PAYROLL INTERNAL AUDIT REPORT

Prepared by: [Your Name] |

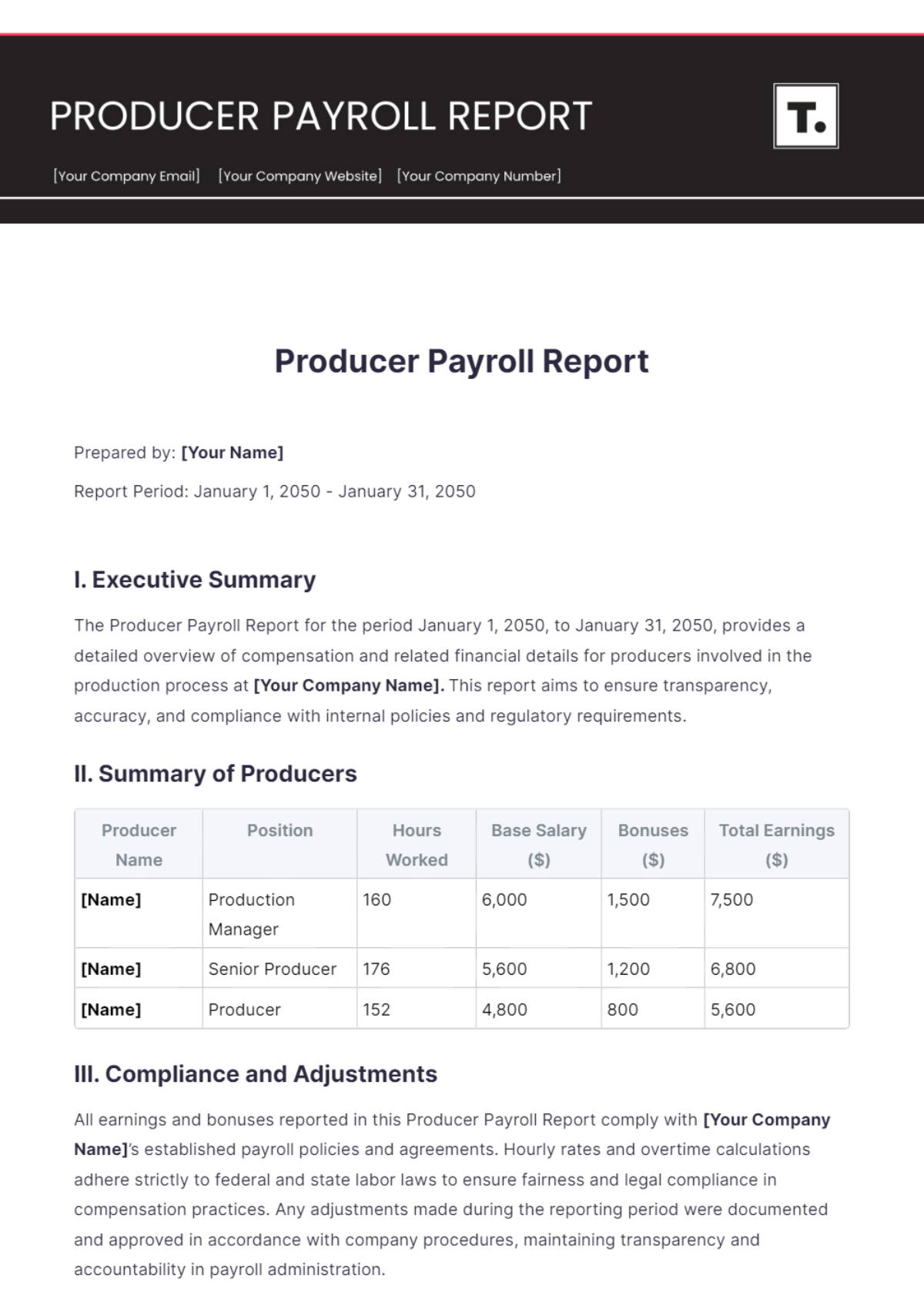

I. Executive Summary

A. Overview

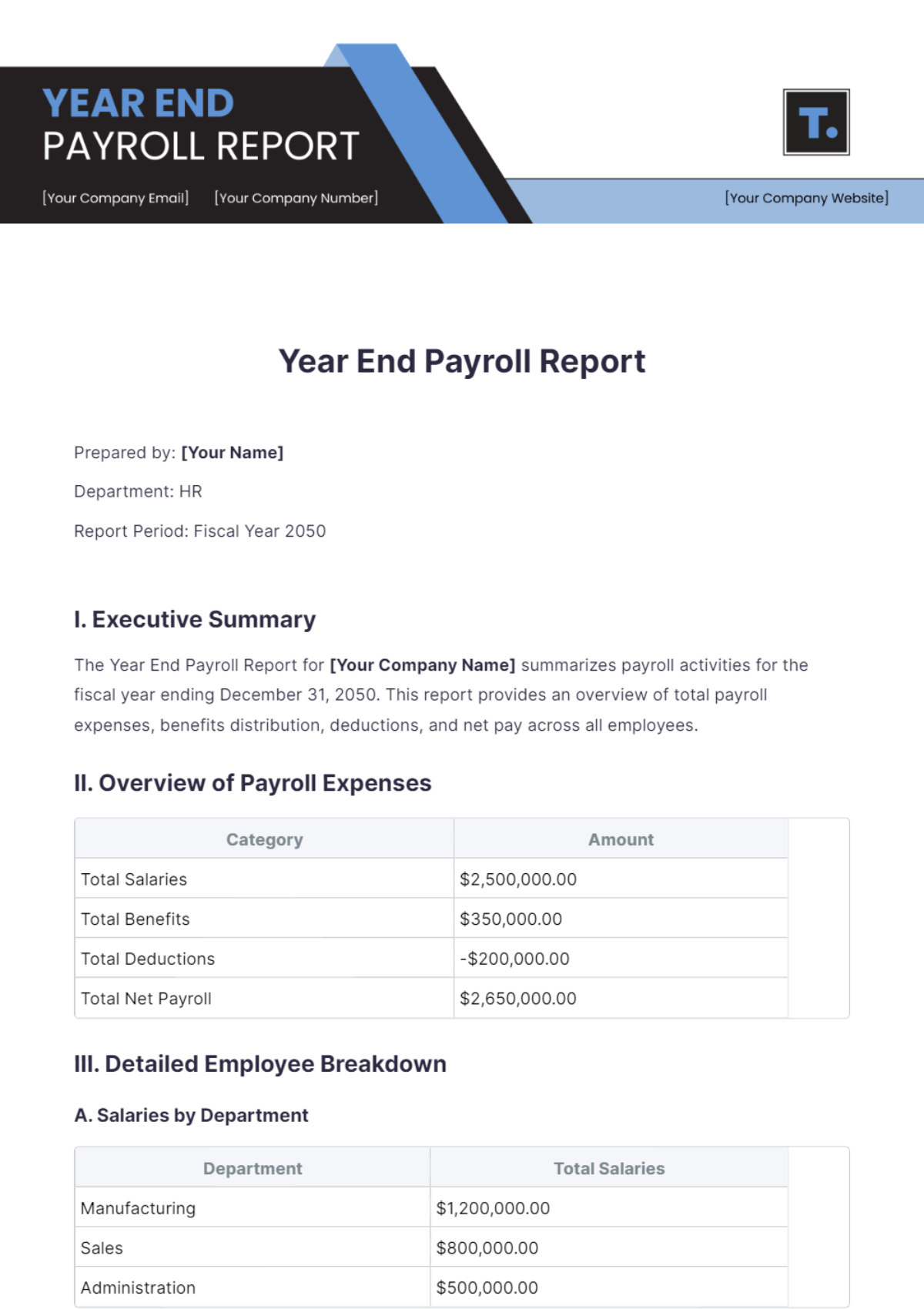

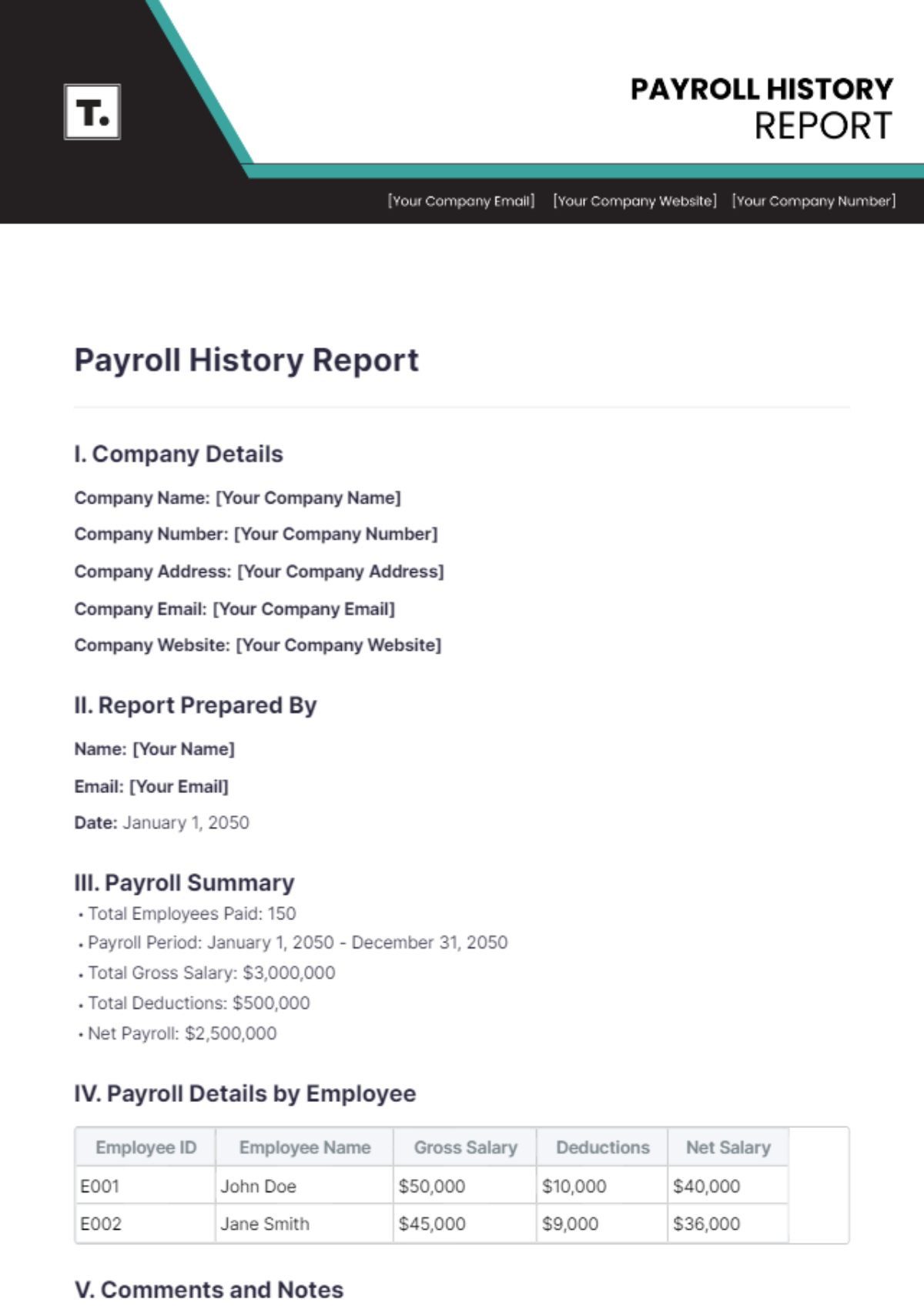

As internal auditors for [Your Company Name], our objective in conducting the Payroll Internal Audit for the year 2051 was to assess the accuracy, compliance, and efficiency of the payroll processes. This report provides an in-depth analysis of payroll operations, identifying strengths and areas for improvement.

B. Key Findings

Our audit revealed that while many payroll processes are functioning effectively, notable discrepancies and compliance issues need to be addressed. Specific findings include minor errors in payroll calculations, generally good adherence to regulatory requirements, and areas of potential fraud risk.

C. Recommendations

Based on our findings, we recommend several measures to enhance payroll accuracy, ensure full regulatory compliance, and strengthen internal controls. These include implementing automated payroll systems, providing regular training for payroll staff, and improving verification processes.

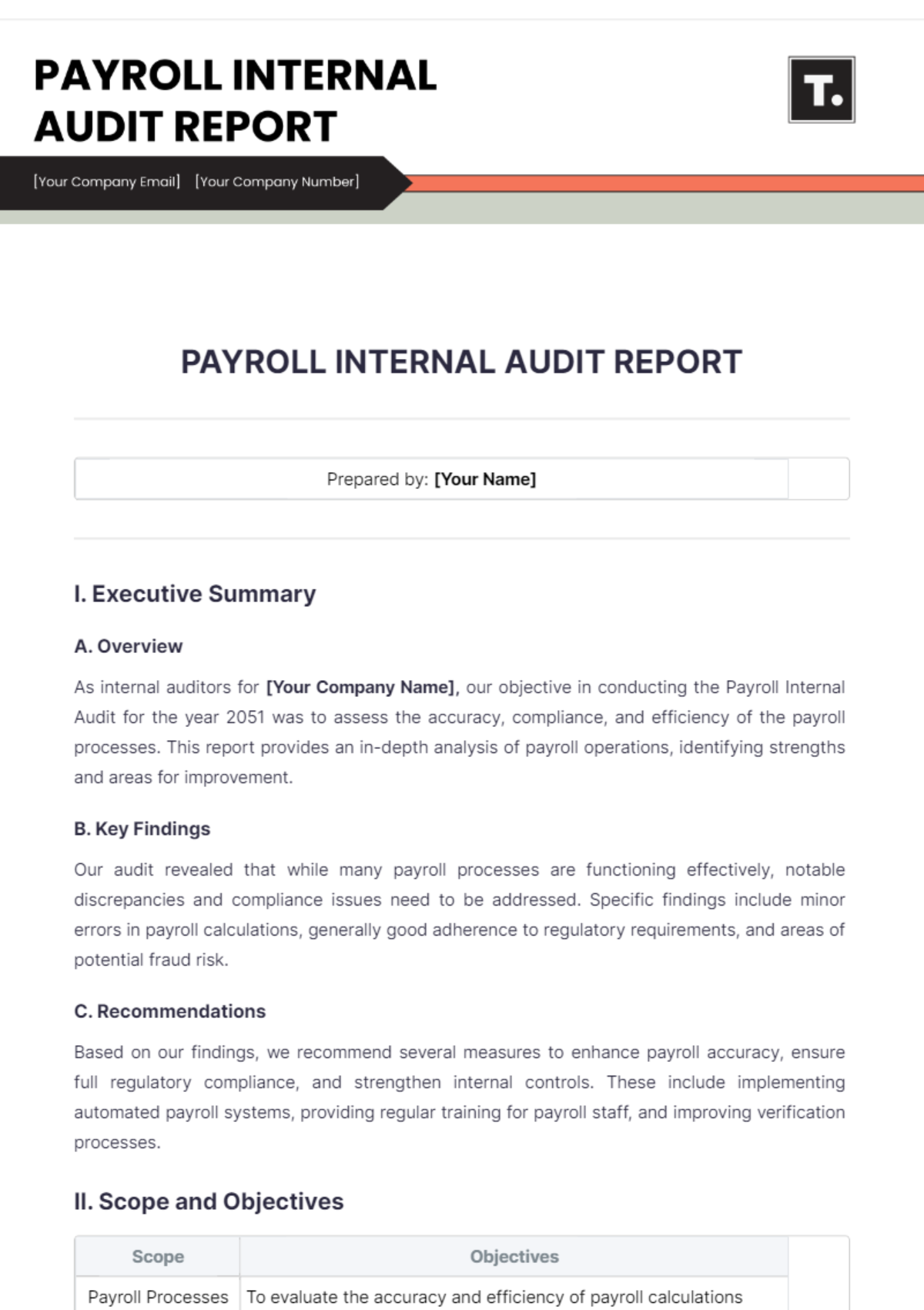

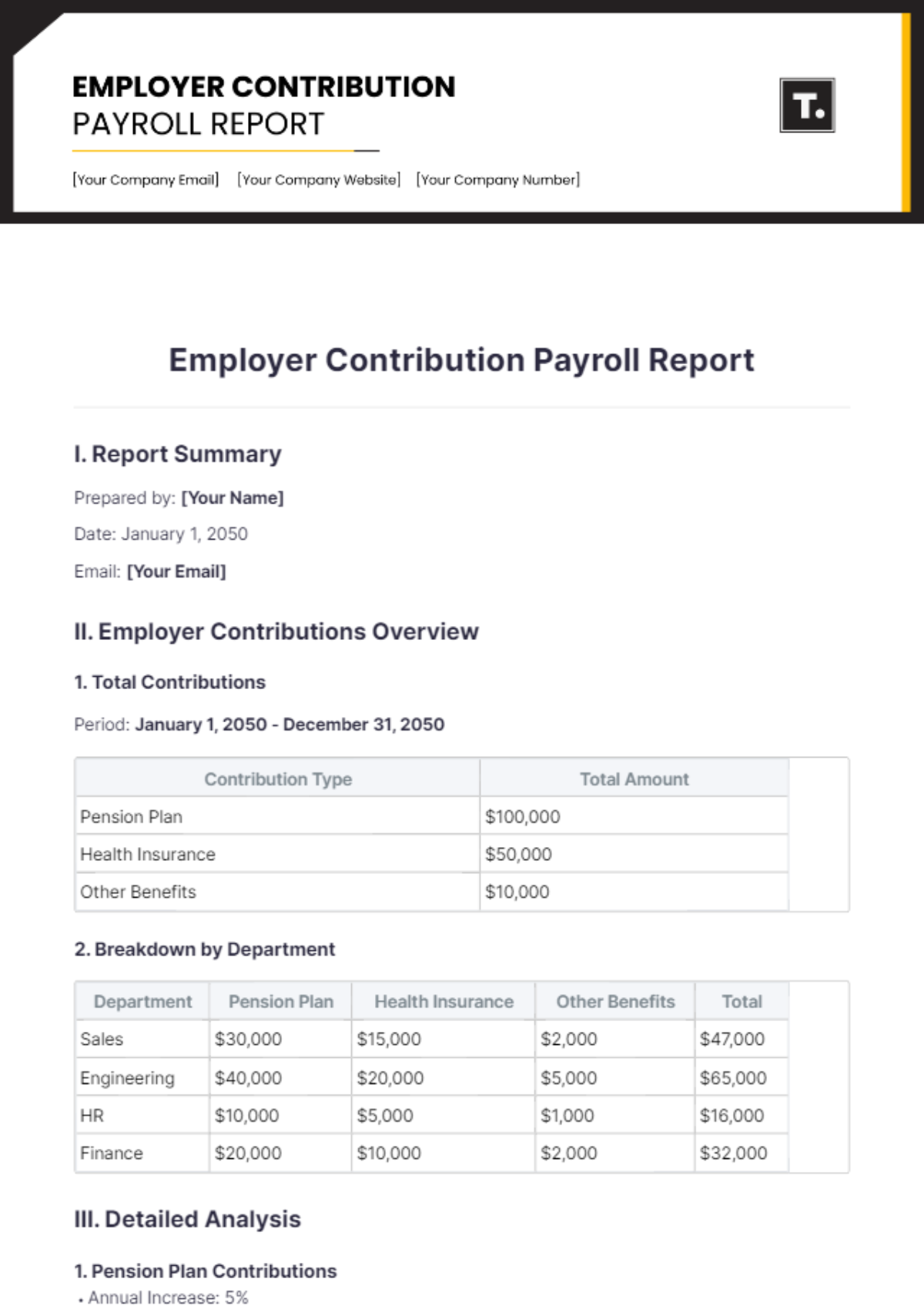

II. Scope and Objectives

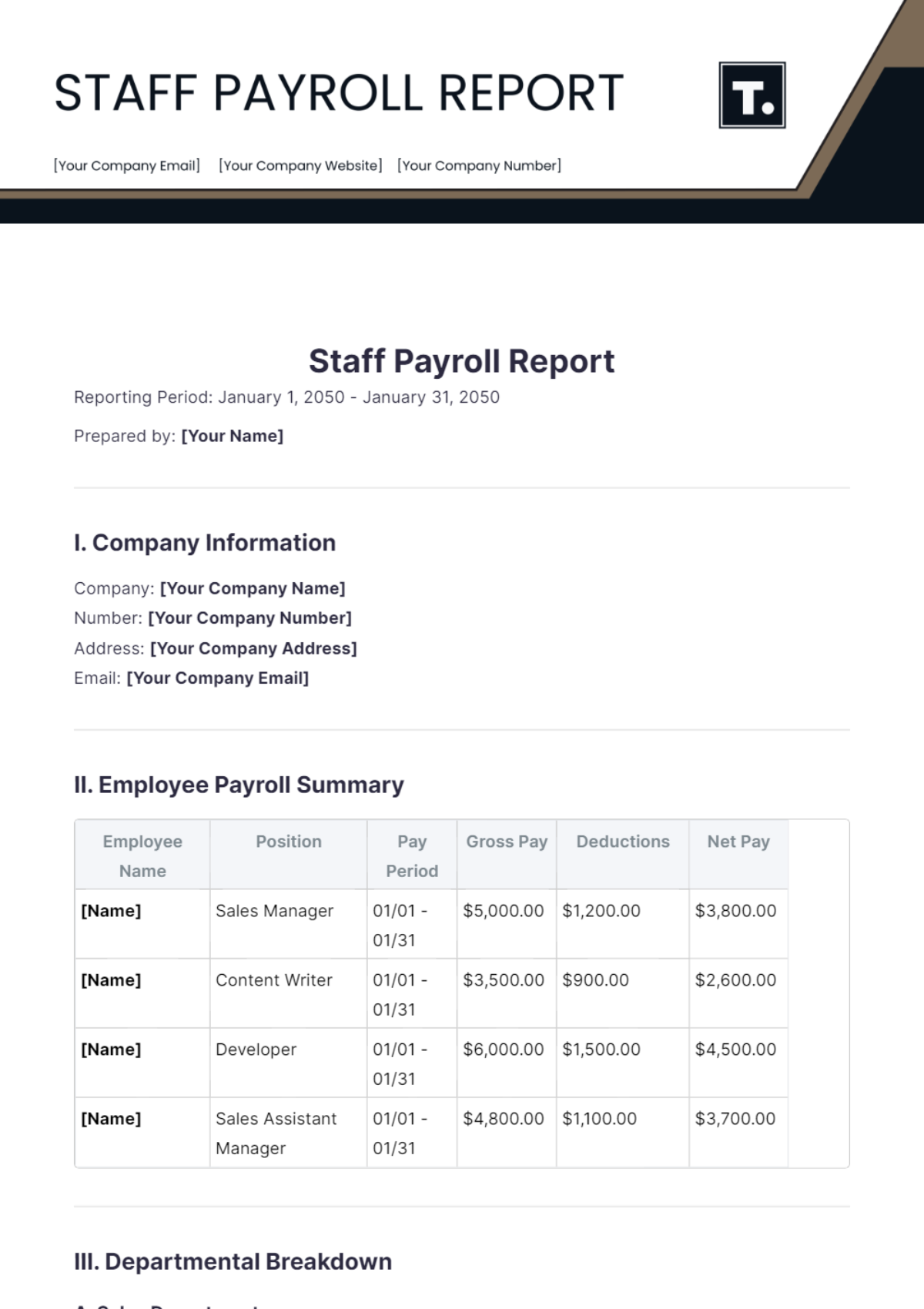

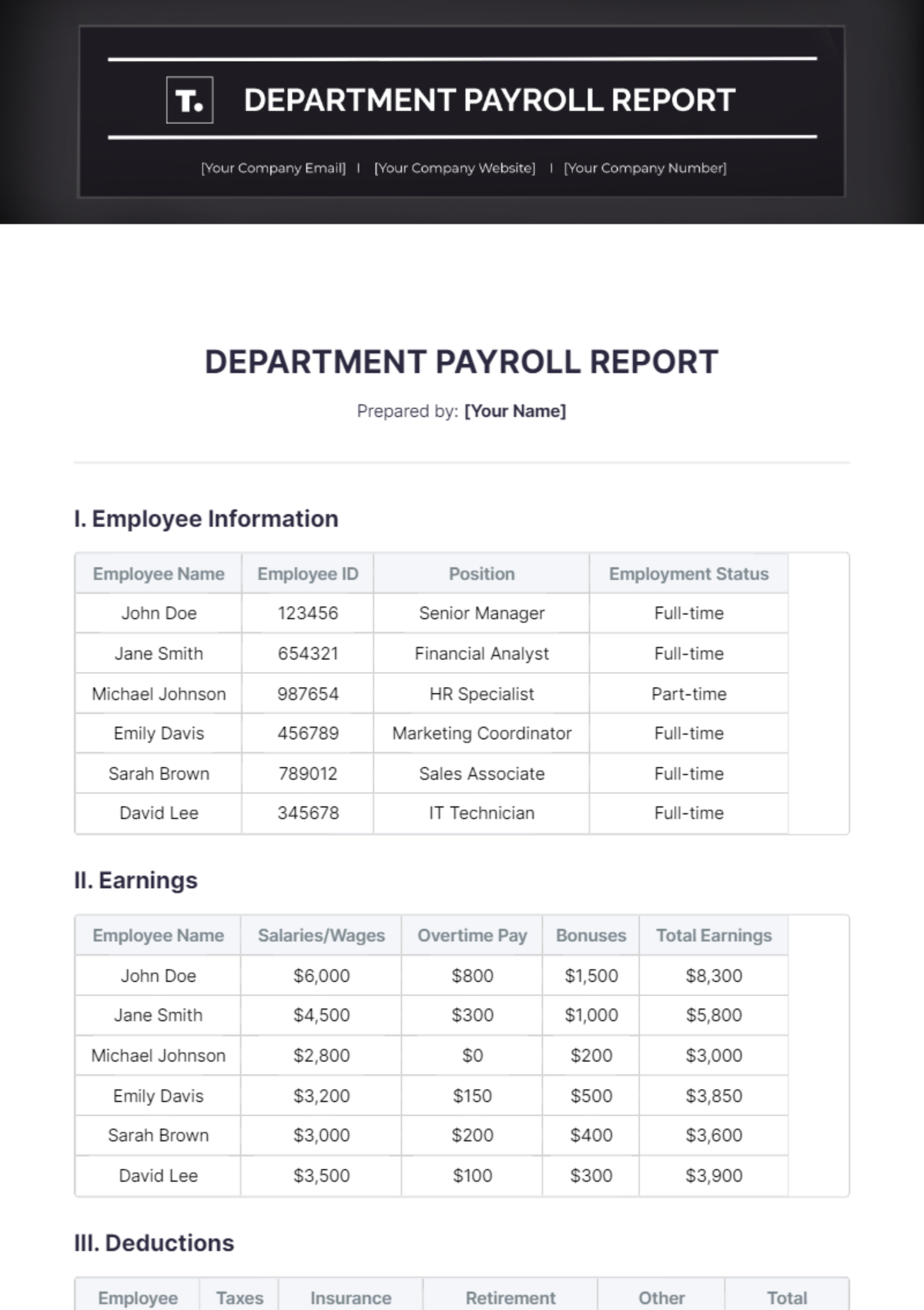

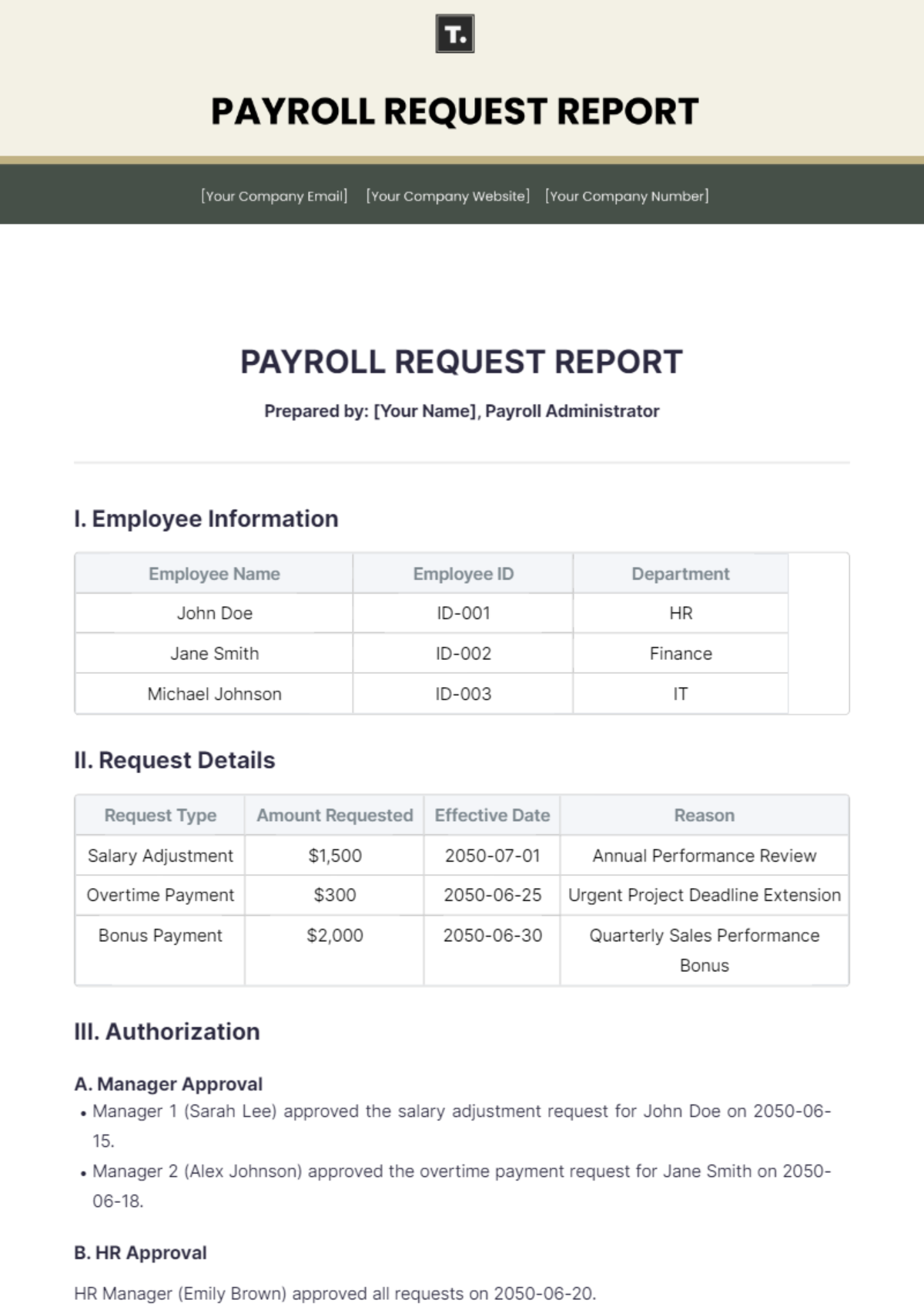

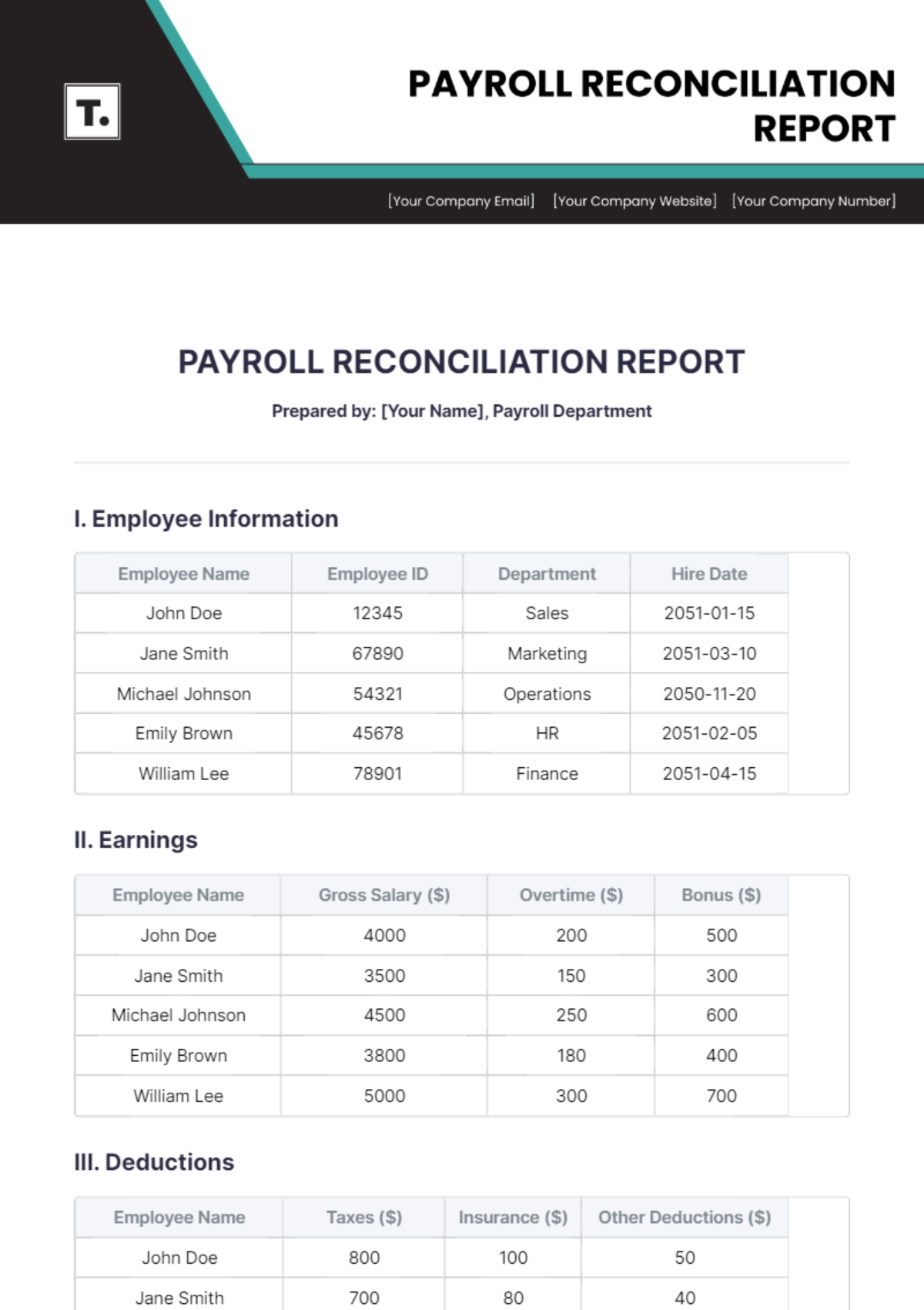

Scope | Objectives |

|---|---|

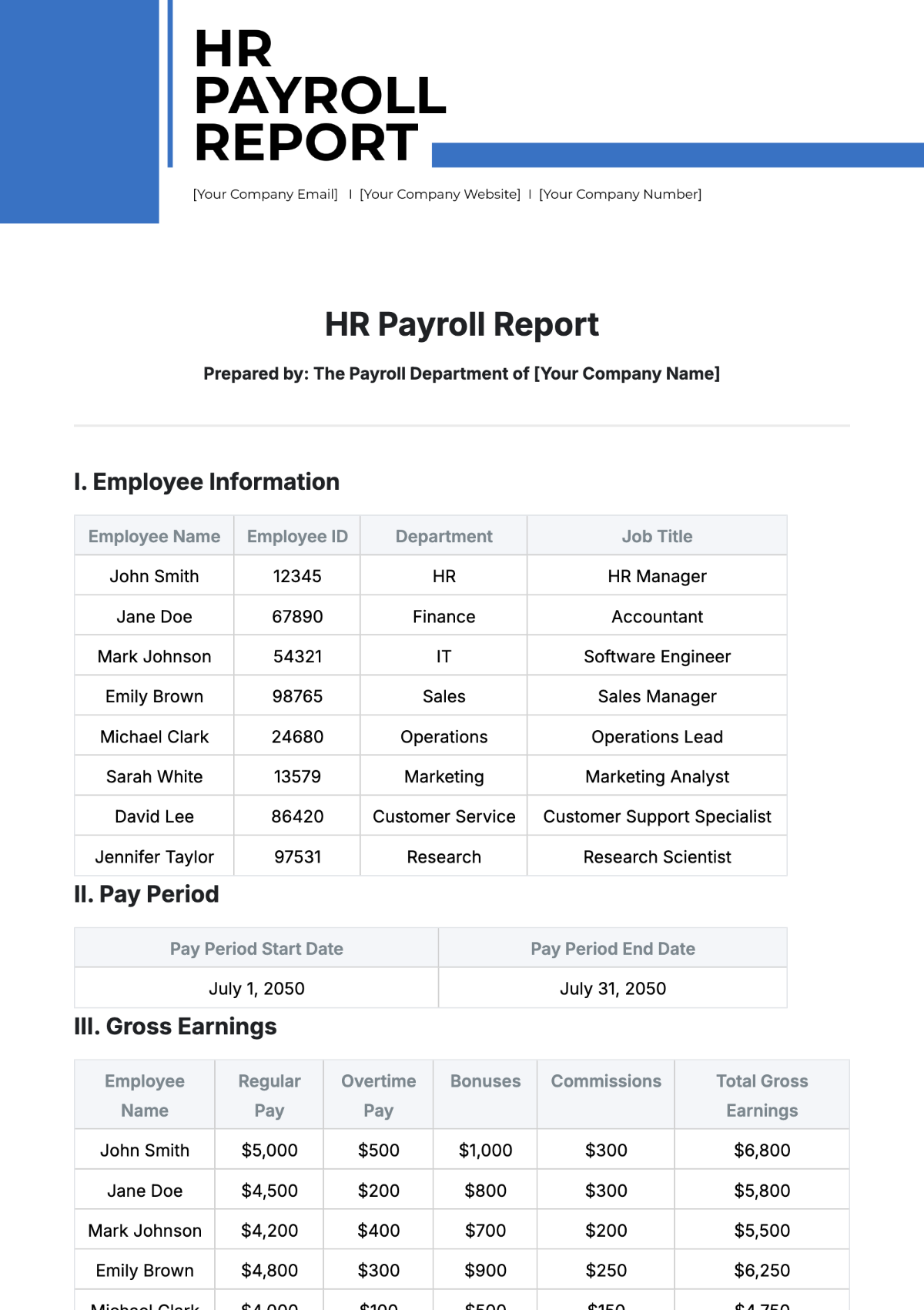

Payroll Processes | To evaluate the accuracy and efficiency of payroll calculations |

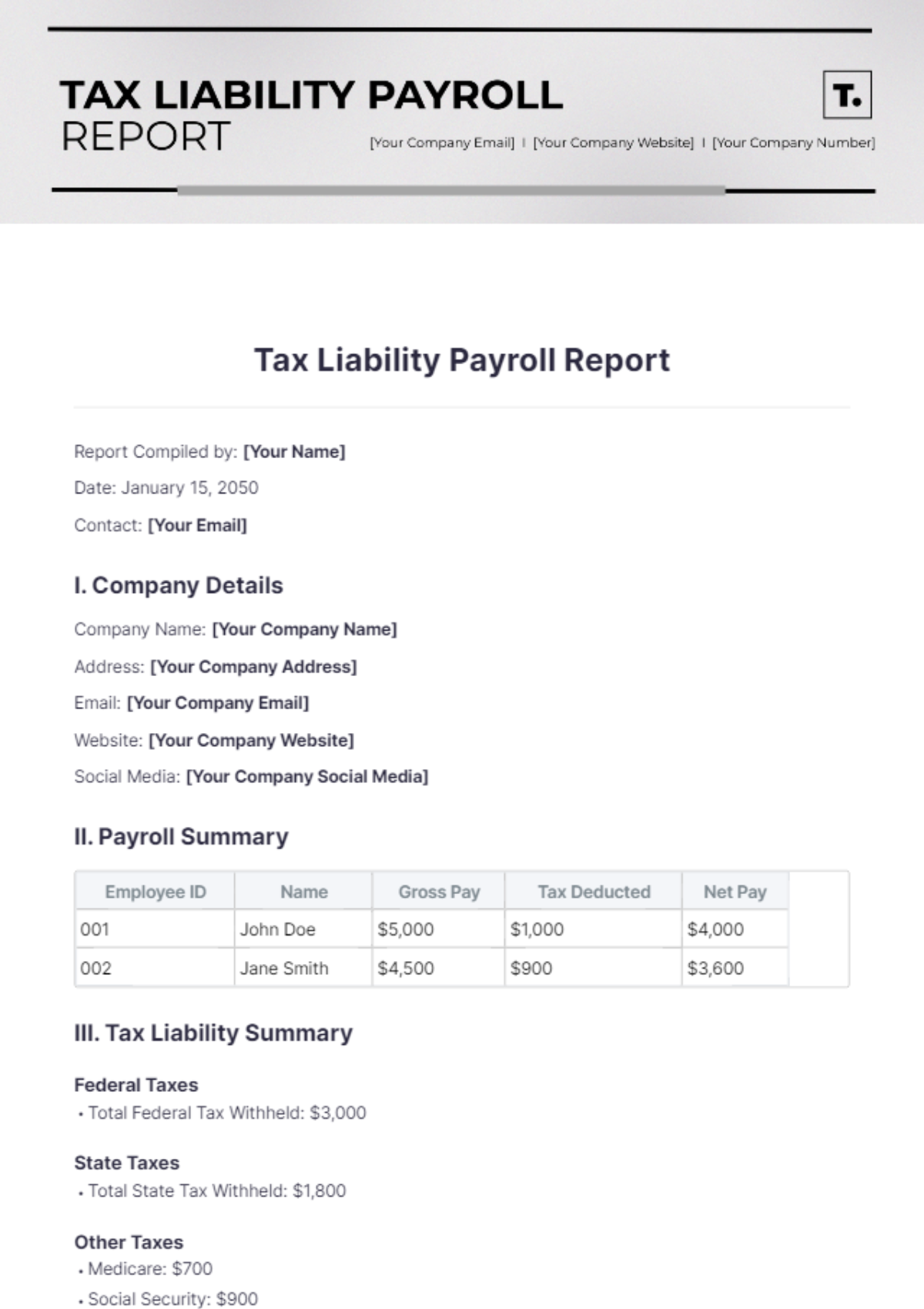

Compliance | To ensure compliance with labor laws and tax regulations |

Risk Management | To identify and mitigate potential risks in payroll processing |

Internal Controls | To assess the effectiveness of internal controls in payroll |

III. Audit Methodology

A. Data Collection

We collected data through a comprehensive review of payroll records, interviews with payroll and HR staff, and examination of payroll software systems. Relevant documents such as payroll registers, tax filings, and employee records were analyzed.

B. Analytical Procedures

Our analytical procedures included variance analysis, trend analysis, and ratio analysis to identify anomalies or irregularities in payroll data. Statistical sampling methods were used to ensure a representative analysis of payroll transactions.

C. Compliance Testing

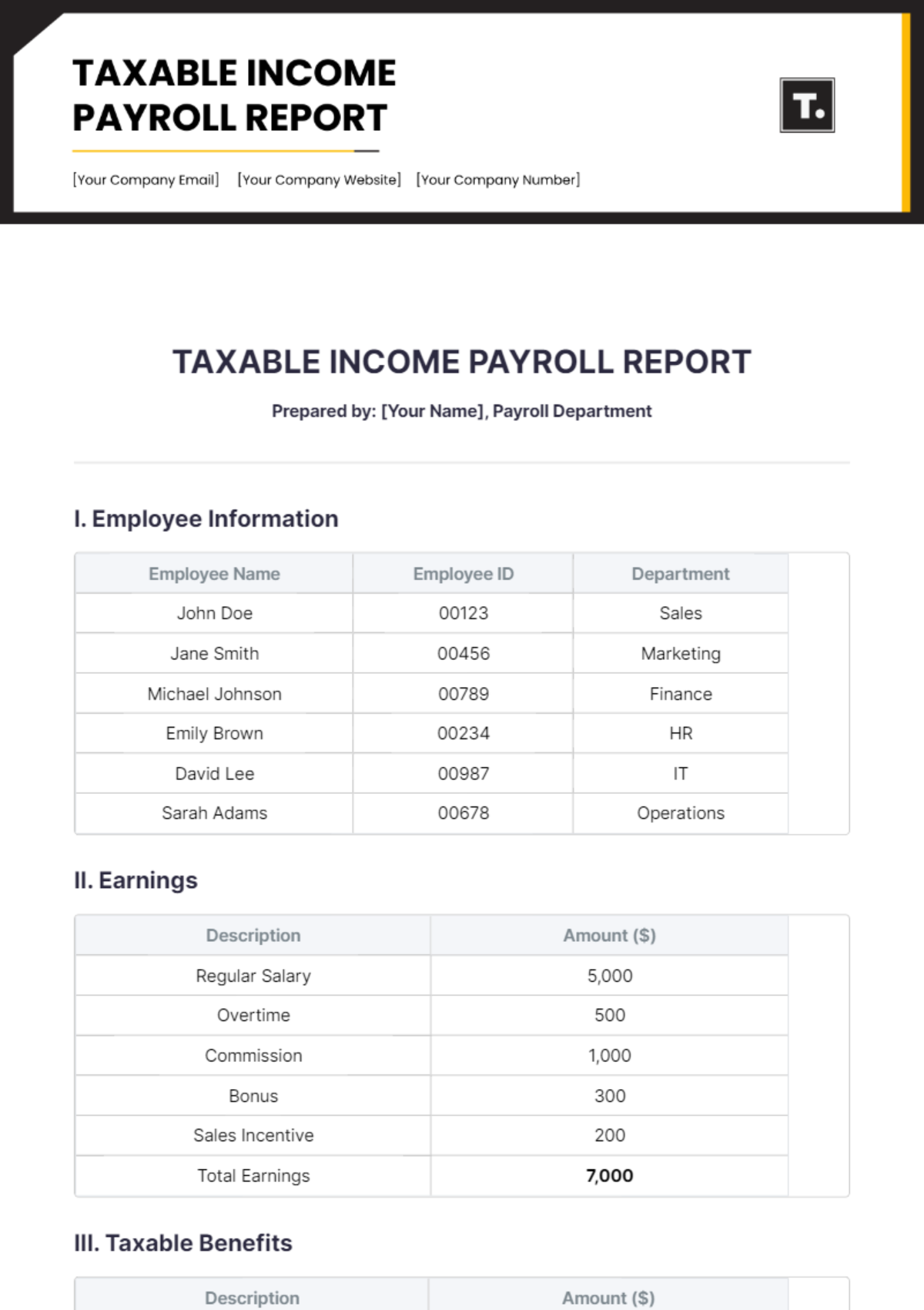

We conducted compliance testing by cross-checking payroll processes against applicable labor laws, tax regulations, and internal policies. This included verifying the correct application of tax rates, employee benefits, and statutory deductions.

IV. Findings

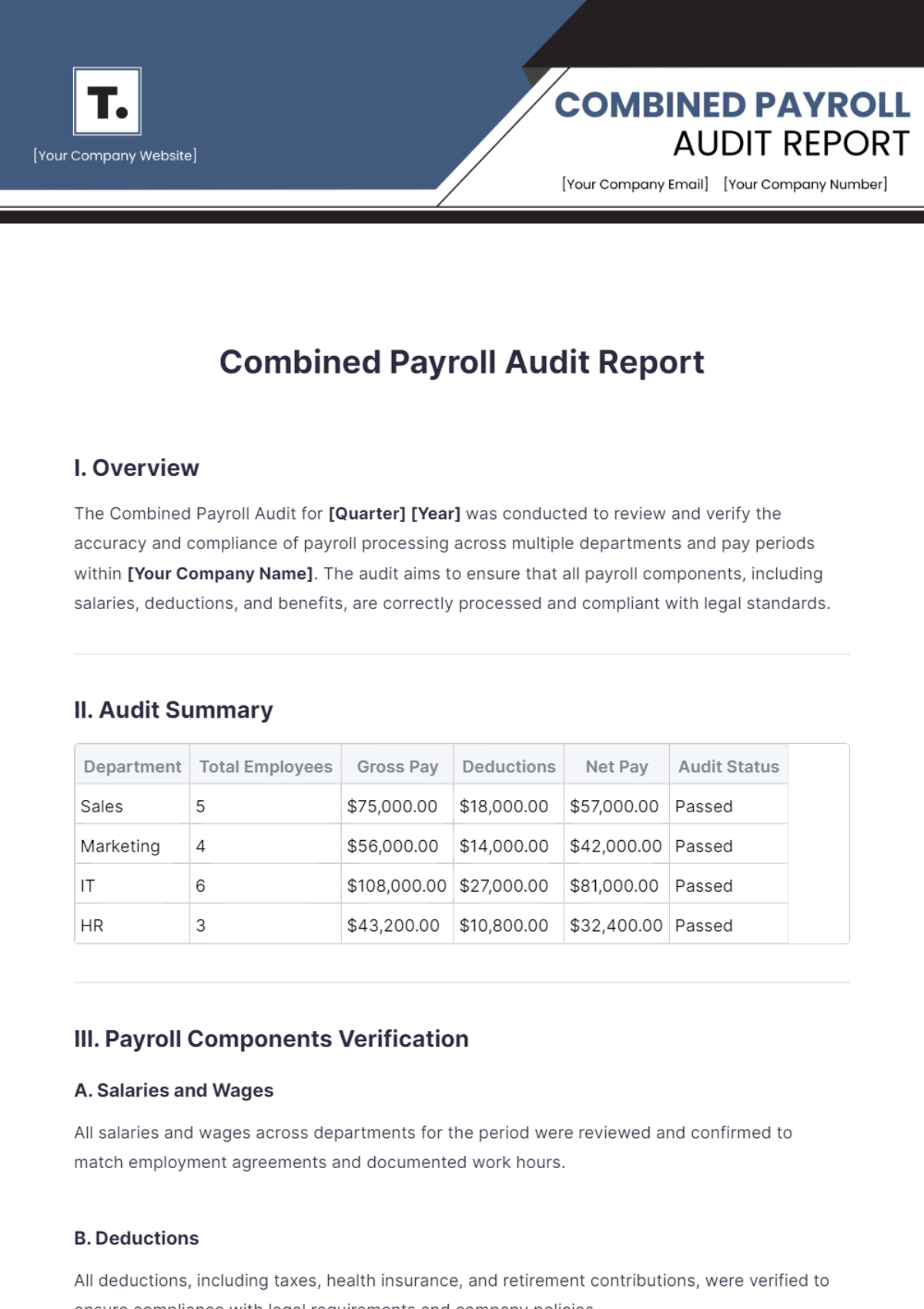

Category | Findings |

|---|---|

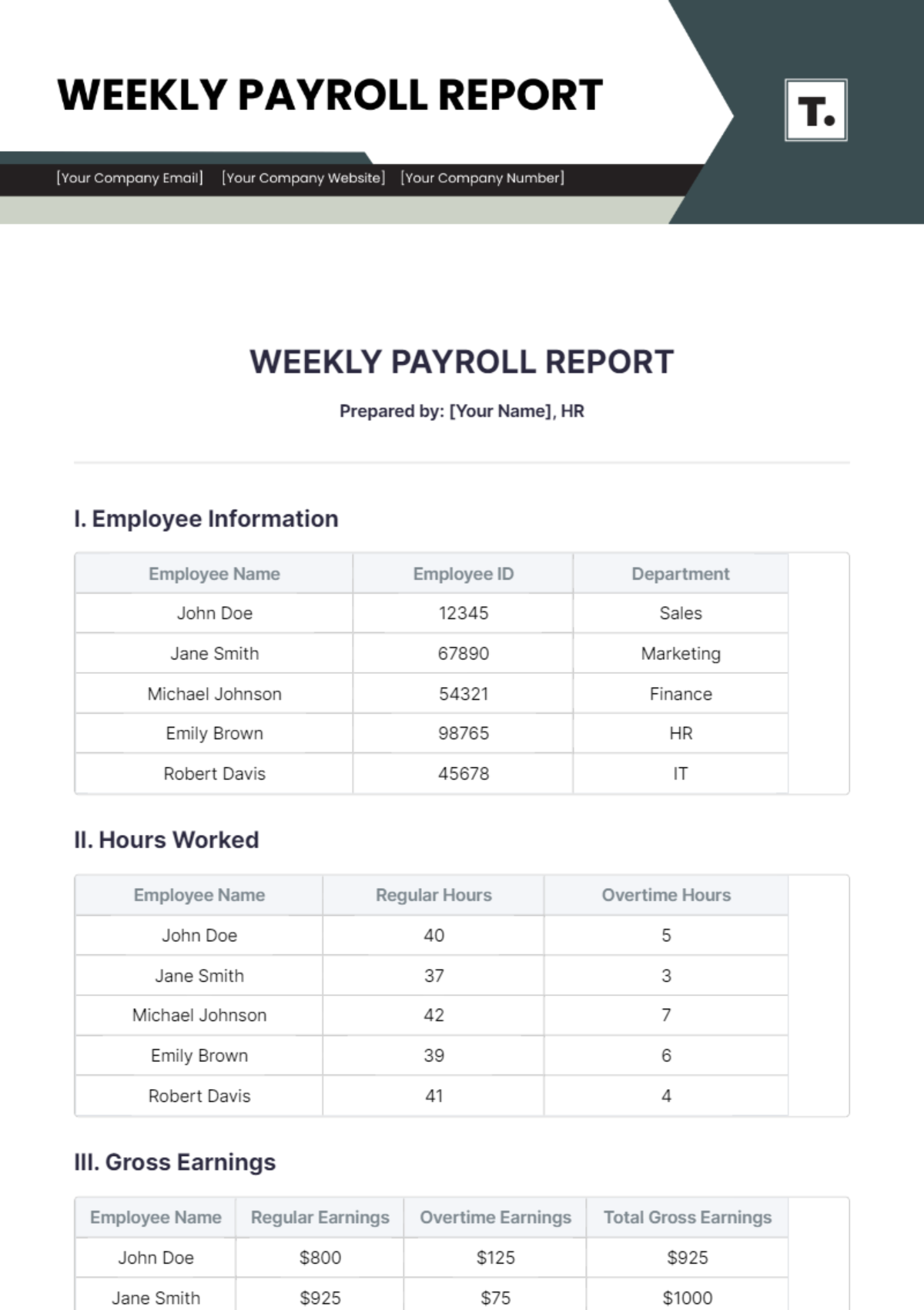

Payroll Calculations | Minor errors found in overtime calculations affecting 2% of employees |

Compliance | Generally compliant with regulations, but some late tax filings noted |

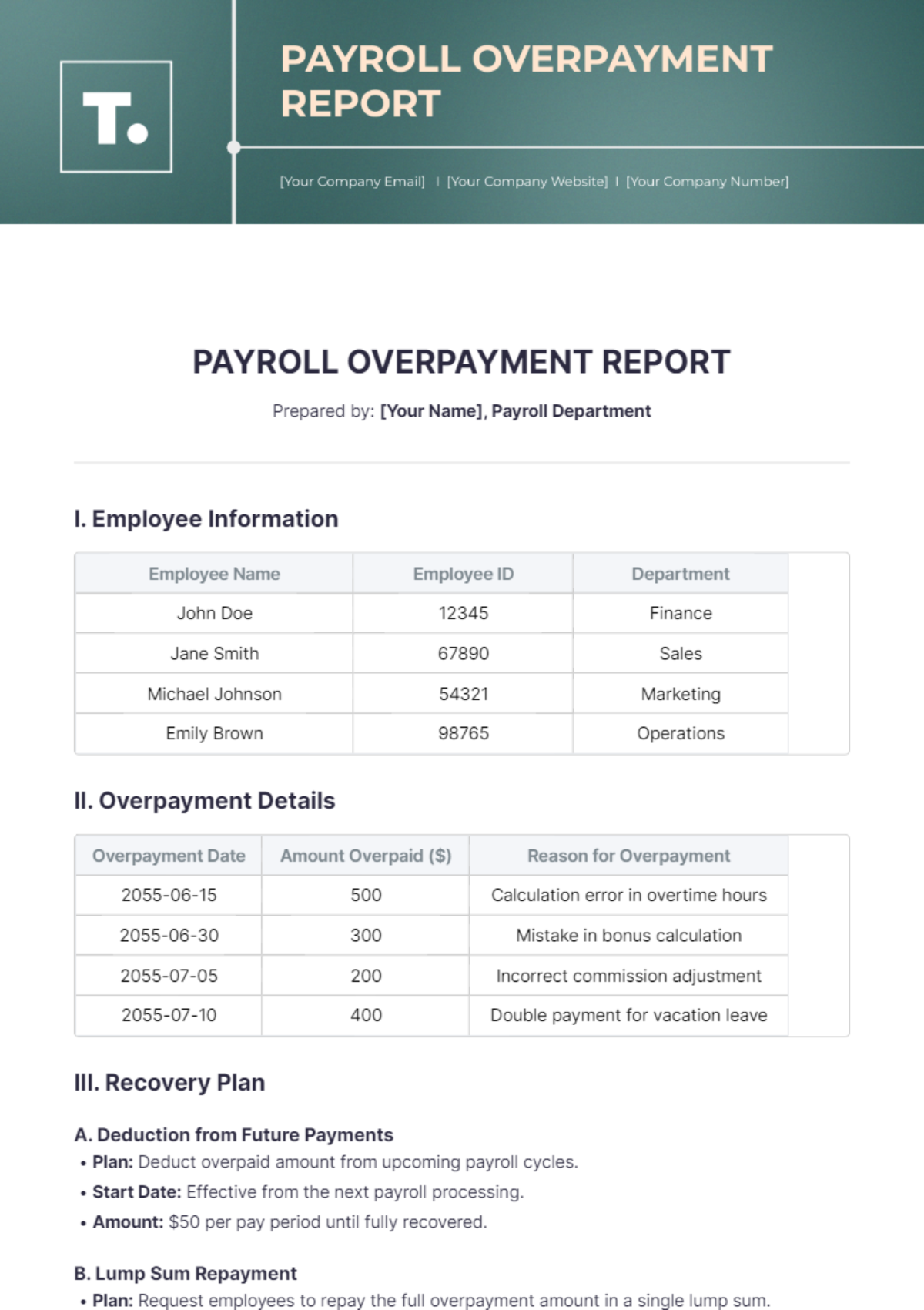

Fraud Risk | Potential risks identified in manual payroll adjustments lacking authorization |

Internal Controls | Internal controls are in place but require strengthening in authorization steps |

V. Recommendations

Implement Automated Payroll Systems: We recommend investing in advanced payroll software to minimize calculation errors and streamline processes.

Regular Training for Payroll Staff: We suggest periodic training sessions to ensure staff are updated on the latest regulations and internal policies.

Enhance Verification Processes: We advise introducing additional verification steps for manual payroll adjustments to prevent unauthorized changes.

Improve Documentation Practices: We recommend ensuring all payroll-related documentation is accurately maintained and easily accessible for audits.

Regular Internal Audits: We propose scheduling frequent internal audits to continually monitor and improve payroll processes.

VI. Management Response

A. Agreement with Findings

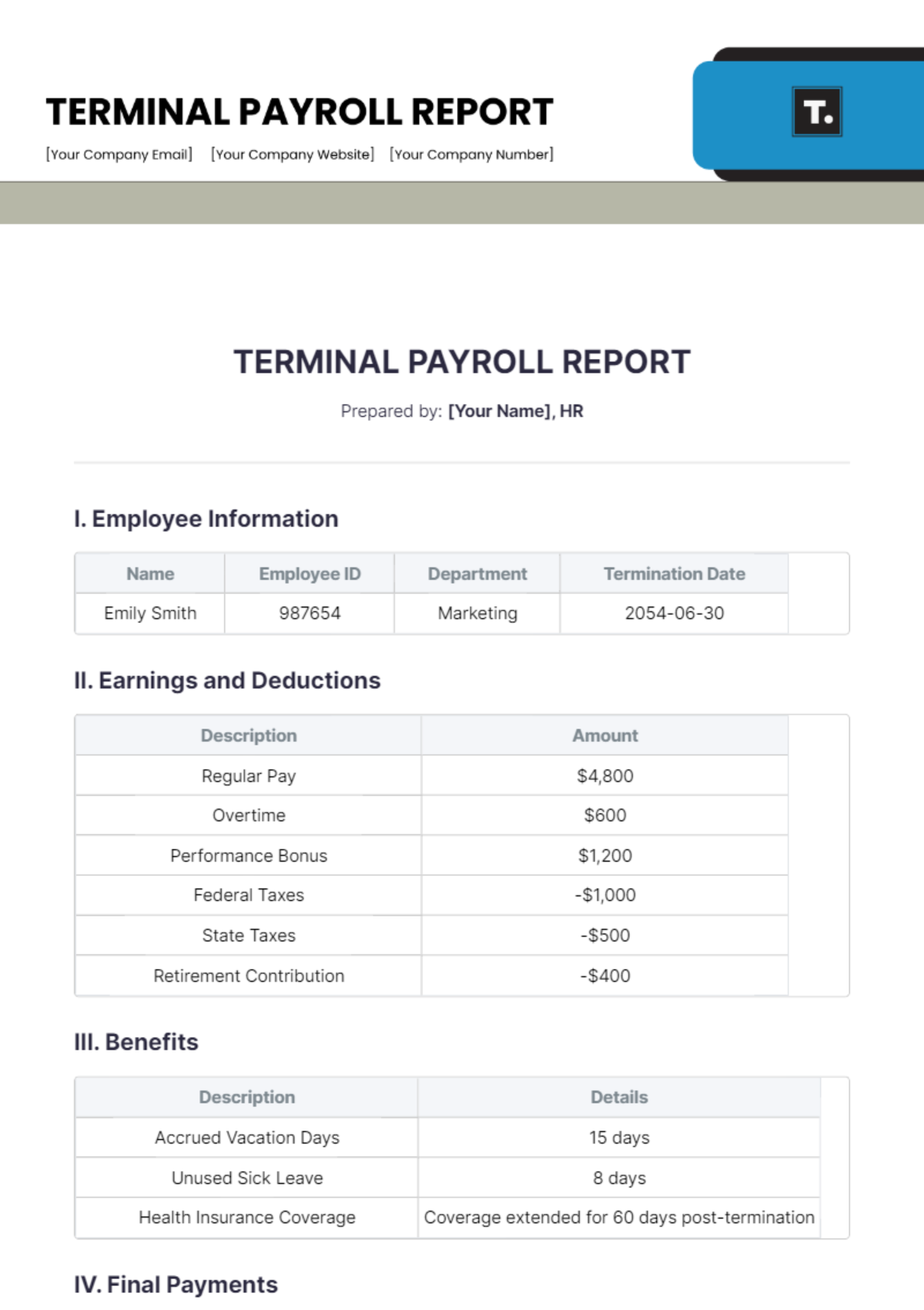

Management has acknowledged our findings and concurs with the identified areas for improvement. The minor errors in overtime calculations and the noted compliance issues will be addressed promptly.

B. Action Plan

Management has developed an action plan to implement our recommendations. This includes allocating the budget for new payroll software, scheduling training sessions, and revising the internal controls framework to incorporate additional verification steps.

C. Timeline for Implementation

Management plans to commence the implementation of the recommended actions immediately, to complete all improvements within the next six months. Regular updates will be provided to the audit committee to track progress.

VII. Conclusion

As internal auditors for [Your Company Name], we have identified the strengths and weaknesses of the current payroll system through our audit. While the organization’s payroll processes are generally effective, there are specific areas that require attention to ensure full accuracy and compliance. By implementing our recommended actions, [Your Company Name] will enhance the reliability of its payroll operations and strengthen internal controls, thereby mitigating risks and improving overall efficiency. Regular follow-up audits will be essential to maintain the integrity of payroll processes and compliance with regulations.