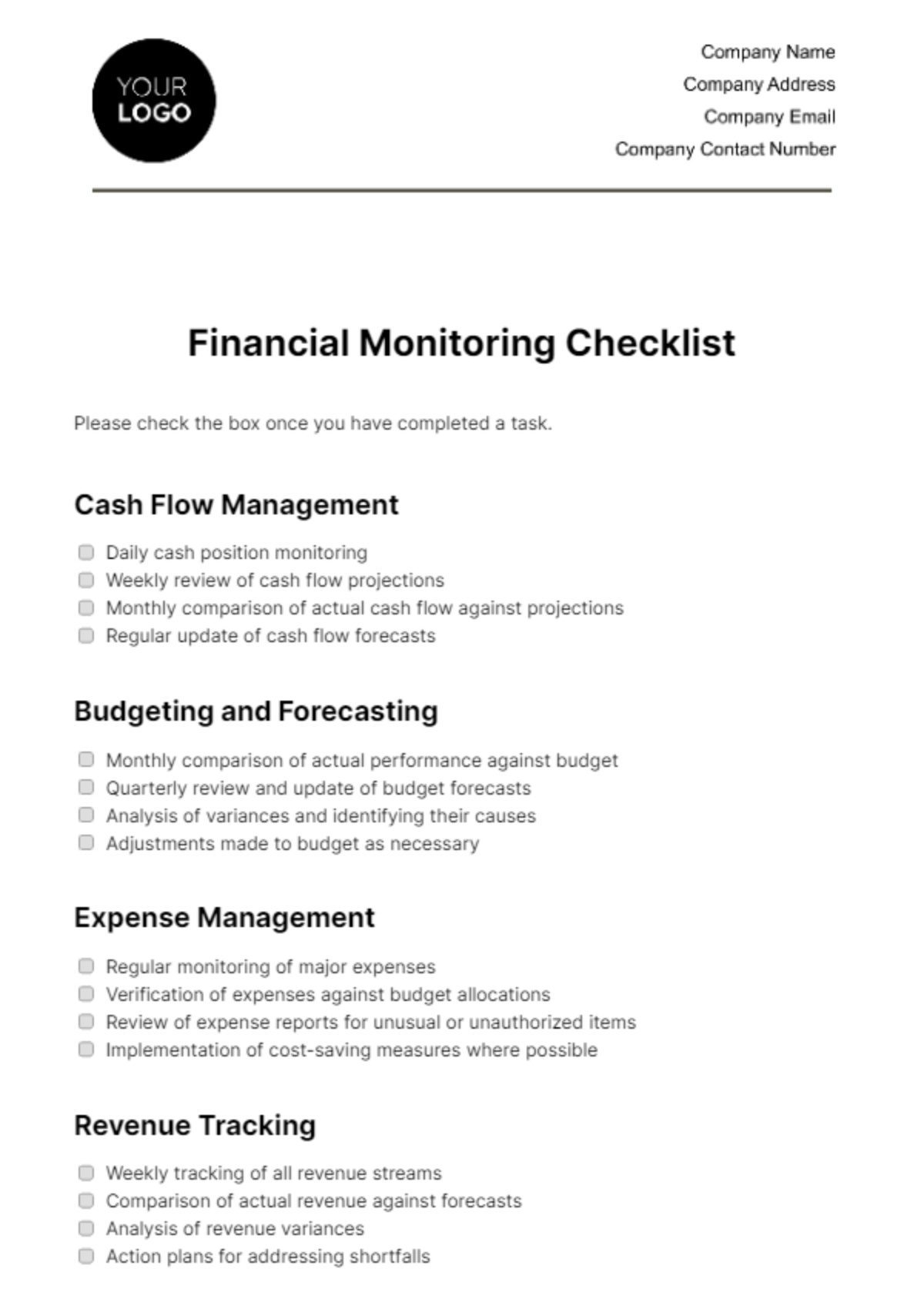

Financial Monitoring Checklist

Please check the box once you have completed a task.

Cash Flow Management

Daily cash position monitoring

Weekly review of cash flow projections

Monthly comparison of actual cash flow against projections

Regular update of cash flow forecasts

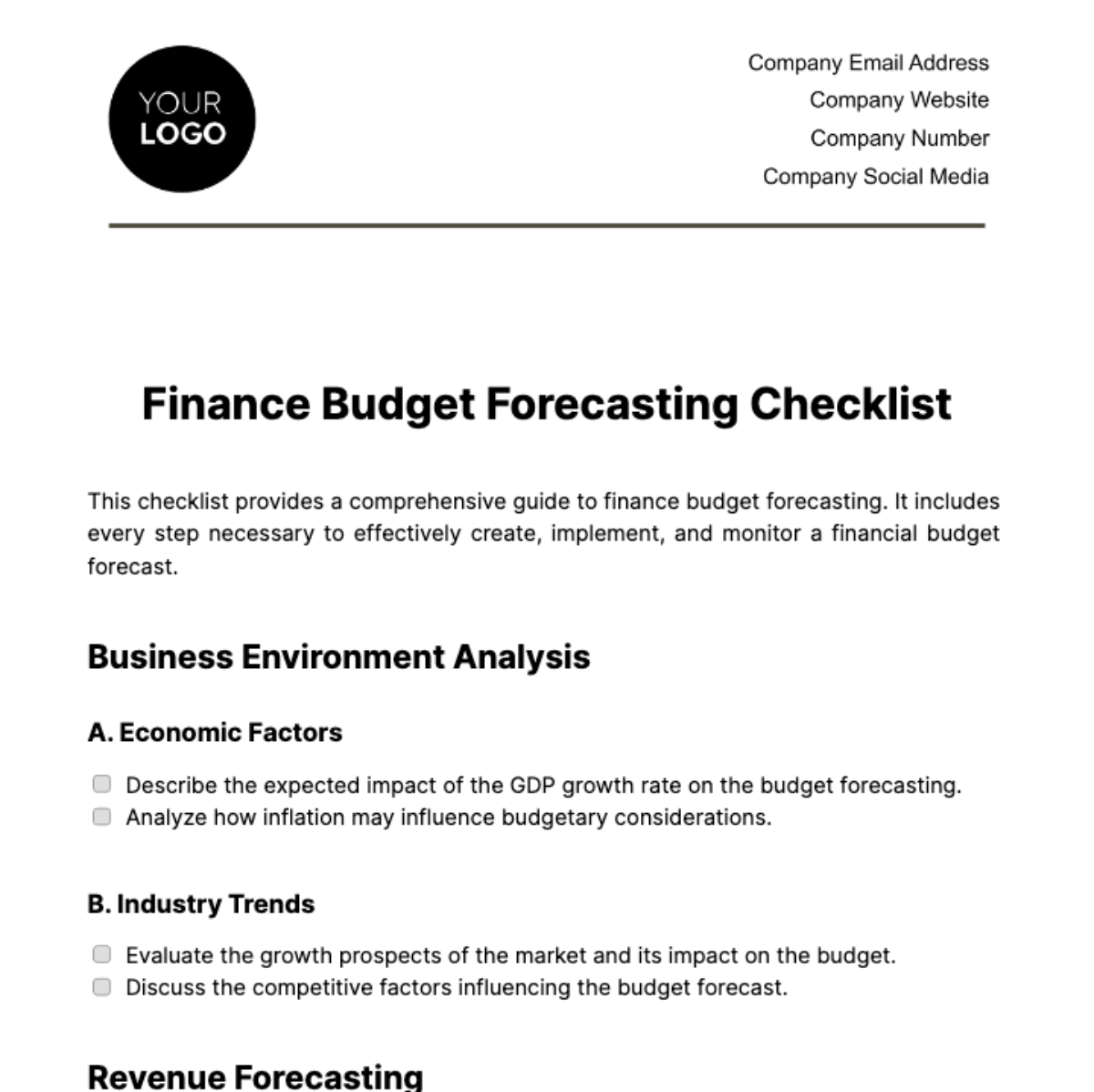

Budgeting and Forecasting

Monthly comparison of actual performance against budget

Quarterly review and update of budget forecasts

Analysis of variances and identifying their causes

Adjustments made to budget as necessary

Expense Management

Regular monitoring of major expenses

Verification of expenses against budget allocations

Review of expense reports for unusual or unauthorized items

Implementation of cost-saving measures where possible

Revenue Tracking

Weekly tracking of all revenue streams

Comparison of actual revenue against forecasts

Analysis of revenue variances

Action plans for addressing shortfalls

Account Reconciliation

Monthly reconciliation of bank accounts

Regular reconciliation of accounts receivable and payable

Verification of ledger balances with actual transactions

Investigation and correction of discrepancies

Compliance and Reporting

Ensuring timely filing of financial reports

Compliance with tax regulations and filing deadlines

Review of financial statements for accuracy and completeness

Internal audits or reviews for compliance with financial policies

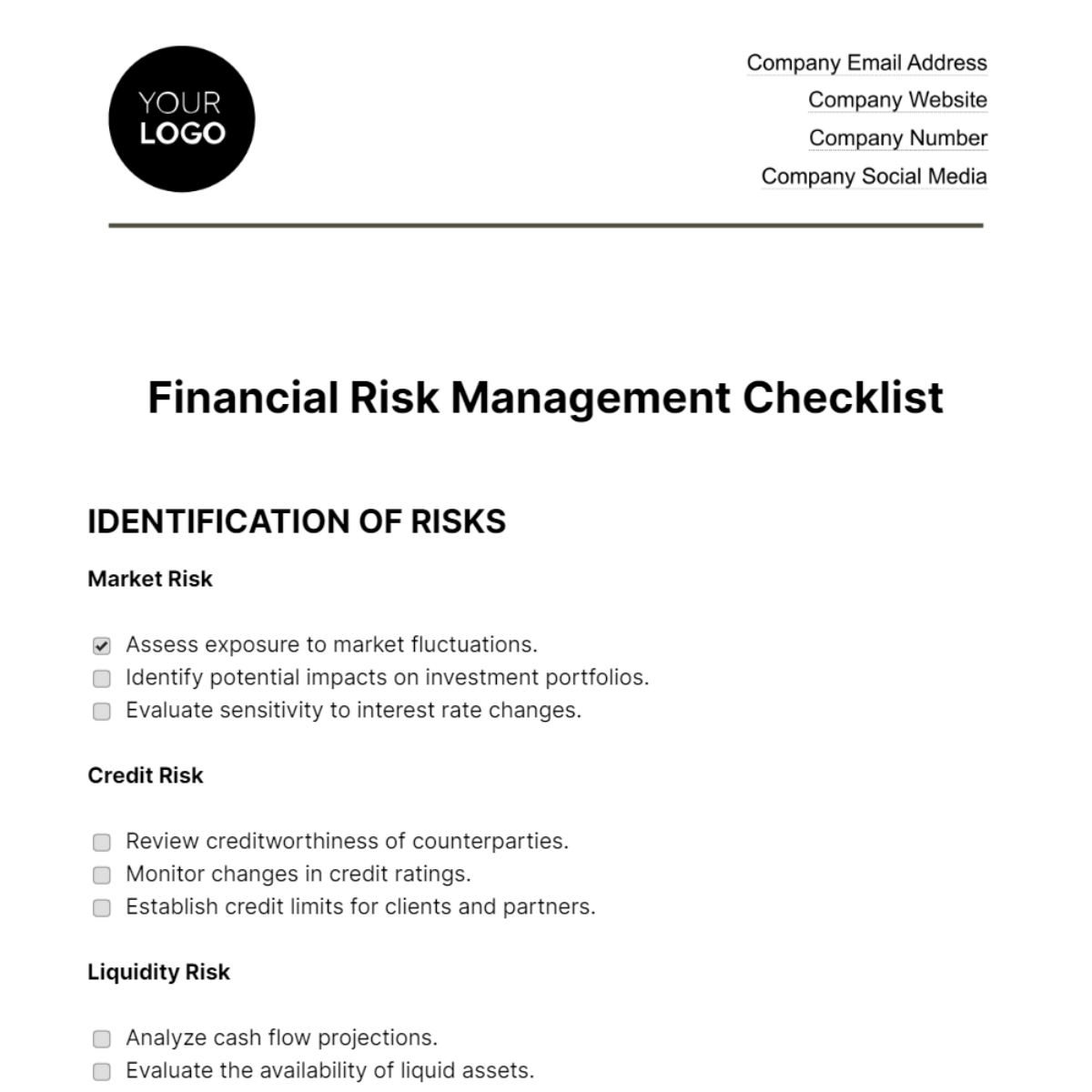

Risk Management

Regular assessment of financial risks

Monitoring risk mitigation strategies

Updating risk management plans as necessary

Reviewed By: [Your Name]

Date: [Month Day, Year]