Grocery Store Financial Report Sample

I. Executive Summary

The third quarter of [2050] presented [Your Company Name] with a blend of economic challenges and growth opportunities. Despite facing inflationary pressures and shifts in consumer purchasing behavior, the grocery store achieved notable progress in several key areas. The report details a robust financial performance, marked by increased revenue and controlled operational costs, demonstrating the store's resilience and adaptability. A strategic focus on enhancing customer experience and optimizing supply chain efficiency has contributed to a stable financial outlook.

This report provides a comprehensive analysis of [Your Company Name]'s financial performance, emphasizing key metrics and strategic insights derived from the data. Financial tables and bullet points will illustrate the store's revenue trends, expense management, and profitability ratios. The narrative will outline the strategies implemented to navigate market challenges, highlight growth areas, and provide actionable recommendations for future improvements. Overall, the third-quarter performance underscores the store's commitment to maintaining financial stability while positioning itself for sustainable growth in a dynamic economic environment.

II. Revenue Analysis

In this section, we delve into the revenue performance of [Your Company Name] for the third quarter of 2050. A detailed analysis of revenue streams and their contributions to overall financial performance is provided to offer insights into the store's market dynamics and growth areas. The following subsections break down revenue data both on a quarterly basis and by product category, helping to understand the financial impact of various operational strategies and market trends.

A. Quarterly Revenue Overview

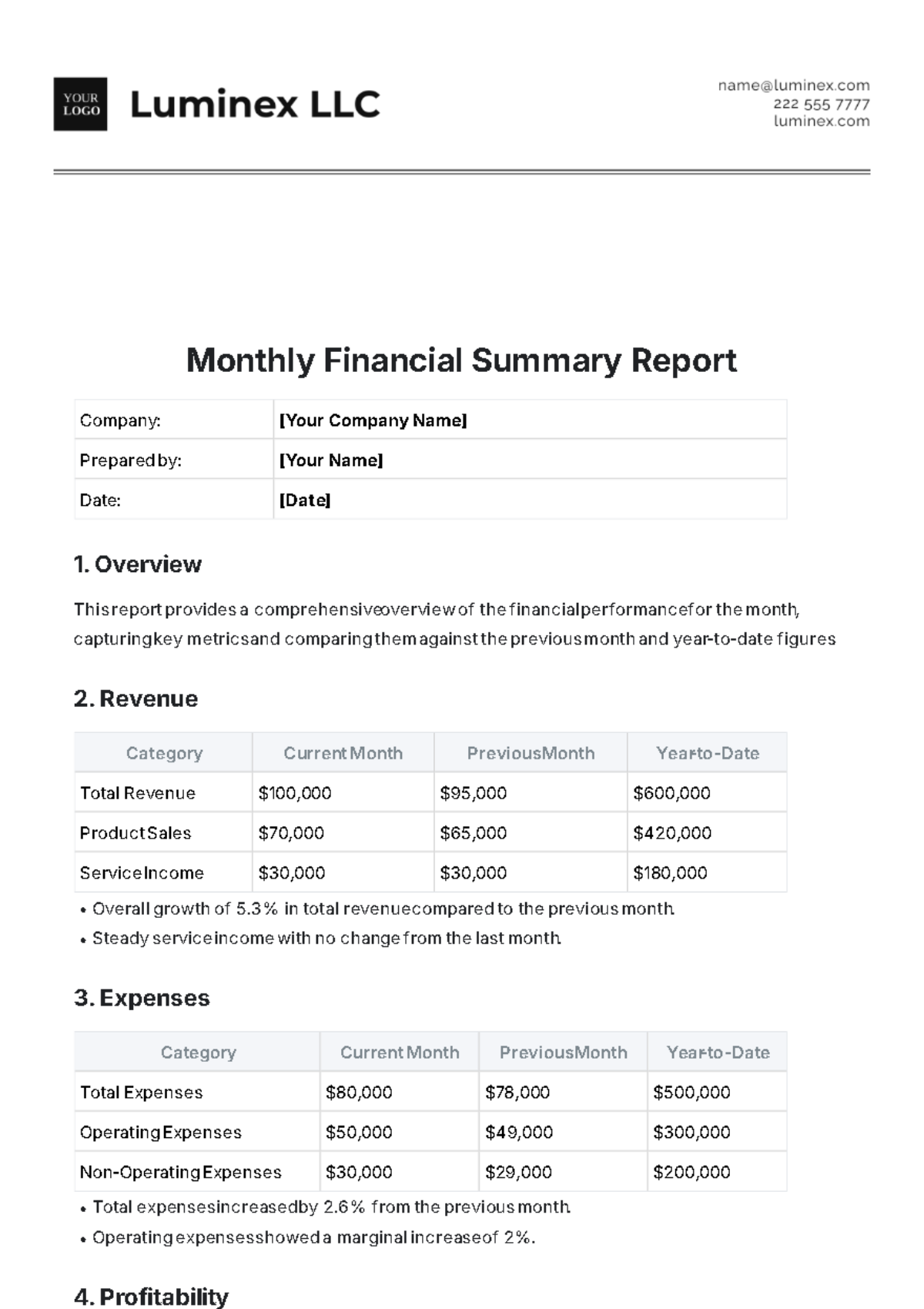

The quarterly revenue overview for Q3 2050 details the store’s earnings over the three-month period. The total revenue for this quarter was $2,300,000, reflecting a 5% increase from the previous quarter. This increase is primarily attributed to successful promotional activities and a rise in customer loyalty. The following table presents a month-by-month breakdown of revenue to provide a clearer picture of performance trends within the quarter.

Month | Revenue ($) |

|---|---|

July | 750,000 |

August | 780,000 |

September | 770,000 |

B. Revenue by Product Category

The revenue by product category analysis provides a detailed breakdown of how different categories contribute to the total revenue. This section examines the performance of various product segments, highlighting their respective contributions and percentages of overall revenue. The following table illustrates the revenue distribution across major product categories, offering insights into which segments are driving financial success.

Category | Revenue ($) | Percentage of Total Revenue |

|---|---|---|

Fresh Produce | 820,000 | 35.65% |

Dairy Products | 450,000 | 19.57% |

Meat and Poultry | 620,000 | 26.96% |

Packaged Goods | 350,000 | 15.22% |

Others | 60,000 | 2.61% |

In Q3 2050, [Your Company Name] achieved a total revenue of $2,300,000, marking a 5% increase from the previous quarter. This growth is attributed to successful promotional campaigns and enhanced customer loyalty. The revenue distribution shows a balanced performance across months, with August generating the highest revenue of $780,000, followed closely by September and July.

Revenue by product category reveals that Fresh Produce is the leading contributor, accounting for 35.65% of total revenue. Meat and Poultry follows with 26.96%, reflecting strong consumer preference for these categories. Dairy Products and Packaged Goods also perform well, indicating diverse customer demand and effective inventory management.

III. Expense Analysis

This section provides a comprehensive breakdown of the operating expenses incurred by [Your Company Name] during the third quarter of 2050. It offers a detailed view of how the store's expenditures are allocated across various key areas, including inventory procurement, staff salaries, and store maintenance. By examining these expenses, we can better understand the store's cost structure and identify areas for potential optimization.

The following breakdown outlines the major expense categories and their respective amounts, along with their percentages of total expenses. This analysis will highlight how resources are allocated and provide insights into the cost management strategies employed during the quarter.

Operating Expenses Breakdown

Key areas of expenditure for the quarter were focused on inventory procurement, staff salaries, and store maintenance. Detailed breakdown is as follows:

Inventory Procurement: $1,100,000

Staff Salaries: $550,000

Store Maintenance: $200,000

Utilities and Other Operating Costs: $100,000

Expense Category | Amount ($) | Percentage of Total Expenses |

|---|---|---|

Inventory Procurement | 1,100,000 | 55% |

Staff Salaries | 550,000 | 27.5% |

Store Maintenance | 200,000 | 10% |

Utilities and Other Operating Costs | 100,000 | 5% |

Miscellaneous | 50,000 | 2.5% |

IV. Profitability Analysis

Examining the profitability of [Your Company Name] for Q3 2050 reveals strong financial health and effective management practices. The gross profit margin reached 45%, showcasing the store's ability to maintain profitability through strategic pricing and efficient procurement. This margin slightly improved from the previous quarter, reflecting successful cost management and revenue optimization strategies.

Net profit margin also showed a positive trend, standing at 12% for the quarter. This represents a significant improvement from the 10% recorded in Q2 2050, underscoring the effectiveness of the store's financial controls and overall strategic planning. These metrics highlight the store’s enhanced profitability and operational efficiency during this period.

Gross Profit Margin

The gross profit margin for Q3 2023 was 45%. Key strategies that contributed to maintaining a healthy margin included optimized pricing strategies and cost-effective procurement practices.

Net Profit Margin

The net profit margin for the quarter stood at 12%, demonstrating robust cost control measures and strategic financial management.

V. Future Outlook

Looking ahead, [Your Company Name] is strategically positioned for continued growth in the next quarter, with a focus on several key areas to drive expansion and operational efficiency. The primary objectives are as follows:

Increase Online Sales by 15%

We aim to achieve a 15% increase in online sales by ramping up our digital marketing efforts, optimizing the online shopping experience, and leveraging data analytics to better understand and meet customer preferences. Enhancing our digital presence and engagement will help capture a larger share of the e-commerce market and drive higher revenue growth.

Expand Private Label Product Line

The introduction of 10 new items to our private label product line is planned. This expansion will diversify our product offerings, strengthen brand loyalty, and improve profit margins. By creating unique products under our private label, we aim to offer exclusive options that cater to customer preferences and set us apart from competitors.

Upgrade Point of Sale (POS) Systems

We will enhance the in-store customer experience by upgrading our POS systems. The new systems are expected to streamline transactions, reduce wait times, and equip staff with better tools to serve customers more efficiently. This upgrade will improve customer satisfaction and encourage repeat business.

Improve Inventory Turnover Rates

To reduce holding costs, we will focus on improving inventory turnover rates. By adopting advanced inventory management practices such as just-in-time inventory and more accurate demand forecasting, we aim to minimize excess stock, reduce waste, and enhance cash flow. Efficient inventory management will ensure optimal stock levels and better cost control.

Through these targeted goals, [Your Company Name] is set to leverage growth opportunities, enhance operational efficiency, and continue delivering exceptional value to customers in the upcoming quarter.

VI. Conclusion

The analysis for the third quarter of 2050, [Your Company Name] has demonstrated a solid financial performance amid a challenging economic landscape. The quarter saw a 5% increase in revenue, driven by effective promotional strategies and heightened customer loyalty. Despite the economic pressures, the store maintained a healthy gross profit margin of 45% and improved its net profit margin to 12%, reflecting robust cost control and strategic financial management. These results underscore the effectiveness of our operational and financial strategies in navigating the current market environment.

Looking forward, the store is poised for continued growth with a clear focus on expanding its online presence, enhancing the private label product line, upgrading customer experience through advanced POS systems, and improving inventory turnover rates. These strategic initiatives are designed to drive further revenue growth, optimize operational efficiency, and strengthen customer engagement. By executing these goals, [Your Company Name] aims to build on its current successes and position itself for sustained prosperity in the coming quarters. The commitment to these strategic objectives will be crucial in adapting to evolving market conditions and achieving long-term business success.