Free Internal Audit Checklist for Real Estate Company

Subject Property | Address | Company | Creator |

|---|---|---|---|

55 Rose Avenue, Phoenix, AZ | [your company address] | [your company name] | [your name] |

Instructions:

This checklist is designed to ensure the thorough assessment of your real estate company's internal processes and compliance. Please go through each item and mark 'Yes' or 'No' accordingly.

For any item marked 'No', provide comments or explanations to specify the areas of concern.

Financial Management and Reporting

Financial Statements: Are financial statements regularly prepared, accurate, and in compliance with accounting standards?

Yes

No

Budget Management: Is there a budget in place, and is it followed consistently?

Yes

No

Cash Flow Monitoring: Is there a robust system for monitoring cash flows and managing liquidity?

Yes

No

Tax Compliance: Are all tax obligations met, including property taxes and income taxes?

Yes

No

Compliance and Legal Matters

Licensing and Permits: Are all required licenses and permits up-to-date?

Yes

No

Contract Management: Is there a process for reviewing, renewing, and ensuring compliance with contracts?

Yes

No

Data Privacy: Is sensitive customer data handled in compliance with privacy regulations?

Yes

No

Environmental Regulations: Is the company in compliance with environmental regulations for properties it manages?

Yes

No

Property Management

Maintenance and Repairs: Are properties regularly inspected, maintained, and repairs promptly addressed?

Yes

No

Tenant Relations: Is there a process for addressing tenant concerns and resolving disputes?

Yes

No

Occupancy Rates: Are occupancy rates consistently monitored and optimized?

Yes

No

Lease Agreements: Are lease agreements and rental collections managed effectively?

Yes

No

Risk Management

Insurance Coverage: Are properties adequately insured, and insurance policies regularly reviewed?

Yes

No

Emergency Response: Is there a well-defined emergency response plan for unexpected events (e.g., natural disasters)?

Yes

No

Internal Controls

Internal Audits: Are regular internal audits conducted to assess the effectiveness of controls and processes?

Yes

No

Segregation of Duties: Are financial responsibilities appropriately segregated to prevent fraud?

Yes

No

Document Management: Are important documents, such as contracts and financial records, securely stored and accessible as needed?

Yes

No

Employee and Training

Staff Training: Are employees regularly trained on compliance, safety, and company policies?

Yes

No

Employee Background Checks: Are background checks conducted for employees handling sensitive information or finances?

Yes

No

Whistleblower Policy: Is there a mechanism for employees to report concerns without fear of retaliation?

Yes

No

Technology and Security

Data Security: Is there a robust cybersecurity policy to protect sensitive data?

Yes

No

Software Updates: Are software and systems regularly updated to protect against vulnerabilities?

Yes

No

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate Internal Audit Checklist for Real Estate Company Template on Template.net. This meticulously crafted resource is your key to efficient audits. It's fully editable and customizable, allowing you to tailor it to your specific needs. Utilize the AI Editable Tool for seamless updates and stay ahead of compliance. Streamline your auditing process with this essential template today!

You may also like

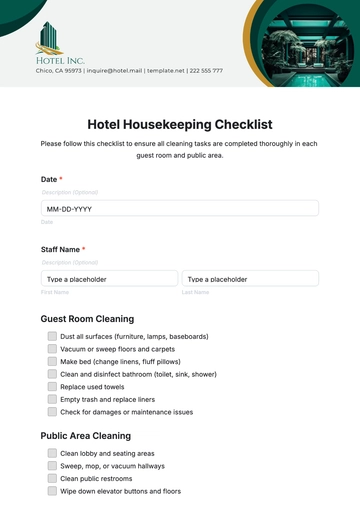

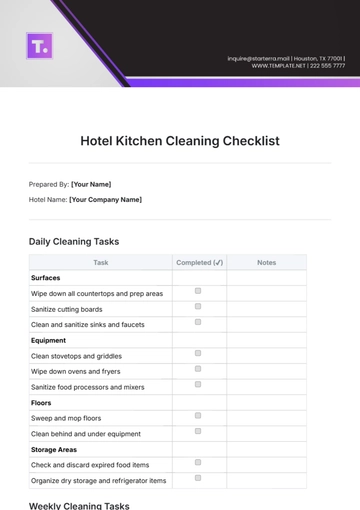

- Cleaning Checklist

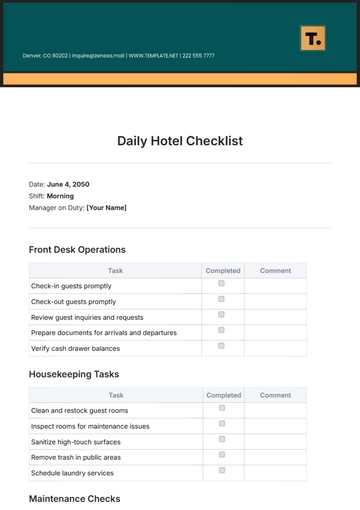

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

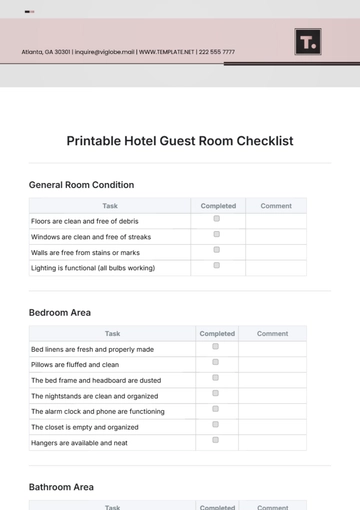

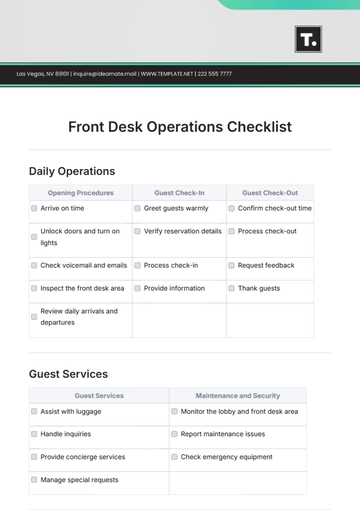

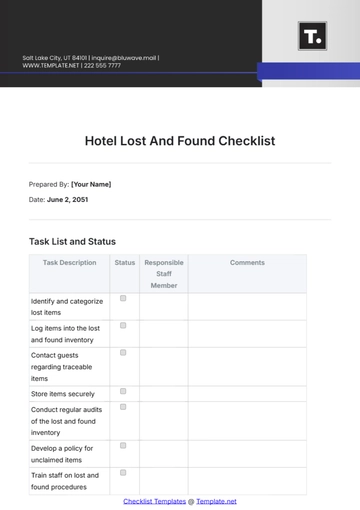

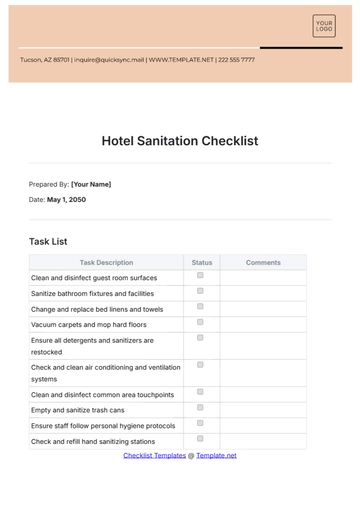

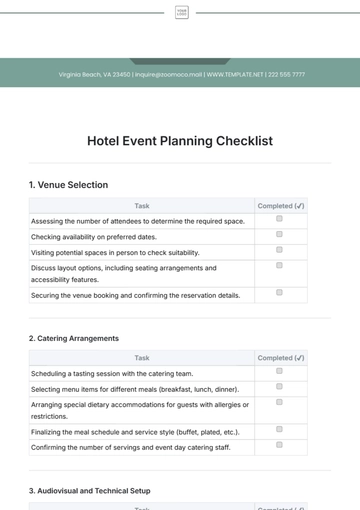

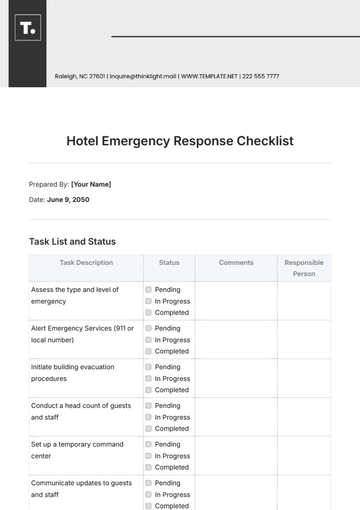

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

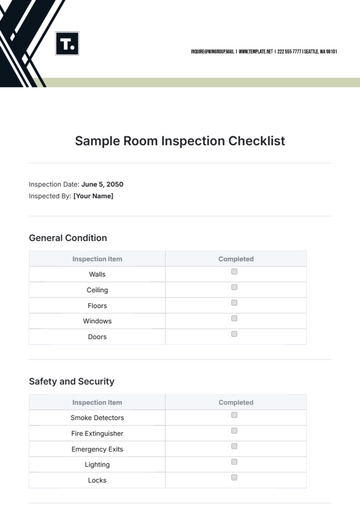

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

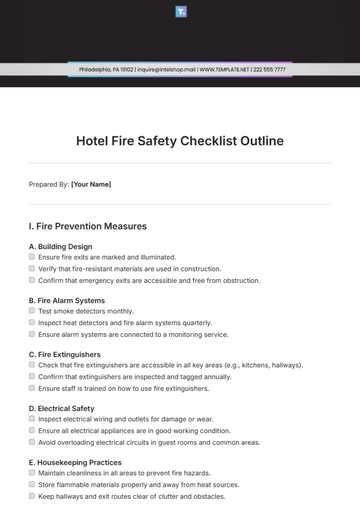

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

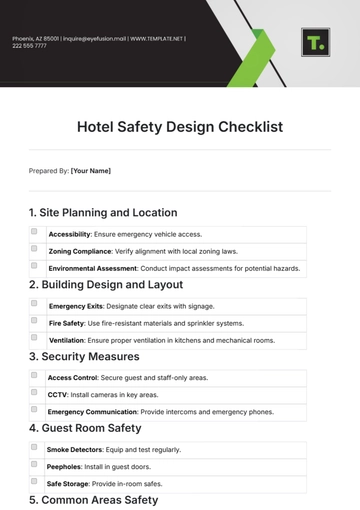

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist