PRIVATE LENDING TERM SHEET

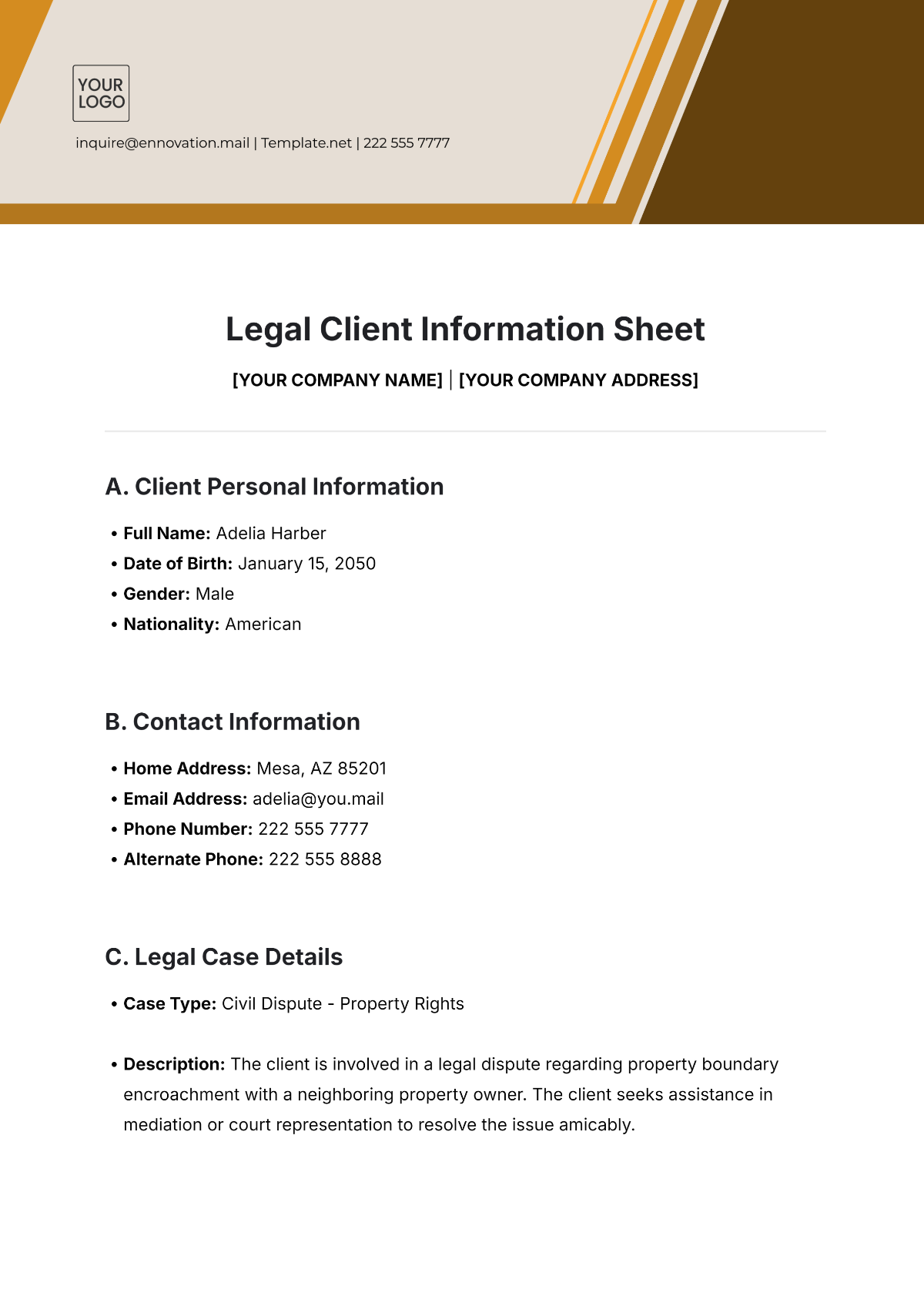

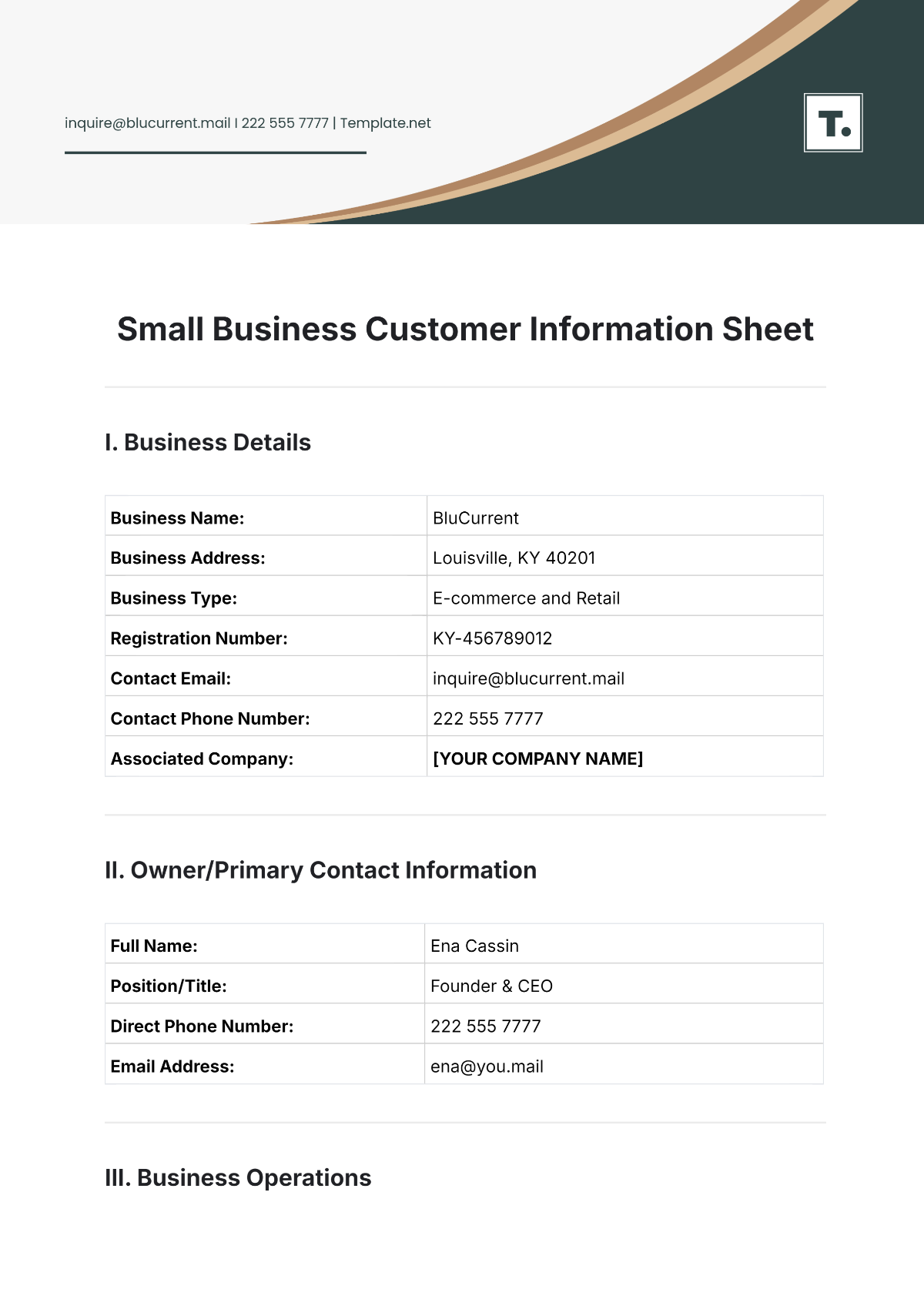

I. Parties

This section is specifically devoted to the task of identifying the key stakeholders who are involved in the arrangement concerning the lending process.

Lender: ABC Capital Ventures LLC

Borrower: XYZ Industries Inc.

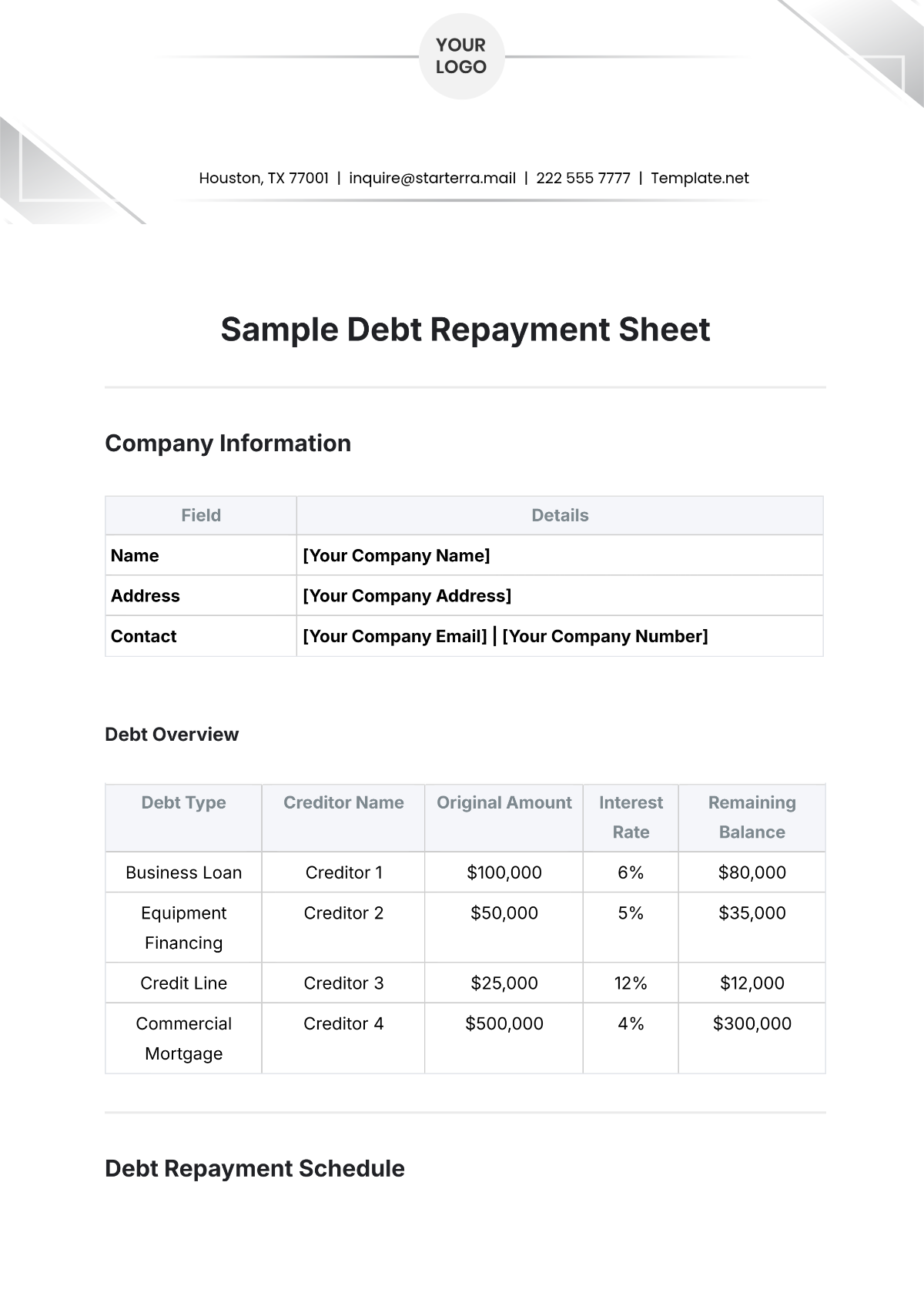

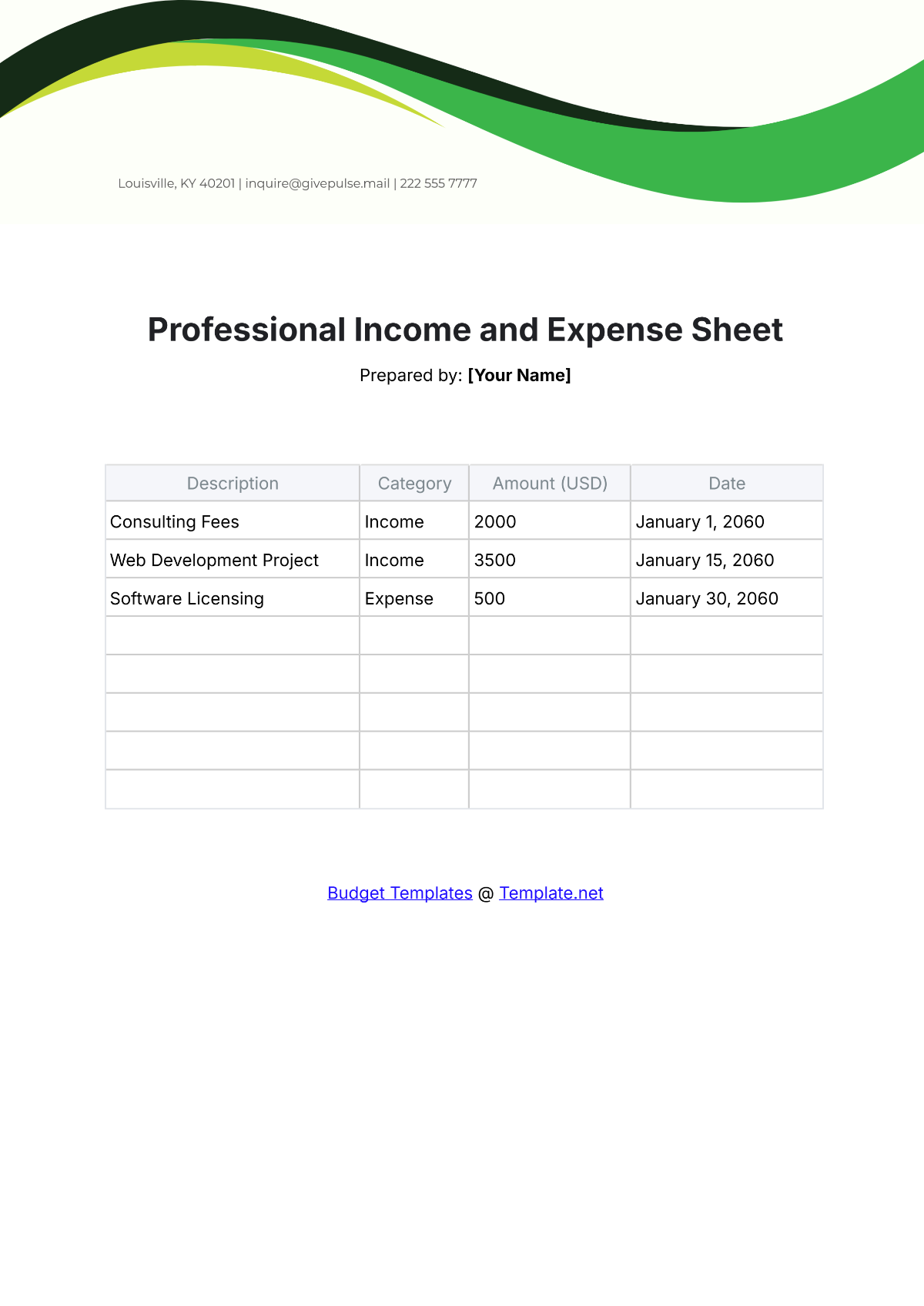

II. Loan Details

Here, the specifics of the loan are laid out.

Loan Amount: USD 500,000

Interest Rate: 6% per annum

Term: 36 months

Repayment Terms: Monthly installments of USD 15,000 via bank transfer.

III. Collateral

If any collateral is provided to secure the loan, it should be described here.

Collateral Type: Commercial real estate

Value: USD 700,000

Description: A 10,000-square-foot office building located at [LOCATION].

IV. Default Provisions

This section outlines the consequences of default and the actions the lender can take.

Default Events: The inability or failure to consistently make payments over a period that spans two consecutive months.

Remedies: The lender possesses the authority to initiate foreclosure proceedings on the collateral in the event of default.

Penalties: A late payment fee, amounting to 5% of the total overdue balance, will be charged.

V. Prepayment

Details regarding the borrower's ability to repay the loan are outlined here.

Prepayment Option: Yes, with a prepayment penalty.

Prepayment Penalty: 2% of the remaining principal balance if prepaid within the first 24 months.

VI. Conditions Precedent

Conditions that must be met before loan disbursement are listed here.

Due Diligence: This condition entails the thorough examination or investigation that a lender conducts before finalizing a loan agreement. Specifically, the lender requires the financial statements for the past three years from the borrower. This allows the lender to assess the financial health and stability of the borrower, evaluate their ability to repay the loan and mitigate risks associated with the lending arrangement. Financial statements typically include balance sheets, income, and cash flow statements, providing insights into the borrower's profitability, liquidity, and overall financial performance over the specified period.

Documentation: Once due diligence is completed and satisfactory, the next condition is the preparation and signing of the necessary legal documents. This typically includes a loan agreement outlining the terms and conditions of the loan, such as the principal amount, interest rate, repayment schedule, and any collateral or security provided by the borrower. Additionally, mortgage documents may be required if the loan is secured by real estate property. These documents serve to formalize the lending arrangement, establish the rights and obligations of both parties, and provide legal recourse in case of default or breach of contract.

VII. Governing Law

The jurisdiction and laws governing the agreement are specified in this section.

Jurisdiction: State of New York, United States

Governing Law: New York State law

VIII. Confidentiality

Provisions for maintaining confidentiality are included in this section.

Confidential Information: All information on finances and business matters, which is revealed throughout negotiating this agreement, shall be fully exchanged and thoroughly deliberated upon.

Non-Disclosure: The Borrower hereby agrees and commits that they shall not reveal, divulge, or make available any confidential information to any third parties unless they have obtained prior written consent to do so.

Exceptions: Information that is already available in the public domain or that must be disclosed due to legal obligations imposed by law enforcement agencies.