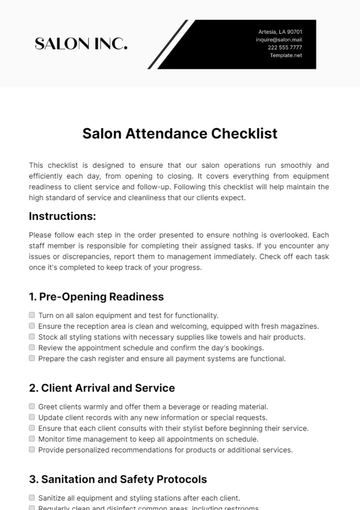

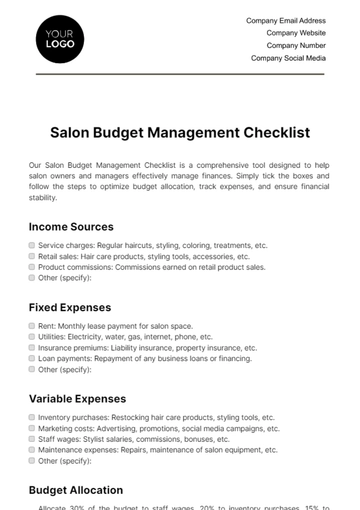

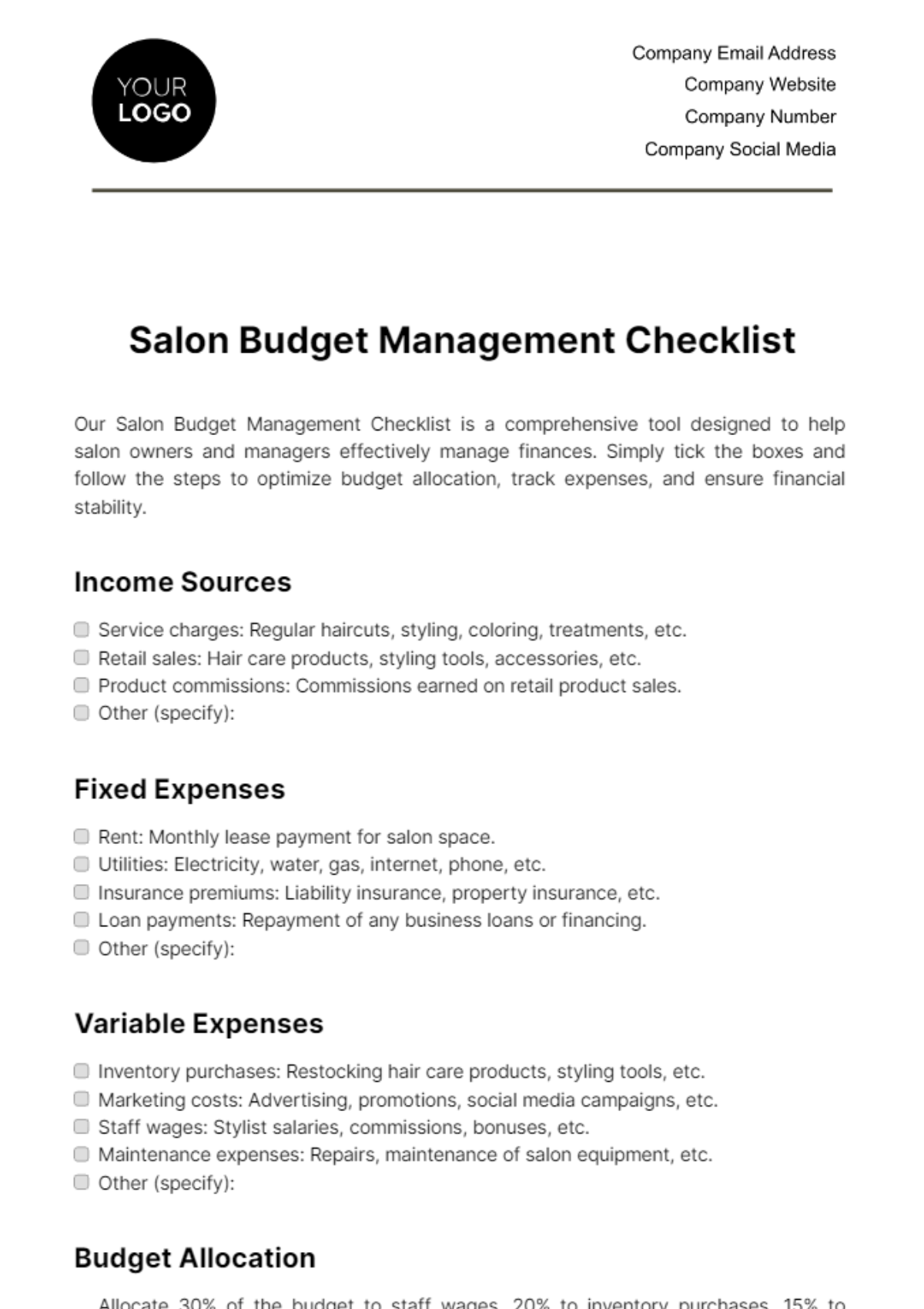

Free Salon Budget Management Checklist

Our Salon Budget Management Checklist is a comprehensive tool designed to help salon owners and managers effectively manage finances. Simply tick the boxes and follow the steps to optimize budget allocation, track expenses, and ensure financial stability.

Income Sources

Service charges: Regular haircuts, styling, coloring, treatments, etc.

Retail sales: Hair care products, styling tools, accessories, etc.

Product commissions: Commissions earned on retail product sales.

Other (specify):

Fixed Expenses

Rent: Monthly lease payment for salon space.

Utilities: Electricity, water, gas, internet, phone, etc.

Insurance premiums: Liability insurance, property insurance, etc.

Loan payments: Repayment of any business loans or financing.

Other (specify):

Variable Expenses

Inventory purchases: Restocking hair care products, styling tools, etc.

Marketing costs: Advertising, promotions, social media campaigns, etc.

Staff wages: Stylist salaries, commissions, bonuses, etc.

Maintenance expenses: Repairs, maintenance of salon equipment, etc.

Other (specify):

Budget Allocation

Allocate 30% of the budget to staff wages, 20% to inventory purchases, 15% to marketing costs, 10% to rent, and 25% to other expenses.

Base budget allocation on previous year's performance, increasing marketing budget by 10% to boost client acquisition efforts.

Adjust budget allocation quarterly based on revenue trends and business priorities, reallocating funds as needed to optimize performance.

Forecasting

Use a combination of historical data, industry benchmarks, and market research to forecast a 10% increase in revenue for the upcoming year.

Incorporate seasonal trends and upcoming promotions to forecast revenue spikes during peak months.

Collaborate with department heads to develop department-specific forecasts, ensuring accuracy and alignment with overall business goals.

Monitoring and Tracking

Implement a weekly review process to track expenses against budgeted amounts, identifying any discrepancies or areas of concern promptly.

Utilize accounting software with built-in budget tracking features to automate monitoring and provide real-time insights into financial performance.

Assign a dedicated staff member to oversee budget monitoring and reporting, providing regular updates to management on key financial metrics.

Adjustments

Conduct monthly budget review meetings with department heads to assess performance and make necessary adjustments to budget allocations.

Establish a contingency fund equivalent to 5% of the total budget to cover unexpected expenses without disrupting planned expenditures.

Implement a zero-based budgeting approach annually, requiring each expense to be justified from scratch to ensure optimal resource allocation.

Contingency Planning

Identify potential risks and their financial implications, such as equipment breakdowns or sudden changes in market conditions, and develop contingency plans to mitigate these risks.

Establish relationships with multiple vendors for critical supplies to minimize the impact of supply chain disruptions and price fluctuations.

Create a cash reserve equivalent to three months' worth of fixed expenses to provide a buffer in case of revenue downturns or unforeseen emergencies.

Profitability Analysis

Conduct a monthly review of key performance indicators (KPIs) such as profit margin, average transaction value, and client retention rate to identify areas for improvement.

Perform a cost-volume-profit (CVP) analysis to determine the breakeven point and evaluate the impact of changes in sales volume or pricing on profitability.

Benchmark salon performance against industry standards and competitors to identify opportunities for cost optimization and revenue growth.

Communication and Collaboration

Hold quarterly budget review meetings with all staff members to solicit feedback, share financial insights, and foster a sense of ownership and accountability.

Establish clear channels of communication for budget-related inquiries and suggestions, such as a dedicated email address or suggestion box, to encourage staff participation in the budgeting process.

Provide training workshops on budget management and financial literacy for all staff members to enhance their understanding of the salon's financial goals and how their roles contribute to overall success.

Training and Education

Offer online courses or seminars on budgeting best practices and financial management for salon managers and department heads to enhance their skills and decision-making capabilities.

Implement cross-training initiatives to ensure that all staff members have a basic understanding of budgeting principles and can contribute to cost-saving efforts in their respective roles.

Provide access to financial management tools and resources, such as budget templates and calculators, to empower staff members to take a proactive approach to budget management and expense tracking.

Review and Audit

Conduct quarterly financial audits to verify the accuracy of financial records, identify potential areas of fraud or error, and ensure compliance with accounting standards and regulations.

Schedule annual budget performance reviews with an external financial advisor or consultant to gain impartial insights and recommendations for improving budget management practices.

Implement a peer review process where department heads review each other's budget performance and provide constructive feedback to drive continuous improvement and accountability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your salon's financial health with the Salon Budget Management Checklist Template from Template.net. This editable and customizable tool empowers you to efficiently allocate resources, track expenses, and ensure profitability. With the intuitive AI Editor Tool, managing your salon's budget has never been easier. Optimize your financial strategy and streamline operations with this essential template.

You may also like

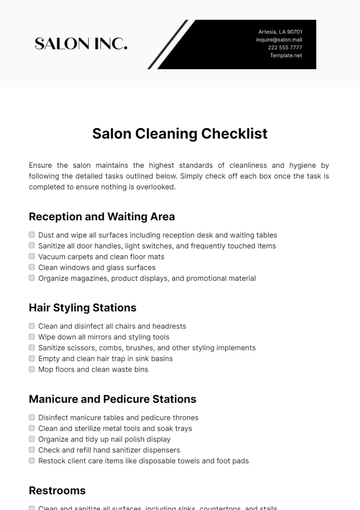

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist