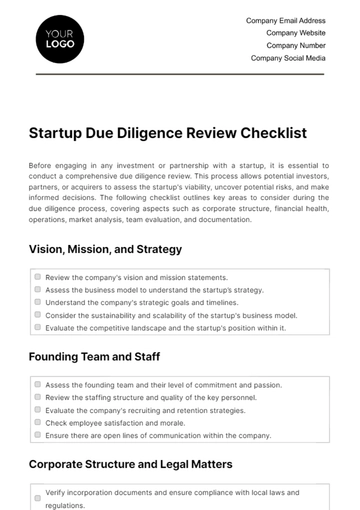

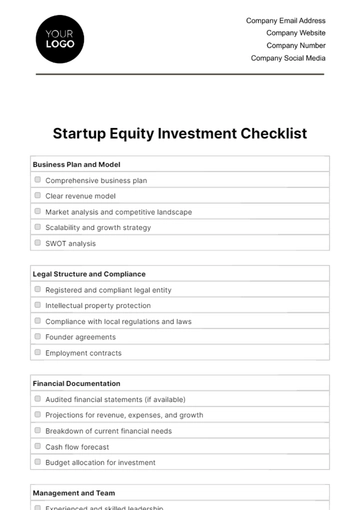

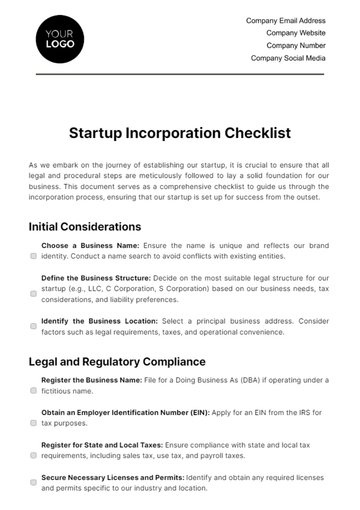

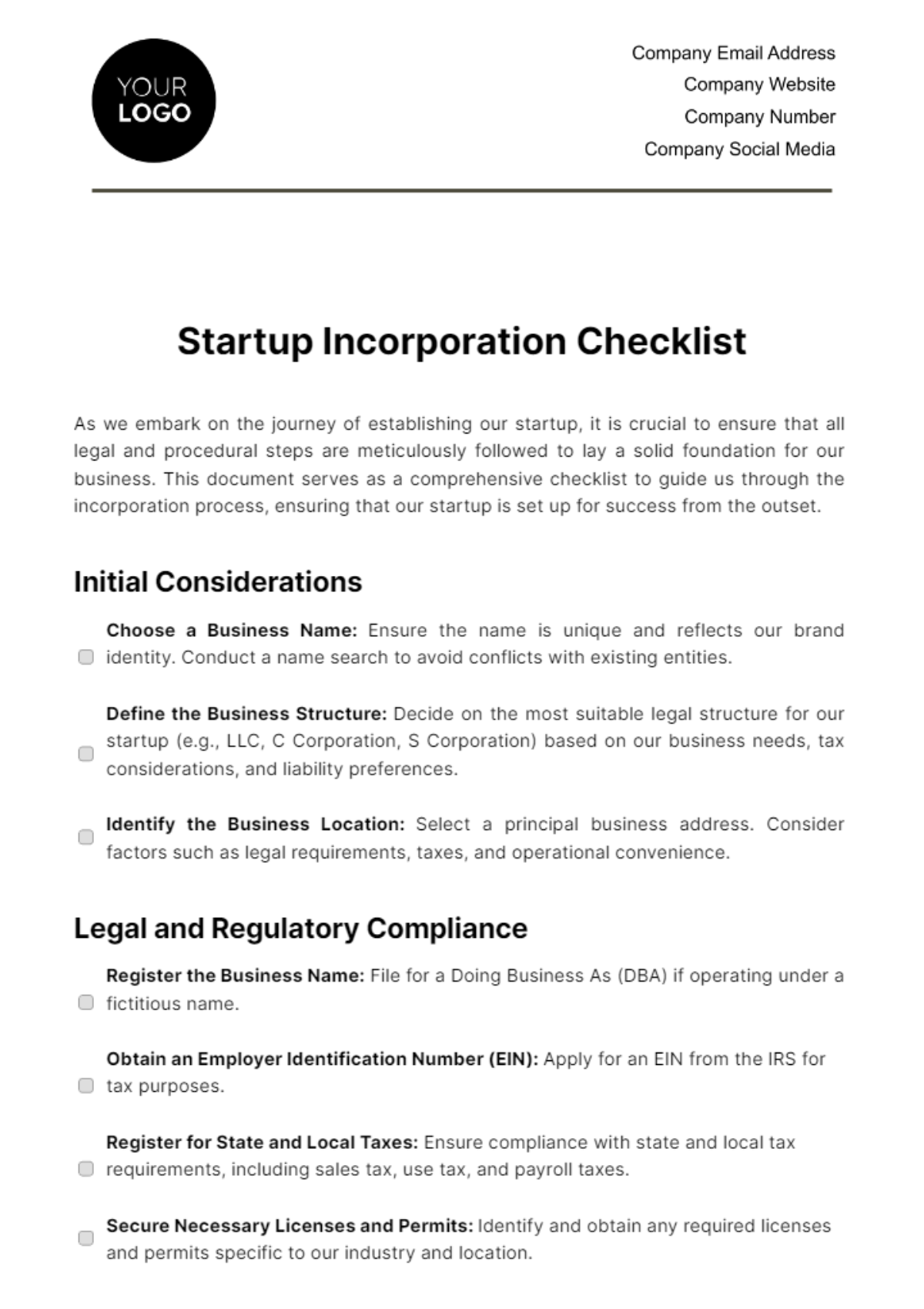

Free Startup Incorporation Checklist

As we embark on the journey of establishing our startup, it is crucial to ensure that all legal and procedural steps are meticulously followed to lay a solid foundation for our business. This document serves as a comprehensive checklist to guide us through the incorporation process, ensuring that our startup is set up for success from the outset.

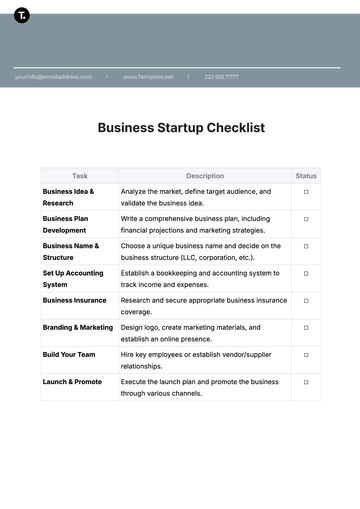

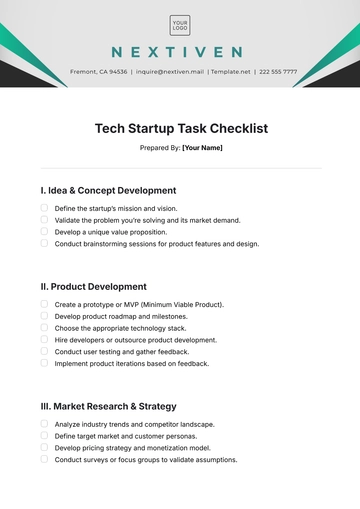

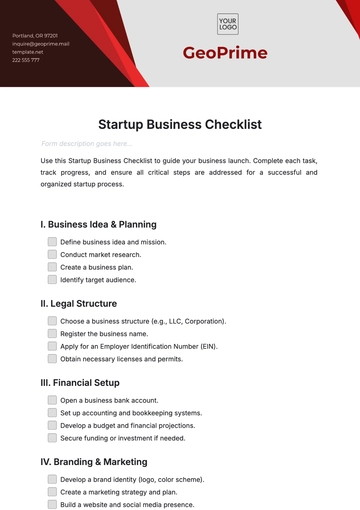

Initial Considerations

Choose a Business Name: Ensure the name is unique and reflects our brand identity. Conduct a name search to avoid conflicts with existing entities.

Define the Business Structure: Decide on the most suitable legal structure for our startup (e.g., LLC, C Corporation, S Corporation) based on our business needs, tax considerations, and liability preferences.

Identify the Business Location: Select a principal business address. Consider factors such as legal requirements, taxes, and operational convenience.

Legal and Regulatory Compliance

Register the Business Name: File for a Doing Business As (DBA) if operating under a fictitious name.

Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS for tax purposes.

Register for State and Local Taxes: Ensure compliance with state and local tax requirements, including sales tax, use tax, and payroll taxes.

Secure Necessary Licenses and Permits: Identify and obtain any required licenses and permits specific to our industry and location.

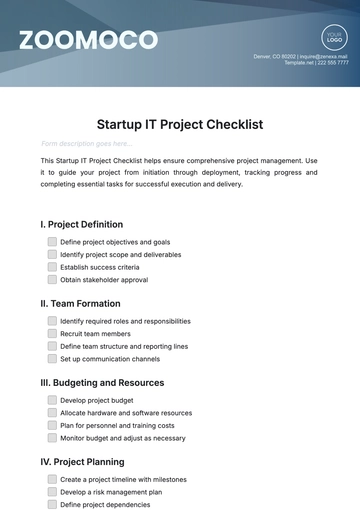

Corporate Governance

Draft Incorporation Documents: Prepare and file articles of incorporation with the relevant state authority to legally form our corporation.

Create Bylaws: Draft bylaws to outline the operating rules for our corporation, including governance, operations, and management.

Appoint Directors: Select a board of directors to oversee the strategic direction of our startup.

Organize an Initial Board Meeting: Conduct the first board meeting to appoint officers, adopt bylaws, and undertake other initial corporate actions.

Issue Stock Certificates: Issue stock to founders, documenting ownership in the corporation.

Financial Setup

Open a Business Bank Account: Open a bank account in the name of our startup to handle all business-related financial transactions.

Set Up Accounting Systems: Implement an accounting system to manage our finances, track expenses, and prepare for tax filings.

Intellectual Property Protection

Assess IP Needs: Identify any intellectual property (IP) that needs protection, such as trademarks, patents, or copyrights.

File for IP Protection: Take steps to protect our startup’s intellectual property through appropriate filings.

Final Steps

Review Compliance Checklist: Regularly review and update our compliance with all legal and regulatory requirements.

Prepare for Ongoing Compliance: Plan for annual reports, tax filings, and any other ongoing legal or regulatory obligations.

By diligently following this incorporation checklist, we are ensuring that our startup is not only compliant with all legal and regulatory requirements but also positioned for sustainable growth and success. Our commitment to thorough preparation and proactive management will pave the way for our future achievements.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Startup Incorporation Checklist Template from Template.net, designed to streamline your business setup process. This template is fully editable and customizable, allowing you to tailor every detail to your needs. Editable in our AI Editor tool, it's the perfect guide to ensure you cover all legal and procedural bases for your startup's incorporation. A must-have for new entrepreneurs.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

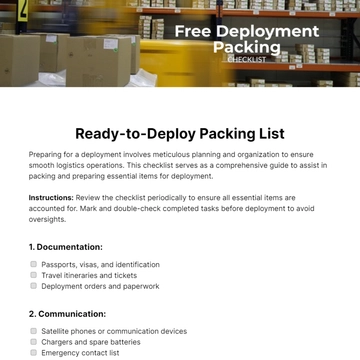

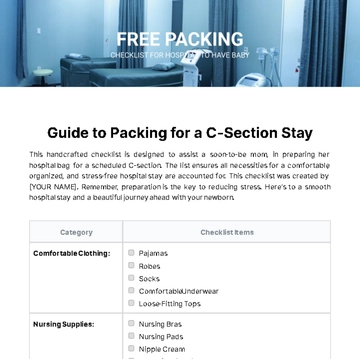

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist