Free Year End Closing Checklist Template

Closing Checklist

Prepared by:

[YOUR NAME]

Purpose:

To serve as a meticulous roadmap for organizations, guiding them through a series of critical financial tasks and processes essential for ensuring accuracy, transparency, and compliance in their financial records, the comprehensive checklist is designed with the overarching purpose of facilitating a smooth and systematic year-end closing process.

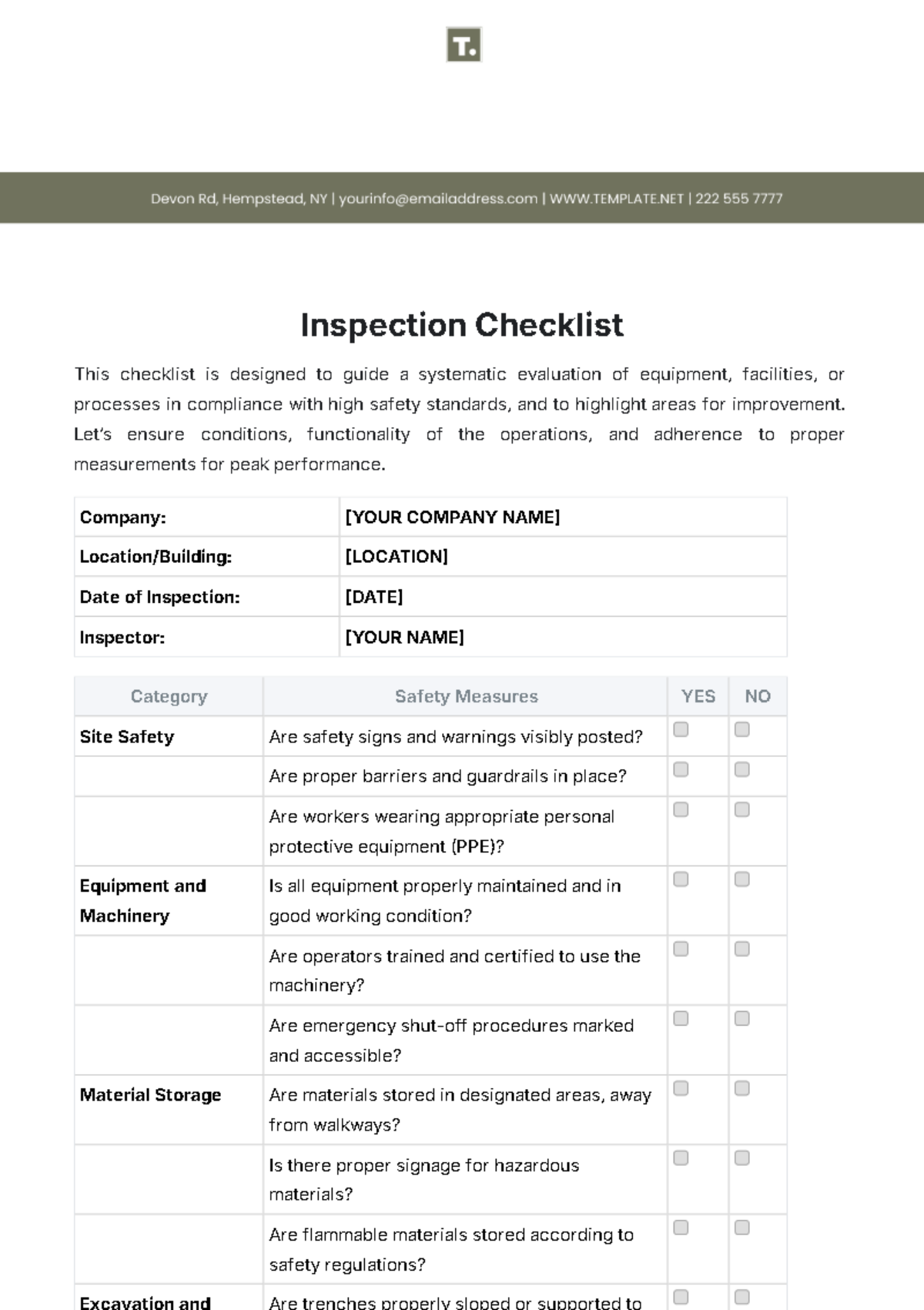

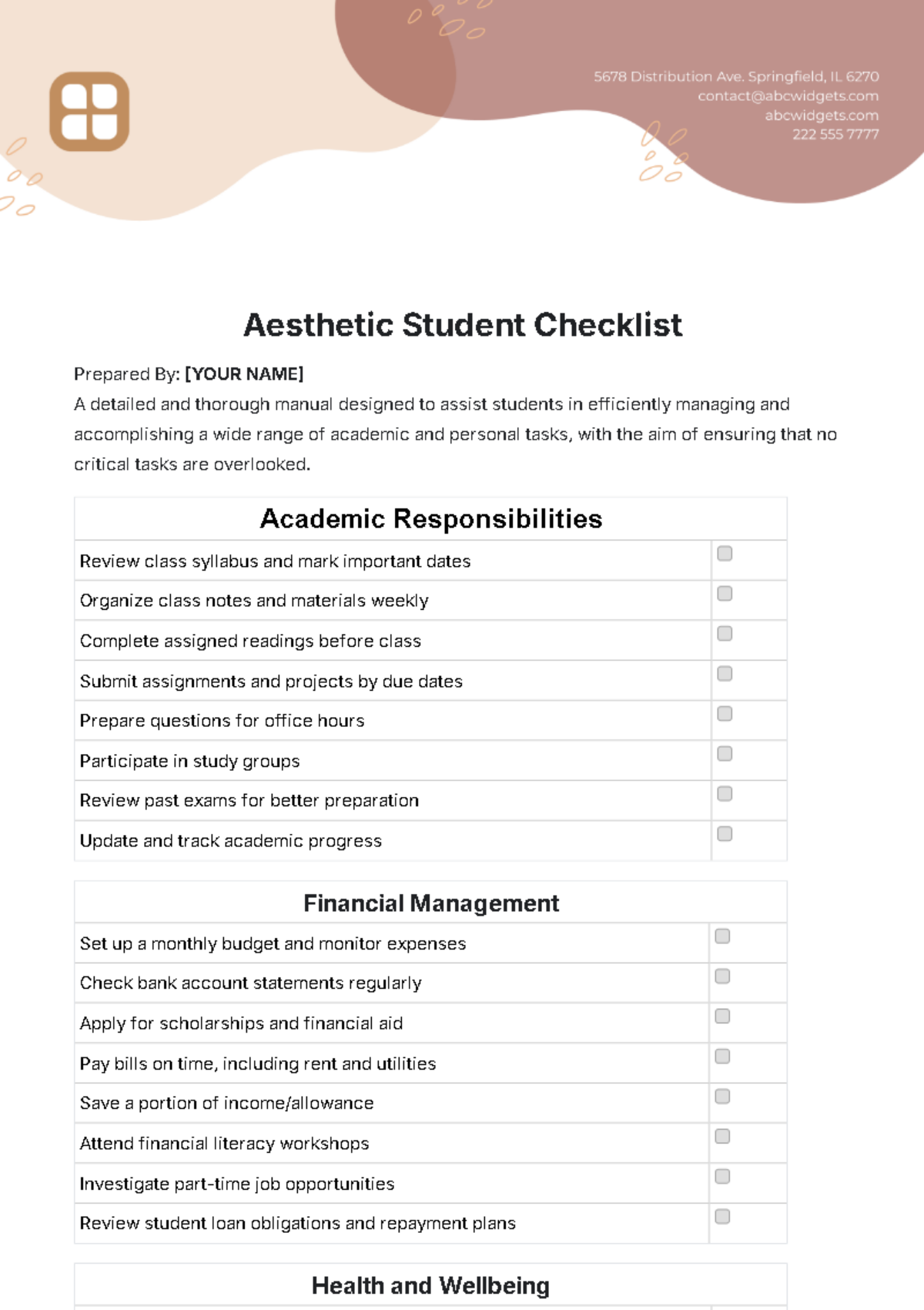

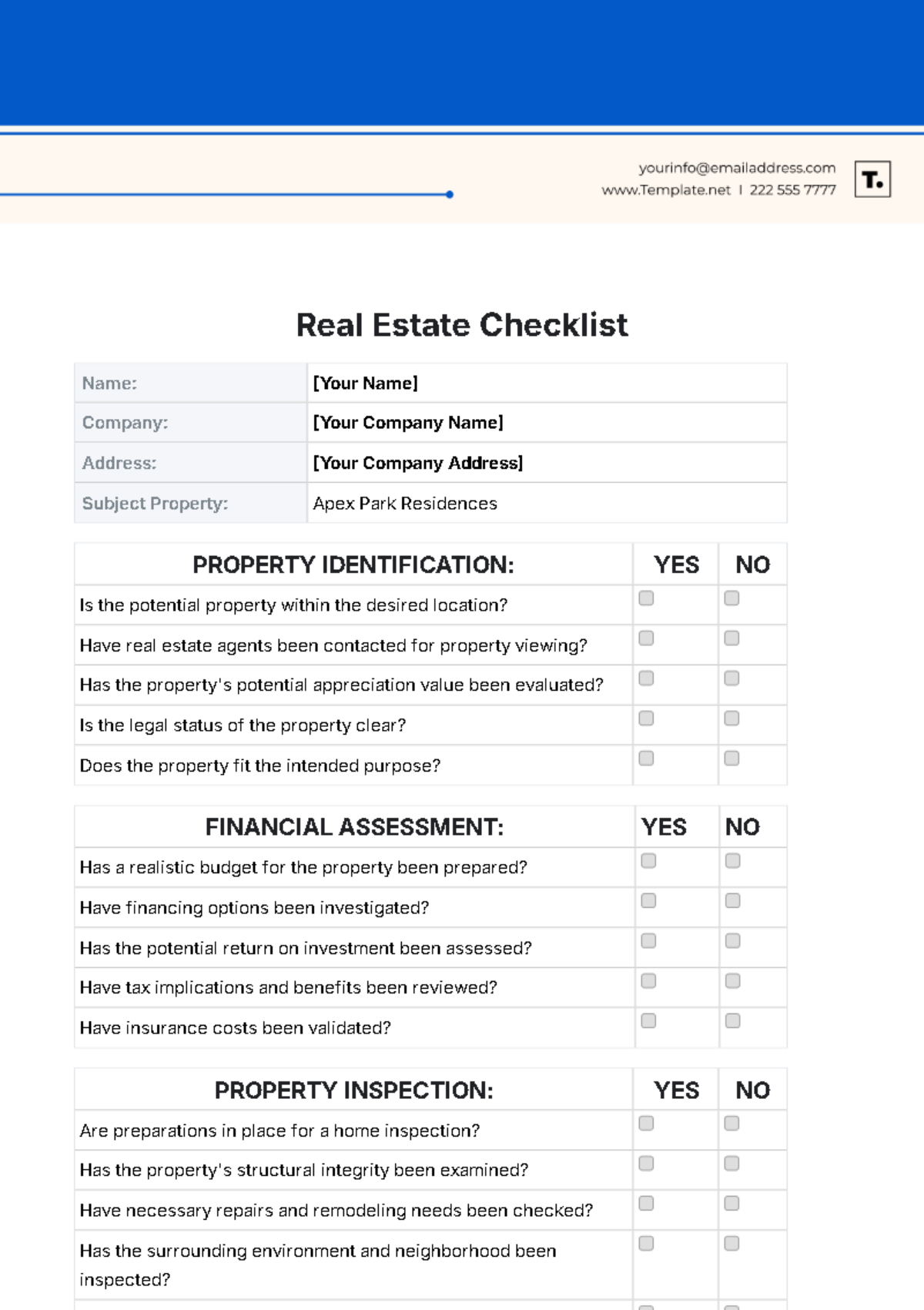

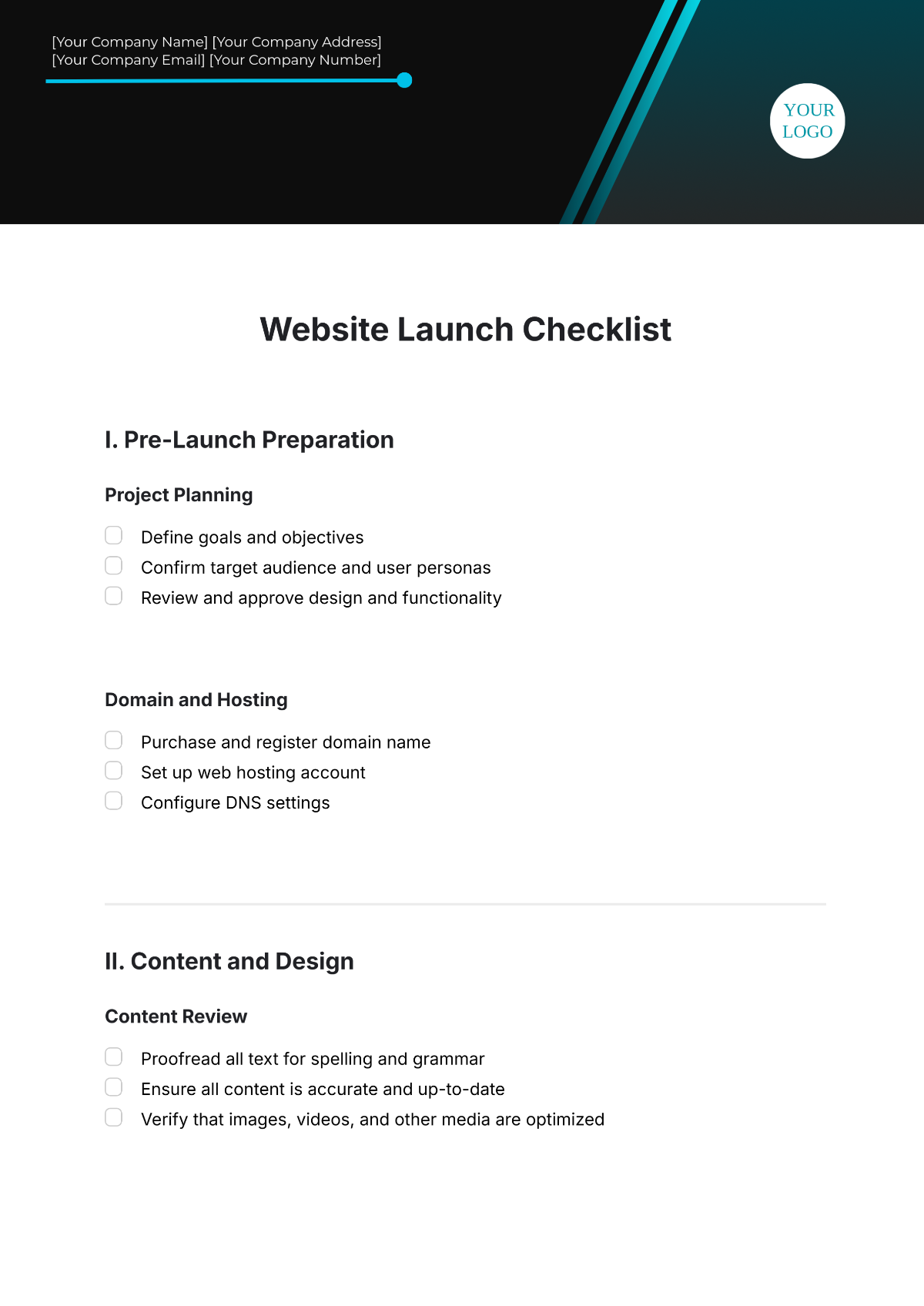

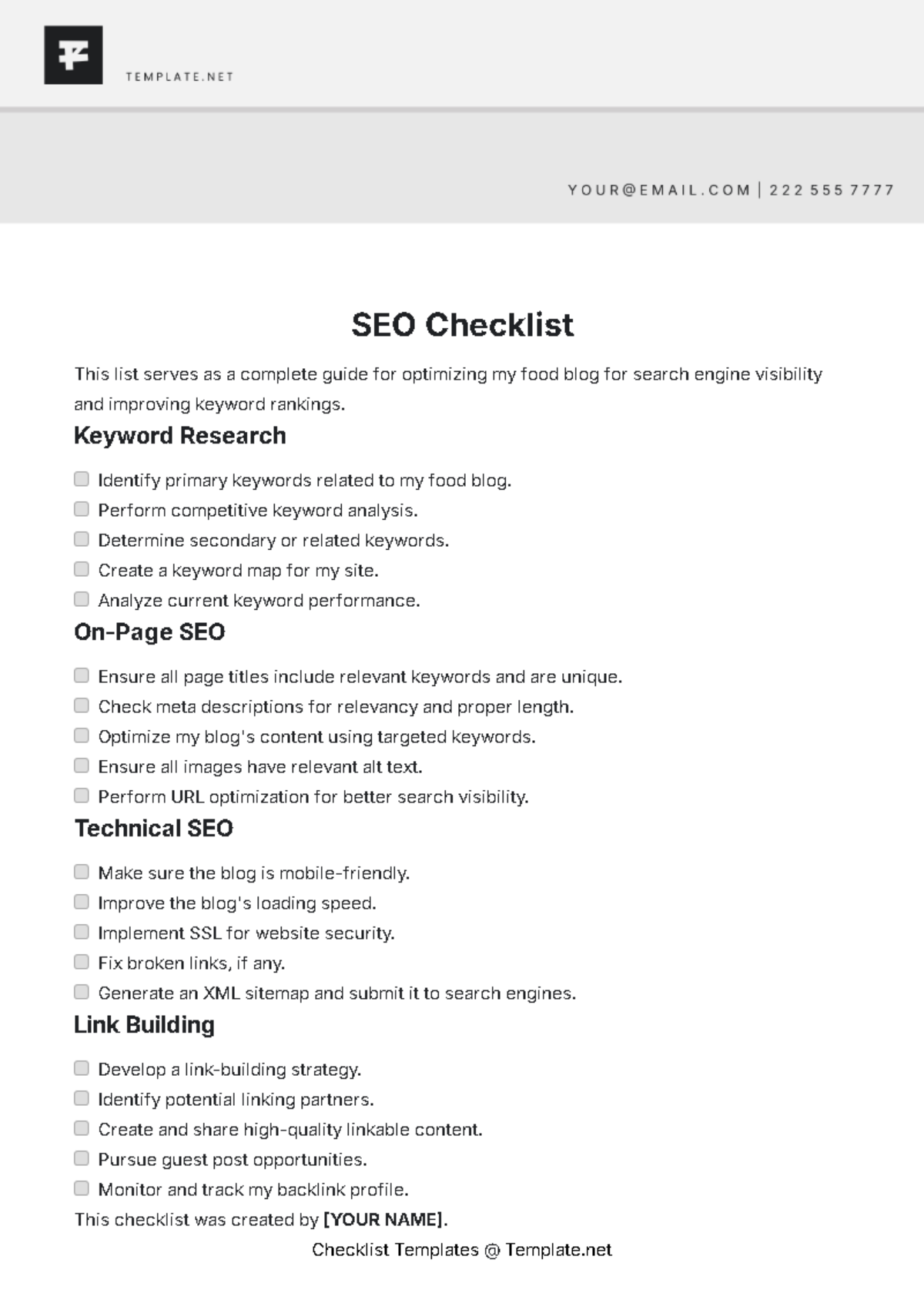

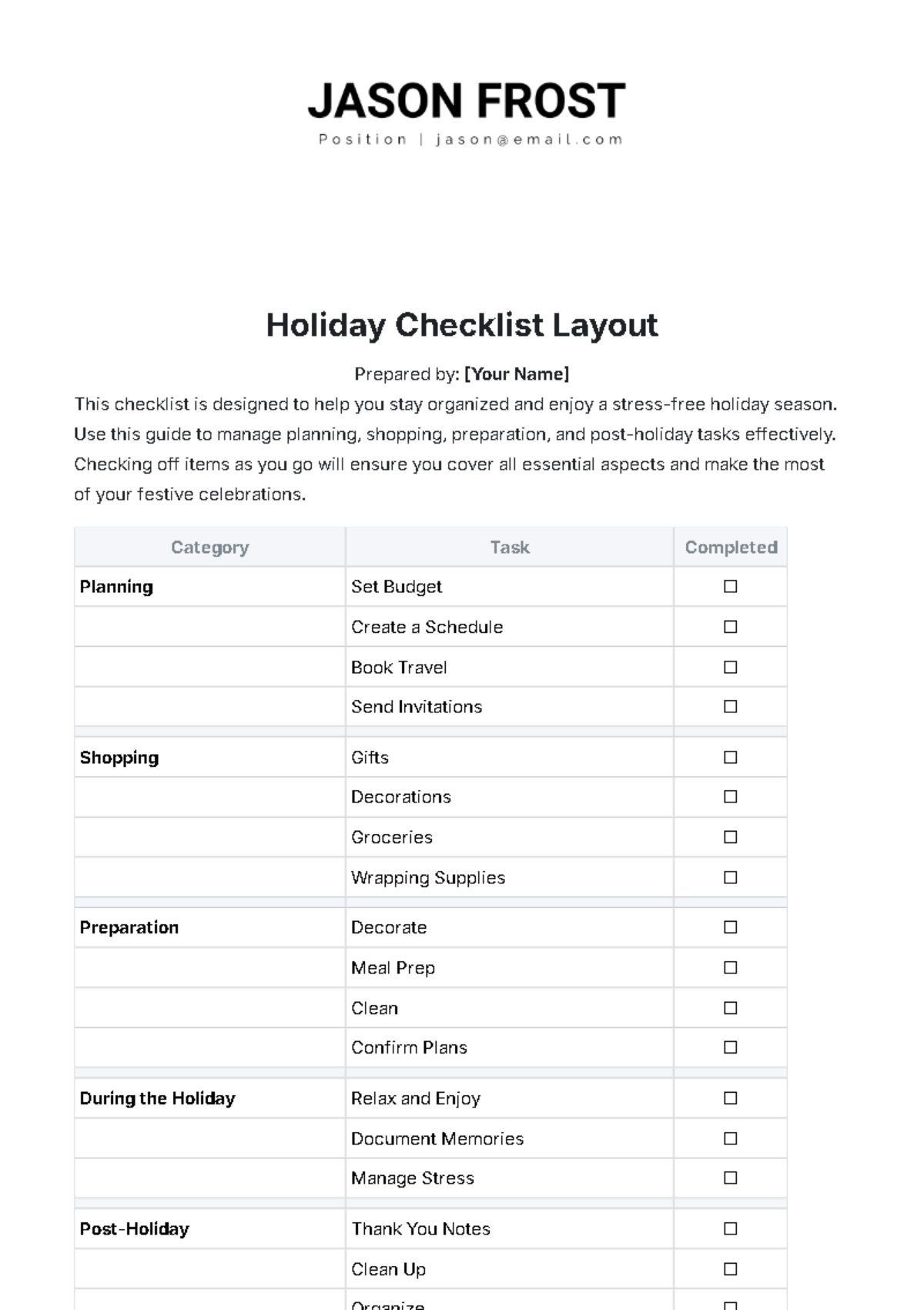

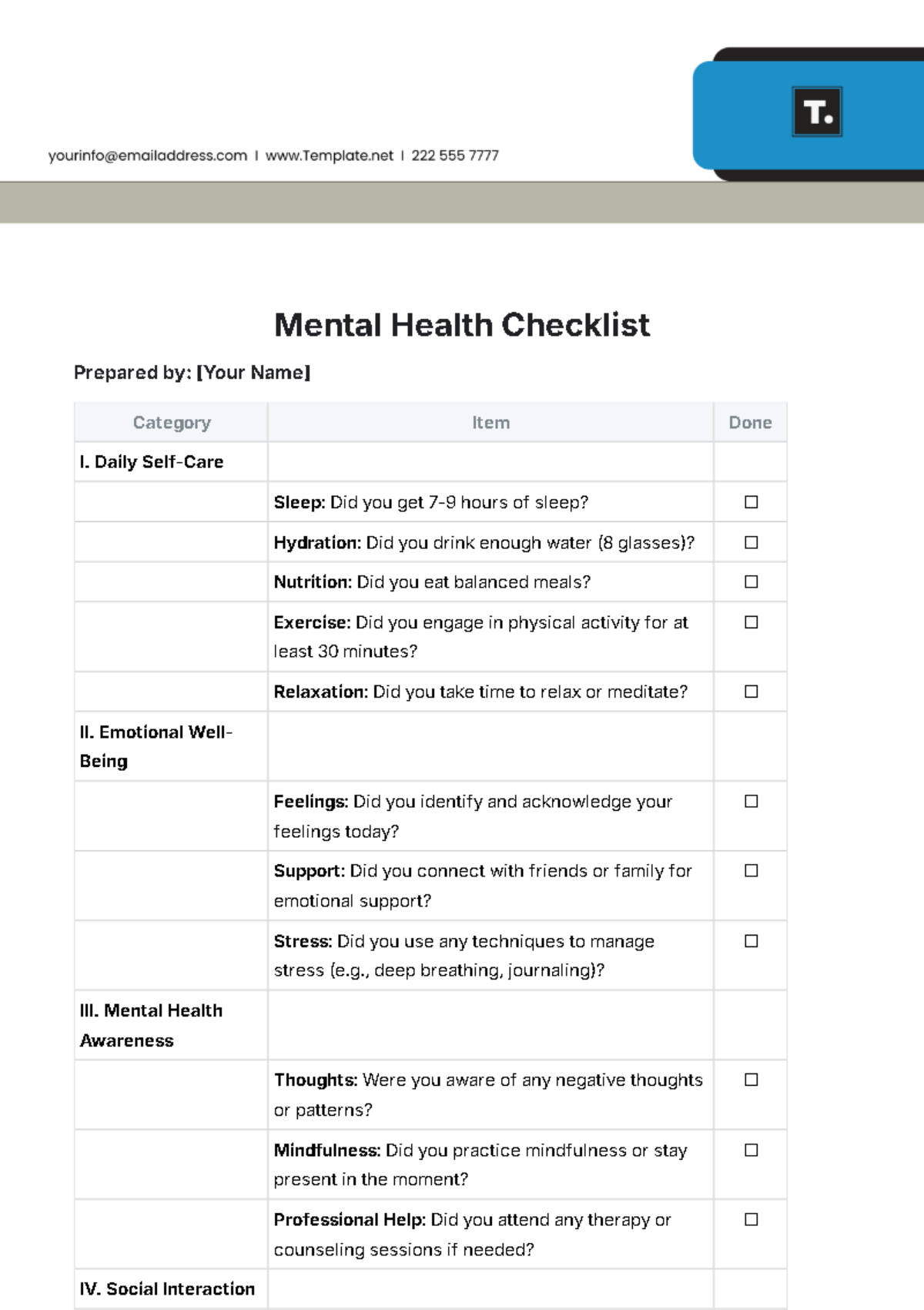

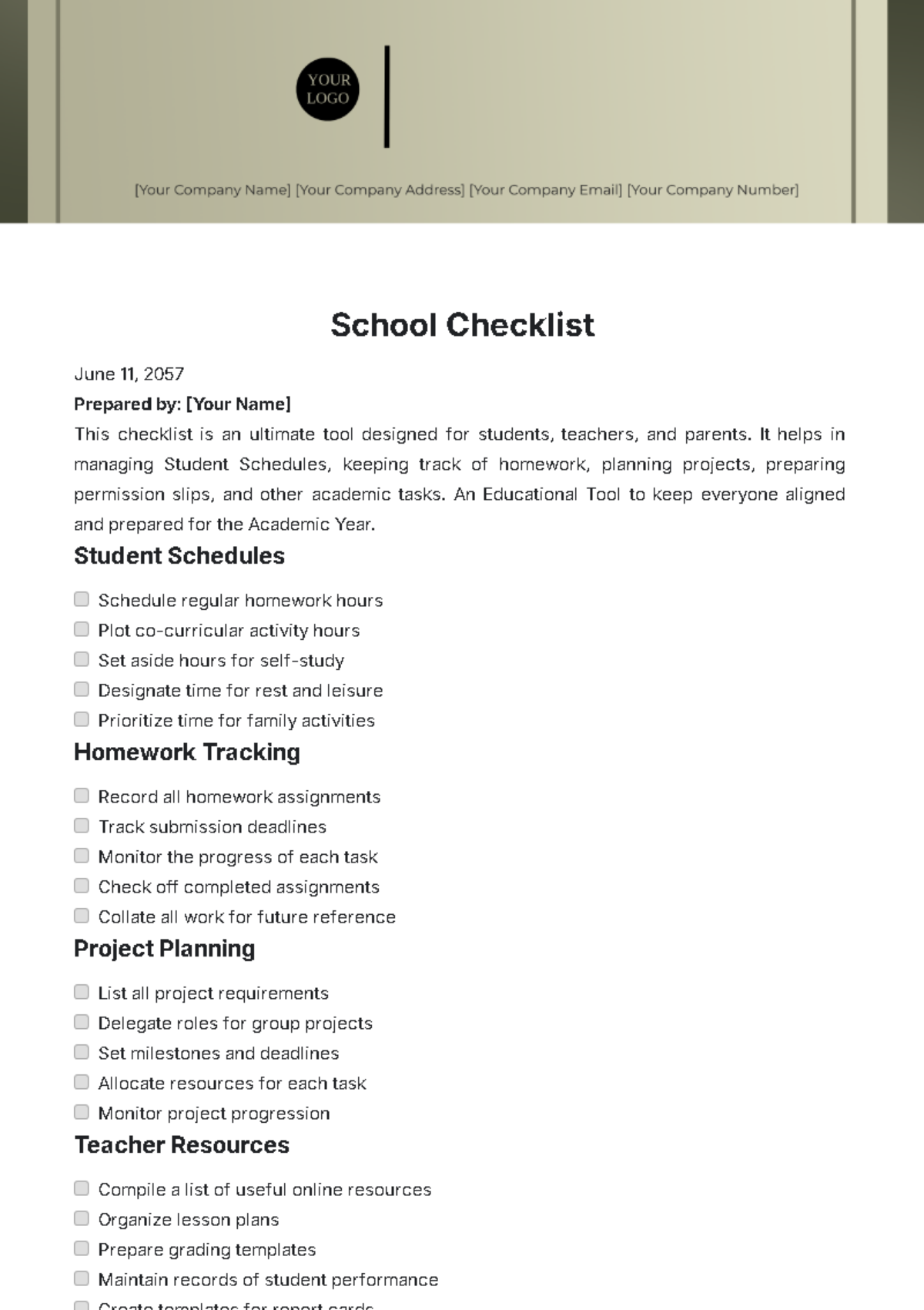

Account Reconciliation

This category focuses on the review of all company accounts to ensure accuracy before finalizing financial statements.

No | Activities | Status |

1 | Reconcile all bank accounts | |

2 | Verify creditor and debtor invoices | |

3 | Check petty cash and cash receipts | |

4 | Balance all ledgers | |

5 | Review all accounts receivable and payable balances |

Tax Records Review

Involves the verification and validation of tax obligations according to local, state, and federal tax requirements.

No | Activities | Status |

1 | Review tax filing statuses | |

2 | Ensure completeness of sales tax submissions | |

3 | Check payroll tax and withholding | |

4 | Validate income tax filings | |

5 | Prepare for potential tax audits |

Financial Documentation

This involves sorting and classifying all relevant financial documents and records for proper storage and retrieval.

No | Activities | Status |

1 | Sort and classify all financial records | |

2 | Verify in-house reports with bank statements | |

3 | Ensure secure storage of important financial documents | |

4 | Digitize all necessary paperwork | |

5 | Discard outdated records according to company policy |

Regulatory Compliance

In this category, the company ensures compliance with all regulatory and legal requirements related to its financial responsibilities.

No | Activities | Status |

1 | Verify all necessary licenses and permits are up-to-date | |

2 | Confirm adherence to all financial regulations | |

3 | Ensure data protection compliance | |

4 | Check labor law adherence for payroll | |

5 | Prepare for possible financial audits |

Financial Closeout

The compilation of all financial statements and summaries of the year's financial activities to conclude the fiscal year

No | Activities | Status |

1 | Prepare profit and loss statement | |

2 | Compile balance sheet | |

3 | Create a cash flow statement | |

4 | Compile an annual financial report | |

5 | Review year-end financial positioning |