Bank Audit Framework for Operational Integrity

Financial Transactions Audit

Reconcile cash transactions to ensure accuracy and completeness, identifying any discrepancies promptly.

Verify interest calculations for loans and deposits, ensuring precision in financial reporting.

Scrutinize ATM transactions for any irregularities or potential fraudulent activities.

Validate electronic fund transfers, examining transactional documentation to guarantee legitimacy.

Confirm credit and debit card transactions, cross-referencing with supporting documents.

Assess adherence to transactional policies, ensuring compliance with established guidelines.

Investigate potential fraud indicators, identifying and addressing any suspicious activities promptly.

Internal Controls Audit

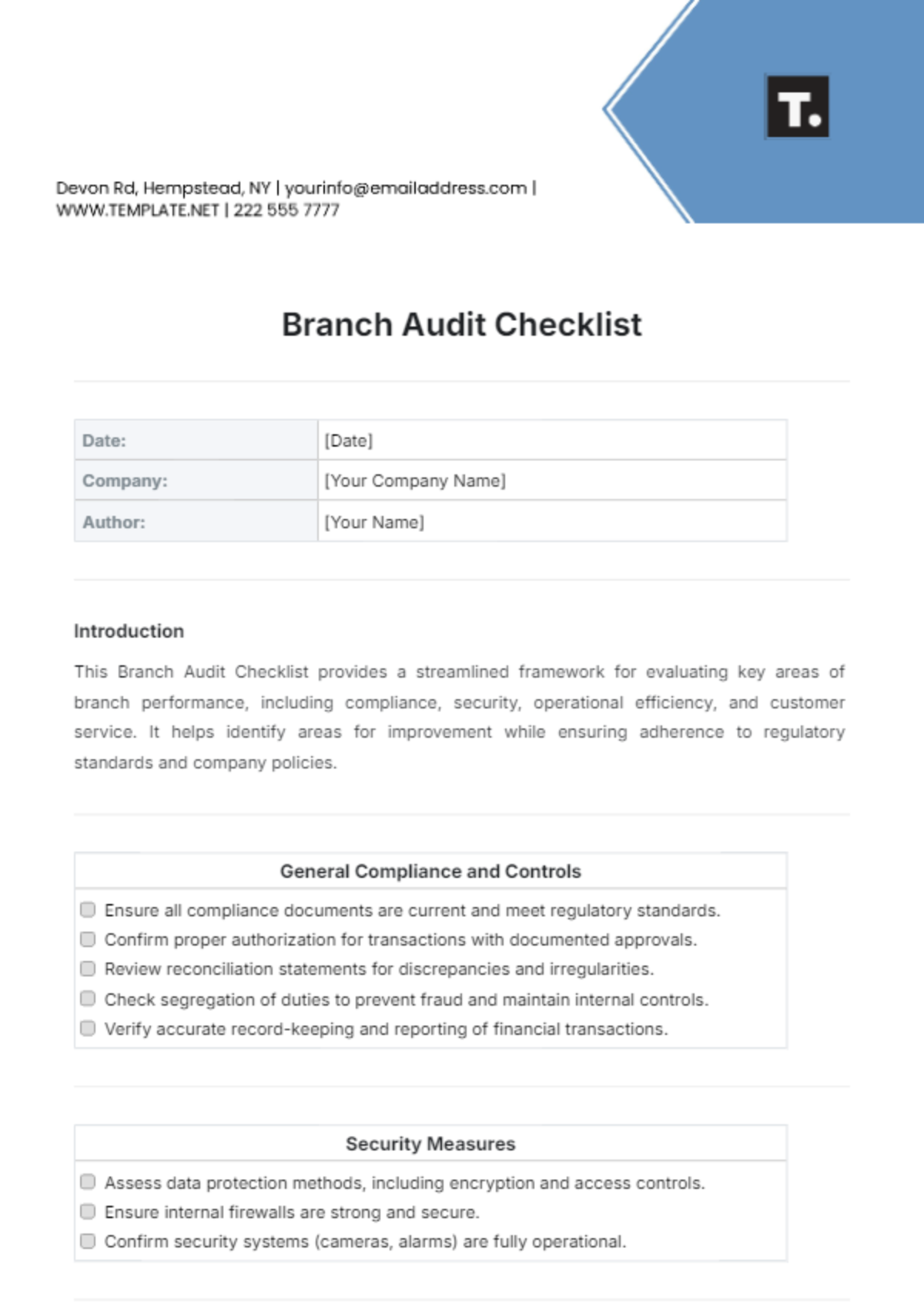

Scrutinize segregation of duties to prevent conflicts and maintain a robust internal control framework.

Evaluate monitoring mechanisms to ensure continuous oversight of critical processes.

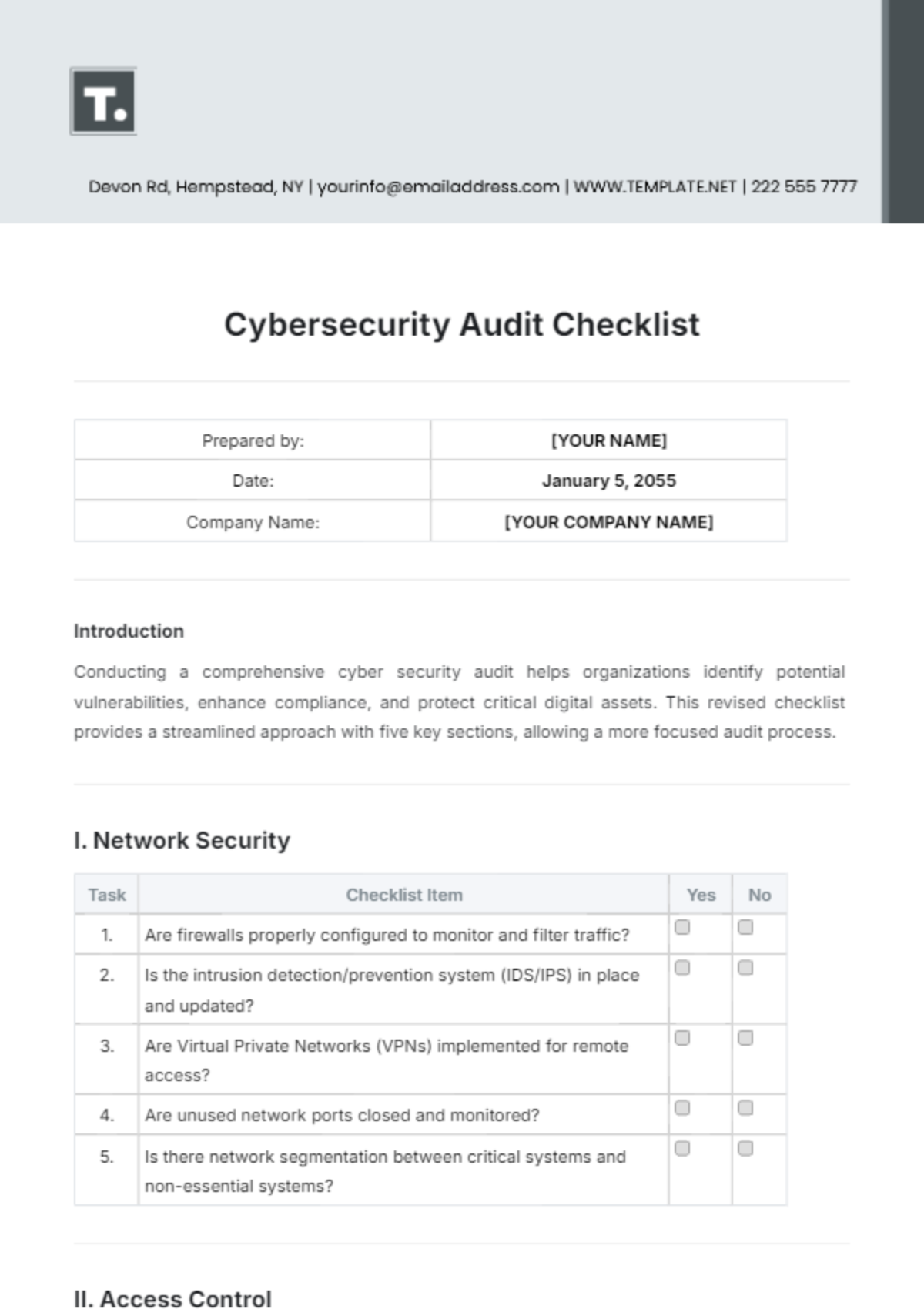

Review information security protocols, focusing on safeguarding sensitive data from unauthorized access.

Examine disaster recovery plans to guarantee the bank's ability to resume operations swiftly in case of emergencies.

Assess the effectiveness of internal audits, emphasizing the importance of thorough and objective assessments.

Analyze the adequacy of whistleblower mechanisms, promoting a culture of transparency and reporting.

Evaluate the robustness of IT general controls, ensuring the integrity and security of information systems.

Regulatory Compliance Audit

Scrutinize customer due diligence processes to verify the accuracy and completeness of customer information.

Verify adherence to fair lending laws, promoting equal access to financial services for all customers.

Assess compliance with privacy regulations, safeguarding customer information and ensuring data protection.

Review adherence to electronic banking regulations, emphasizing secure and compliant online transactions.

Confirm compliance with the Bank Secrecy Act, focusing on preventing money laundering and fraud.

Examine adherence to the Dodd-Frank Act, ensuring transparency and accountability in financial institutions.

Evaluate compliance with the Sarbanes-Oxley Act, emphasizing financial reporting integrity and corporate governance.

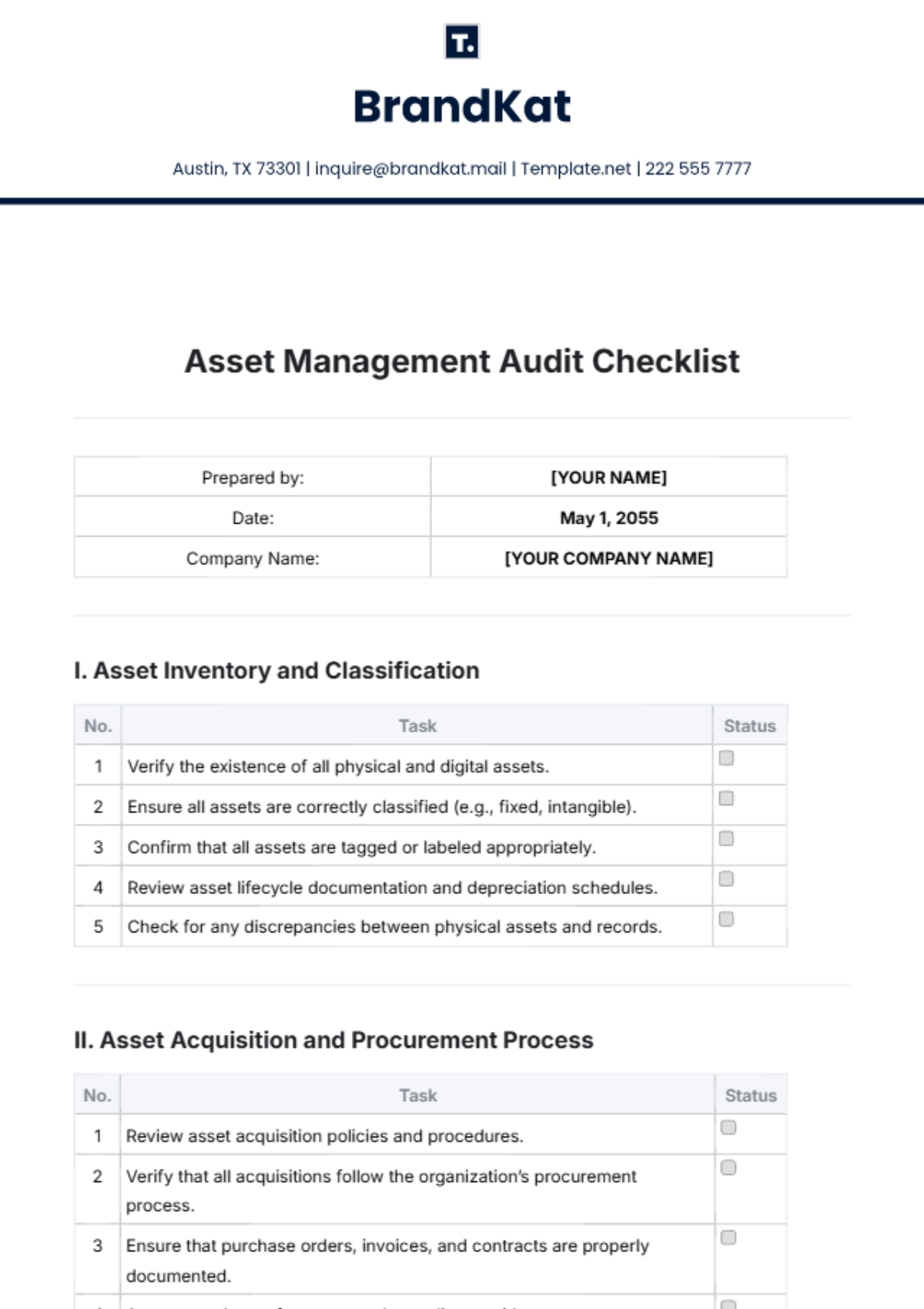

Prepared by: | [YOUR NAME] |

Date: | [DATE] |

Company: | [YOUR COMPANY NAME] |