Startup Vesting Schedule

This document outlines the vesting schedule for startup equity grants, ensuring that company founders, employees, and advisors earn their equity stakes over time. Vesting schedules help align interests, retain talent, and ensure commitment to the startup's long-term success.

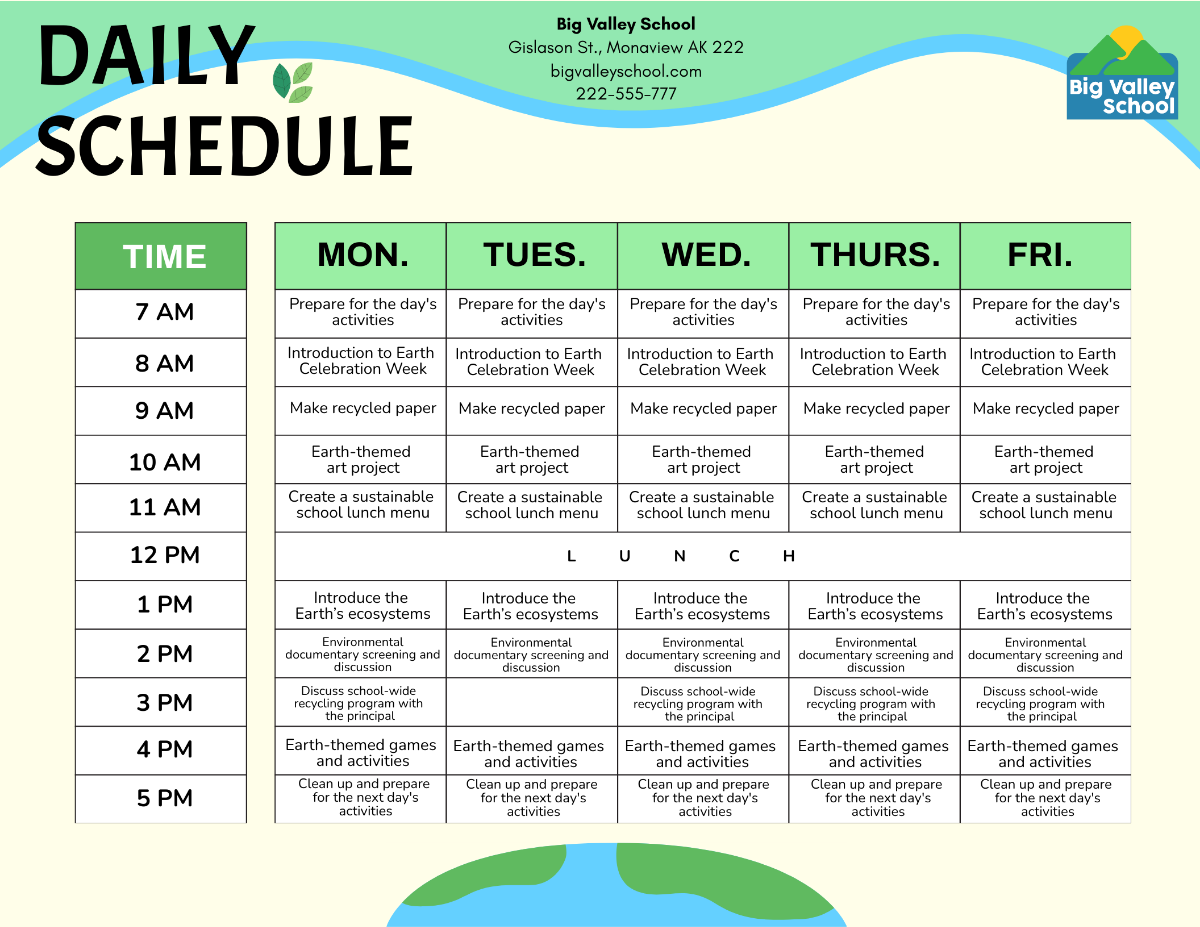

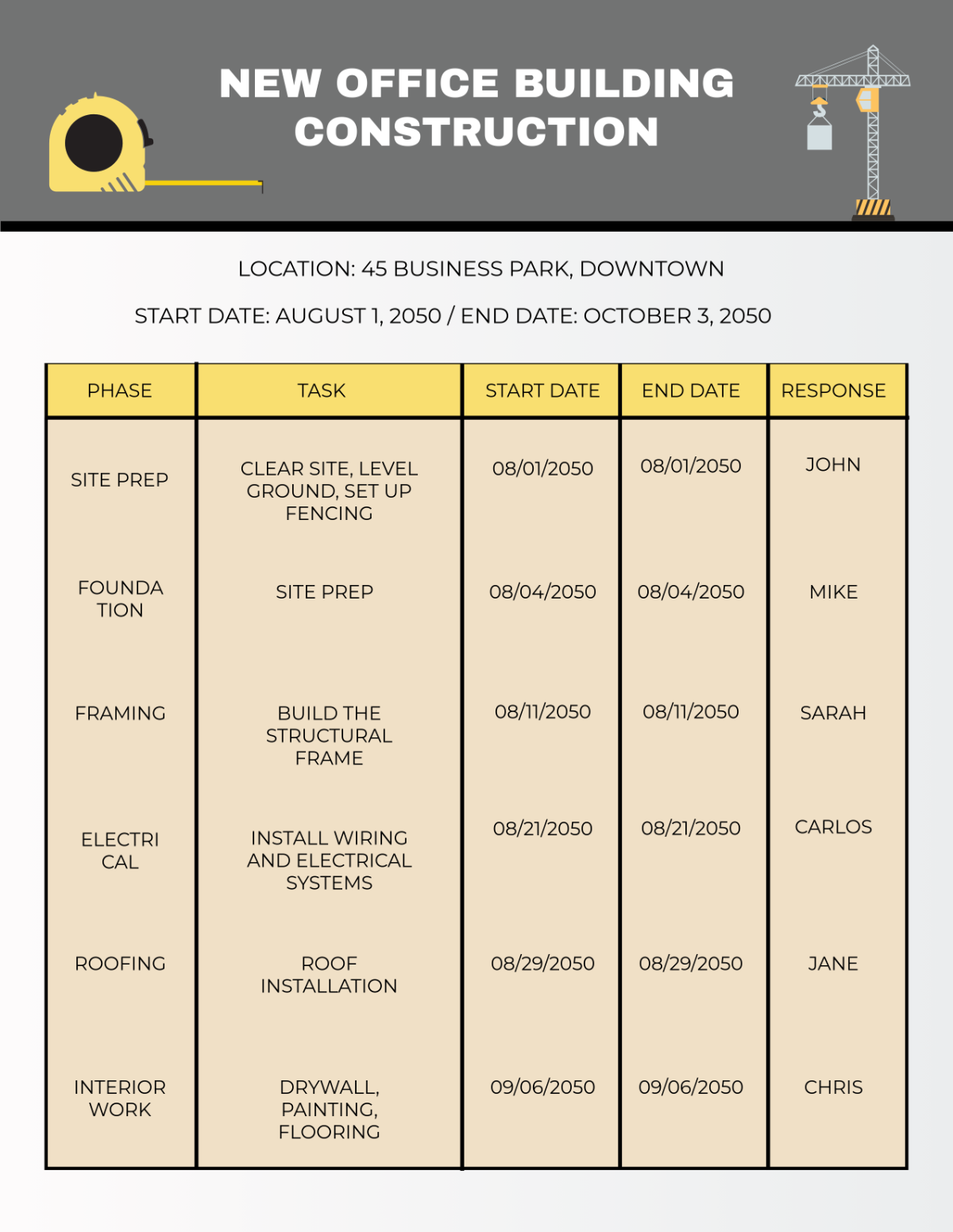

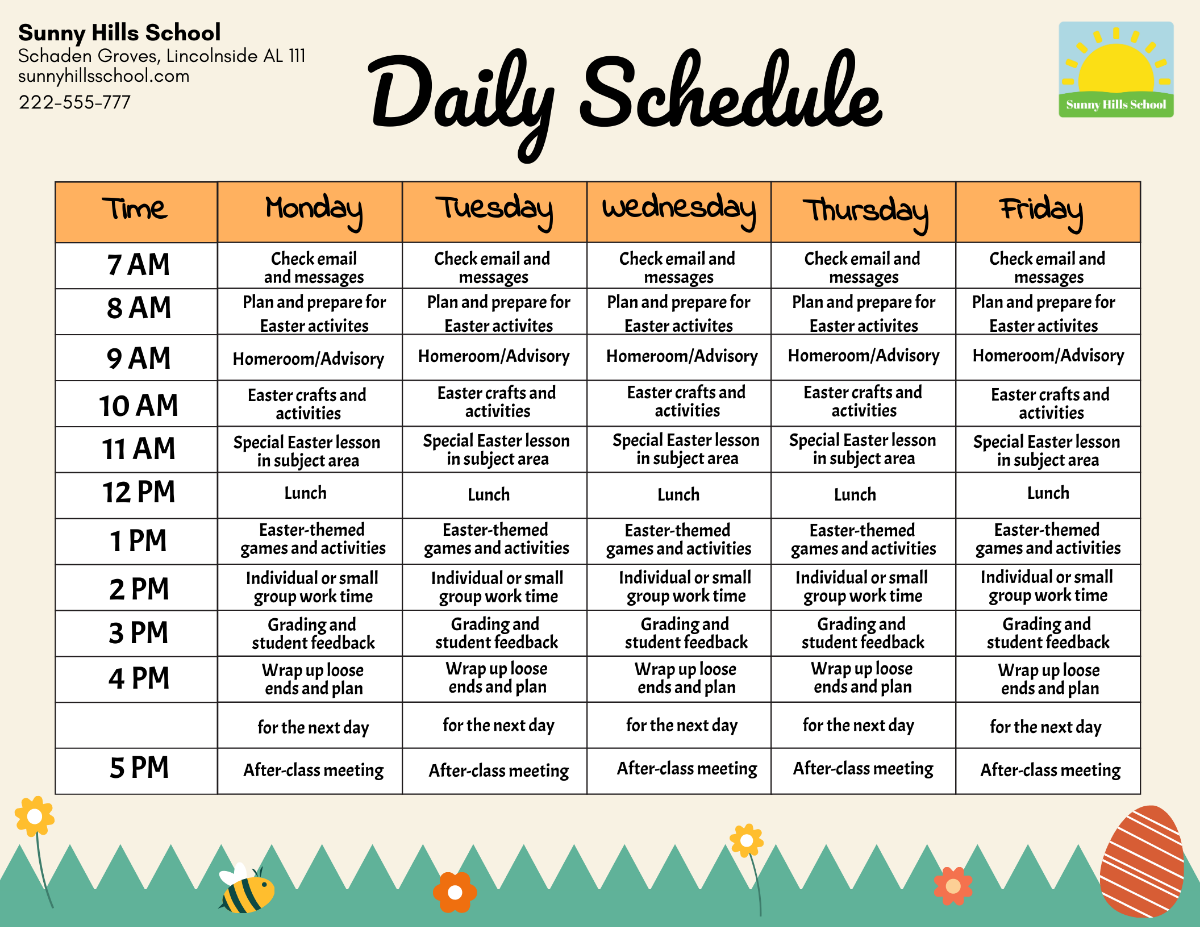

Detailed Vesting Schedule Table

The following table illustrates a sample vesting schedule for equity grants:

Employee/Advisor | Grant Date | Total Equity Granted | Cliff Period | Vesting Period | Monthly Vesting | Equity Vested After 1 Year | Equity Vested at End of Vesting Period |

|---|---|---|---|---|---|---|---|

John Doe | Jan 1, 2050 | 10,000 shares | 1 year | 4 years | 208.33 shares | 2,500 shares | 10,000 shares |

Jane Smith | Feb 1, 2050 | 5,000 shares | 1 year | 4 years | 104.17 shares | 1,250 shares | 5,000 shares |

Notes:

Cliff Period: No equity vests during the first year. After one year, the cliff period ends, and the initial batch of equity vests.

Monthly Vesting: After the cliff period, equity vests monthly based on the total amount granted and the remaining vesting period.

Equity Vested: Shows the amount of equity that has vested at the end of the cliff period and the total amount vested by the end of the vesting period.