Non-Binding Term Sheet

I. Overview

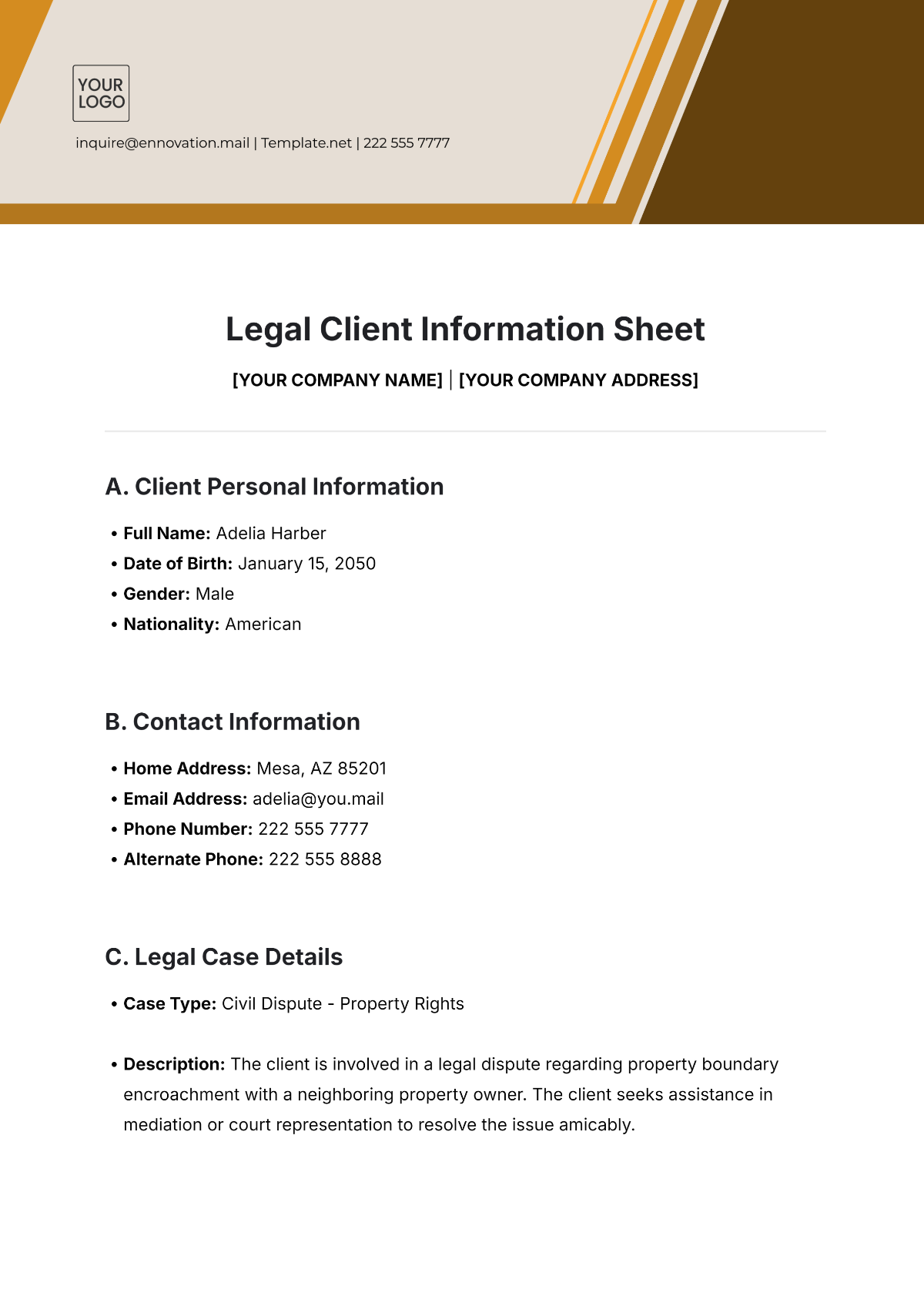

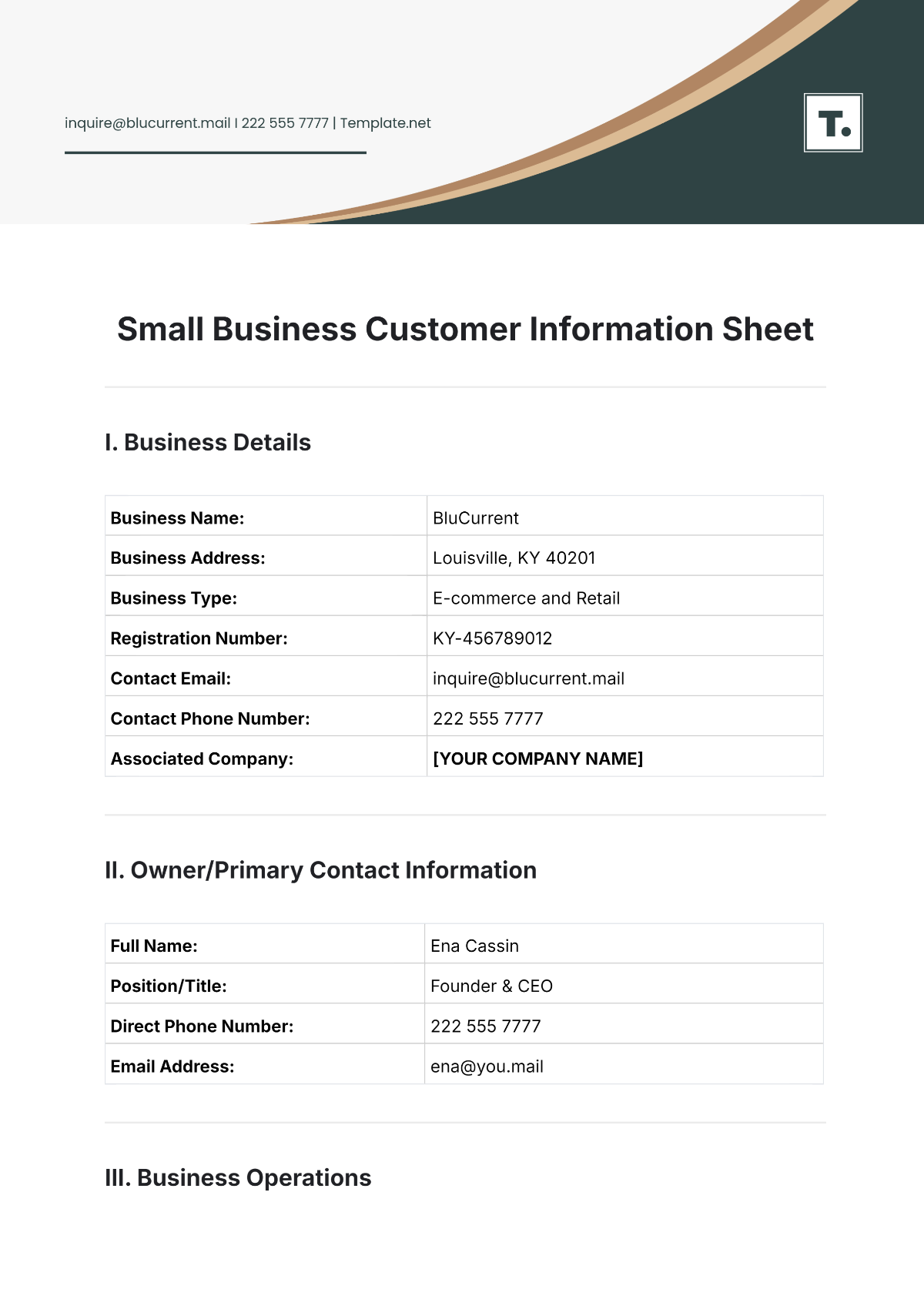

This Non-Binding Term Sheet (hereinafter referred to as "Term Sheet") is intended to outline the principal terms and conditions between [Your Company Name] ("Company") and [Investor Name] ("Investor") concerning a potential transaction.

This Term Sheet serves as a basis for further negotiations and does not constitute a legally binding commitment, except for the clauses related to confidentiality and exclusivity.

The purpose of this Term Sheet is to provide a preliminary framework to guide the due diligence and negotiations process leading to a detailed Definitive Agreement.

The parties agree that no obligation to consummate a transaction shall arise unless and until a final agreement has been executed and delivered by all necessary parties.

II. Transaction Details

The proposed transaction contemplated by this Term Sheet involves an equity investment by the Investor in [Your Company Name] under the following proposed terms:

Investment Amount: $[Amount] USD

Price per Share: $[Amount] USD

Pre-Money Valuation: $[Amount] USD

Type of Securities: Common Stock

Closing Conditions:

Completion of satisfactory due diligence by the Investor.

Execution of a definitive agreement acceptable to both parties.

Receipt of all necessary regulatory approvals.

Other customary closing conditions for transactions of this nature.

III. Use of Proceeds

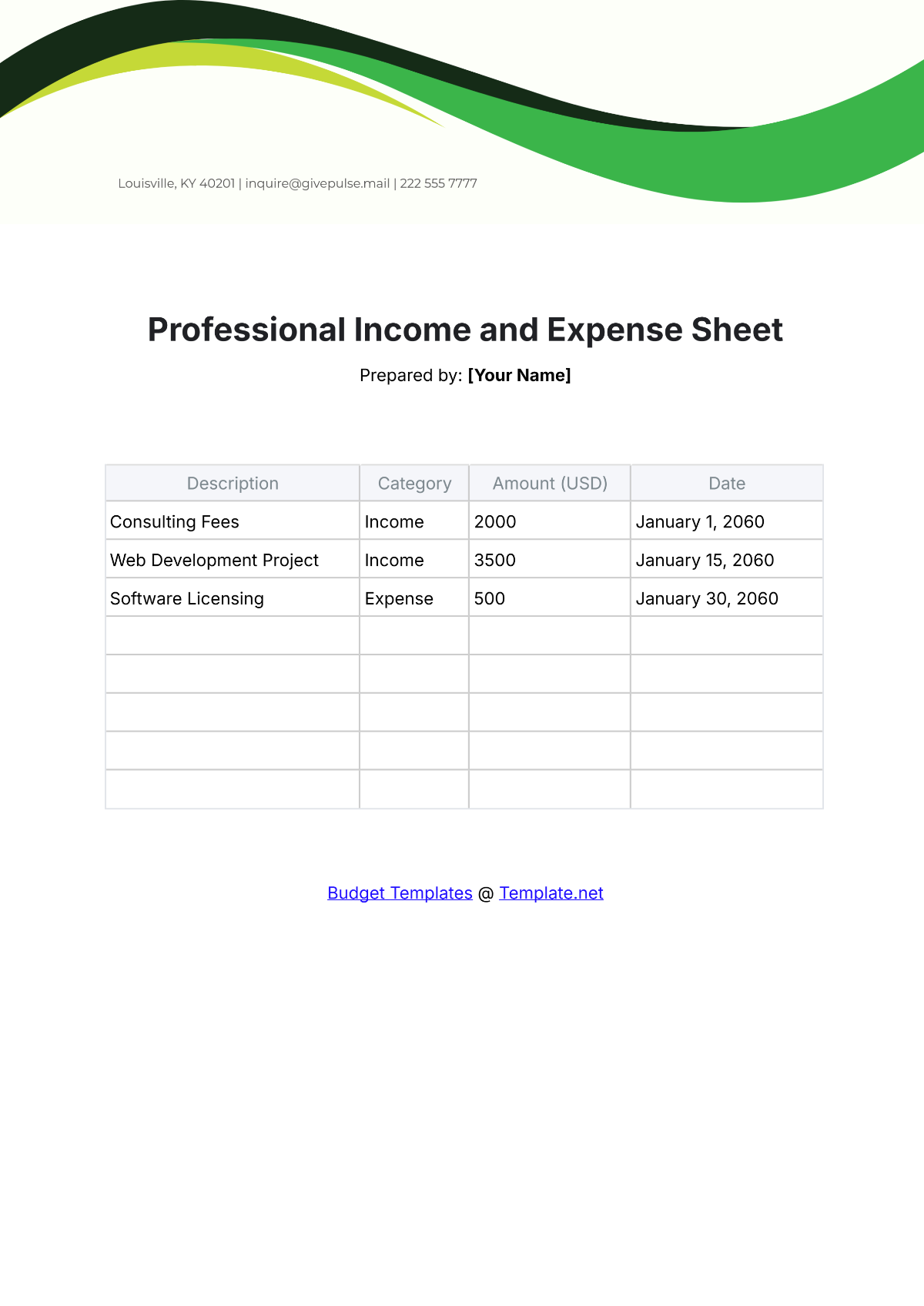

The raised funds will be utilized by [Your Company Name] in the following manner to achieve strategic objectives and enhance overall business growth:

Expansion of operations: $[Amount] USD allocated to open three new regional offices and launch an international marketing campaign to enter new markets.

Research and Development: $[Amount] USD allocated to intensify R&D efforts, particularly in developing a new product line focused on sustainability.

Working Capital: $[Amount] USD to ensure fluid operational capabilities and fund daily expenditures, including payroll and inventory management.

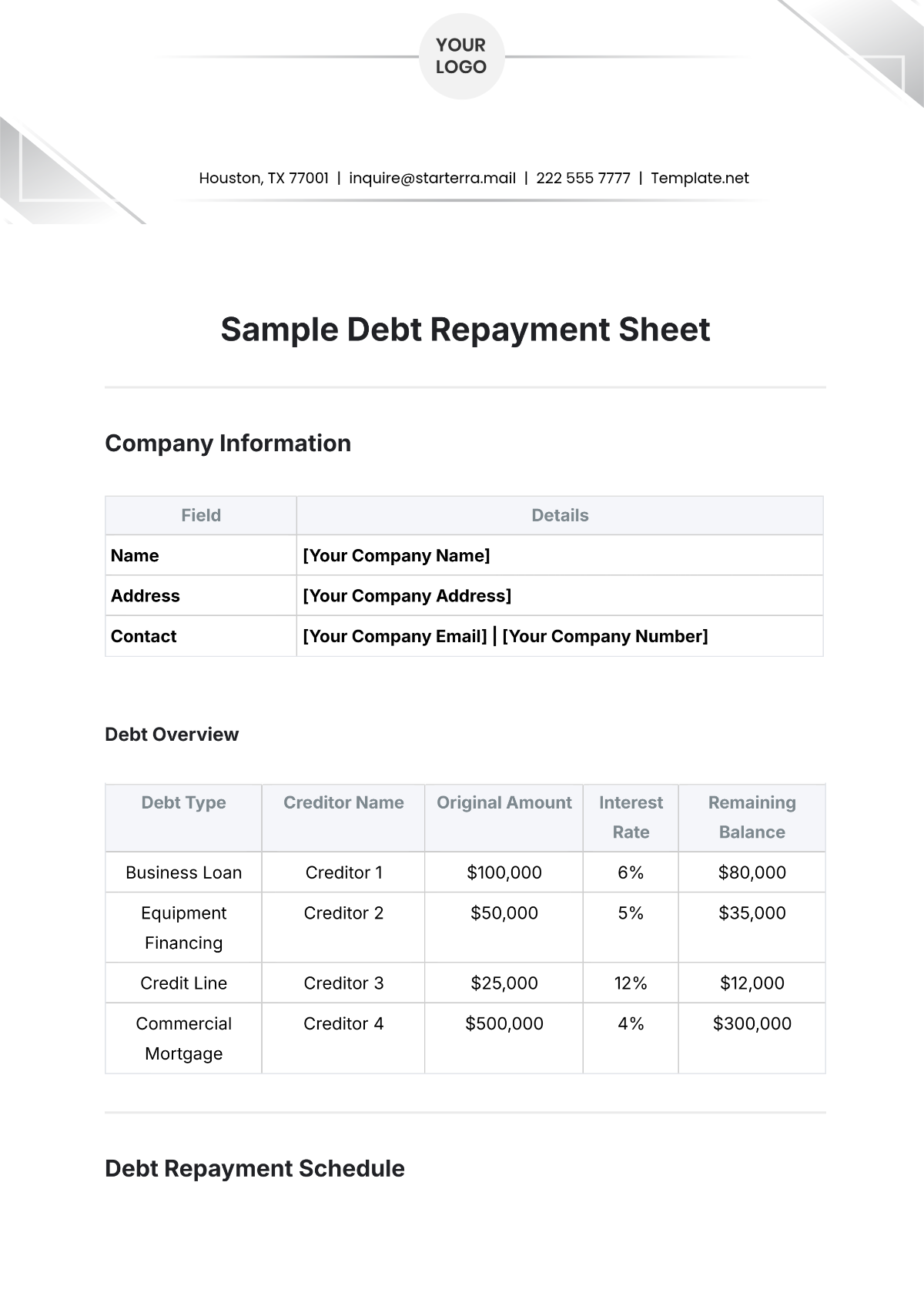

Debt Reduction: $[Amount] USD to reduce leverage and improve balance sheet health by paying off high-interest loans.

IV. Governance

Upon the closing of the transaction, the governance structure of [Your Company Name] will be modified to include provisions beneficial for both [Your Company Name] and the Investor. These provisions typically encompass:

Board Composition: The board will be expanded to include two additional seats, one of which will be filled by a nominee of the Investor. This will result in a total of seven board seats, with the Investor holding one seat.

Voting Rights: The Investor's securities will carry special voting rights, including the right to approve certain strategic decisions such as mergers, acquisitions, and major capital expenditures.

Drag-Along Rights: In the event of a sale of the company, the Investor, as a majority shareholder, will have the right to require minority shareholders to sell their shares on the same terms and conditions as the majority shareholders.

Tag-Along Rights: Minority shareholders, including the Investor, will have the right to join in the sale of shares by majority shareholders, ensuring fair treatment in the event of a sale.

Anti-dilution Protections: The Investor will be protected from dilution of their ownership stake through anti-dilution provisions, which may include adjustments to the conversion price of their securities in certain circumstances, such as subsequent equity issuances at a lower price.

These governance provisions are intended to ensure a fair and transparent governance structure that aligns the interests of both [Your Company Name] and the Investor.

V. Confidentiality

All discussions, agreements, and information exchanged regarding this Term Sheet and subsequent negotiations are considered confidential. Both parties agree not to disclose any information without prior written consent from the other party, unless legally required to do so.

This confidentiality clause shall remain in effect irrespective of whether the transaction is successfully concluded or not.

A definitive agreement will be drafted to include detailed confidentiality obligations enforceable by law.

VI. Exclusivity

[Your Company Name] agrees to not solicit or engage in negotiations with any other party concerning the proposed transaction for a period of [Duration] from the date of this agreement.

This exclusivity clause is intended to ensure good faith negotiations between [Your Company Name] and [Investor Name].

In the event that a transaction is not consummated within the agreed period, both parties are free to pursue other opportunities without any restrictions.

VII. No Binding Offer

This Term Sheet is not and should not be considered a binding offer by either party. The terms discussed herein are solely for the purpose of negotiation and may be subject to change as both parties work towards a Definitive Agreement.

The final transaction will only be binding if a Definitive Agreement is executed and delivered by both [Your Company Name] and [Investor Name].

Acceptance of this Term Sheet must be acknowledged by both parties through their authorized representatives and does not constitute a commitment to proceed to a definitive transaction.