Accounting System Implementation Phases

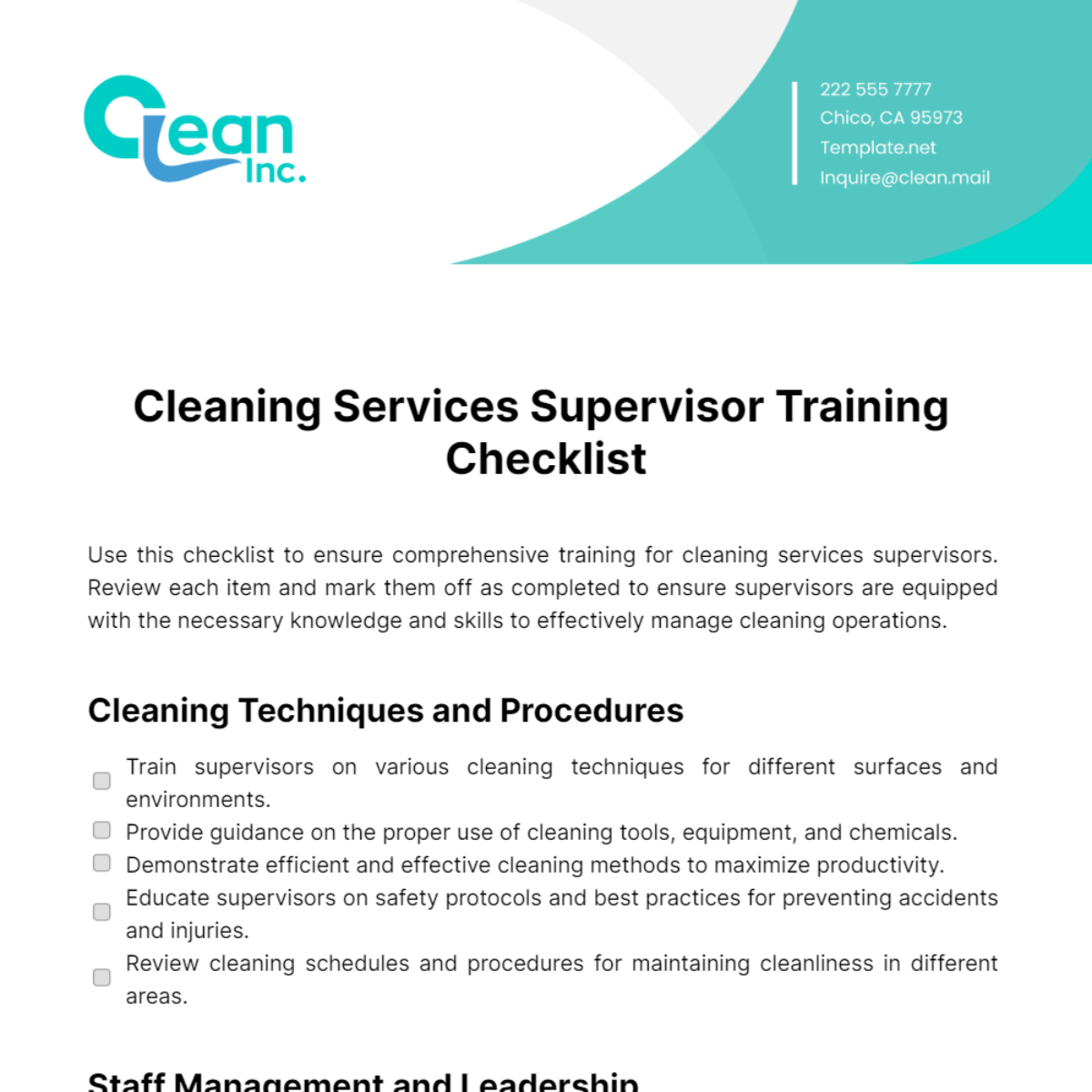

Implementing a new accounting system is a critical process for any organization. To ensure a smooth transition and successful integration, it's essential to follow this comprehensive checklist.

Instructions:

Tick the checkboxes as each item is completed to track progress effectively.

Objectives:

Ensure a systematic approach to accounting system implementation.

Minimize disruptions to daily operations during the transition.

Achieve user adoption and satisfaction with the new system.

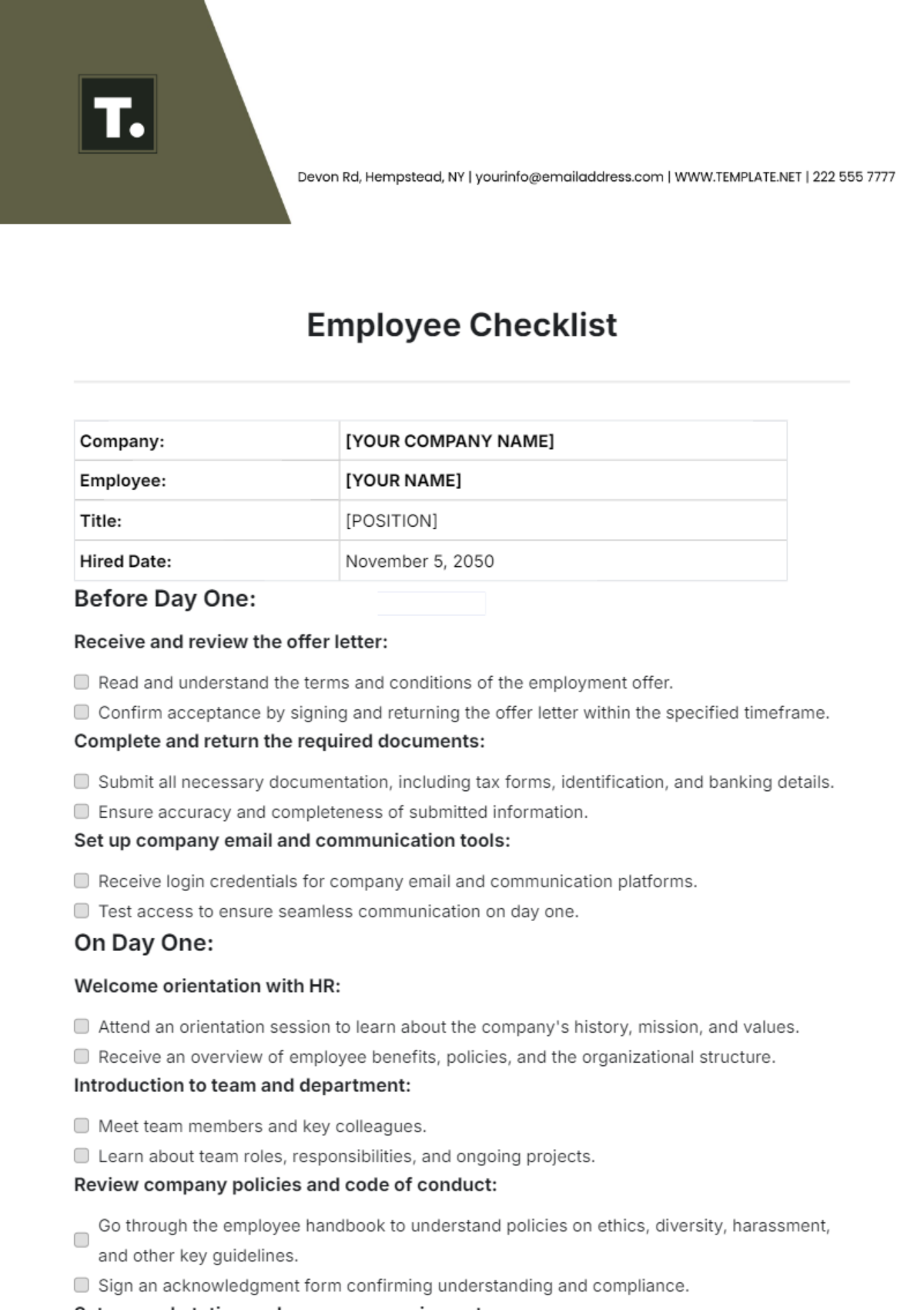

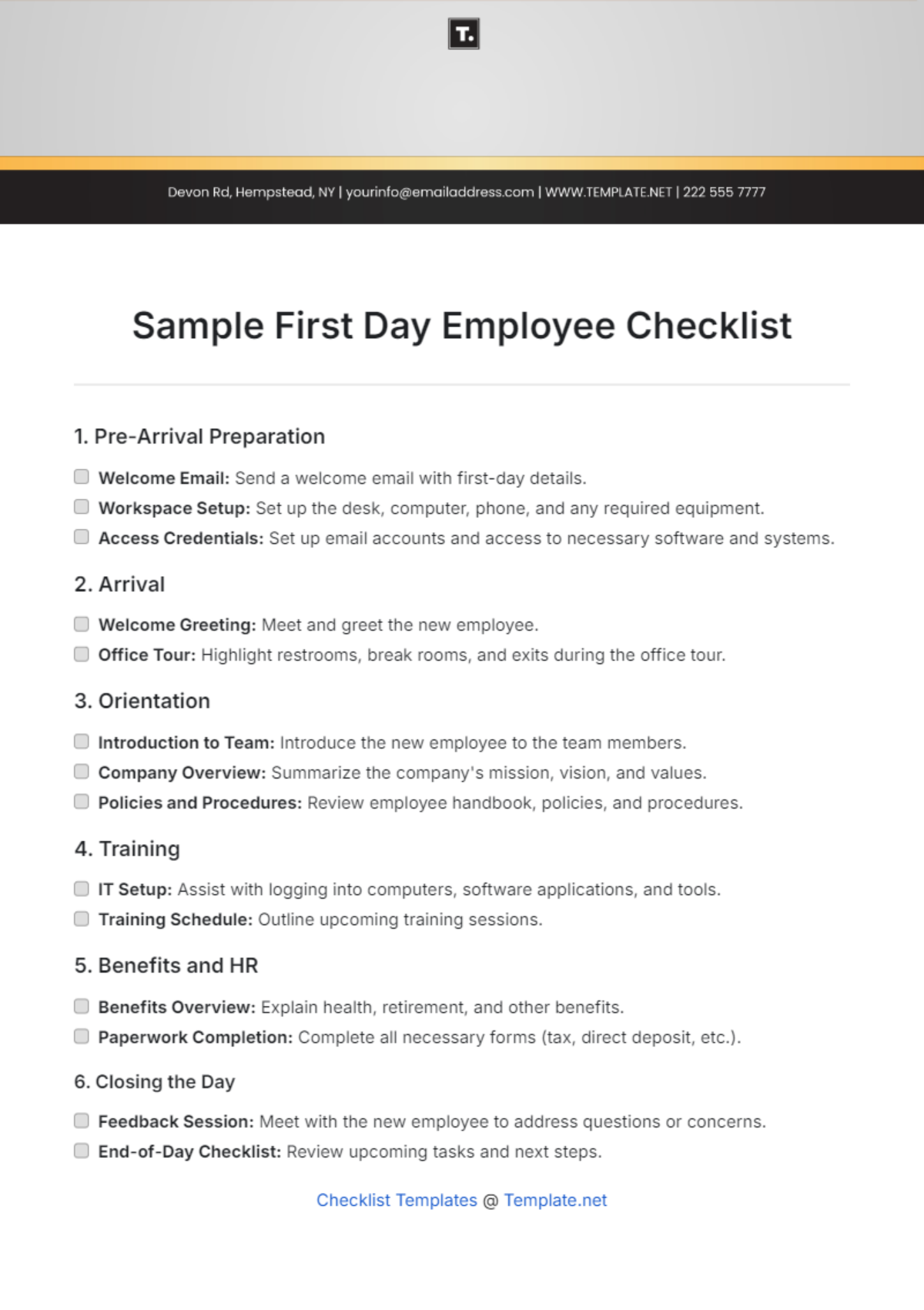

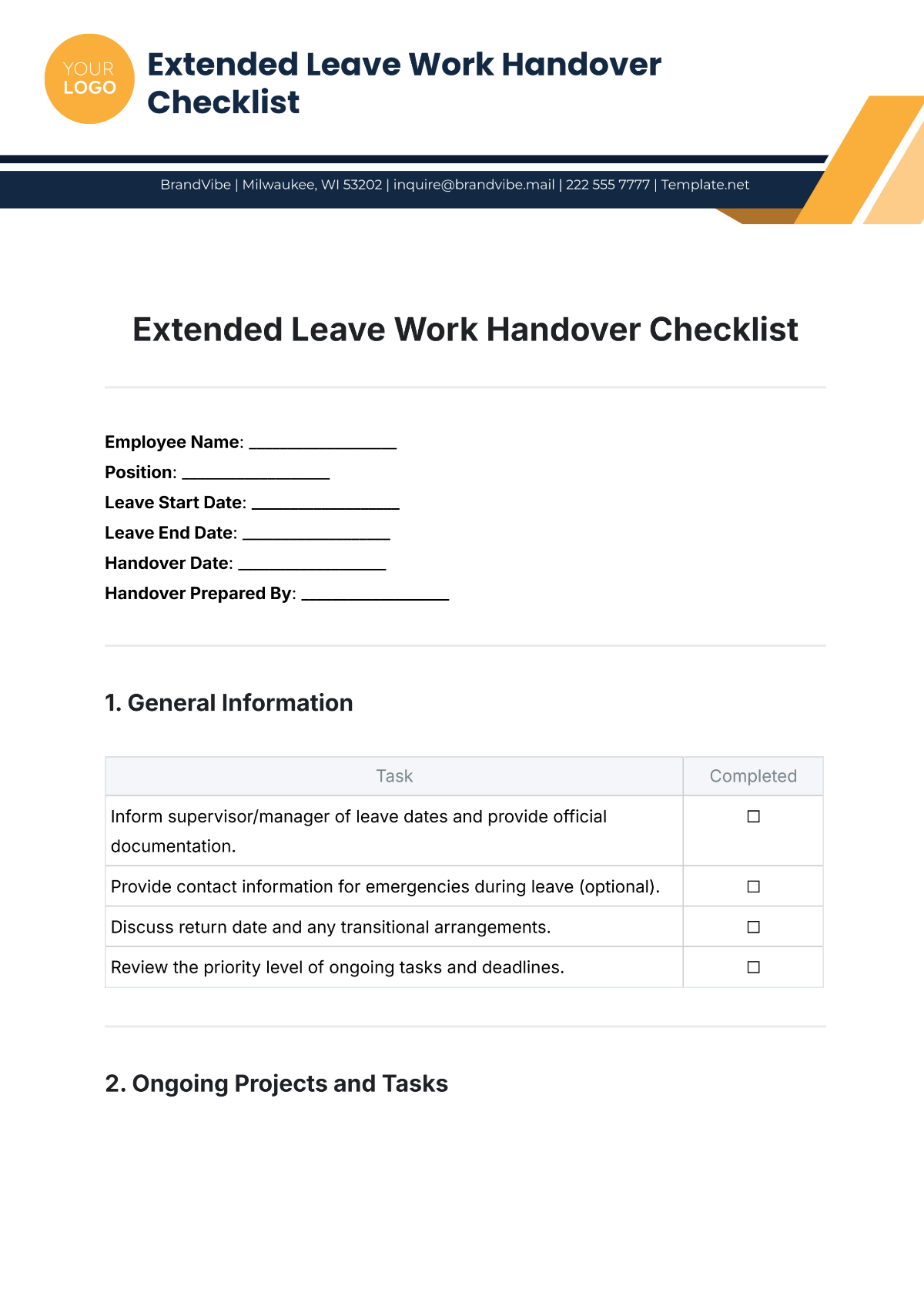

1. Planning Phase

Initial Assessment

Evaluate current accounting processes and software.

Identify key stakeholders and their requirements.

Determine the budget and timeline for implementation.

Assess the need for customization or integration with other systems.

Set clear goals and objectives for the new accounting system.

Selection of Accounting Software

Research and compare different accounting software options.

Evaluate features such as scalability, user-friendliness, and reporting capabilities.

Request demos and trials to test usability and functionality.

Consider compatibility with existing hardware and software.

Obtain feedback from end-users and IT department.

2. Pre-Implementation Preparation

Data Migration Planning

Conduct a thorough data audit to identify what needs to be migrated.

Cleanse and standardize data to ensure accuracy and consistency.

Develop a data migration plan, including mapping data fields and formats.

Allocate resources for data extraction, transformation, and loading.

Test data migration processes in a sandbox environment.

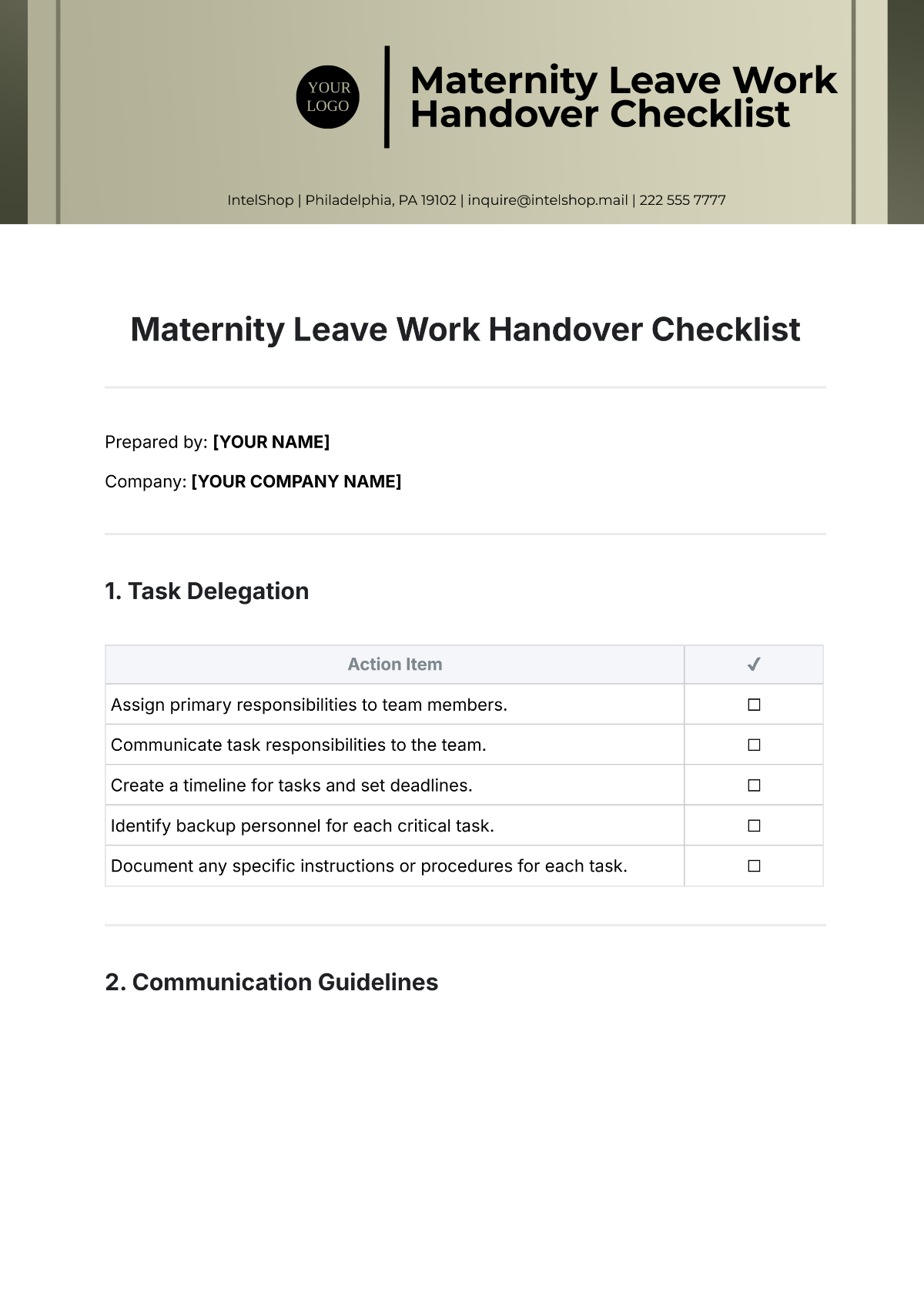

Training and Change Management

Develop a training program for end-users and administrators.

Provide training materials, manuals, and online resources.

Assign roles and responsibilities for system administration and support.

Communicate the benefits of the new system and address concerns.

Establish a feedback mechanism for ongoing training and support.

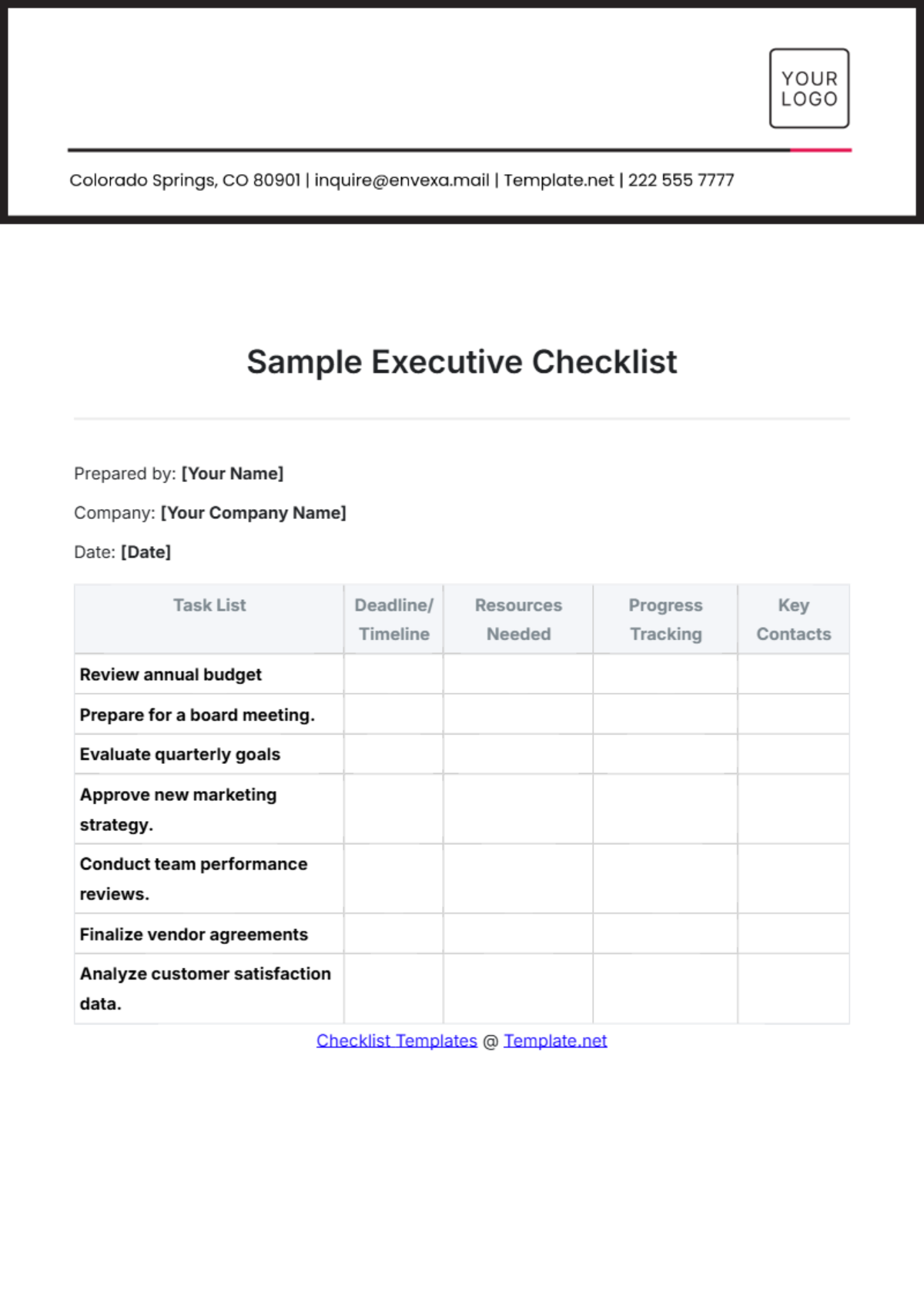

3. Implementation Phase

System Configuration and Customization

Configure the accounting software settings to align with business requirements.

Customize templates for invoices, reports, and financial statements.

Set up user permissions and access controls based on roles.

Integrate third-party applications or modules as needed.

Conduct thorough testing of configurations and customizations.

Go-Live Preparation

Develop a contingency plan for potential issues or disruptions.

Schedule a final data backup before transitioning to the new system.

Communicate the go-live date and any downtime or service interruptions.

Conduct a pilot run or soft launch to identify any last-minute issues.

Ensure adequate support resources are available during the go-live period.

Conducted by: [Your Name]

Company: [Your Company Name]