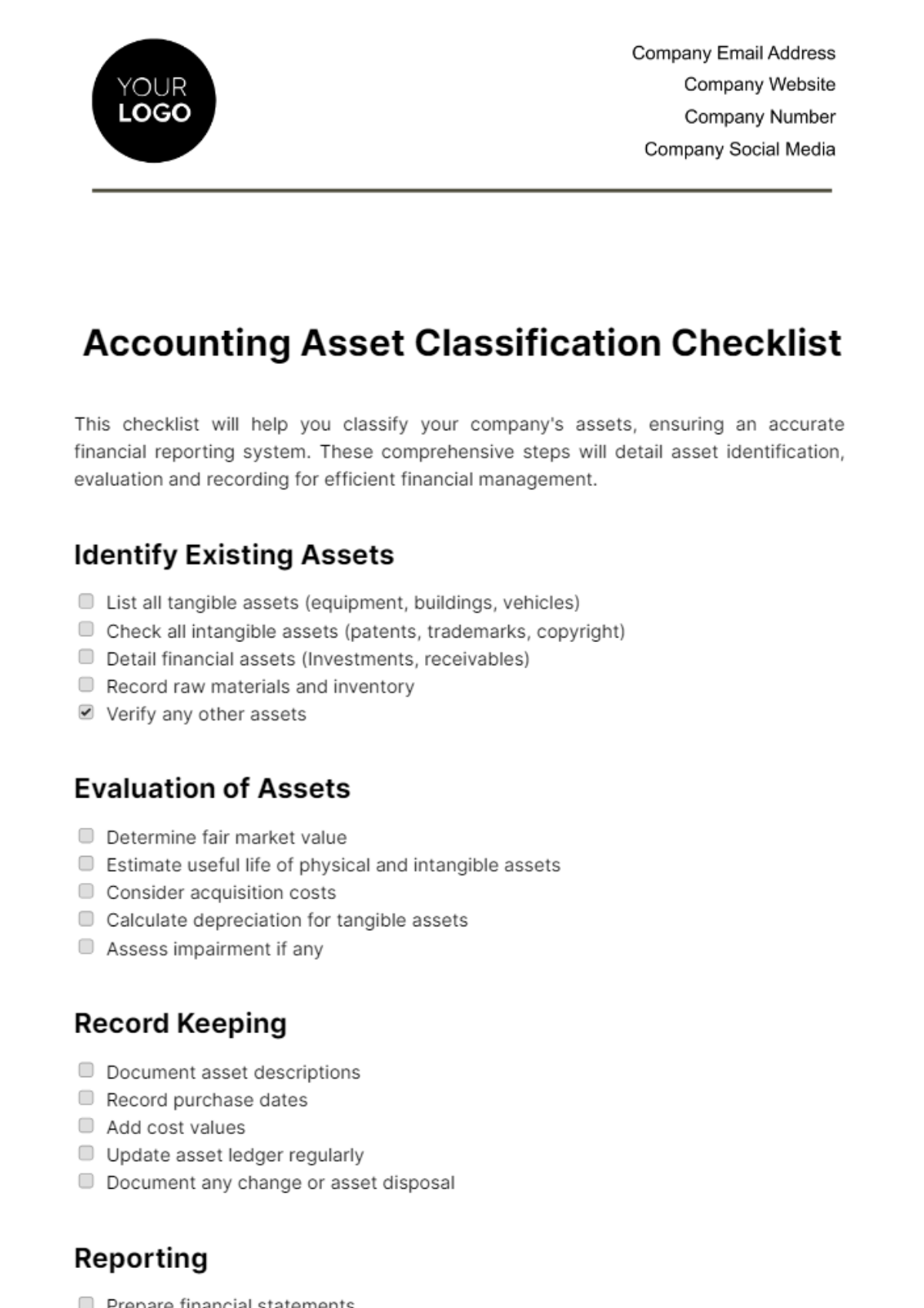

Accounting Asset Classification Checklist

This checklist will help you classify your company's assets, ensuring an accurate financial reporting system. These comprehensive steps will detail asset identification, evaluation and recording for efficient financial management.

Identify Existing Assets

List all tangible assets (equipment, buildings, vehicles)

Check all intangible assets (patents, trademarks, copyright)

Detail financial assets (Investments, receivables)

Record raw materials and inventory

Verify any other assets

Evaluation of Assets

Determine fair market value

Estimate useful life of physical and intangible assets

Consider acquisition costs

Calculate depreciation for tangible assets

Assess impairment if any

Record Keeping

Document asset descriptions

Record purchase dates

Add cost values

Update asset ledger regularly

Document any change or asset disposal

Reporting

Prepare financial statements

Update balance sheets

Generate asset reports

Assess company's financial health

Present reports to company's management

Review Process

Conduct frequent reviews and audits

Ensure your assets are being valued properly

Check if you’re following regulations

Reclassify assets if necessary

Update accounting policies as needed

Prepared by: [YOUR NAME]