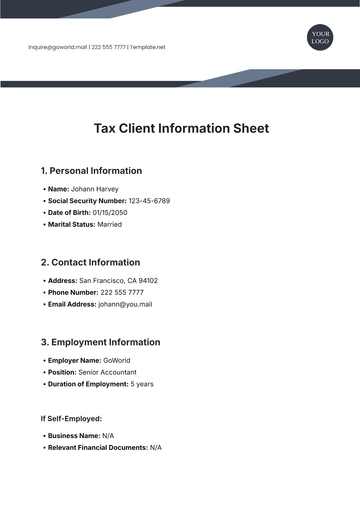

Free Tax Client Datasheet

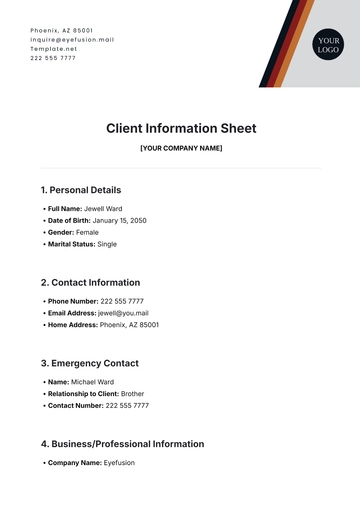

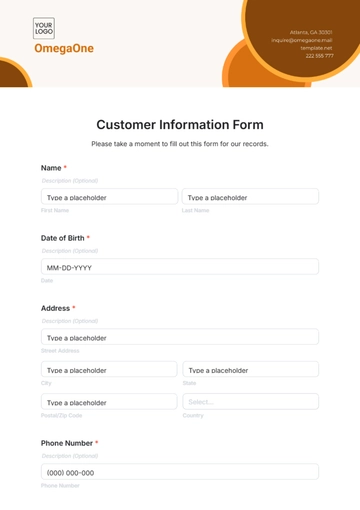

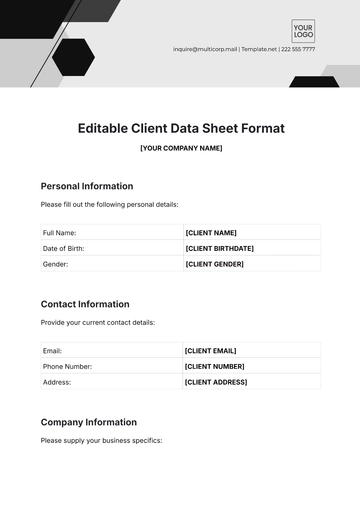

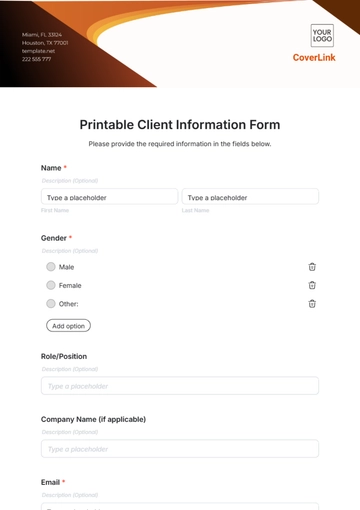

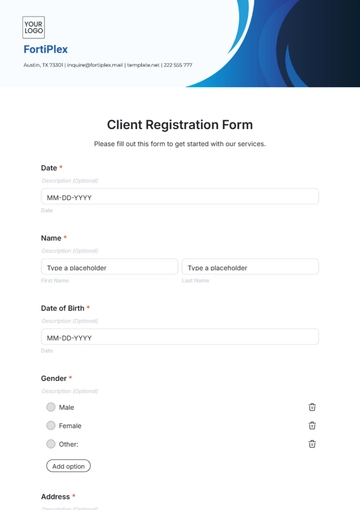

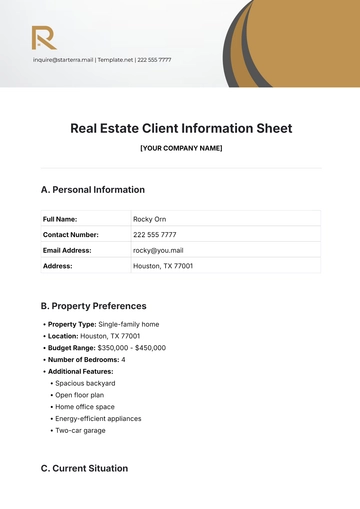

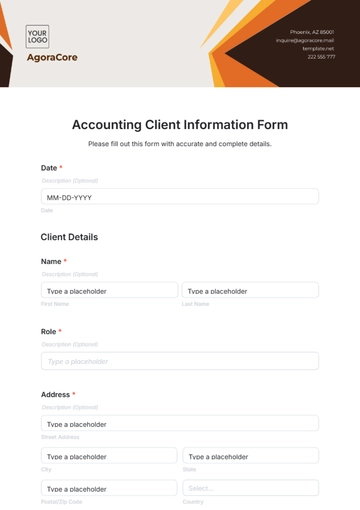

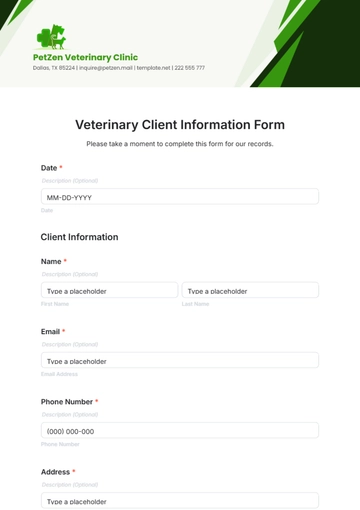

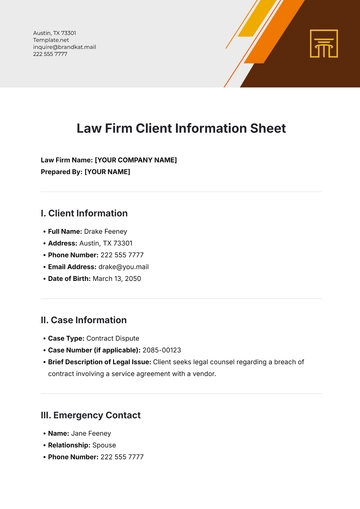

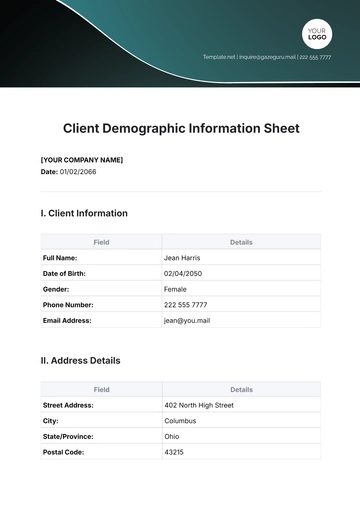

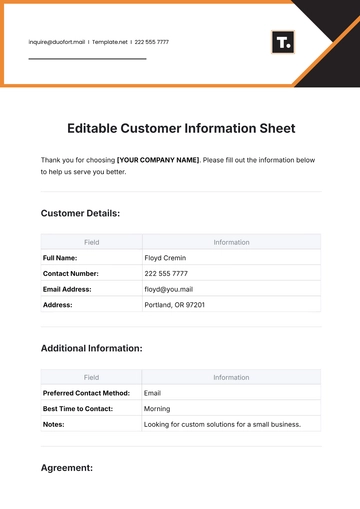

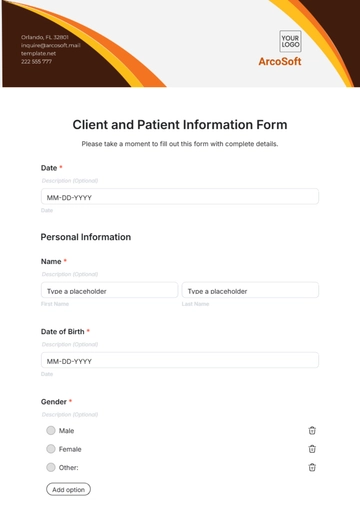

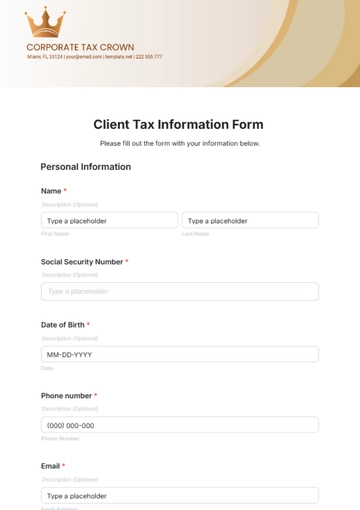

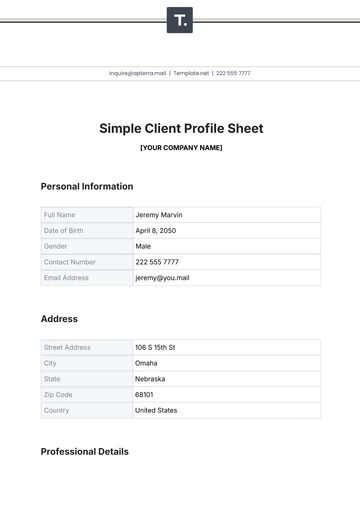

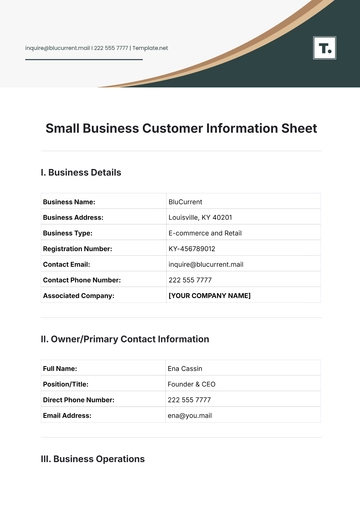

I. Client Information

When managing tax clients, it's imperative to have comprehensive information at hand to ensure efficient handling of their tax affairs. The following details should be collected and maintained for each client:

Client Name: [Your Name]

Contact Information: [Your Email]

Business Type: Sole Proprietorship

Tax Identification Number (TIN): 123-45-6789

Address: [Your Company Address]

Additionally, it's crucial to note any specific preferences or instructions provided by the client regarding their tax filings or related matters.

II. Tax Filing History

Understanding a client's tax filing history provides valuable insights into their financial situation and tax compliance. Here's how to document their filing history:

Understanding a client's tax filing history provides valuable insights into their financial situation and tax compliance. Here's how to document their filing history:

Previous Years' Tax Returns: 2050, 2051, 2052

Filing Status: Married Filing Jointly

Tax Credits and Deductions Claimed: Child Tax Credit, Mortgage Interest Deduction

By reviewing past filings, we can identify trends, anticipate future needs, and ensure accurate and timely submissions.

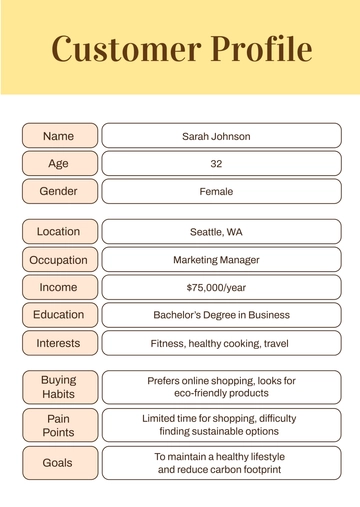

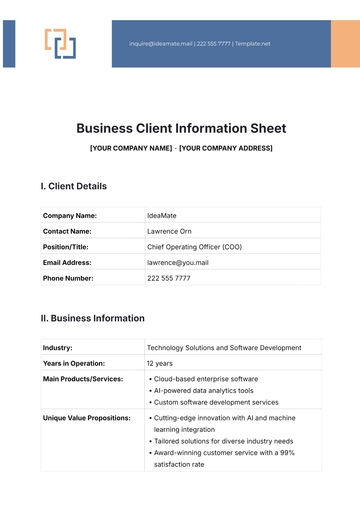

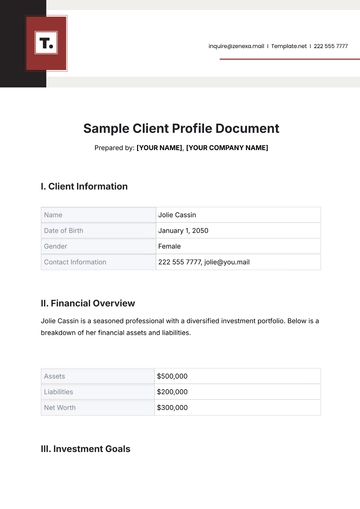

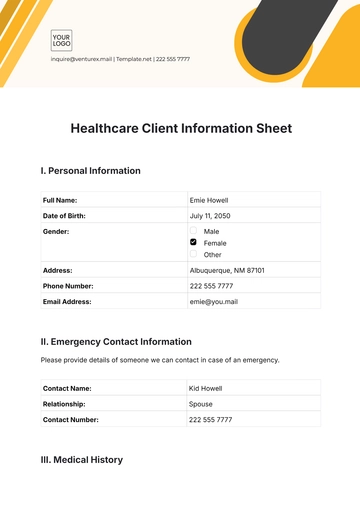

III. Financial Information

Gathering comprehensive financial information is essential for preparing accurate tax returns and providing strategic tax planning advice. This includes:

A. Income Sources

Employment Income: $70,000

Business Income: $20,000

Investment Income: $5,000

Rental Income: $10,000

B. Deductions and Credits

Itemized Deductions: $12,000 (including charitable contributions, mortgage interest, etc.)

Tax Credits: $1,000 (Child Tax Credit)

Maintaining up-to-date financial records enables us to maximize deductions and credits while minimizing tax liabilities.

IV. Compliance Documents

Ensuring compliance with tax laws and regulations requires meticulous documentation. Here's what to include:

W-2 and 1099 Forms: Available

Business Financial Statements: Available

Receipts and Invoices: Organized electronically

By keeping compliance documents organized and accessible, we can streamline the tax preparation process and mitigate the risk of audits.

TABLE 1: Tax Client Checklist

Tasks | Status |

|---|---|

Gather client information | [✓] |

Review tax filing history | [✓] |

Collect financial information | [✓] |

Ensure compliance documents are complete | [✓] |

TABLE 2: Tax Credits and Deductions Summary

Category | Amount |

|---|---|

Charitable Contributions | $5,000 |

Mortgage Interest | $7,000 |

Education Expenses | $0 |

Retirement Contributions | $0 |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

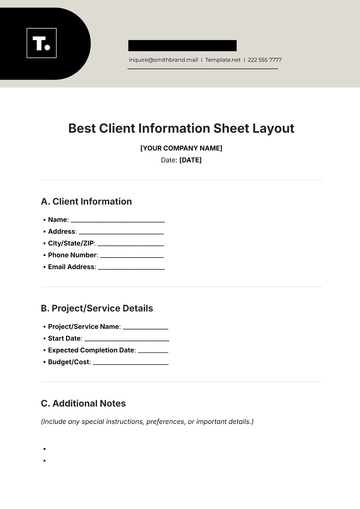

A Tax Client Datasheet is a document that contains detailed information about a client's tax situation, obligations, filings, and related financial data. It serves as a comprehensive reference tool for tax professionals to efficiently manage and address their clients' tax needs.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet