Floating Rate Fund Fact Sheet

_____________________________________________________________________________________

I. Introduction

This Fact Sheet provides an overview of the [Your Company Name] Rate Fund for individual investors to evaluate the fund's performance and investment strategy. Investors are encouraged to review this information carefully before making any investment decisions.

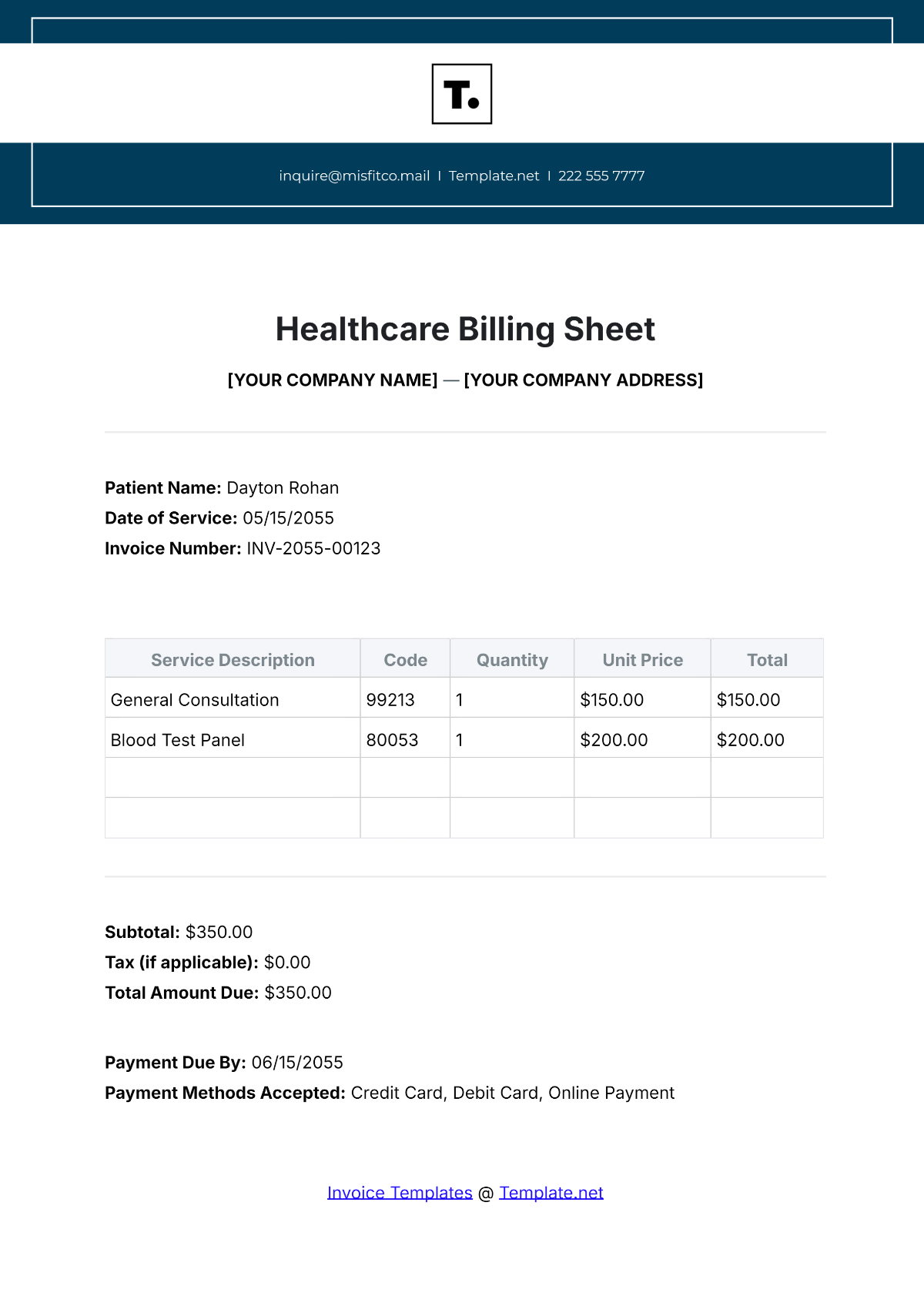

II. Fund Overview

Fund Name: [Fund Name]

Fund Manager: [Your Name]

Inception Date: January 1, 2050

Ticker Symbol: GOFRF

Investment Objective: To provide investors with a high level of current income by investing primarily in a diversified portfolio of floating-rate loans and other floating-rate debt securities.

Benchmark: [Location]

III. Investment Strategy

A. Objective

The fund seeks to achieve its investment objective by primarily investing in floating-rate loans and other floating-rate debt securities issued by U.S. and non-U.S. entities. These securities typically have interest rates that reset periodically based on changes in a specified reference rate.

B. Strategy

The fund employs a bottom-up approach to credit selection, focusing on fundamental credit analysis and issuer-specific factors. It may also utilize derivatives to manage interest rate risk and enhance returns.

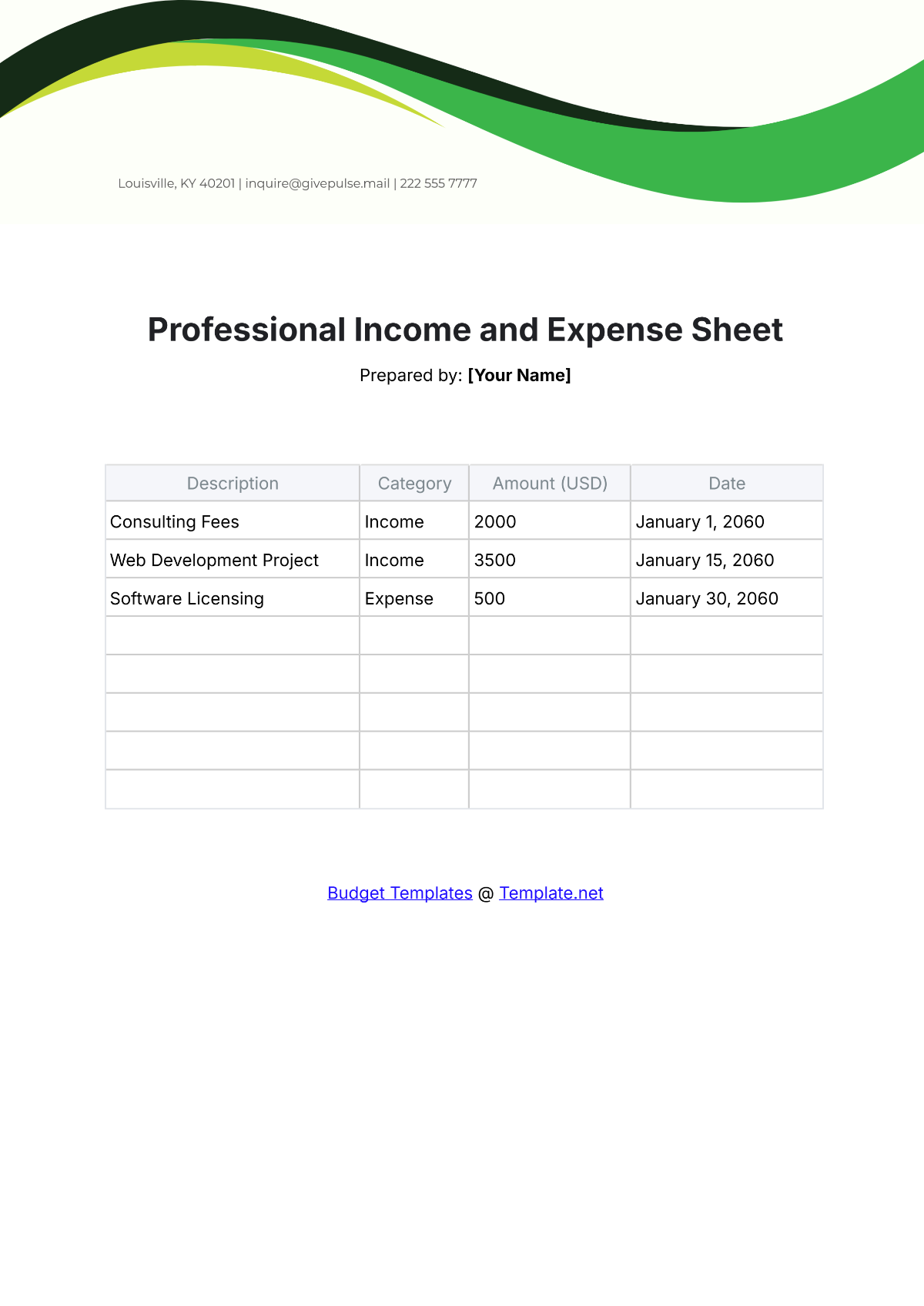

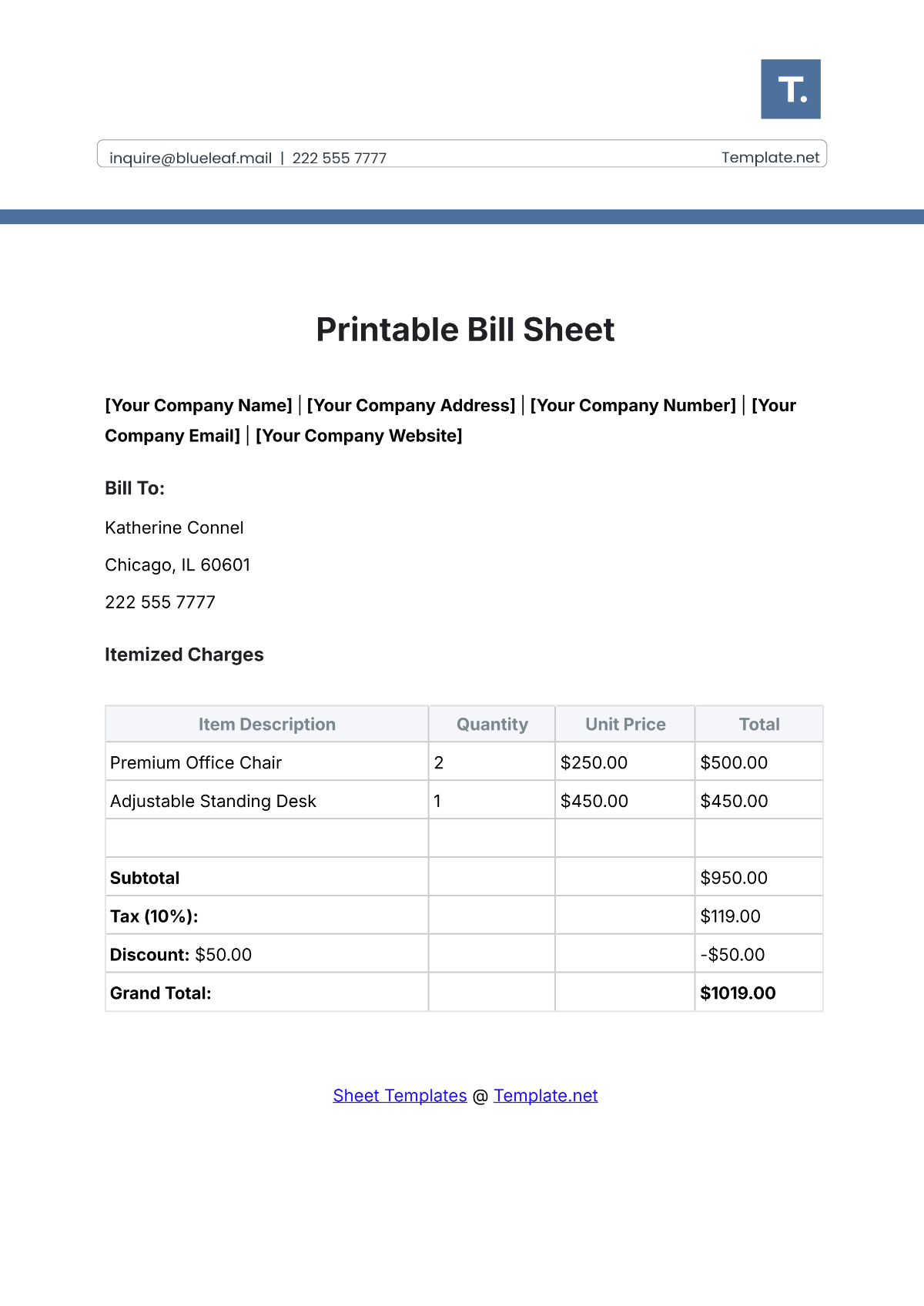

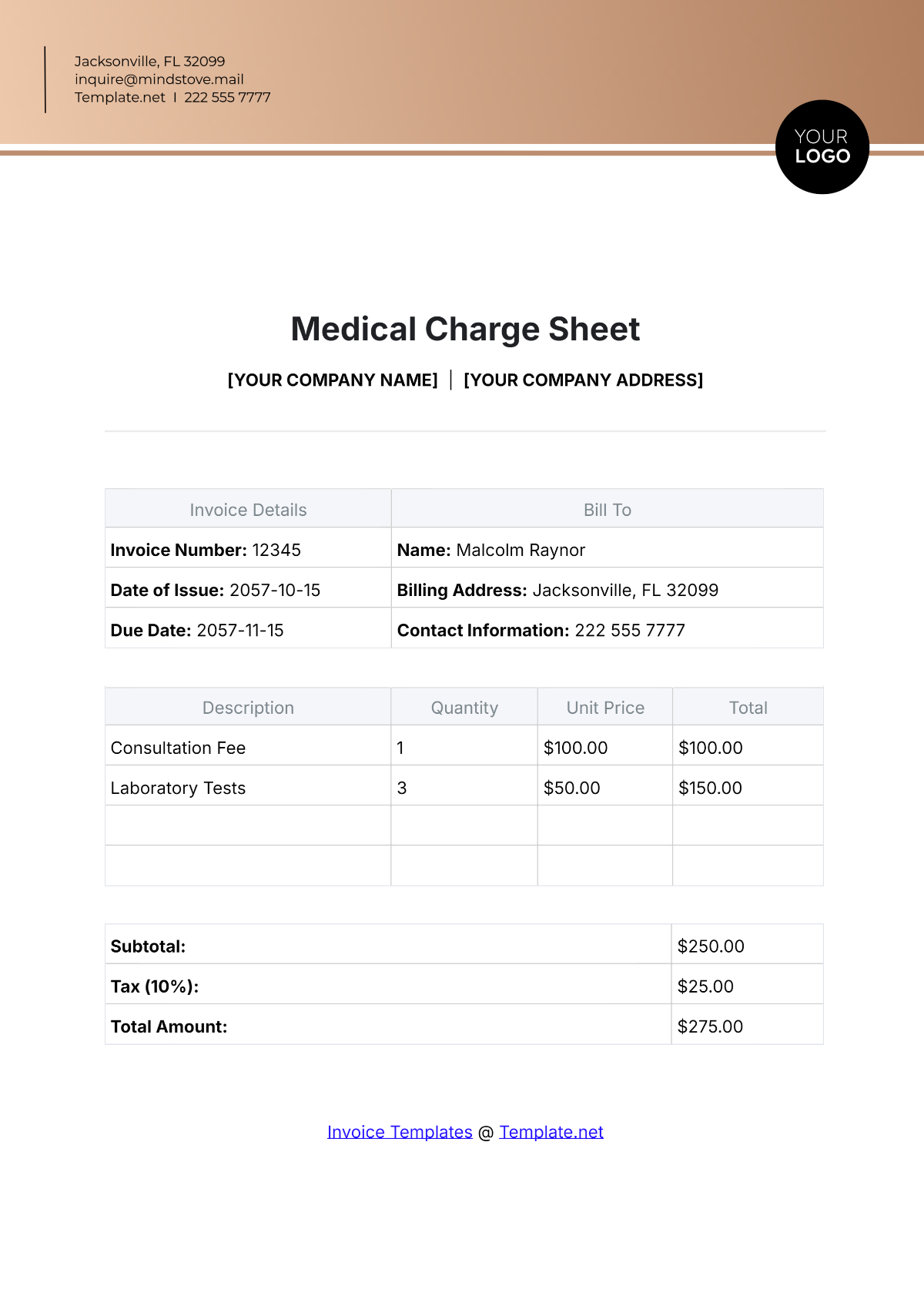

IV. Performance

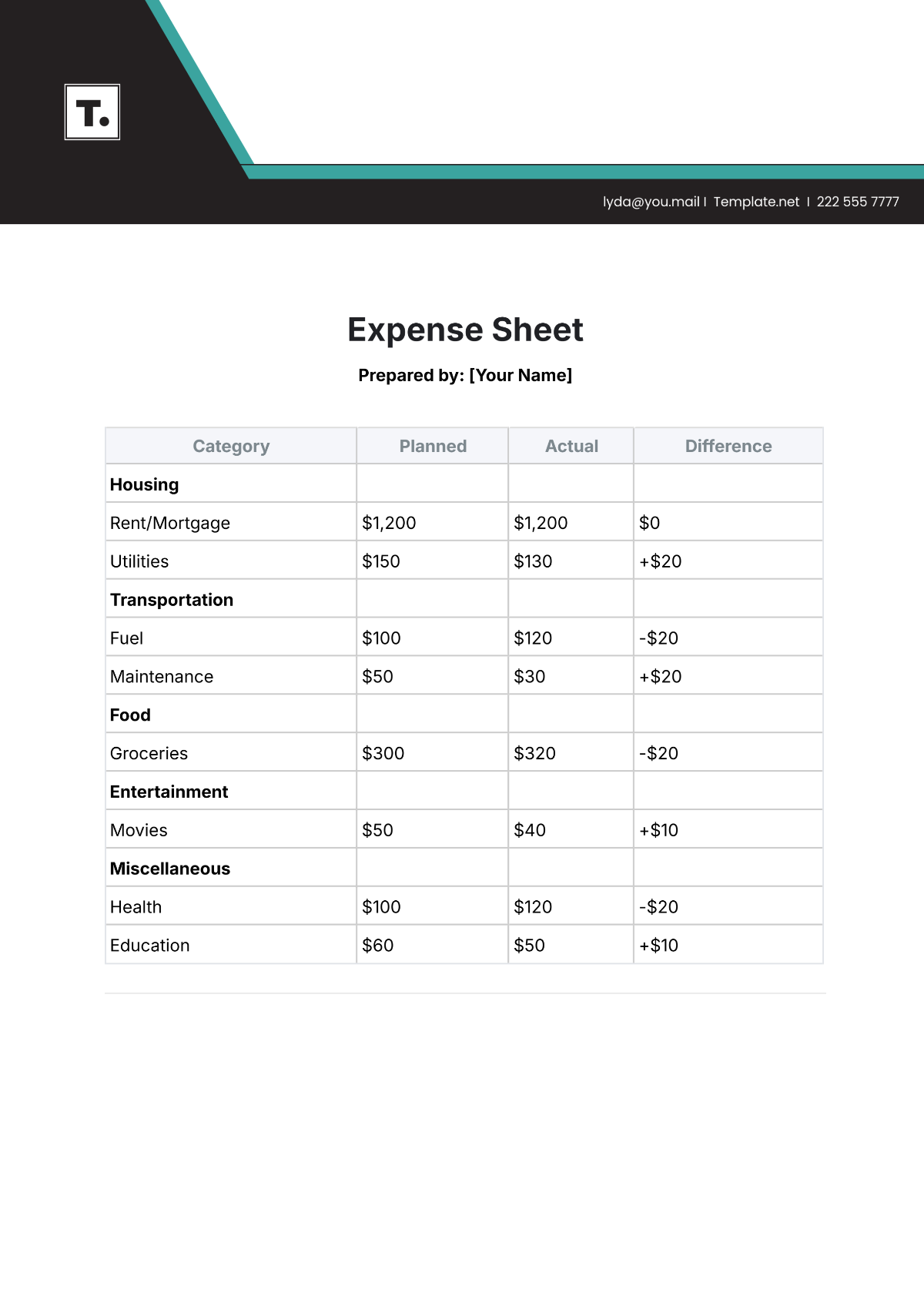

A. Historical Performance

Annualized Return (YTD): 5.2%

Annualized Return (1 Year): 6.8%

Annualized Return (3 Years): 5.5%

Annualized Return (5 Years): 6.2%

Annualized Return (Since Inception): 6.0%

B. Risk Metrics

Standard Deviation (1 Year): 1.2

Sharpe Ratio (1 Year): 0.85

Beta: 0.75

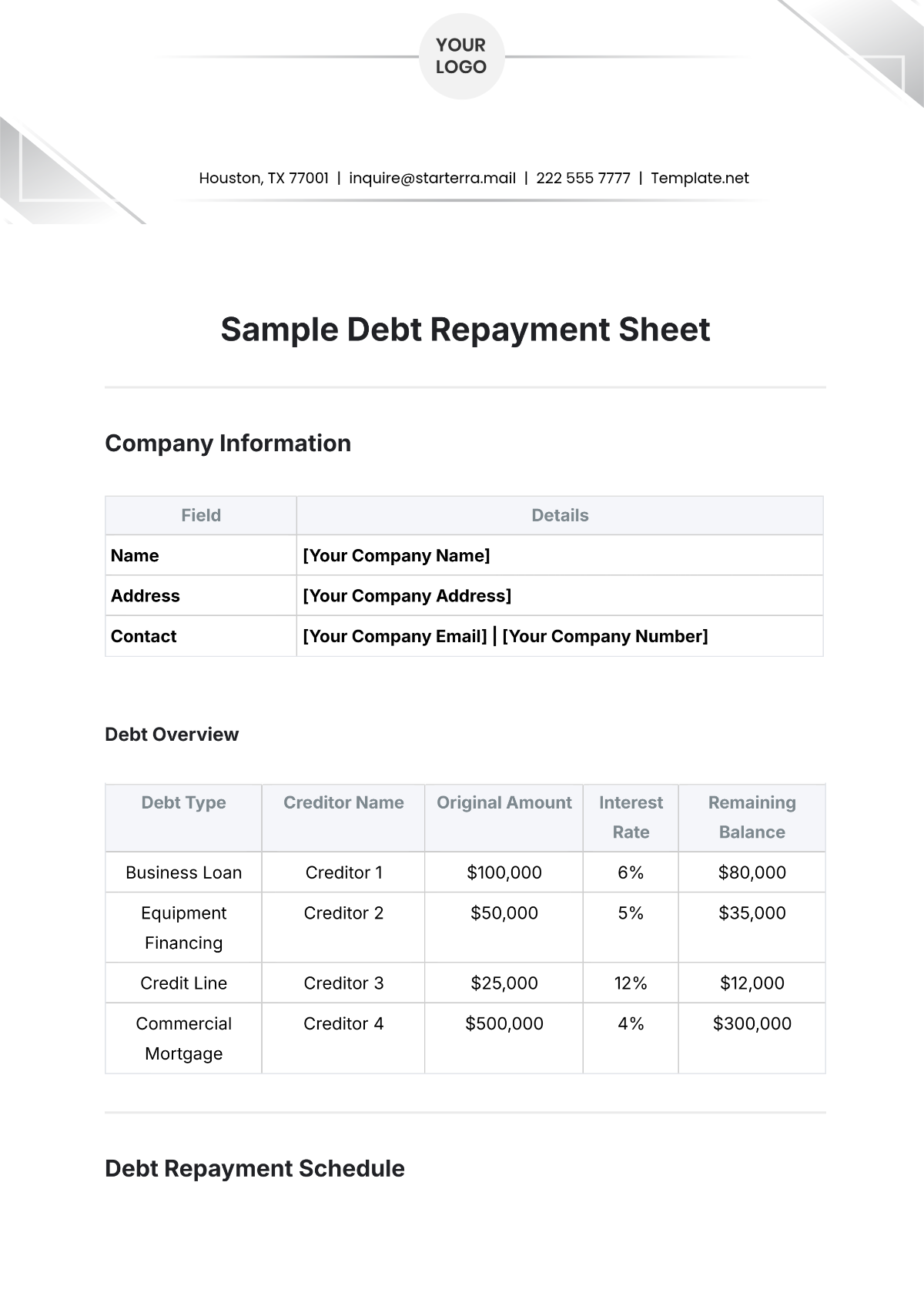

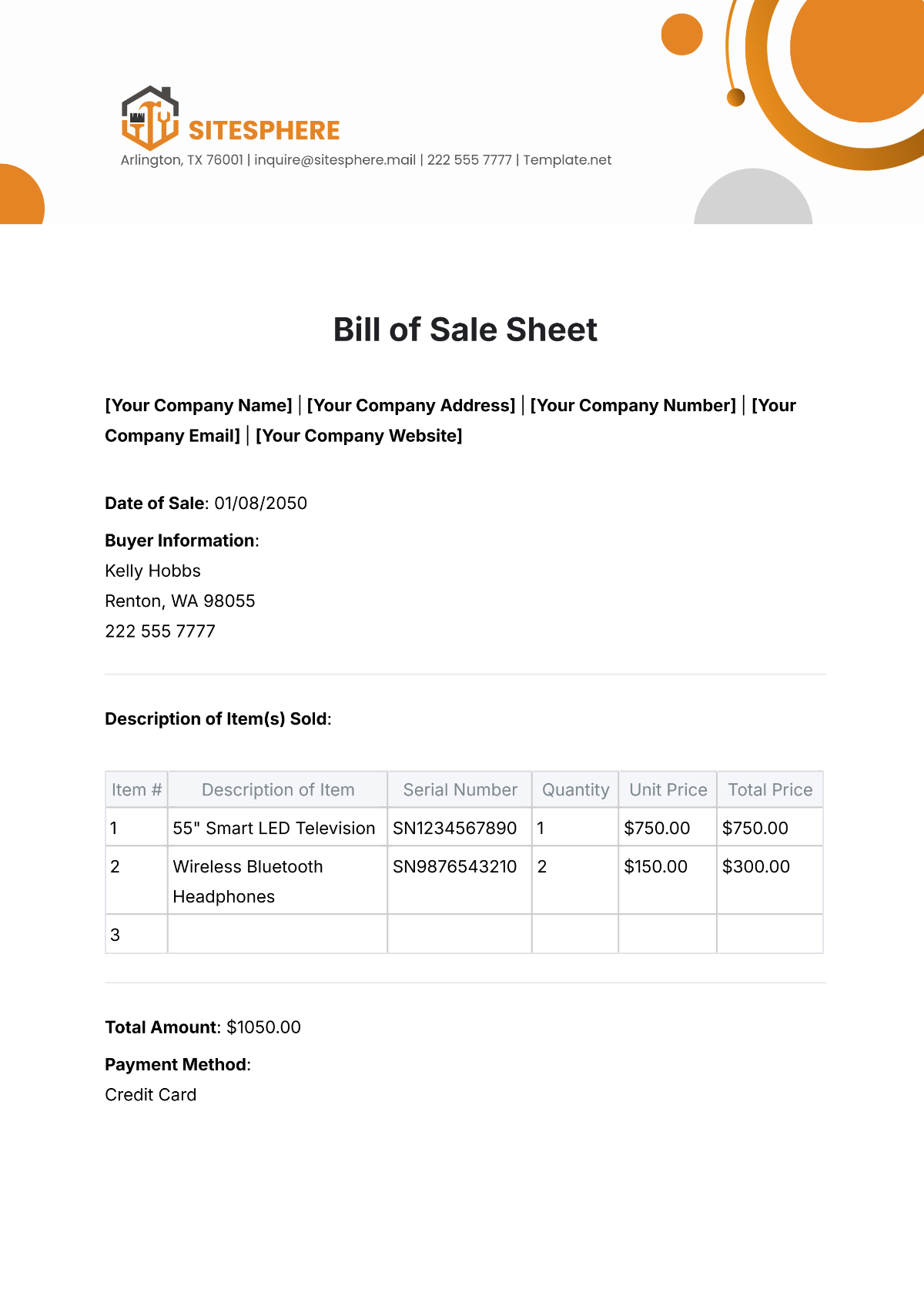

V. Top Holdings

A. Top Holdings (as of December 31, 2050)

Company Name | Ticker Symbol | % of Portfolio |

|---|---|---|

Acme Corporation | ACME | 5.3% |

XYZ International Inc. | XYZ | 4.8% |

Global Enterprises Ltd. | GLOBAL | 4.5% |

Oceanic Holdings Group | OCEAN | 4.2% |

Tech Innovations Limited | TECH | 3.9% |

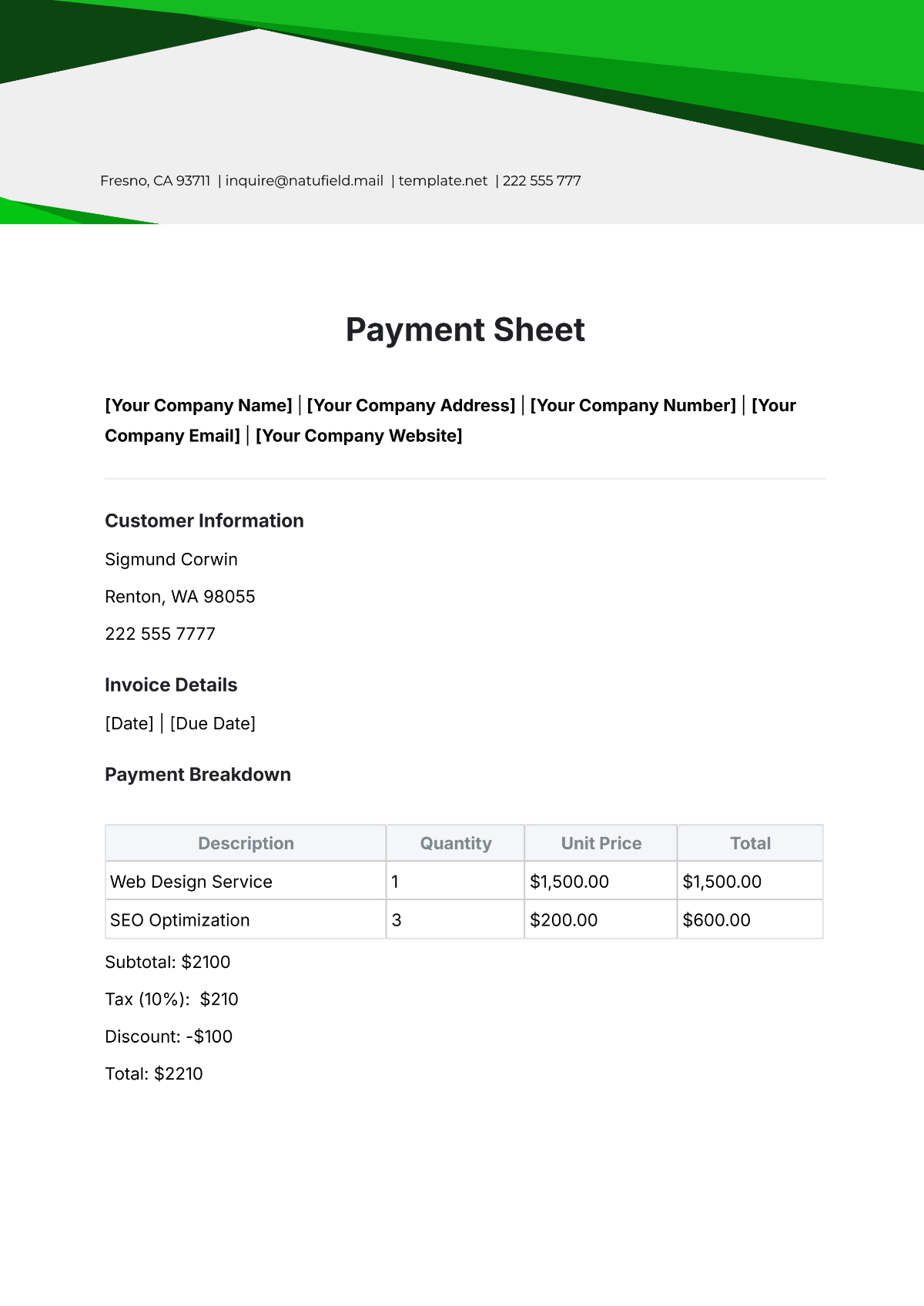

VI. Fees and Expenses

Expense Ratio: 0.75%

Front-End Load: None

Back-End Load: 1.0%

Other Fees: Management fee: 0.50%

VII. Additional Information

Minimum Initial Investment: $1,000

Distribution Policy: Distributions are made quarterly

Tax Considerations: Investors should consult with their tax advisor regarding the tax implications of investing in the fund.

VIII. Conclusion

The [Your Company Name] Floating Rate Fund presents a compelling opportunity for investors seeking current income with the potential for capital appreciation. With a proven investment strategy focused on floating-rate debt securities and a track record of solid performance, this fund aims to meet the needs of individual investors. Investors are encouraged to carefully consider the information provided in this fact sheet before making any investment decisions.

_____________________________________________________________________________________