Efficient Financial Closing Process

The closing process in accounting is crucial for ensuring accuracy and completeness in financial reporting. This checklist provides a structured approach to facilitate a smooth and efficient closing process. Check the completed task accordingly.

Objectives:

Ensure accuracy and completeness in financial reporting.

Comply with accounting standards and regulations.

Provide insights for informed decision-making through financial analysis.

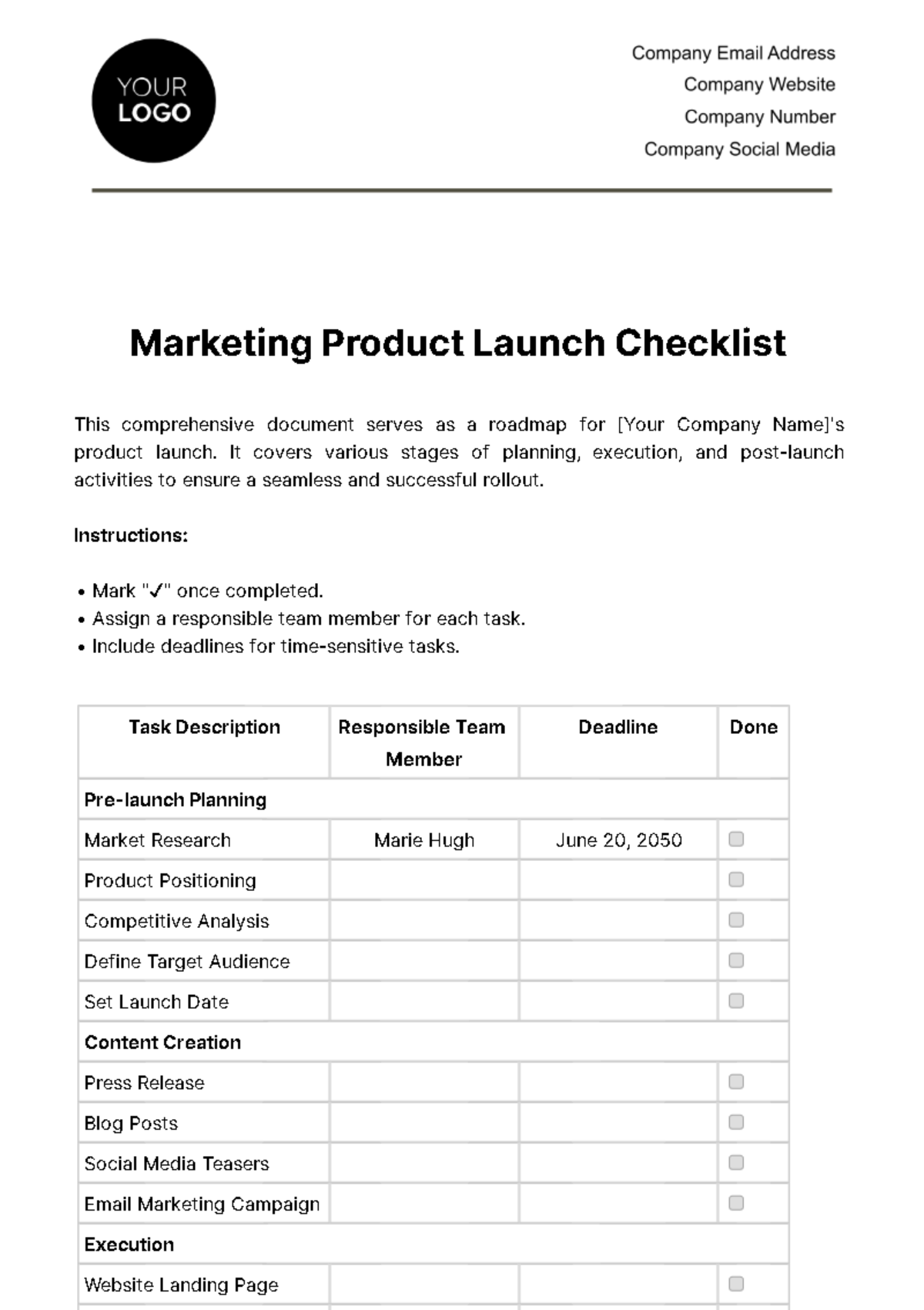

Pre-Closing Preparation

|

|

|

|

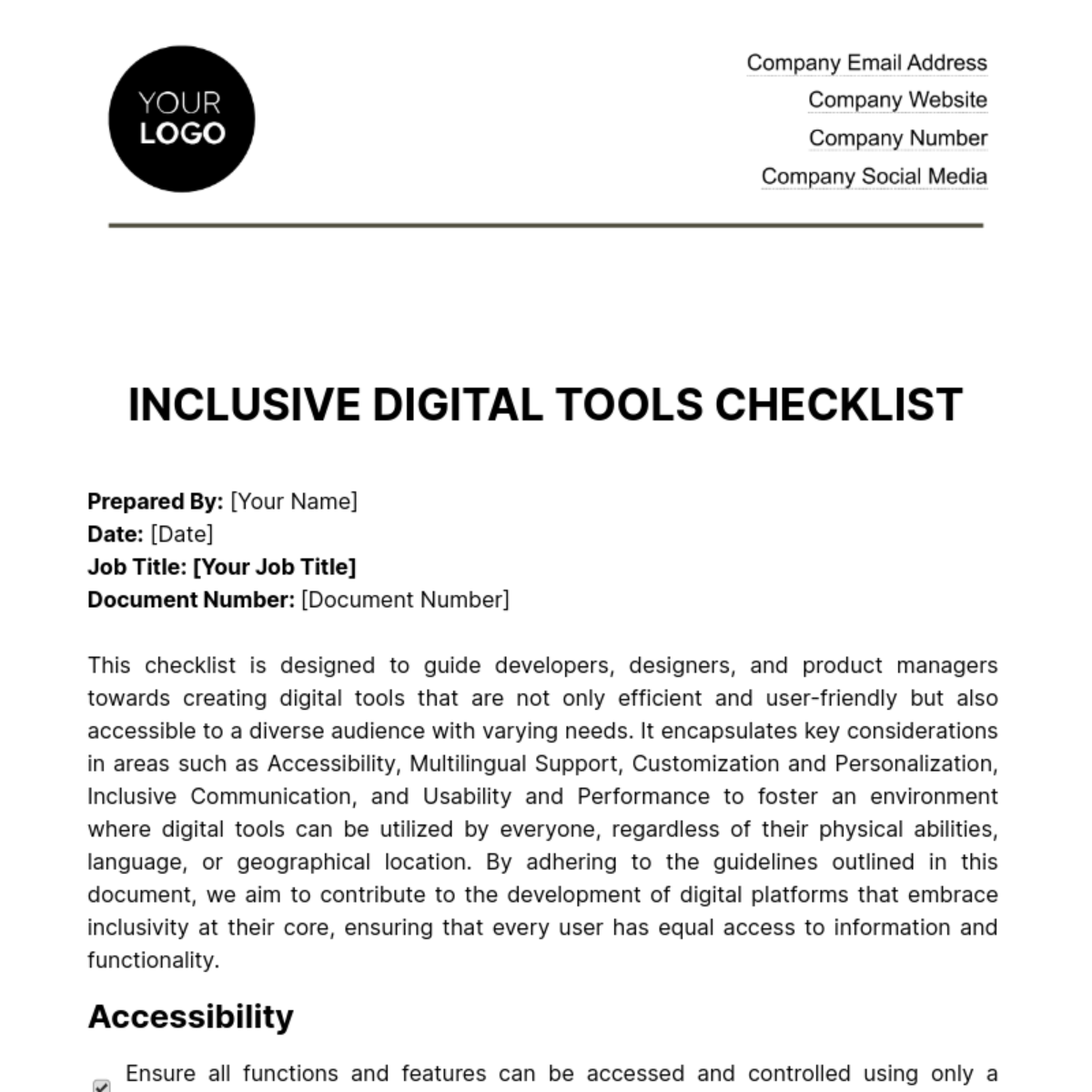

Closing Entries and Procedures

|

|

|

|

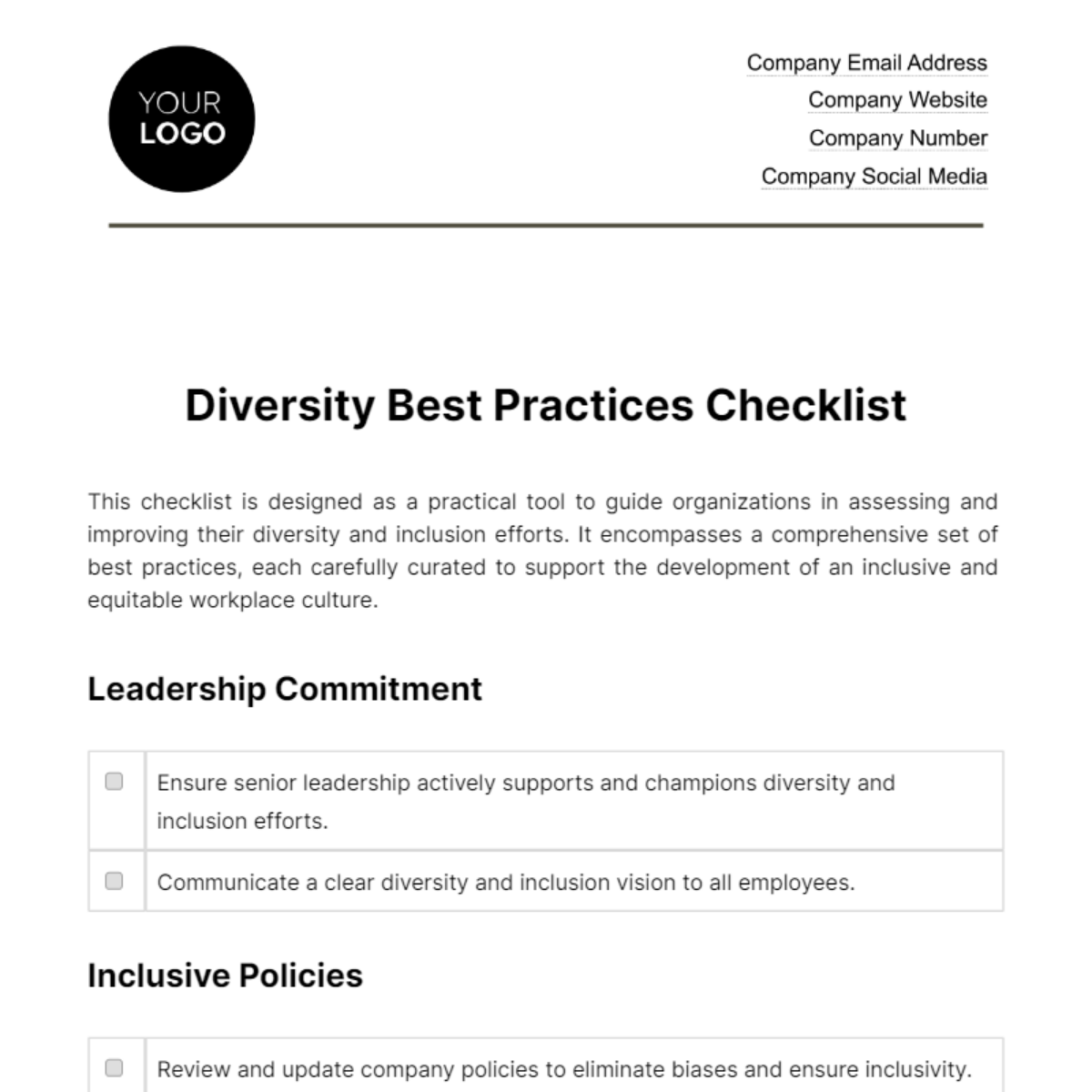

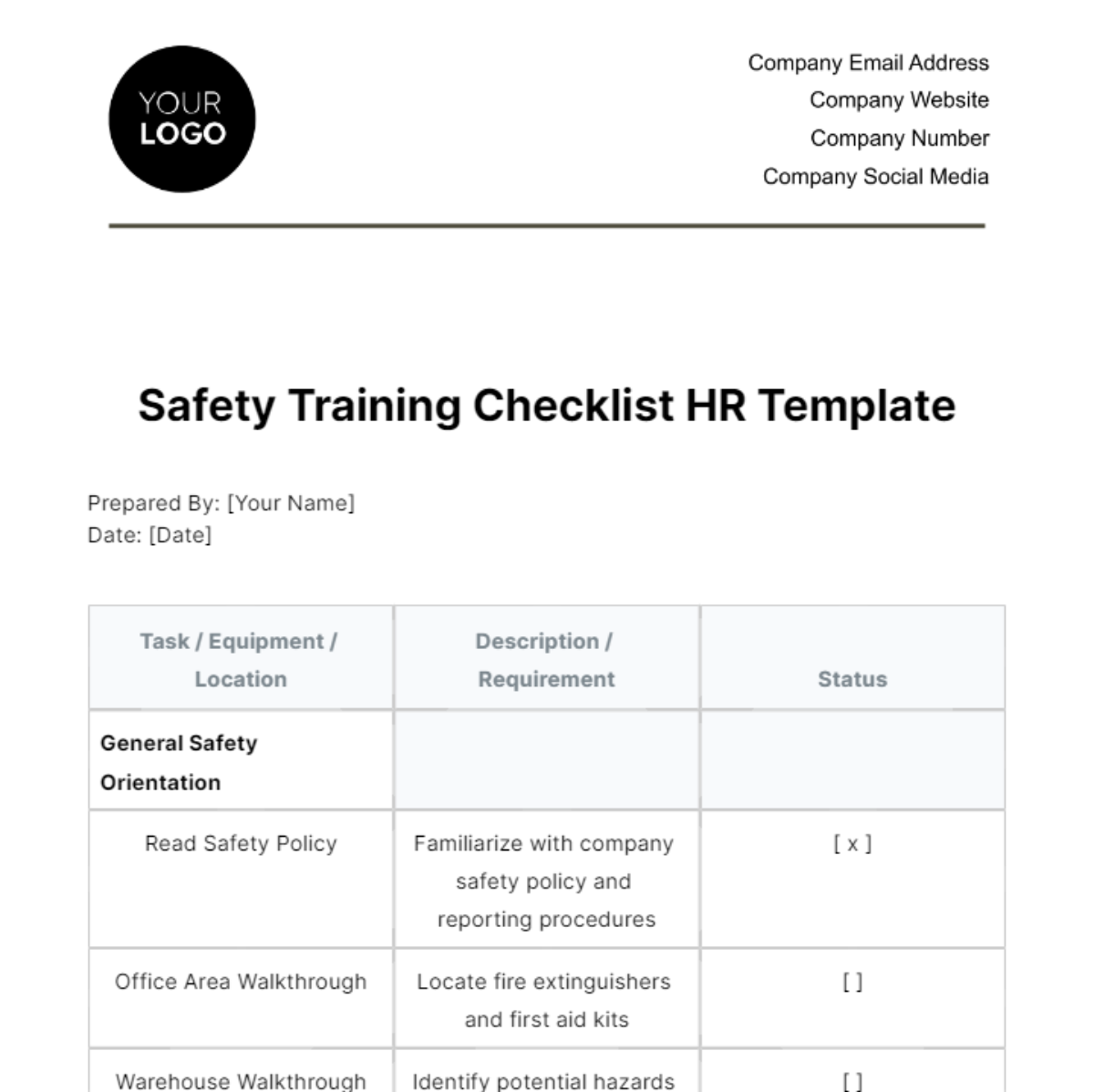

Financial Reporting and Analysis

|

|

|

|