Operations Fraud Prevention Checklist

Instructions for Use: This checklist is designed to help our organization identify and mitigate potential risks of fraud. Each item on the checklist should be reviewed and assessed regularly to ensure effective fraud prevention measures are in place. If any item cannot be completed, it should be prioritized for resolution. Regular audits should be conducted using this checklist to maintain our vigilance against fraud.

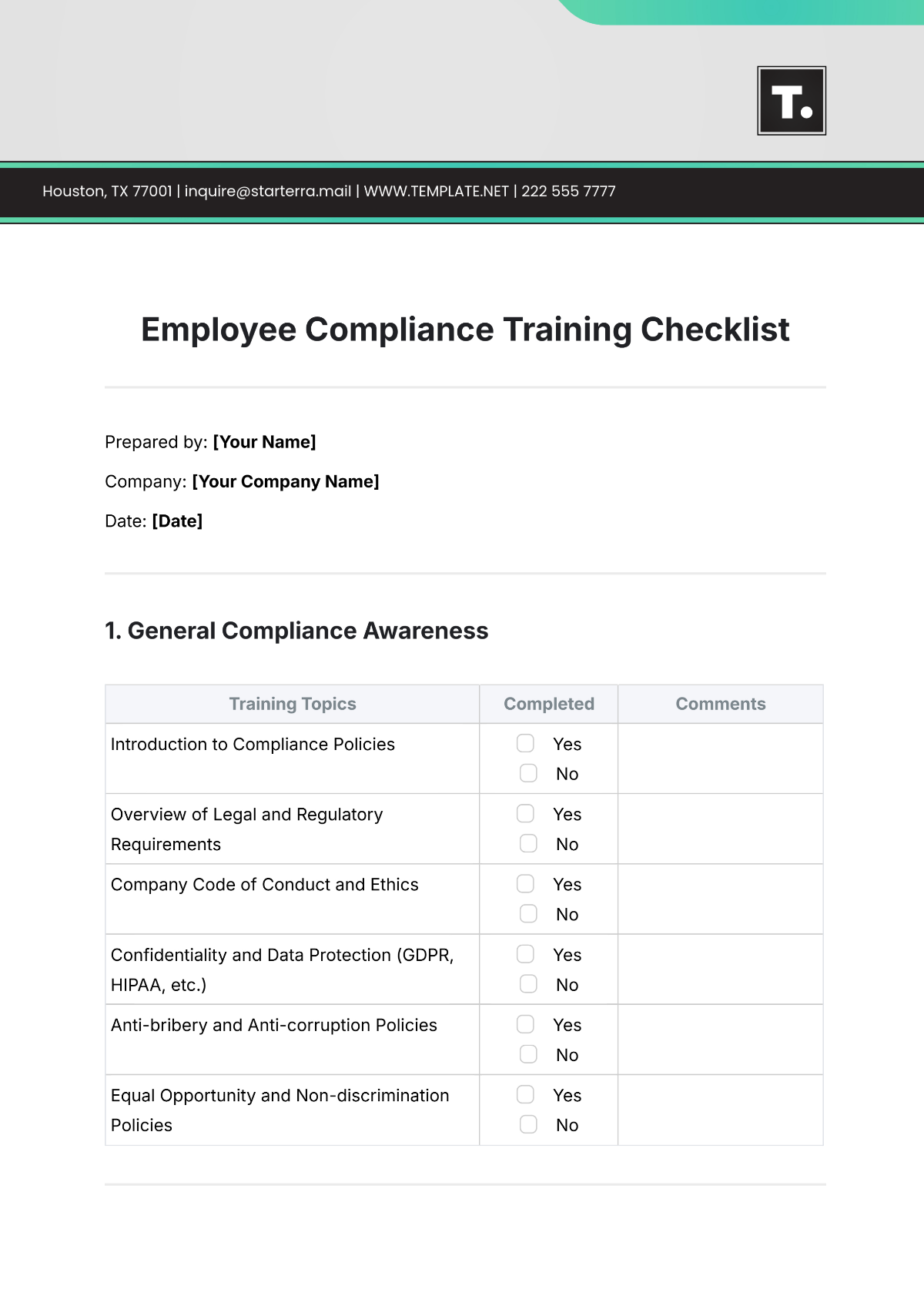

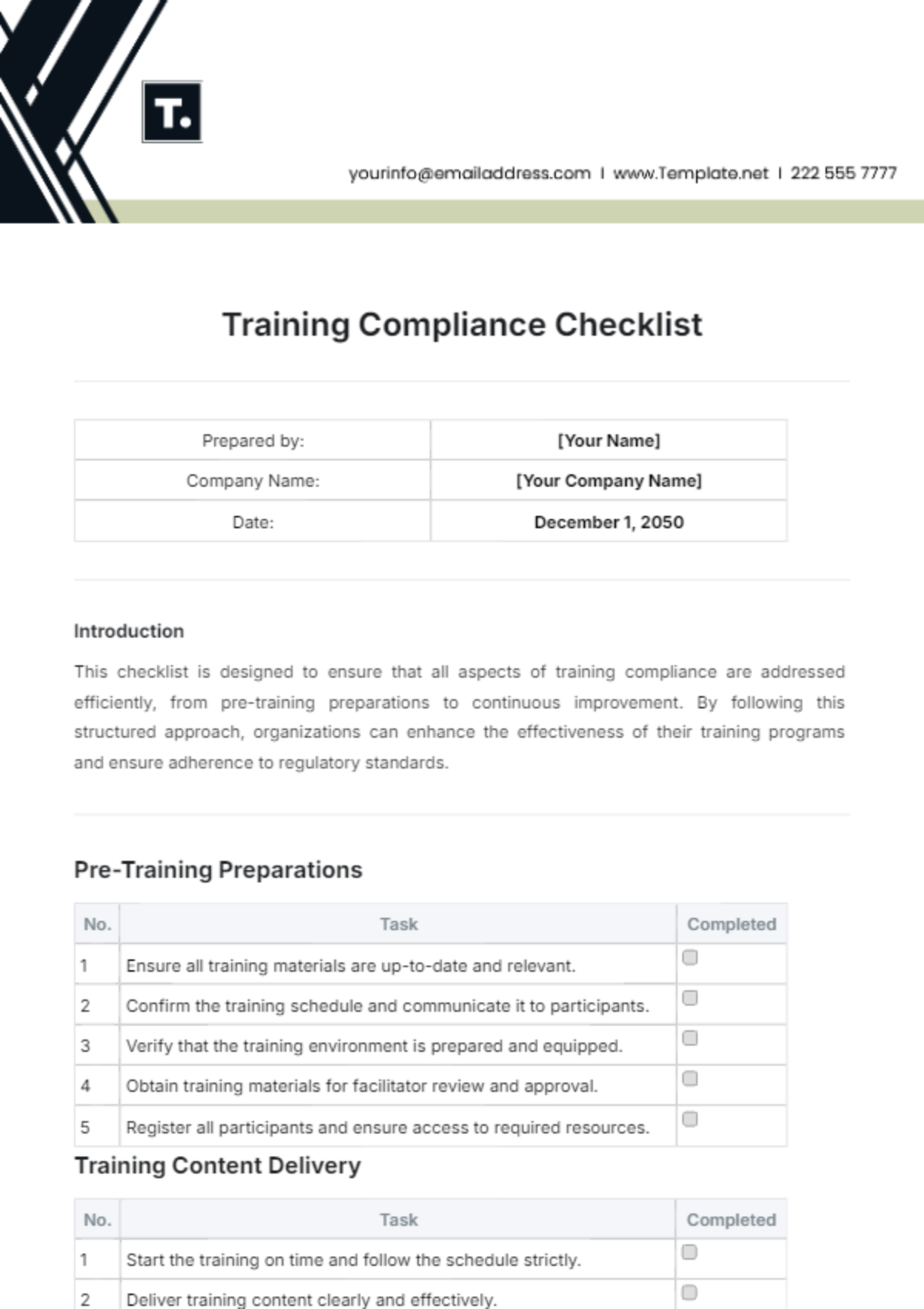

Employee Training and Awareness

Provide regular training on fraud awareness and prevention for all employees.

Ensure employees understand the consequences of engaging in fraudulent activities.

Segregation of Duties

Implement segregation of duties to prevent any single individual from having control over key processes.

Require authorization and oversight for financial transactions, particularly those involving sensitive information or assets.

Internal Controls

Establish and maintain robust internal controls over financial reporting and asset management.

Regularly review and update control procedures to adapt to changing risks and business processes.

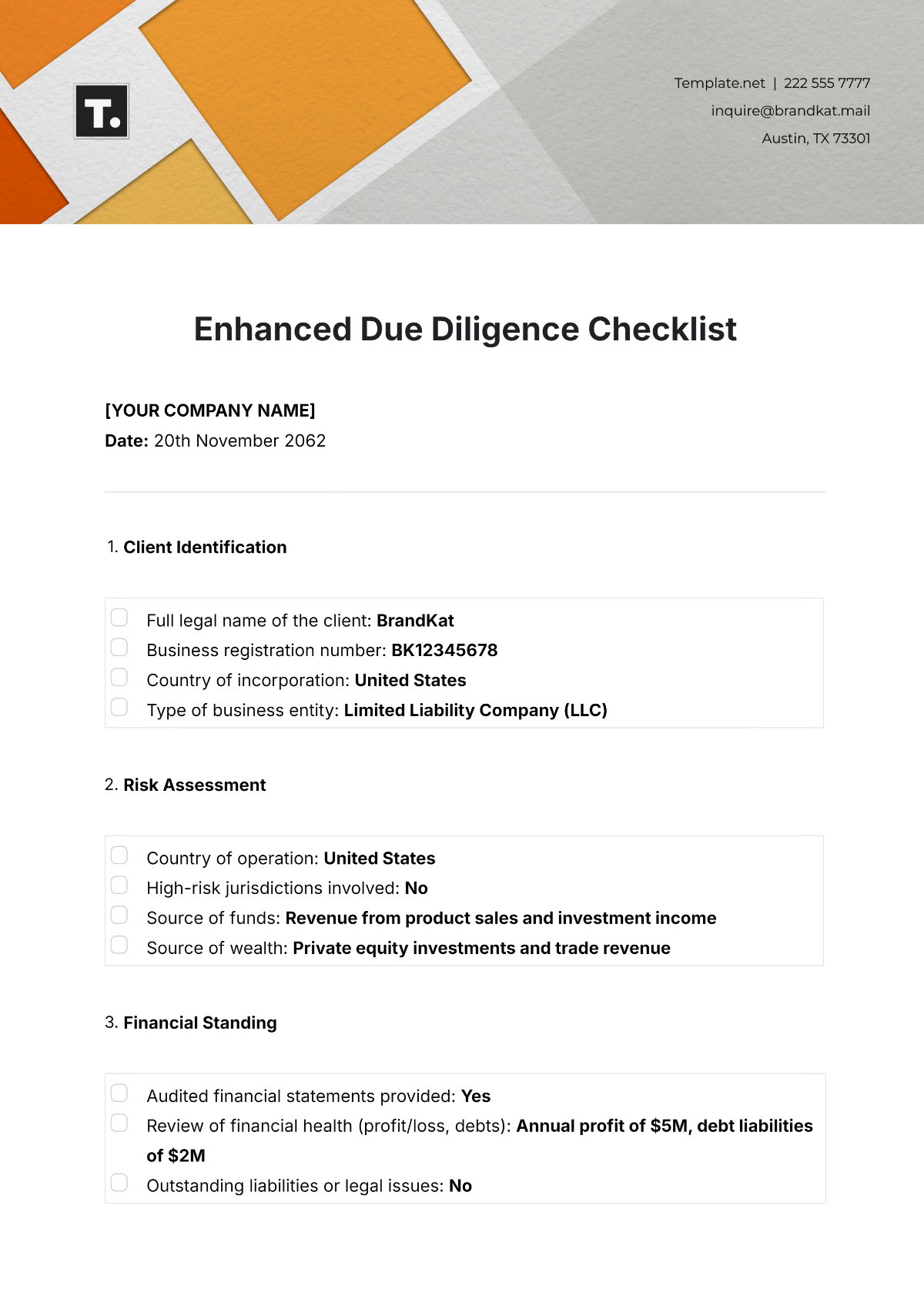

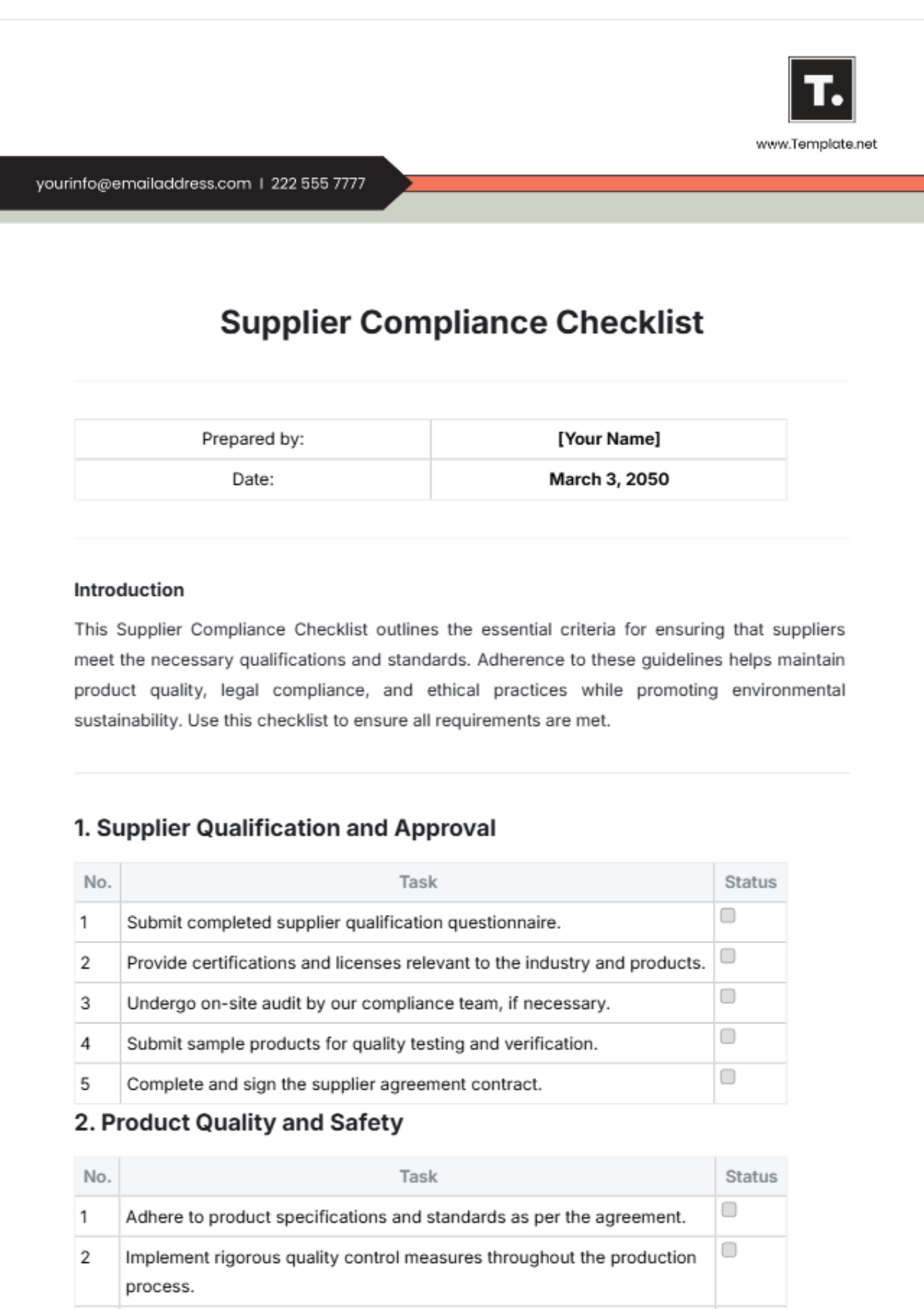

Vendor and Supplier Due Diligence

Conduct thorough due diligence on vendors and suppliers, including background checks and financial reviews.

Monitor vendor performance and maintain open communication to detect any signs of potential fraud.

Monitoring and Detection Systems

Implement monitoring and detection systems to identify suspicious activities or anomalies in financial transactions and employee behavior.

Regularly review logs and reports generated by these systems for signs of potential fraud.

Whistleblower Policy

Establish a clear and confidential process for employees to report suspected fraudulent activities.

Provide protection for whistleblowers against retaliation and ensure their concerns are investigated promptly and impartially.

Data Security Measures

Implement strong data security measures to protect sensitive information from unauthorized access or disclosure.

Regularly review and update security protocols to address emerging threats and vulnerabilities.

Management Oversight

Ensure active involvement and oversight by management in fraud prevention efforts.

Hold regular meetings to review fraud risks, controls, and any incidents or allegations of fraud.

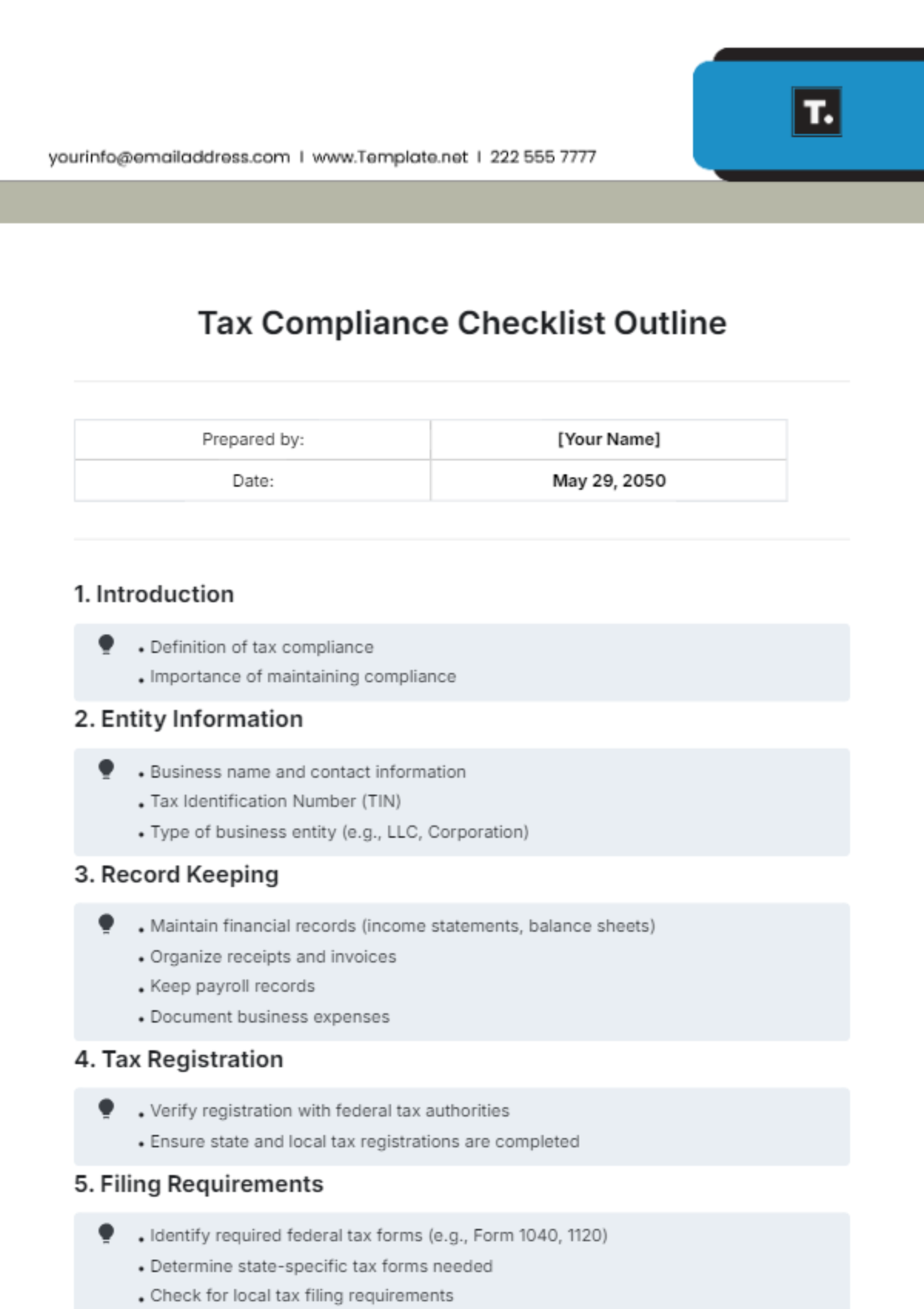

Compliance with Laws and Regulations

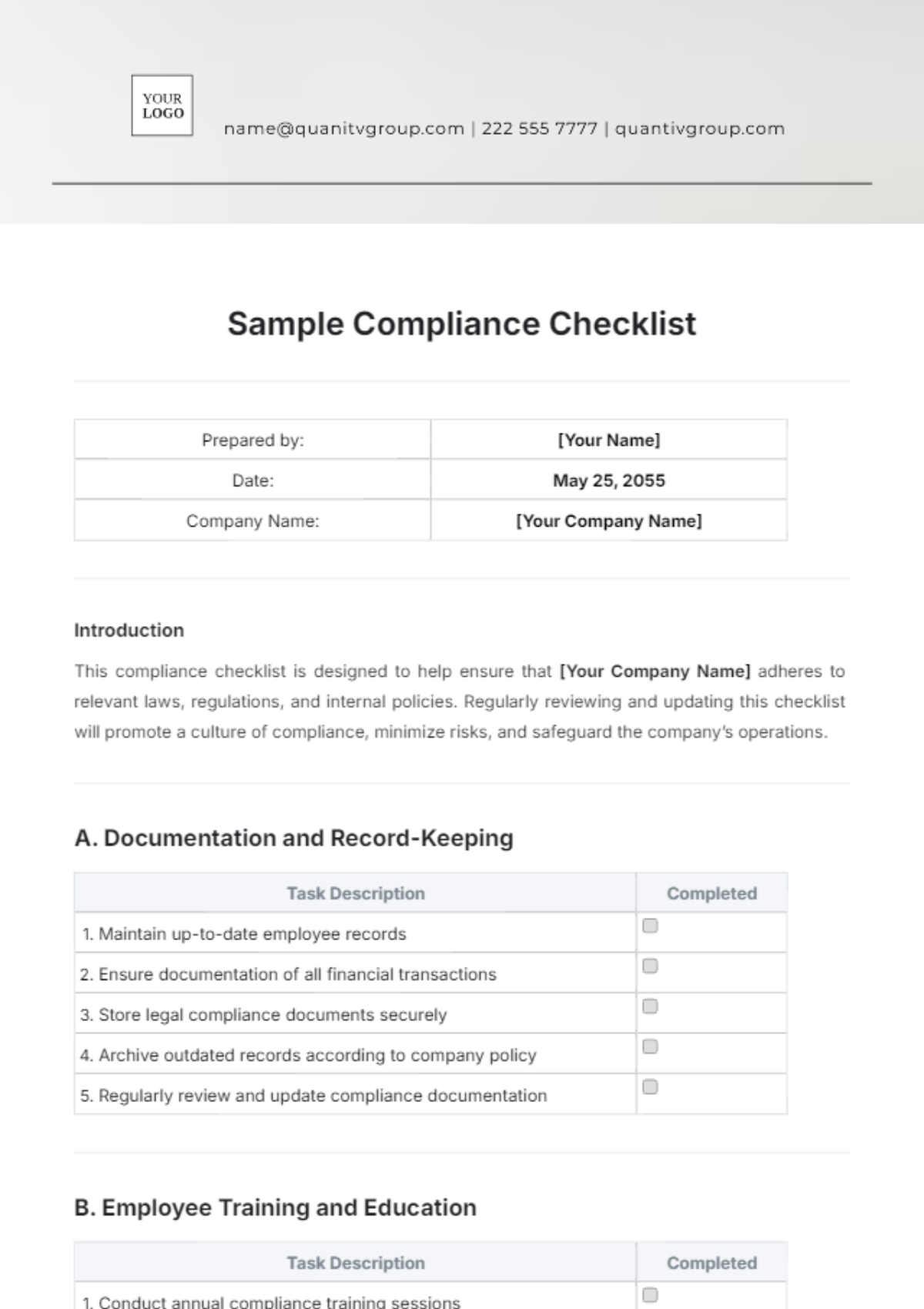

Ensure compliance with relevant laws, regulations, and industry standards related to fraud prevention and detection.

Stay informed about changes in regulations and adapt our practices accordingly.

Continuous Improvement

Encourage a culture of continuous improvement in fraud prevention efforts.

Conduct regular reviews and assessments to identify areas for improvement and implement corrective actions as needed.