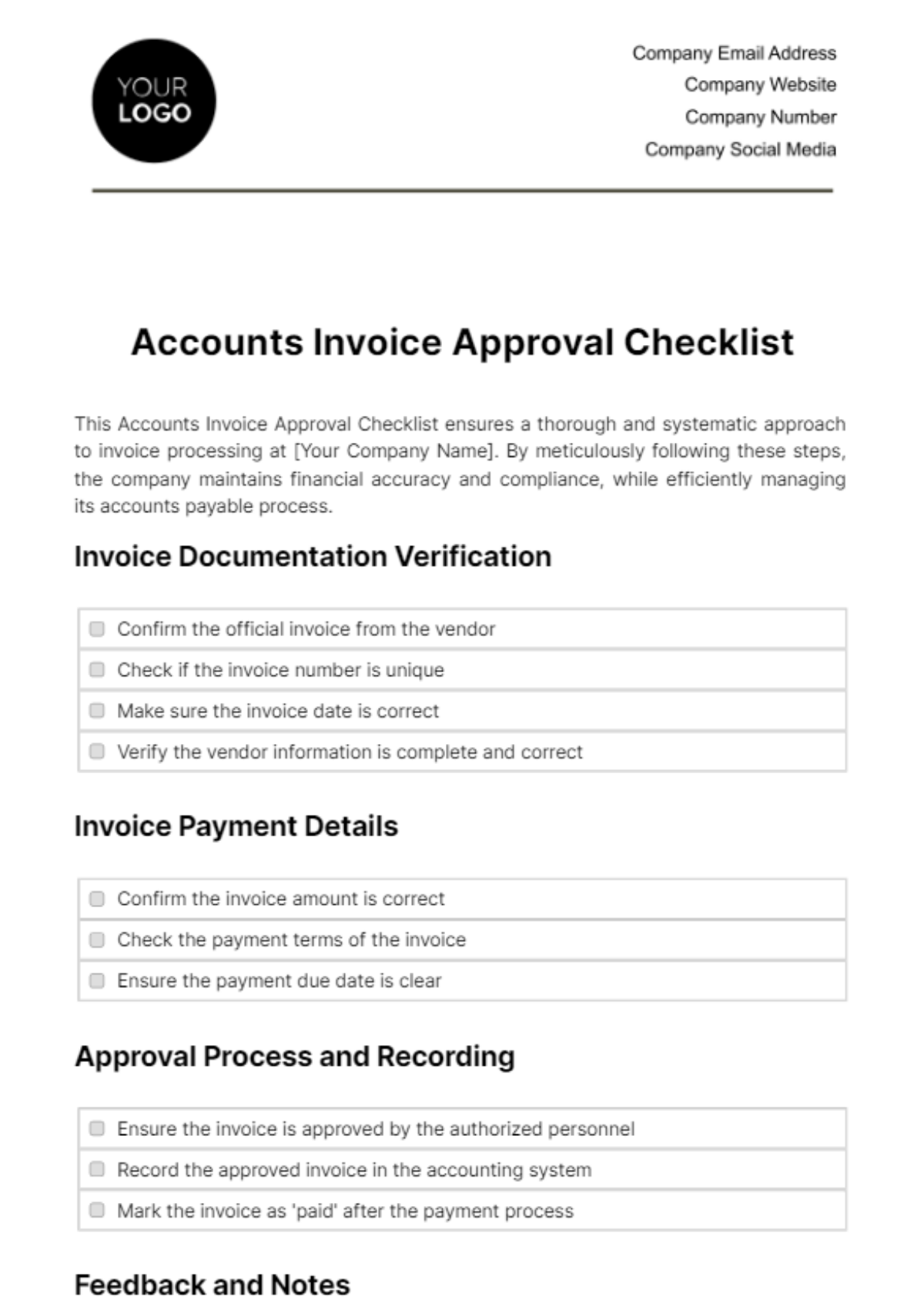

Account Expense Management Checklist

This comprehensive checklist serves as a guide for [Your Company Name] to effectively manage its expenses and monitor financial operations.

Expense Tracking:

Record all business expenditures.

Establish an organized system for filing receipts.

Utilize digital tools, such as software or apps, for tracking expenses.

Closely monitor credit card statements.

Conduct regular audits of expense reports.

Budget Planning:

Develop a detailed budget plan for the fiscal year.

Allocate funds to various departments and projects.

Consider historical data and forecasts for accurate budgeting.

Ensure alignment with company goals and objectives.

Review and adjust the budget as needed throughout the year.

Financial Controls:

Implement robust financial controls and policies.

Define spending limits for different expense categories.

Approve expenditures according to established guidelines.

Monitor cash flow and liquidity.

Maintain a contingency fund for unexpected expenses.

Reporting and Analysis:

Generate regular financial reports, including income statements and balance sheets.

Analyze expense trends and patterns.

Identify cost-saving opportunities.

Share financial insights with relevant stakeholders.

Use data-driven analysis for informed decision-making.

Expense Policy Compliance:

Develop and communicate a clear expense policy.

Ensure employees are aware of the policy and its guidelines.

Provide training on expense reporting procedures.

Monitor compliance with the expense policy.

Enforce consequences for policy violations when necessary.

By following this Account Expense Management Checklist, [Your Company Name] can maintain financial stability, control costs, and optimize budget allocation for sustainable growth.