Early Stage Financing Term Sheet

I. Introduction

This Term Sheet outlines the preliminary terms under which [Your Company Name] (“Company”) and the [Investor's Name] (“Investors”) intend to execute an investment. This document serves as a foundation for further negotiations, aiming to simplify the upcoming detailed legal documentation and negotiation process. The purpose of this Term Sheet is to establish a mutual understanding of the primary terms and conditions proposed for the investment.

II. Basic Information

Company Name: [Your Company Name]

Company Address: [Your Company Address]

Investor: [Investor's Name/Entity]

Date: [Date]

III. Investment Details

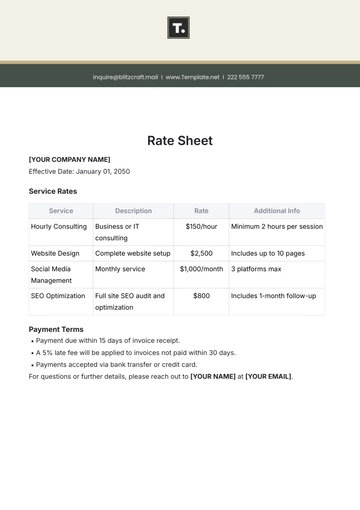

Clause | Details |

|---|

Type of Investment | Equity/Convertible Notes (as agreed upon) |

Amount of Investment | [Investment Amount] |

Valuation of Company | [Pre-Money Valuation or Post-Money Valuation] |

Investment Rounds | Seed/Series A/Series B etc. |

This section of the Term Sheet specifies the nature and details of the investment proposed. It outlines the financial commitment from the Investors and the equity stake offered by the Company. The valuation method agreed upon should reflect the current and potential value of the Company, recognizing both the risks and the opportunities involved.

IV. Terms of the Agreement

The following terms are designed to protect the interests of both the Company and the Investors:

Voting Rights: Detail the voting rights assigned to the investors, if any.

Liquidation Preferences: Specifies how the proceeds will be distributed among shareholders in the event of liquidation.

Anti-Dilution Protection: Protects the Investors from dilution in future funding rounds by adjusting the price per share.

Board Composition: Details regarding the composition of the Board of Directors.

These terms are crucial as they define the governance structure of the Company post-investment and the economic rights of the investors. These terms must be discussed in detail to align the interests of the Company with those of the Investors, ensuring long-term success.

V. Conditions Precedent and Covenants

Conditions precedent are conditions that must be met for the transaction to proceed. These might include but are not limited to due diligence outcomes, approval from the Board of Directors, and compliance with applicable laws and regulations. Covenants imposed on the Company could include operational or financial benchmarks that the Company agrees to meet throughout the investment period.

Typical covenants may cover areas such as:

Financial reporting obligations

Operational performance targets

Restrictions on further fundraising activities

VI. Confidentiality and Exclusivity

The Terms enclosed within this document are confidential and are intended solely for the negotiating parties. Both parties agree to not disclose the information to third parties without mutual consent. Furthermore, exclusivity terms may restrict the Company from engaging in discussions with other potential investors for a specified period to enable focused negotiations with the current Investor.

Exclusivity helps in streamlining the investment process and ascertain dedicated interest from both parties. It is typically negotiated to last a period that allows ample time for due diligence and detailed contract preparation without unduly hindering the Company’s operational capabilities.

VII. Binding Effect and Termination

This Term Sheet, except for the confidentiality and exclusivity clauses, is not legally binding. Either party can terminate negotiations at any point if the terms are not agreeable. It is essential, however, to communicate such decisions transparently and promptly to maintain professional integrity and avoid unnecessary expenditures.

Final agreements and contracts will replace this Term Sheet once all parties consent to the detailed terms through respective legal counsel and due diligence is satisfactorily completed.

VIII. Signature

By signing below, the parties agree to the terms outlined in this Term Sheet as the basis for further negotiations:

Name: [Your Name]

Title: [Your Title]

Date: [Date]

Name: [Investor's Name]

Title: [Investor's Title]

Date: [Date]

Term Sheet Templates @ Template.net