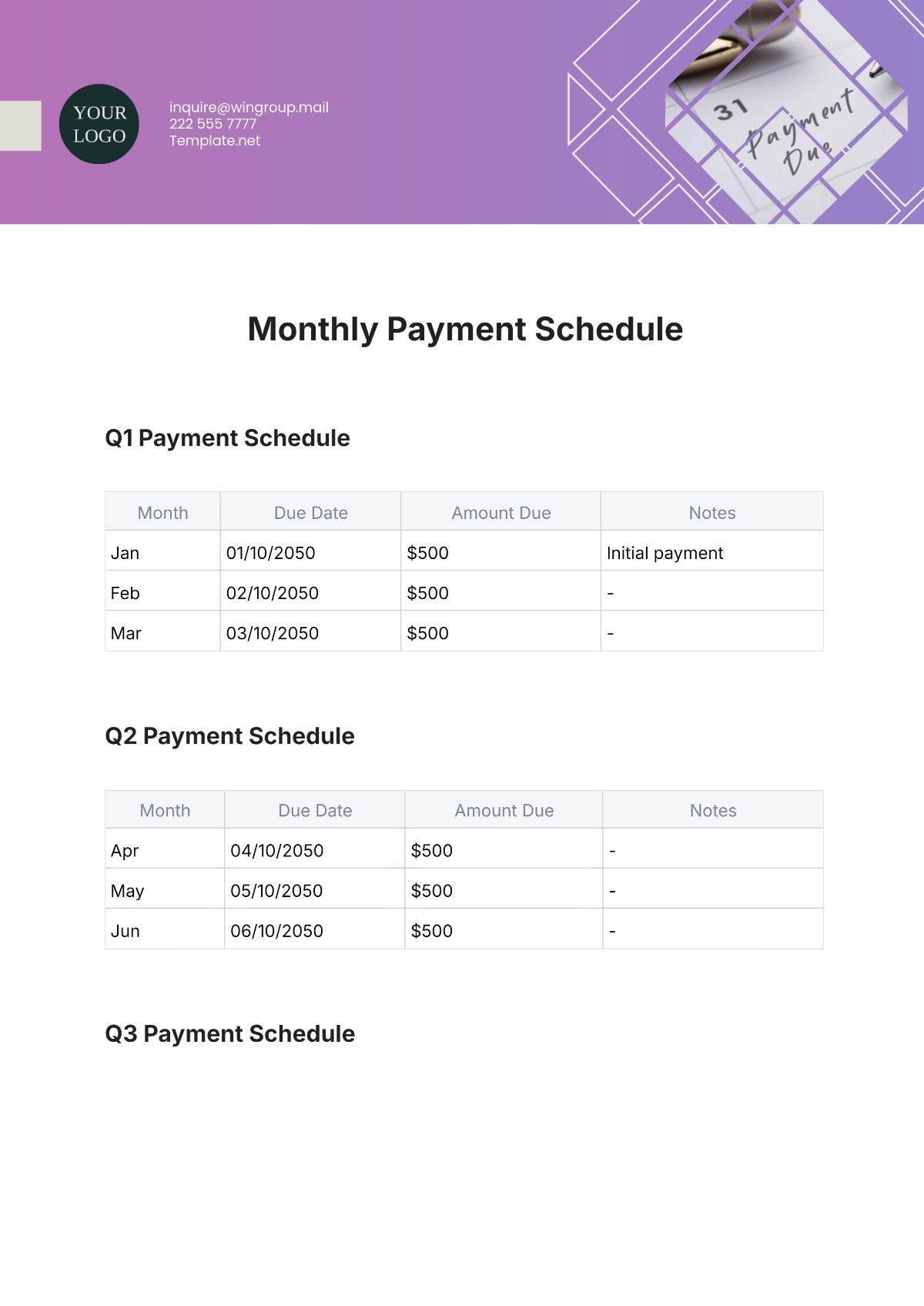

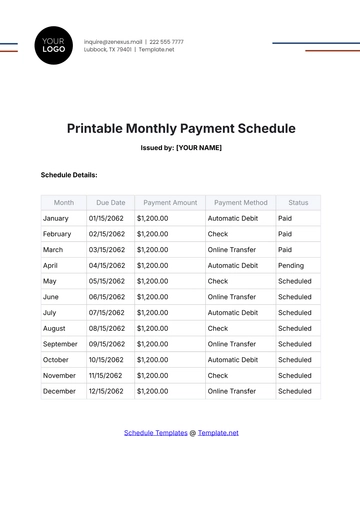

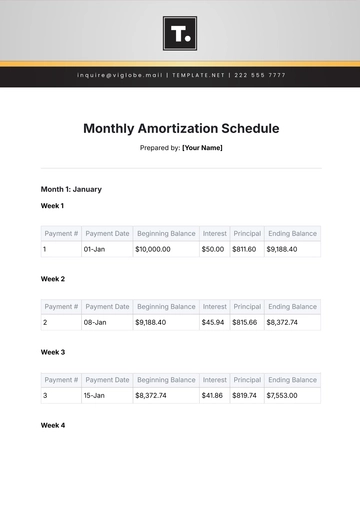

Monthly Payment Schedule

Q1 Payment Schedule

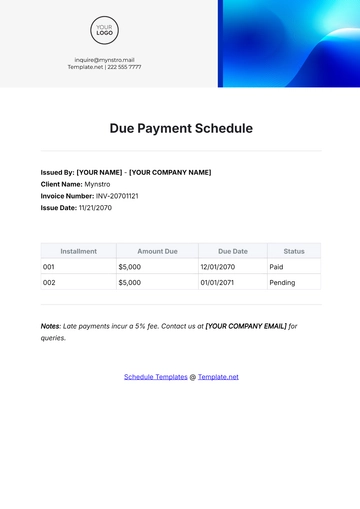

Month | Due Date | Amount Due | Notes |

|---|

Jan | 01/10/2050 | $500 | Initial payment |

Feb | 02/10/2050 | $500 | - |

Mar | 03/10/2050 | $500 | - |

Q2 Payment Schedule

Month | Due Date | Amount Due | Notes |

|---|

Apr | 04/10/2050 | $500 | - |

May | 05/10/2050 | $500 | - |

Jun | 06/10/2050 | $500 | - |

Q3 Payment Schedule

Month | Due Date | Amount Due | Notes |

|---|

Jul | 07/10/2050 | $500 | Mid-year review |

Aug | 08/10/2050 | $500 | - |

Sep | 09/10/2050 | $500 | - |

Q4 Payment Schedule

Month | Due Date | Amount Due | Notes |

|---|

Oct | 10/10/2050 | $500 | - |

Nov | 11/10/2050 | $500 | - |

Dec | 12/10/2050 | $500 | Final payment for the year |

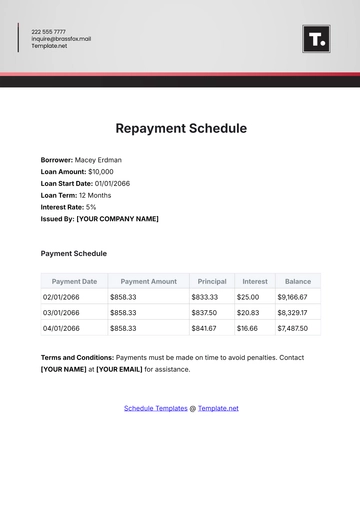

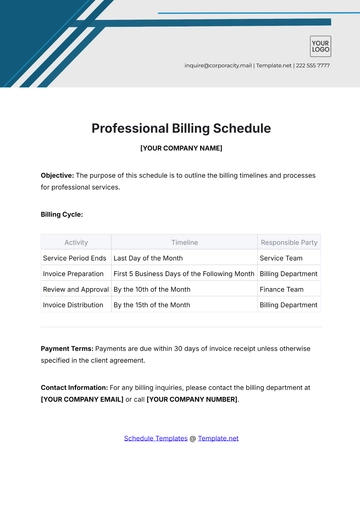

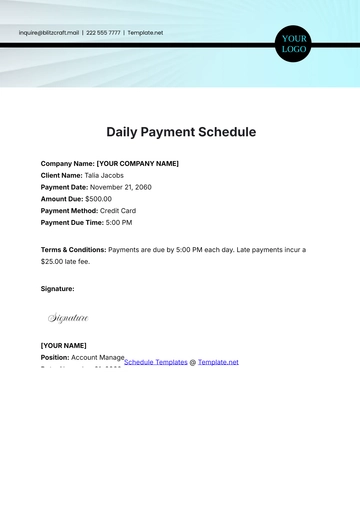

A. Late Payment Penalties

If a payment is not received by the due date, a late fee of $25 will be added to the amount due. Continued late payments may result in additional penalties or service interruptions. It is crucial to ensure payments are made on time to avoid these extra charges.

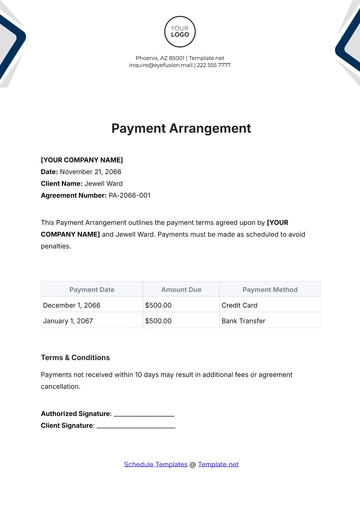

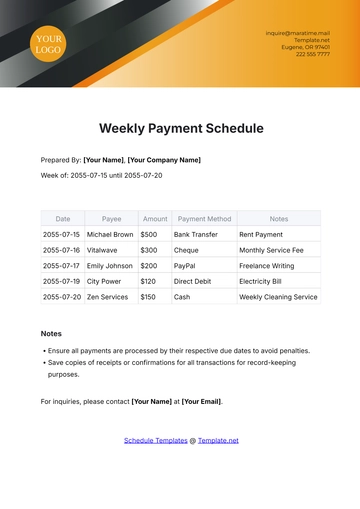

B. Payment Methods

[Your Company Name] offers several convenient methods to make your monthly payments:

Online Payment: Log in to your account and pay via credit card or bank transfer.

Automatic Debit: Set up automatic monthly debits from your bank account.

Mail: Send a check or money order to our billing address.

In-Person: Visit [Your Company Address] to pay by cash, check, or credit card.

Schedule Templates @ Template.net