Direct Investment Fact Sheet

I. Introduction

This Fact Sheet provides detailed information about the direct investment opportunity offered by [Your Company Name]. It is designed to help potential investors make informed decisions by highlighting crucial aspects of the investment.

II. Investment Overview

Summary of the investment opportunity laid out by [Your Company Name] to assist in the understanding of the scope and nature of the investment.

Investment Name: [Investment Name]

Investment Type: Real Estate Investment Trust (REIT)

Investment Objective: To generate stable income and capital appreciation through diversified real estate investments.

Minimum Investment: $50,000

Offering Period: January 1, 2050 - December 31, 2050

III. Performance Metrics

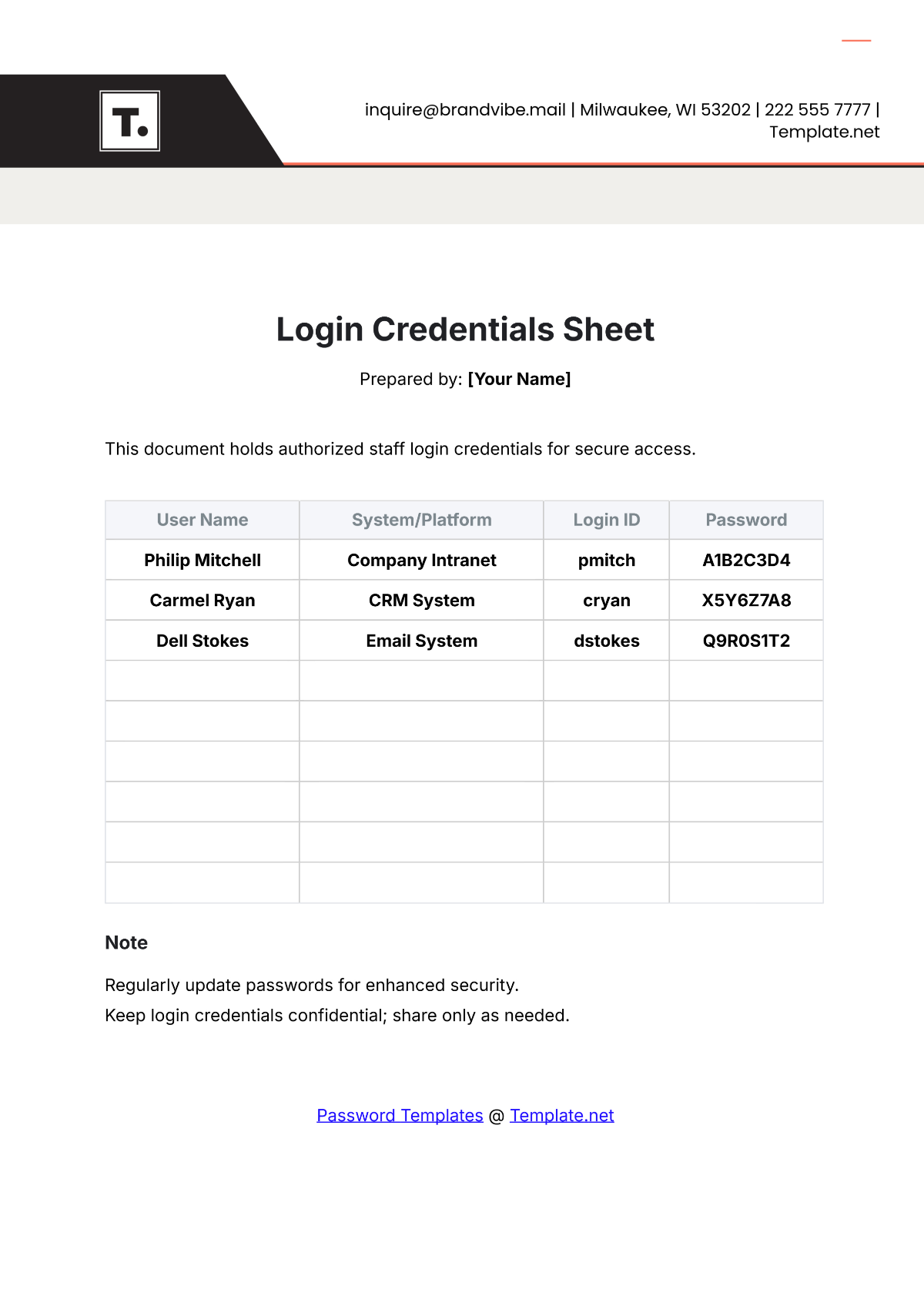

Concise performance data and past results to provide a snapshot of the investment's profitability and stability.

Year | Return on Investment (ROI) | Net Income |

|---|---|---|

Year 1 | 8% | $500,000 |

Year 2 | 7.5% | $550,000 |

Year 3 | 9% | $600,000 |

IV. Risk Factors

Analysis of potential risks associated with the investment to help assess the level of risk tolerance needed.

Market Volatility - The value of real estate properties can experience fluctuations as a result of varying economic conditions.

Regulatory Changes - Alterations to regulatory frameworks have the potential to significantly influence operational methodologies and profitability margins within the realm of real estate business.

Interest Rate Risks - Changes in the levels of interest rates can have an impact on the costs associated with borrowing money as well as the returns that investors might receive from their investments.

V. Fees and Expenses

Detailed breakdown of all fees and expenses that an investor might incur throughout the investment period.

Management Fee: 1% of assets under management annually.

Performance Fee: 10% of profits exceeding 10% ROI per annum.

Other Fees: Transaction fees may apply for property acquisitions and divestitures.

VI. Frequently Asked Questions (FAQs)

What is the minimum investment required?

The minimum investment required is $50,000 to participate in [Investment Name].How is investment performance measured?

Performance is measured using Return on Investment (ROI) and net income from the investment portfolio.Are there any redemption restrictions?

Investors can redeem shares quarterly, subject to terms in the investment agreement.What types of properties does the fund invest in?

The fund invests in commercial, residential, and industrial properties across strategic locations.Can investors participate through retirement accounts (IRA/401k)?

Yes, investors can participate through eligible retirement accounts, subject to custodian and regulatory approvals.

VII. Contact Information

Complete contact details for inquiries and further details regarding the investment.

Name: [Your Name]

Your Position: [Position] in [Your Company Name].

Your Email: [Your Email]

Your Phone Number: [Your Company Number]

For more detailed information or to discuss the investment opportunity further, please don’t hesitate to reach out to the provided contact information.