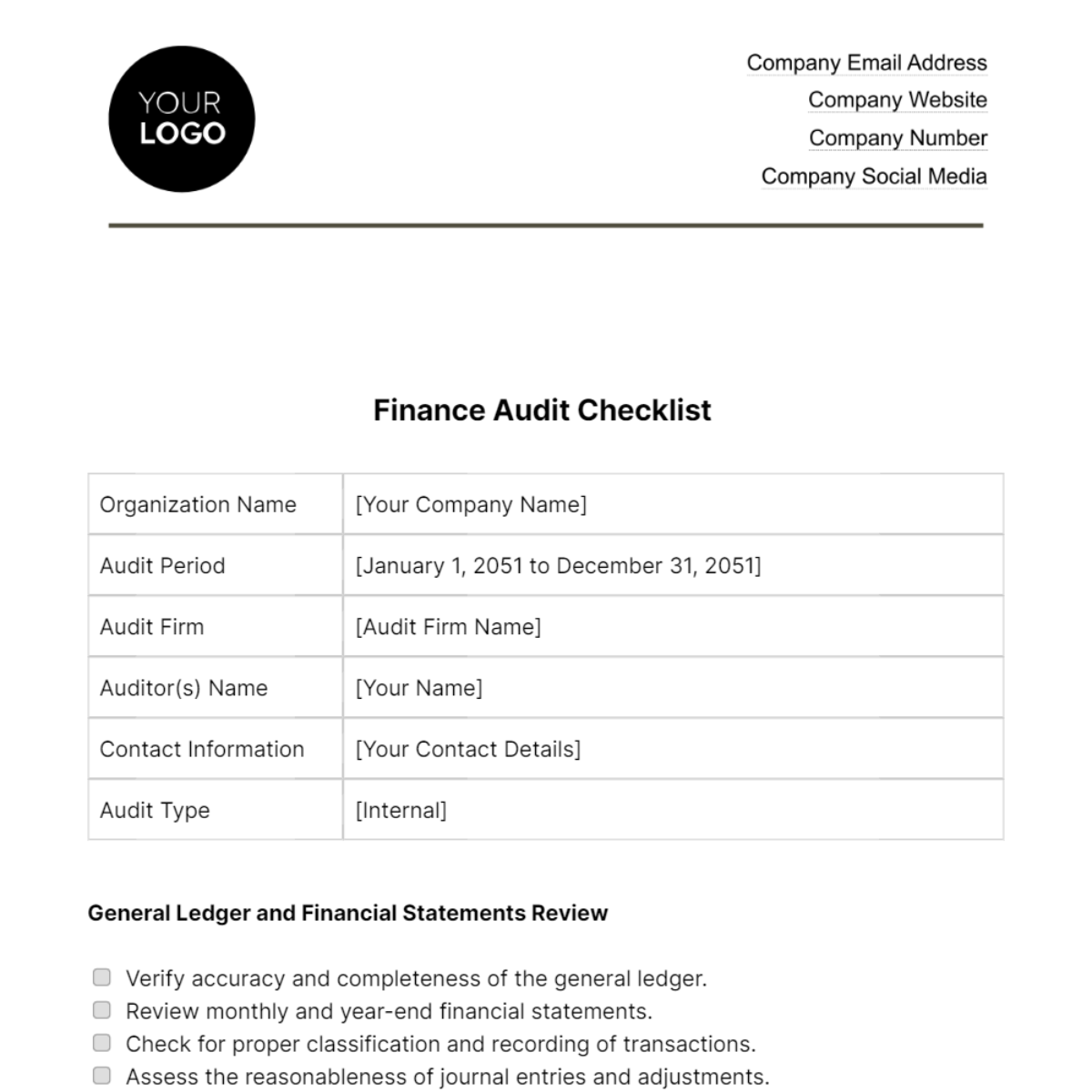

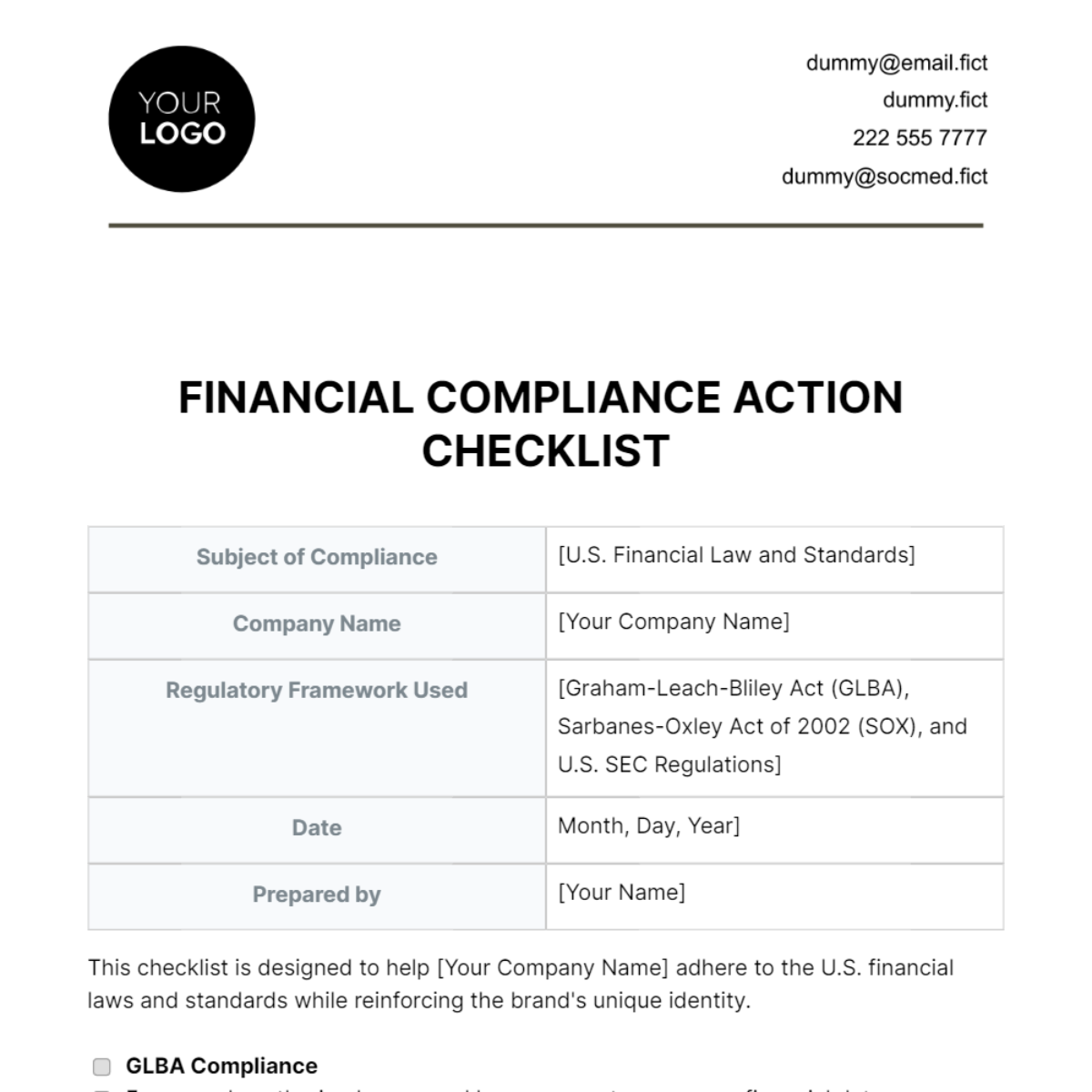

Finance Audit Checklist

Organization Name | [Your Company Name] |

Audit Period | [January 1, 2051 to December 31, 2051] |

Audit Firm | [Audit Firm Name] |

Auditor(s) Name | [Your Name] |

Contact Information | [Your Contact Details] |

Audit Type | [Internal] |

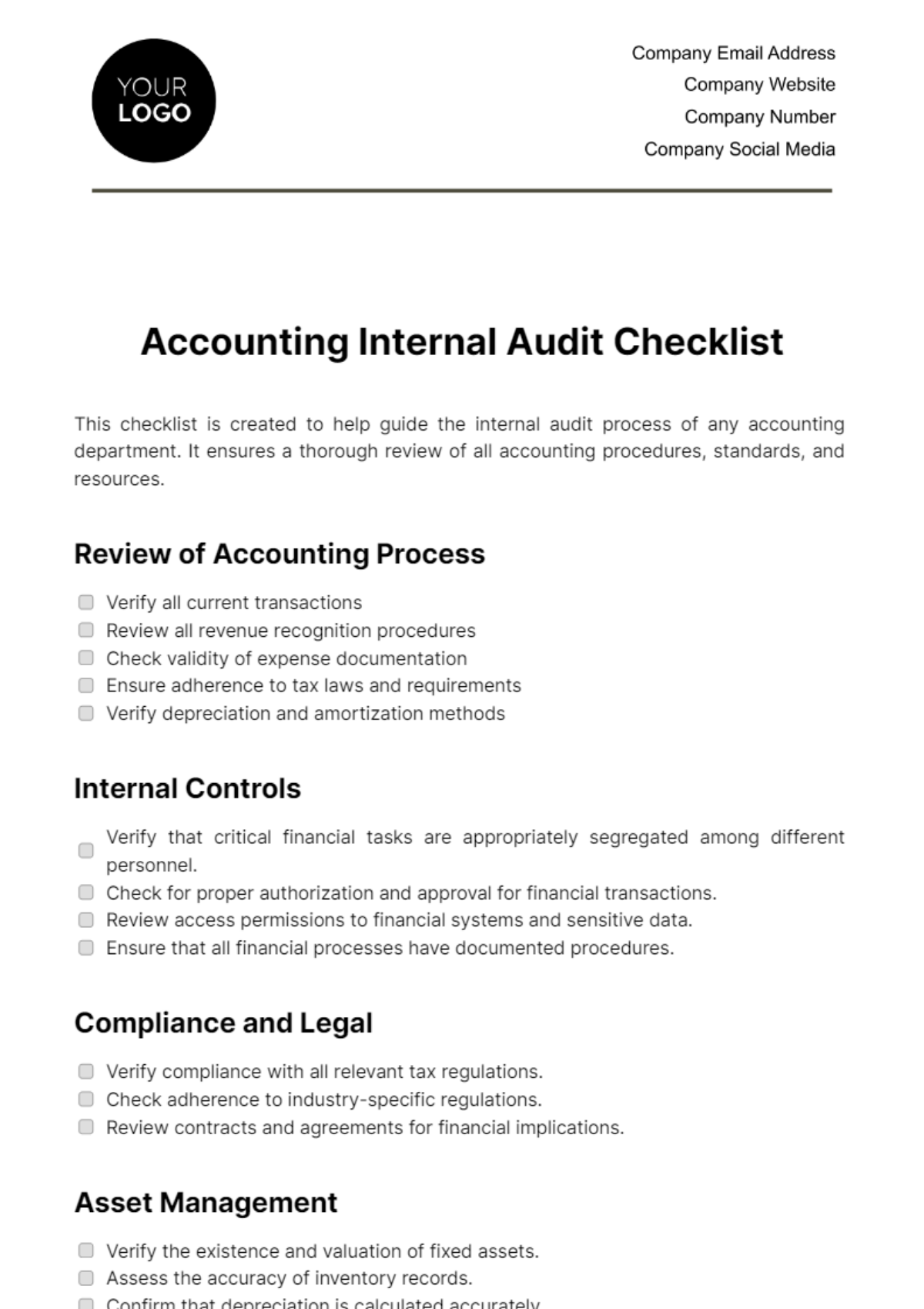

General Ledger and Financial Statements Review

Verify accuracy and completeness of the general ledger.

Review monthly and year-end financial statements.

Check for proper classification and recording of transactions.

Assess the reasonableness of journal entries and adjustments.

Cash and Bank Reconciliations

Ensure all bank accounts are reconciled monthly.

Review reconciliation statements for any long-standing unreconciled items.

Inspect cash handling procedures and petty cash management.

Accounts Receivable and Payable

Verify aging analysis of accounts receivable and payable.

Assess adequacy of allowance for doubtful accounts.

Review procedures for invoice processing and payment.

Confirm proper authorization for expenditures.

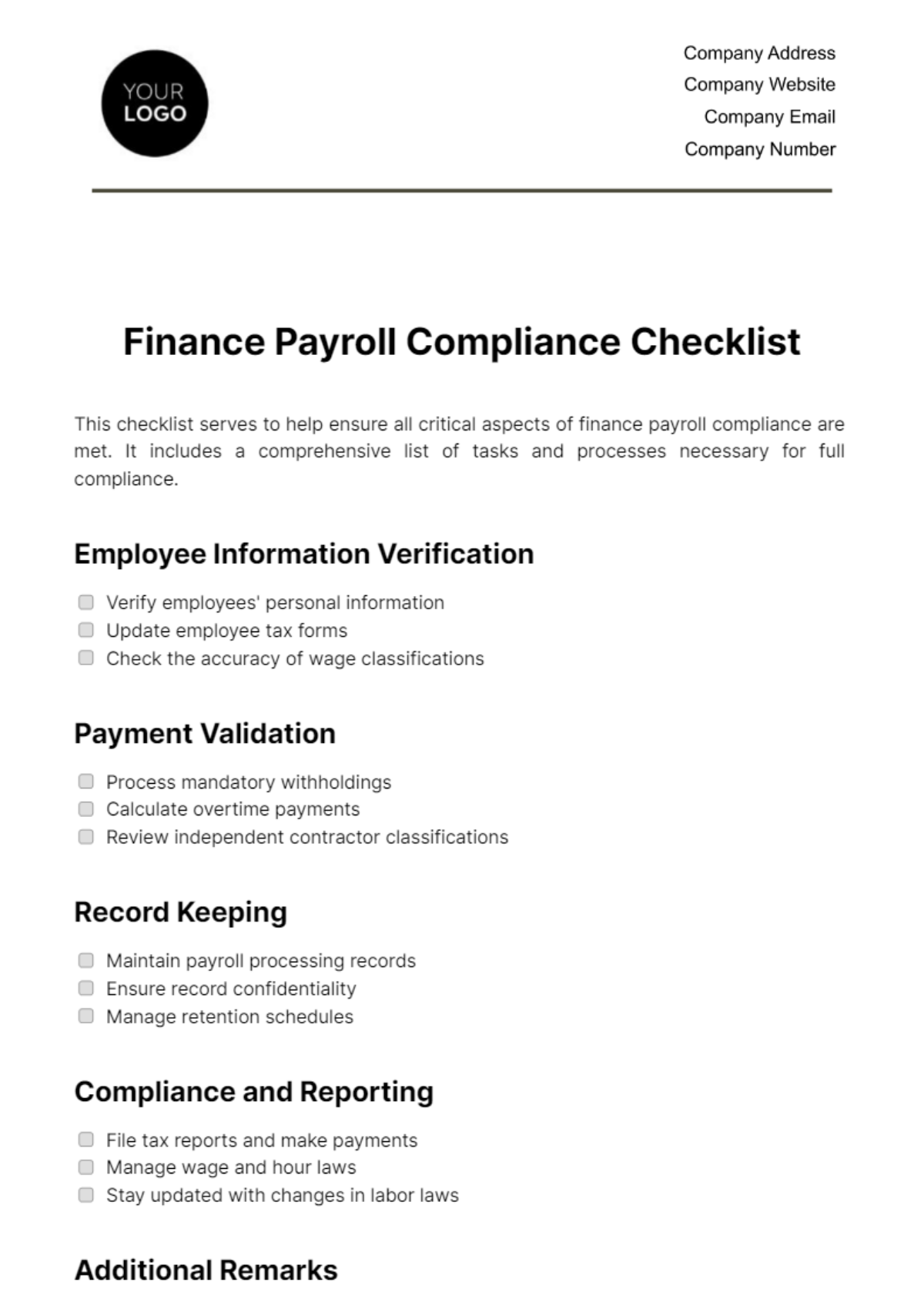

Payroll and Employee Benefits

Examine payroll records for accuracy and compliance with wage laws.

Review employee benefits disbursement and record-keeping.

Inspect adherence to tax withholding and reporting requirements.

Fixed Assets and Depreciation

Audit physical existence and condition of fixed assets.

Review depreciation methods and calculations.

Ensure proper documentation for acquisitions and disposals.

Inventory Management

Conduct physical inventory counts and compare with records.

Evaluate adequacy of inventory valuation methods.

Inspect inventory storage and security measures.

Internal Control Systems

Review internal control procedures for financial reporting.

Assess risk management and fraud prevention measures.

Examine authorization and approval processes.

Compliance with Laws and Regulations

Verify compliance with relevant financial regulations.

Review filings and reports submitted to regulatory authorities.

Inspect adherence to contractual obligations and agreements.

Taxation

Review tax returns and payments for accuracy.

Inspect compliance with tax laws and reporting requirements.

Evaluate documentation supporting tax calculations.

IT Systems and Data Security

Assess security of financial data and IT systems.

Review backup and recovery procedures for financial data.

Examine controls over access to financial systems and data.

Conclusion and Recommendations

Summarize audit findings and any identified issues.

Provide recommendations for improvement and corrective actions.

Author: Your Name

Company: Your Company Name