Market Fund Term Sheet

I. Introduction

This Market Fund Term Sheet ("Term Sheet") outlines the terms and conditions governing investment in the [Your Company Name] (the "Fund"). The Fund is managed by [Your Name], a [Type of Entity] registered with [Regulatory Authority]. This document provides prospective investors with key information about the Fund's investment objectives, strategies, fees, redemption terms, and other important details.

II. Investment Objectives

The Fund aims for long-term capital growth by investing in high-potential companies across diverse sectors and regions, focusing on emerging markets.

Identifying and investing in innovative companies with disruptive technologies or business models that have the potential for exponential growth.

Employing active management strategies to capitalize on market inefficiencies and mispricing, with a focus on fundamental analysis and thorough due diligence.

Maintaining a flexible investment approach to adapt to changing market conditions and capitalize on emerging investment opportunities while managing risk through portfolio diversification and rigorous risk management practices.

III. Key Terms and Conditions

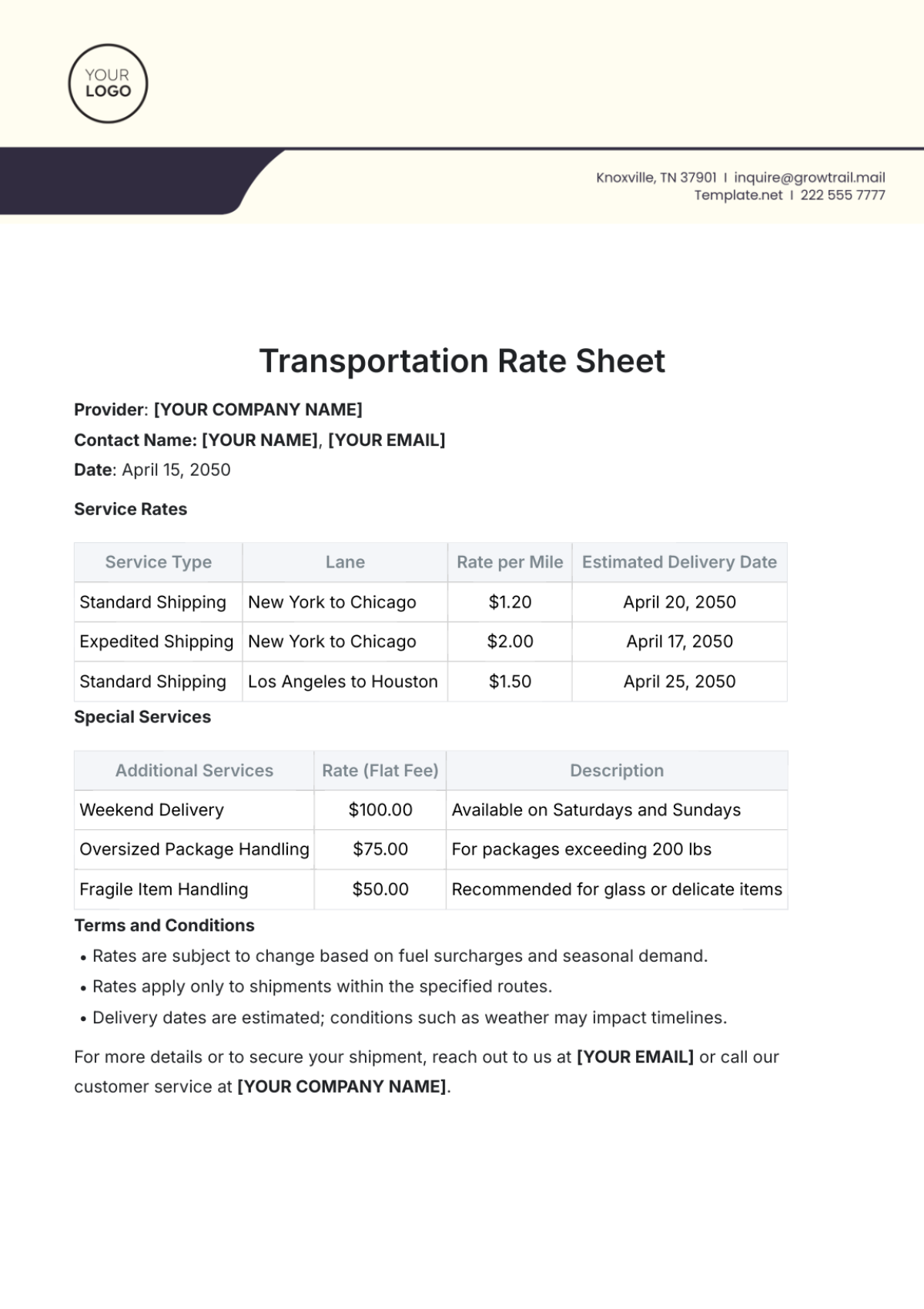

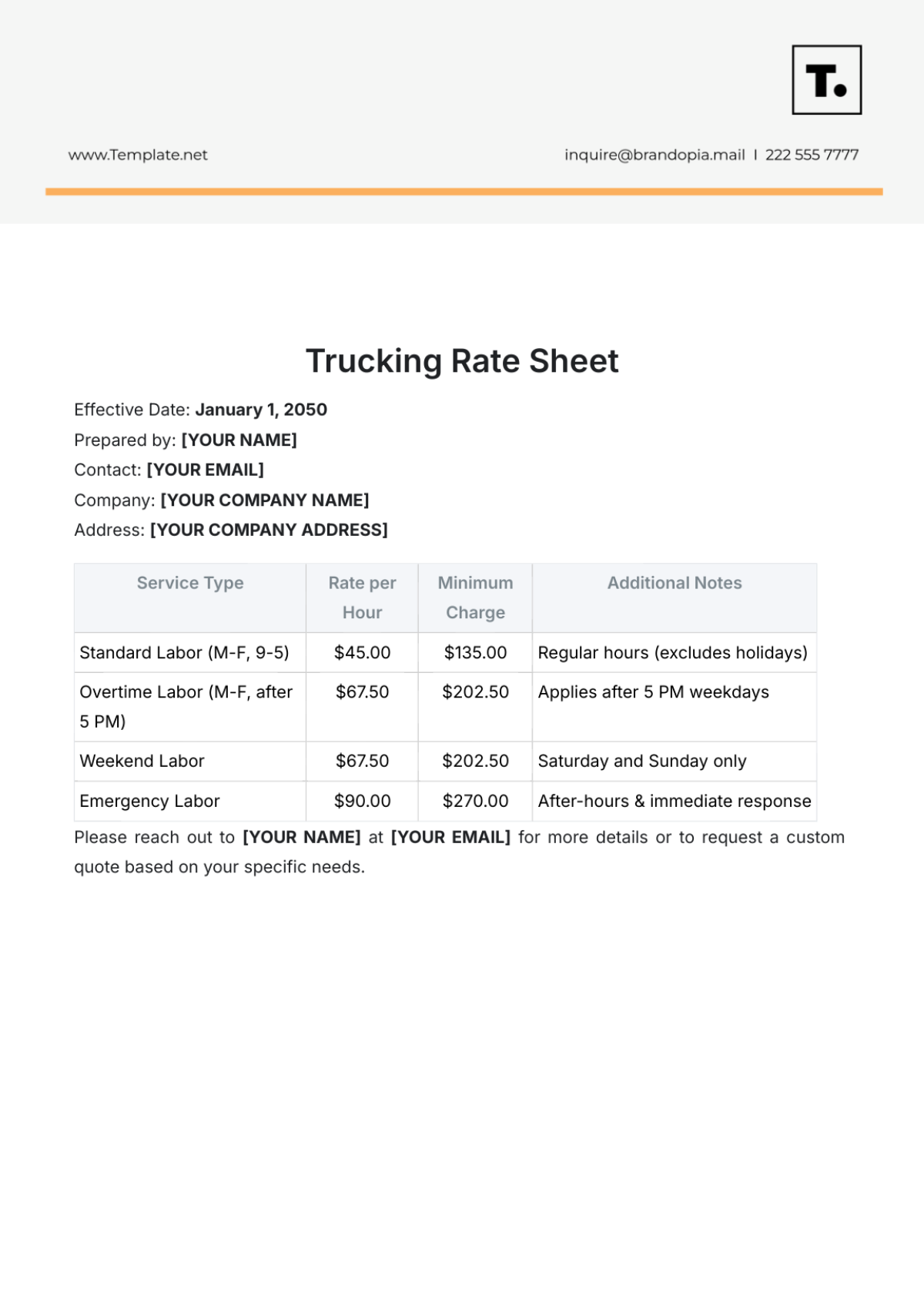

A. Fee Structure

The fee structure for investing in the Fund is as follows:

Fee Type | Description |

|---|---|

Management Fee | 1.5% annually of total assets under management |

Performance Fee | 20% of profits exceeding a Hurdle Rate of 8% |

Other Fees | Portfolio transaction fees for trading securities. |

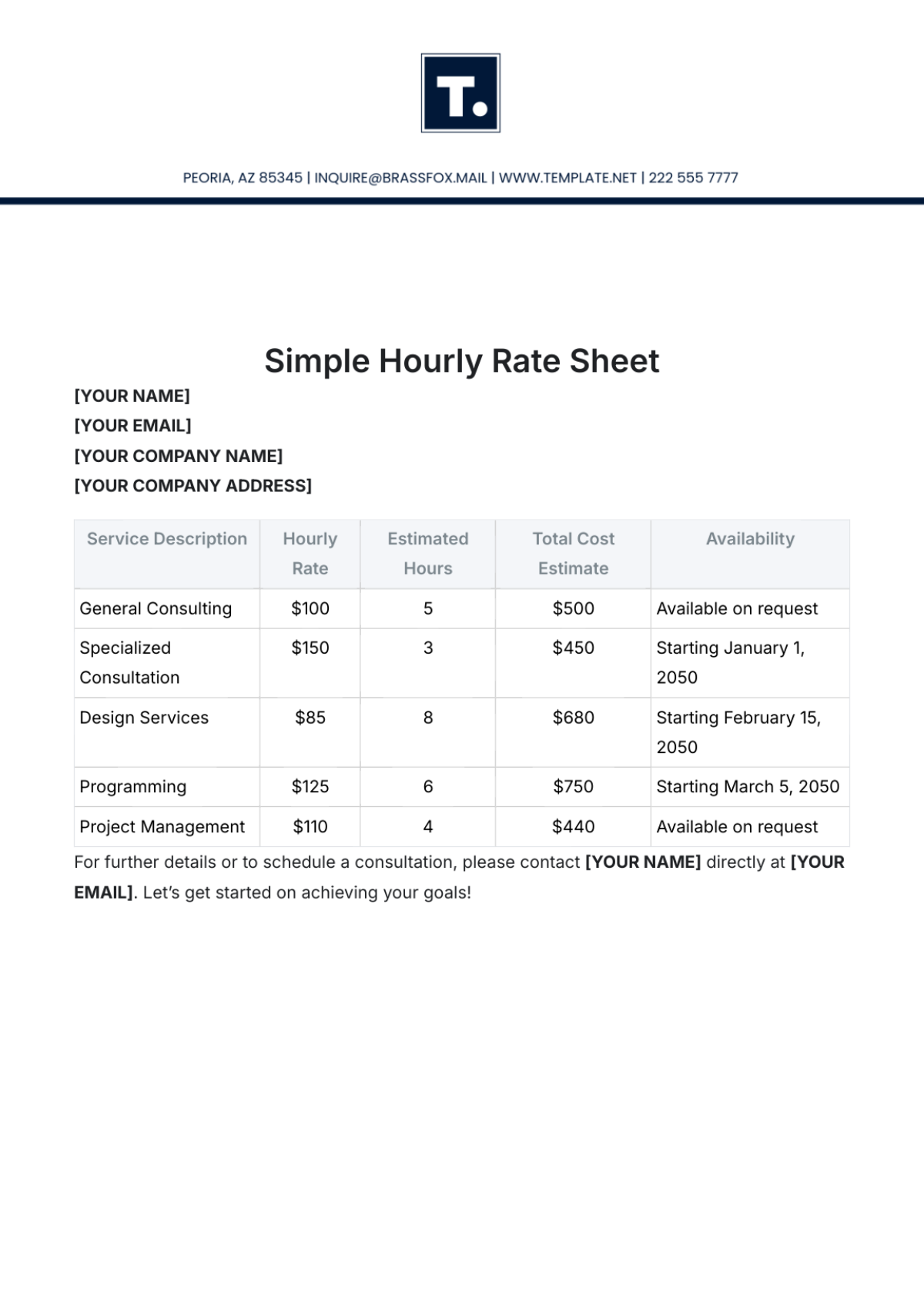

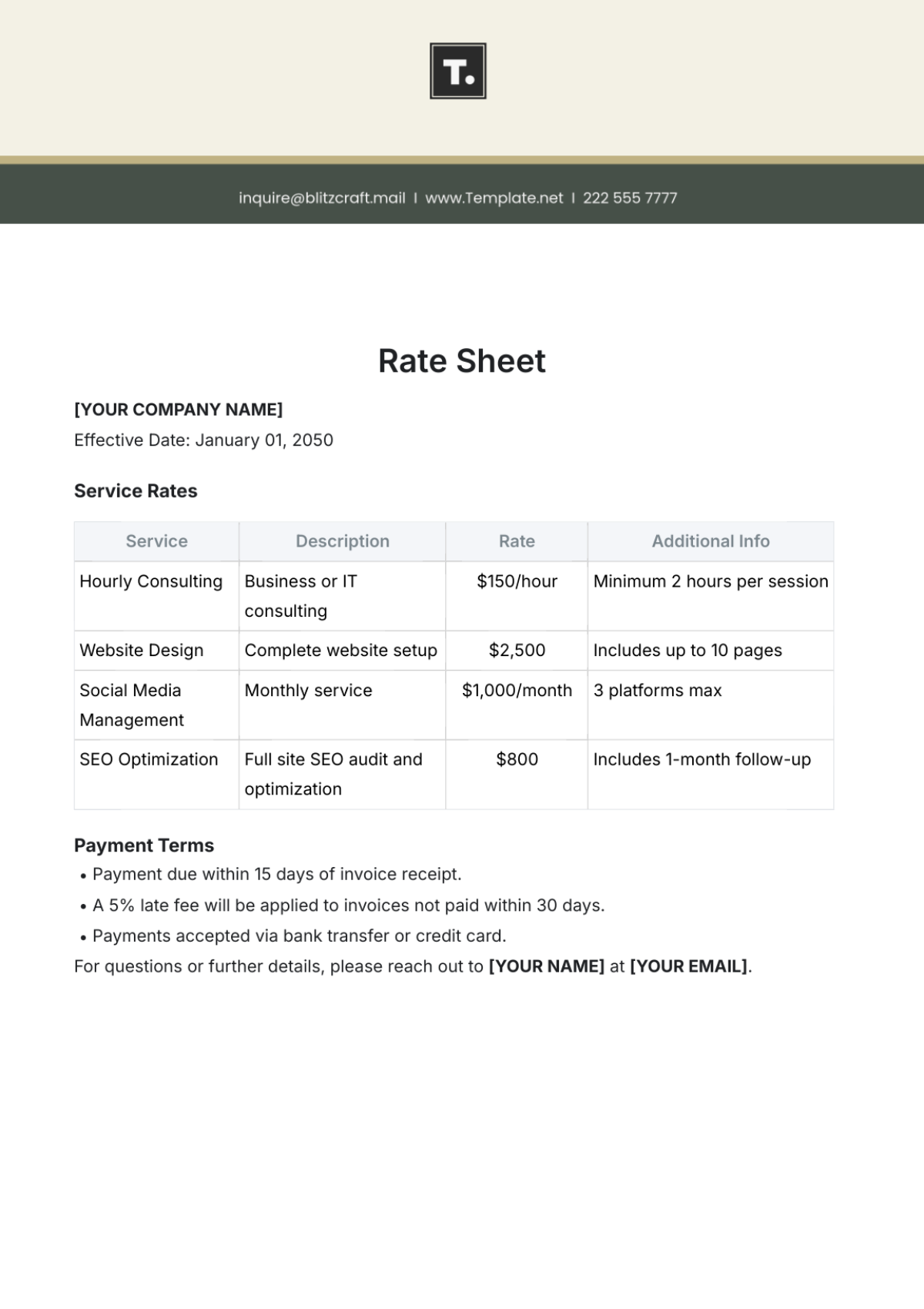

B. Redemption Terms

Investors may redeem their shares in the Fund subject to the following terms:

Redemption Frequency: Quarterly redemption windows, with requests processed at the end of each calendar quarter.

Notice Period: Investors must provide a notice period of 30 days before the redemption date.

Redemption Fees: No redemption fees are applicable.

Minimum Redemption Amount: The minimum redemption amount is [$10,000] or equivalent in the fund's base currency.

IV. Risk Factors

Investing in the Fund involves certain risks. Prospective investors should carefully consider the following risk factors before making an investment decision:

Market Risk: Fluctuations in the financial markets may affect the value of the Fund's investments.

Liquidity Risk: The Fund may face challenges in selling investments at desired prices due to market conditions.

Regulatory Risk: Changes in regulations may impact the Fund's operations and investment strategy.

V. Legal and Regulatory Information

The Fund operates by [Jurisdiction] regulations and is subject to oversight by [Regulatory Authority]. Investors are encouraged to review the Fund's offering documents and consult with legal or financial advisors for further information on regulatory compliance and legal considerations.