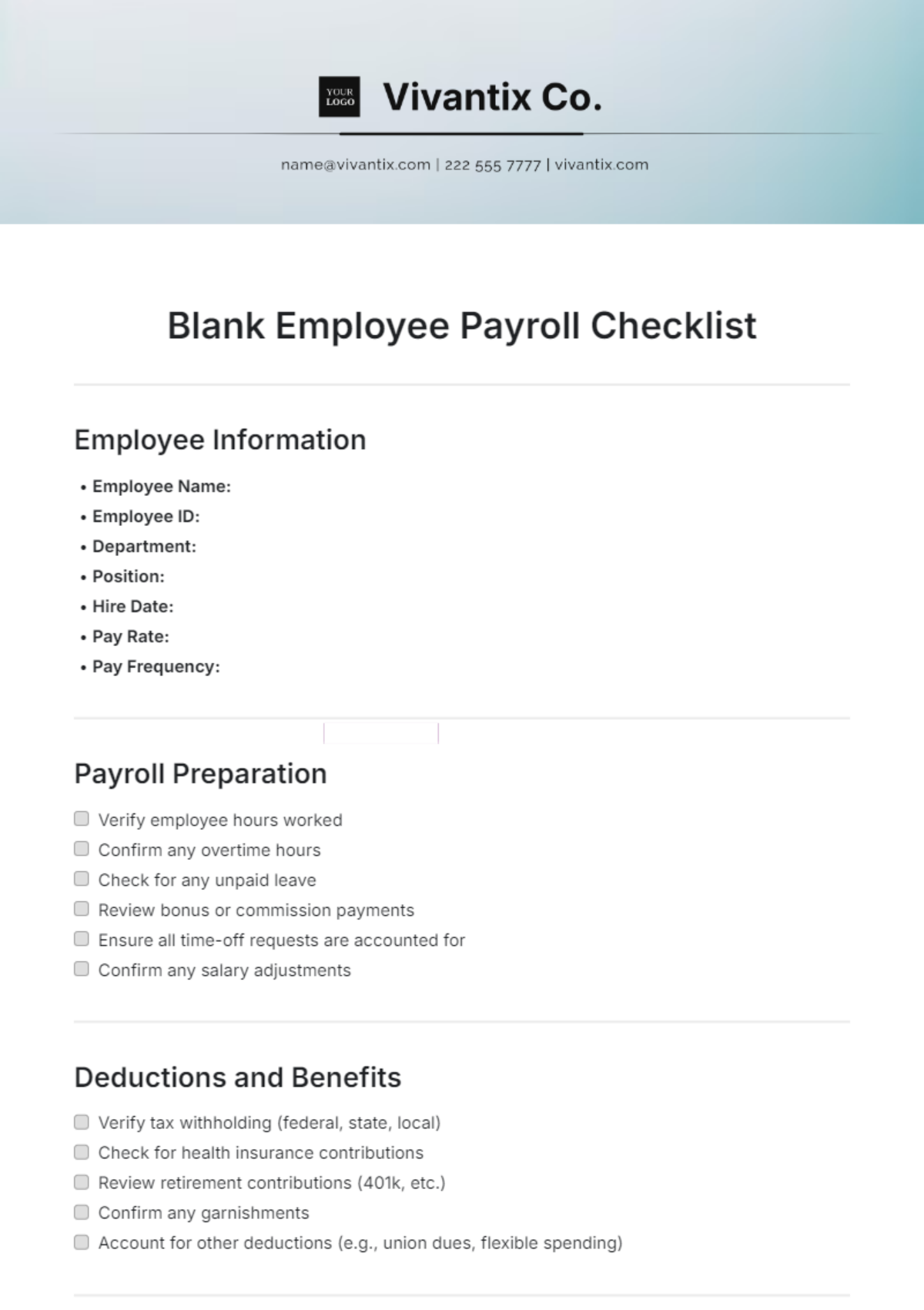

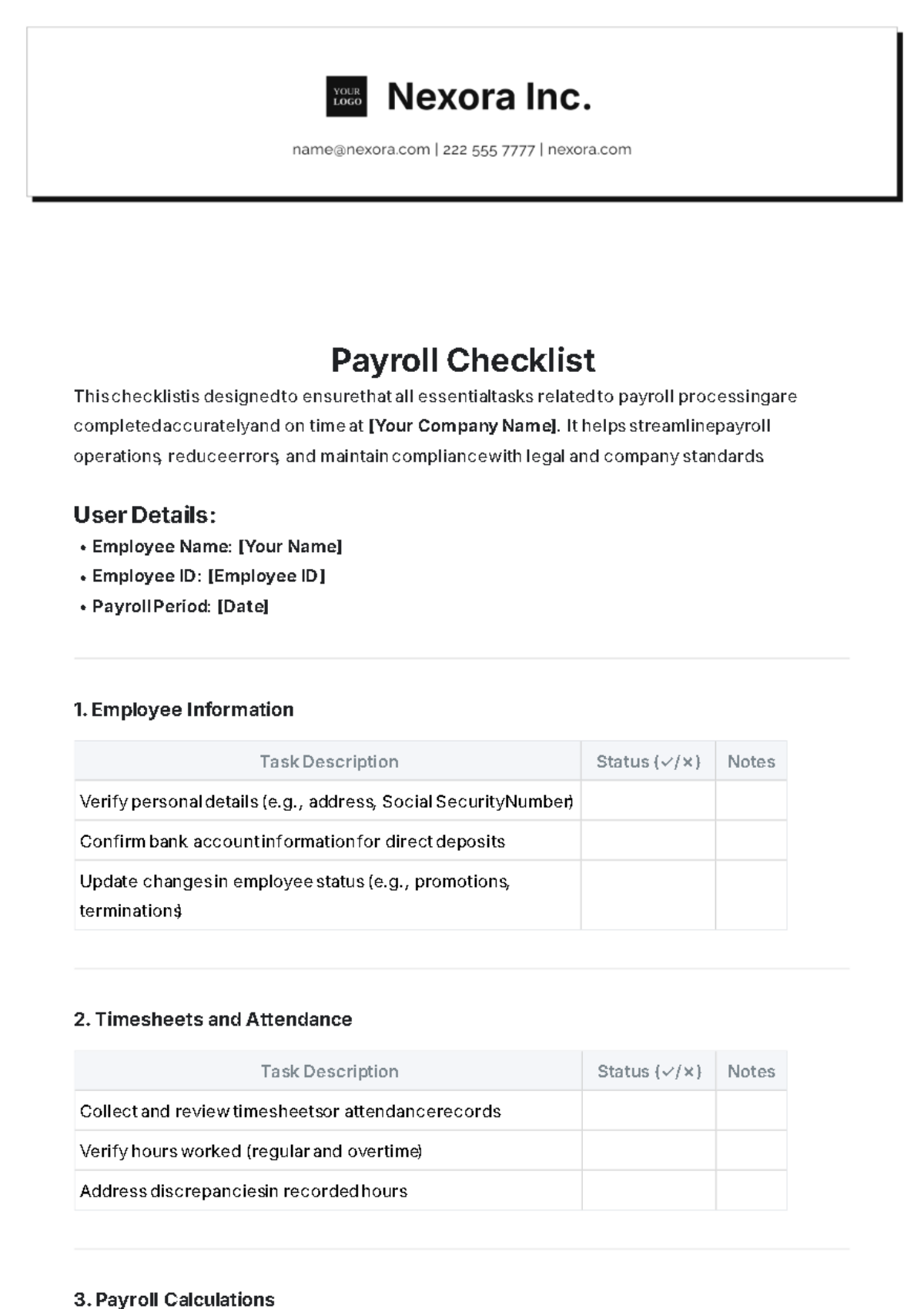

Payroll Checklist

This checklist is designed to ensure that all essential tasks related to payroll processing are completed accurately and on time at [Your Company Name]. It helps streamline payroll operations, reduce errors, and maintain compliance with legal and company standards.

User Details:

Employee Name: [Your Name]

Employee ID: [Employee ID]

Payroll Period: [Date]

1. Employee Information

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Verify personal details (e.g., address, Social Security Number) | ||

Confirm bank account information for direct deposits | ||

Update changes in employee status (e.g., promotions, terminations) |

2. Timesheets and Attendance

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Collect and review timesheets or attendance records | ||

Verify hours worked (regular and overtime) | ||

Address discrepancies in recorded hours |

3. Payroll Calculations

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Calculate gross pay (regular hours, overtime, bonuses) | ||

Deduct federal taxes | ||

Deduct state and local taxes | ||

Deduct other withholdings (e.g., health insurance premiums, retirement contributions) |

4. Benefits and Deductions

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Review and apply employee benefits (e.g., health insurance, retirement plans) | ||

Process voluntary deductions (e.g., charitable contributions) | ||

Update changes in benefits or deductions |

5. Payroll Processing

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Input payroll data into the payroll system | ||

Review payroll calculations for accuracy | ||

Approve payroll for processing |

6. Compliance and Reporting

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Ensure compliance with federal and state labor laws | ||

Prepare and submit required payroll reports (e.g., W-2s, 1099s) | ||

File tax forms with appropriate agencies |

7. Payments

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Distribute paychecks or initiate direct deposits | ||

Confirm all payments are processed correctly | ||

Address issues with payments |

8. Post-Payroll Tasks

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Archive payroll records securely | ||

Review and address any payroll issues or discrepancies | ||

Prepare for the next payroll cycle |

9. Audits and Reconciliation

Task Description | Status (✓/✗) | Notes |

|---|---|---|

Perform payroll reconciliation to ensure accuracy | ||

Conduct periodic audits to verify compliance and correctness | ||

Document and resolve any audit findings |