Free Senior Loan Term Sheet

I. Overview

This Term Sheet outlines the principal terms and conditions proposed for the Senior Loan to be extended to [Your Company Name] ("Borrower") by [Lender Name] ("Lender"). This document serves as a preliminary agreement and will be followed by a definitive loan agreement that elaborates on the terms herein in greater detail. This Term Sheet is intended to facilitate further discussions and does not constitute a legally binding obligation until a full agreement is executed by all parties.

Borrower: [Your Company Name]

Lender: [Lender Name]

Purpose of Loan: The funds will be used for [Specify Purpose of Loan, e.g., working capital, expansion, debt refinancing].

Date of Issue: [Date]

II. Loan Amount and Disbursement

Total Loan Amount: The total loan amount will be [Specify Loan Amount].

Disbursement Schedule: The loan amount will be disbursed as follows:

First Disbursement: [Specify Amount] on [Specify Date]

Subsequent Disbursements: Based on milestones agreed between [Your Company Name] and [Lender Name].

Final Disbursement: To be made by [Specify Date], subject to fulfillment of conditions set forth in this Term Sheet.

III. Interest Rate and Repayment Terms

Interest Rate: The loan will carry an interest rate of [Specify Interest Rate]% per annum.

Interest Calculation: Interest will be calculated on a 360-day year basis and charged on the actual outstanding balance.

Repayment Schedule:

Repayment will commence [Specify Period, e.g., six months] after the first disbursement.

The loan will be repaid in [Specify Number] equal quarterly installments of principal plus accrued interest, starting [Specify Start Date].

IV. Security and Covenants

Collateral: The loan will be secured by [Specify Collateral, e.g., property, equipment, inventory].

Covenants: [Your Company Name] agrees to maintain the following financial ratios throughout the term of the loan:

Debt to Equity Ratio: Not to exceed [Specify Ratio]

Current Ratio: Minimum of [Specify Ratio]

Additional Security: [Your Company Name] will provide [Additional Security Measures] if specific performance targets are not met.

V. Conditions Precedent to Disbursement

Legal and Regulatory Approvals: All necessary legal and regulatory approvals must be obtained prior to any disbursement of the loan funds.

Due Diligence: Completion of satisfactory due diligence by [Lender Name], including but not limited to financial, legal, and operational aspects of [Your Company Name].

Documentation: Execution of definitive loan documentation including but not limited to a Loan Agreement, Security Agreement, and any other related documents.

VI. Representations and Warranties

Accuracy of Information: [Your Company Name] represents and warrants that all financial statements and other information provided to [Lender Name] are true, accurate, and complete.

Compliance with Laws: [Your Company Name] warrants that it is and will remain in compliance with all laws and regulations applicable to its operations and the use of the loan funds.

VII. Miscellaneous

Governing Law: This Term Sheet and the ensuing loan documents will be governed by the laws of [Specify Jurisdiction].

Confidentiality: Both parties agree to keep the terms of this loan and all related negotiations confidential.

Amendment: This Term Sheet can only be amended in writing signed by both parties.

This Term Sheet is intended to outline the fundamental terms of a Senior Loan and facilitate further negotiation towards a definitive agreement. Please review carefully and provide feedback or confirmation of the terms so that we may proceed to finalize the loan documentation.

Name: [Your Name]

Date: [Date Signed]

Name: [Lender's Name]

Date: [Date Signed]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial agreements with our Senior Loan Term Sheet Template, offered by Template.net. This customizable and downloadable template ensures precision and professionalism in drafting your terms. Easily editable in our AI Editor Tool, it's also printable for your convenience. Ideal for banks, financial institutions, and private lenders, this template saves time and enhances clarity in every transaction.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

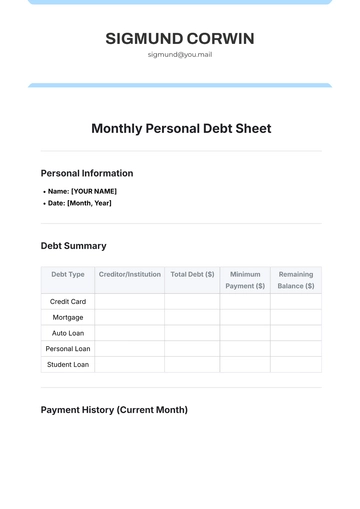

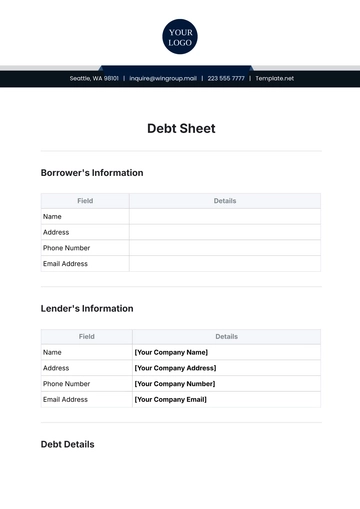

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet