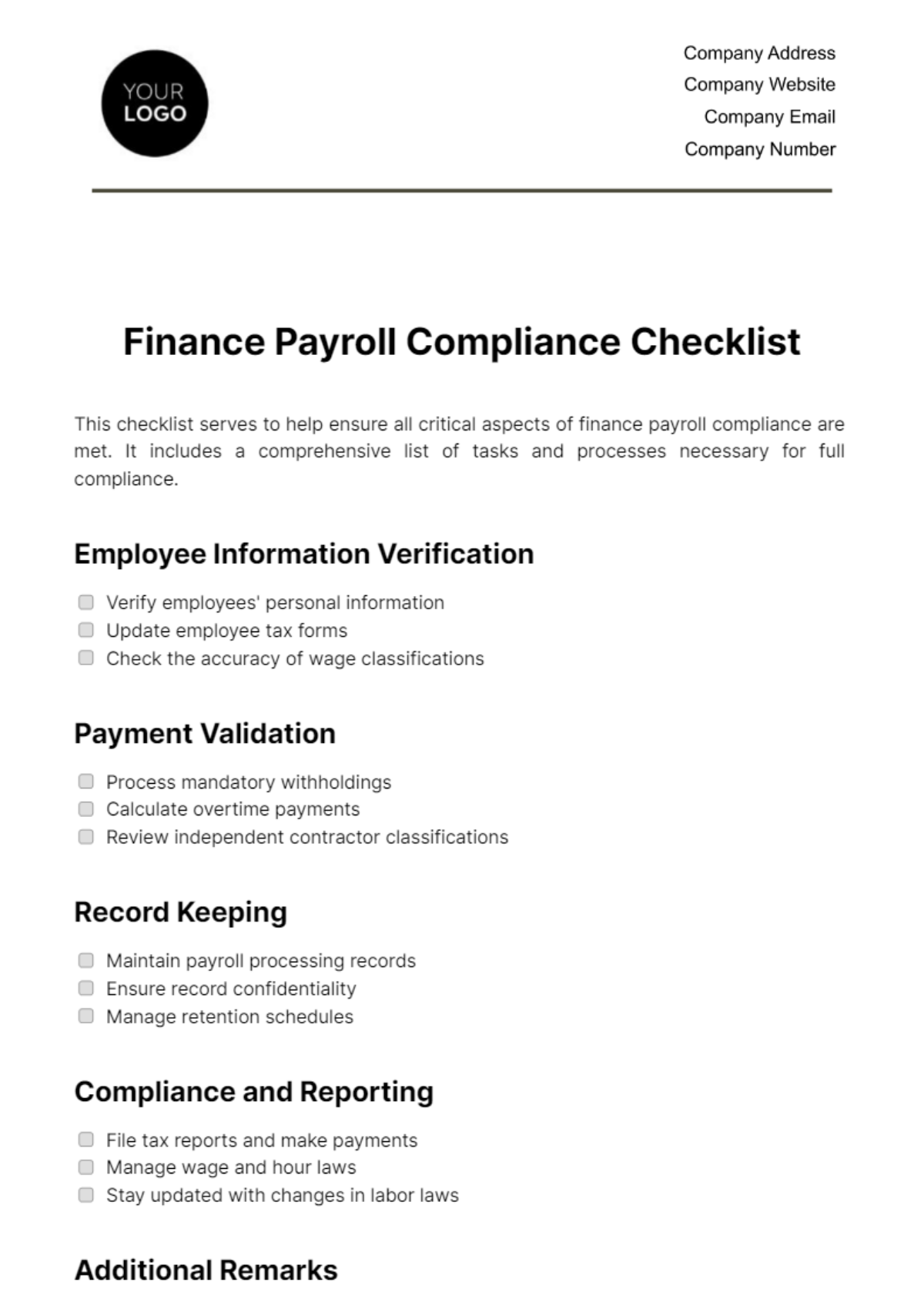

Finance Payroll Variance Checklist

Project/Period: [Month] - [Month]

Date: [Month Day, Year]

This checklist is designed to ensure accuracy and completeness in the payroll process. It serves as a tool to identify and address any discrepancies or variances in payroll data.

Payroll Data Verification

Verify employee names, IDs, and contact information.

Confirm employment status (full-time, part-time, contractor).

Check for any changes in employee details (e.g., promotions, terminations)

Validate the number of hours worked by each employee.

Ensure overtime calculations are accurate, if applicable.

Confirm the accuracy of time and attendance records.

Verify gross earnings for each employee.

Check for any special payments or bonuses.

Ensure that deductions for taxes and benefits are correctly applied.

Confirm that federal, state, and local tax withholdings are accurate.

Validate deductions for benefits (healthcare, retirement plans, etc.).

Check for any wage garnishments or liens.

Verify employer contributions to payroll taxes (e.g., Social Security, Medicare).

Confirm compliance with tax regulations.

Corrective Actions

Document any identified discrepancies or variances.

Investigate the root cause of the discrepancies.

Take corrective actions to rectify errors.

Communicate with affected employees if necessary.

Update payroll records and reports as needed.

Notes

Reviewed By: [Name]

Date: [Month Day, Year]

Approved By: [Name]

Date: [Month Day, Year]