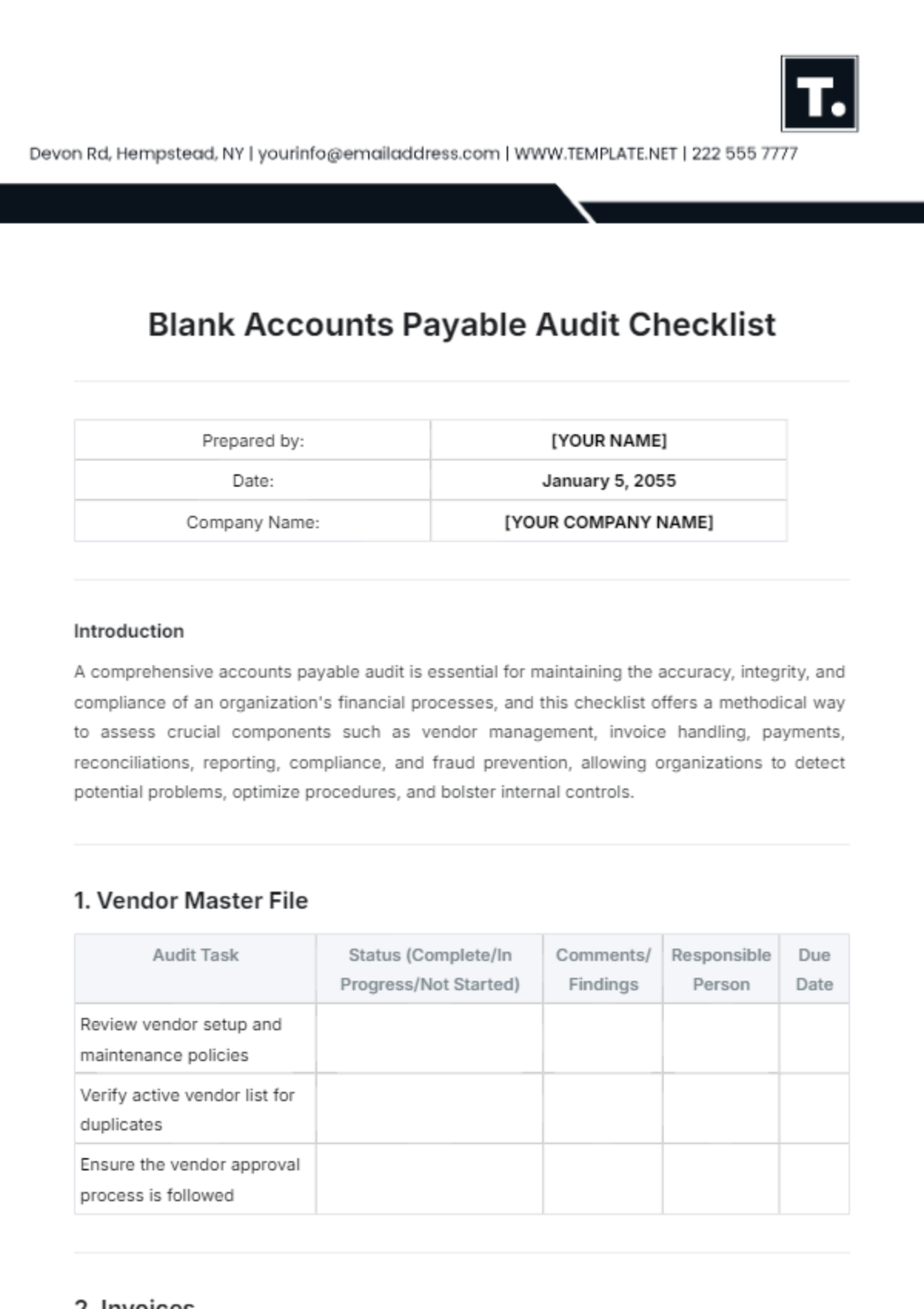

Ensuring Robust Accounts Payable Management

Date: | [Date] |

Conducted by: | [Your Name] |

Company: | [Your Company Name] |

Audit Objective:

The objective of this audit is to systematically assess and enhance the accuracy, completeness, compliance, and controls within the Accounts Payable process, with a specific focus on minimizing financial risks and ensuring optimal operational efficiency.

1. Verification of Accuracy

Verify mathematical accuracy of invoices by cross-referencing with supporting documentation.

Confirm legitimacy of suppliers through thorough vetting processes.

Review and confirm the correctness of account coding for each transaction.

2. Assessment of Completeness

Ensure systematic recording of all received invoices.

Confirm accurate and comprehensive recording of all payments made.

Conduct a meticulous review of the reconciliation between the accounts payable ledger and the general ledger.

3. Review of Compliance

Verify strict adherence to established Accounts Payable policies and procedures.

Ensure compliance with relevant tax regulations governing payment transactions.

Confirm adherence to contractual terms and agreements with suppliers.

4. Effectiveness of Controls

Thoroughly review internal control procedures implemented in the Accounts Payable process.

Evaluate the segregation of duties within the Accounts Payable department for enhanced internal control.

Assess the effectiveness of controls in place for payment processing, focusing on accuracy and security.

5. Minimization of Financial Risks

Identify and address potential fraudulent activities through comprehensive scrutiny.

Assess the risk associated with overpayments or duplicate payments, implementing preventive measures.

Evaluate the potential financial impact of late payment penalties, if applicable, and devise strategies for mitigation.