Hourly Payment Schedule

Prepared by: [YOUR NAME]

A. Introduction

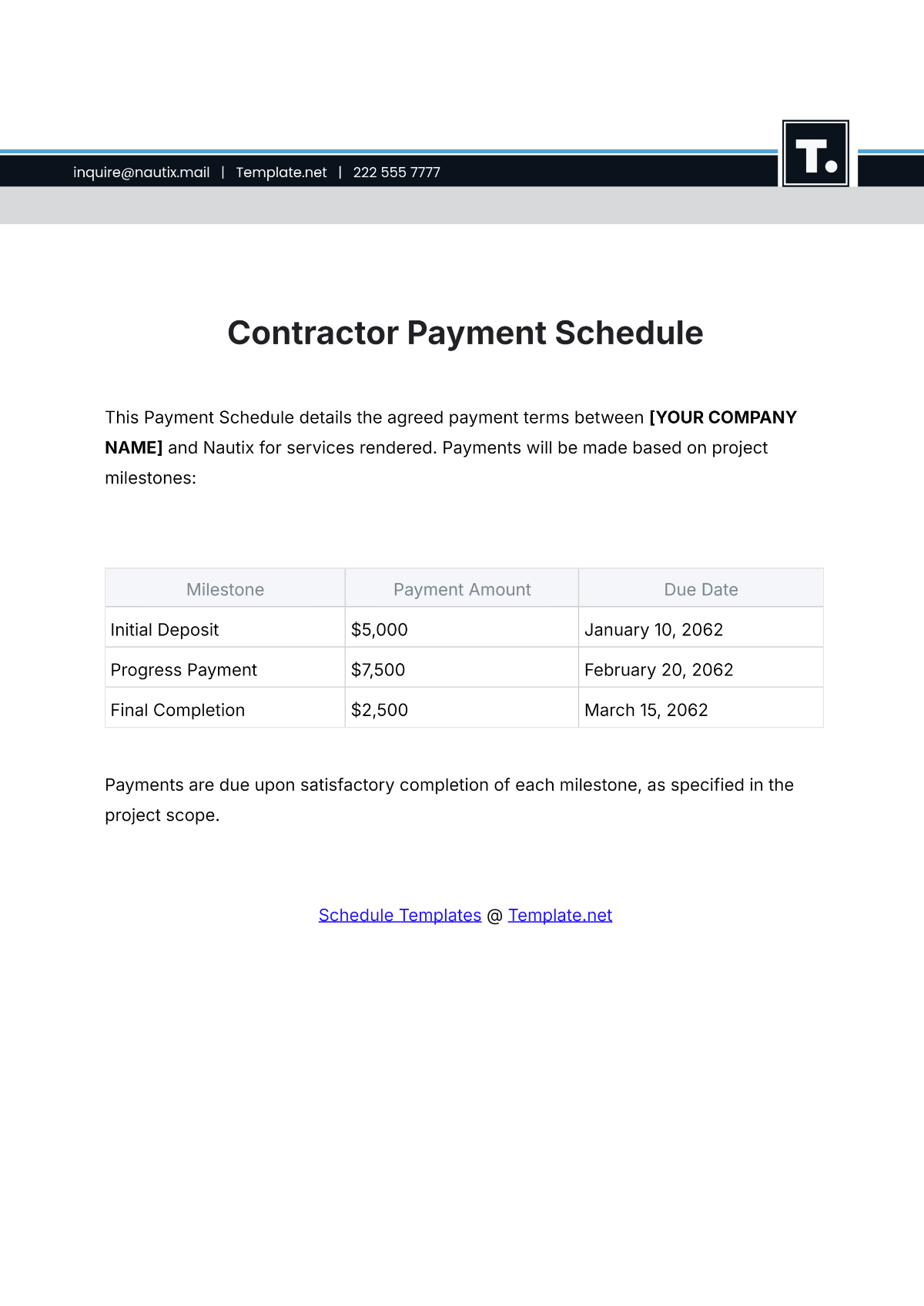

This document outlines the hourly payment schedule for employees at [YOUR COMPANY NAME]. The payment schedule is designed to ensure timely and accurate compensation for hours worked, in compliance with applicable labor laws and company policies.

B. Payment Periods

Employees are paid on a bi-weekly basis. The payment period covers a two-week span starting on Monday and ending on the second Sunday. Payments are processed and distributed on the following Friday.

C. Payment Calculation

Hourly wages are calculated based on the number of hours worked during the payment period. Overtime is calculated at 1.5 times the regular hourly rate for any hours worked over 40 in a week.

D. Timekeeping

Employees are required to accurately record their hours worked using the company’s timekeeping system. Timesheets must be submitted by the end of the workday on the final day of the pay period.

E. Deductions

Standard deductions, such as federal and state taxes, Social Security, and Medicare, are automatically withheld from each paycheck. Additional deductions may include contributions to retirement plans, health insurance premiums, and other authorized deductions.

F. Disbursement Method

Payments are disbursed via direct deposit into the employee’s designated bank account. Employees must ensure their banking information is up-to-date and notify the HR department of any changes.

G. Contact Information

For any questions or concerns regarding the hourly payment schedule, employees should contact the HR department at [YOUR COMPANY EMAIL] or [YOUR COMPANY NUMBER].

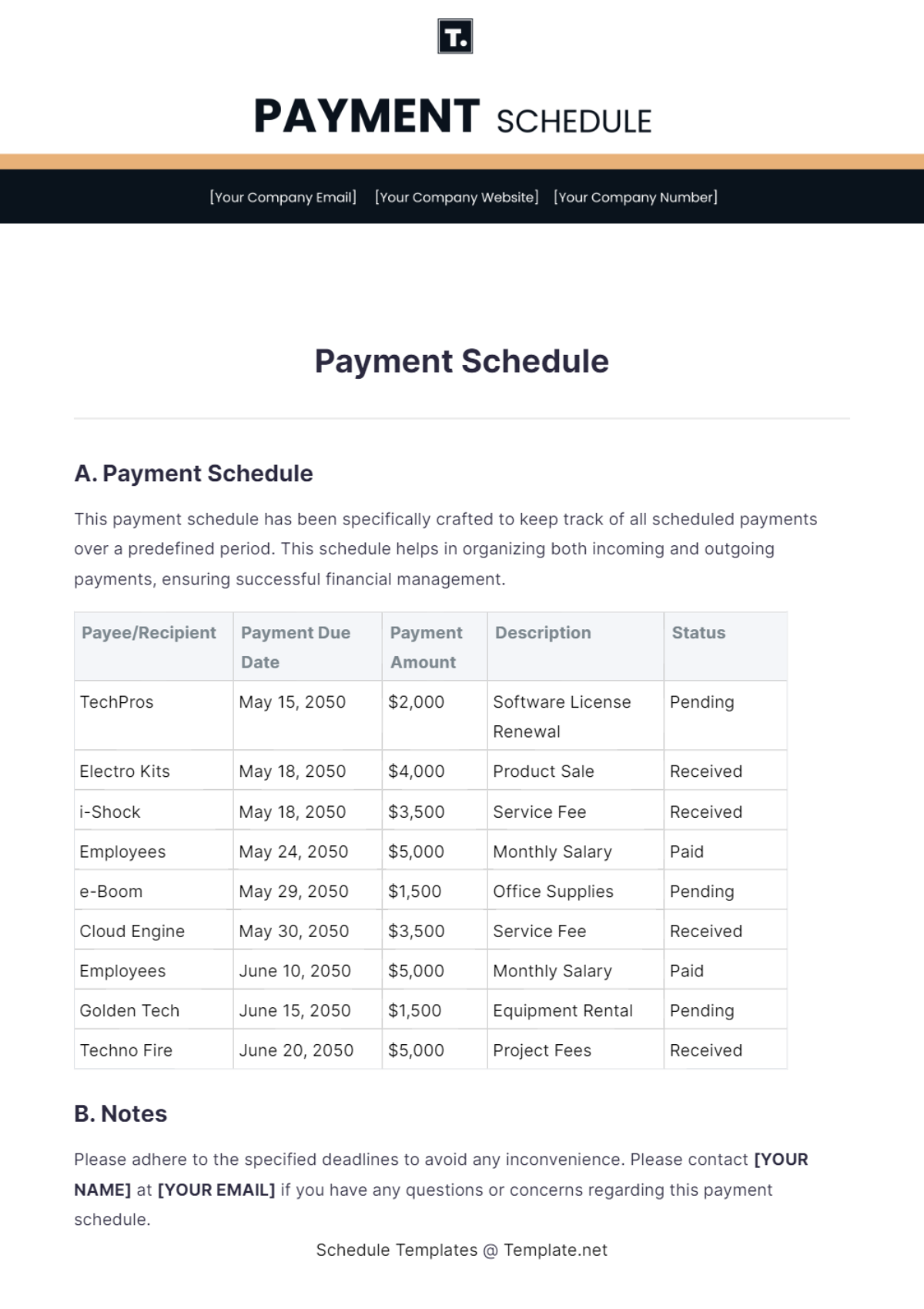

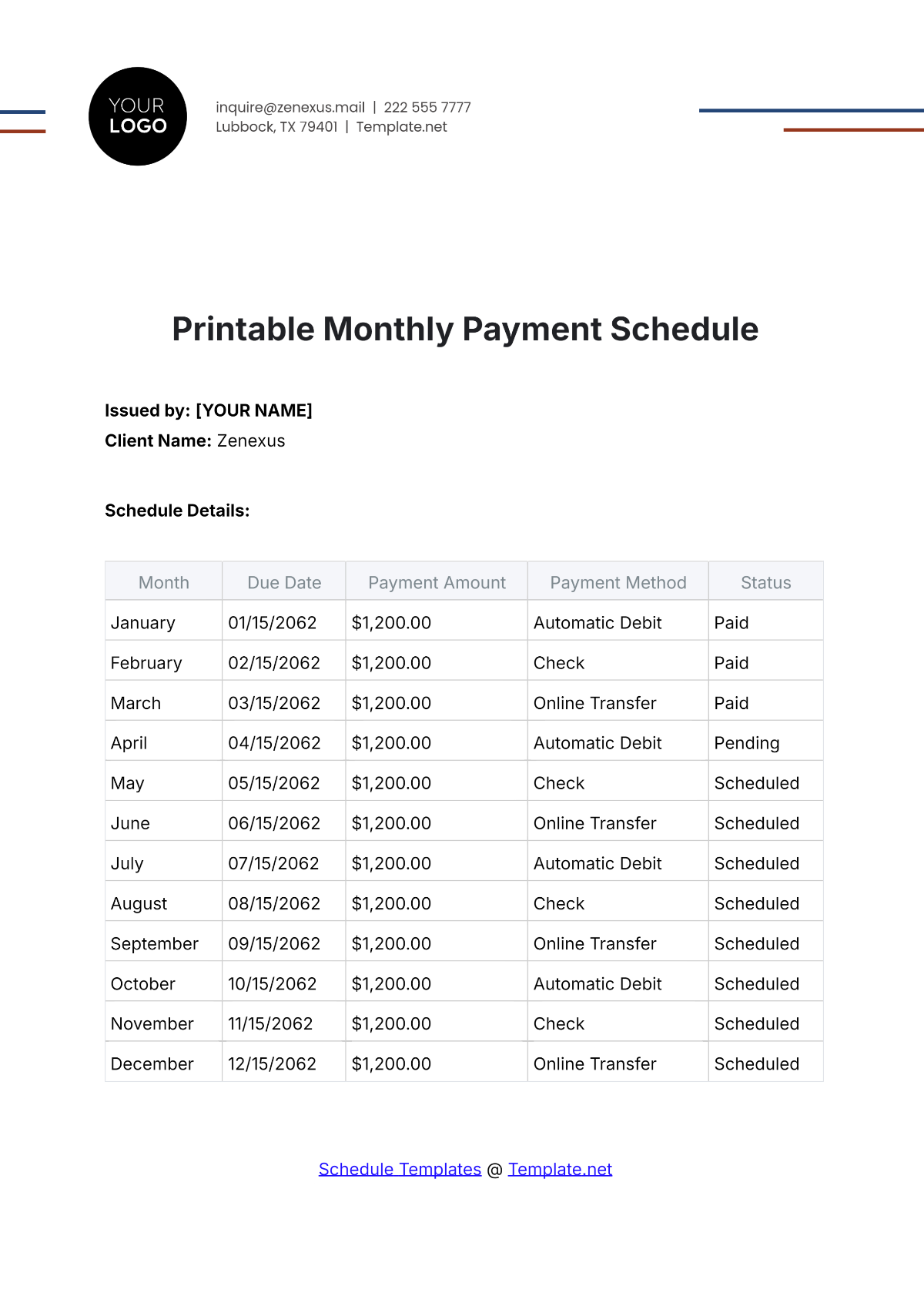

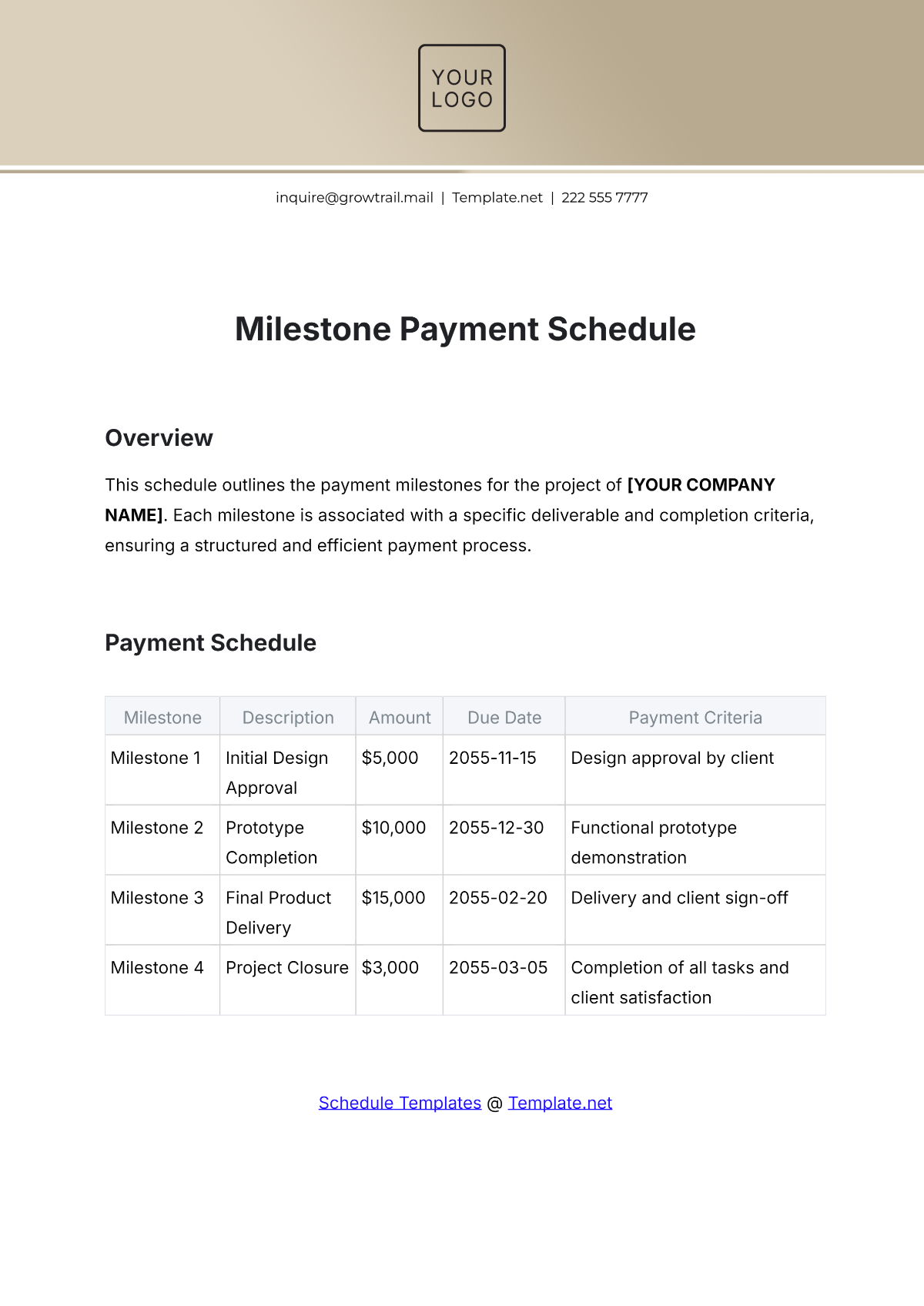

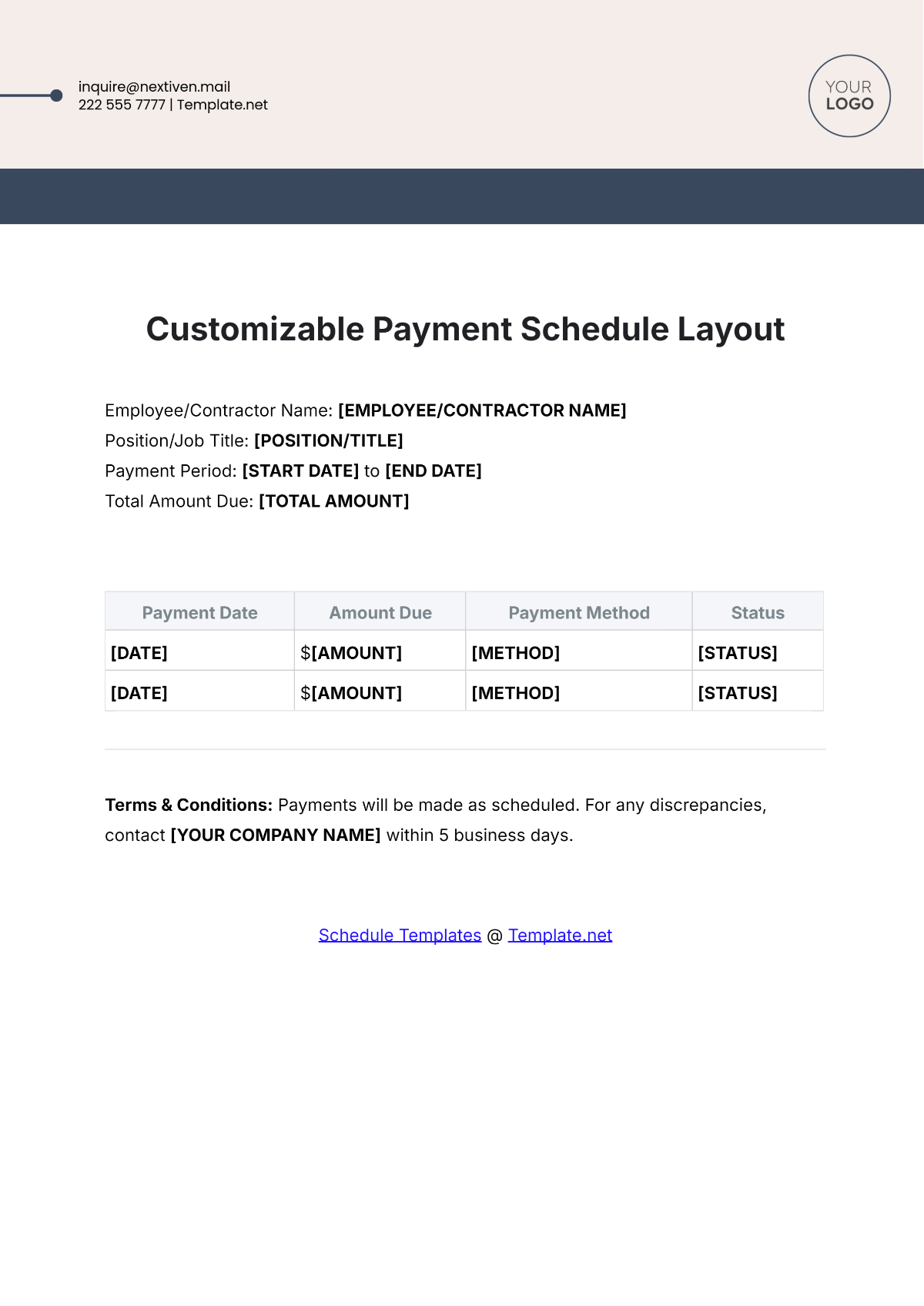

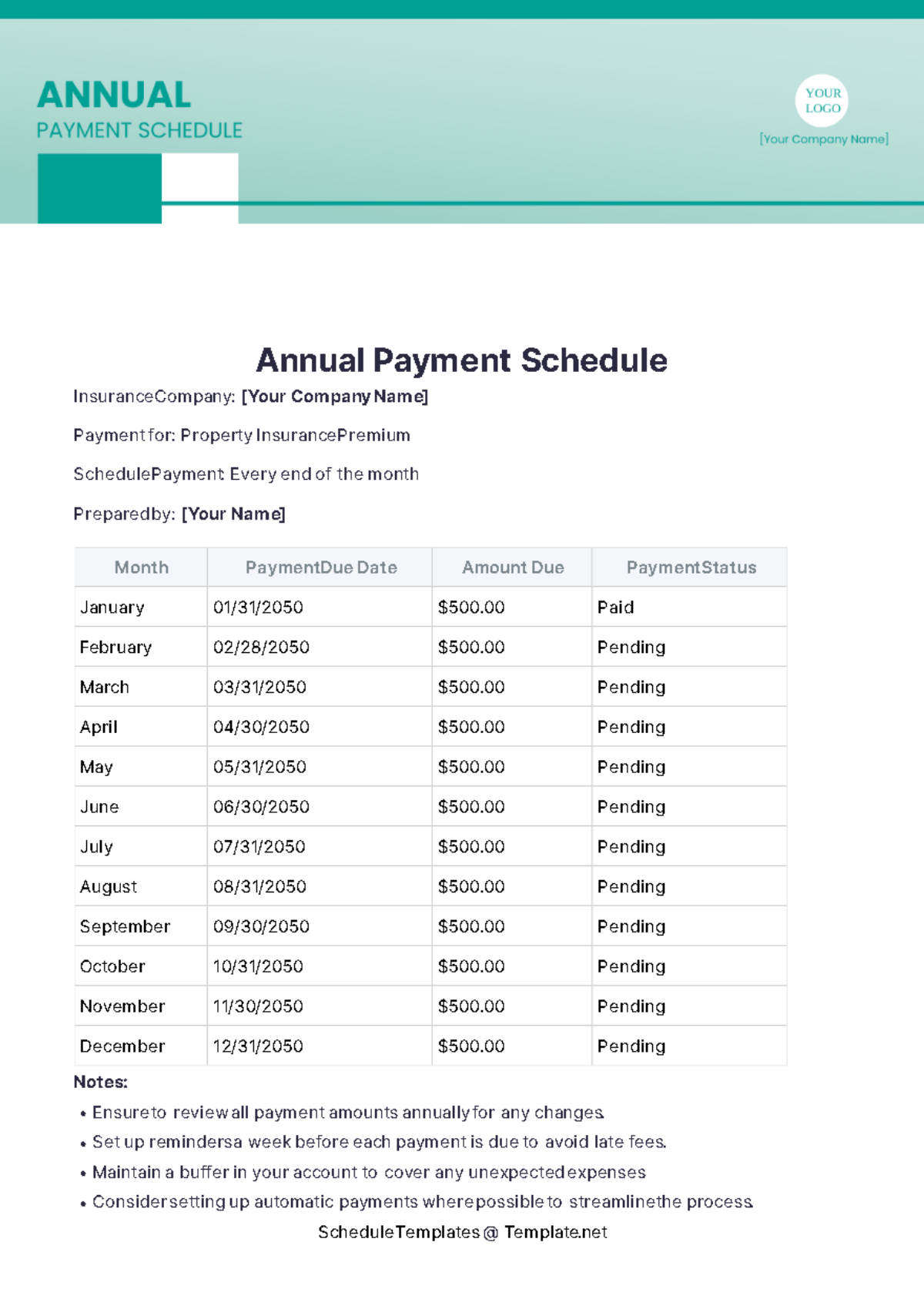

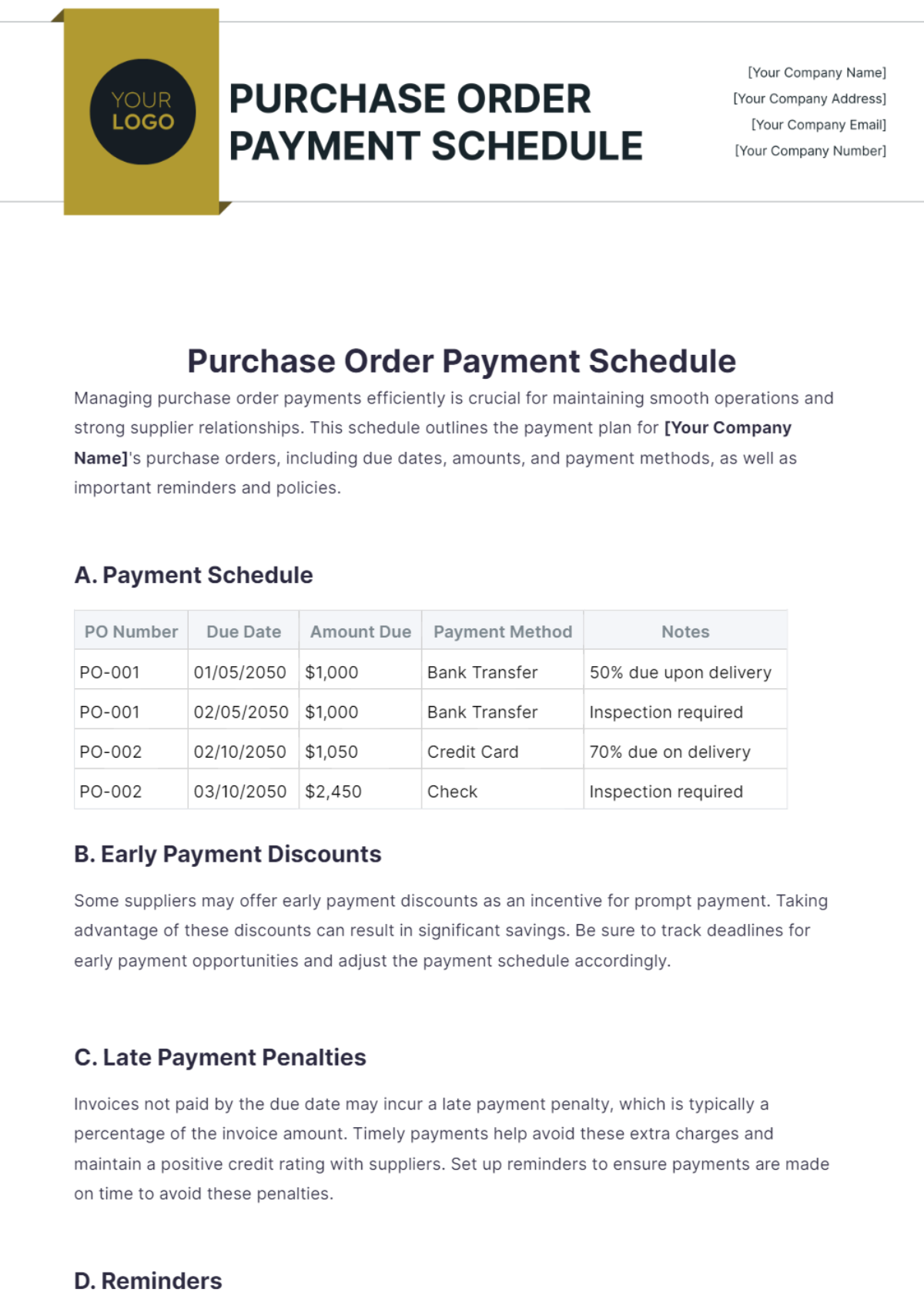

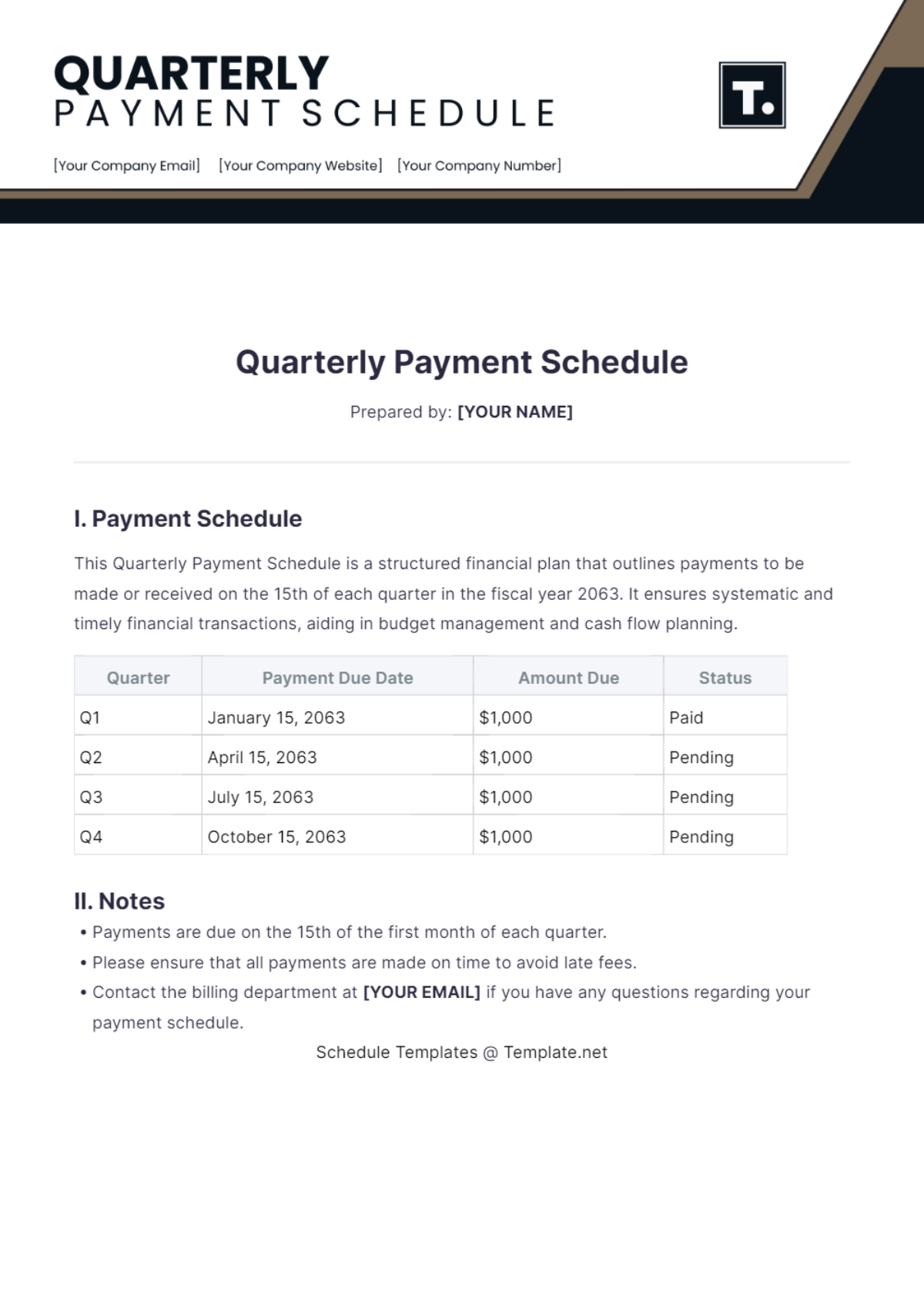

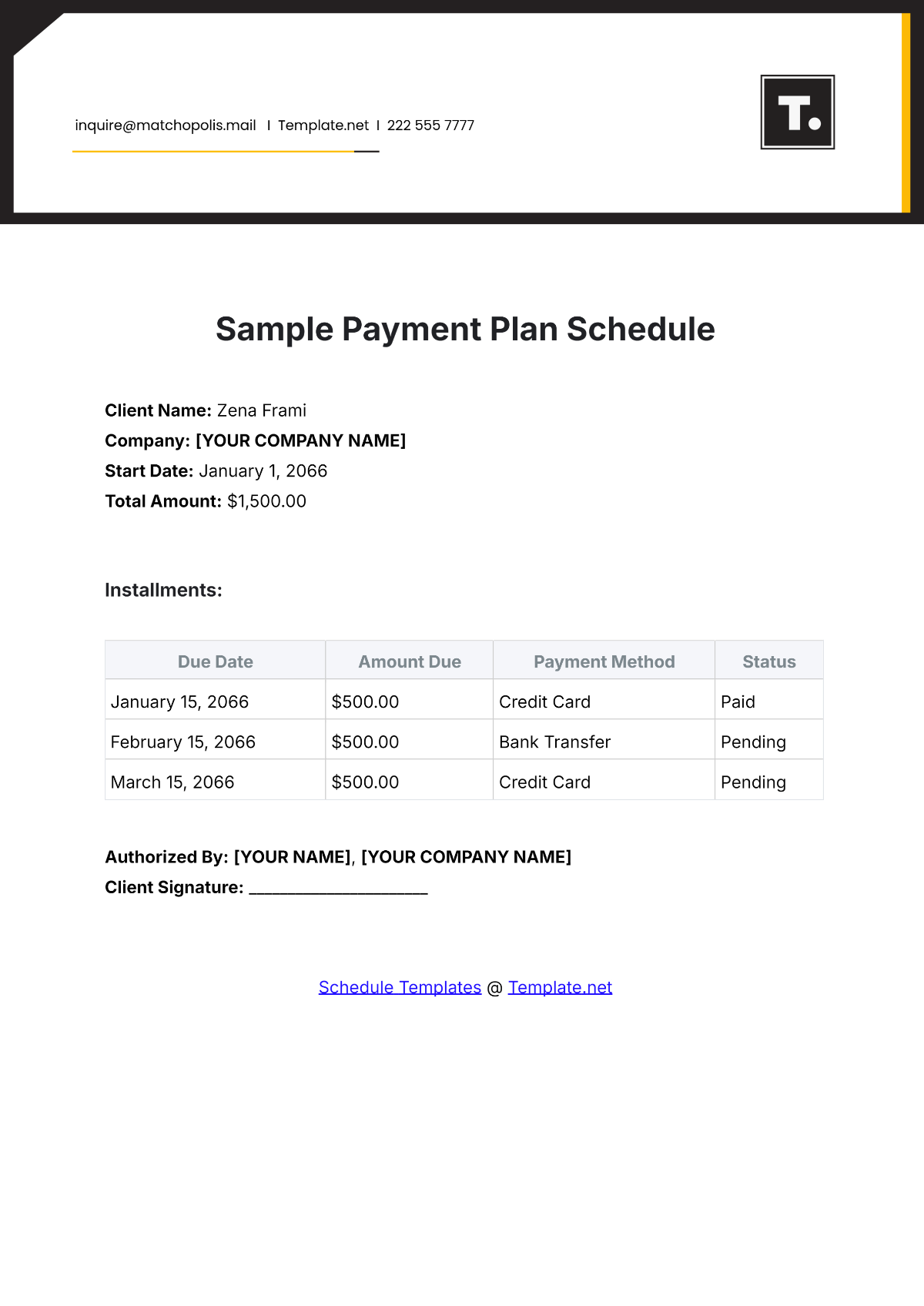

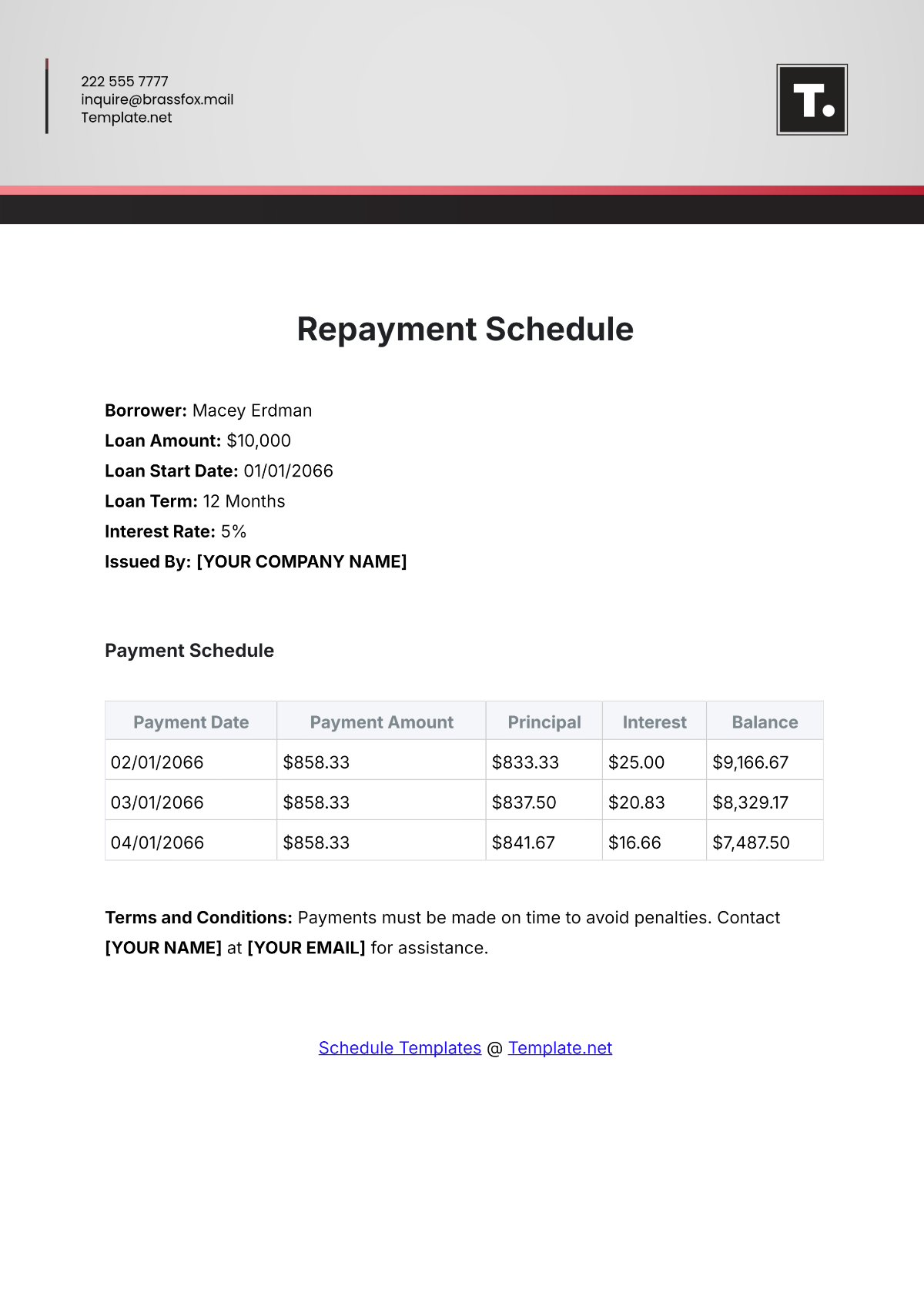

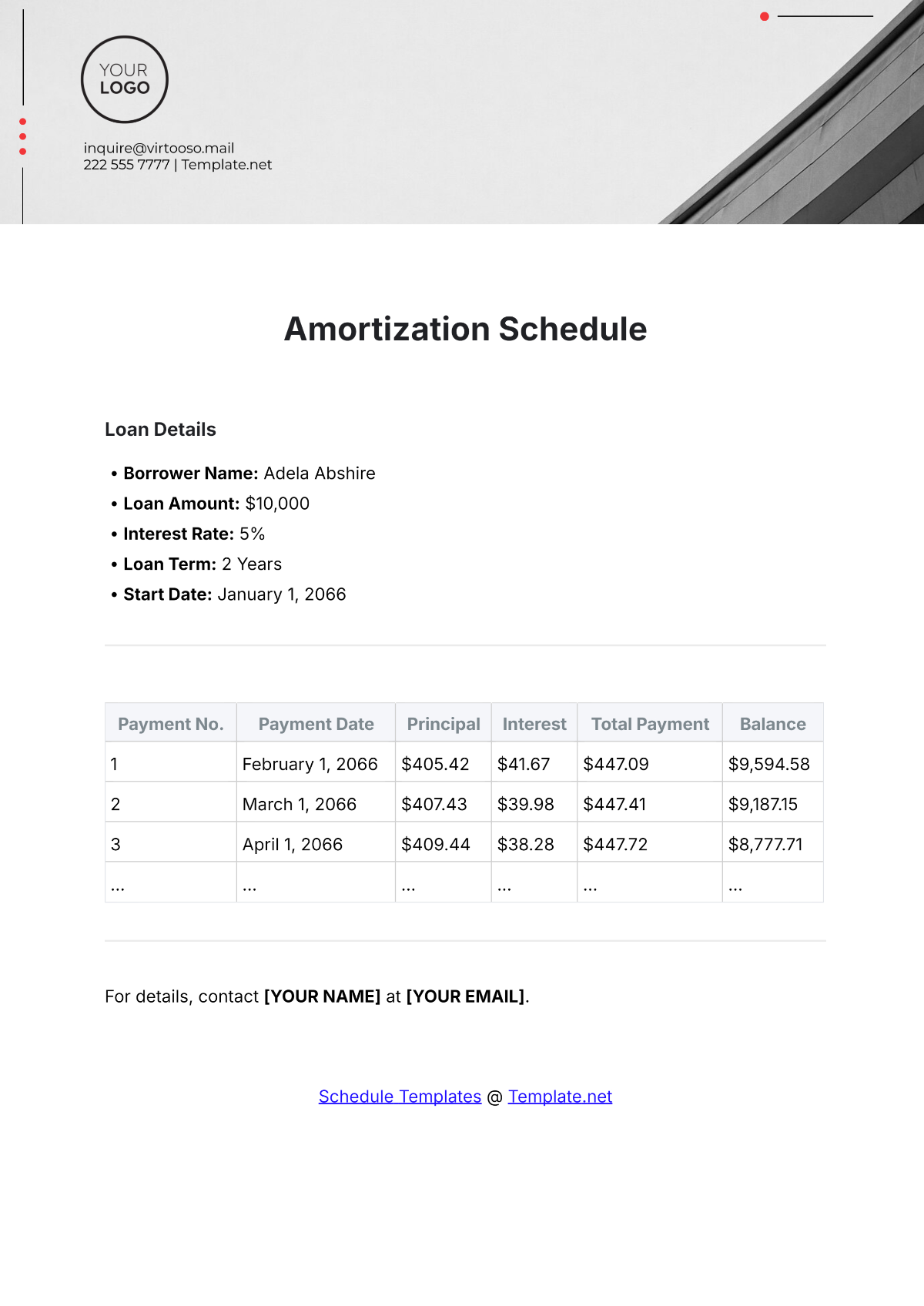

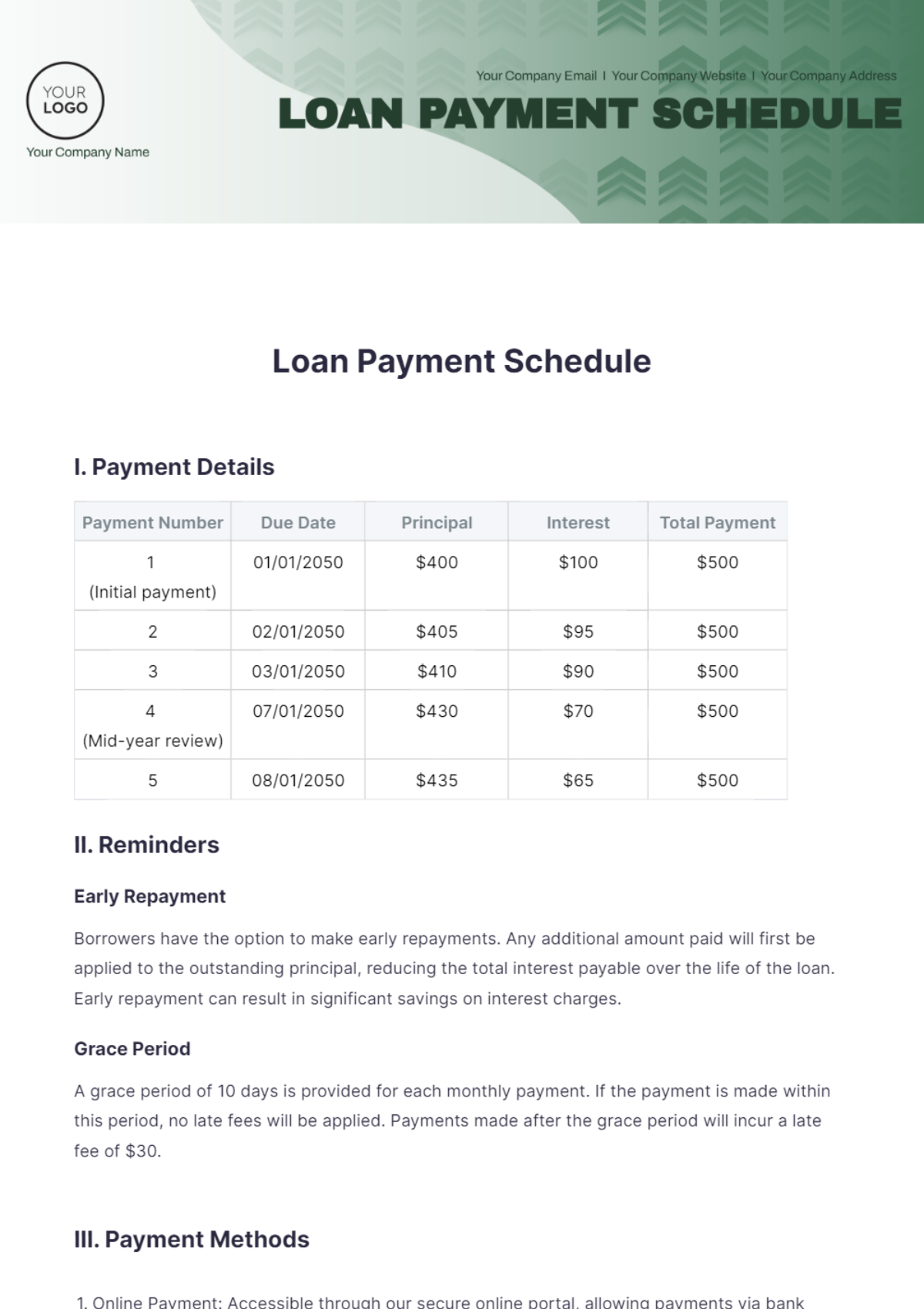

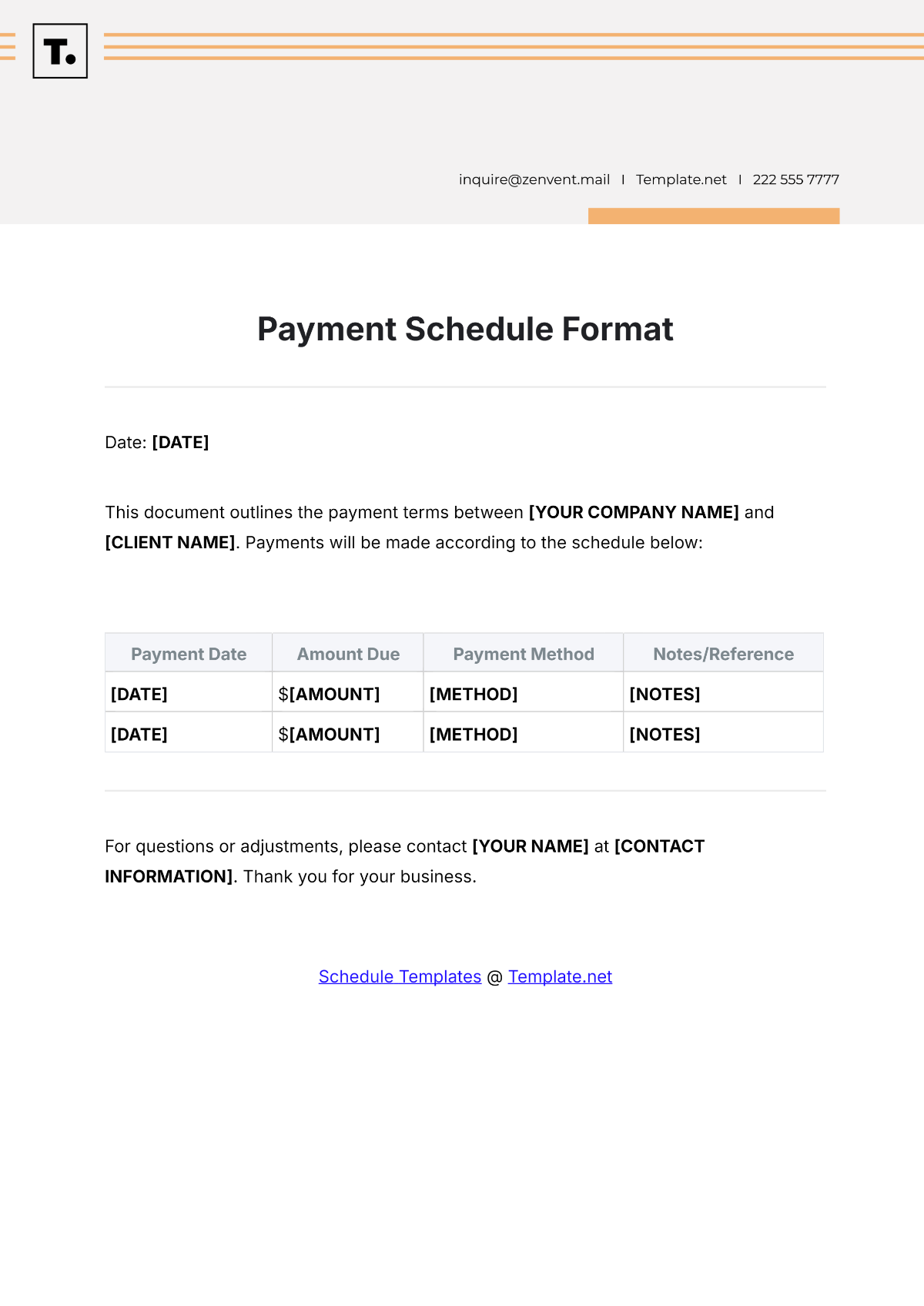

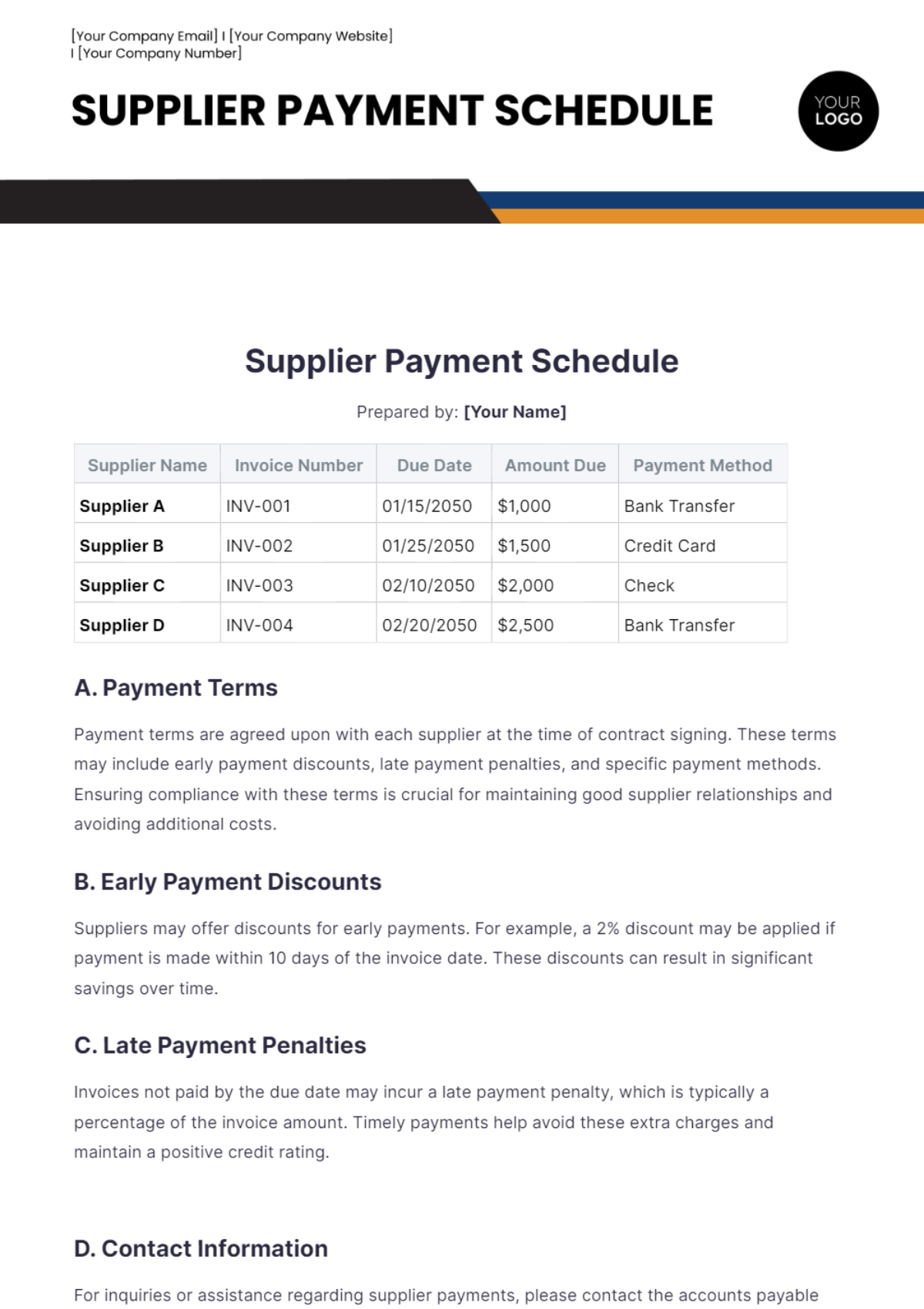

H. Hourly Payment Schedule Table

Pay Period Start Date | Pay Period End Date | Hours Worked | Overtime Hours | Total Payment |

|---|---|---|---|---|

01/01/2050 | 01/14/2050 | 80 | 5 | $1,700 |

01/15/2050 | 01/28/2050 | 75 | 10 | $1,850 |

01/29/2050 | 02/11/2050 | 80 | 0 | $1,600 |

02/12/2050 | 02/25/2050 | 78 | 8 | $1,760 |

02/26/2050 | 03/10/2050 | 85 | 5 | $1,825 |