Accounting Essential Tasks

This Accounting Tasks Checklist is designed to ensure thoroughness and accuracy in managing financial responsibilities. Whether you're a small business owner or an accountant overseeing multiple clients, use this checklist to streamline your accounting processes.

Instructions:

Tick the checkboxes to track the completion of each task.

Review and update this checklist regularly to adapt to changing accounting needs.

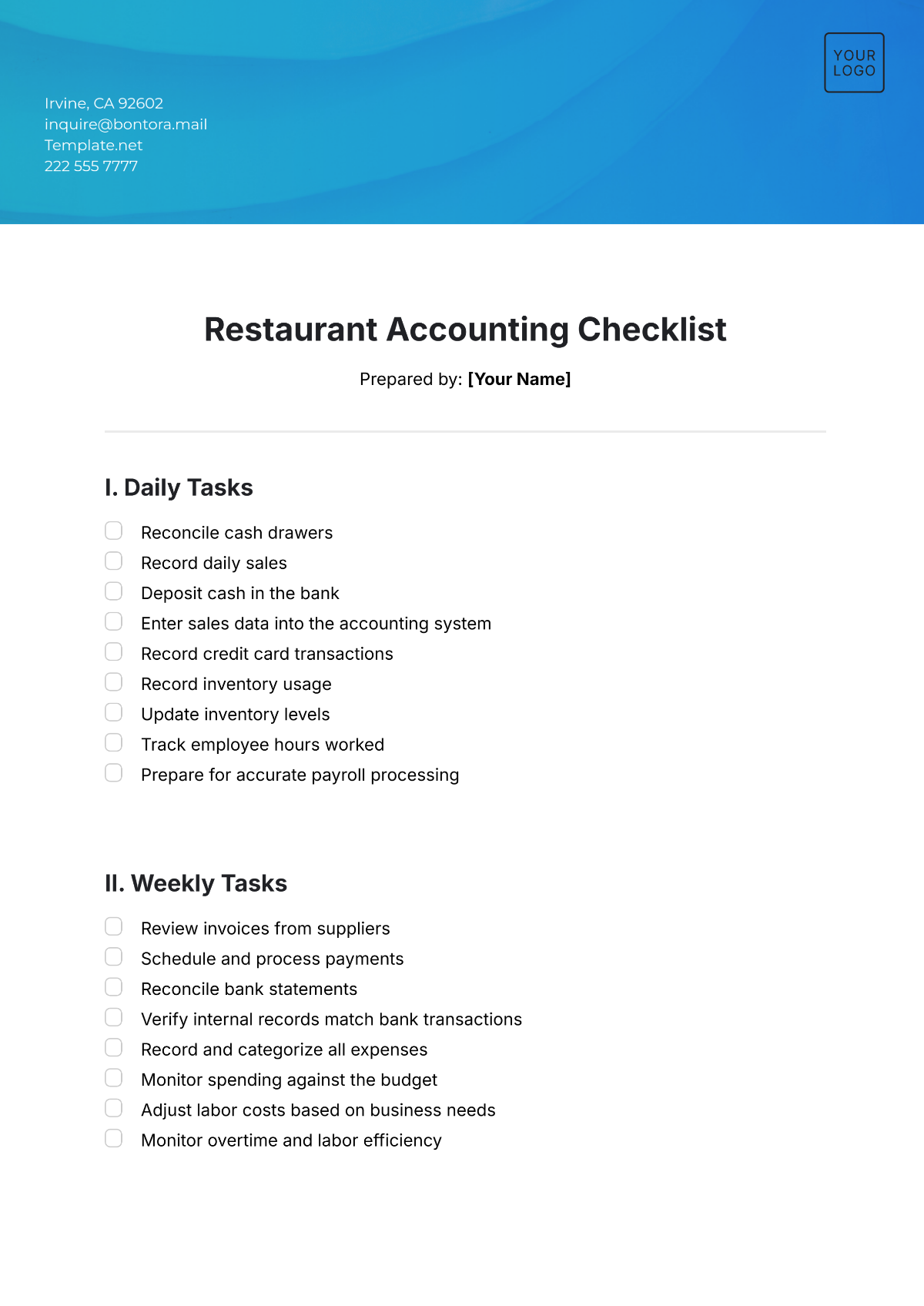

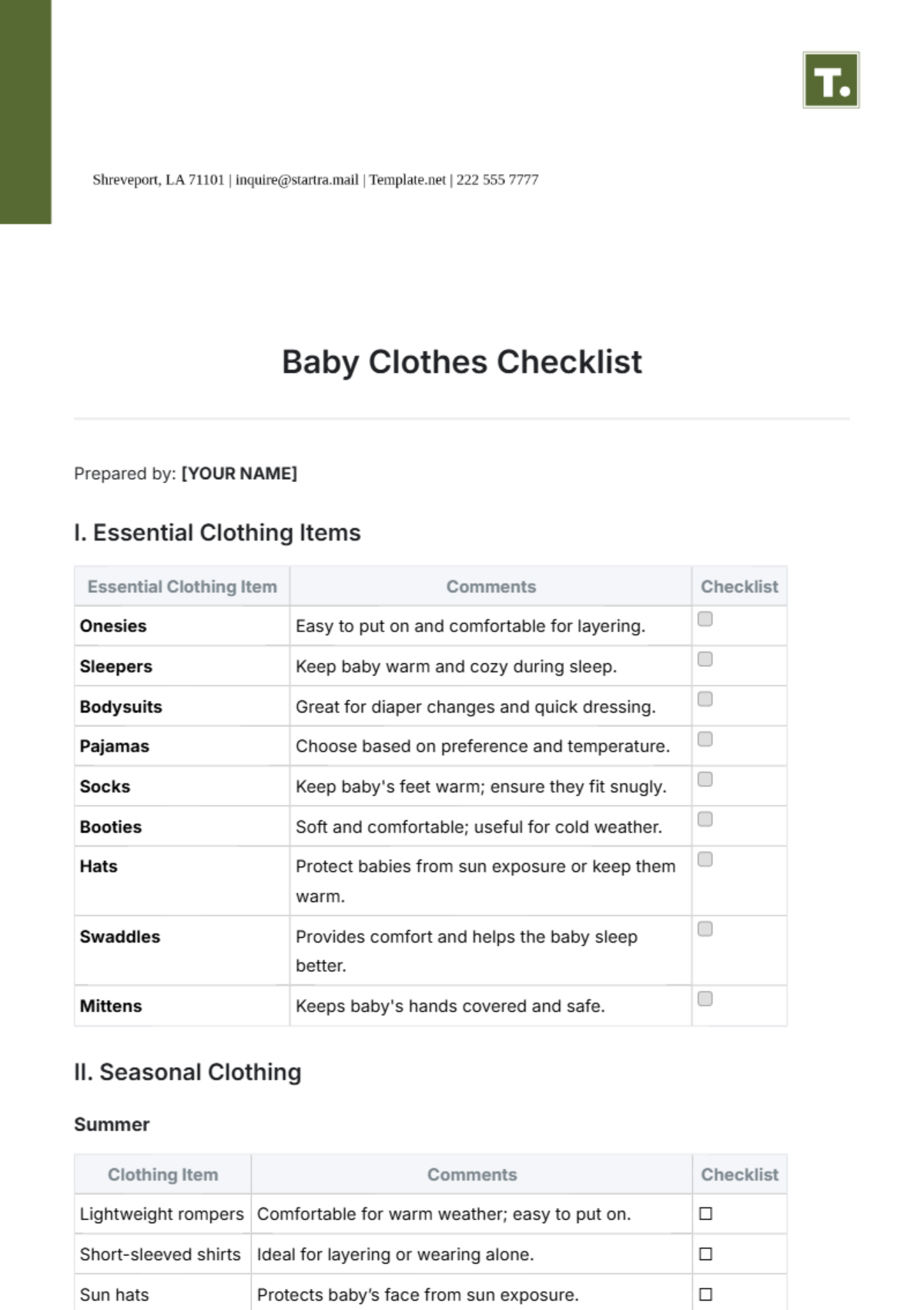

Financial Recordkeeping

Maintain detailed records of all income sources, including sales, services rendered, and interest earned.

Record and categorize expenses meticulously, including purchases, overhead costs, and taxes paid.

Reconcile bank statements regularly to ensure accuracy in recorded transactions.

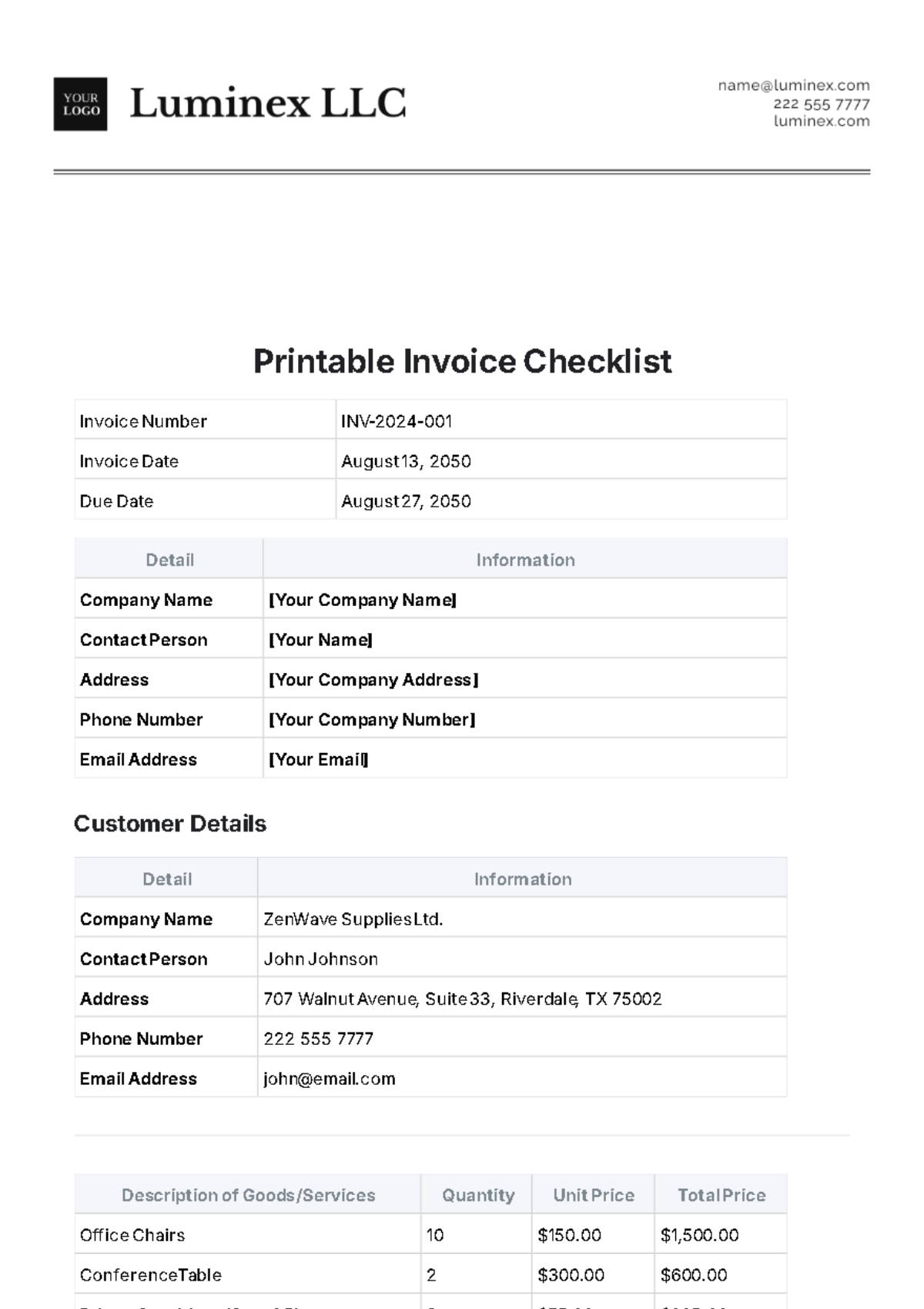

Keep track of invoices issued and payments received, following up on overdue accounts promptly.

Document any financial discrepancies and investigate their causes promptly.

Reporting and Analysis

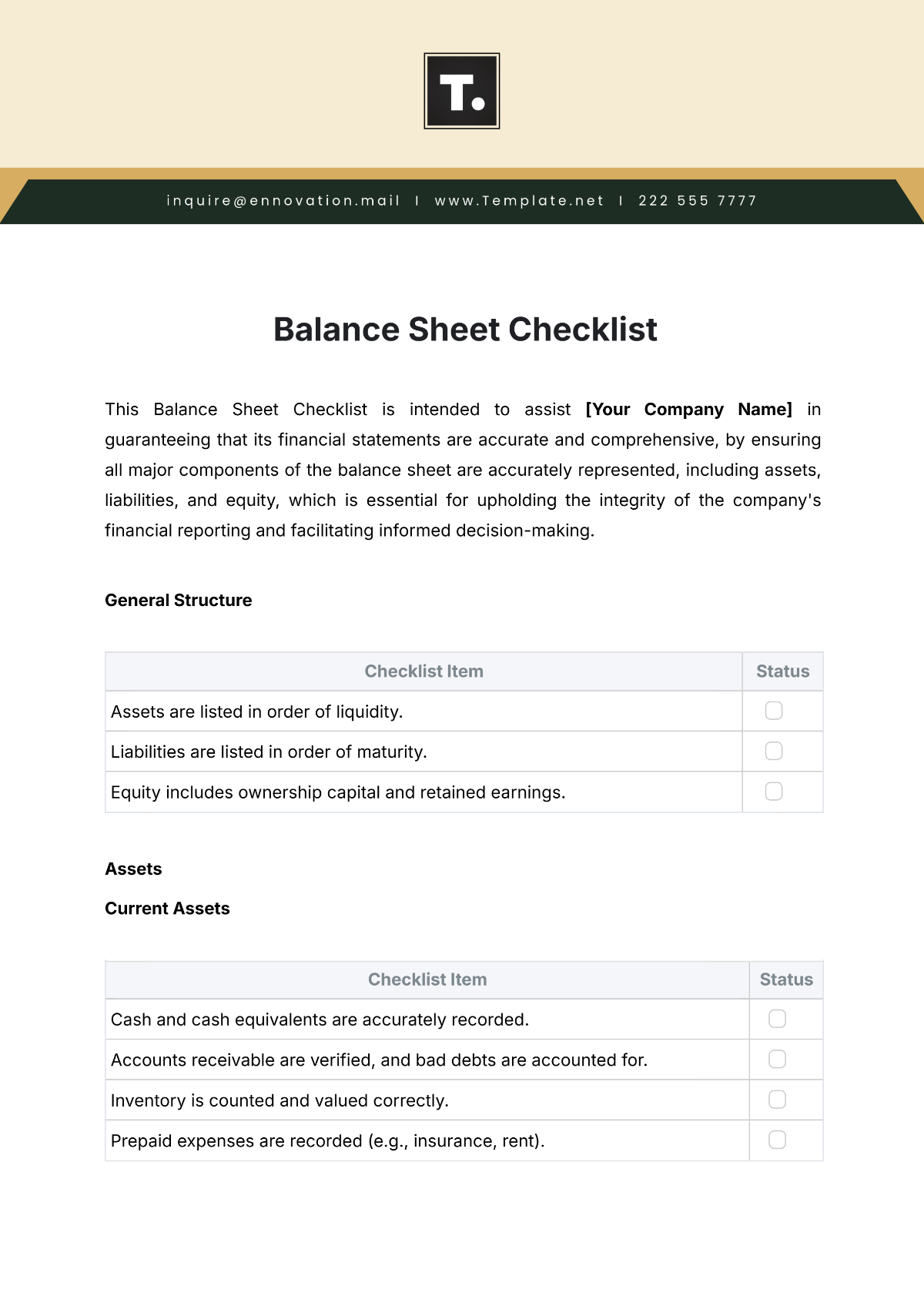

Prepare accurate balance sheets, showing assets, liabilities, and equity at a specific point in time.

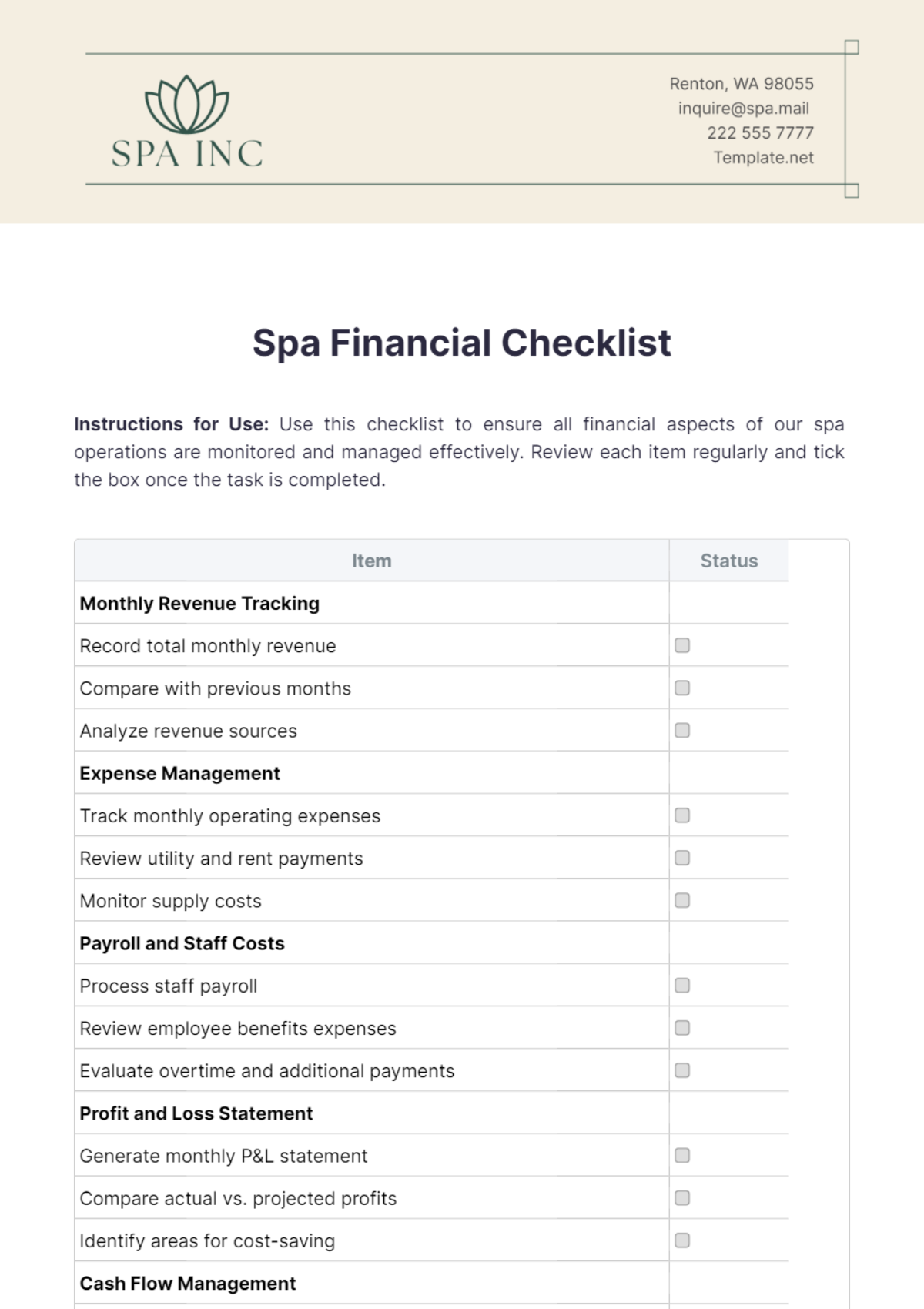

Generate comprehensive income statements, summarizing revenues, expenses, gains, and losses over a specific period.

Compile cash flow statements to analyze the inflows and outflows of cash within the business.

Review financial ratios and key performance indicators to assess the company's financial health and profitability.

Provide timely financial reports to stakeholders, such as management, investors, and regulatory authorities.

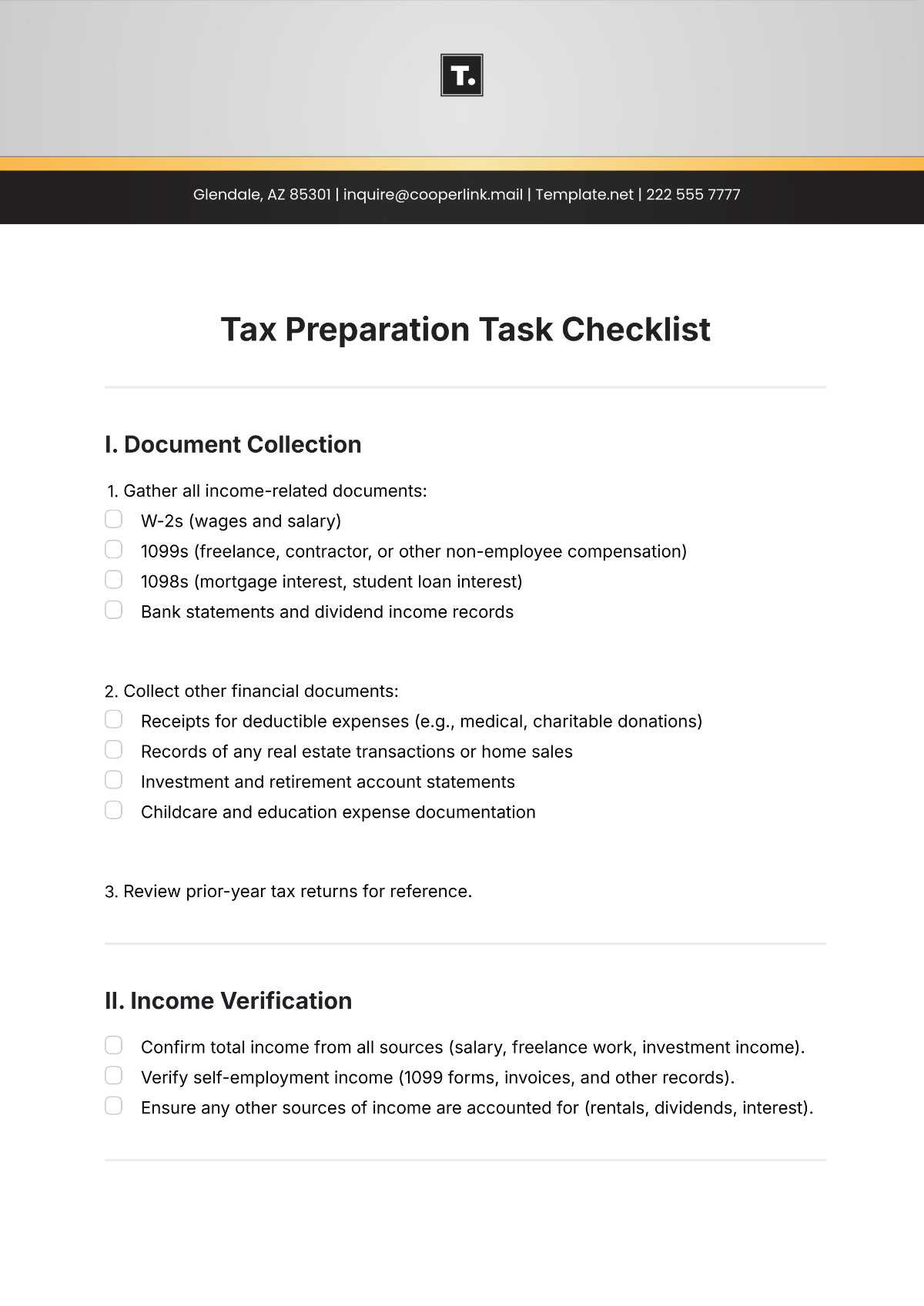

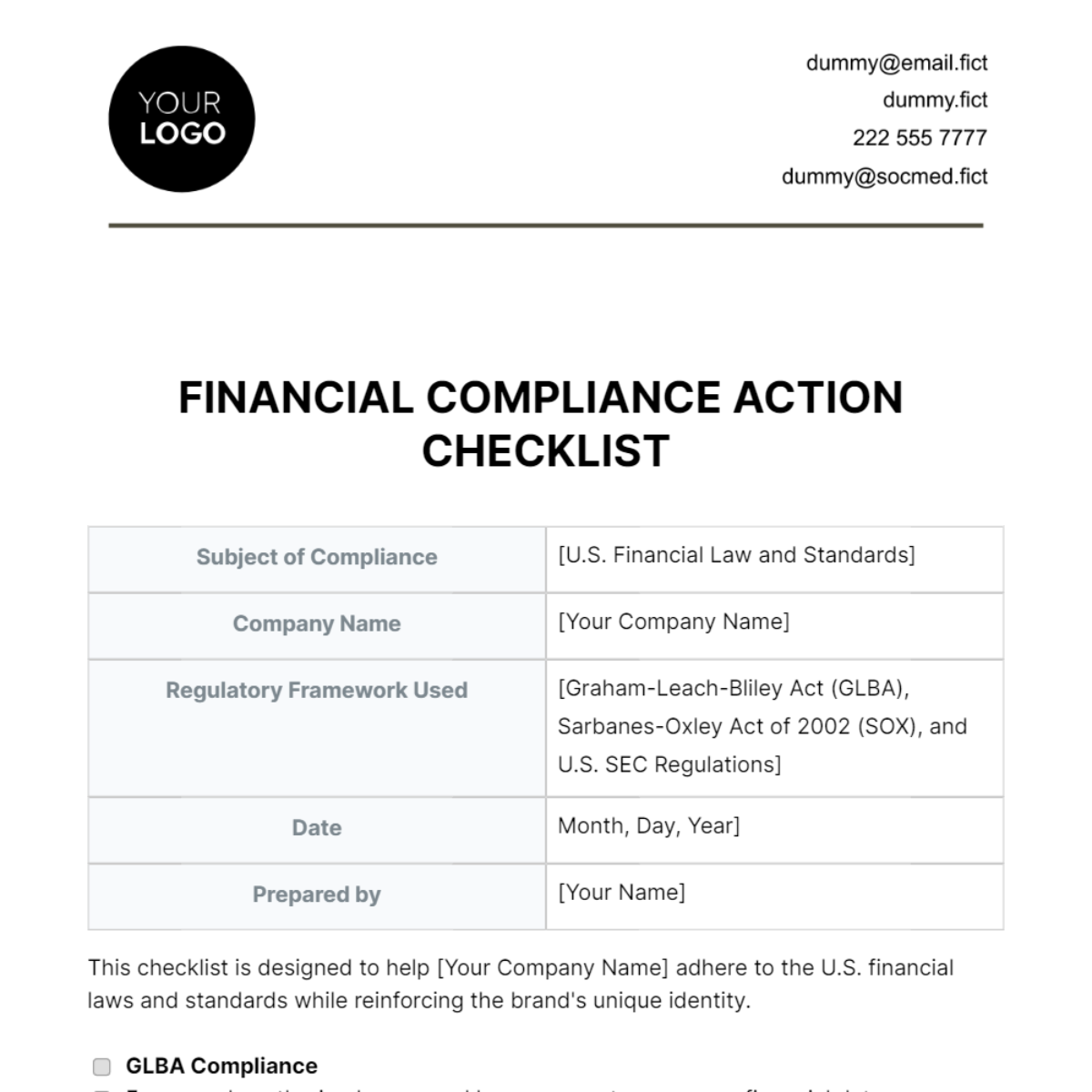

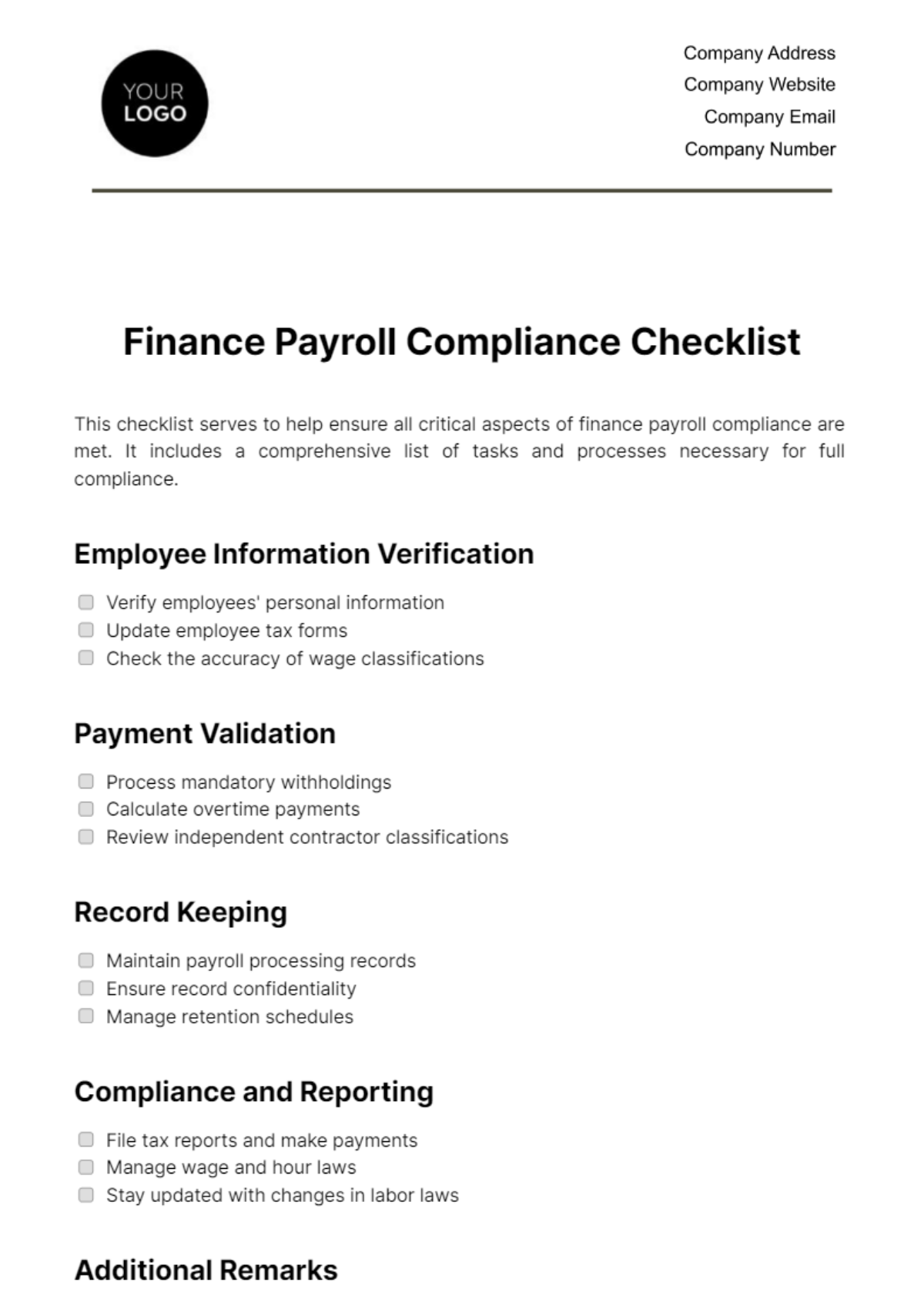

Compliance and Taxation

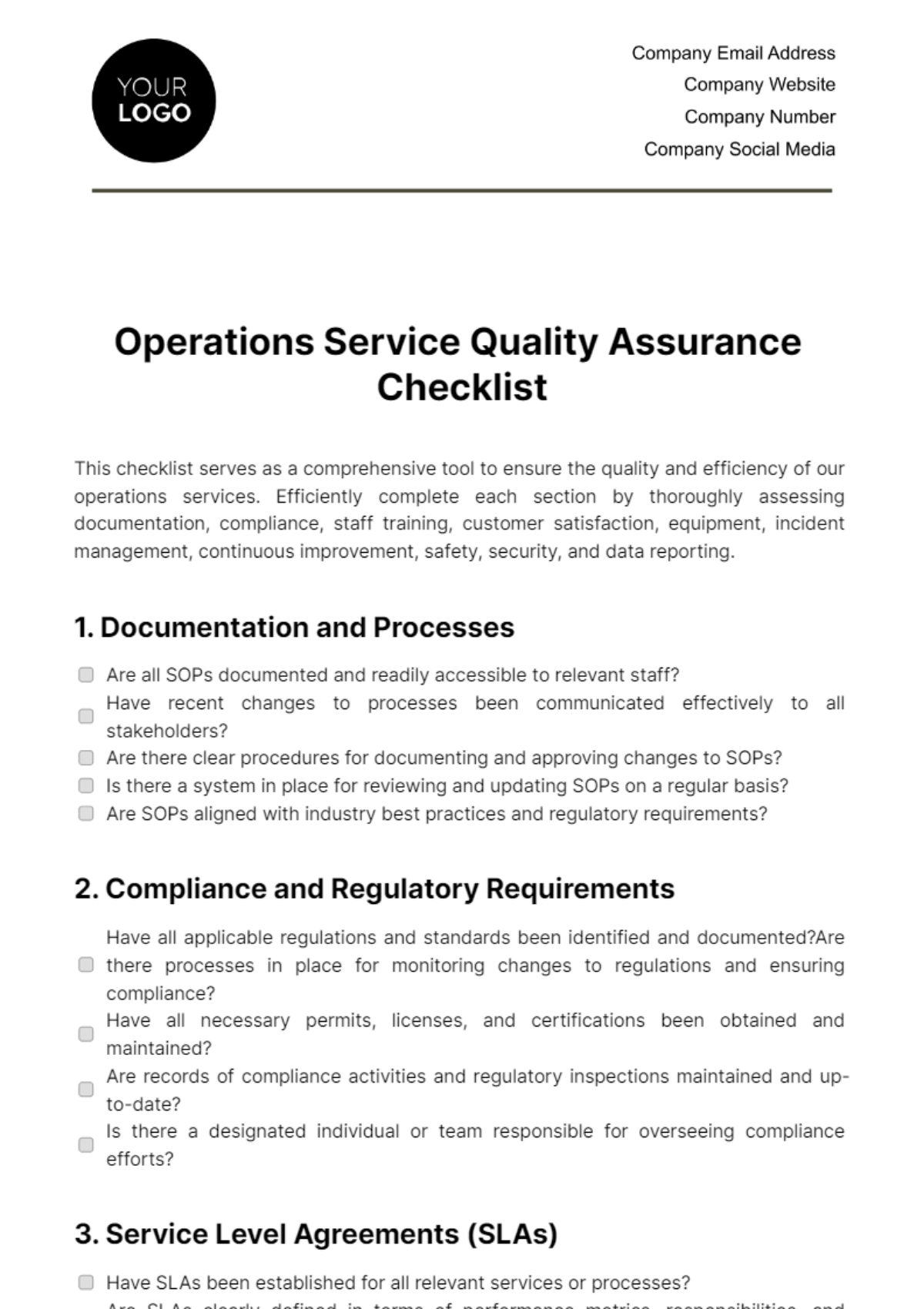

Stay updated on relevant accounting standards, laws, and regulations, ensuring compliance with GAAP or other applicable frameworks.

File all necessary tax returns accurately and on time, including income tax, sales tax, and payroll taxes.

Maintain proper documentation to support tax deductions, credits, and exemptions claimed.

Collaborate with tax professionals to maximize tax efficiency while minimizing risks of non-compliance.

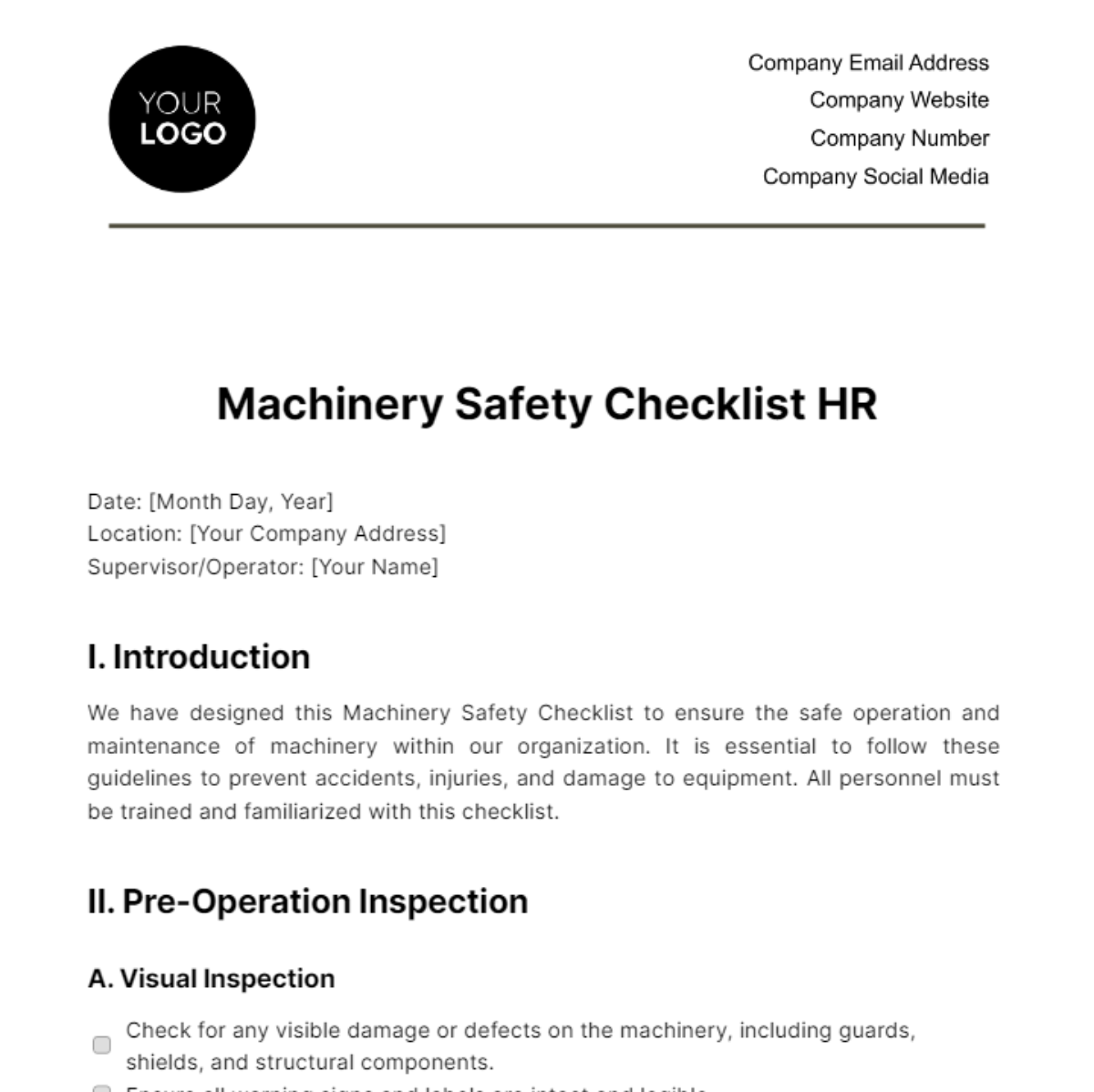

Implement internal controls to safeguard financial data and prevent fraud or errors.