Financial Tasks Management

As the fiscal year concludes, a well-organized accounting process is paramount for business stability. This checklist outlines daily, weekly, monthly, and annual tasks to ensure a smooth transition and accurate financial reporting. Please tick the checkbox next to each task once completed.

Objectives:

Guarantee accurate bookkeeping and financial organization.

Ensure financial transparency in all transactions and expenses.

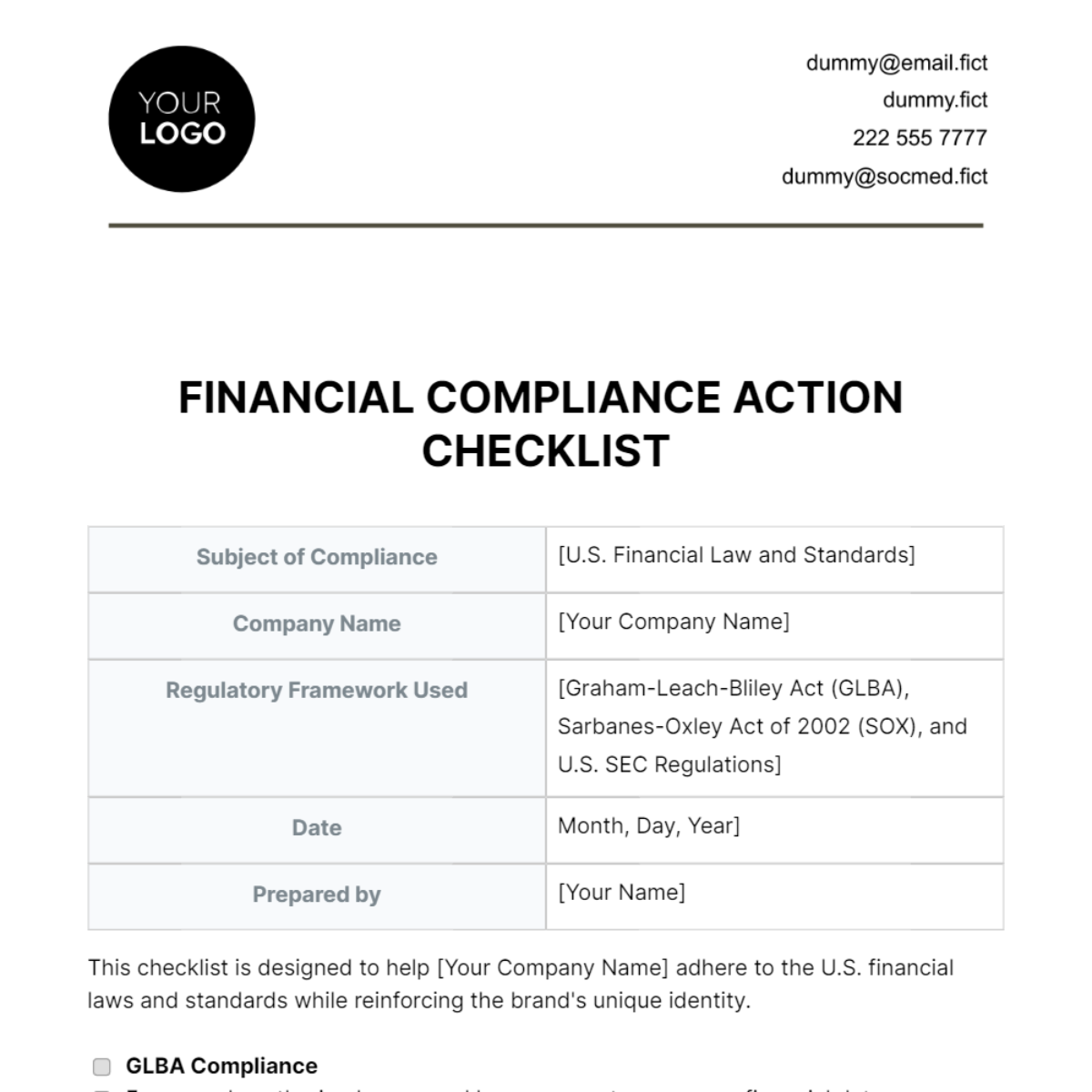

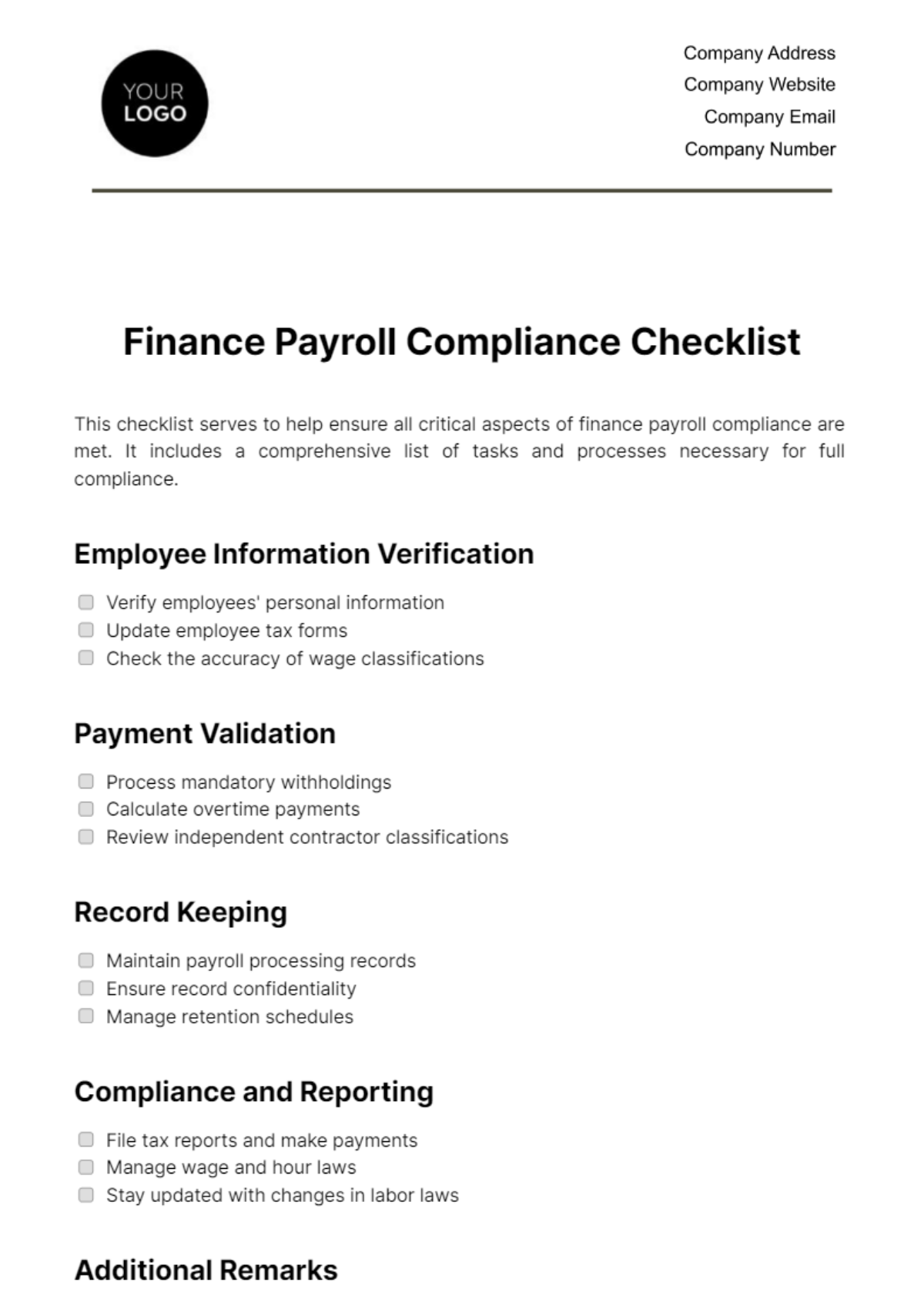

Validate regulatory compliance to avoid financial and legal penalties.

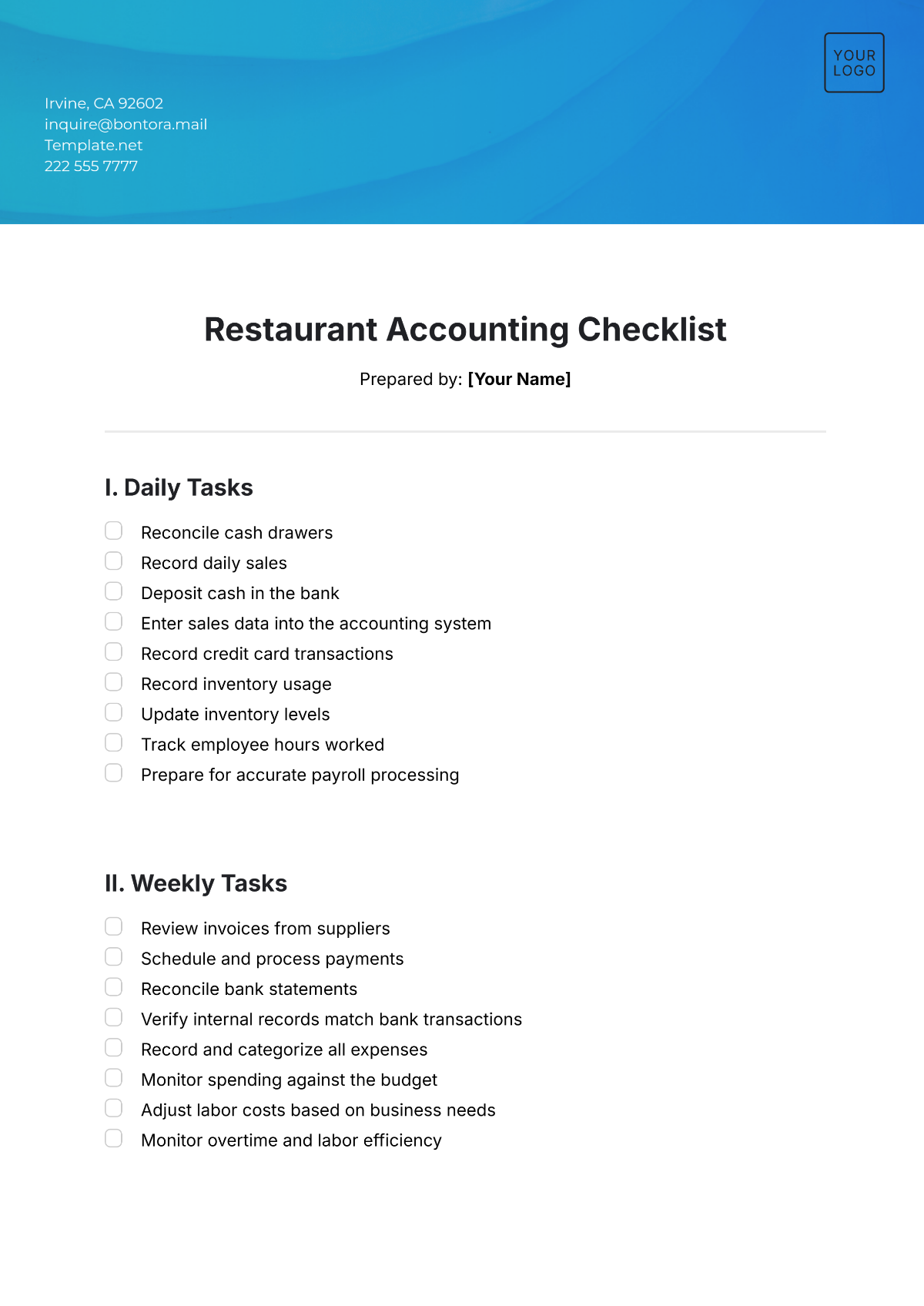

Daily Tasks:

Record and categorize all transactions for real-time financial insights.

Review and input supplier invoices to maintain accurate payables.

Process and pay authorized expense reports promptly.

Regularly reconcile bank accounts for accuracy.

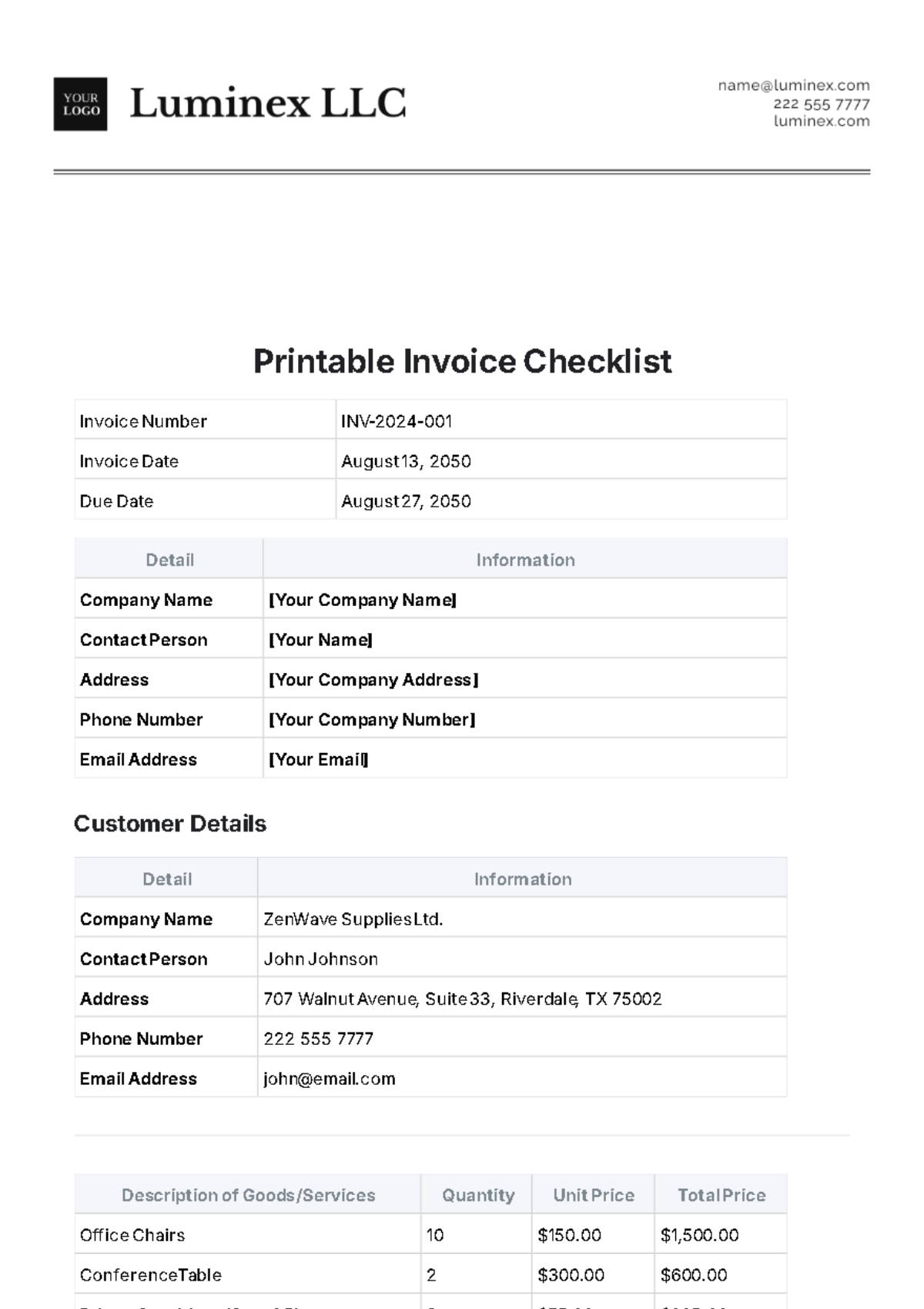

Timely preparation and dispatch of customer invoices for optimal cash flow.

Monitor and address credit control to ensure timely customer payments.

Update and review cash flow projections for short-term financial planning.

Weekly Tasks:

Proactively address any accounting discrepancies or irregularities.

Monitor and manage employee expense reports and travel expenses.

Manage petty cash expenses to support miscellaneous costs.

Record financial transactions with an emphasis on meeting tax obligations.

Conduct periodic audits of financial documents and contracts.

Review and optimize vendor relationships for cost-effectiveness.

Conduct internal reviews to ensure compliance with accounting policies.

Monthly Tasks:

Compile comprehensive monthly financial statements.

Undertake basic administrative tasks, such as filing paperwork and updating records.

Thoroughly review and approve reconciliation and reports prepared by the finance staff.

Generate and analyze accounts receivable aging reports.

Reconcile revenue accounts to ensure alignment with business goals.

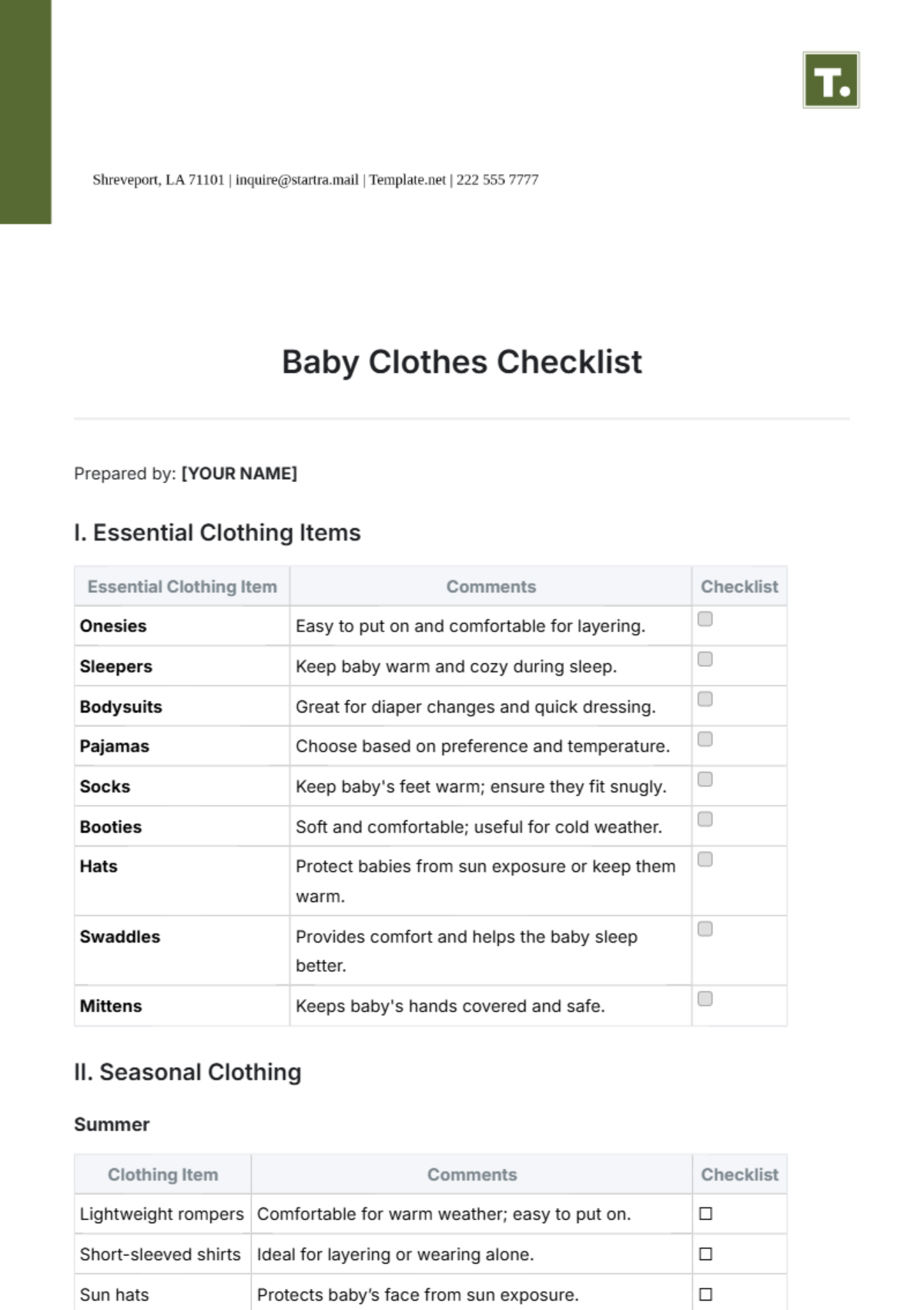

Evaluate and adjust inventory levels based on sales forecasts.

Review and optimize operational expenses for efficiency.

Annual Tasks:

Develop detailed annual budgets aligned with strategic goals.

Summarize year-end financial activities in comprehensive reports.

Coordinate with external auditors for a smooth annual audit.

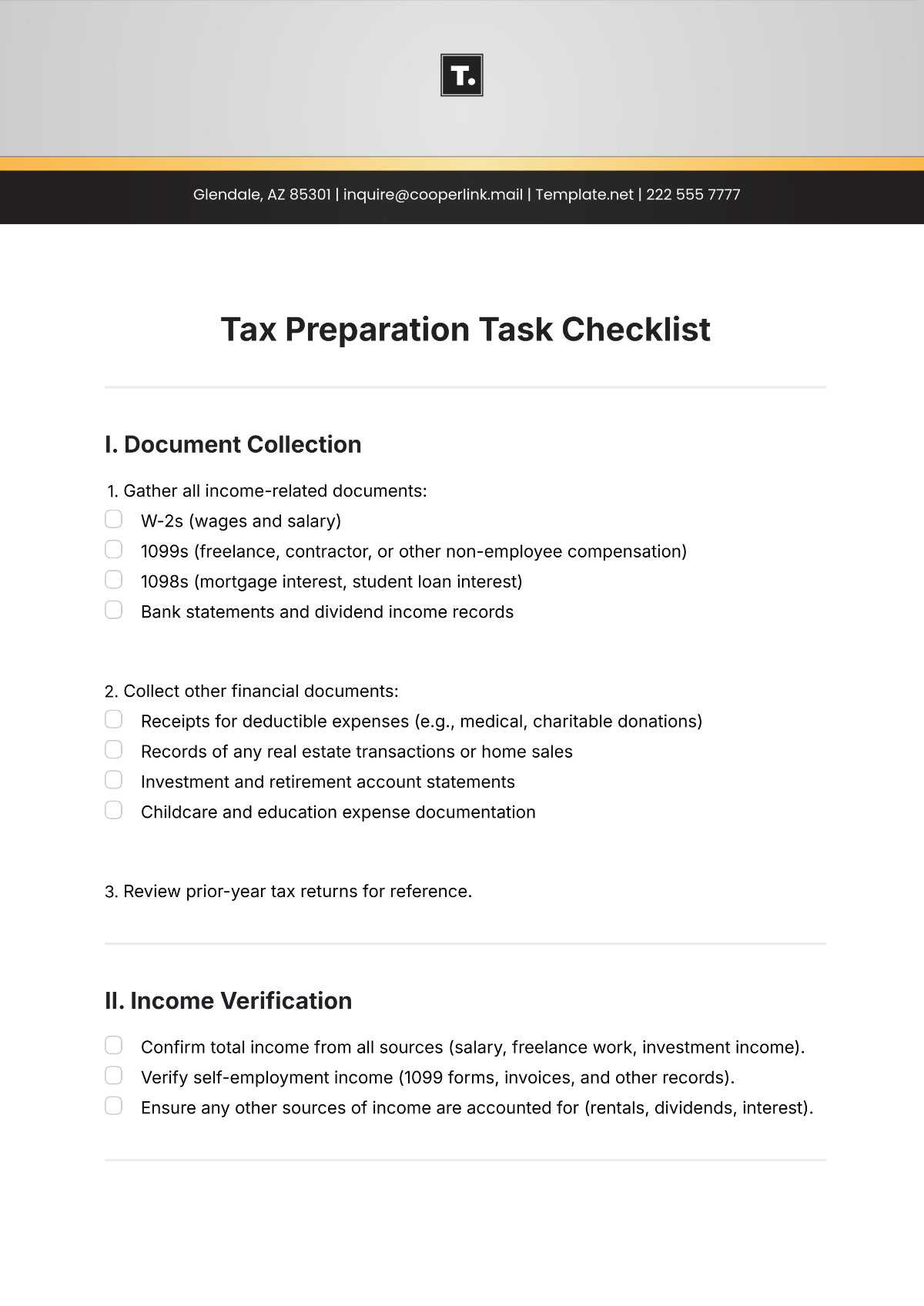

Prepare accurate tax returns and meet corporate reporting requirements.

Analyze and forecast financial needs for the upcoming year.

Assess and update long-term financial strategies.

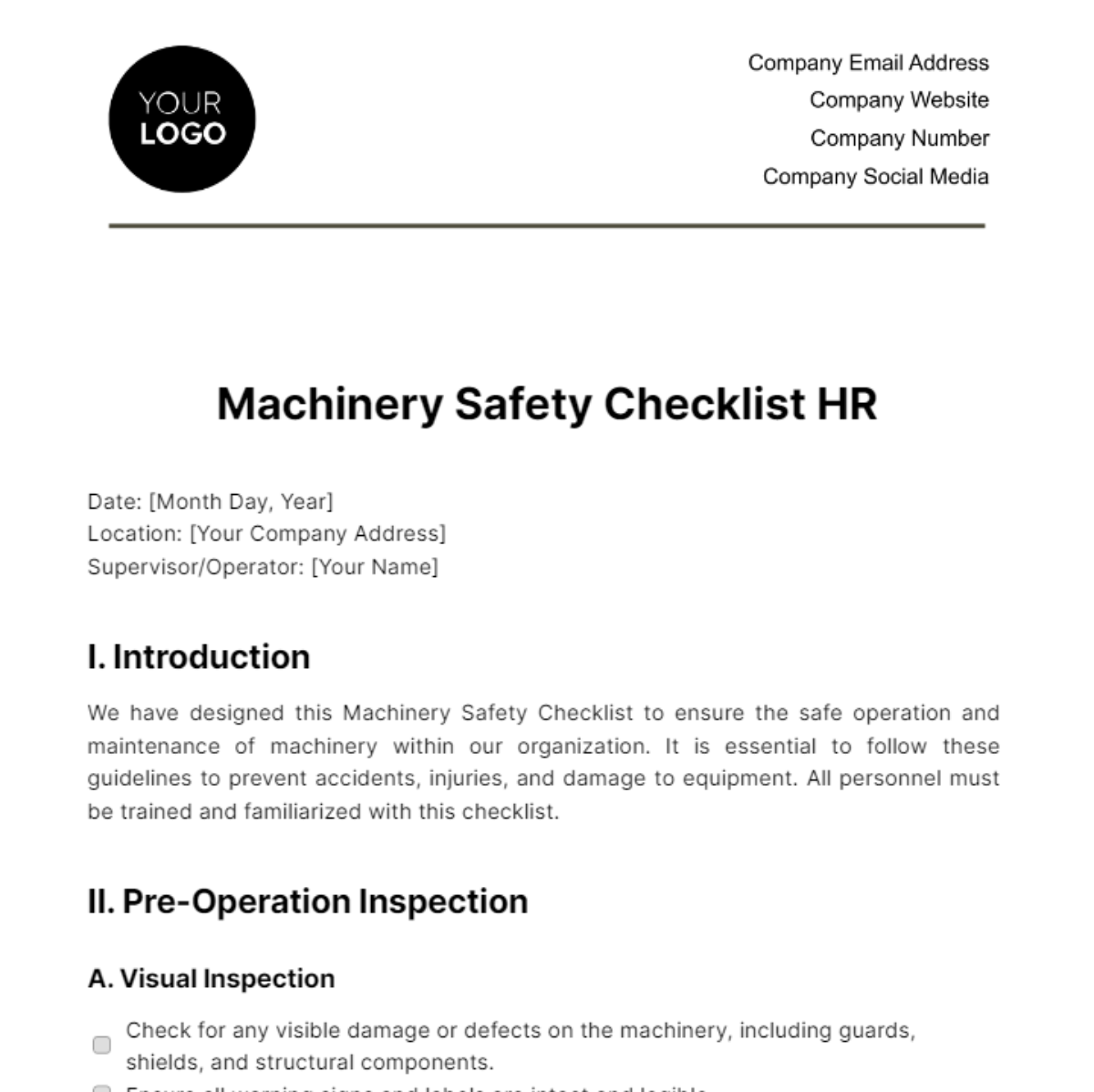

Conduct a thorough risk assessment and update risk management plans.