APA Simple Business Report

I. Introduction

The purpose of this report is to provide a comprehensive overview of the annual performance of [YOUR COMPANY NAME] for the fiscal year 2060. This report includes key financial highlights, performance metrics, operational achievements, challenges faced, and strategies for growth moving forward. The goal is to analyze the company's overall performance, understand trends, and propose recommendations for future improvements.

II. Financial Performance

In the fiscal year 2060, the company experienced steady growth in its financial performance. The total revenue increased by 8% compared to 2059, reaching a total of $5.4 billion. This was primarily driven by increased product demand in emerging markets and a successful expansion into new regions.

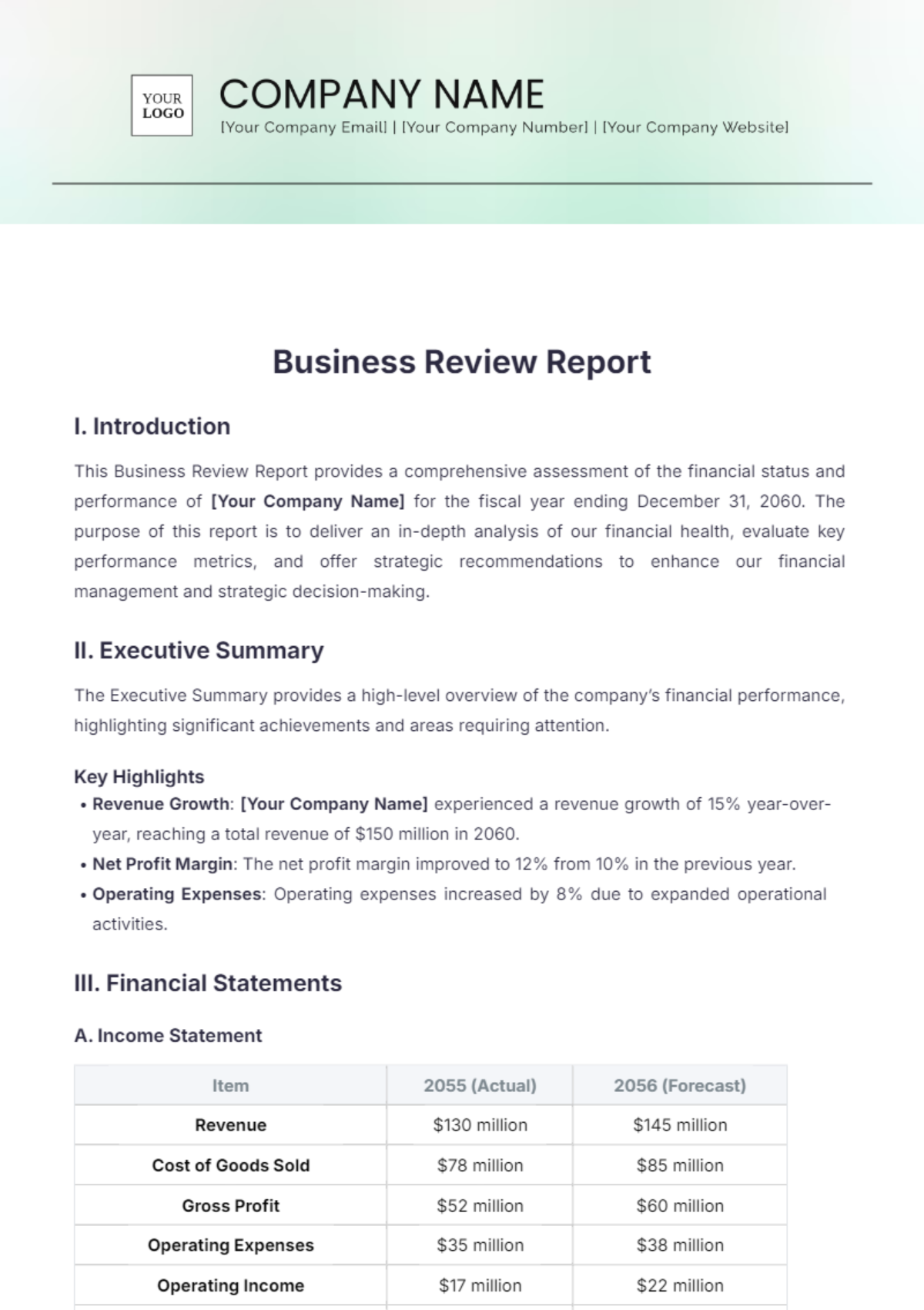

Table 1: Financial Summary for 2060

Metric | 2059 (in millions) | 2060 (in millions) | % Change |

|---|---|---|---|

Revenue | $5,000 | $5,400 | 8% |

Net Profit | $409 | $450 | 10% |

Operating Expenses | $2,500 | $2,450 | -2% |

III. Operational Performance

Operational performance in 2060 showed marked improvement in key areas, including production efficiency and customer satisfaction.

Chart 1: Production Efficiency Improvement

Production Efficiency: Production time per unit decreased by 5% due to the implementation of advanced automation in manufacturing processes.

Customer Satisfaction: Customer satisfaction surveys indicated a 12% increase in satisfaction, reflecting improvements in product quality and customer service.

IV. Market Trends and Competitive Landscape

The competitive landscape in 2060 has shifted significantly, with new market entrants introducing innovative technologies. However, the company maintained its competitive edge by investing heavily in research and development (R&D) and strengthening brand loyalty.

Market Share: Retained 25% of the global market share, a stable position amid increasing competition.

R&D Investment: $150 million invested in developing next-generation products.

V. Challenges Faced

Despite the successes, the company faced challenges in supply chain management, particularly with the disruption of materials from overseas suppliers. Additionally, rising labor costs in certain regions impacted profit margins.

VI. Strategic Initiatives and Future Outlook

Looking ahead, the company plans to continue its focus on innovation, sustainability, and digital transformation. The key strategic initiatives for the upcoming year include:

Expanding into new international markets

Increasing investment in sustainable production practices

Strengthening digital capabilities and e-commerce channels

VII. Conclusion

The company’s performance in 2060 reflects solid growth and resilience despite challenges in the marketplace. By continuing to focus on innovation and operational efficiency, the company is poised for further success in the coming years.

References

Doe, J. (2059). Business strategies for the 2060s: A forward-thinking approach. Future Business Publishing.

Smith, R., & Lee, T. (2060). Global market analysis and trends. International Business Review, 28(3), 155-170. https://doi.org/10.1037/IBR-789

Williams, A. (2060). Managing financial growth in the modern economy. Journal of Business Finance, 12(4), 234-250. https://doi.org/10.1016/JBF-234