Free Financial Planning Business Fact Sheet

I. Introduction

Introducing the Financial Planning Business Sheet by [YOUR COMPANY NAME]. This resource has been meticulously curated to provide essential insights into financial planning, empowering you to make informed decisions and optimize your financial strategies.

II. Overview

A. Definition:

Financial planning encompasses the process of evaluating one's current financial status and creating a comprehensive roadmap to achieve future financial goals.

B. Importance:

Financial planning is crucial for [INDIVIDUALS/BUSINESSES] alike as it ensures efficient allocation of resources, risk mitigation, and attainment of long-term financial objectives.

C. Key Points:

Goal Setting: Identifying short-term and long-term financial goals.

Budgeting: Creating a budget to manage expenses and savings effectively.

Investment Planning: Strategizing investments to maximize returns while managing risk.

III. Benefits

Understanding financial planning offers various benefits, including:

Financial Security: Ensure stability and security for you and your [FAMILY/COMPANY].

Wealth Accumulation: Facilitate wealth creation and asset accumulation.

Risk Management: Minimize financial risks and uncertainties.

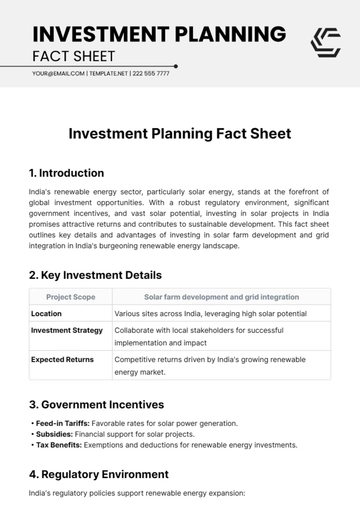

IV. Statistics and Figures

A. Overview:

Here are some key statistics and figures related to financial planning:

B. Retirement Savings Comparison:

Age Group | Average Savings | Percentage with Comprehensive Financial Plans |

|---|---|---|

20-30 years | $[AMOUNT] | [PERCENTAGE]% |

31-40 years | $[AMOUNT] | [PERCENTAGE]% |

41-50 years | $[AMOUNT] | [PERCENTAGE]% |

51-60 years | $[AMOUNT] | [PERCENTAGE]% |

Over 60 years | $[AMOUNT] | [PERCENTAGE]% |

C. Market Projection Chart:

This graphical representation showcases the anticipated expansion of the worldwide financial planning market over the forthcoming [NUMBER] years, incorporating a Compound Annual Growth Rate (CAGR) of [PERCENTAGE]%."

V. Common Myths

Financial Planning is Only for the Wealthy: False. Financial planning is beneficial for individuals of all income levels.

Financial Planning is Only About Investments: False. It encompasses budgeting, insurance, tax planning, and more.

VI. Frequently Asked Questions

When Should I Start Financial Planning?: It's never too early to start. The earlier, the better.

Do I Need a Professional Financial Planner?: While it's not mandatory, a professional can provide expertise and guidance tailored to your needs.

VII. Conclusion

In conclusion, financial planning is indispensable for securing your financial future and achieving your life goals. By adhering to sound financial principles and leveraging strategic planning, you can pave the way for long-term prosperity and stability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Empower your financial planning endeavors with our expertly crafted Fact Sheet Template from Template.net. Fully editable and customizable, it’s tailored to streamline your business's data presentation. Harness its potential within our AI tool, ensuring efficiency and accuracy. Elevate your financial strategies and impress stakeholders with this indispensable resource.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet