Contingency Fund Fact Sheet

I. Introduction

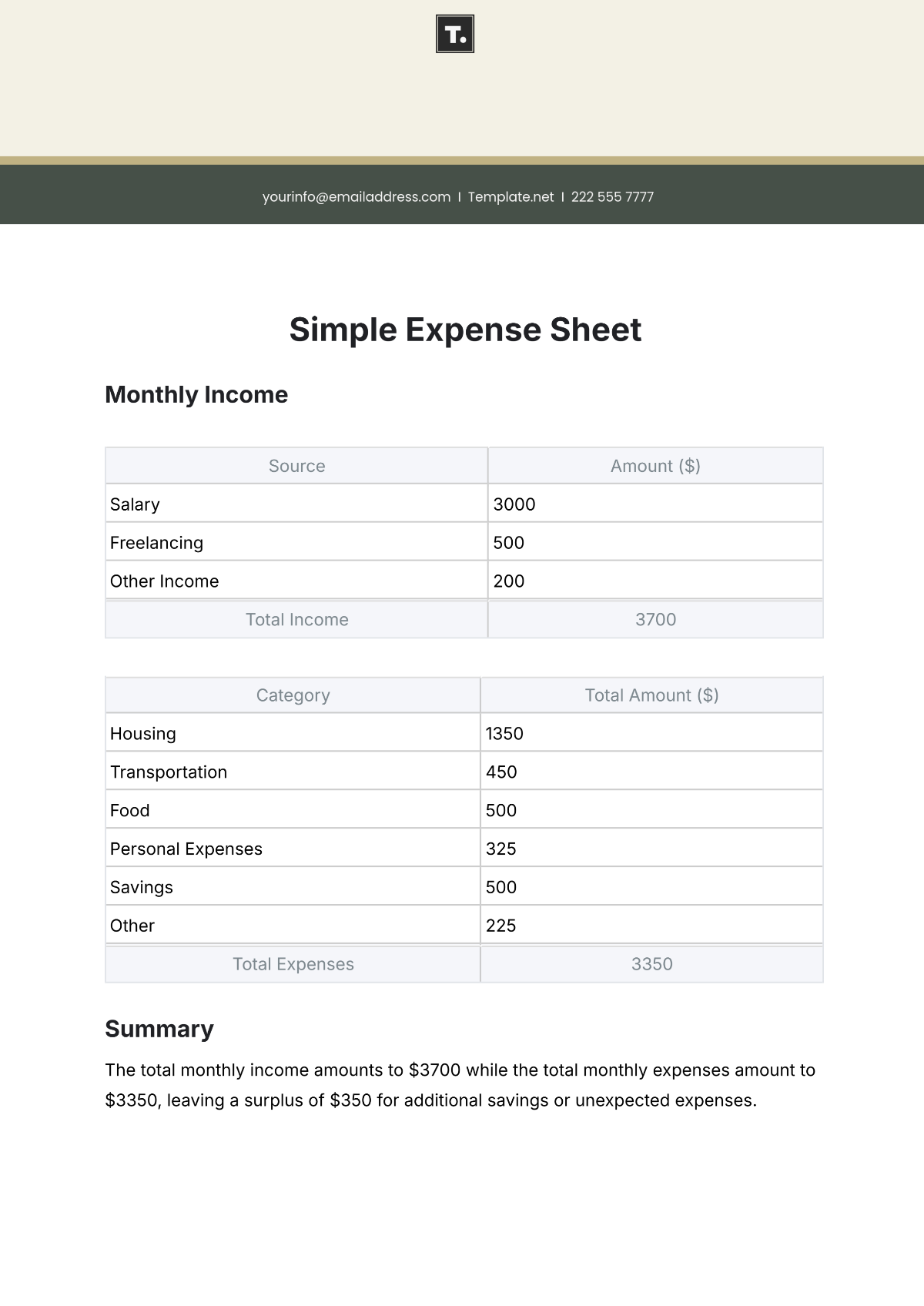

Welcome to the [Your Company Name] Contingency Fund Fact Sheet. This document aims to provide comprehensive insights into the fund established to address unforeseen expenses or emergencies, ensuring financial stability and resilience for our organization.

II. Overview

The [Your Company Name] Contingency Fund serves as a crucial financial safety net, designed to mitigate risks and uncertainties that may impact our operations. This Fact Sheet outlines the fund's purpose, funding sources, usage guidelines, reserves, and strategies for risk mitigation.

III. Purpose

The primary objective of the [Your Company Name] Contingency Fund is to:

Provide Financial Safety Net: The fund acts as a safety net for unexpected expenses by providing immediate access to financial resources without disrupting normal operations. It ensures that the organization can address emergencies promptly without relying on external financing, thereby maintaining financial stability and protecting long-term viability.

Ensure Business Continuity: During crises such as natural disasters, economic downturns, or operational disruptions, the Contingency Fund ensures business continuity by covering critical expenses and enabling the organization to maintain essential operations. This helps minimize downtime, mitigate potential losses, and uphold customer confidence and trust.

IV. Funding Sources

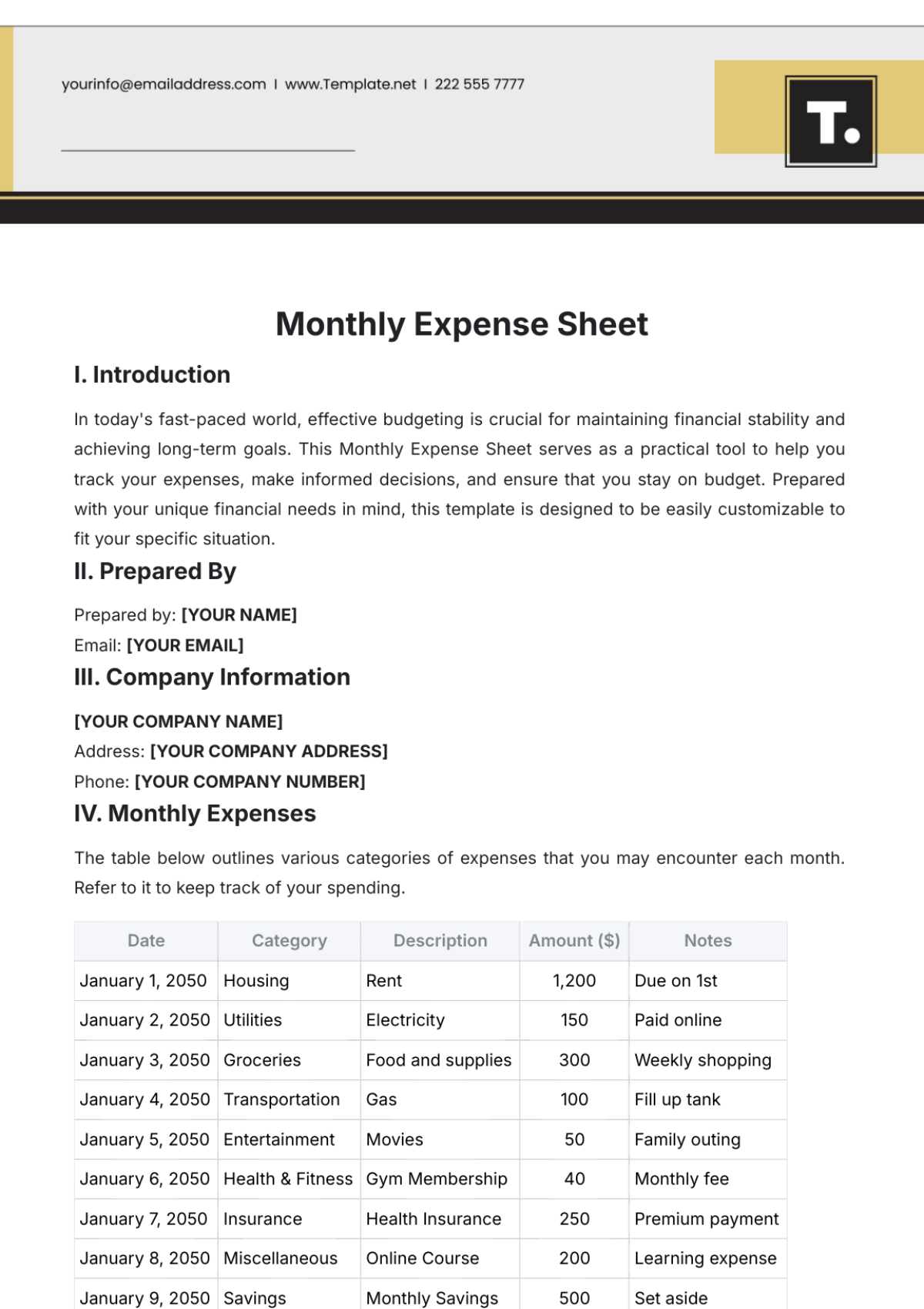

The Contingency Fund receives contributions from various sources, including:

Operating Budget Surpluses: Surpluses from the annual operating budget are allocated to the Contingency Fund to bolster reserves and ensure readiness for unexpected expenses.

Specific Donations: Generous donations from stakeholders and philanthropic organizations are earmarked for contingency purposes, augmenting the fund's resources and enhancing its capacity to address emergencies.

Investment Returns: The fund generates returns through prudent investment strategies, including interest income, dividends, and capital gains. These investment gains contribute to the growth and sustainability of the Contingency Fund, reinforcing its ability to fulfill its purpose effectively.

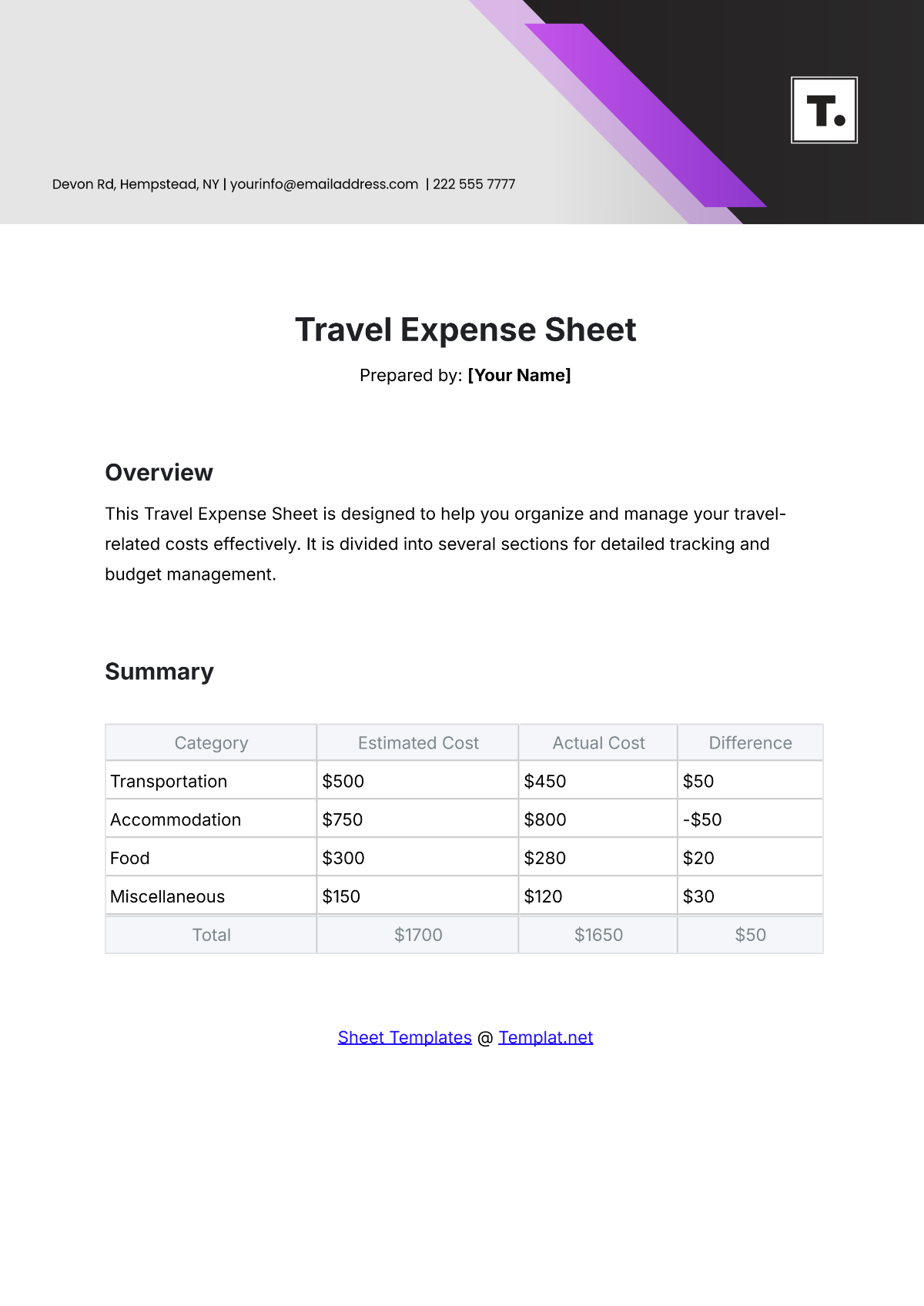

V. Risk Management

Explanation of how risks associated with unforeseen expenses are managed.

Risk Assessment: Regularly scheduled or event-triggered assessments are conducted to identify potential risks and vulnerabilities that may impact the organization's financial stability. These assessments inform proactive measures to mitigate risks and enhance preparedness.

Risk Mitigation Plans: Strategies are in place to minimize the financial impact of identified risks, including contingency planning, insurance coverage, and diversified investment portfolios. These plans aim to mitigate potential losses and ensure the organization's ability to withstand various adverse scenarios.

VI. Reporting and Monitoring

Monitoring Mechanisms: Various tools and methods, including financial reports, performance metrics, and internal audits, are utilized to monitor the Contingency Fund's activities and financial health.

Reporting Schedule: Status reports on the fund's reserves, expenditures, and utilization are generated periodically, typically every quarter, and presented to relevant stakeholders, including the board of directors and executive management.

Transparent Access: Information regarding the Contingency Fund, including its purpose, funding sources, reserves, and usage guidelines, is made accessible to stakeholders through official communications, website publications, and annual reports, ensuring transparency and accountability.

VII. Amendment and Review Policy

Review Frequency: The Contingency Fund's policies and practices are reviewed annually to assess their effectiveness, relevance, and alignment with organizational objectives and regulatory requirements.

Amendment Procedures: Amendments to the fund's policies and practices are proposed by the Finance Department and approved by the Board of Directors. Proposed amendments undergo thorough evaluation and consideration to ensure consistency with the organization's strategic priorities and risk management objectives.

Responsible Parties: The Finance Department is responsible for overseeing the review and amendment process, in collaboration with relevant stakeholders, including executive management, legal counsel, and external auditors.

VIII. FAQs

Q: How often is the Contingency Fund reviewed?

A: The fund's performance is regularly reviewed to ensure its effectiveness and relevance.

Q: Can the Contingency Fund be used for routine expenses?

A: No, the fund is reserved for unforeseen expenses or emergencies only.

IX. Conclusion

The [Your Company Name] Contingency Fund plays a vital role in safeguarding our organization's financial health and resilience. Through transparent management, strategic planning, and prudent use, we ensure readiness to tackle any unforeseen challenges that may arise.