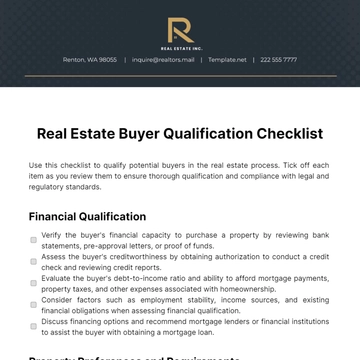

Free Real Estate Buyer Qualification Checklist

Use this checklist to qualify potential buyers in the real estate process. Tick off each item as you review them to ensure thorough qualification and compliance with legal and regulatory standards.

Financial Qualification

Verify the buyer's financial capacity to purchase a property by reviewing bank statements, pre-approval letters, or proof of funds.

Assess the buyer's creditworthiness by obtaining authorization to conduct a credit check and reviewing credit reports.

Evaluate the buyer's debt-to-income ratio and ability to afford mortgage payments, property taxes, and other expenses associated with homeownership.

Consider factors such as employment stability, income sources, and existing financial obligations when assessing financial qualification.

Discuss financing options and recommend mortgage lenders or financial institutions to assist the buyer with obtaining a mortgage loan.

Property Preferences and Requirements

Identify the buyer's preferences and requirements for a property, including location, size, amenities, and budget.

Discuss specific features or characteristics desired in a home, such as the number of bedrooms, bathrooms, and outdoor space.

Consider factors such as proximity to schools, workplaces, public transportation, and recreational facilities when assessing property preferences.

Explore potential neighborhoods or communities that meet the buyer's criteria and align with their lifestyle and preferences.

Discuss the availability of properties that match the buyer's requirements and conduct property searches accordingly.

Legal and Regulatory Compliance

Ensure compliance with legal and regulatory requirements when qualifying buyers for real estate transactions.

Provide information about fair housing laws, anti-discrimination regulations, and equal opportunity housing principles to both buyers and sellers.

Educate buyers about their rights and responsibilities as real estate consumers, including disclosure requirements and contractual obligations.

Review legal documents such as purchase agreements, contracts, and disclosure forms with the buyer to ensure understanding and compliance.

Consult with legal counsel or real estate professionals to address any legal or regulatory concerns or questions raised by the buyer.

Buyer Representation and Agency Disclosure

Establish the buyer's representation agreement and disclose the nature of the agency relationship between the buyer and the real estate agent or broker.

Explain the duties and responsibilities of the buyer's agent or broker, including loyalty, confidentiality, and fiduciary obligations.

Provide information about dual agency, designated agency, and other agency arrangements that may affect the buyer's representation.

Ensure that the buyer understands the implications of buyer representation and the potential conflicts of interest that may arise in real estate transactions.

Obtain written consent from the buyer acknowledging their understanding of the agency relationship and representation agreement.

Due Diligence and Offer Preparation

Guide the buyer through the due diligence process, including property inspections, appraisals, and title searches.

Coordinate with inspectors, appraisers, and other professionals to evaluate the condition and value of the property.

Assist the buyer in preparing a competitive offer based on market analysis, property valuation, and negotiation strategy.

Review offer terms, contingencies, and deadlines with the buyer to ensure clarity and understanding.

Facilitate communication between the buyer and the seller's agent or broker to negotiate terms and finalize the purchase agreement.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your buyer qualification process with this editable Real Estate Buyer Qualification Checklist Template from Template.net! This tool is designed to help you ensure potential buyers are thoroughly qualified. It’s customizable, allowing you to adapt it to your specific needs. With our AI Editor Tool, editing is easy and intuitive!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist