Comprehensive Guidance for Effective Acquisition Accounting

Acquisition accounting is a critical process that ensures the accurate recording and reporting of acquired assets, liabilities, and equity. This checklist provides a structured approach to effectively manage the acquisition accounting process. Simply tick the checkboxes next to each item as you complete the corresponding task.

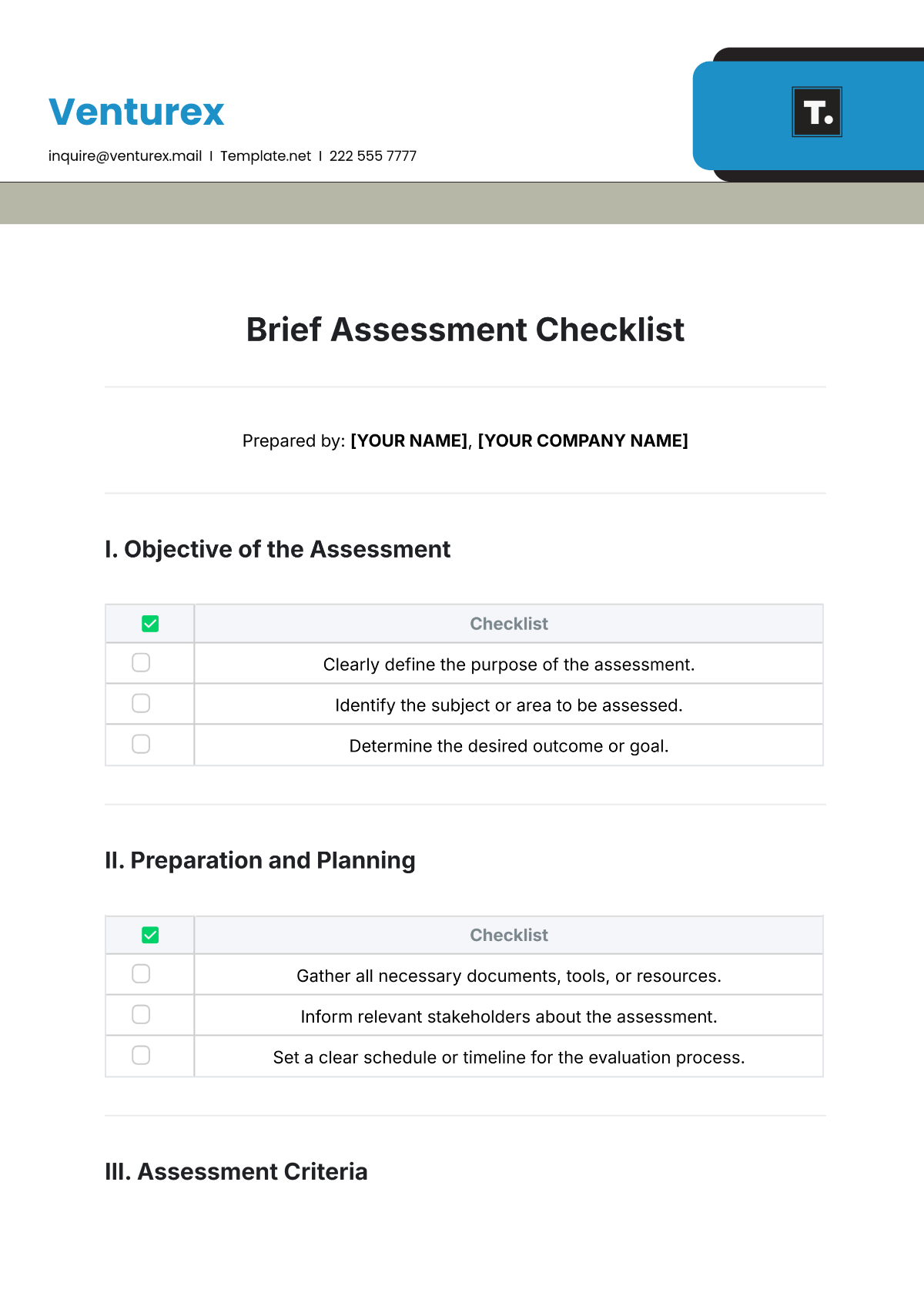

Objectives:

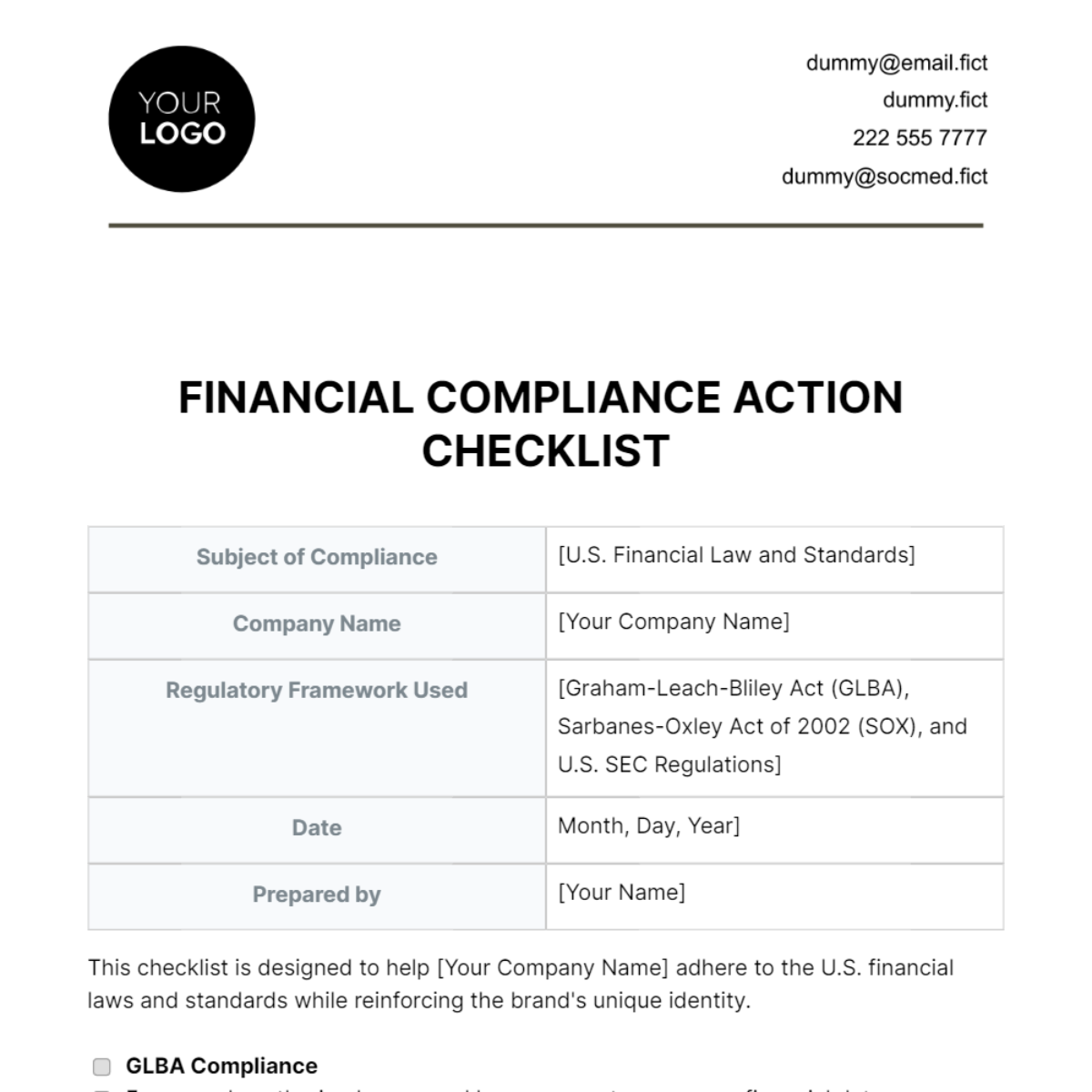

Ensure compliance with accounting standards and regulatory requirements.

Facilitate a seamless transition and integration of acquired entities into the acquiring company.

Enhance transparency and accuracy in financial reporting following the acquisition.

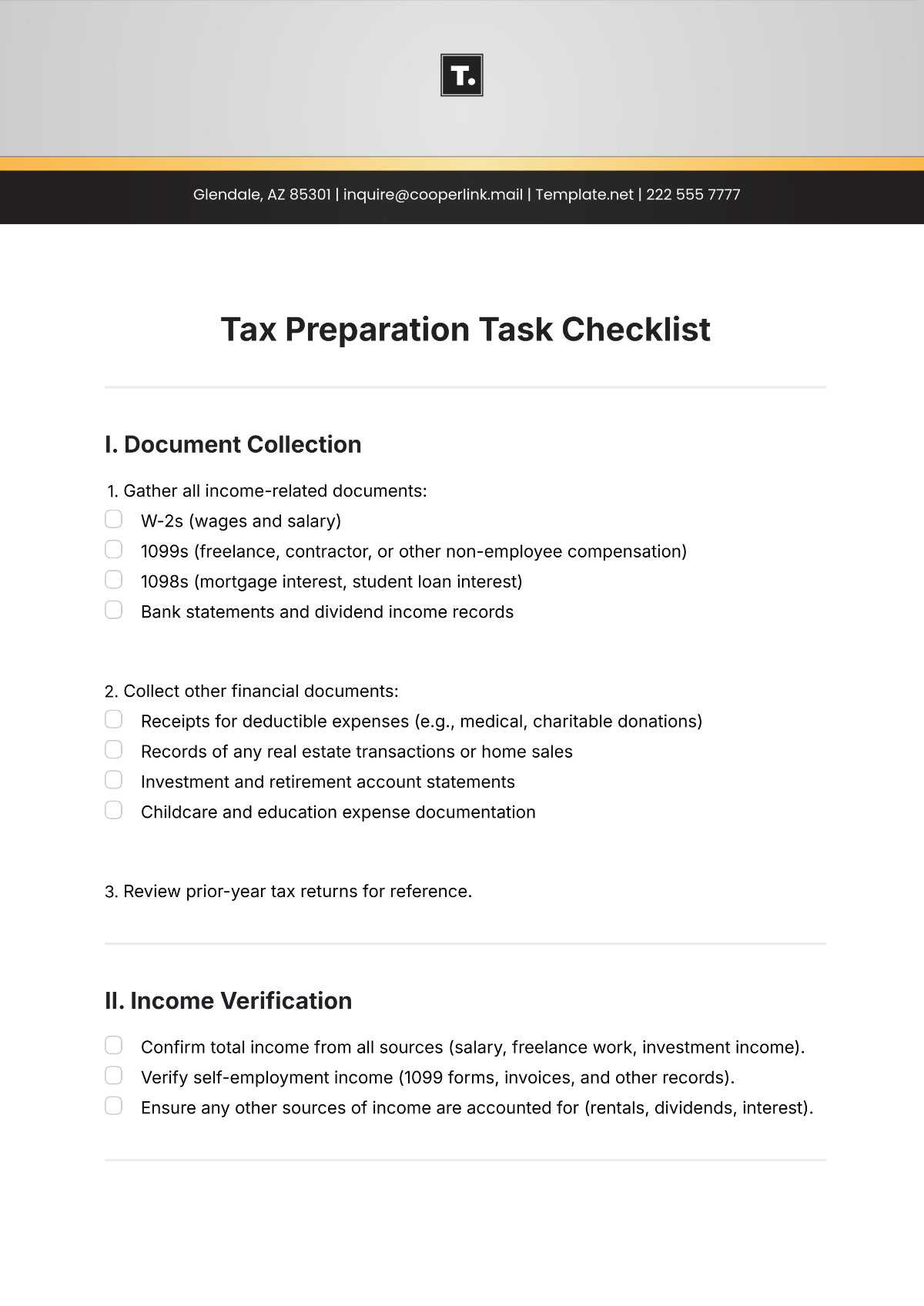

1. Pre-Acquisition Preparation

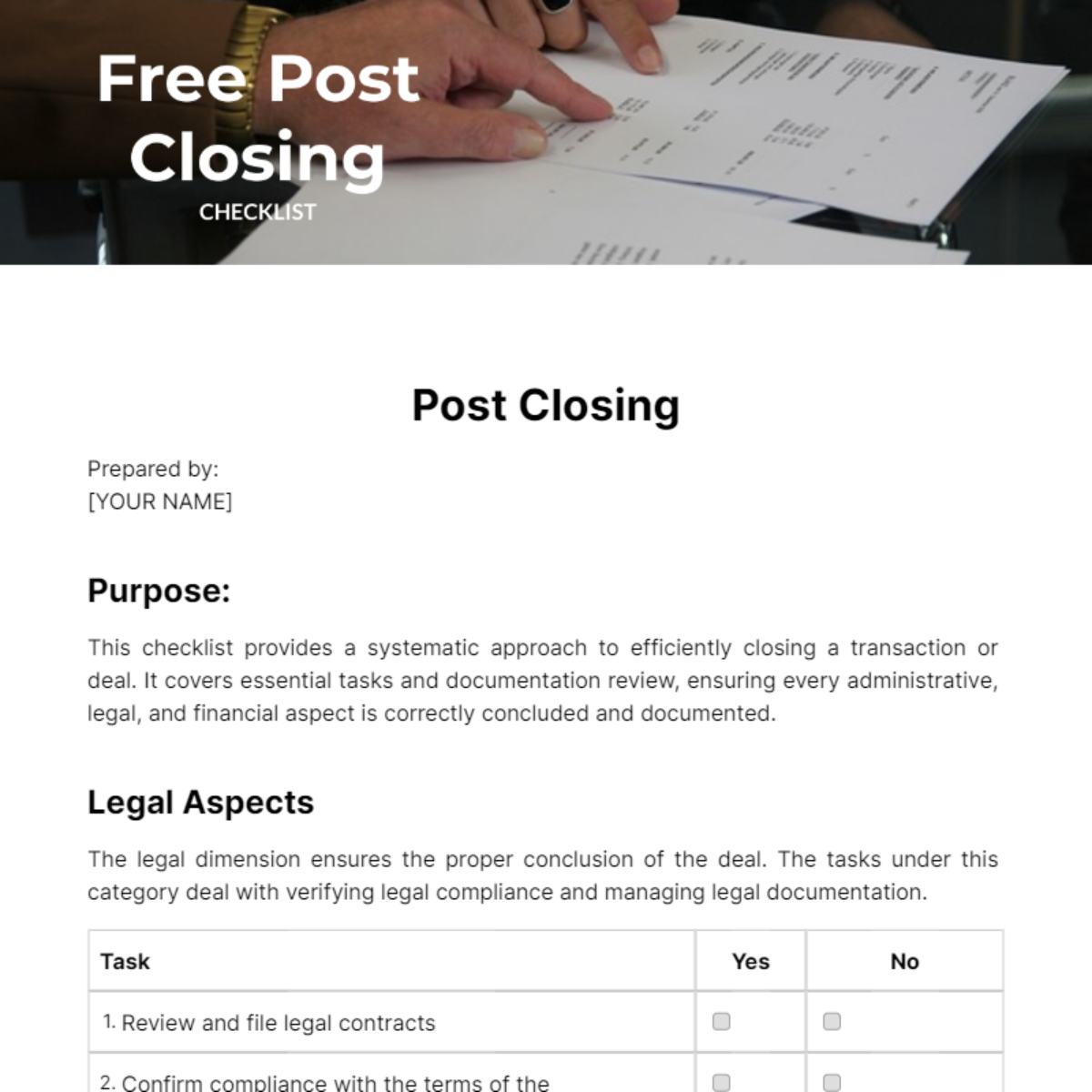

Legal Due Diligence

Review legal documents, such as contracts, agreements, and licenses to identify any potential risks or liabilities.

Verify the ownership and validity of intellectual property rights associated with the acquired entity.

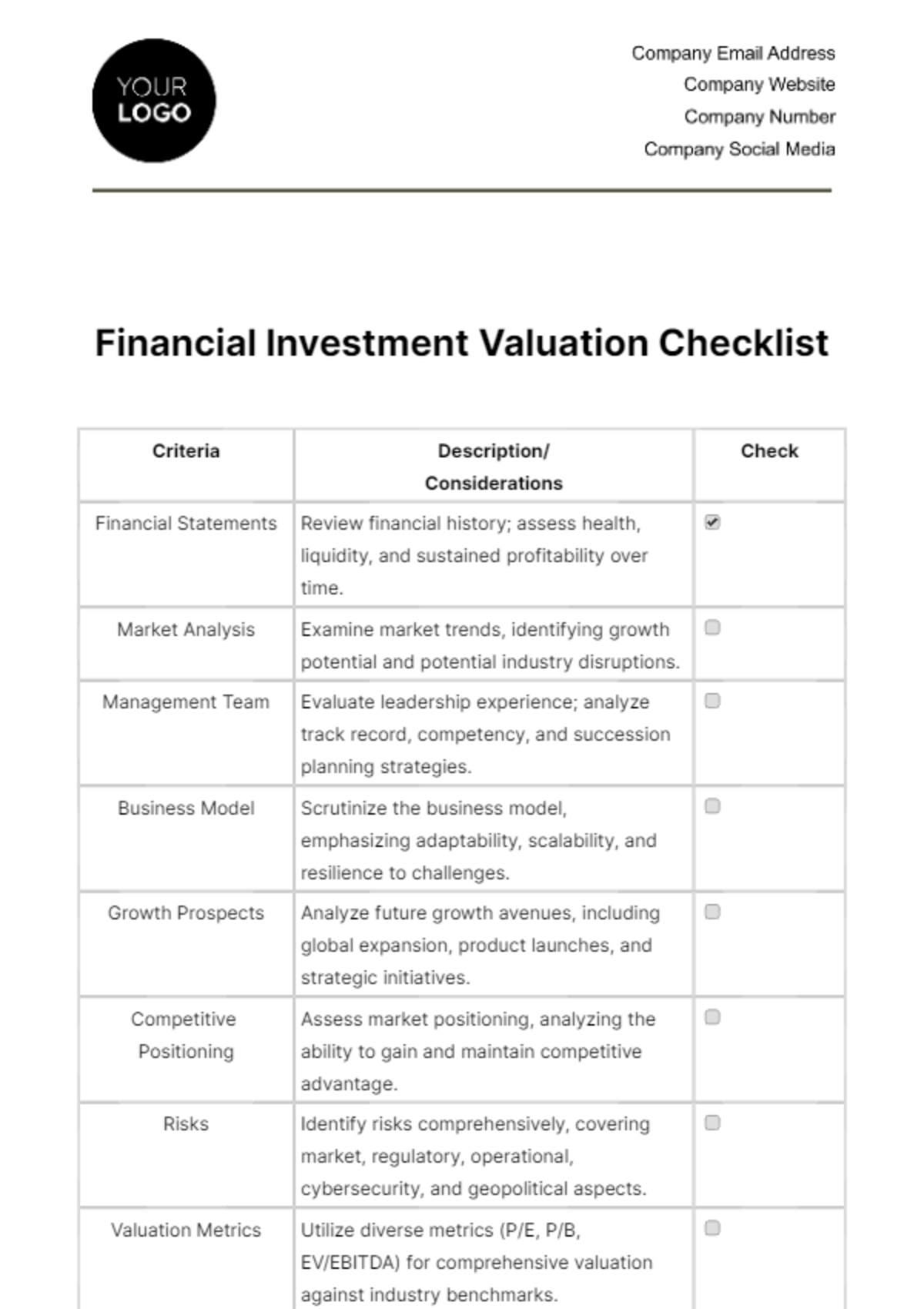

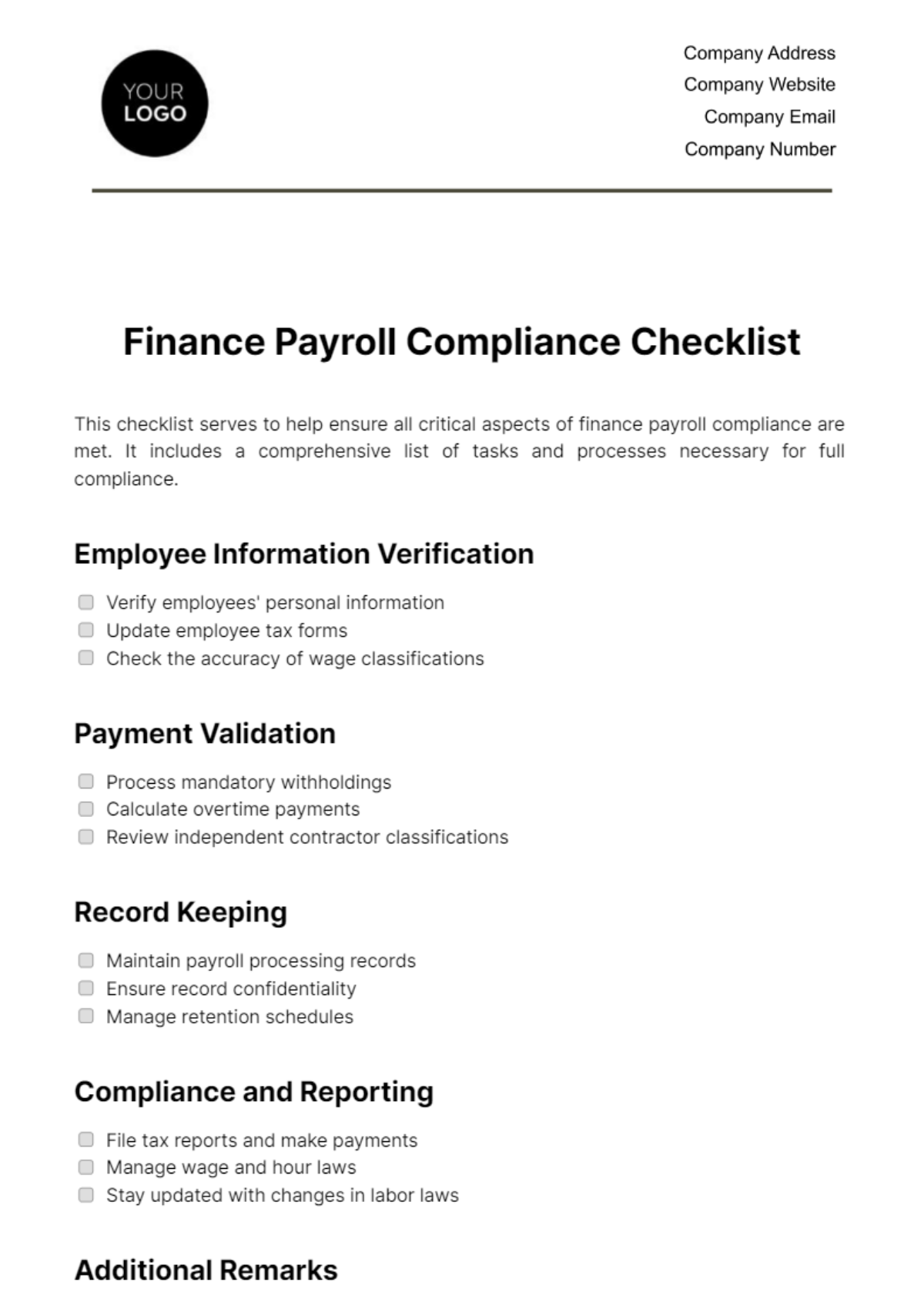

Financial Due Diligence

Examine historical financial statements, tax returns, and audit reports to assess the financial health and performance of the target company.

Analyze the quality of earnings, cash flow trends, and potential contingent liabilities.

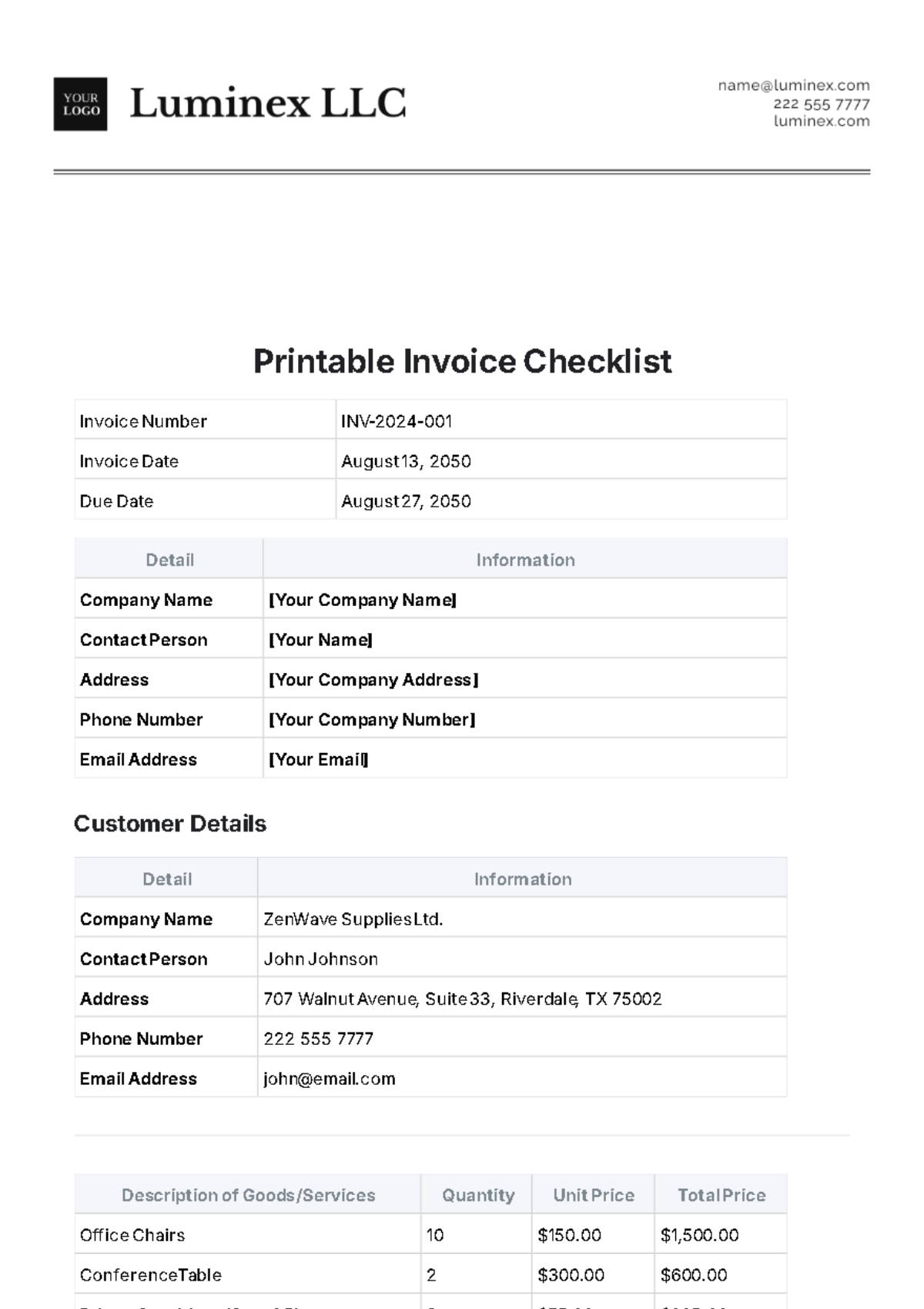

2. Acquisition Execution

Valuation Assessment

Engage with valuation experts to determine the fair value of identifiable assets, liabilities, and contingent liabilities.

Assess the fair value of intangible assets such as goodwill, trademarks, and customer relationships.

Purchase Price Allocation

Allocate the purchase price to tangible and intangible assets based on their fair values determined during the valuation process.

Ensure compliance with accounting standards, such as ASC 805 (IFRS 3) regarding the allocation of purchase consideration.

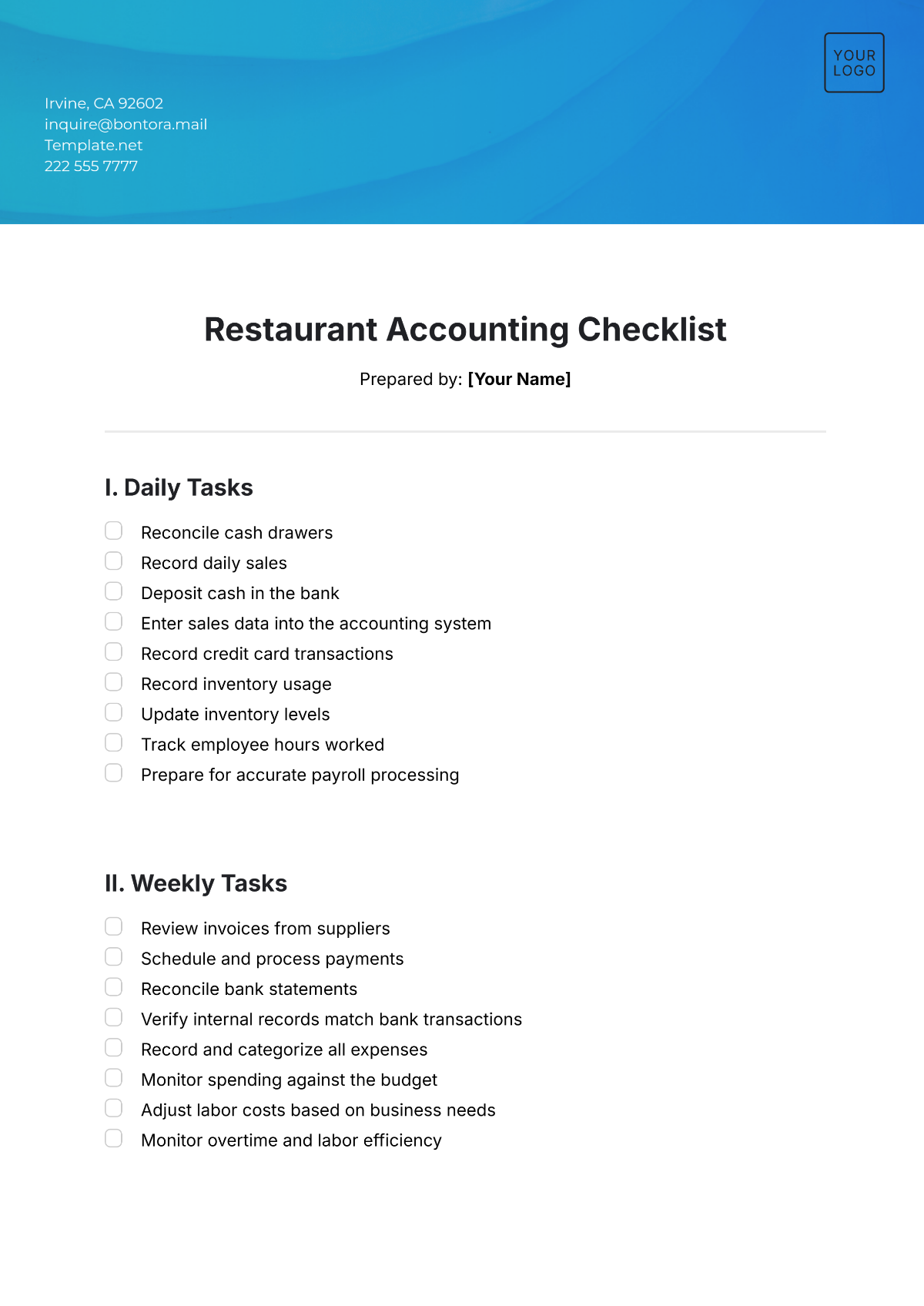

3. Post-Acquisition Integration

Accounting System Integration

Integrate the financial reporting systems of the acquired entity with those of the acquiring company to streamline reporting processes.

Establish controls and procedures to ensure the accurate recording and consolidation of financial data.

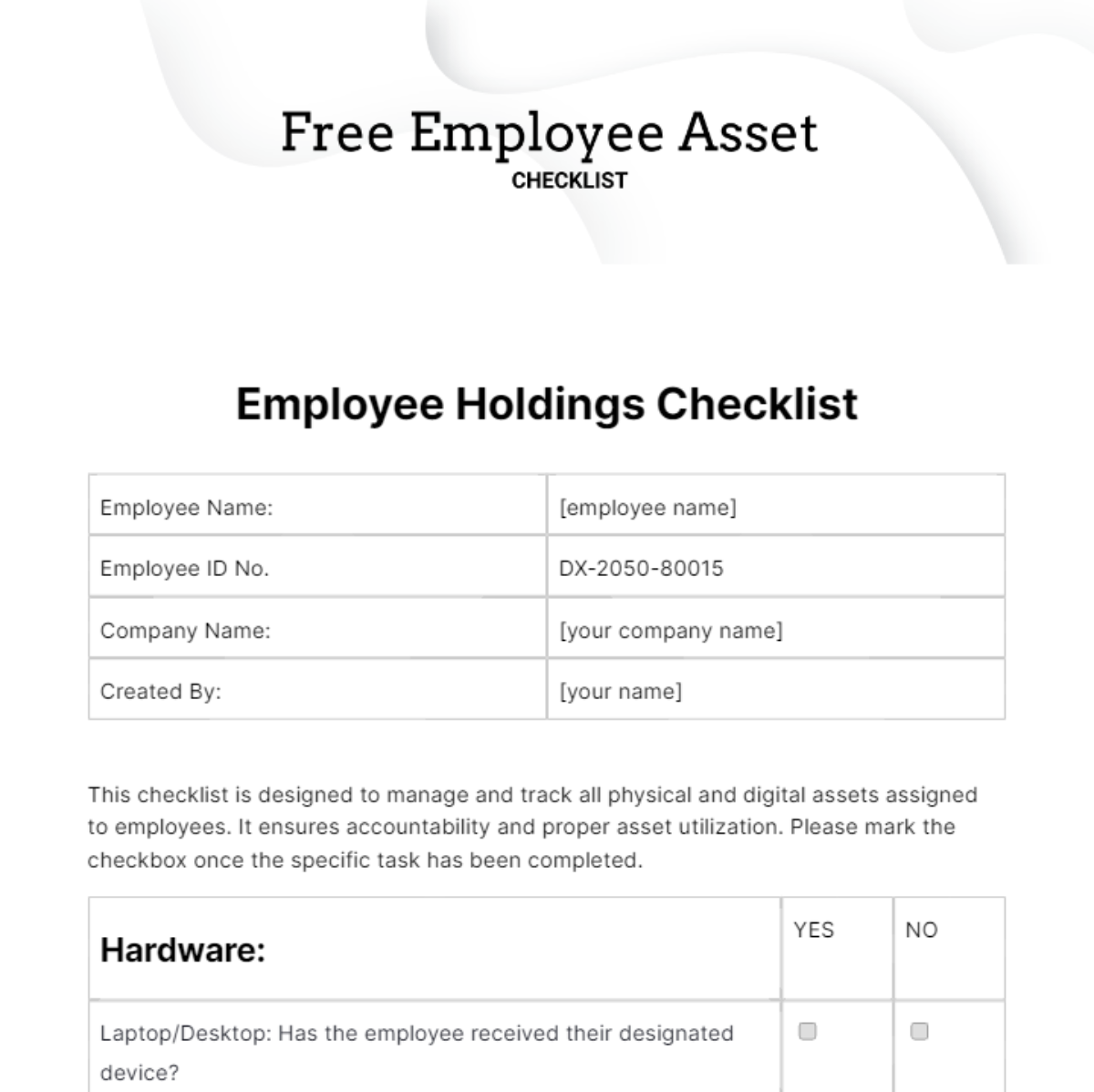

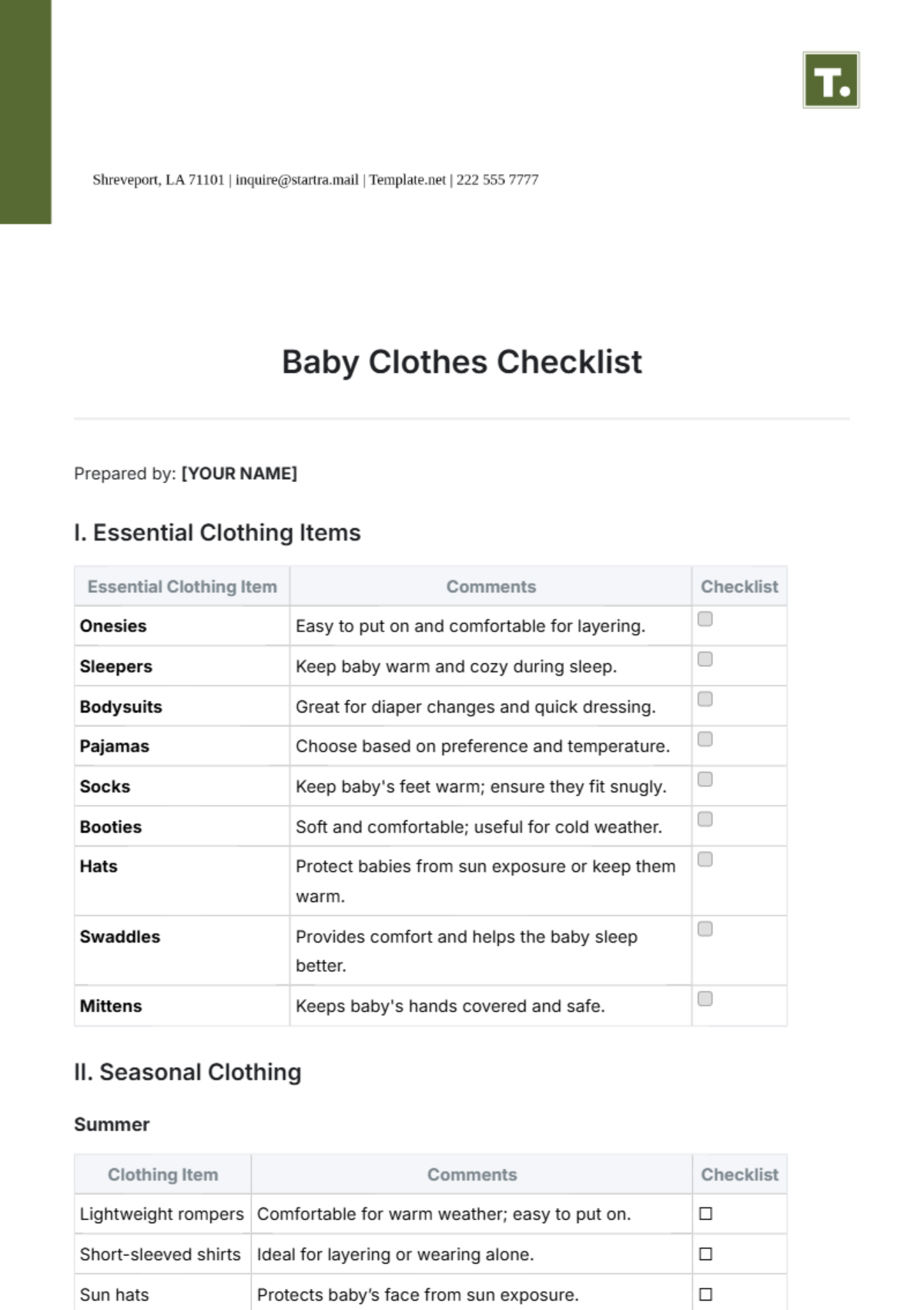

Employee Integration

Assess the impact of the acquisition on the workforce and implement strategies for integrating employees into the organizational structure.

Provide training and support to employees to facilitate a smooth transition and alignment with company culture.