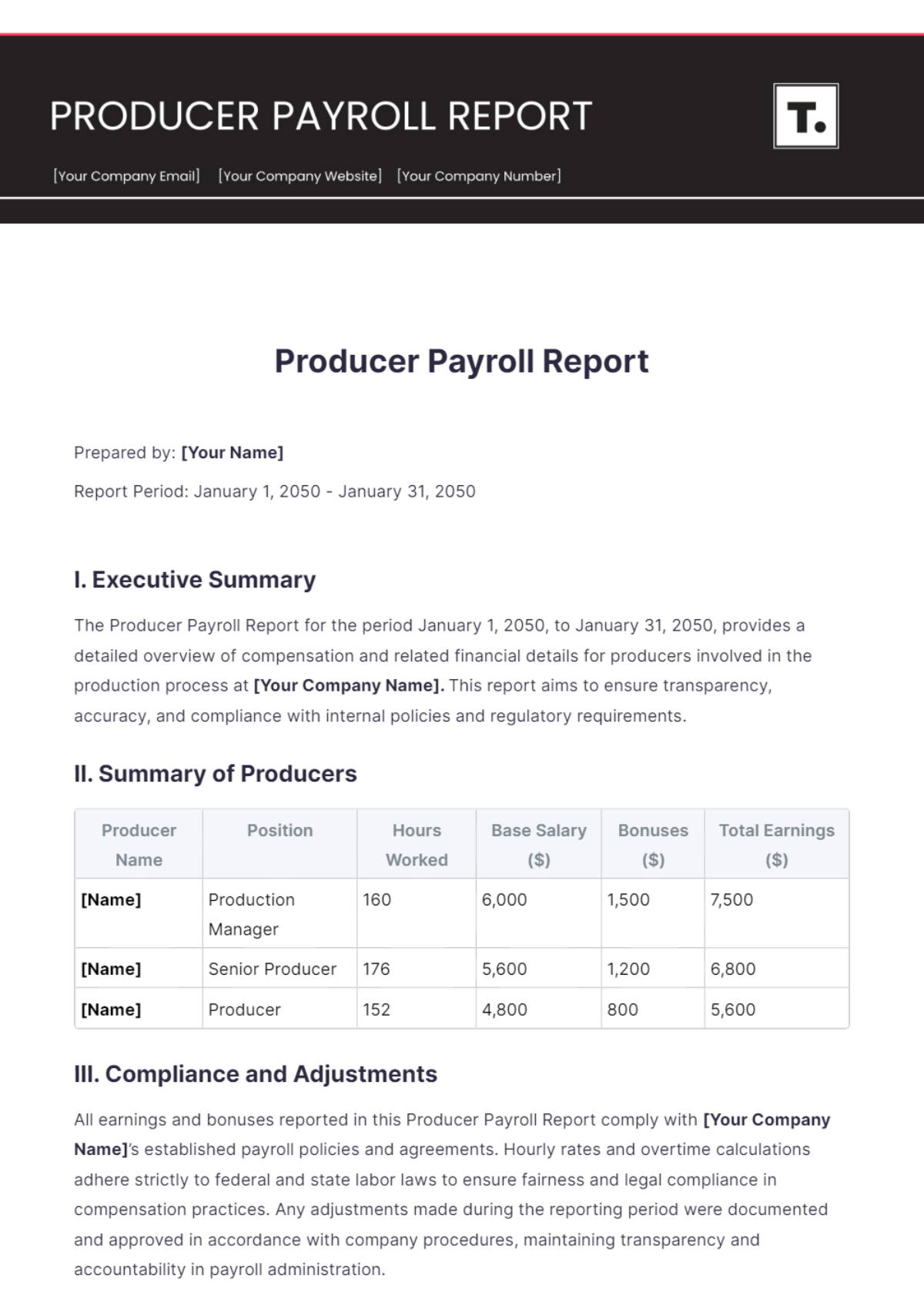

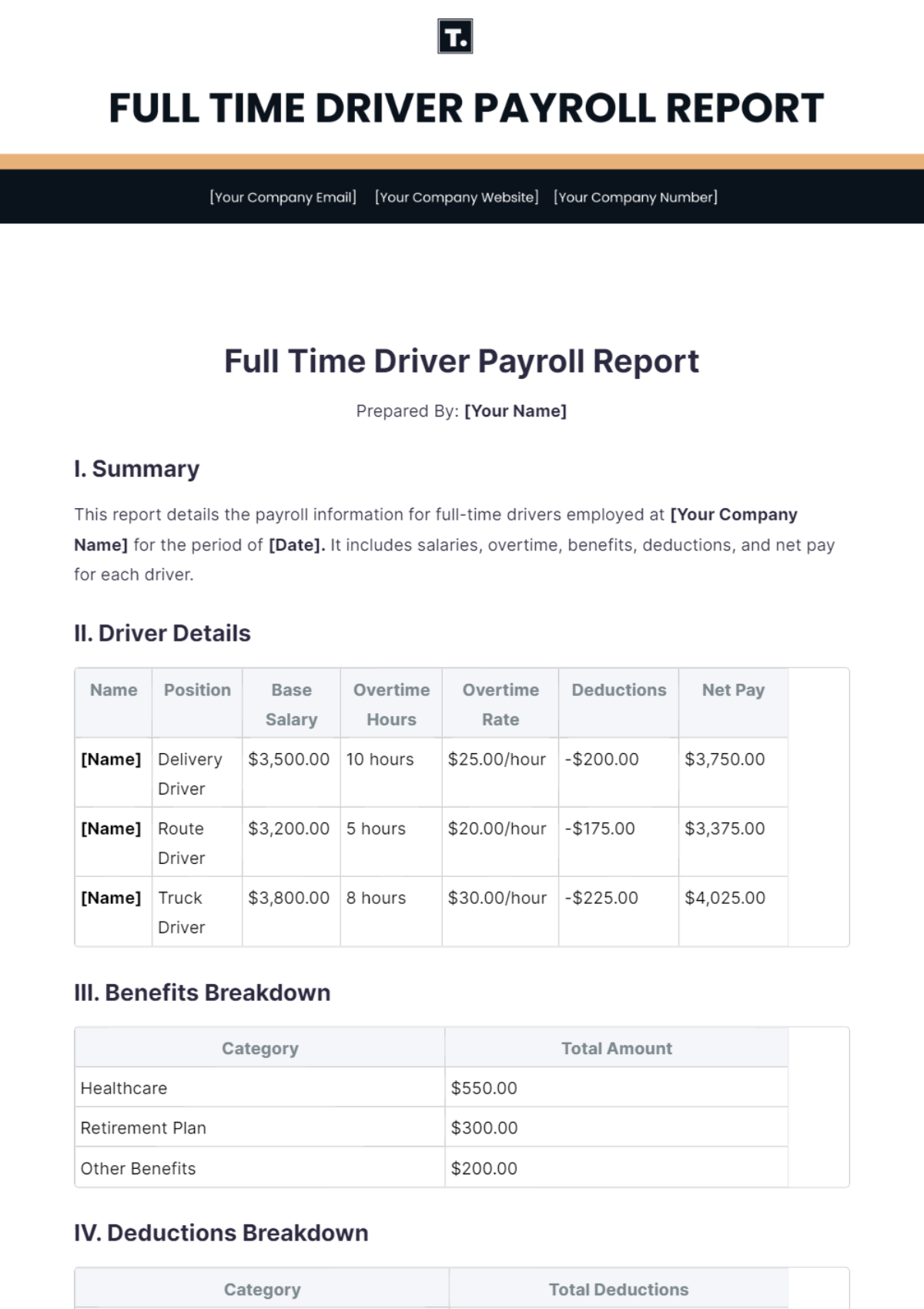

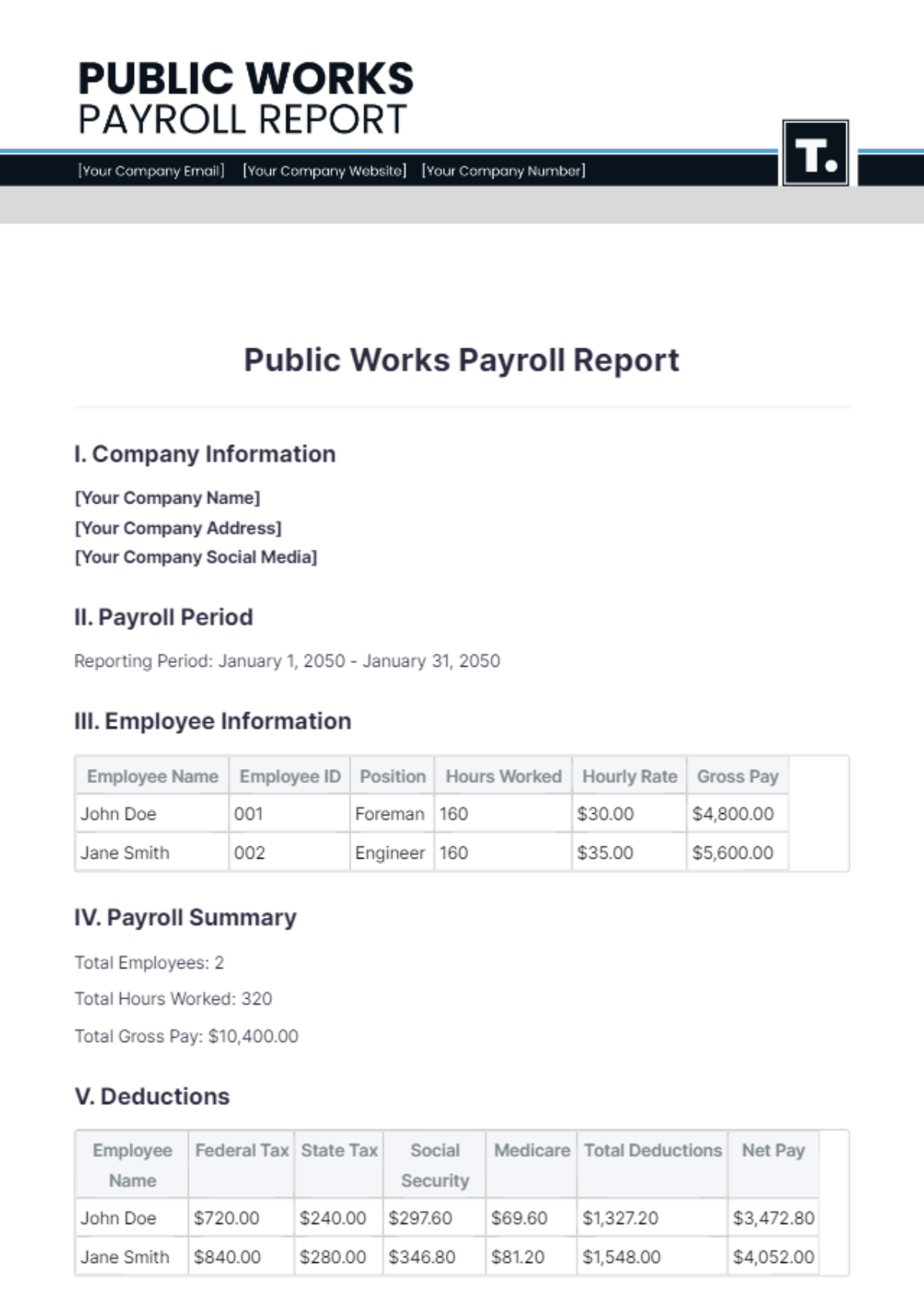

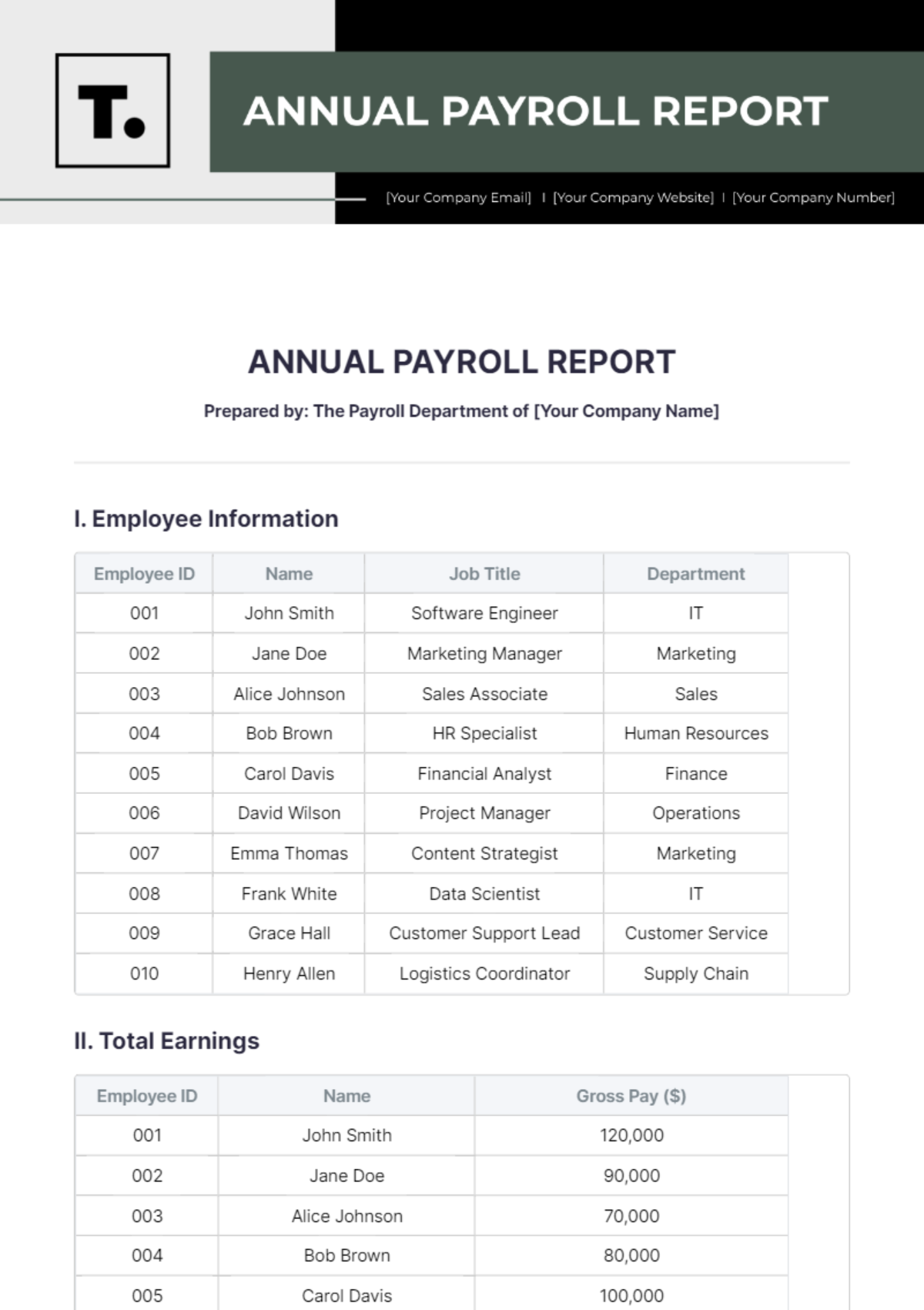

I. Audit Overview

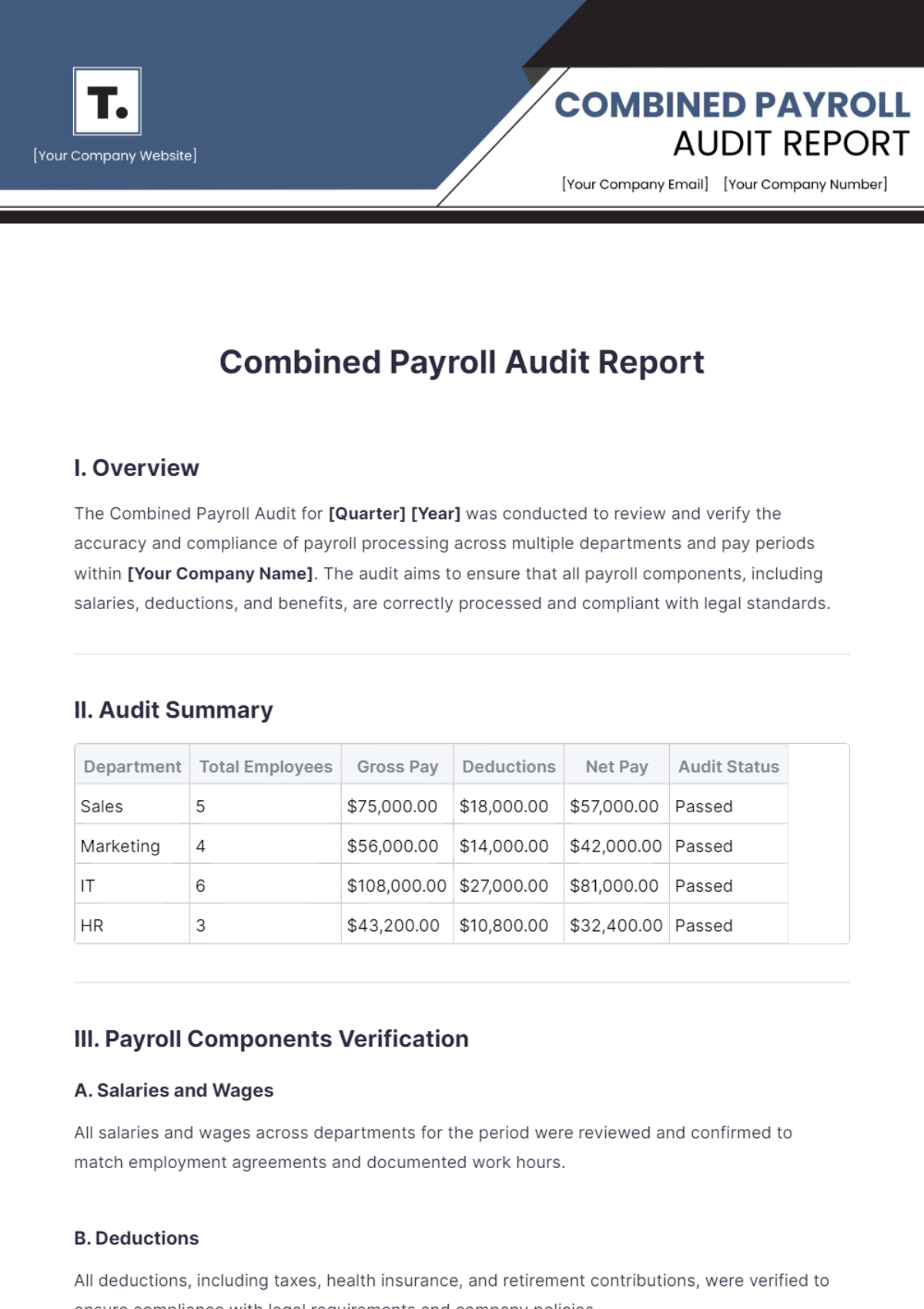

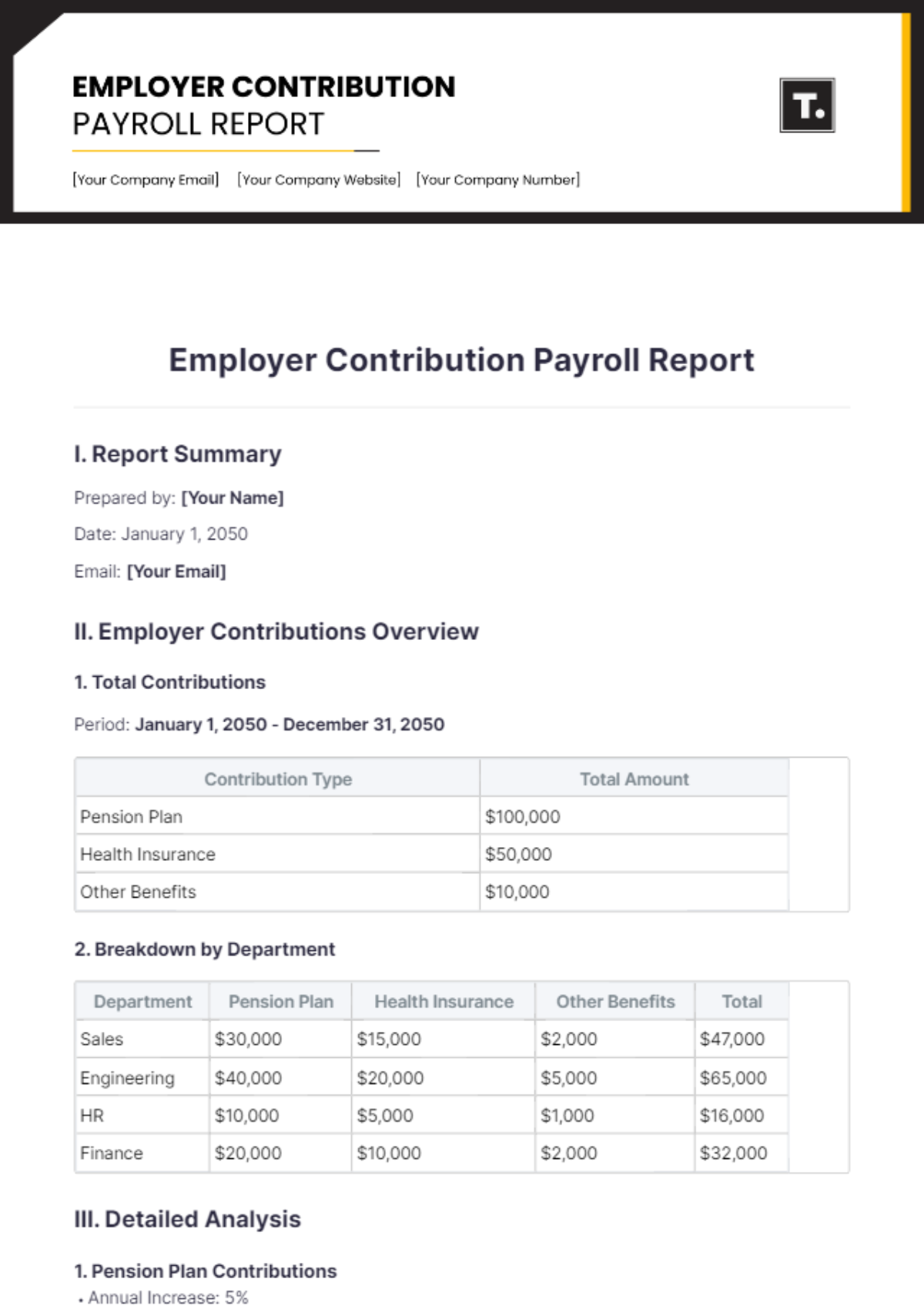

The Final Payroll Processing Audit for [Month], [Year] was conducted to ensure accuracy and compliance in payroll processing. This audit covers [Your Company Name] employee salaries, deductions, benefits, and other compensation components for the specified period.

II. Audit Summary

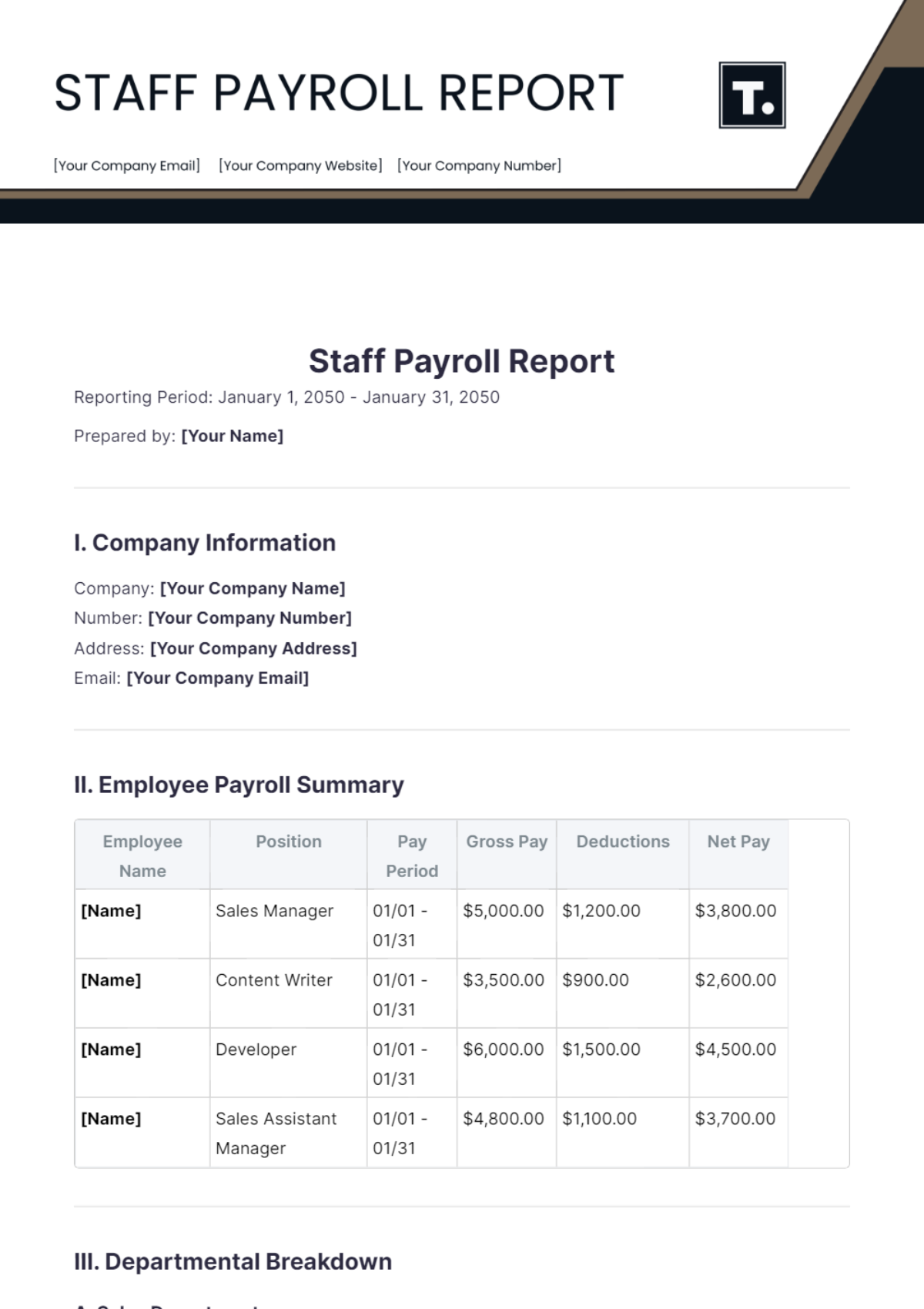

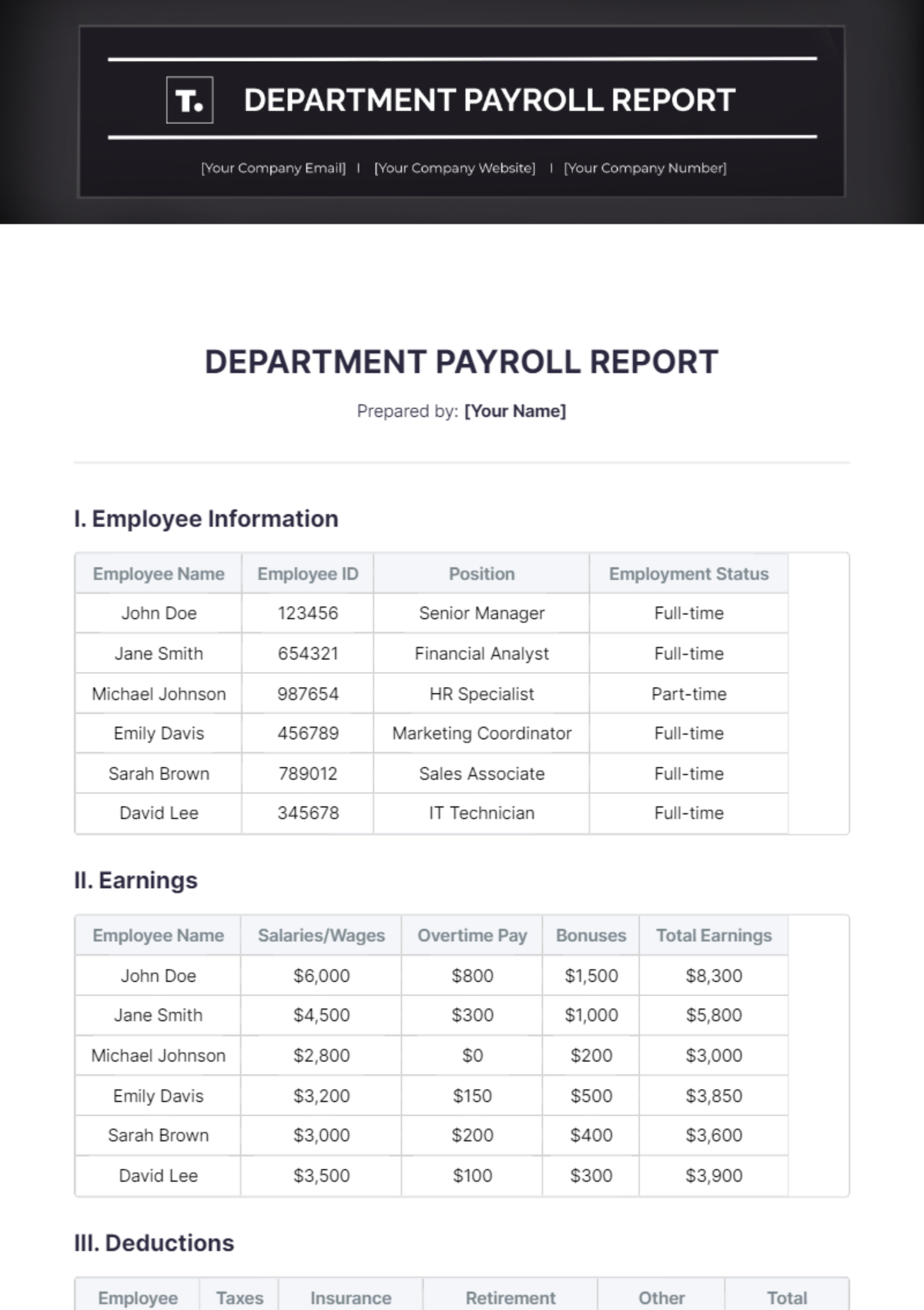

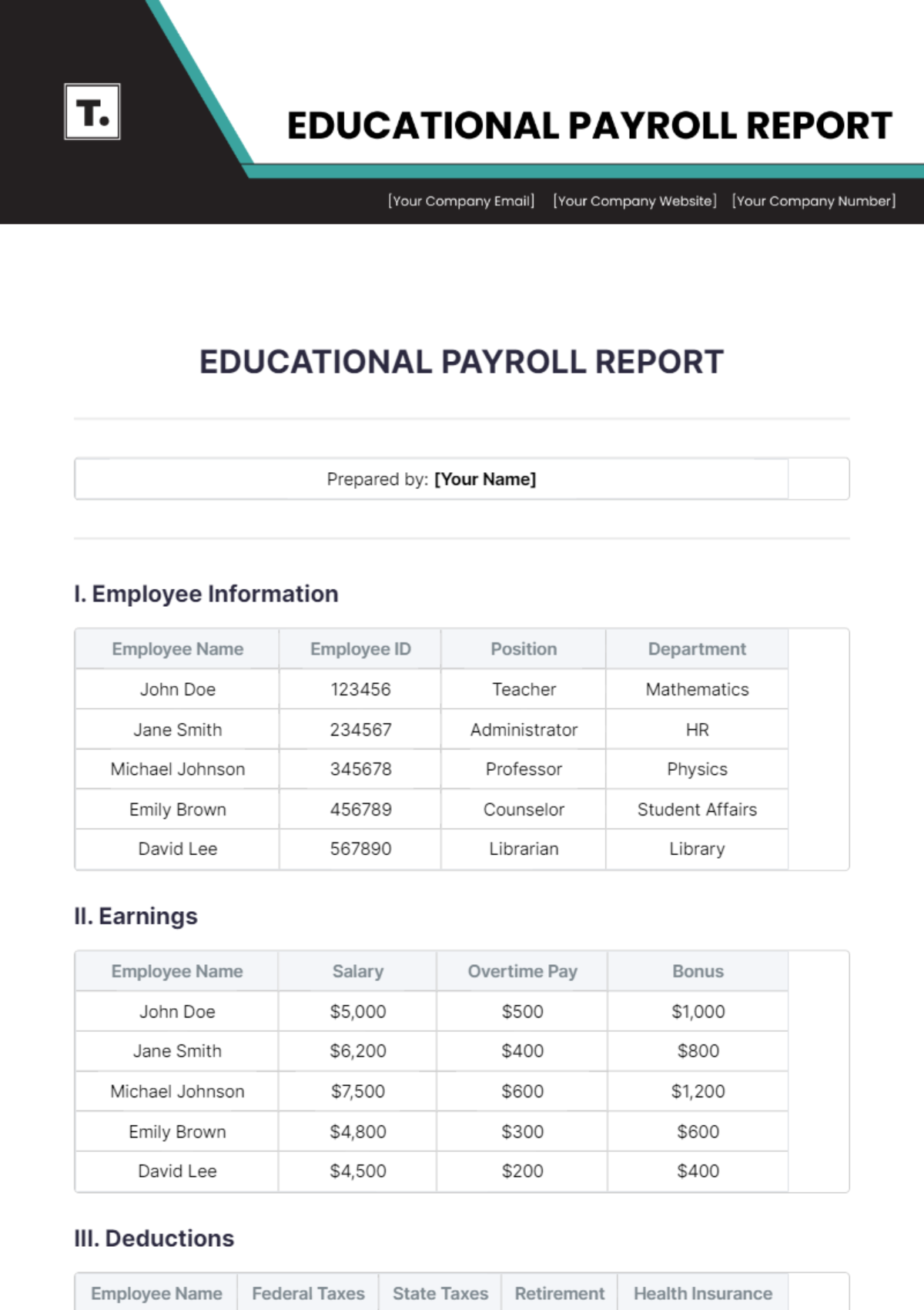

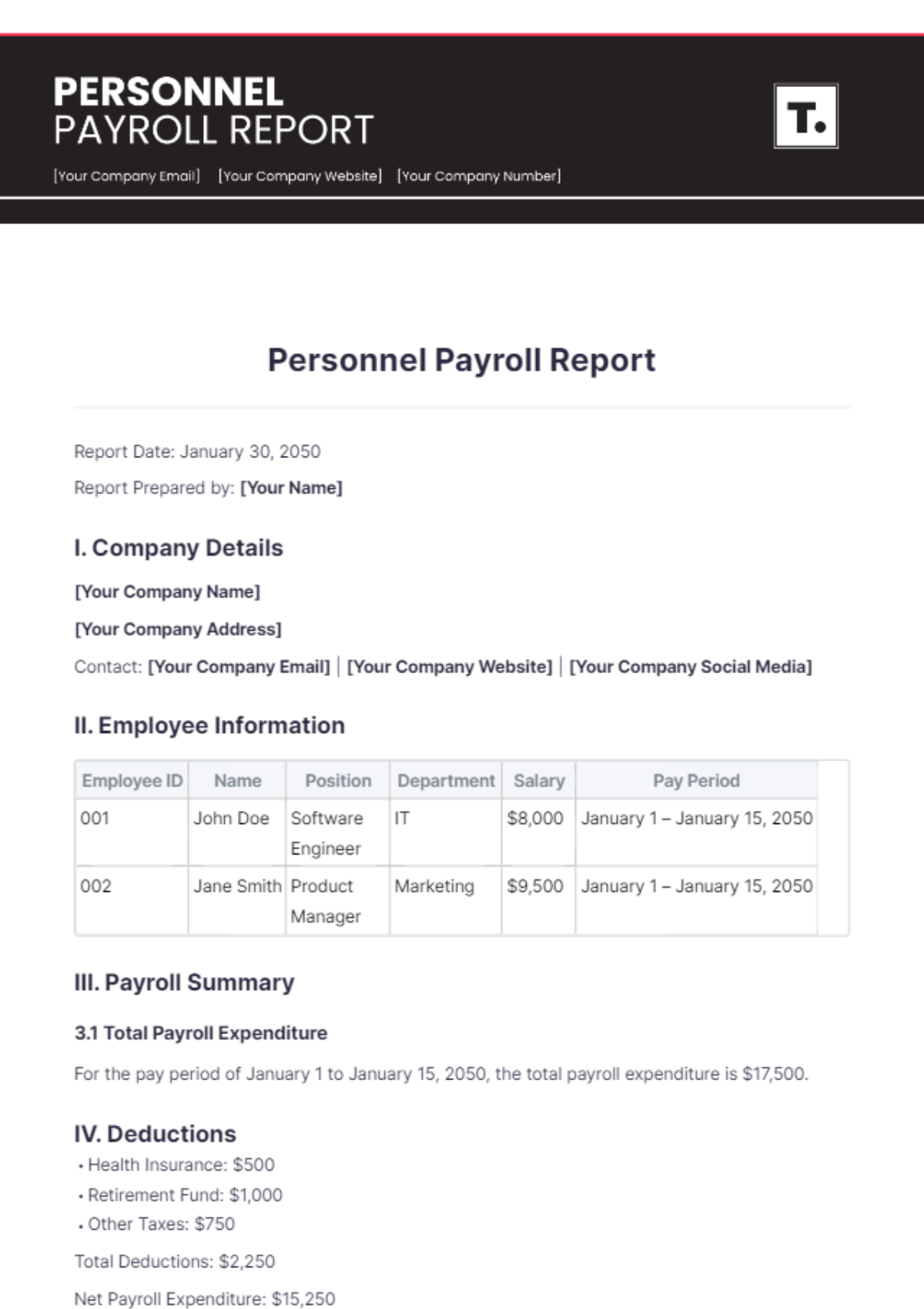

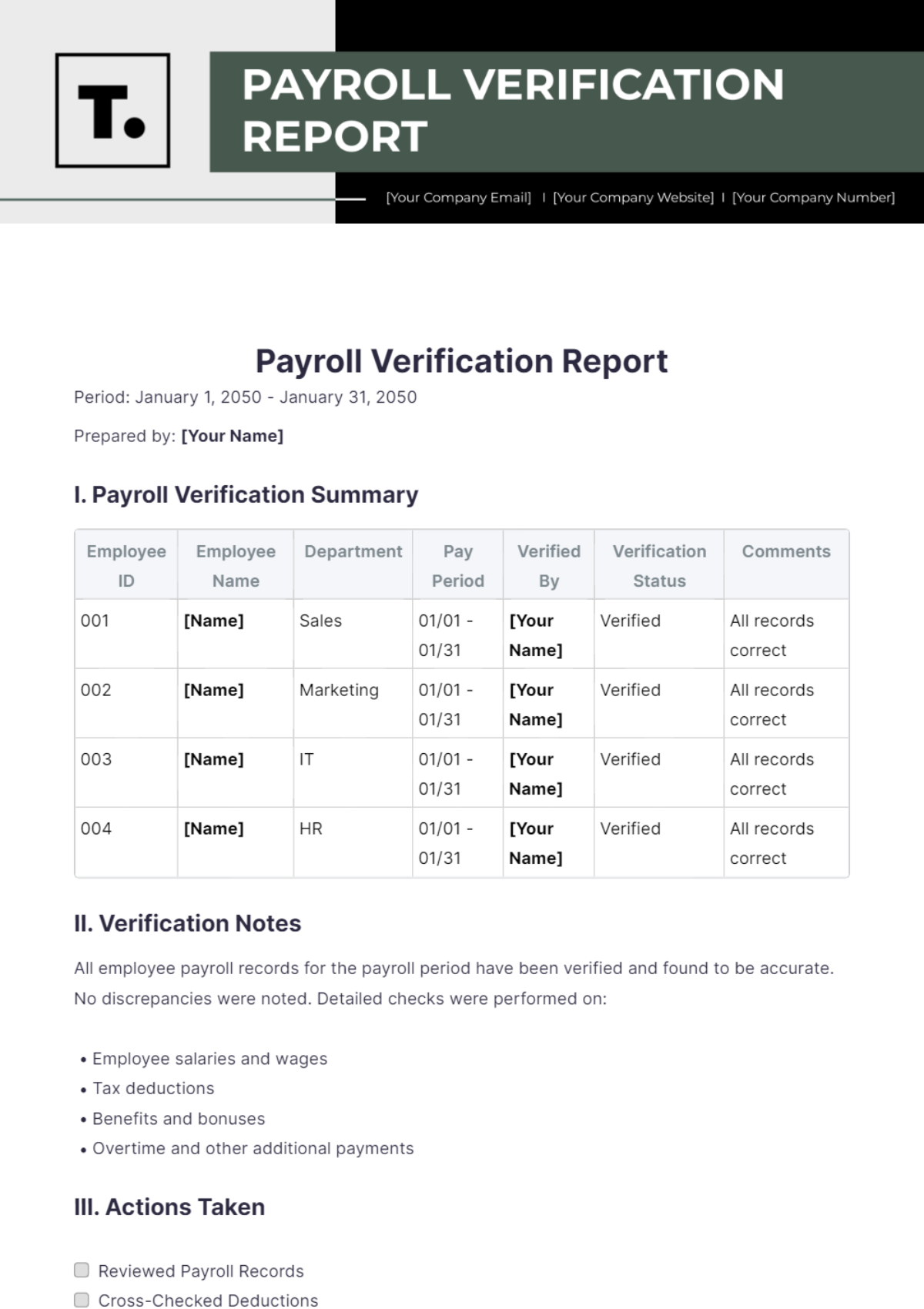

Employee Name | Department | Position | Gross Pay | Deductions | Net Pay | Audit Status |

|---|---|---|---|---|---|---|

[Name] | Sales | Sales Manager | $5,000.00 | $1,200.00 | $3,800.00 | Passed |

[Name] | Marketing | Content Writer | $3,500.00 | $900.00 | $2,600.00 | Passed |

[Name] | IT | Developer | $6,000.00 | $1,500.00 | $4,500.00 | Passed |

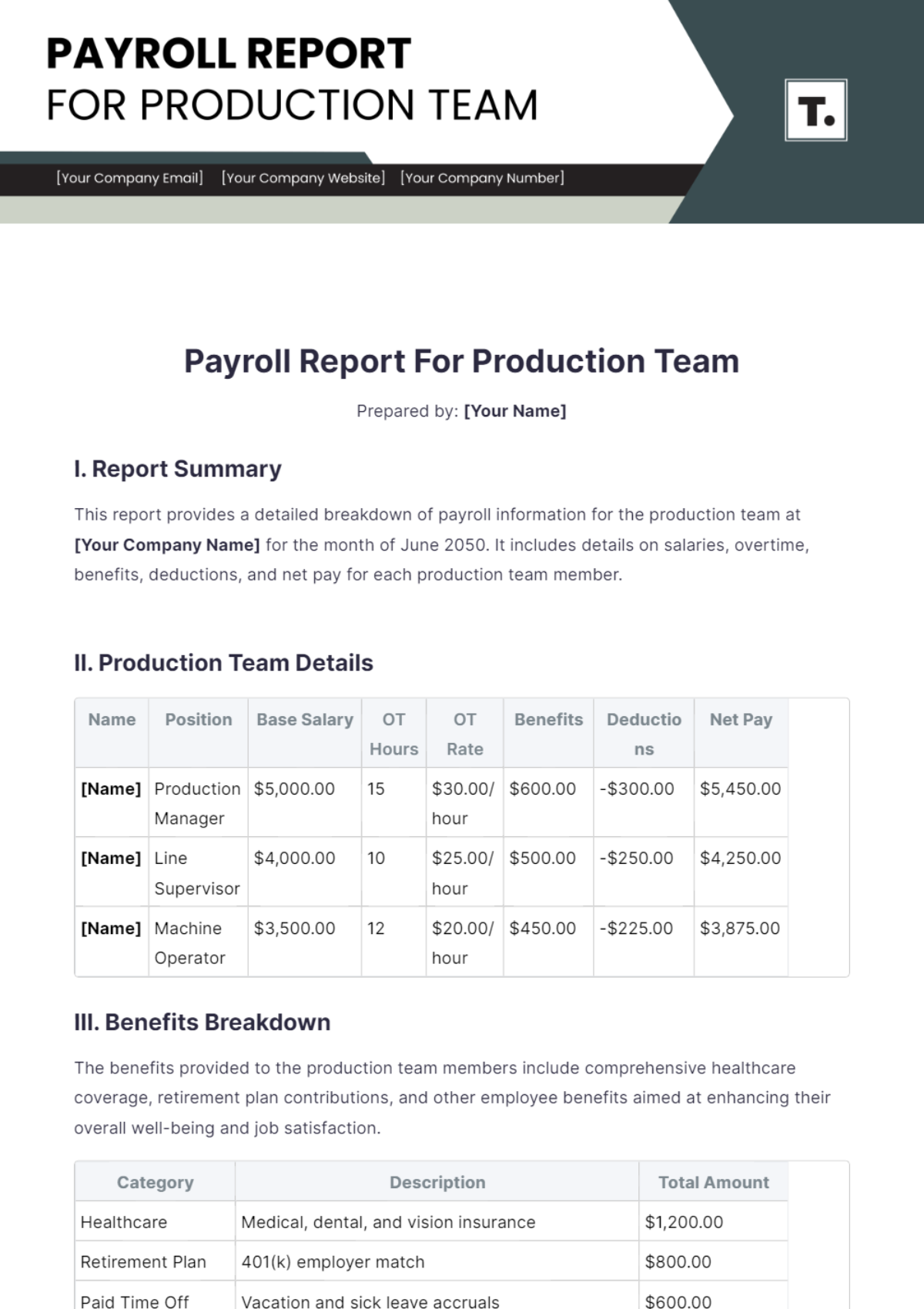

III. Payroll Components Verification

A. Salaries and Wages

All salaries and wages for the month were reviewed and confirmed to match employment agreements and documented work hours.

B. Deductions

All deductions, including taxes, health insurance, and retirement contributions, were verified to ensure they comply with legal requirements and company policies.

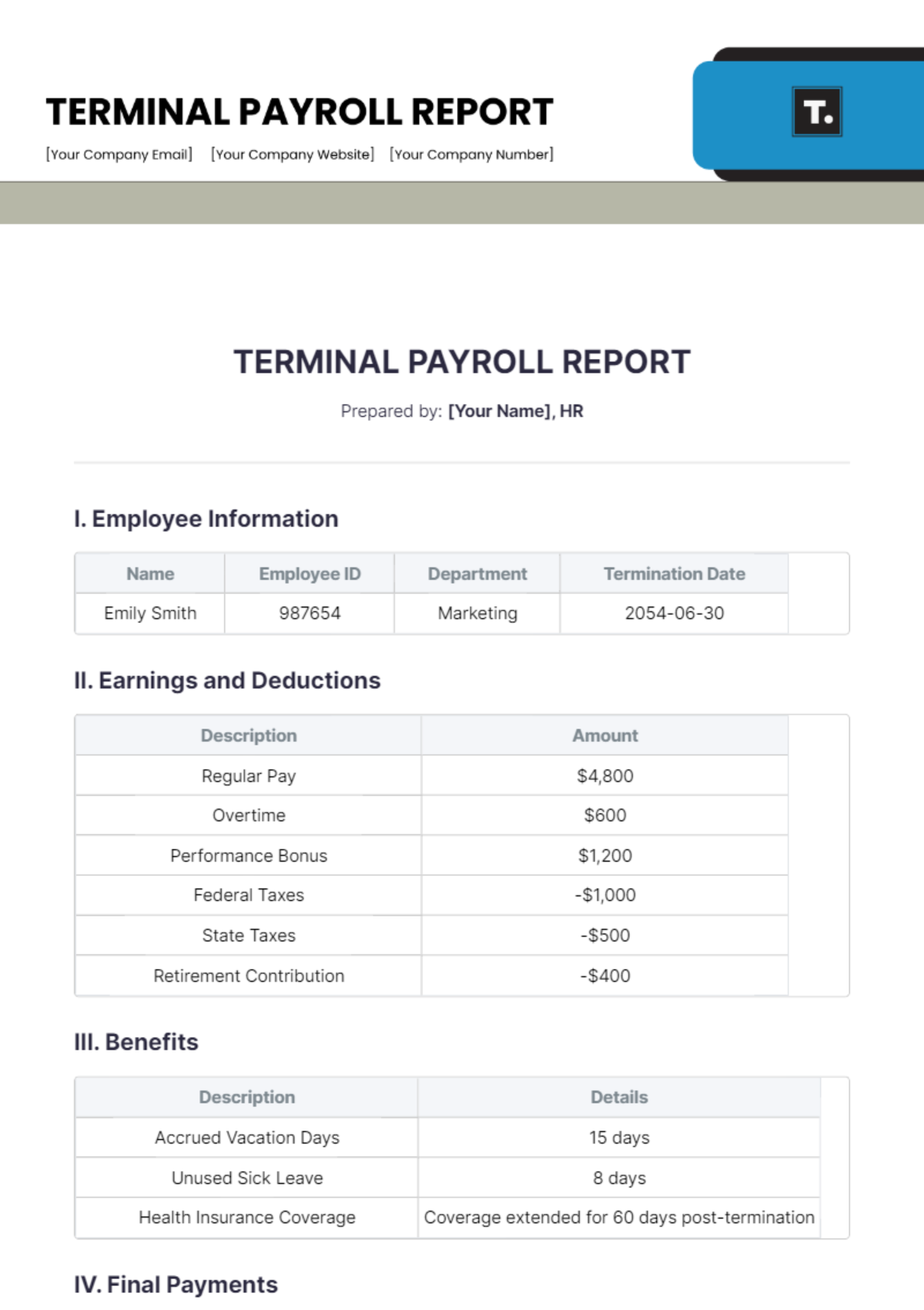

C. Benefits and Bonuses

Benefits and bonuses were reviewed and confirmed to be accurately applied as per company policy. This included health insurance benefits totaling $3,000.00 and performance bonuses amounting to $2,000.00.

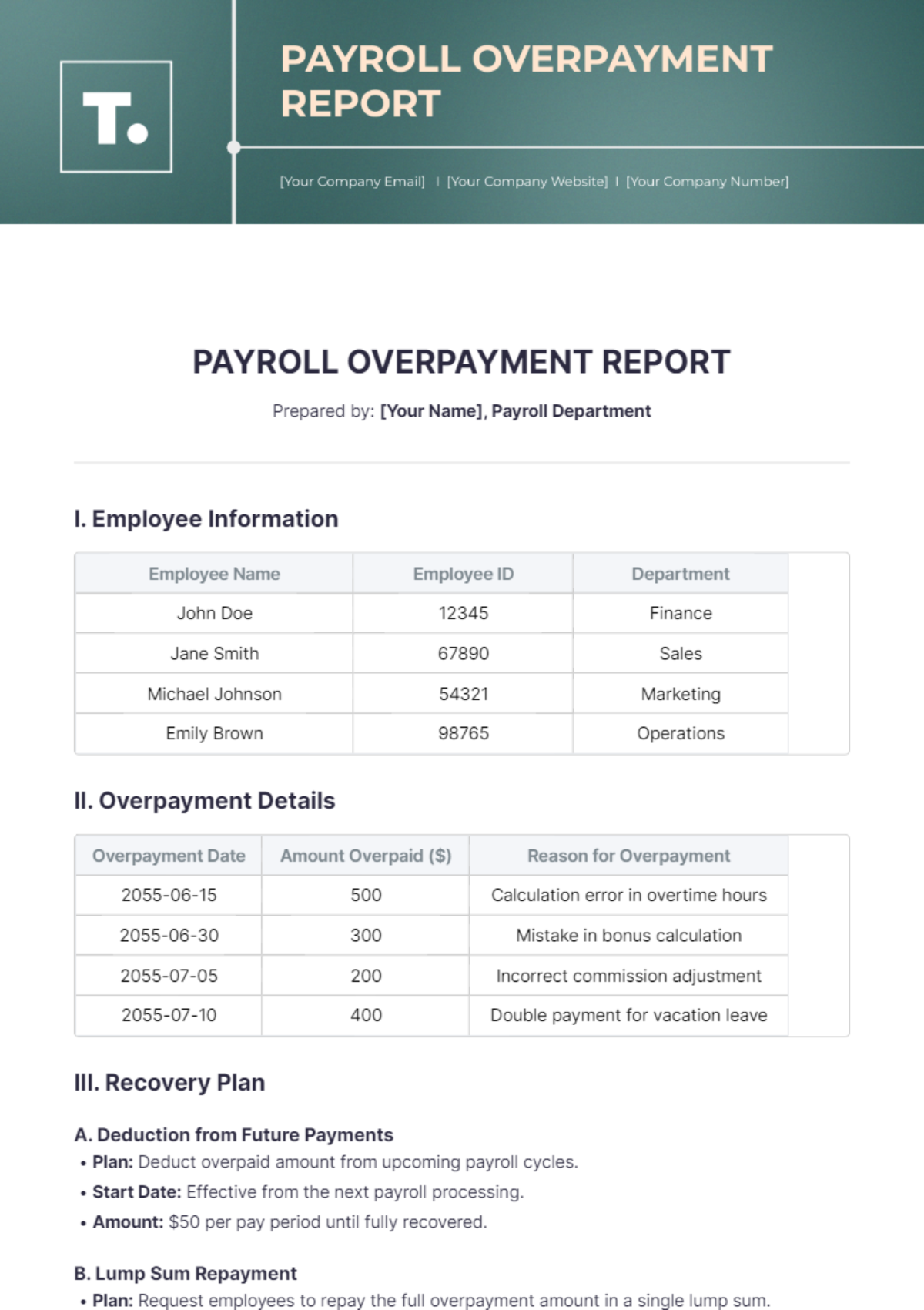

IV. Discrepancies and Resolutions

During the audit, a few minor discrepancies were identified and promptly resolved. The following issues were noted:

Overtime Calculation Error: Two employees in the IT department were found to have overtime hours incorrectly calculated. The error resulted in underpayment of $200.00 each. This was due to a manual entry mistake in the payroll system.

Resolution: The payroll system was updated to correct the overtime hours, and the underpaid amounts were included in the next payroll cycle. Additionally, an automated system check was implemented to prevent future manual entry errors.

Incorrect Tax Deductions: An employee in the Sales department had incorrect tax deductions due to a change in their tax status that was not updated in the system.

Resolution: The employee's tax status was updated in the payroll system, and the tax deductions were recalculated. The necessary adjustments were made to correct the deductions in the subsequent payroll period.

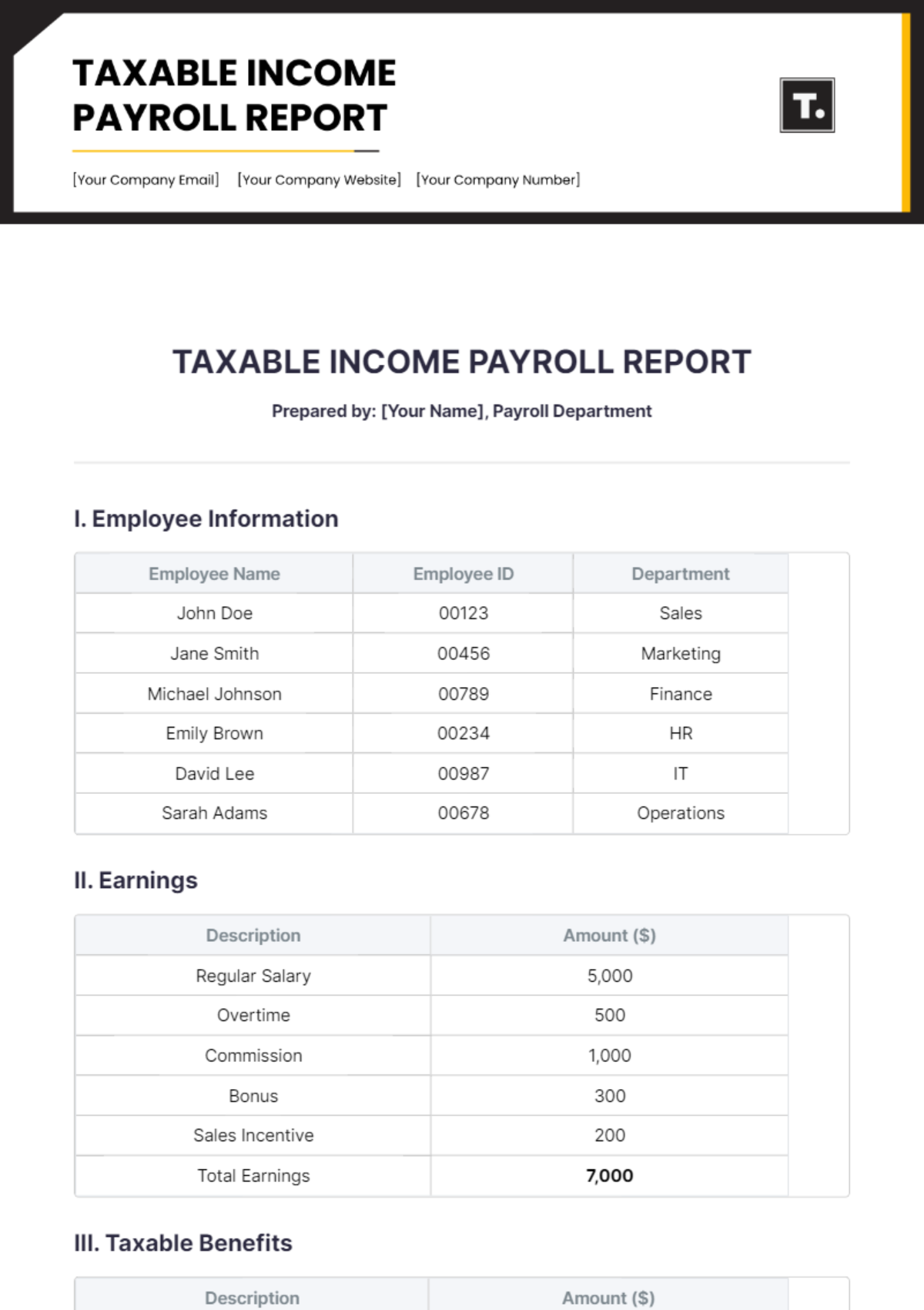

V. Compliance and Regulatory Review

Tax Withholding Compliance: All employee tax withholdings were verified to ensure they were in accordance with current tax laws and regulations. This included federal income tax, state income tax, and Social Security and Medicare taxes.

Findings: All tax withholdings were found to be accurate and compliant. The payroll system's tax tables were up-to-date, reflecting the latest tax rates and regulations.

Labor Law Adherence: Payroll practices were reviewed to ensure compliance with labor laws, including minimum wage requirements, overtime pay regulations, and timely payment of wages.

Findings: The company’s payroll processes were fully compliant with labor laws. Overtime pay was correctly calculated and paid, and all employees received their wages within the legally required time frame.

Audit Trail and Reporting: The audit confirmed that the payroll system maintained a clear and detailed audit trail of all payroll transactions, changes, and approvals.

Findings: The audit trail was comprehensive, documenting all payroll activities, including edits, approvals, and processing dates. This ensured transparency and accountability in payroll operations.

VI. Recommendations

Continue regular audits to maintain accuracy and compliance.

Implement additional training for payroll staff to stay updated on regulatory changes.

Enhance payroll software to automate compliance checks.

Prepared by:

[Your Name]

Auditor