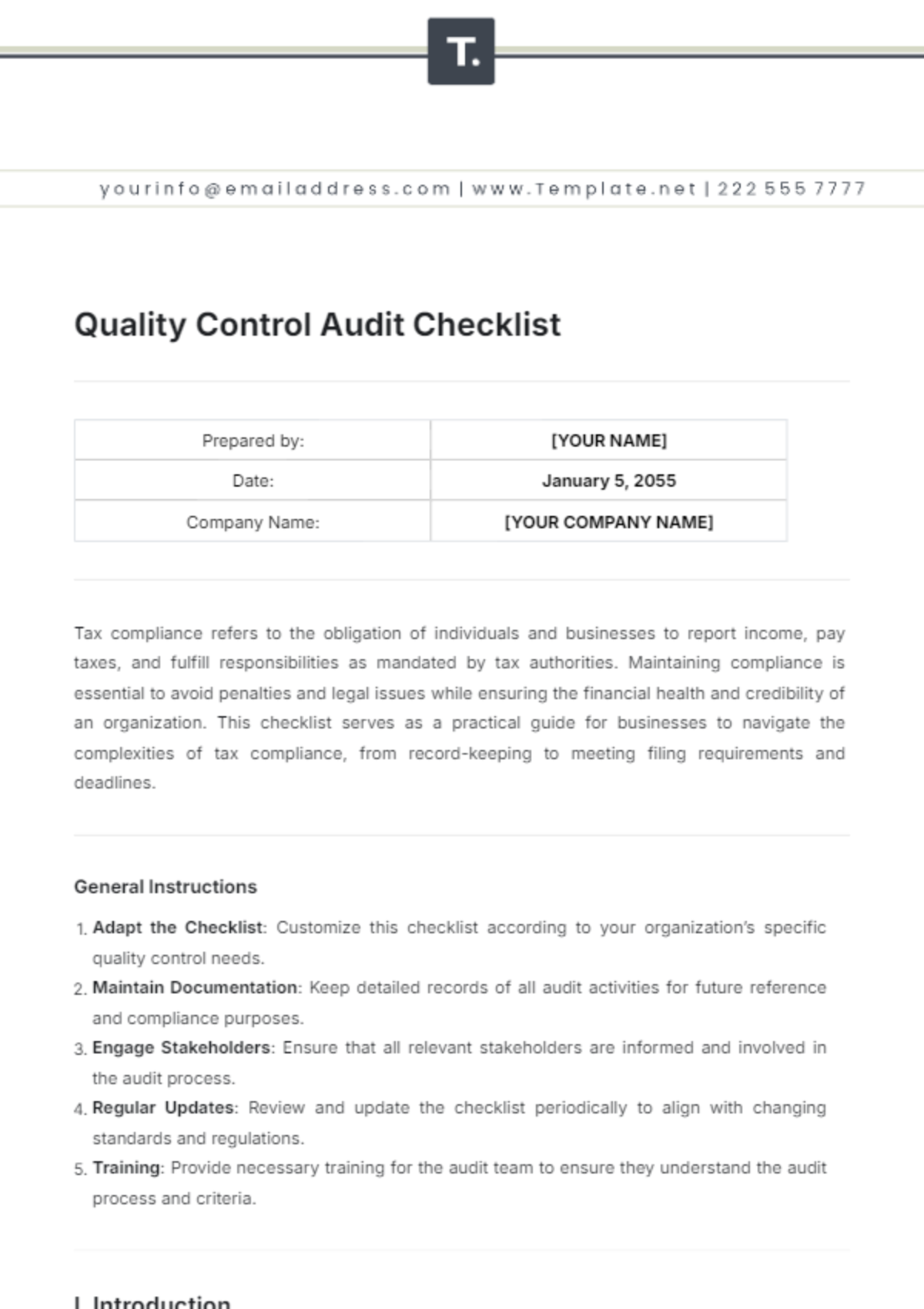

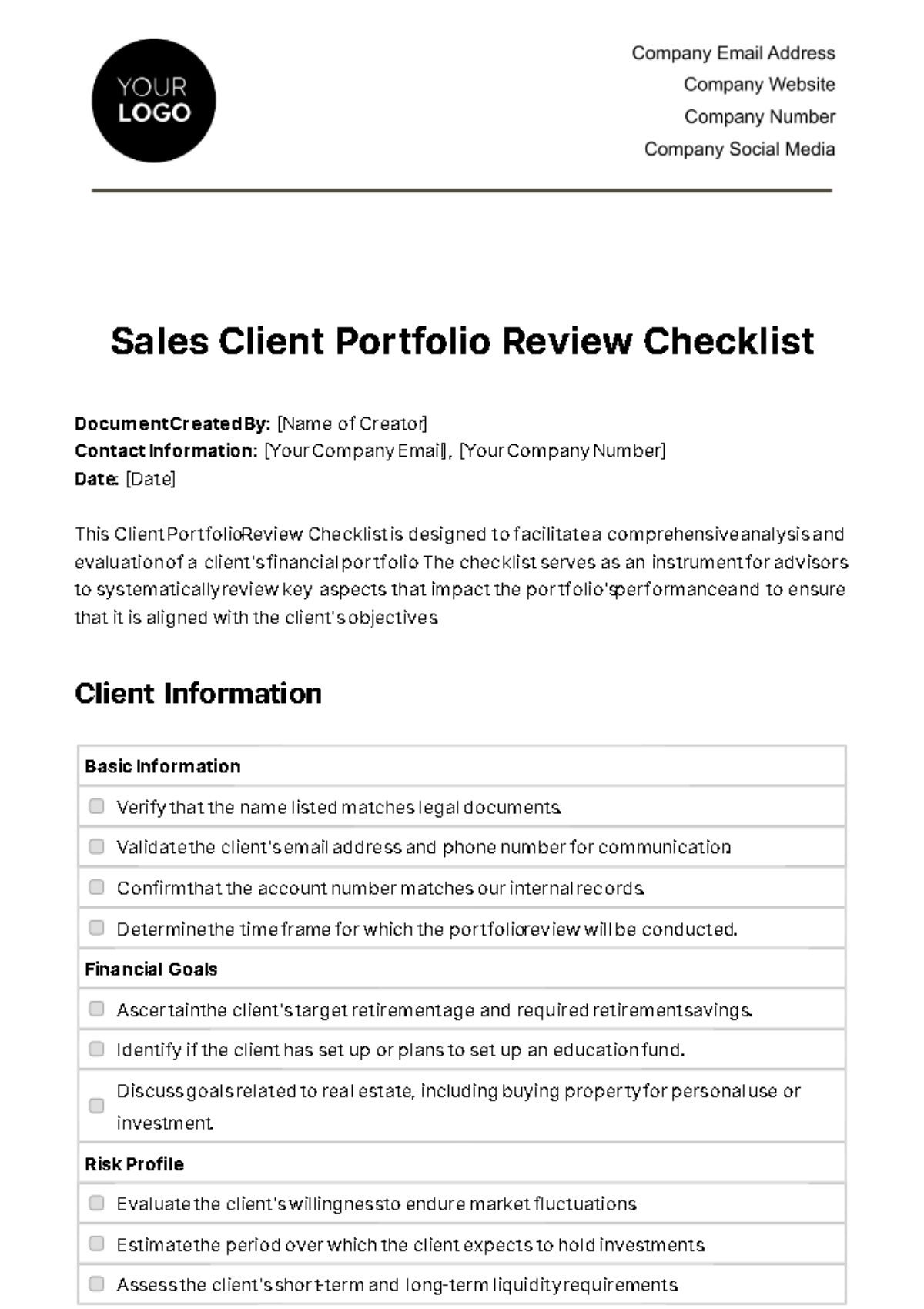

Sales Client Portfolio Review Checklist

Document Created By: [Name of Creator]

Contact Information: [Your Company Email], [Your Company Number]

Date: [Date]

This Client Portfolio Review Checklist is designed to facilitate a comprehensive analysis and evaluation of a client's financial portfolio. The checklist serves as an instrument for advisors to systematically review key aspects that impact the portfolio's performance and to ensure that it is aligned with the client's objectives.

Client Information

Basic Information |

|

|

|

|

Financial Goals |

|

|

|

Risk Profile |

|

|

|

Asset Allocation

Current Allocation |

|

|

|

|

Recommended Allocation |

|

|

|

|

Investment Review

Asset Performance |

|

|

|

|

Fee Structure |

|

|

|

Tax Implications

Tax Efficiency |

|

|

|

|

Tax Planning Strategies |

|

|

For further details, please contact:

Portfolio Manager:

[Manager Name]

[Manager Email]

Document Compiled on: [Date Compiled]

Review Date: [Review Date]