Free Company Fund Term Sheet

I. Overview

This Term Sheet outlines the principal terms under which [Investor Name] ("Investor") plans to invest in [Your Company Name] ("Company") and serves as a non-binding preliminary agreement to facilitate further negotiations. Final investment terms will be detailed and finalized after thorough due diligence and legal review.

Both parties agree that this Term Sheet is strictly confidential and any discussions or information shared as part of this negotiation shall not be disclosed to third parties without prior written consent from both [Investor Name] and [Your Company Name].

II. Financial Terms

The proposed financial terms outlined below detail the investment amount, valuation of the company, and the equity to be offered:

Investment Amount: $1,000,000

Pre-Money Valuation: $5,000,000

Percentage Ownership: 20%

Type of Security: Preferred Stock, Convertible Notes

If Preferred Stock:

Dividend Rate: 8%

Liquidation Preference: 1x

If Convertible Notes:

Conversion Price: $1.00 per share

Maturity Date: December 31, 2050

Final valuations will be determined based on due diligence findings. In the scenario where adjustments are necessary, both parties agree to negotiate in good faith to reach a mutually beneficial agreement.

III. Use of Proceeds

The investment amount will be strategically allocated to facilitate the growth and development of [Your Company Name]. Specific allocations will include, but are not limited to, the following areas:

Research and Development: The provision of financial resources for the development of new products, the advancement of technology, and the creation and protection of intellectual property.

Marketing and Sales Expansion: The company is making investments in several strategic areas, including the development and implementation of marketing campaigns, the expansion of the sales team, and the execution of strategies to increase market penetration.

Operational Enhancements: Enhancing and upgrading the existing infrastructure, optimizing and streamlining various processes, and working towards improving and augmenting the overall operational efficiency.

New Hires: Recruitment of key talent across various departments to support growth initiatives and strengthen organizational capabilities.

Details regarding specific allotments and target milestones tied to the fund usage will be elaborated in the Definitive Agreements.

IV. Rights & Restrictions

Investor rights associated with this transaction are crafted to protect the investment while supporting the operational flexibility of [Your Company Name]:

Board Representation: The number of board seats that will be allocated shall be determined based on an ownership percentage of 20 percent.

Voting Rights: Investors shall have voting rights proportional to their ownership percentage as per the applicable laws and corporate governance principles.

Dividends: Dividends shall be paid annually at a rate of 20X% based on profits available for distribution, subject to board discretion.

Anti-dilution Protections: In the event of future equity issuances at a lower valuation, investors shall be entitled to anti-dilution protections through a weighted average or full ratchet mechanism, as agreed upon.

Exit Rights: Investors shall have preferential returns on their initial investment in the event of specific exit scenarios, such as acquisition or IPO, ensuring a prioritized return on investment.

Additional investor rights such as information rights, first refusal, co-sale agreement, drag-along, and tag-along rights will be stipulated in the Definitive Agreements.

V. Conditions & Milestones

Completion of this investment is subject to various prerequisites and milestones which ensure the readiness and commitment of both [Your Company Name] and [Investor Name] towards a successful partnership:

Successful completion of financial and legal due diligence by [Date]: Both parties agree to complete thorough financial and legal due diligence processes by [Date]. This includes reviewing financial records, legal documents, and any other relevant information necessary for the investment decision.

Approval from Securities Commission (if applicable): If required by relevant regulatory bodies both parties agree to obtain necessary approvals before finalizing the investment.

Achievement of agreed-upon business metrics by [Date]. Both parties agree on specific business metrics revenue targets, and product milestones that must be achieved by [Date]. These metrics serve as indicators of the company's growth and readiness for investment.

Execution of Definitive Agreements: Both parties agree to negotiate, finalize, and execute Definitive Agreements outlining the detailed terms of the investment, including but not limited to investor rights, obligations, and governance structure, by [Date].

Both parties shall endeavor to satisfy all conditions promptly to ensure a smooth investment process and foster the long-term success of [Your Company Name].

VI. Legal & Binding Agreement

This Term Sheet is intended to serve as a preliminary outline of the terms of the proposed investment and is not a legally binding contract. The terms are subject to modifications following a more detailed legal and financial review. The final and binding terms will be outlined in the Definitive Agreements to be negotiated and executed by both parties.

Any disputes arising out of this Term Sheet or the subsequent Definitive Agreements will be resolved via arbitration in [Arbitration Location] under the rules of [Arbitration Association].

VII. Miscellaneous

Confidentiality: Both parties agree to maintain the confidentiality of all information shared during negotiations and due diligence, except as required by law or with prior written consent.

Governing Law: This agreement and any disputes arising from it shall be governed by and construed following the laws of [Jurisdiction], without regard to its conflict of law principles.

Notices: Any notices or communications required or permitted under this agreement shall be in writing and delivered to the respective parties at their addresses as provided in the agreement or as subsequently communicated in writing.

Amendment and Waiver: Any amendment or waiver of terms under this agreement must be in writing and signed by both parties. The failure of either party to enforce any provision of this agreement shall not constitute a waiver of that provision or any other provision.

Severability: If any provision of this agreement is found to be invalid or unenforceable, the remaining provisions shall continue in full force and effect.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

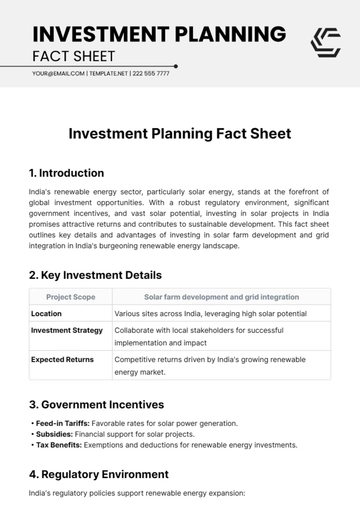

Discover the Company Fund Term Sheet Template on Template.net. This customizable and editable template streamlines fundraising efforts with sections for investment terms, funding details, and governance provisions. Editable in our Ai Editor Tool, it ensures a structured agreement for successful fund allocation, providing clarity and transparency to stakeholders throughout the fundraising process for optimal outcomes.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet