Combined Payroll Audit Report

I. Overview

The Combined Payroll Audit for [Quarter] [Year] was conducted to review and verify the accuracy and compliance of payroll processing across multiple departments and pay periods within [Your Company Name]. The audit aims to ensure that all payroll components, including salaries, deductions, and benefits, are correctly processed and compliant with legal standards.

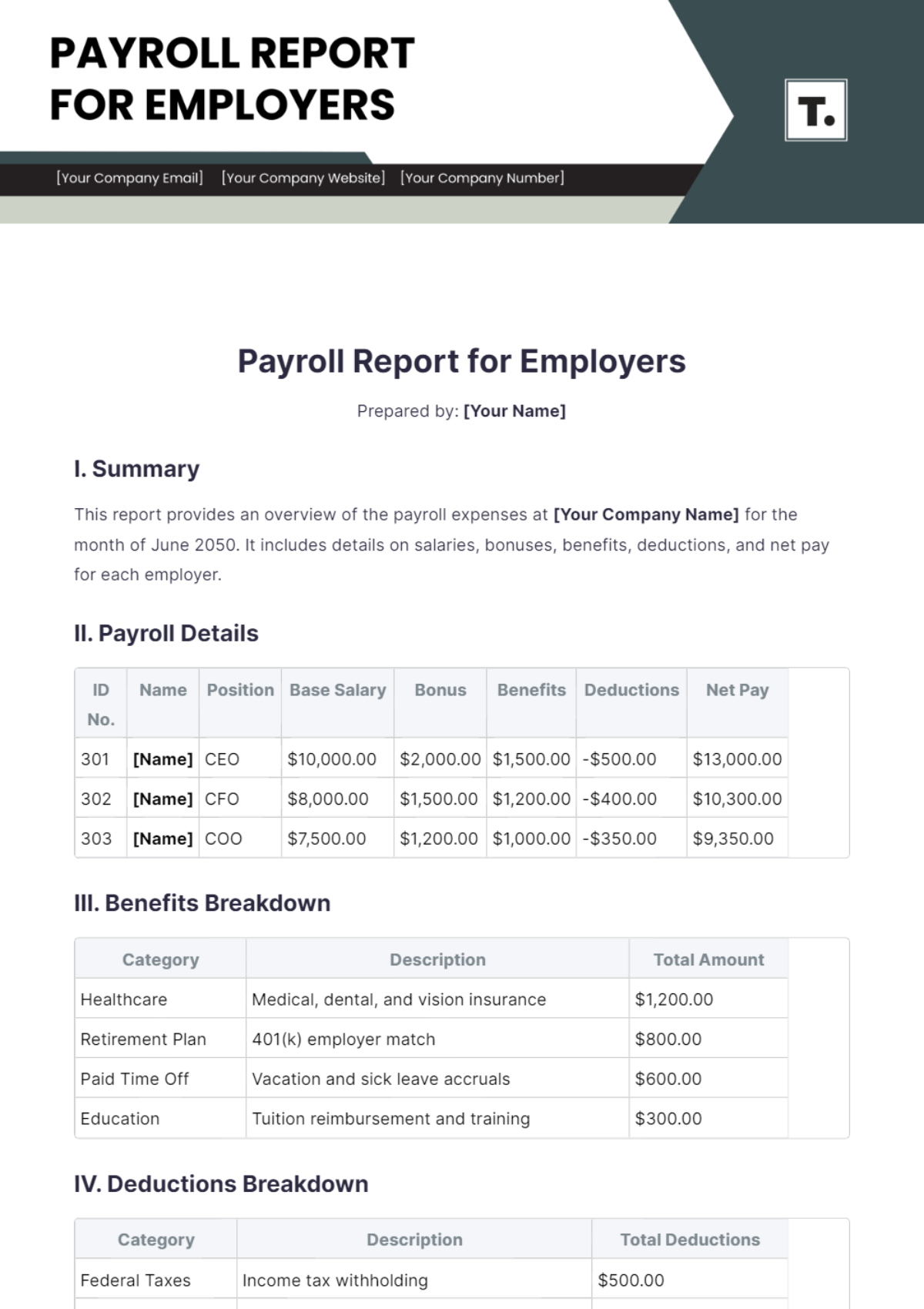

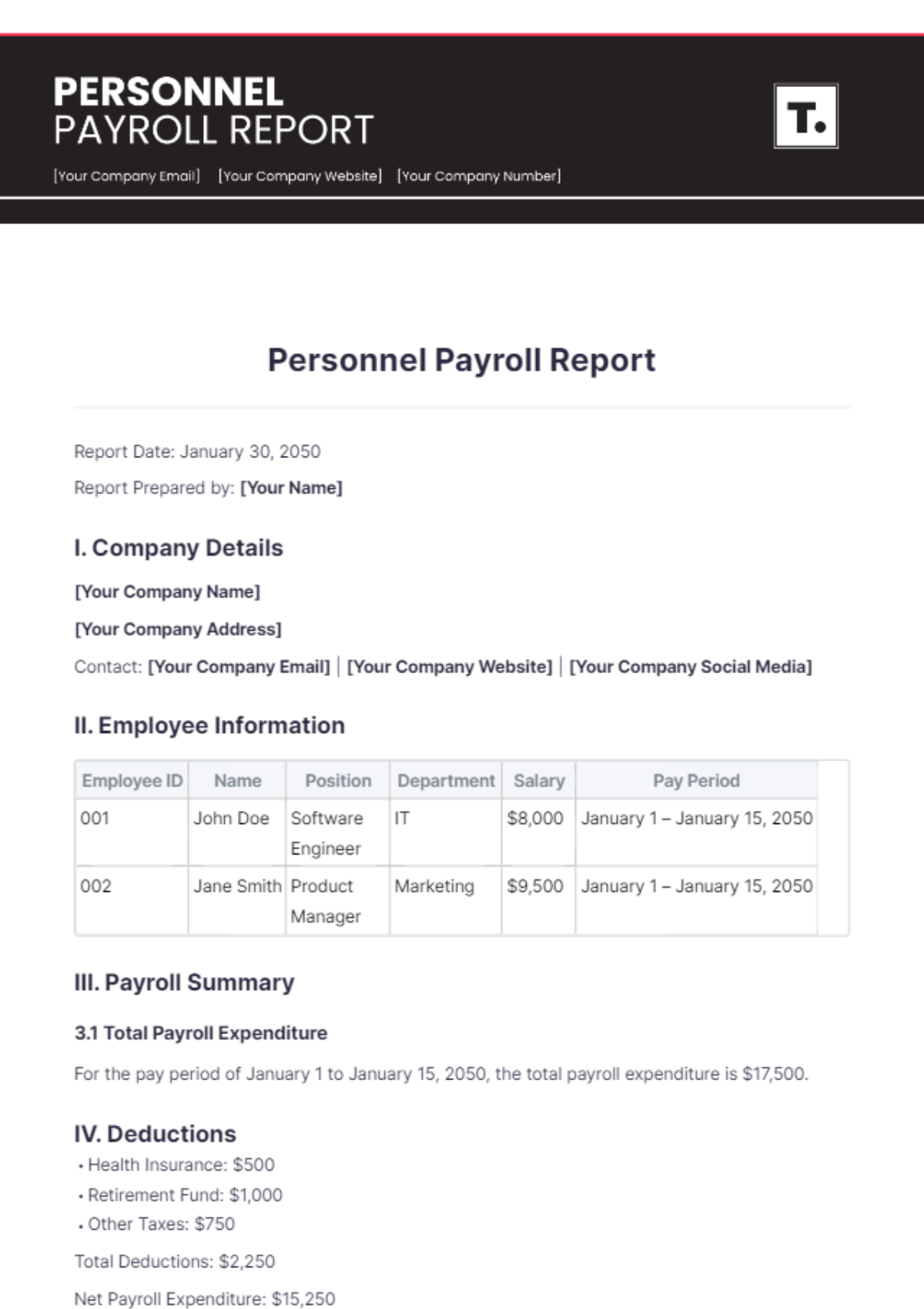

II. Audit Summary

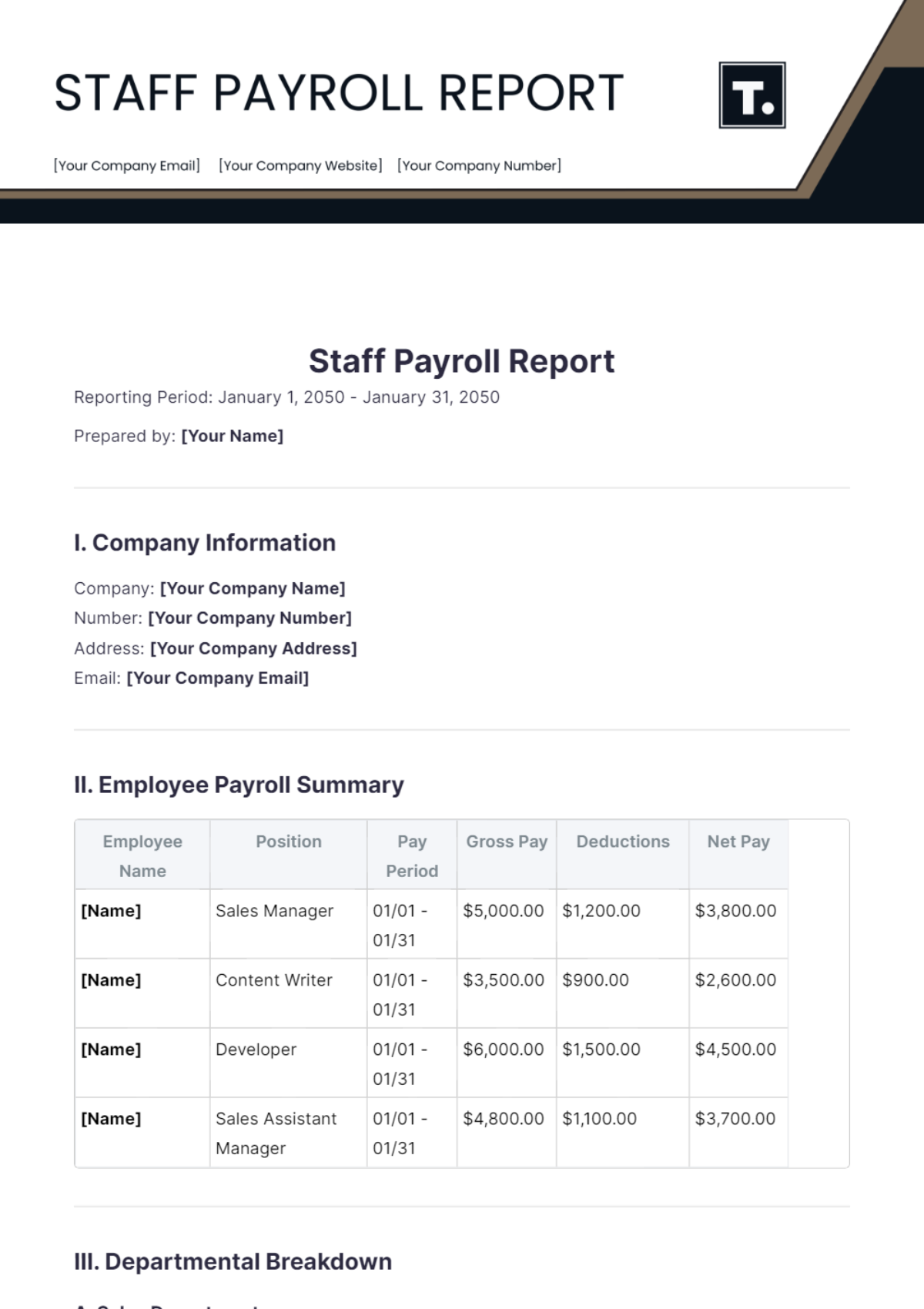

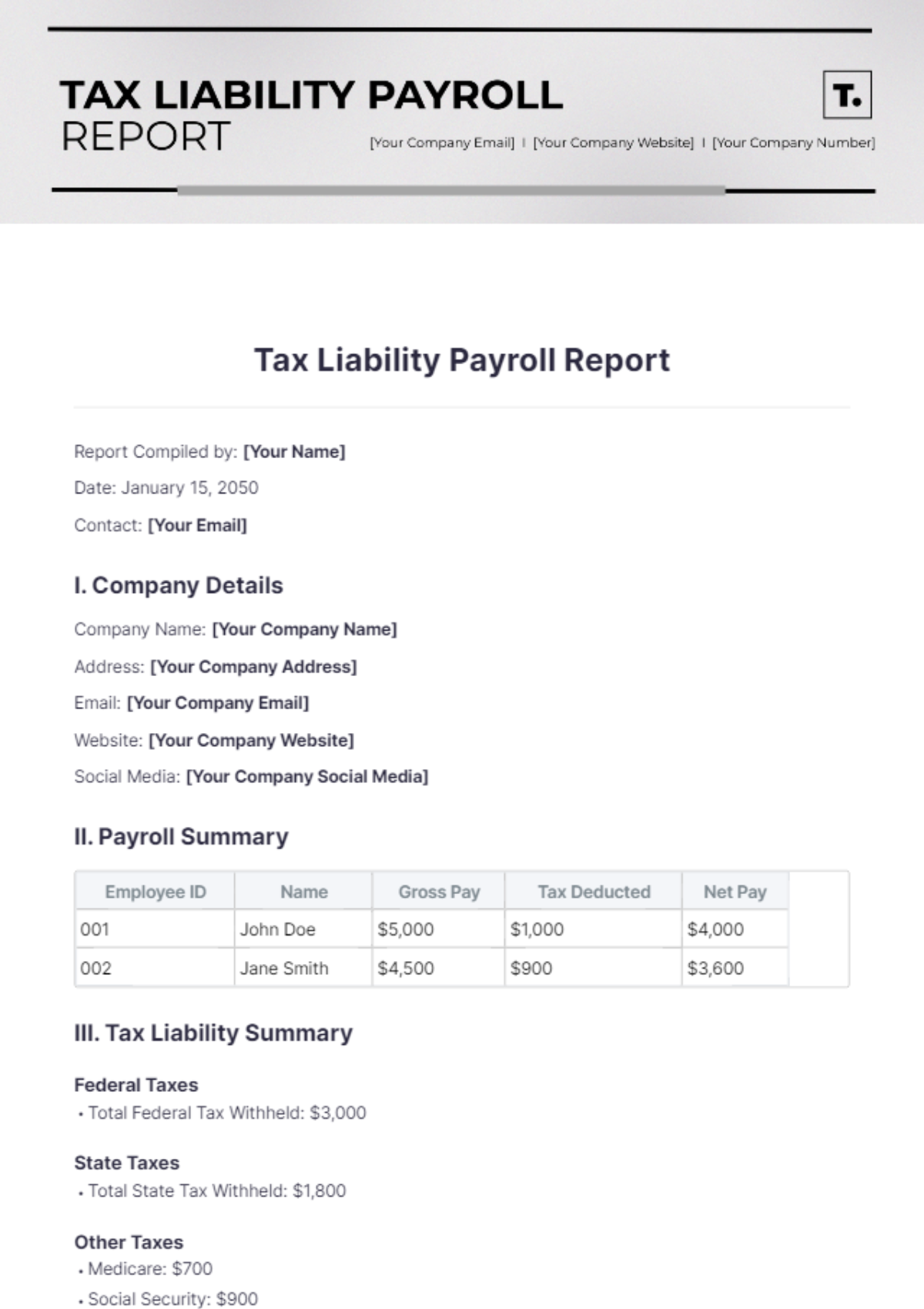

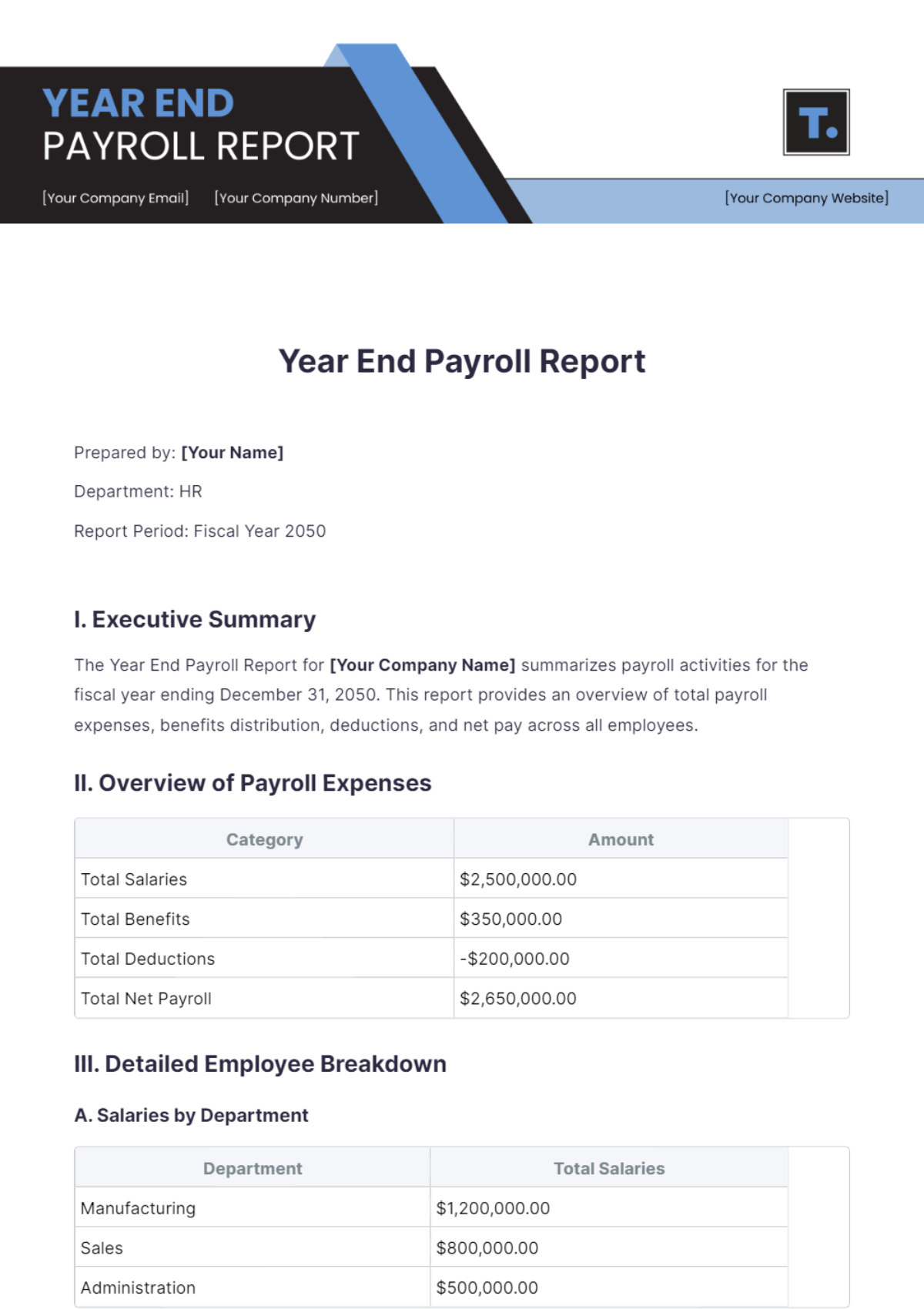

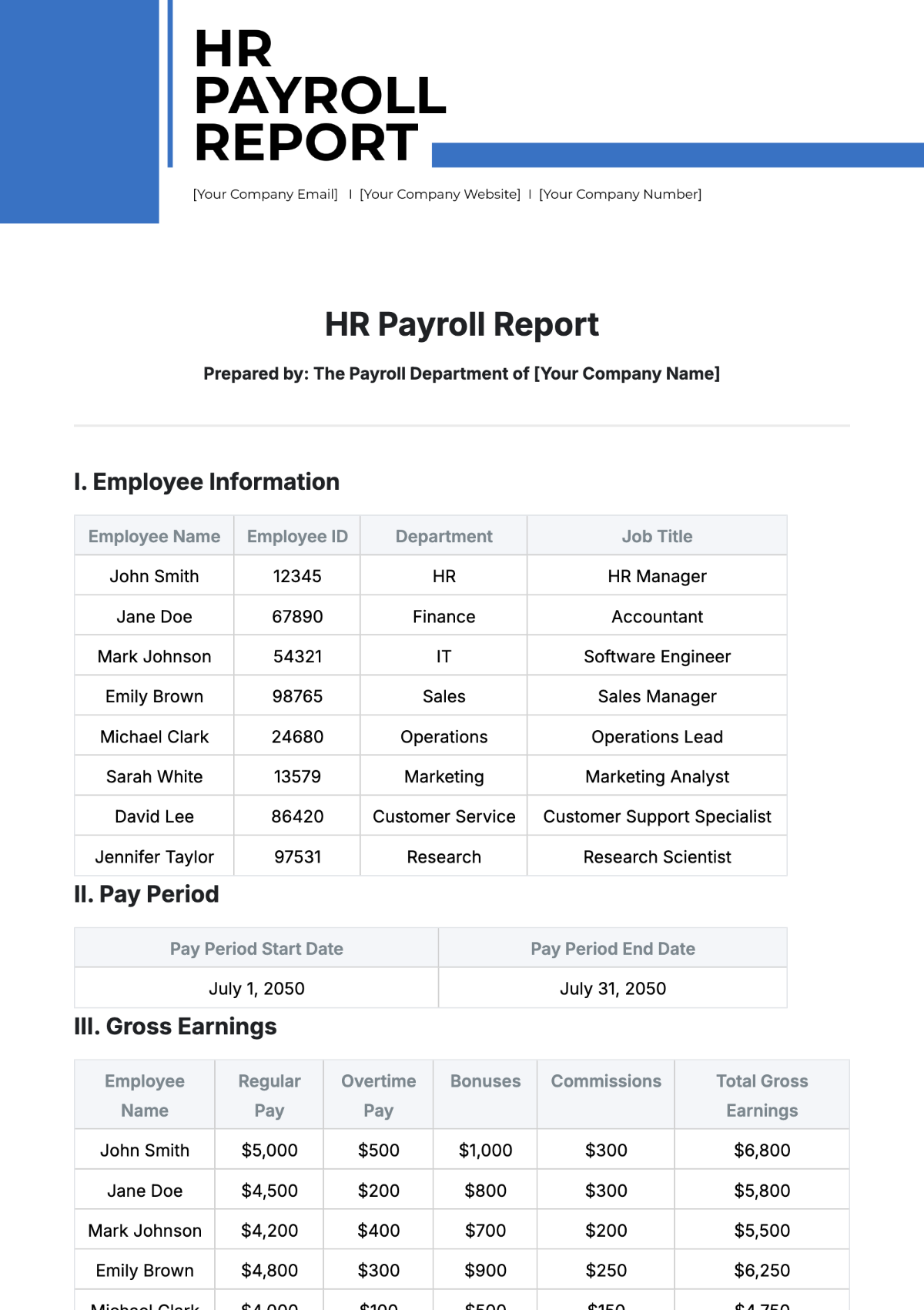

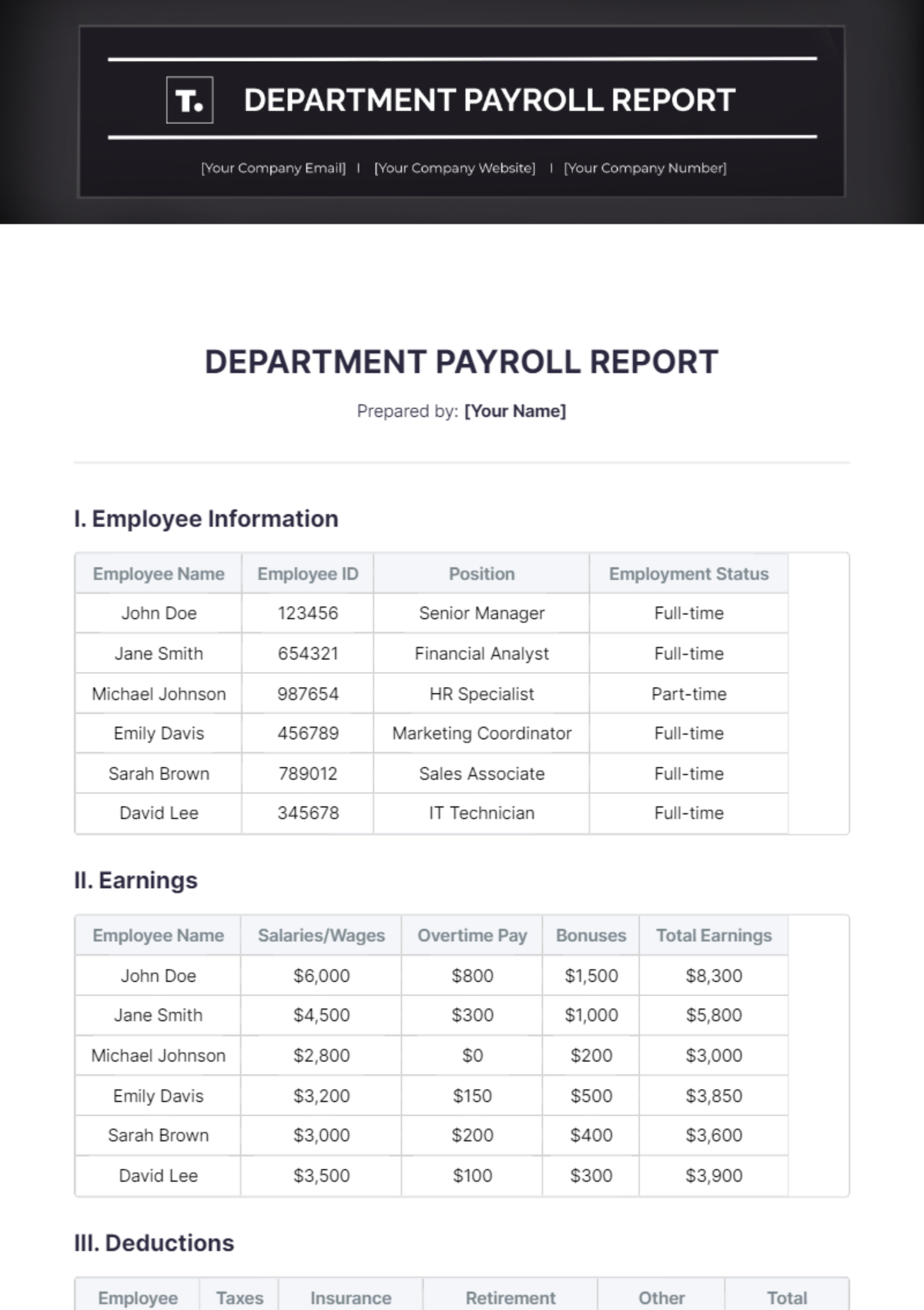

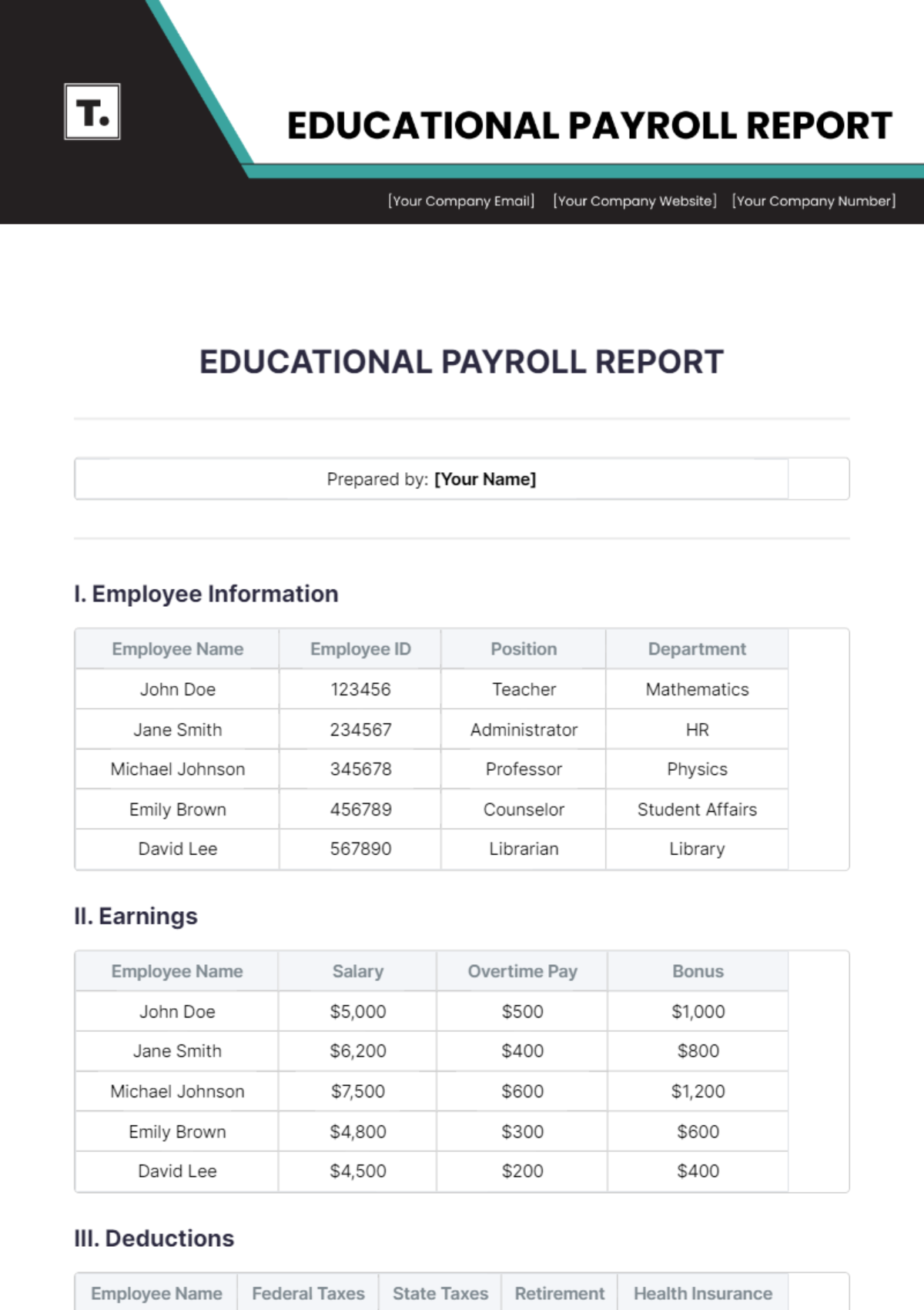

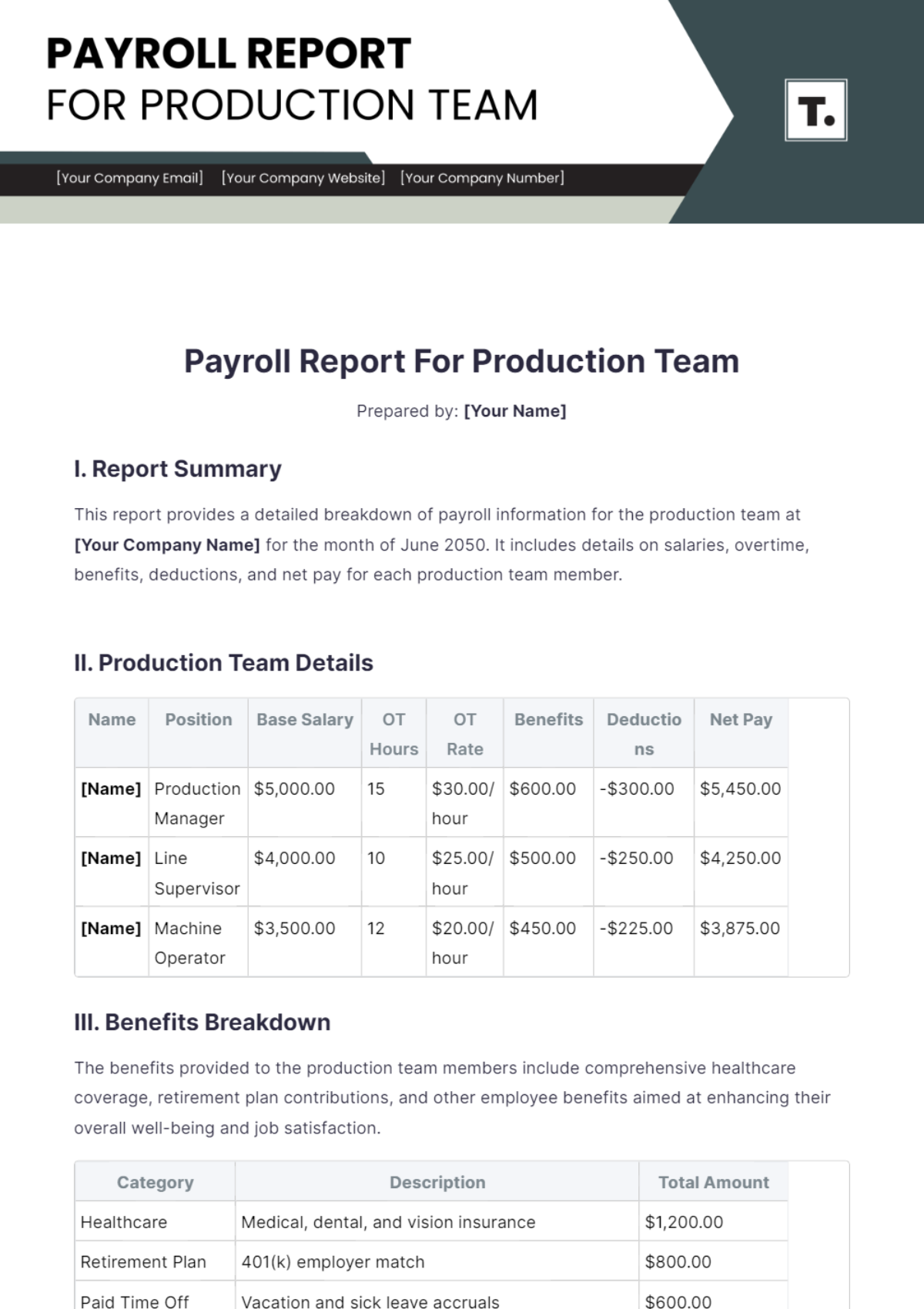

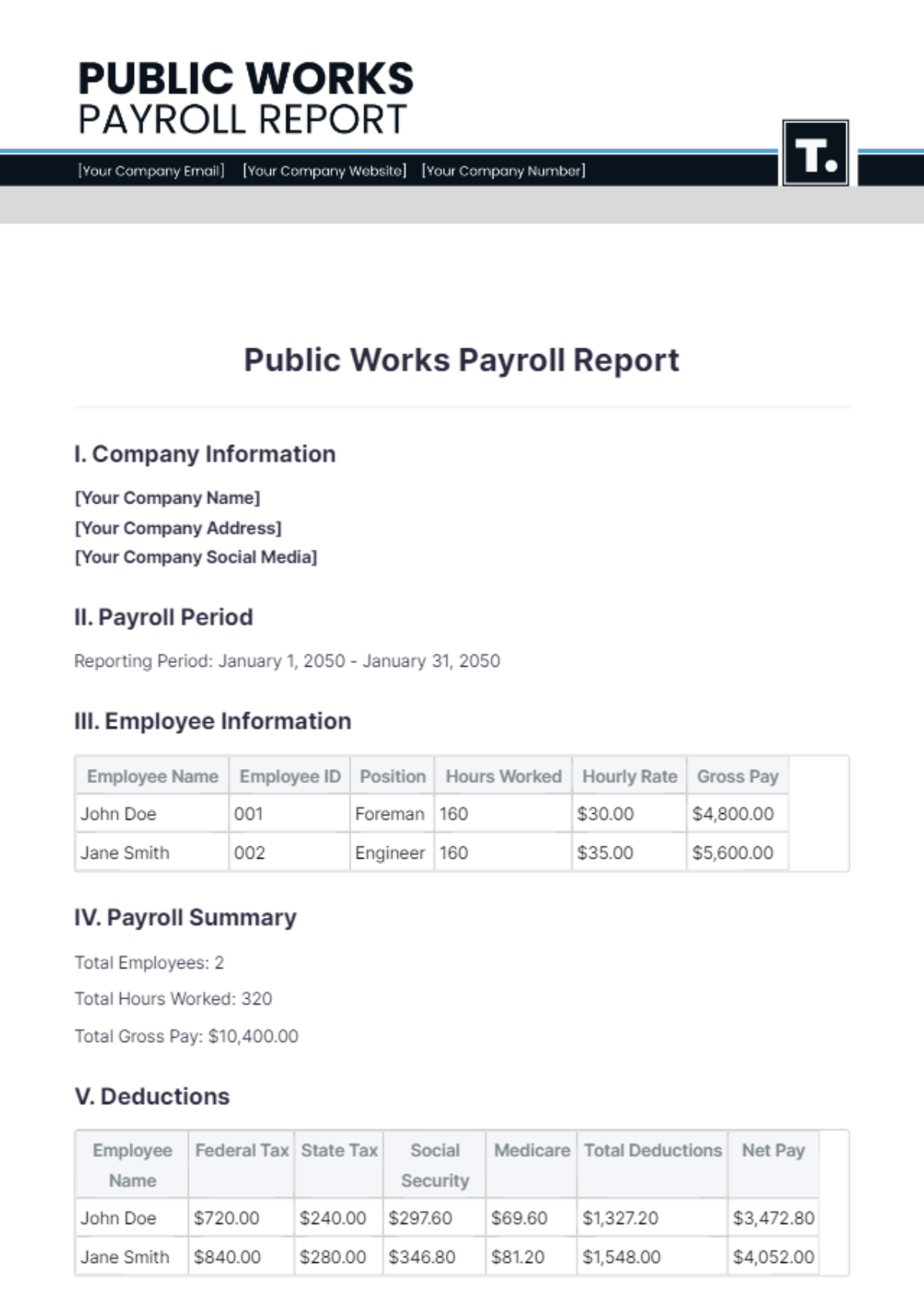

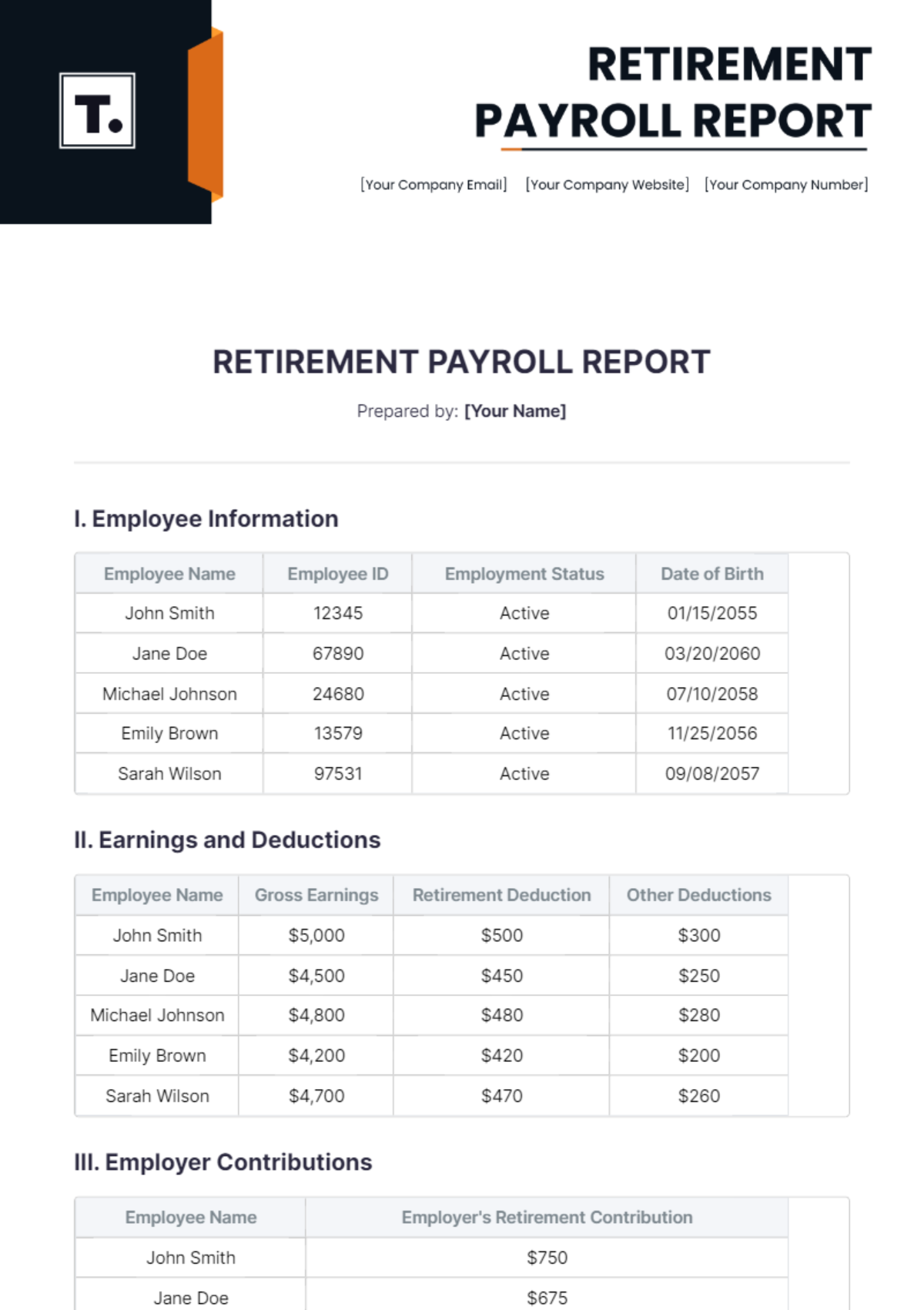

Department | Total Employees | Gross Pay | Deductions | Net Pay | Audit Status |

|---|---|---|---|---|---|

Sales | 5 | $75,000.00 | $18,000.00 | $57,000.00 | Passed |

Marketing | 4 | $56,000.00 | $14,000.00 | $42,000.00 | Passed |

IT | 6 | $108,000.00 | $27,000.00 | $81,000.00 | Passed |

HR | 3 | $43,200.00 | $10,800.00 | $32,400.00 | Passed |

III. Payroll Components Verification

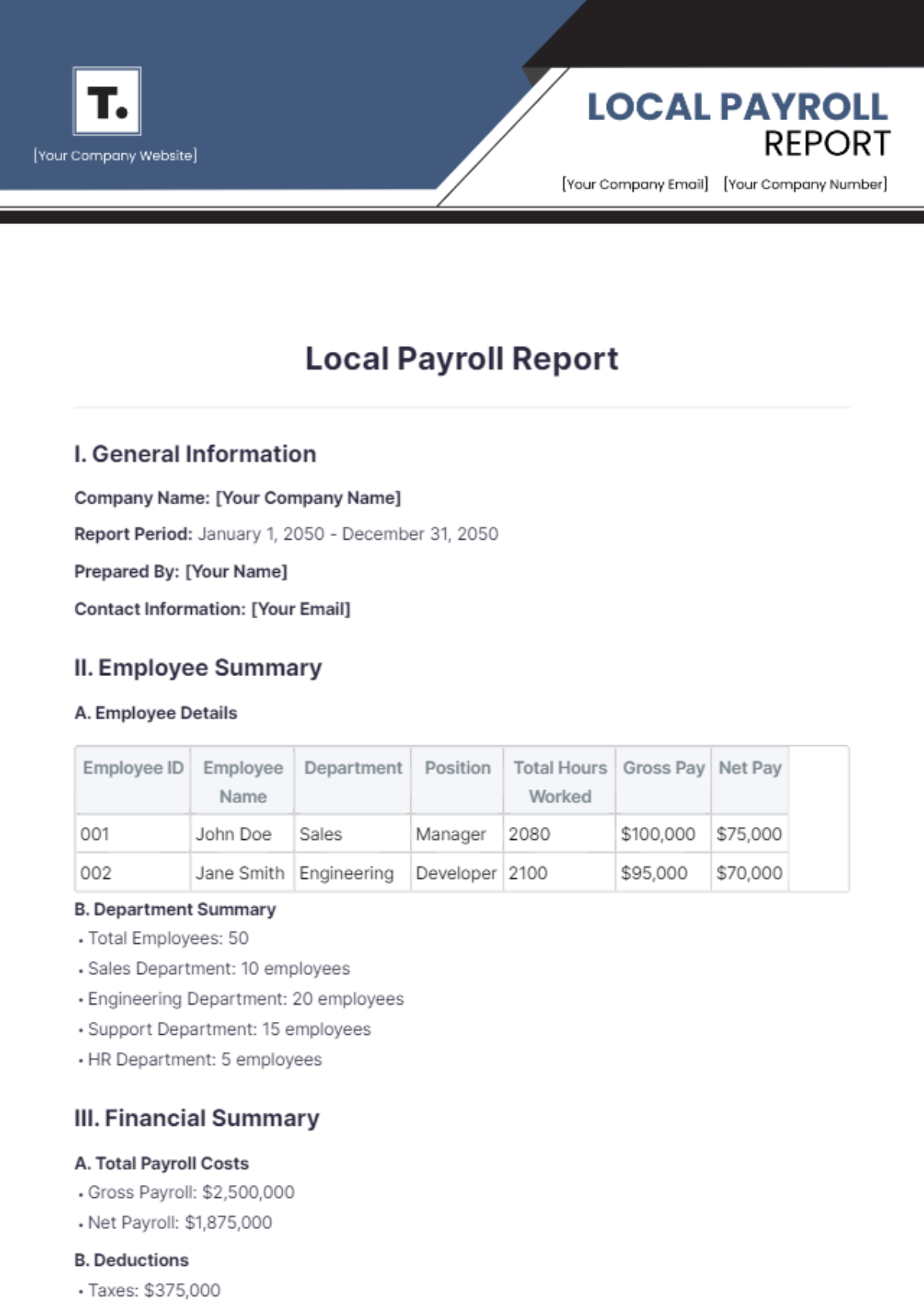

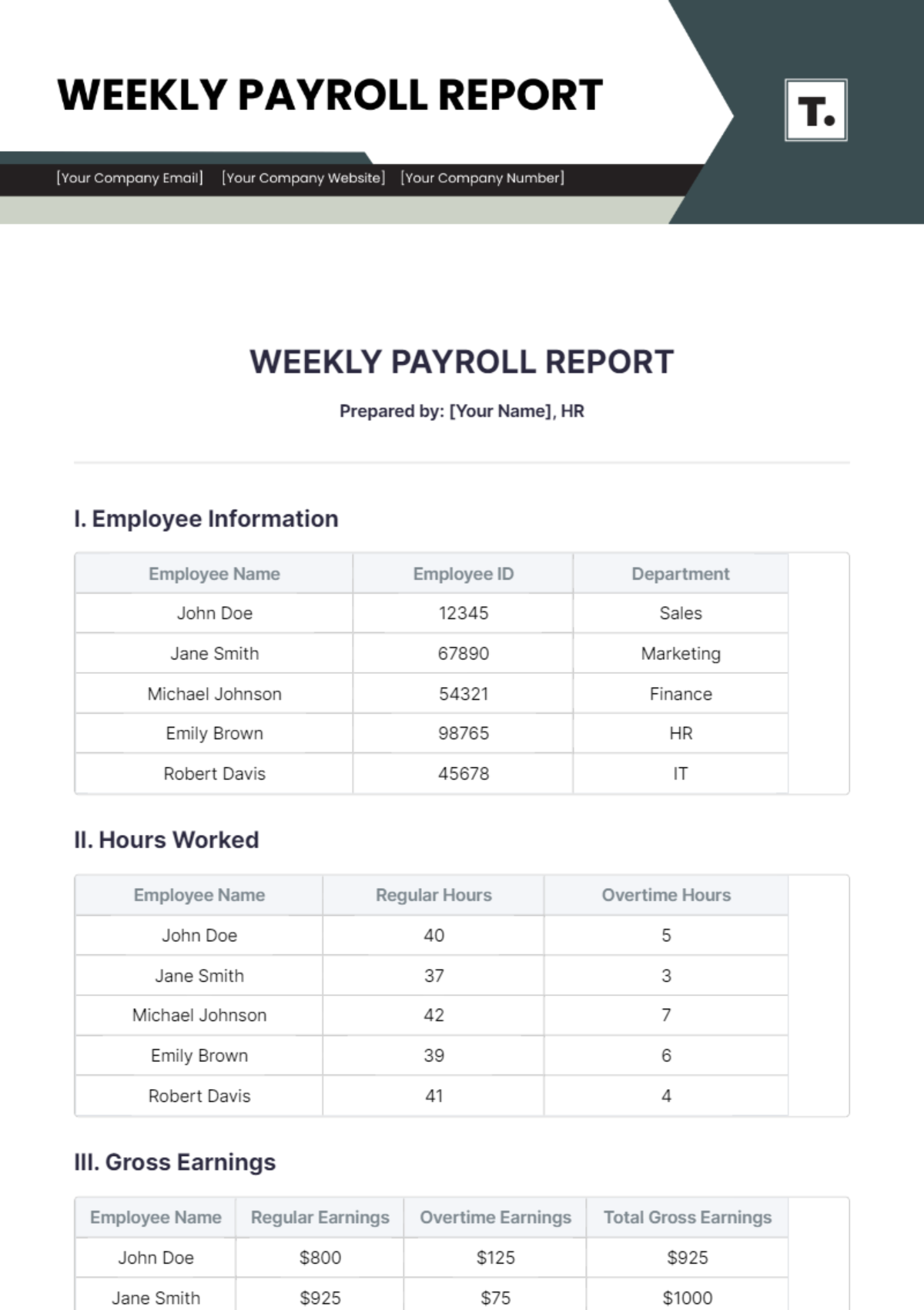

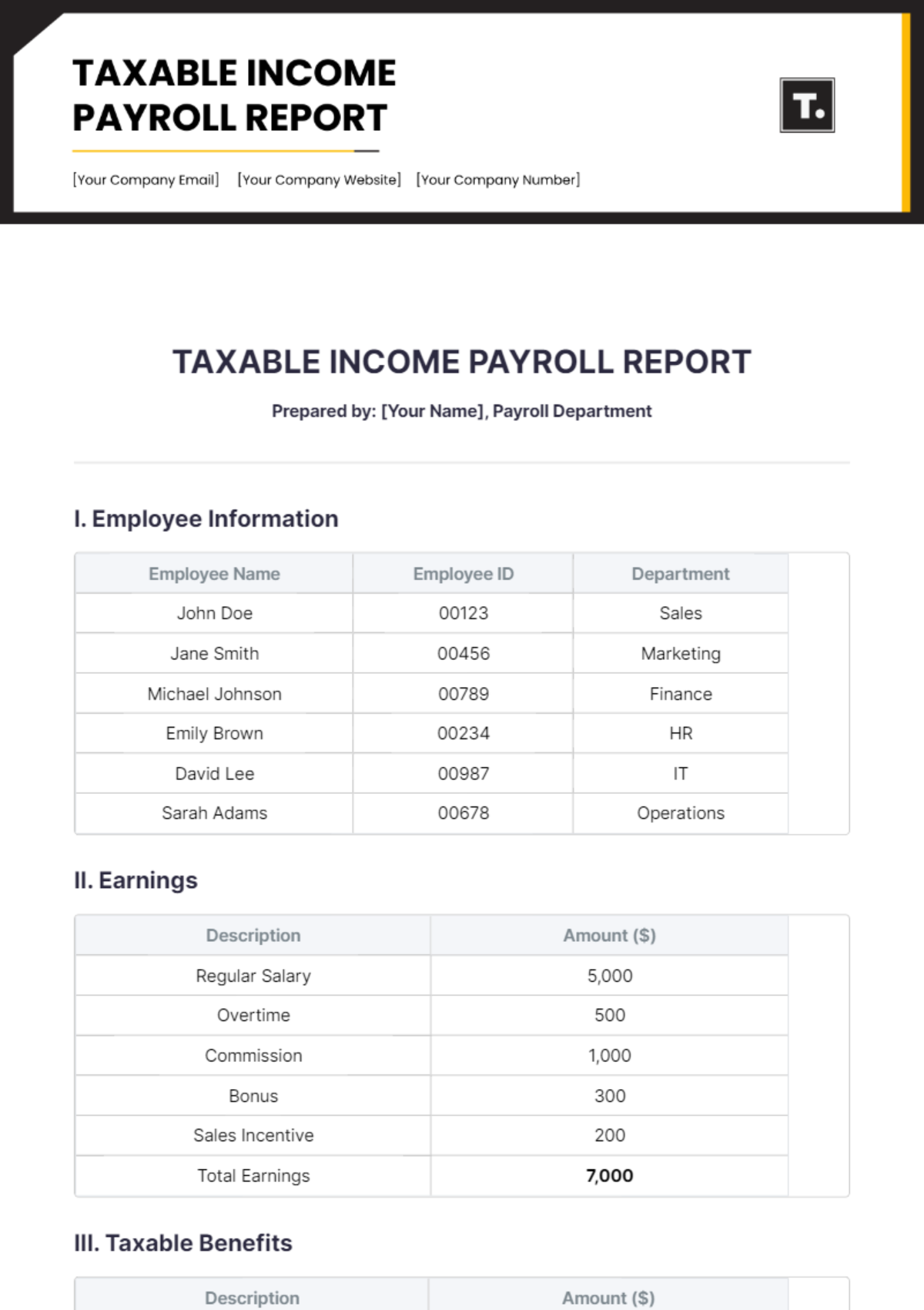

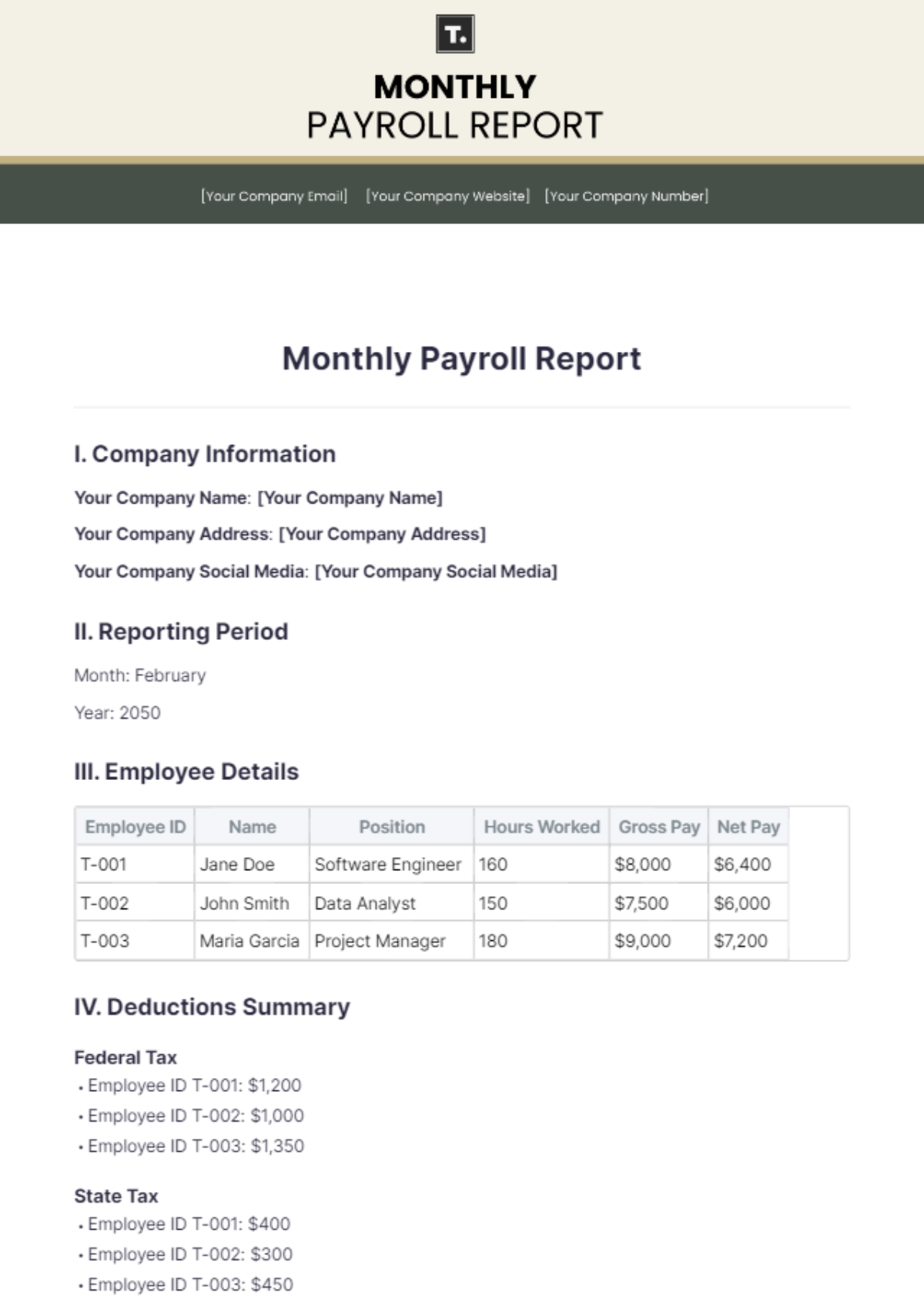

A. Salaries and Wages

All salaries and wages across departments for the period were reviewed and confirmed to match employment agreements and documented work hours.

B. Deductions

All deductions, including taxes, health insurance, and retirement contributions, were verified to ensure compliance with legal requirements and company policies.

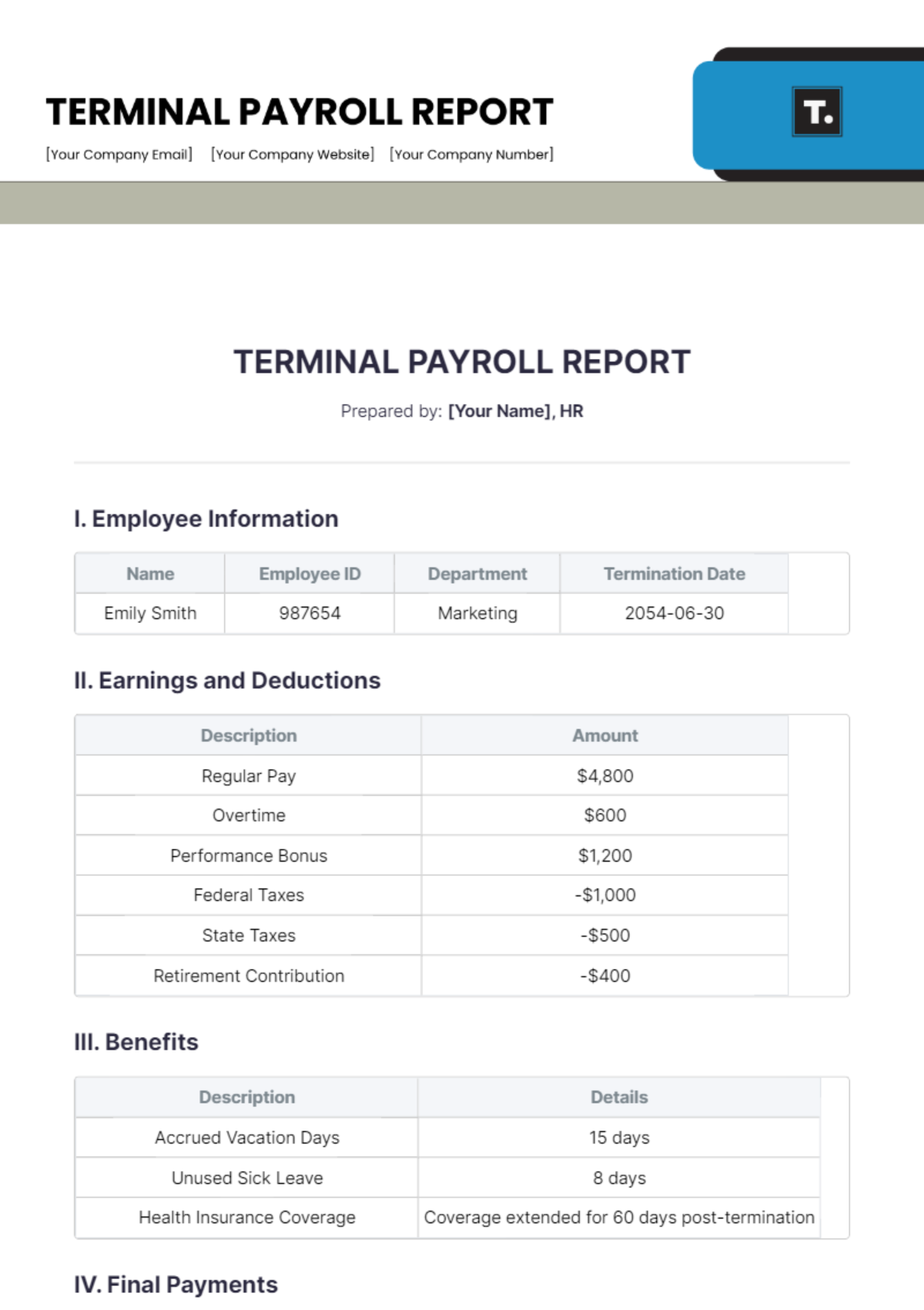

C. Benefits and Bonuses

Benefits and bonuses were reviewed and confirmed to be accurately applied. The total benefits provided amounted to $18,000.00, and bonuses totaled $10,000.00 across all departments.

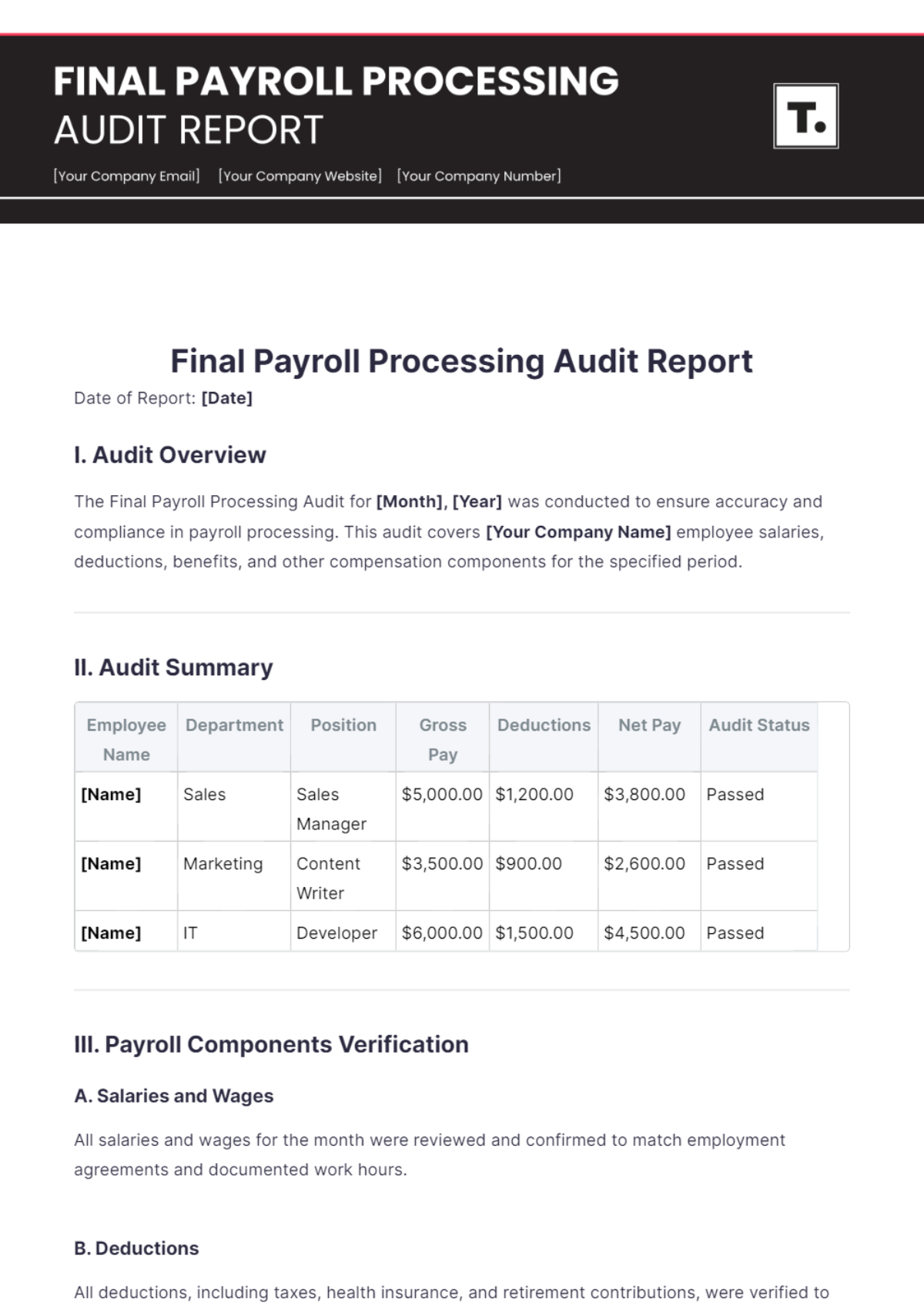

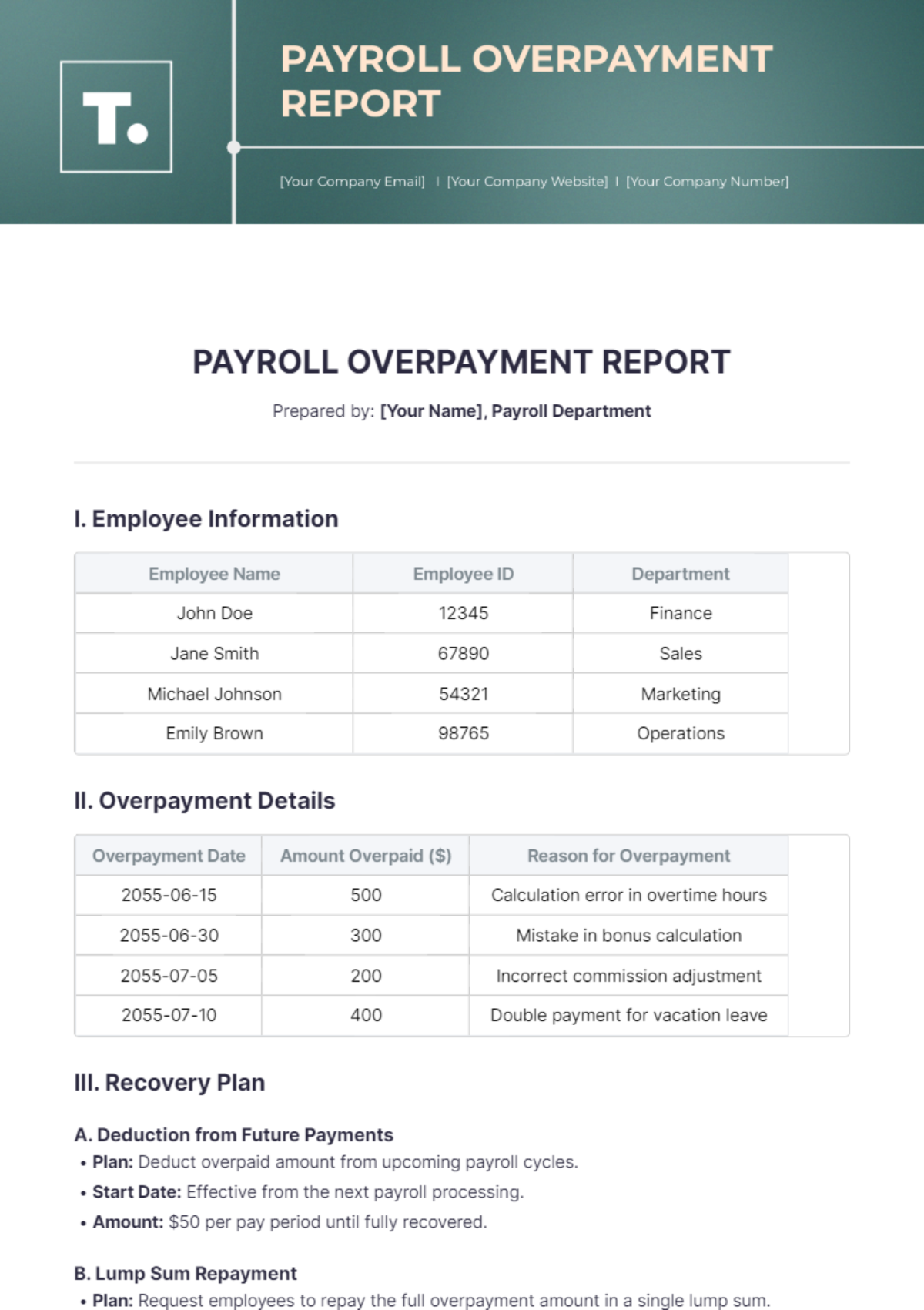

IV. Discrepancies and Resolutions

No major discrepancies were identified during the audit. Minor adjustments were made for two employees in the Marketing department due to incorrect overtime calculations, which were promptly corrected.

V. Compliance and Regulatory Review

During this audit, a thorough review of payroll compliance with federal, state, and local laws was conducted. All payroll practices were found to be in full compliance with legal standards, ensuring no risk of penalties or legal issues.

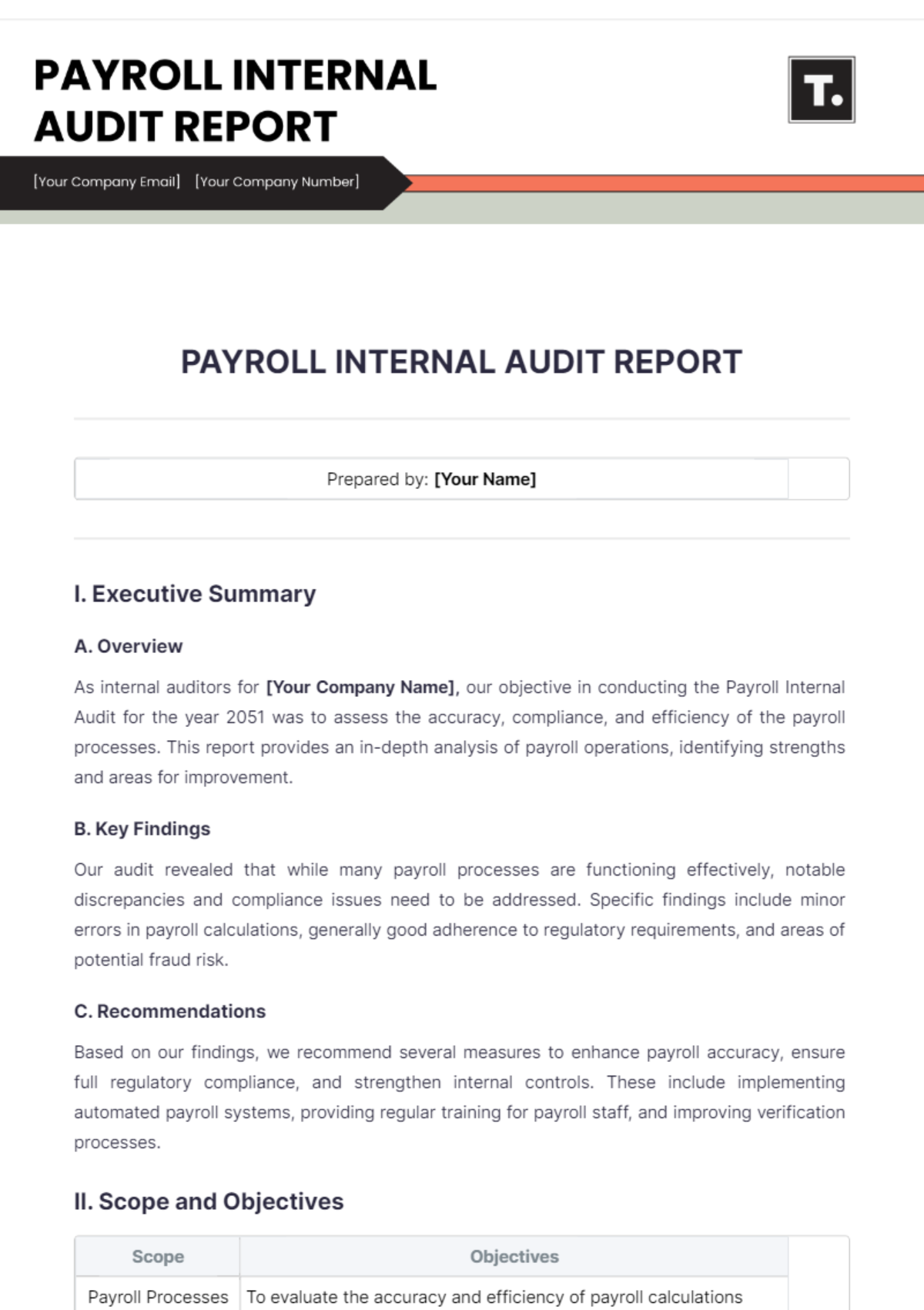

VI. Recommendations

Implement periodic training sessions for payroll staff to stay updated on regulatory changes.

Invest in advanced payroll software to enhance accuracy and automate compliance checks.

Conduct quarterly internal audits to preemptively identify and rectify any potential issues.

VII. Continuous Improvement

To ensure ongoing payroll accuracy and compliance, it is recommended to implement a continuous improvement plan. This plan should include regular audits, staff training, and updates to payroll processing systems to adapt to new regulations and best practices. Continuous monitoring and improvement will help maintain the integrity and efficiency of payroll operations.

VIII. Conclusion

The Combined Payroll Audit Report for [Quarter] [Year] demonstrates that [Your Company Name]'s payroll processes are robust, accurate, and compliant with all relevant regulations. The audit did not reveal any significant issues, reflecting the effectiveness of the current payroll system and practices. By maintaining these standards and implementing the recommended improvements, the company can ensure continued compliance and operational excellence in payroll management.

Audit Conducted by:

[Your Name]

[Date]