Monthly Accounting Excellence: Enhancing Financial Precision

Streamlining financial processes is crucial for sustained business success. This Monthly Accounting Checklist ensures your financial health by covering three core areas: Bookkeeping, Financial Reporting, and Compliance and Risk Management.

Objectives:

To provide a systematic approach in managing financial tasks.

To ensure accuracy and compliance in all accounting practices.

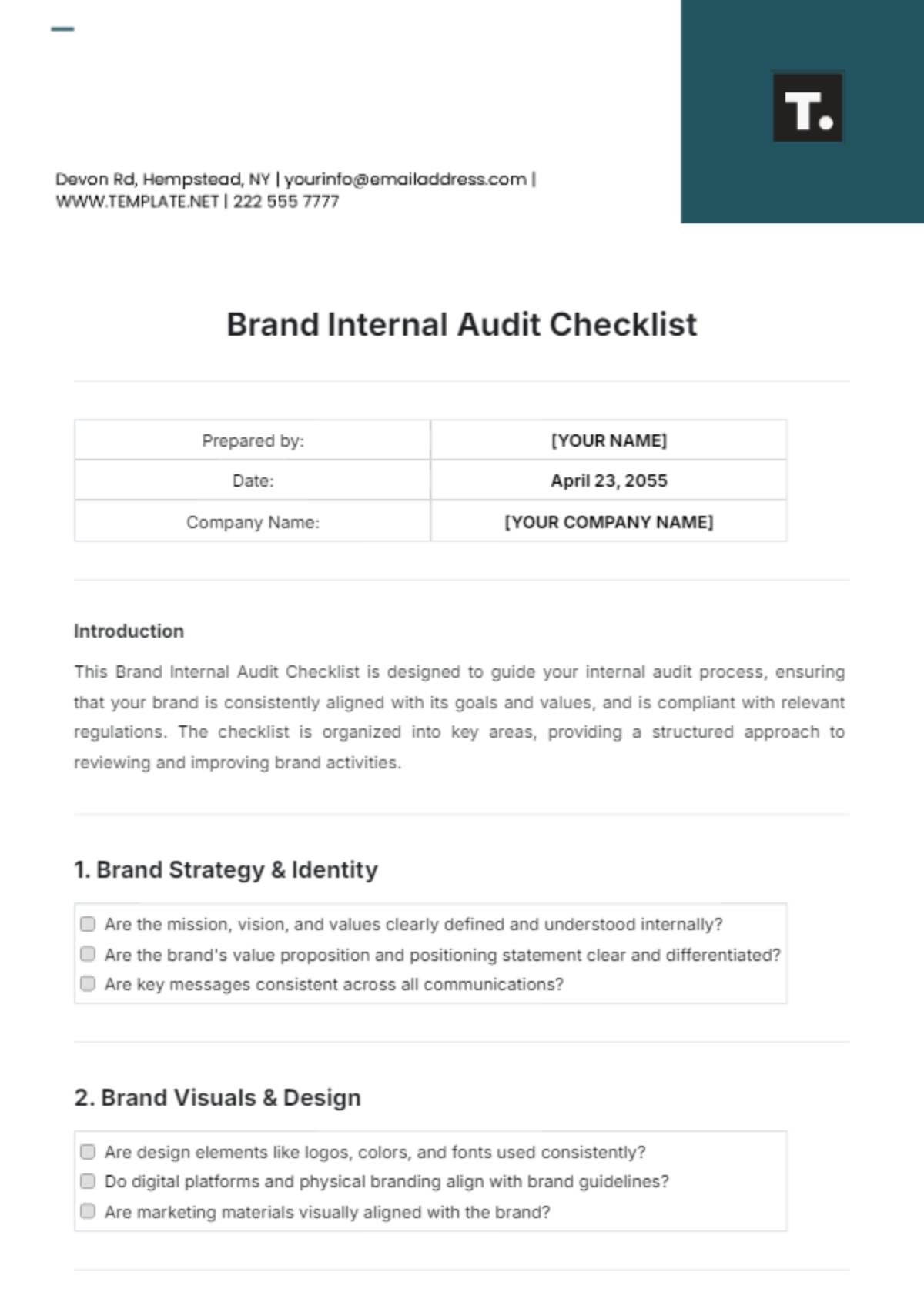

To enhance the brand identity of the company.

Bookkeeping

1. Detailed Transaction Records:

Document every financial transaction meticulously.

Log receipts, invoices, and expenses for a comprehensive financial trail.

2. Ledger Accuracy:

Regularly verify and ensure precision in ledger entries.

Address discrepancies promptly to maintain data integrity.

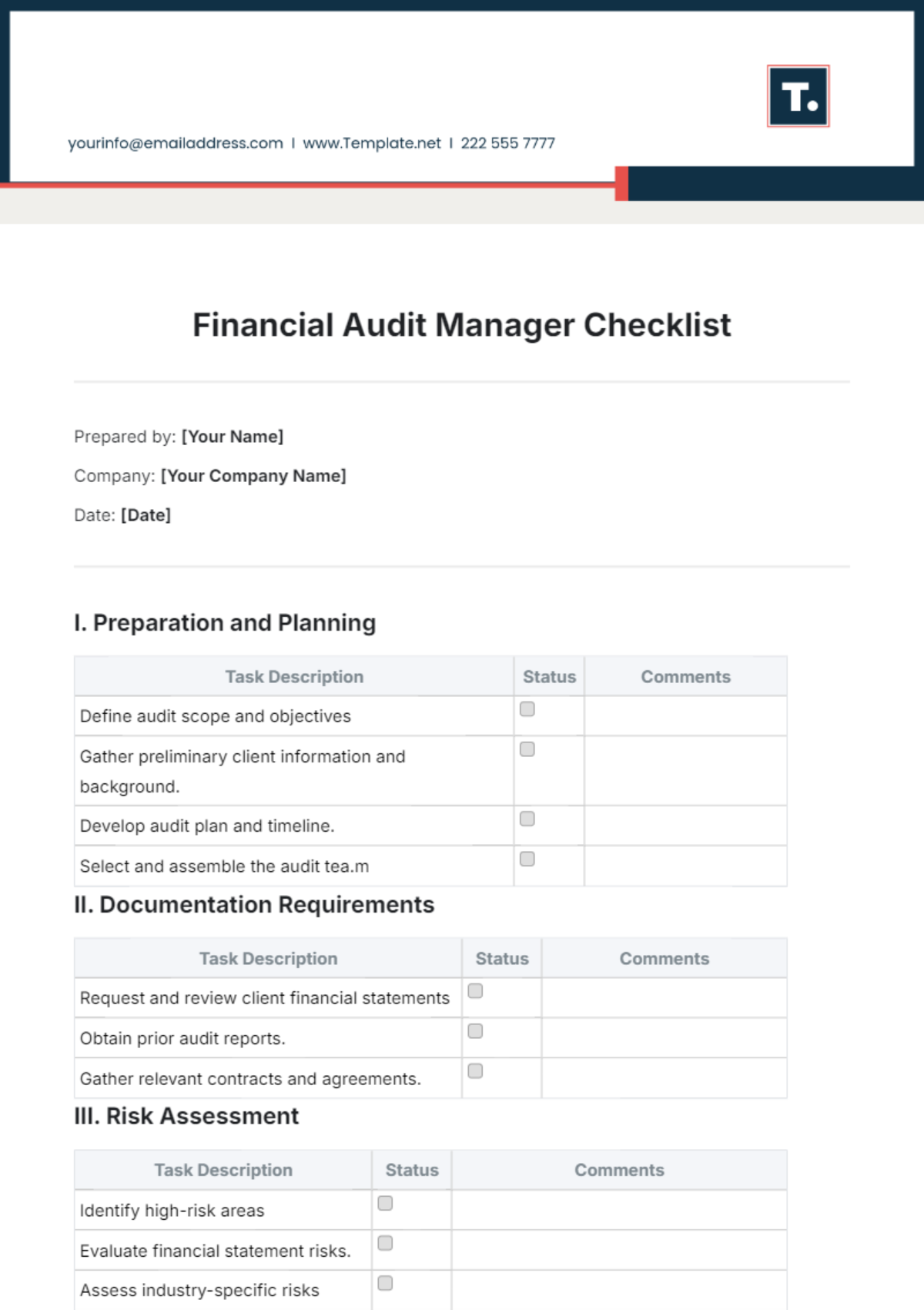

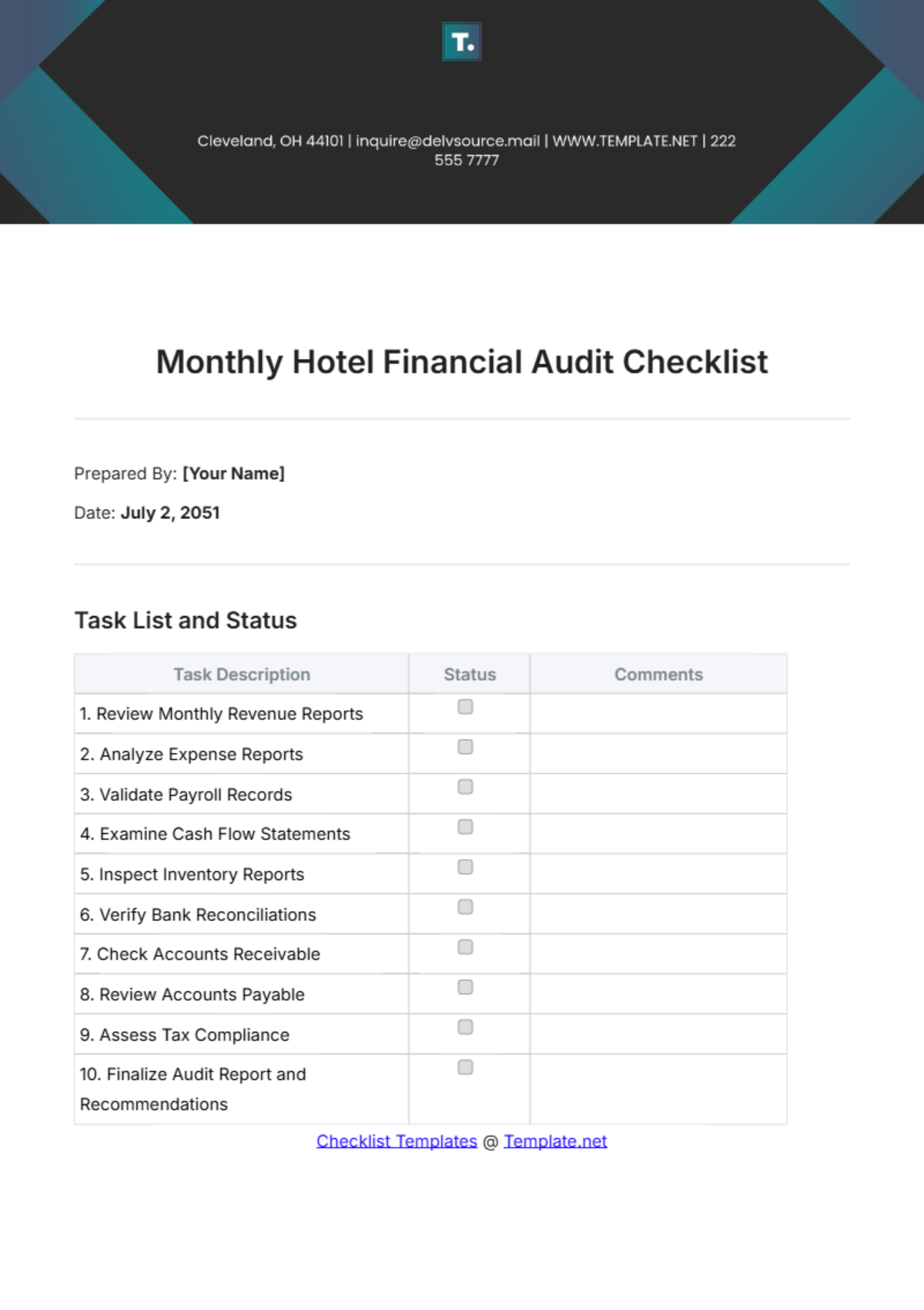

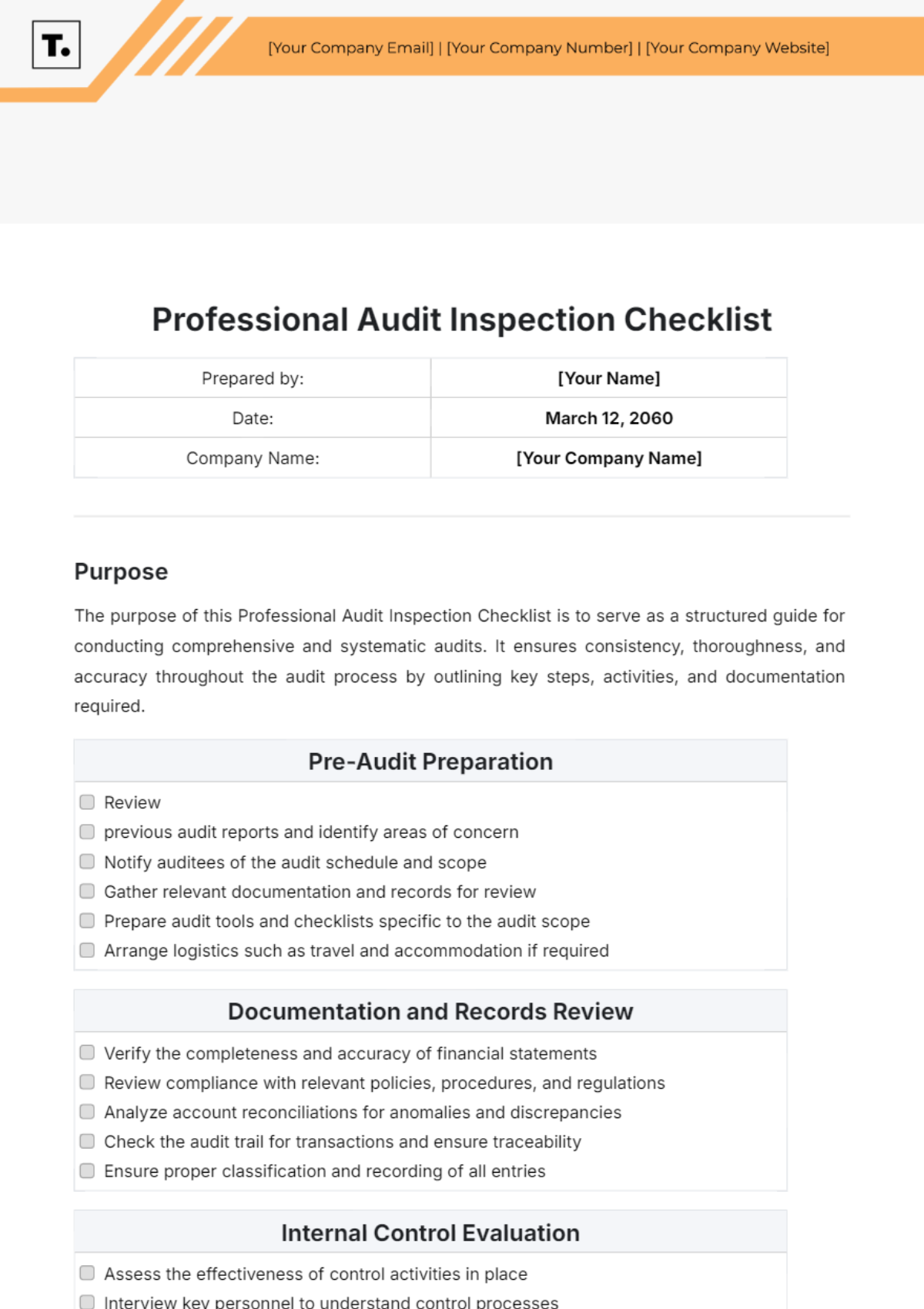

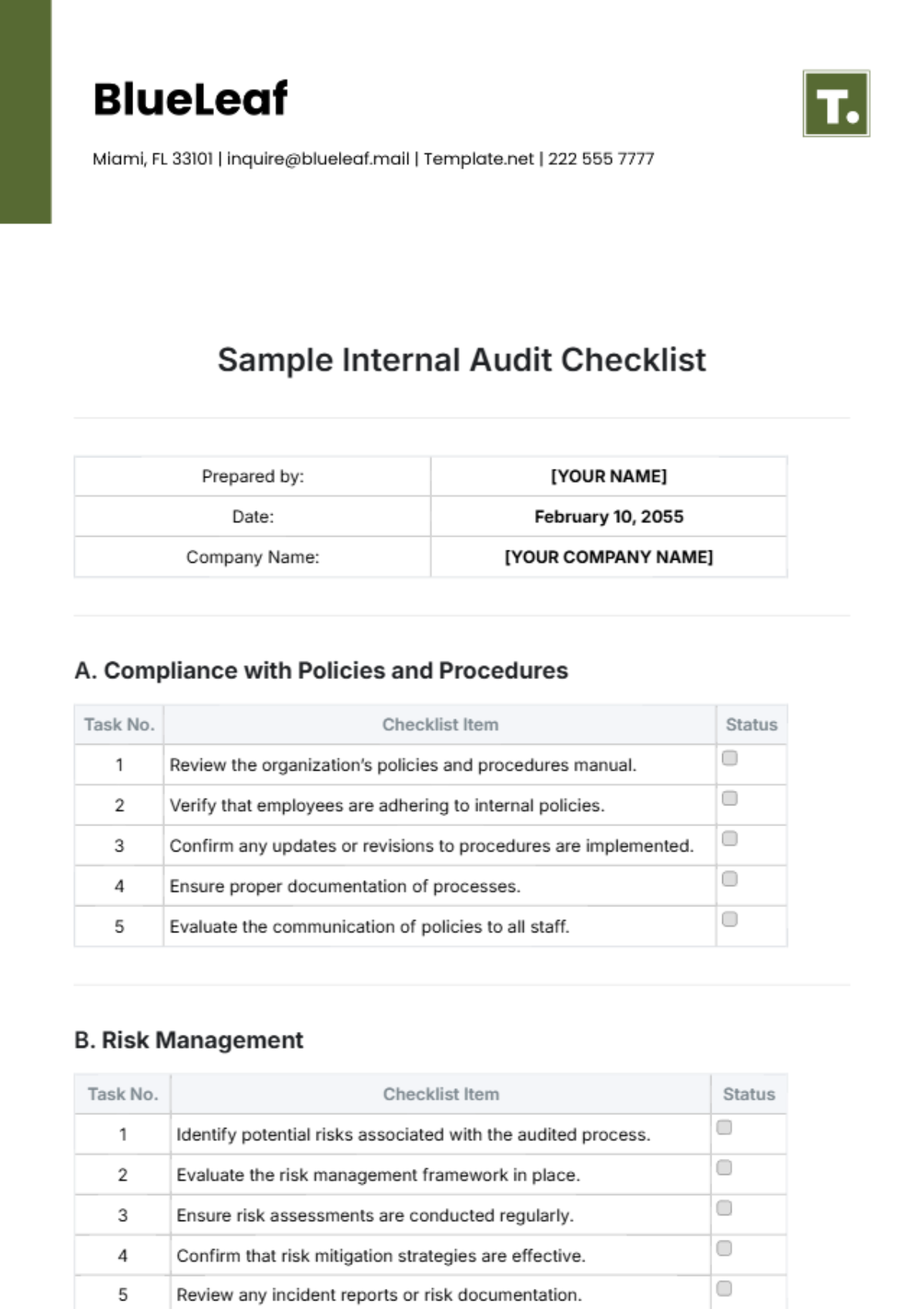

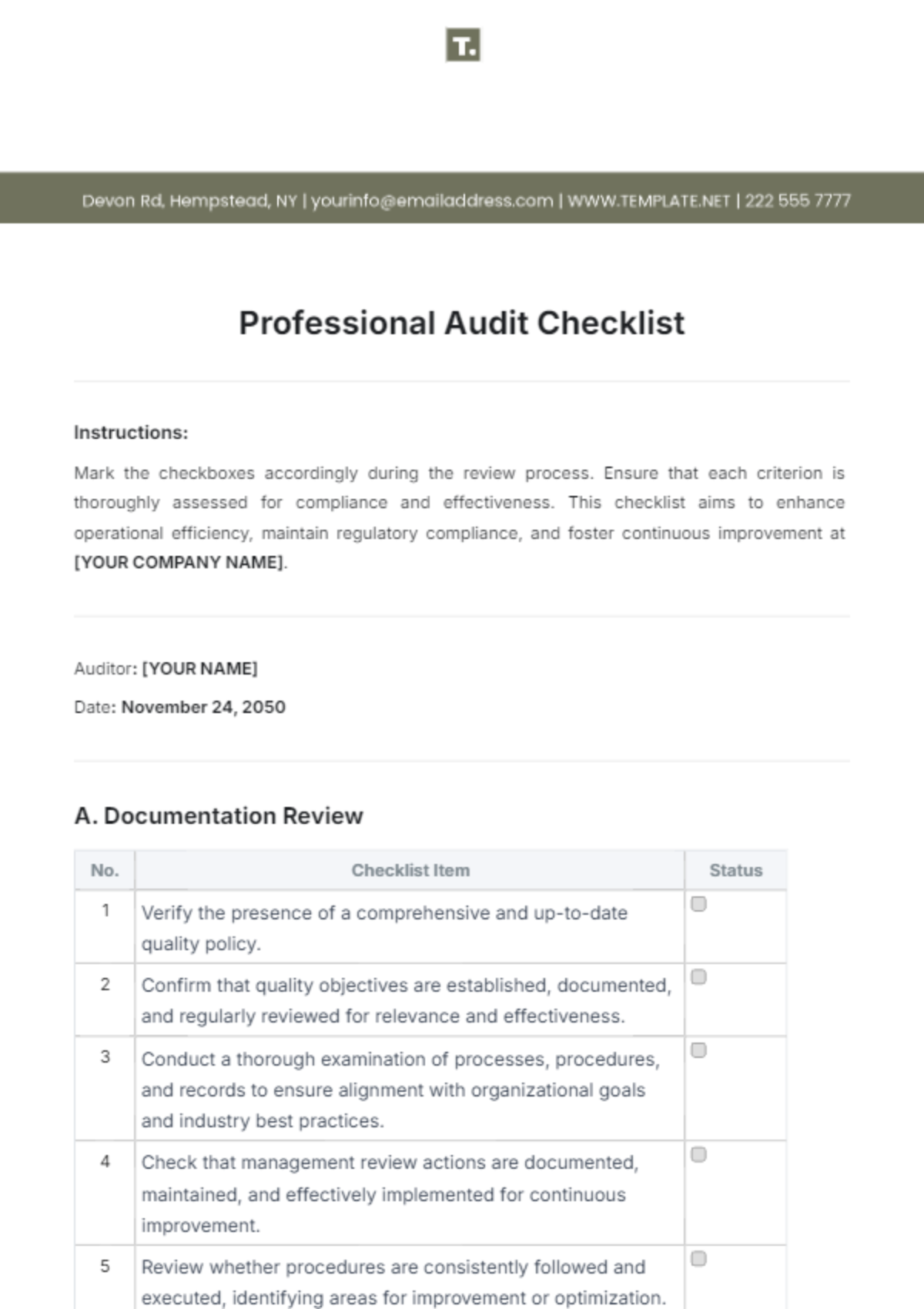

3. Internal Audits:

Conduct frequent internal audits for data validation.

Identify and rectify errors to enhance the reliability of financial information.

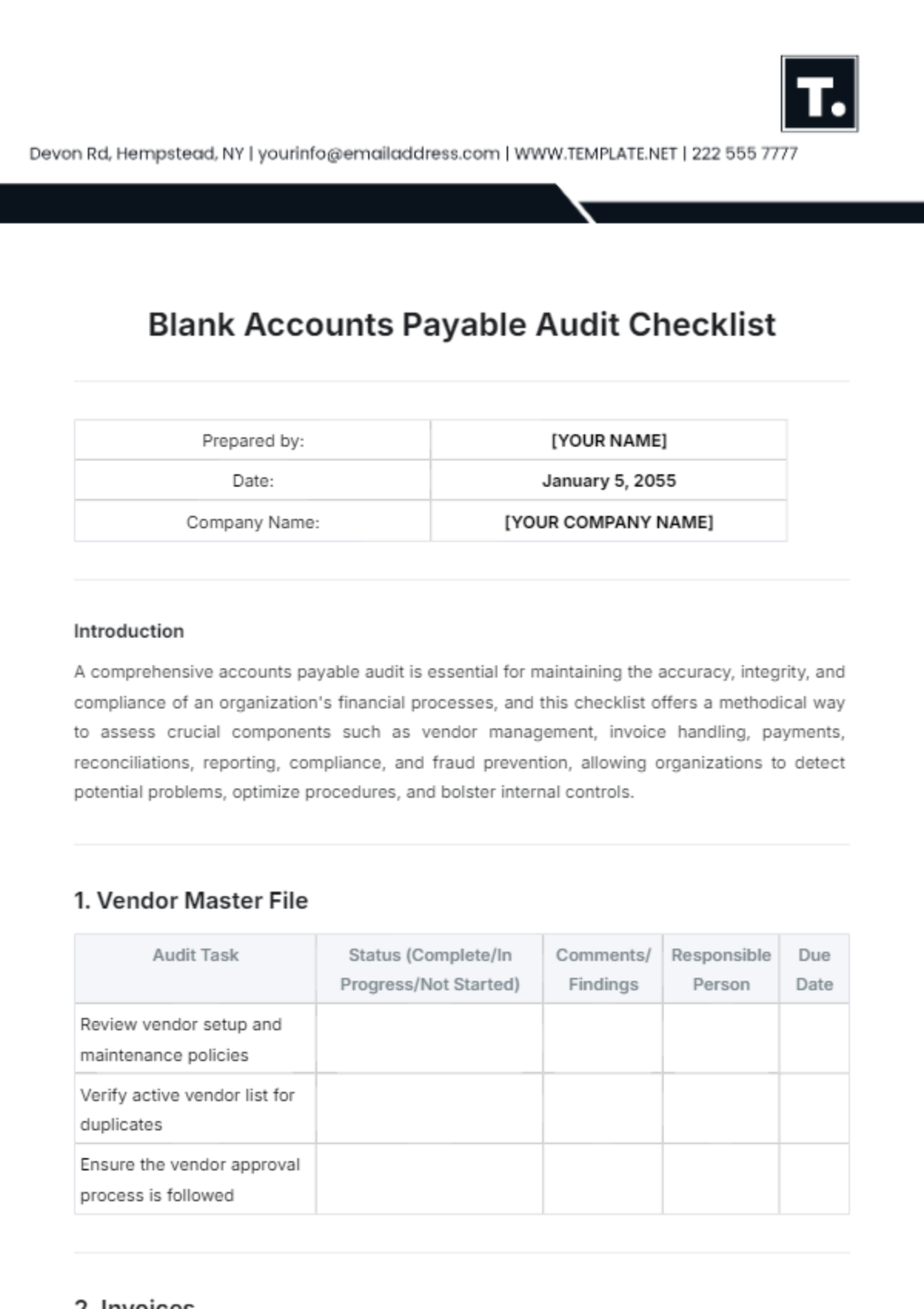

4. Invoice Monitoring:

Keep a close eye on receivables and payables.

Implement strategies to optimize cash flow and minimize payment delays.

5. Period Closure:

Summarize financial activities at the end of each period.

Facilitate smoother transitions between financial reporting periods.

Financial Reporting

1. Profit and Loss Statements:

Generate detailed monthly profit and loss statements.

Analyze trends and financial health to inform strategic decision-making.

2. Financial Forecasts:

Develop quarterly financial forecasts for proactive planning.

Anticipate potential challenges and capitalize on emerging opportunities.

3. Budget Planning:

Provide annual budget planning and reporting.

Align financial goals with overall business objectives.

4. Comprehensive Statements:

Prepare detailed financial statements for stakeholders.

Enhance transparency by presenting a clear overview of the financial position.

5. Timely Filings:

Furnish tax filings and financial disclosures promptly.

Ensure compliance with regulatory timelines.

Compliance and Risk Management

1. Regulatory Compliance:

Regularly review and update processes to meet financial regulations.

Stay informed about changes in compliance requirements.

2. Risk Management:

Develop and implement a robust risk management plan.

Identify, assess, and mitigate potential risks to financial stability.

3. Audit-Based Corrective Actions:

Implement corrective actions based on internal audit findings.

Continuously refine processes to minimize risks.

4. Insurance Coverage:

Maintain up-to-date insurance coverage.

Ensure adequate protection against unforeseen financial challenges.

Conducted by: [Your Name]

Company: [Your Company Name]