Fair Lending Compliance Checklist

I. Compliance Overview

Objective: Ensure that [Your Company Name] adheres to all relevant legal and industry standards regarding fair lending practices.

Responsible Party: [Your Name], [Your Title]

Date of Last Review: [Date]

Next Scheduled Review: [Next Review Date]

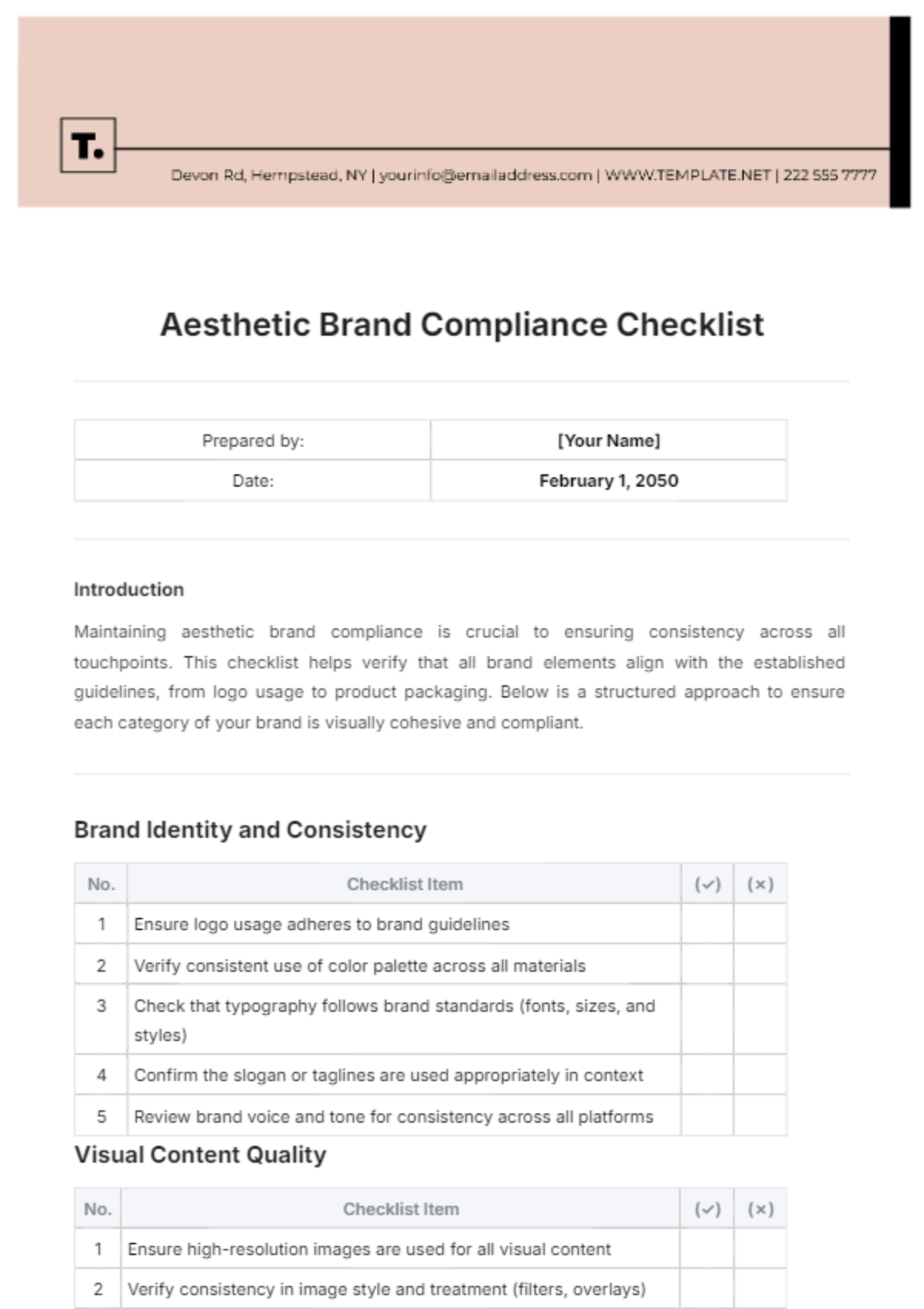

II. Policies and Procedures

[Your Company Name] has established and documented fair lending policies and procedures.

Policies and procedures are regularly reviewed and updated to reflect changes in fair lending laws and regulations.

Policies and procedures are communicated to all relevant staff members and are readily accessible.

III. Staff Training

[Your Company Name] provides regular training on fair lending laws and regulations to all employees involved in lending activities.

Training sessions cover topics such as fair lending principles, prohibited discriminatory practices, and handling of customer complaints.

Records of training sessions, including attendance and content covered, are maintained

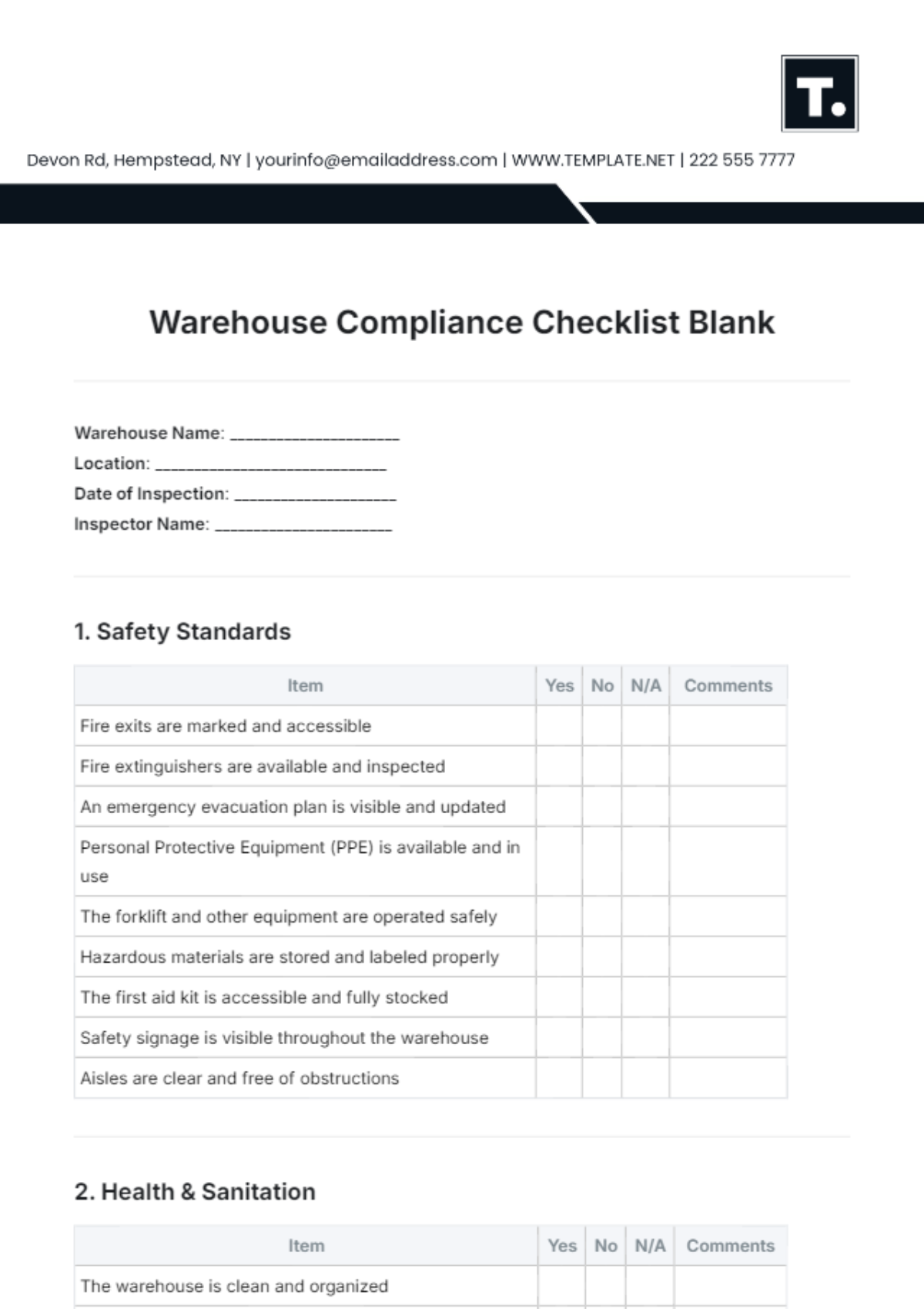

IV. Monitoring and Testing

Regular monitoring and testing are conducted to assess compliance with fair lending laws and regulations.

Monitoring activities include reviewing loan applications, underwriting decisions, pricing practices, and marketing materials for potential disparities.

Testing methodologies are documented, and results are analyzed to identify any areas of non-compliance.

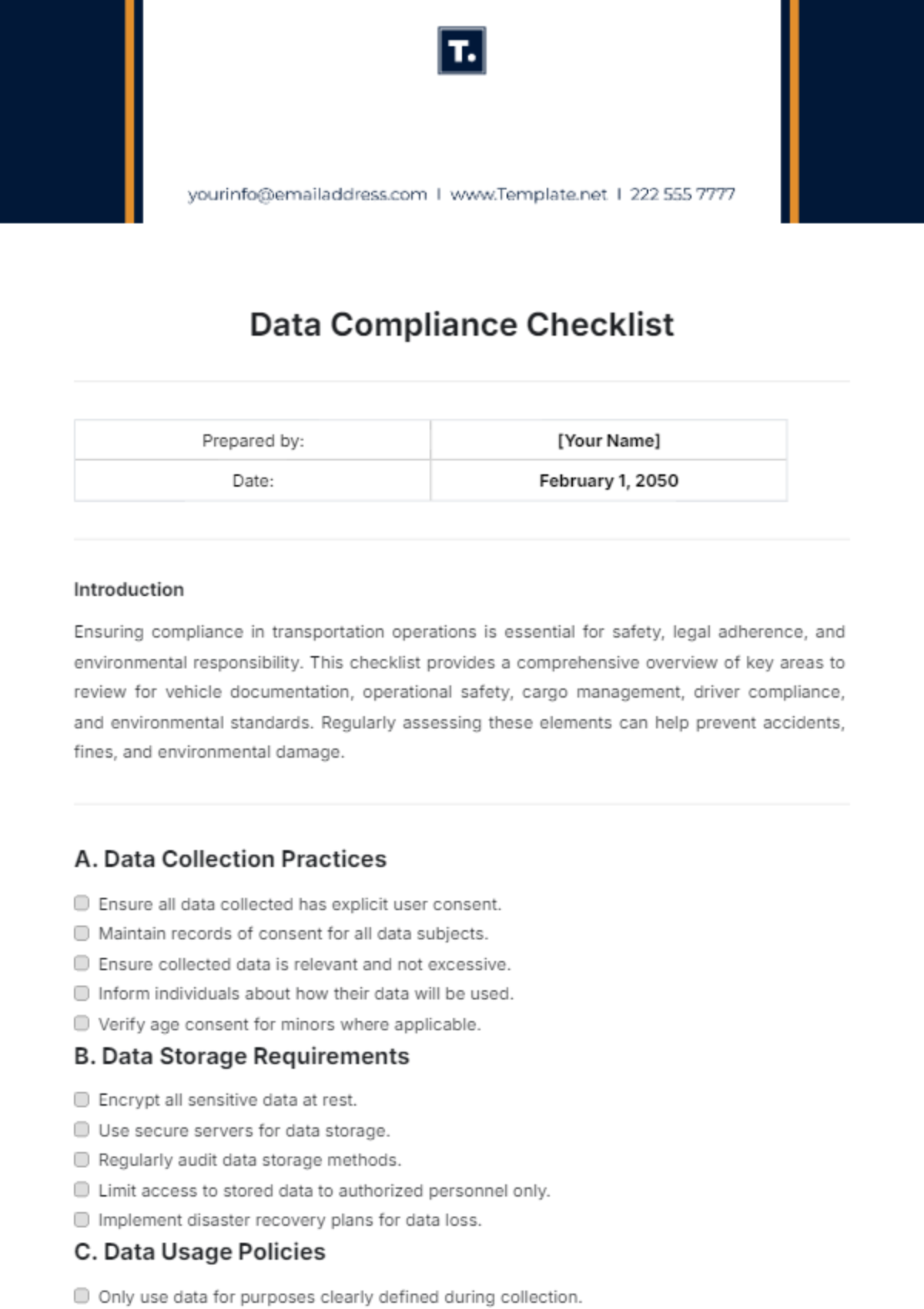

V. Data Collection and Analysis

[Your Company Name] collects and maintains data on lending activities, including applicant demographics, loan terms, and pricing information.

Data analysis is conducted to identify any disparities or patterns that may indicate potential discrimination.

Corrective actions are taken if disparities are identified, such as adjusting underwriting criteria or pricing practices.

VI. Complaint Handling

[Your Company Name] has established procedures for handling customer complaints related to fair lending issues.

Complaints are promptly investigated, and appropriate actions are taken to address any substantiated allegations of discrimination.

Records of complaints and resolutions are maintained for regulatory purposes.

VII. Documentation and Reporting

[Your Company Name] maintains comprehensive documentation of its fair lending compliance efforts, including policies, training records, monitoring reports, and complaint logs.

Regulatory reports on fair lending compliance are prepared accurately and submitted on time.

Documentation is organized and readily accessible for regulatory examinations or audits.

VIII. Signature

I, [Your Name], hereby confirm that I have reviewed the Fair Lending Compliance Checklist Template for [Your Company Name] and acknowledge the importance of adhering to the outlined procedures and practices to ensure compliance with fair lending laws and regulations.

Your Company Name]

Date: