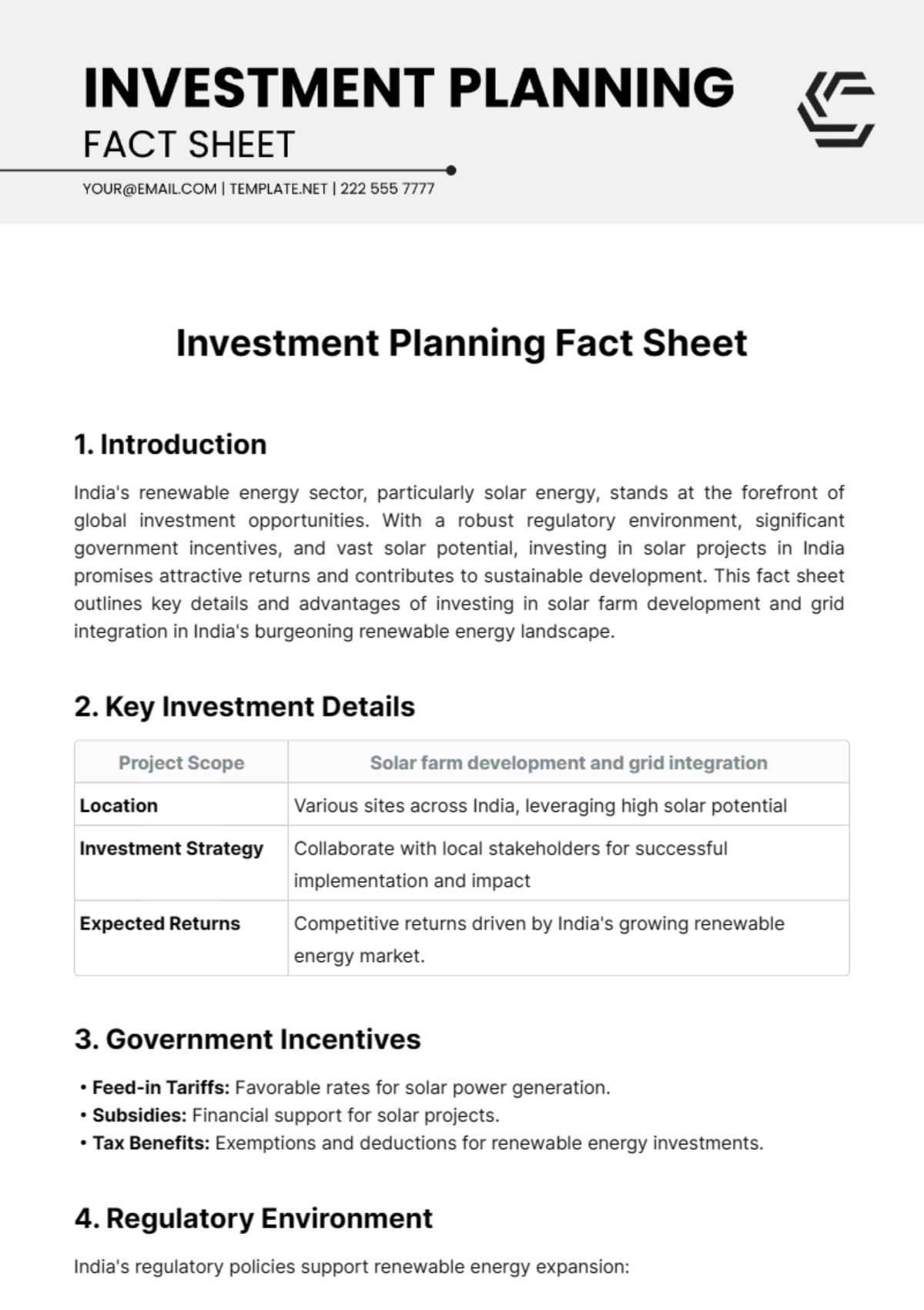

Free Investment Planning Fact Sheet

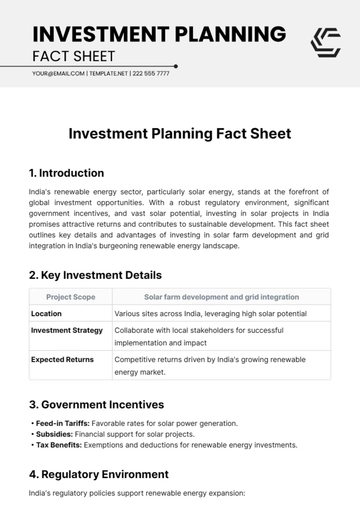

1. Introduction

India's renewable energy sector, particularly solar energy, stands at the forefront of global investment opportunities. With a robust regulatory environment, significant government incentives, and vast solar potential, investing in solar projects in India promises attractive returns and contributes to sustainable development. This fact sheet outlines key details and advantages of investing in solar farm development and grid integration in India's burgeoning renewable energy landscape.

2. Key Investment Details

Project Scope | Solar farm development and grid integration |

|---|---|

Location | Various sites across India, leveraging high solar potential |

Investment Strategy | Collaborate with local stakeholders for successful implementation and impact |

Expected Returns | Competitive returns driven by India's growing renewable energy market. |

3. Government Incentives

Feed-in Tariffs: Favorable rates for solar power generation.

Subsidies: Financial support for solar projects.

Tax Benefits: Exemptions and deductions for renewable energy investments.

4. Regulatory Environment

India's regulatory policies support renewable energy expansion:

Clear guidelines for solar project approvals.

Ease of land acquisition and environmental clearances.

Priority grid access for solar energy.

5. Investment Opportunities

Scale: India's vast solar potential allows for large-scale projects.

Technological Advancements: Integration of innovative technologies for efficient solar energy production.

Partnership Potential: Collaborate with experienced local developers and EPC (Engineering, Procurement, Construction) firms.

6. Timeline and Milestones

2025: Complete site selection and feasibility studies.

2027: Commence construction of first phase solar farms.

2030: Achieve operational capacity of 500 MW.

2035: Expand capacity to 1,000 MW through additional projects.

2050: Aim for a diversified portfolio with multiple solar farms across India.

7. Risk Mitigation

Market Fluctuations: Long-term power purchase agreements mitigate revenue risks.

Policy Changes: Regular monitoring of regulatory developments to adapt strategies.

Operational Challenges: Robust project management and local partnerships ensure smooth execution.

8. Conclusion

Investing in India's solar energy sector represents a strategic opportunity for sustainable growth and financial returns. The combination of favorable government policies, technological advancements, and vast solar potential positions solar projects as a cornerstone of India's renewable energy landscape. By partnering with local stakeholders and leveraging regulatory support, investors can contribute to India's clean energy transition while maximizing their investment potential.

For more information and investment inquiries, please contact [YOUR COMPANY EMAIL] or [YOUR COMPANY NUMBER].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Investment Planning Fact Sheet Template on Template.net. This editable and customizable document provides detailed investment insights. Effortlessly modify content using our Ai Editor Tool for precision and clarity. Effectively showcase investment plans with this comprehensive template. Access today for impactful presentations and insightful analysis of investment strategies, empowering you to make informed financial decisions.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet