Core Equity Fund Fact Sheet

I. Introduction

Welcome to the [Your Fund Name] Fact Sheet, providing essential information about our Core Equity Fund. Investors rely on this document to gain insights into our fund's investment strategy, performance, holdings, expenses, and other pertinent details.

II. Overview

This fact sheet provides essential information about the [Your Fund Name], managed by [Your Company Name]. It aims to offer investors insights into the fund's objectives, investment strategies, and overall management approach.

III. Fund Details

Fund Name: [Your Fund Name]

Fund Manager: [Fund Manager's Name]

Inception Date: January 20, 2050

Total Assets under Management: [$Amount]

Fund Type: Core Equity

NAV (Net Asset Value): [$NAV] as of [Date]

IV. Investment Strategy

The investment strategy of [Your Fund Name] focuses on achieving long-term capital growth through investments in a diversified portfolio of equities. Equity selections are conducted with a focus on industries and sectors with potential for sustainable growth, financial stability, and strong market positioning.

V. Performance

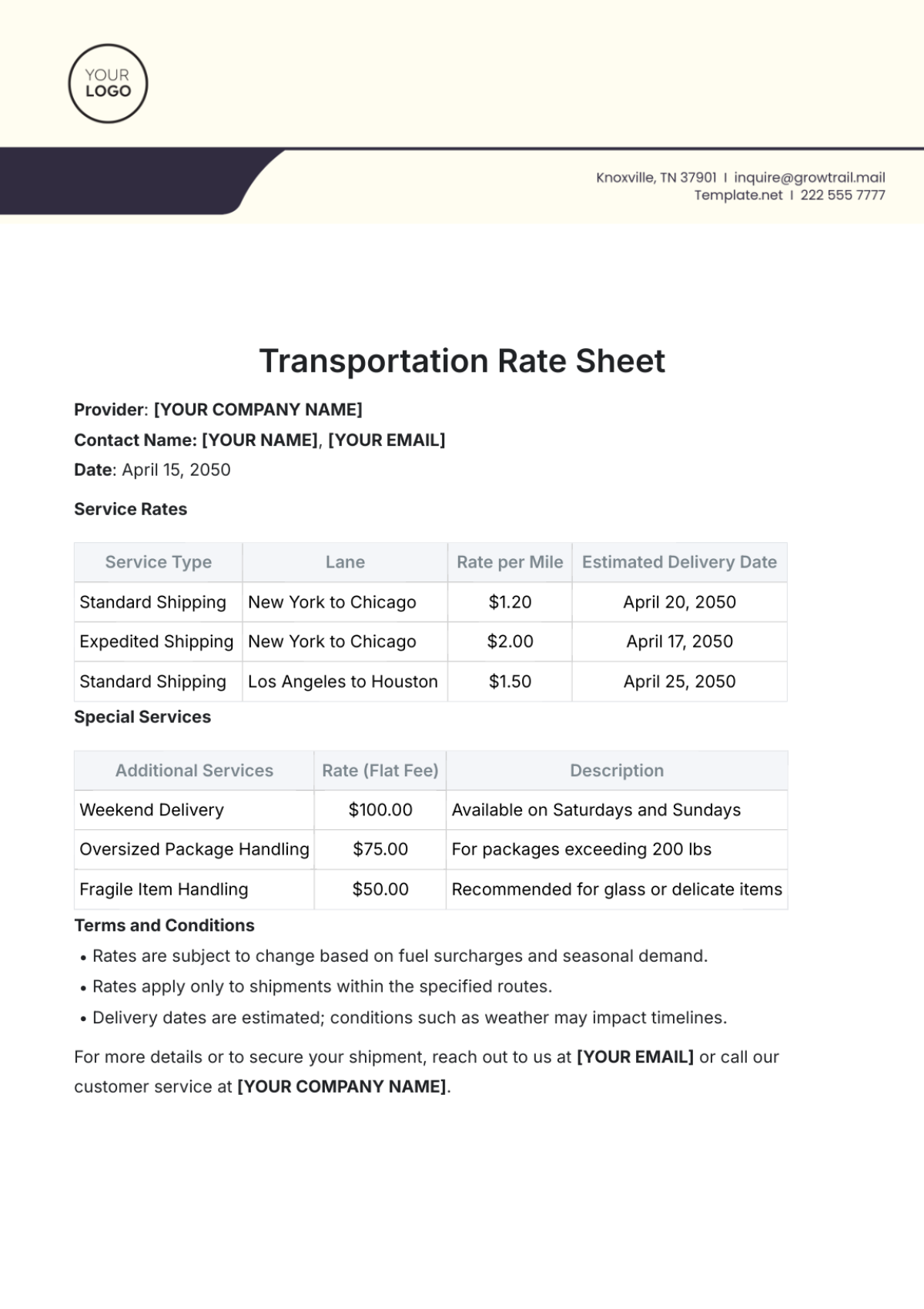

Year | Return | Benchmark |

|---|---|---|

2050 | 12.5% | 10.5% |

2051 | 9.8% | 8.5% |

2052 | 11.2% | 9.6% |

2053 | 10.5% | 9.8% |

VI. Top Holdings

The core equity portfolio is diversified across the following major holdings:

[Company Name 1]: 5.2 %

[Company Name 2]: 4.8 %

[Company Name 3]: 4.5 %

VII. Risk Profile

The fund's risk rating is based on historical volatility and market factors.

Risk Level: Moderate

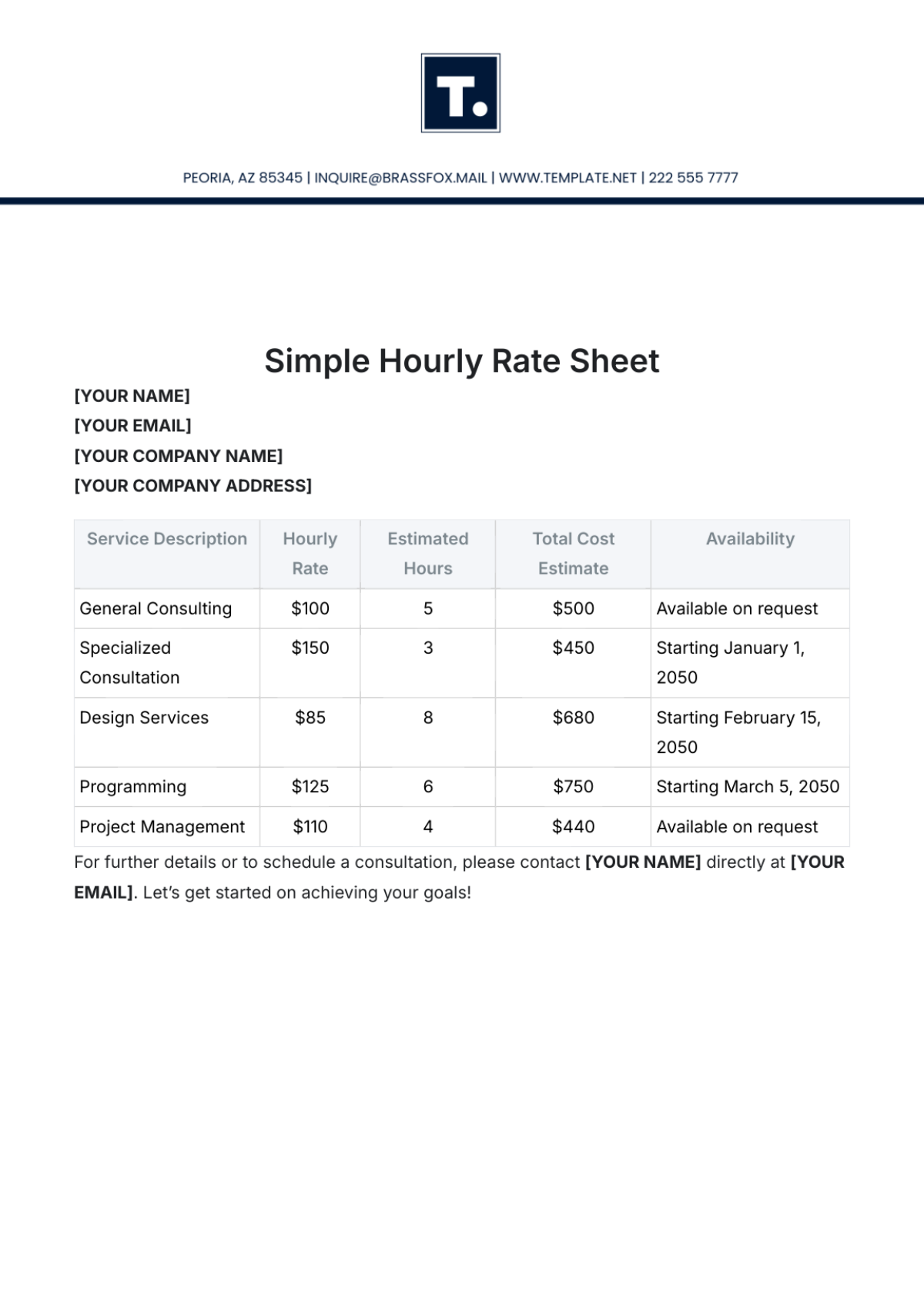

VIII. Fees and Expenses

An overview of the costs associated with investing in the fund.

Management Fee: 1.0%

Performance Fee: None

Total Expense Ratio (TER): 1.2%

IX. Common Myths

A. Myth 1: The fund only invests in tech stocks.

The fund has a diversified portfolio across various sectors, including tech, healthcare, finance, and consumer goods.

B. Myth 2: High fees mean better returns.

Fees are an important consideration, but they do not guarantee better returns. The fund's performance is driven by its investment strategy and market conditions.

X. FAQs

A. What is the minimum investment requirement?

The minimum initial investment is $1,000.

B. How often are distributions made?

Distributions are made quarterly.

XI. Conclusion

In conclusion, [Your Fund Name] offers investors a diversified portfolio of stocks representing various sectors and industries. With a clear investment strategy, strong performance history, and transparent fee structure, it aims to help investors achieve their financial goals.