Daily Accounting Procedures

This checklist serves to streamline daily accounting processes, promote accuracy and compliance, and support informed decision-making based on real-time financial insights. By diligently following this checklist, businesses can maintain financial integrity and optimize their operational performance.

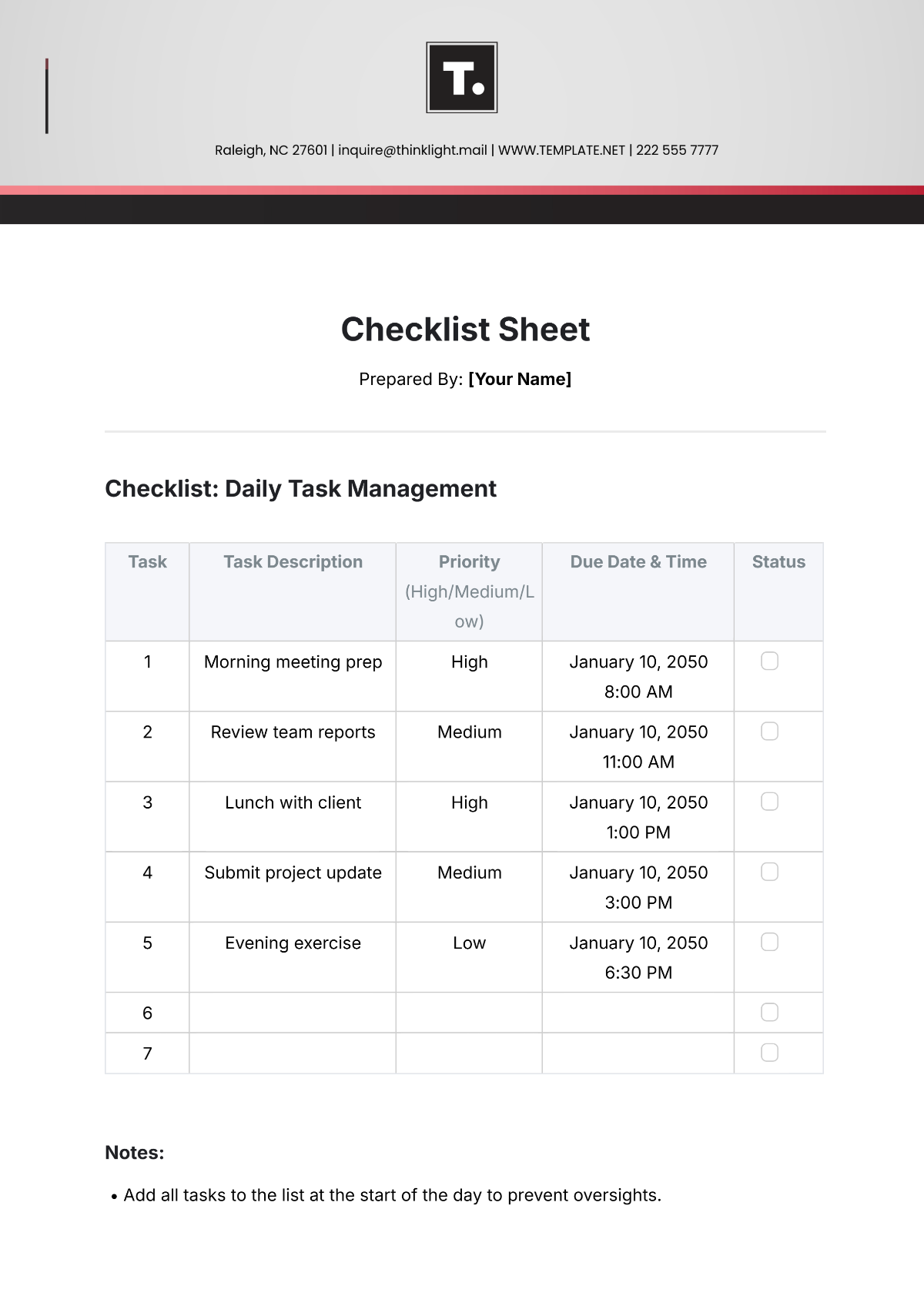

Instructions: Tick the checkboxes next to each checklist item upon completion. Review the checklist at the end of the day to ensure all tasks are completed.

Daily Transactions Review

Sales Transactions:

Verify all sales transactions are recorded accurately in the system.

Reconcile sales receipts with POS or online payment platforms.

Confirm sales tax calculations are correct for each transaction.

Check for any unusual or suspicious transactions that may require further investigation.

Ensure all discounts, refunds, and returns are properly accounted for.

Expense Transactions:

Review and categorize all expense transactions.

Validate vendor invoices against purchase orders or contracts.

Check for duplicate or unauthorized expenses.

Reconcile credit card statements with receipts.

Verify that all recurring expenses are accounted for and appropriately documented.

Bank Reconciliation

Compare Bank Statements:

Match bank statement transactions with the accounting records.

Investigate any discrepancies or missing transactions.

Reconcile differences between the ending balance in the bank statement and the company's records.

Confirm the accuracy of bank charges and interest earned.

Ensure all outstanding checks and deposits are properly recorded.

Cash Flow Analysis:

Analyze cash inflows and outflows for the day.

Assess liquidity and identify any potential cash flow issues.

Monitor outstanding receivables and payables.

Evaluate the adequacy of cash reserves for upcoming expenses.

Adjust cash management strategies as needed to optimize liquidity.

Financial Reporting

Generate Financial Reports:

Compile daily financial data to generate reports, such as income statements and balance sheets.

Review reports for accuracy and completeness.

Compare current performance with previous periods and budgeted projections.

Analyze key financial metrics to assess business performance.

Distribute reports to relevant stakeholders in a timely manner.

Documentation and Filing:

Ensure all supporting documents are properly filed and organized.

Archive electronic copies of financial records for future reference.

Maintain compliance with regulatory requirements regarding record retention.

Implement backup procedures to safeguard financial data.

Update documentation protocols to reflect any process changes or improvements.

Prepared by: [Your Name]

Date: [Date]