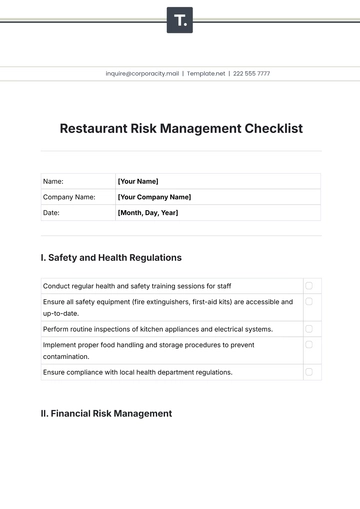

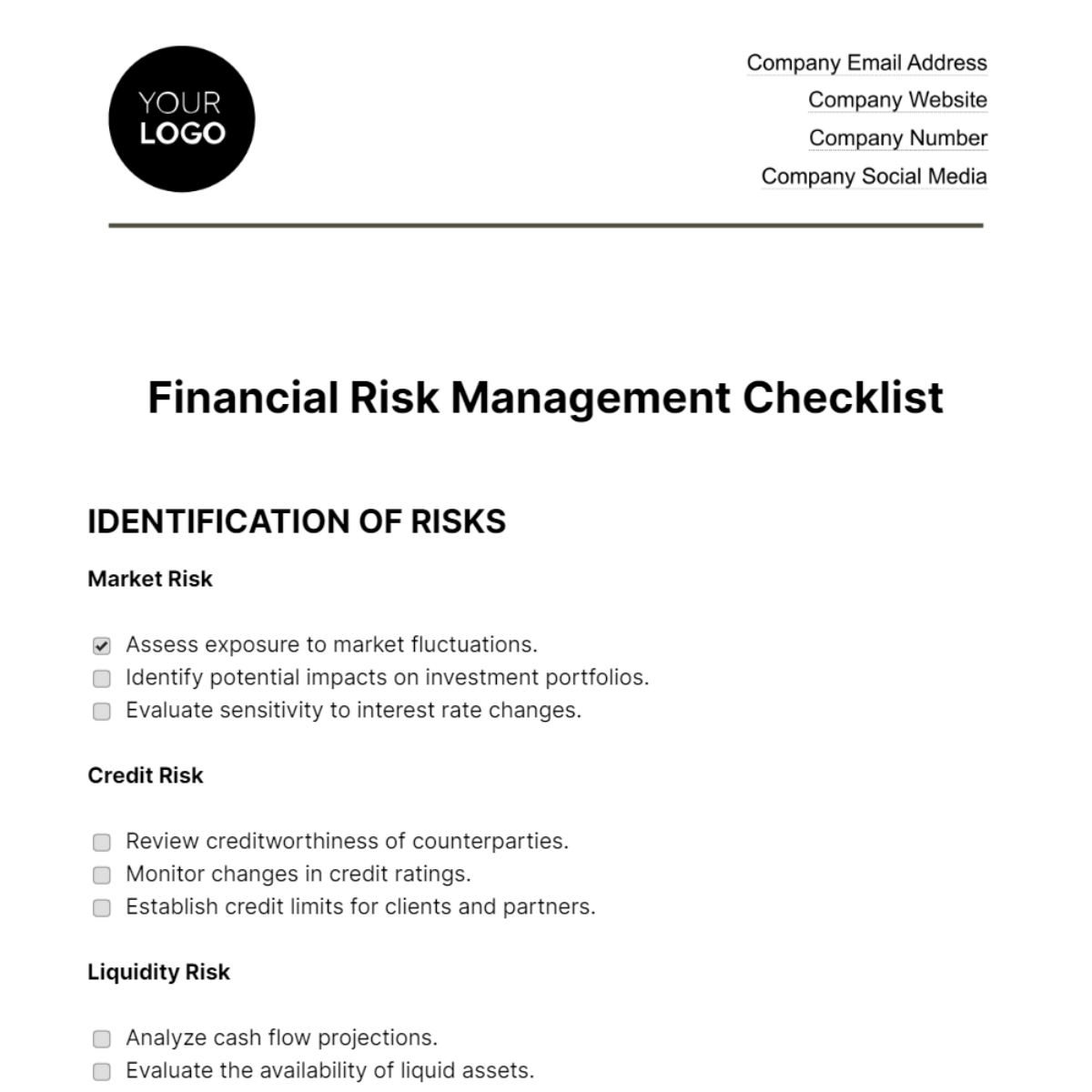

Free Financial Risk Management Checklist

IDENTIFICATION OF RISKS

Market Risk

Assess exposure to market fluctuations.

Identify potential impacts on investment portfolios.

Evaluate sensitivity to interest rate changes.

Credit Risk

Review creditworthiness of counterparties.

Monitor changes in credit ratings.

Establish credit limits for clients and partners.

Liquidity Risk

Analyze cash flow projections.

Evaluate the availability of liquid assets.

Establish contingency plans for liquidity shortages.

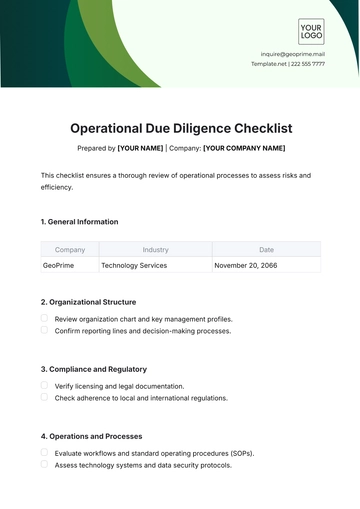

Operational Risk

Identify key operational processes.

Assess vulnerabilities in systems and procedures.

Implement measures to mitigate operational disruptions.

RISK ASSESSMENT

Evaluate the potential impact of identified risks.

Analyze the likelihood of occurrence for each risk.

Assign risk severity levels based on impact and probability.

RISK MITIGATION STRATEGIES

Market Risk Mitigation

Diversify investment portfolios.

Implement hedging strategies.

Regularly review and adjust risk exposure.

Credit Risk Mitigation

Establish a robust credit risk management framework.

Utilize credit derivatives for risk transfer.

Monitor and enforce credit limits.

Liquidity Risk Mitigation

Maintain adequate cash reserves.

Establish credit facilities for liquidity needs.

Develop emergency funding plans.

Operational Risk Mitigation

Implement robust internal controls.

Conduct regular staff training on risk awareness.

Establish contingency plans for operational disruptions.

COMPLIANCE AND REGULATORY REQUIREMENTS

Ensure adherence to relevant financial regulations.

Regularly update policies to reflect changes in compliance standards.

Conduct internal audits to verify compliance with regulatory requirements.

MONITORING AND REPORTING

Establish a regular reporting schedule for financial risk monitoring.

Implement key risk indicators (KRIs) for early detection of potential issues.

Communicate risk status and mitigation efforts to stakeholders.

CONTINGENCY PLANNING

Develop comprehensive contingency plans for each identified risk.

Conduct scenario analysis to prepare for adverse events.

Test and update contingency plans regularly.

COMMUNICATION AND DOCUMENTATION

Clearly communicate financial risk management policies to relevant stakeholders.

Maintain detailed documentation of risk management processes.

Ensure transparency and accessibility of documentation for audits.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify risk management with Template.net's customizable Financial Risk Management Checklist Template! This adaptable checklist, seamlessly editable with the user-friendly AI Editor Tool, surpasses traditional methods. Tailor it dynamically for user-friendly risk assessments, ensuring clarity and efficiency in your risk management approach. Let this checklist be your compass to risk control!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

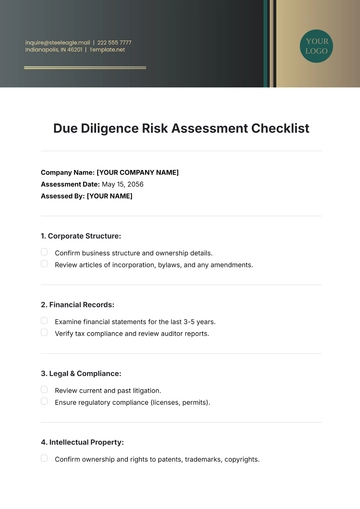

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

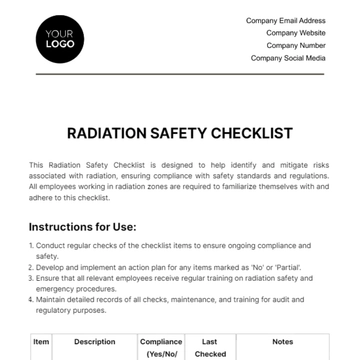

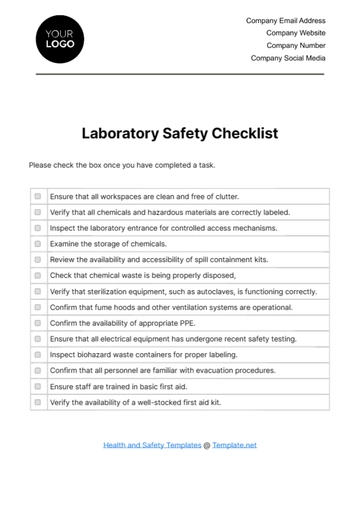

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

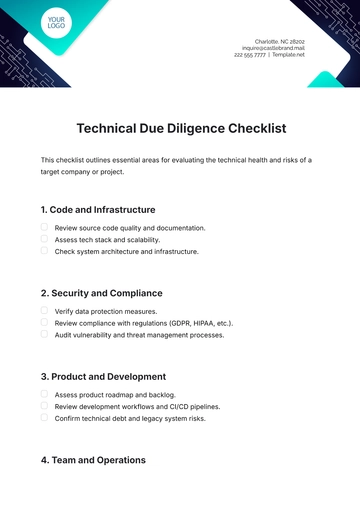

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

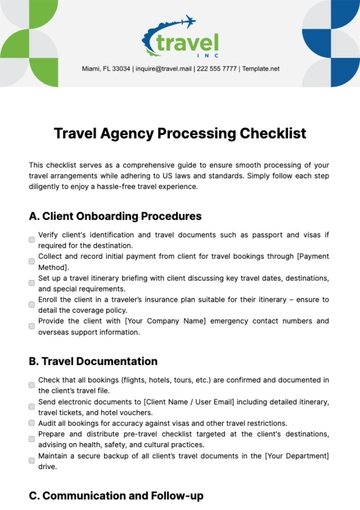

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

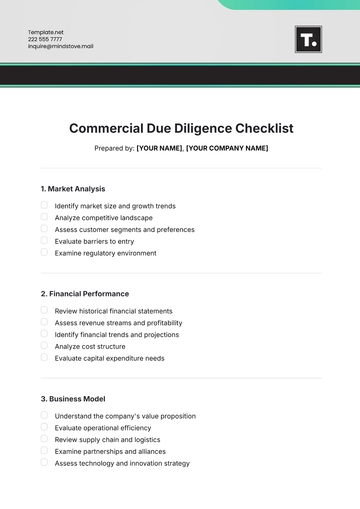

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist