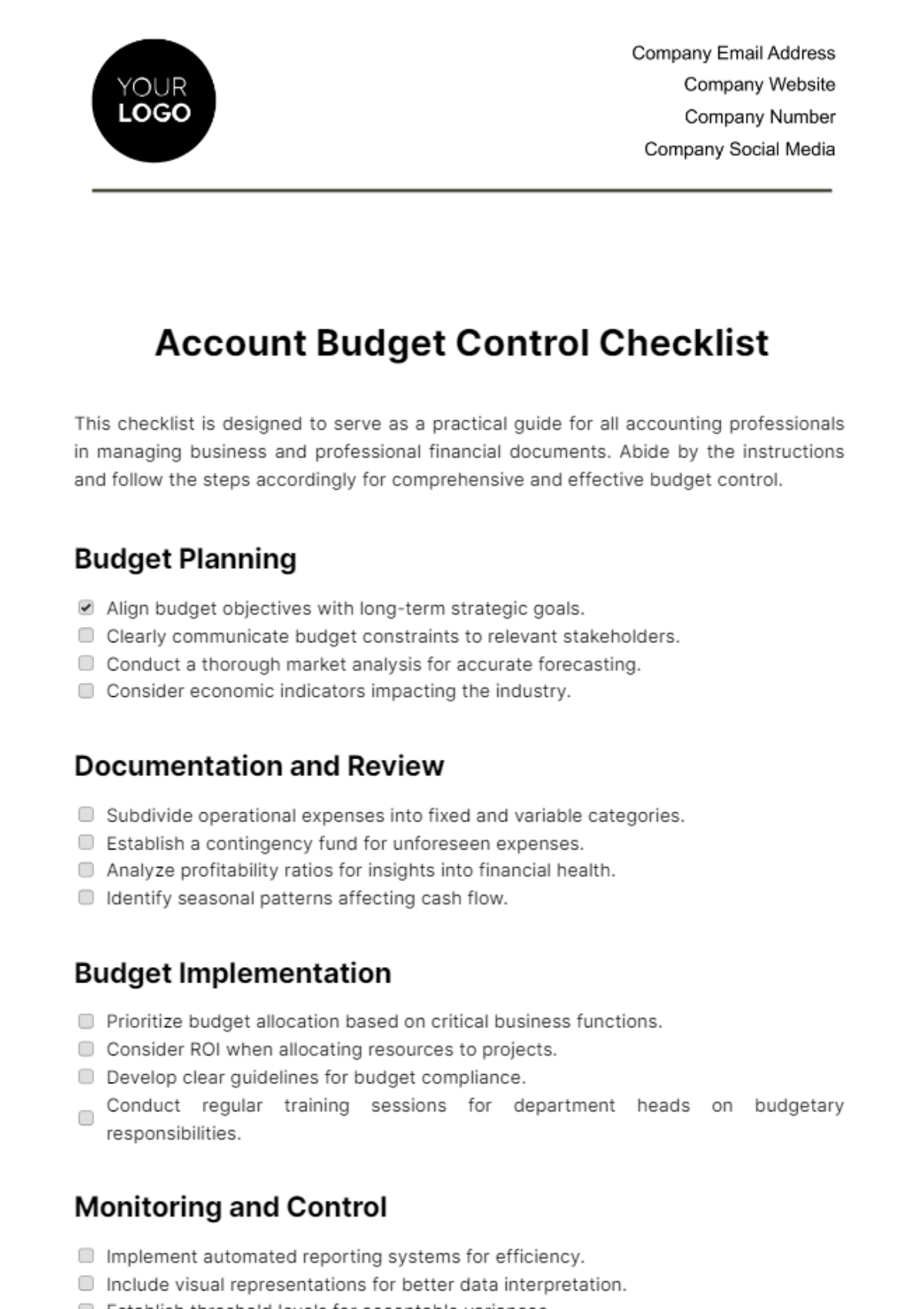

Account Budget Control Checklist

This checklist is designed to serve as a practical guide for all accounting professionals in managing business and professional financial documents. Abide by the instructions and follow the steps accordingly for comprehensive and effective budget control.

Budget Planning

Align budget objectives with long-term strategic goals.

Clearly communicate budget constraints to relevant stakeholders.

Conduct a thorough market analysis for accurate forecasting.

Consider economic indicators impacting the industry.

Documentation and Review

Subdivide operational expenses into fixed and variable categories.

Establish a contingency fund for unforeseen expenses.

Analyze profitability ratios for insights into financial health.

Identify seasonal patterns affecting cash flow.

Budget Implementation

Prioritize budget allocation based on critical business functions.

Consider ROI when allocating resources to projects.

Develop clear guidelines for budget compliance.

Conduct regular training sessions for department heads on budgetary responsibilities.

Monitoring and Control

Implement automated reporting systems for efficiency.

Include visual representations for better data interpretation.

Establish threshold levels for acceptable variances.

Conduct a root cause analysis for significant budget discrepancies.

Periodic Evaluation

Evaluate customer acquisition cost against revenue generated.

Assess employee productivity in relation to budgeted labor costs.

Develop a system for reallocation of funds based on changing priorities.

Monitor and adjust budget allocations based on industry trends.

Continuous Improvement

Encourage department heads to provide feedback on budget effectiveness.

Conduct regular surveys to gather input from employees.

Explore AI-driven financial management tools for improved accuracy.

Regularly update software to leverage the latest budgeting features.

Notes

The company's budget planning is aligned with strategic goals.