CPA Term Sheet

Date: August 30, 2060

Parties:

Client: John Enterprises

CPA Firm: [YOUR COMPANY NAME]

Contact Information:

Client: New York, NY 10001

Phone Number: 222 555 7777

Email: info@johnenterprises.com

CPA Firm: [YOUR COMPANY ADDRESS]

Phone Number: [YOUR COMPANY NUMBER]

Email: [YOUR COMPANY EMAIL]

1. Engagement Overview

The purpose of this Term Sheet is to outline the terms and conditions under which [YOUR COMPANY NAME] will provide accounting and auditing services to John Doe Enterprises. This engagement covers audit, tax preparation, and financial advisory services for the period commencing September 1, 2060, and concluding August 31, 2061.

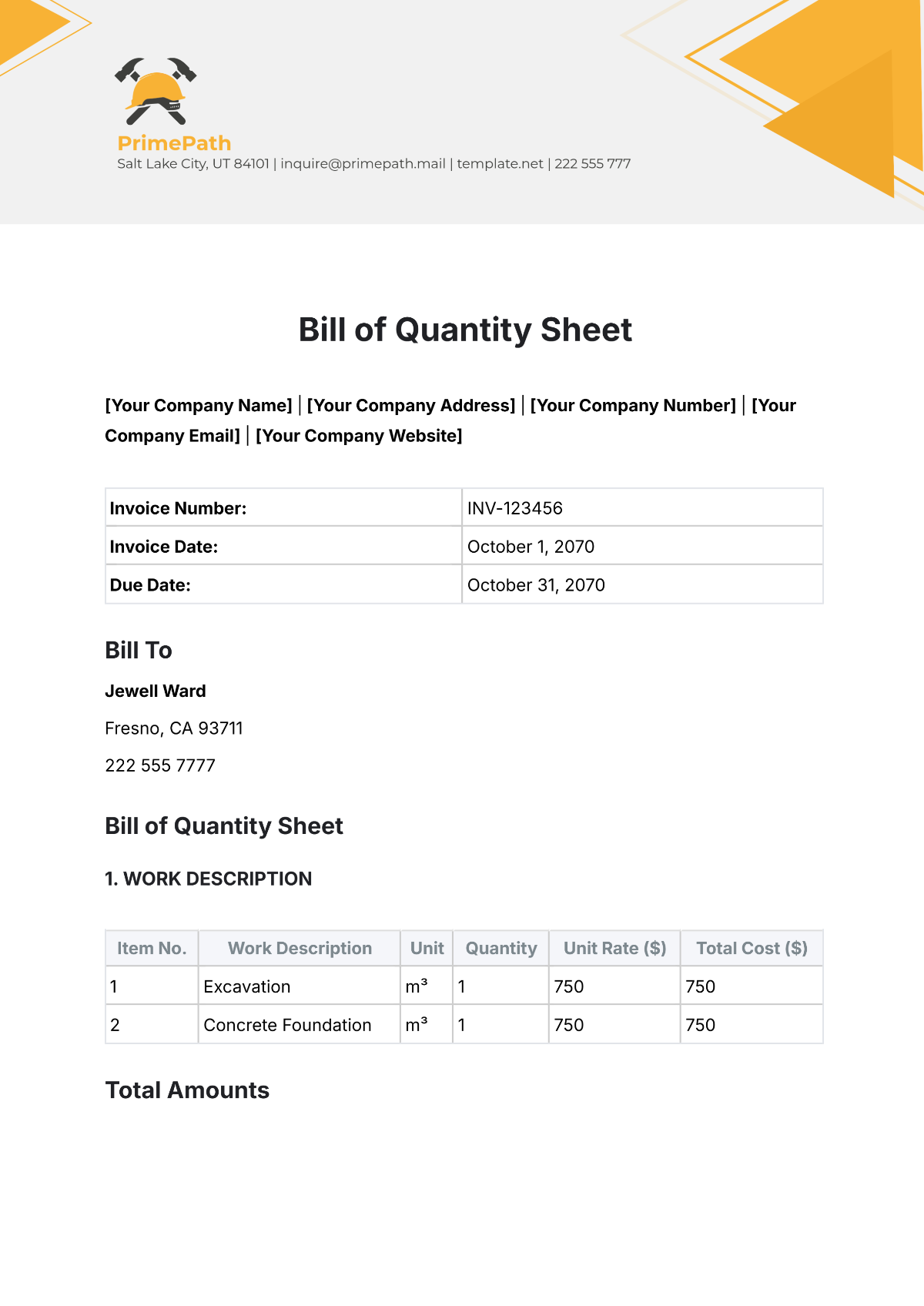

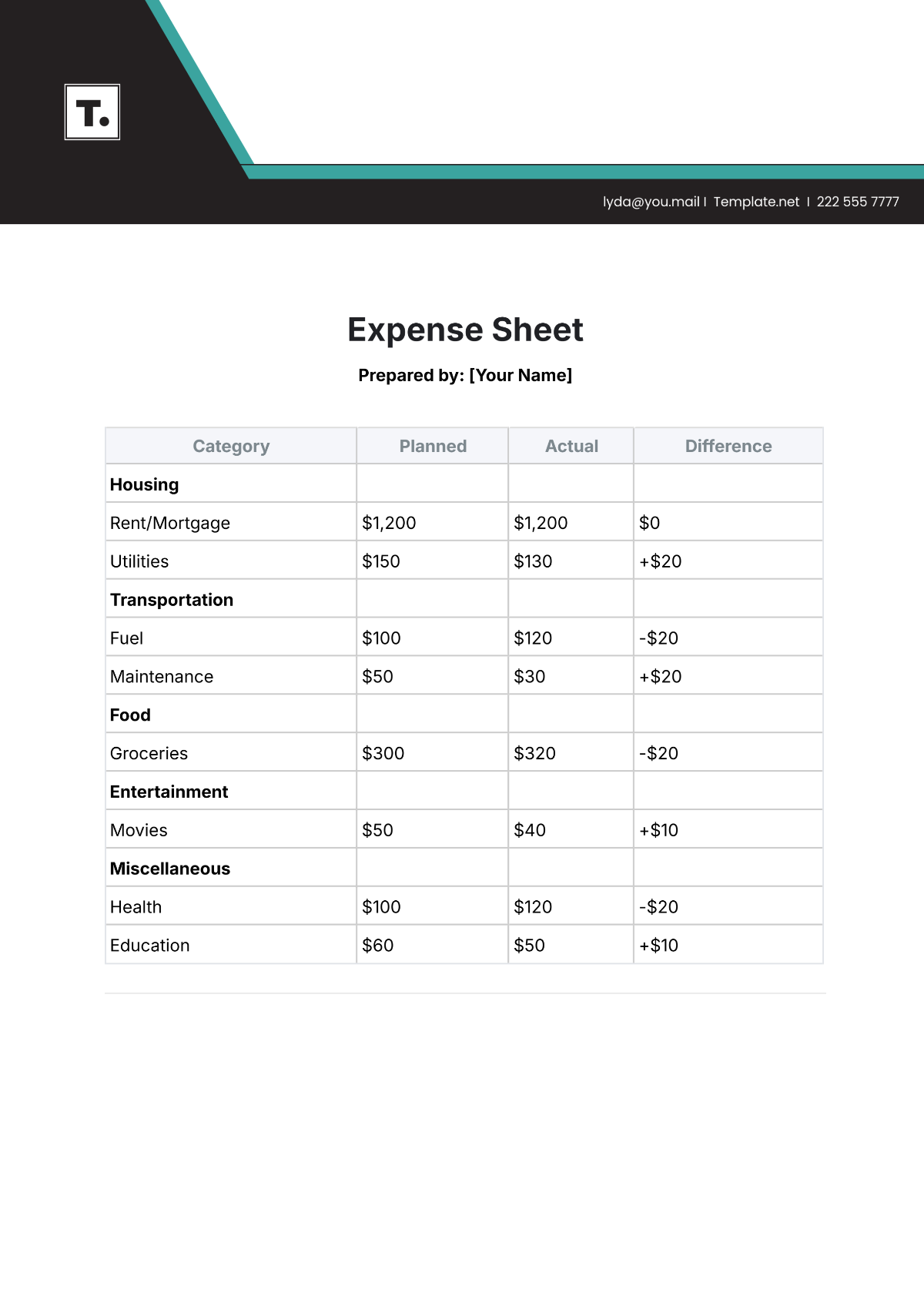

2. Scope of Services

The CPA Firm will provide the following services:

Audit Services: Examination of financial statements to provide an opinion on their fairness and adherence to generally accepted accounting principles (GAAP).

Tax Services: Preparation and filing of federal and state tax returns, tax planning, and advisory.

Consulting Services: Business strategy and financial planning advisory.

Other Services: Assistance with regulatory compliance and internal controls.

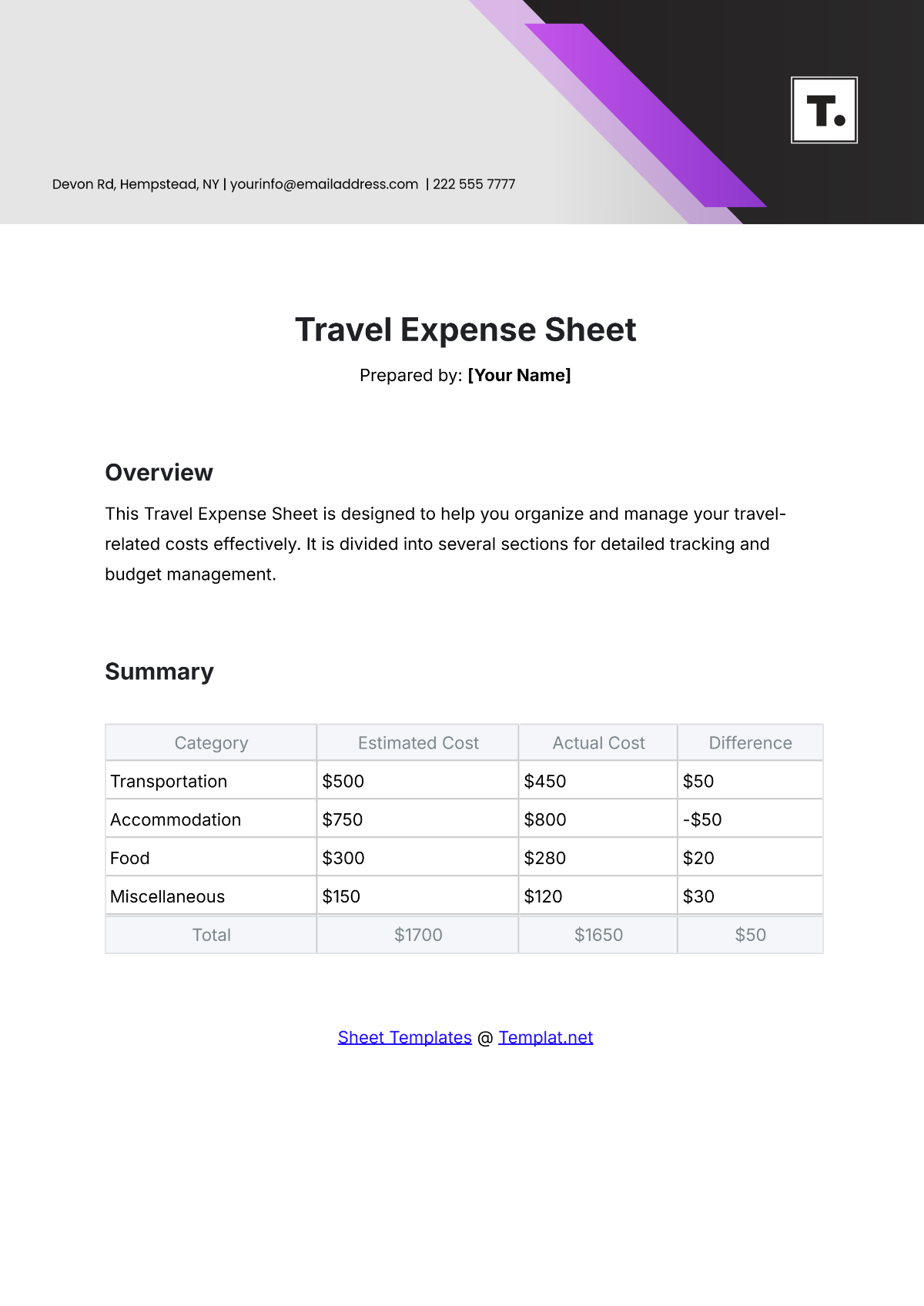

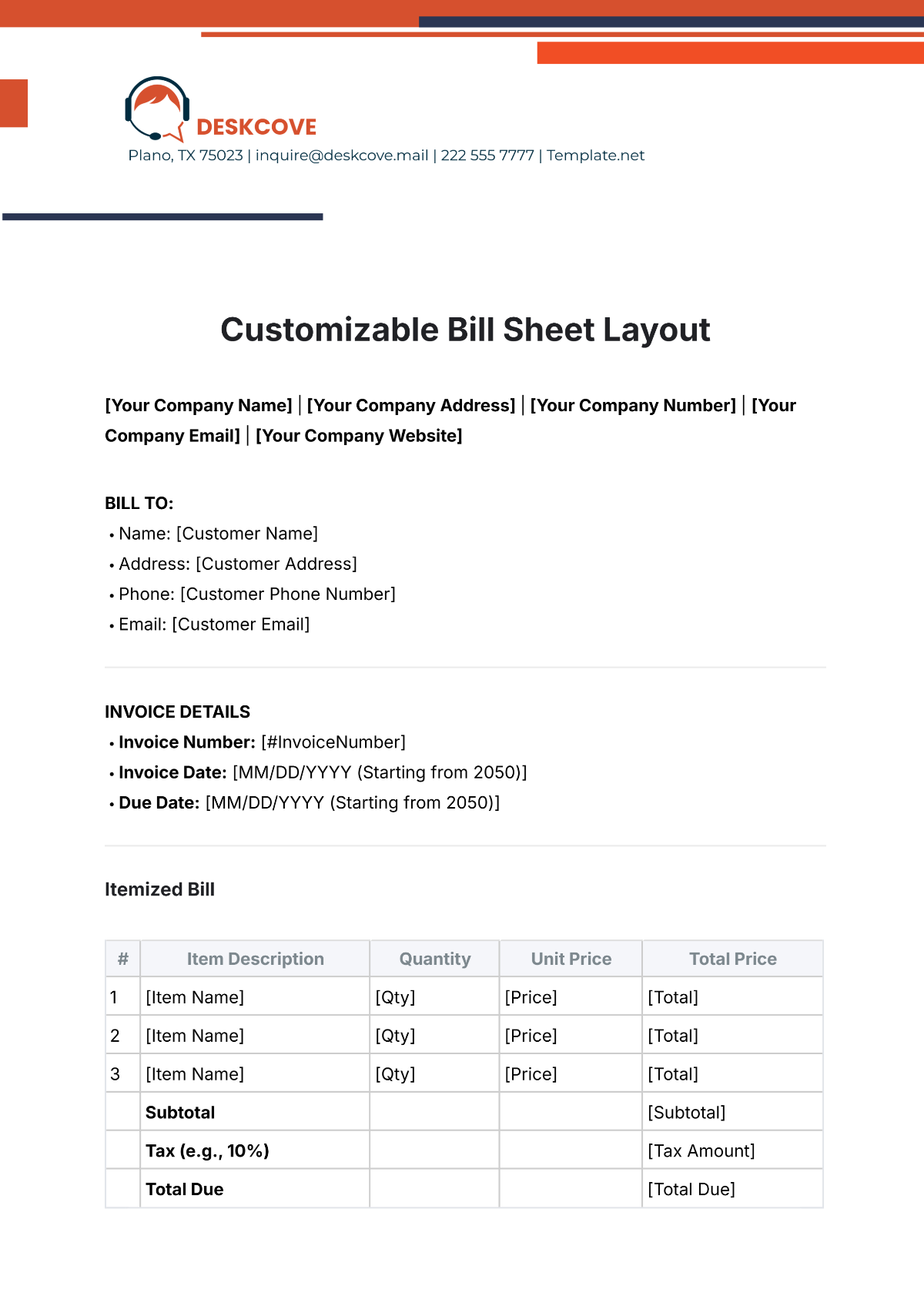

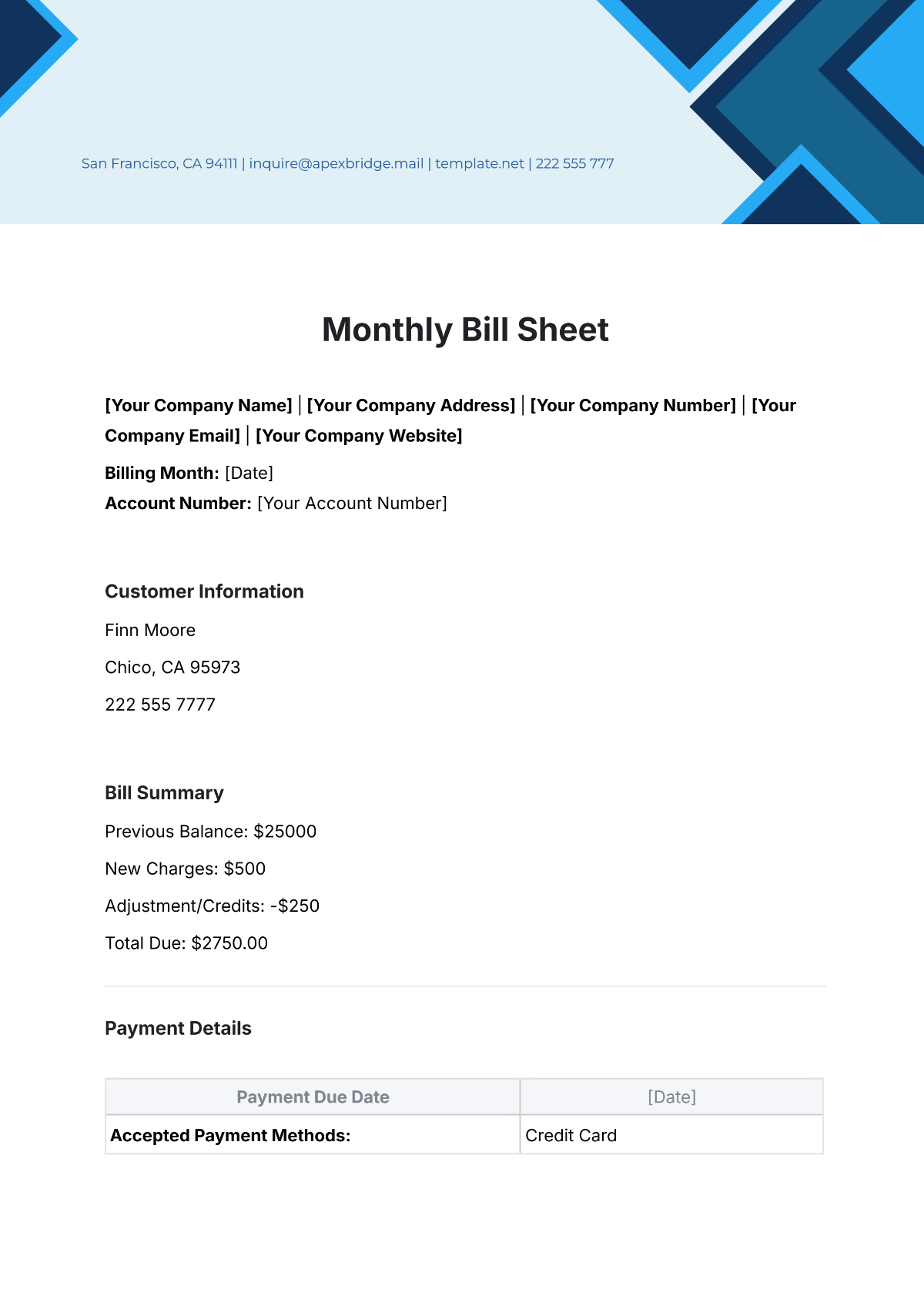

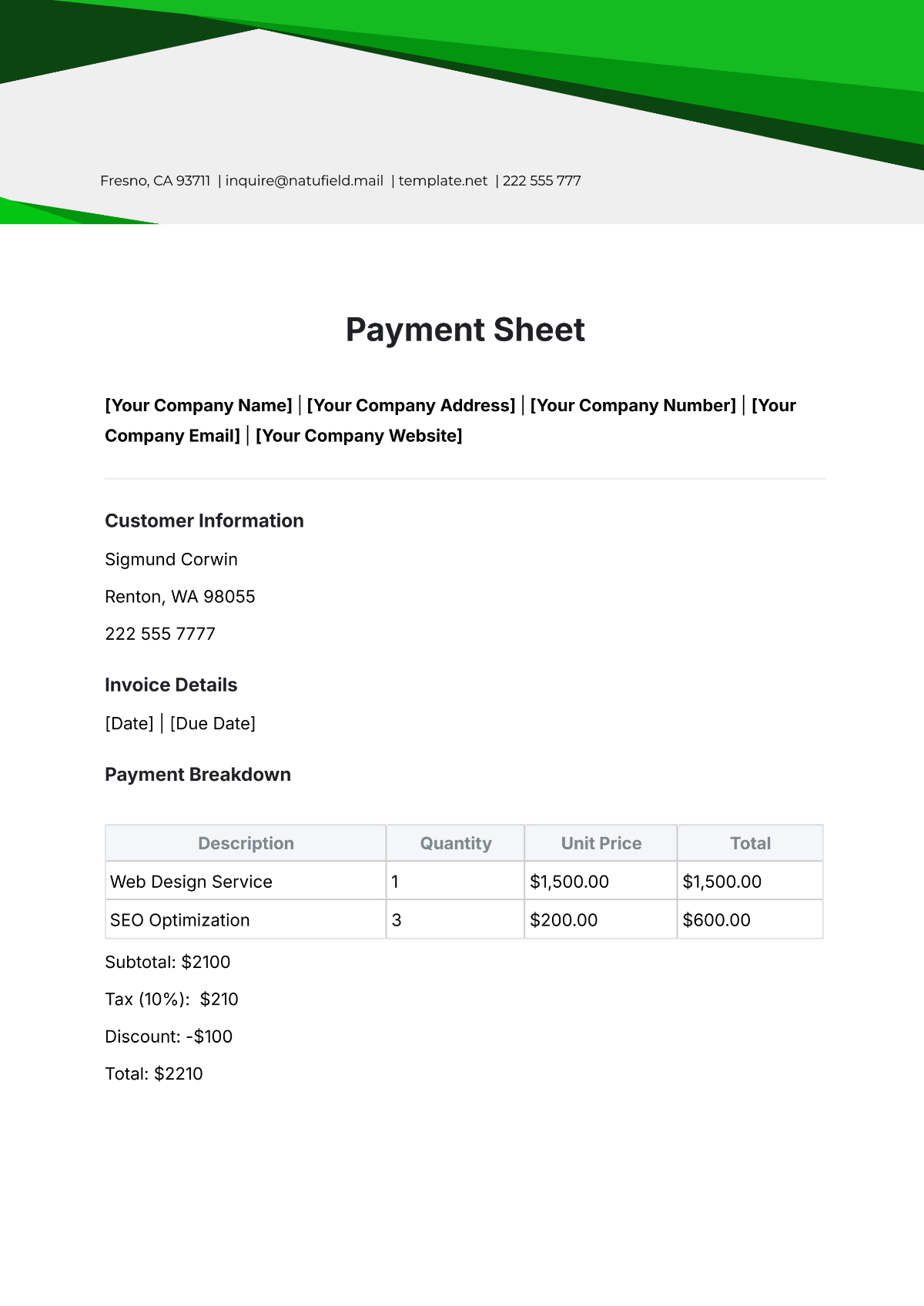

3. Fees and Payment Terms

Fee Structure: Fixed Fee

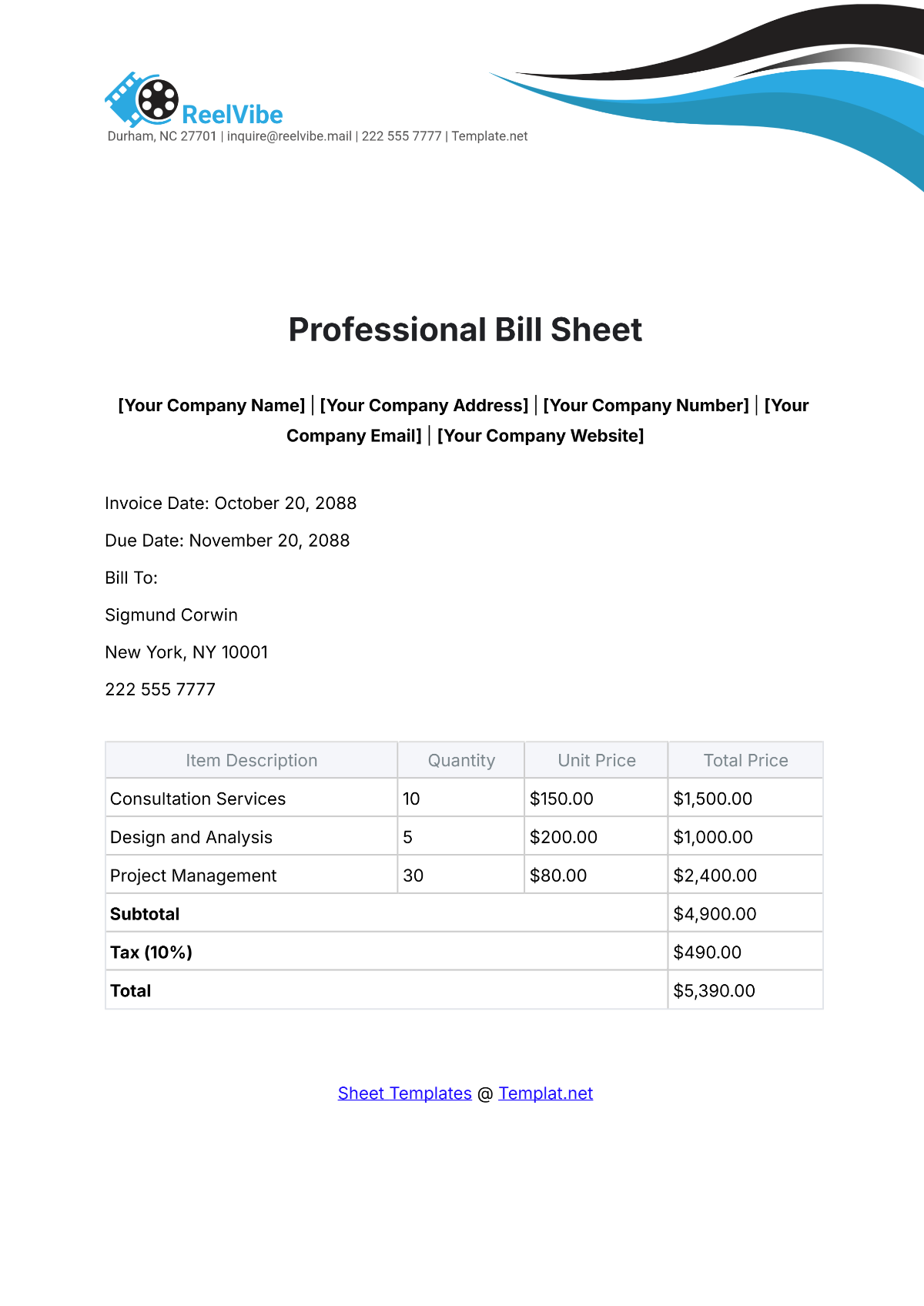

Estimated Fees: $50,000 for the full engagement period.

Payment Schedule: 25% upon signing the engagement letter, 25% at the midpoint of the engagement period, and 50% upon completion of services.

Additional Costs: Travel and out-of-pocket expenses will be billed separately with prior client approval.

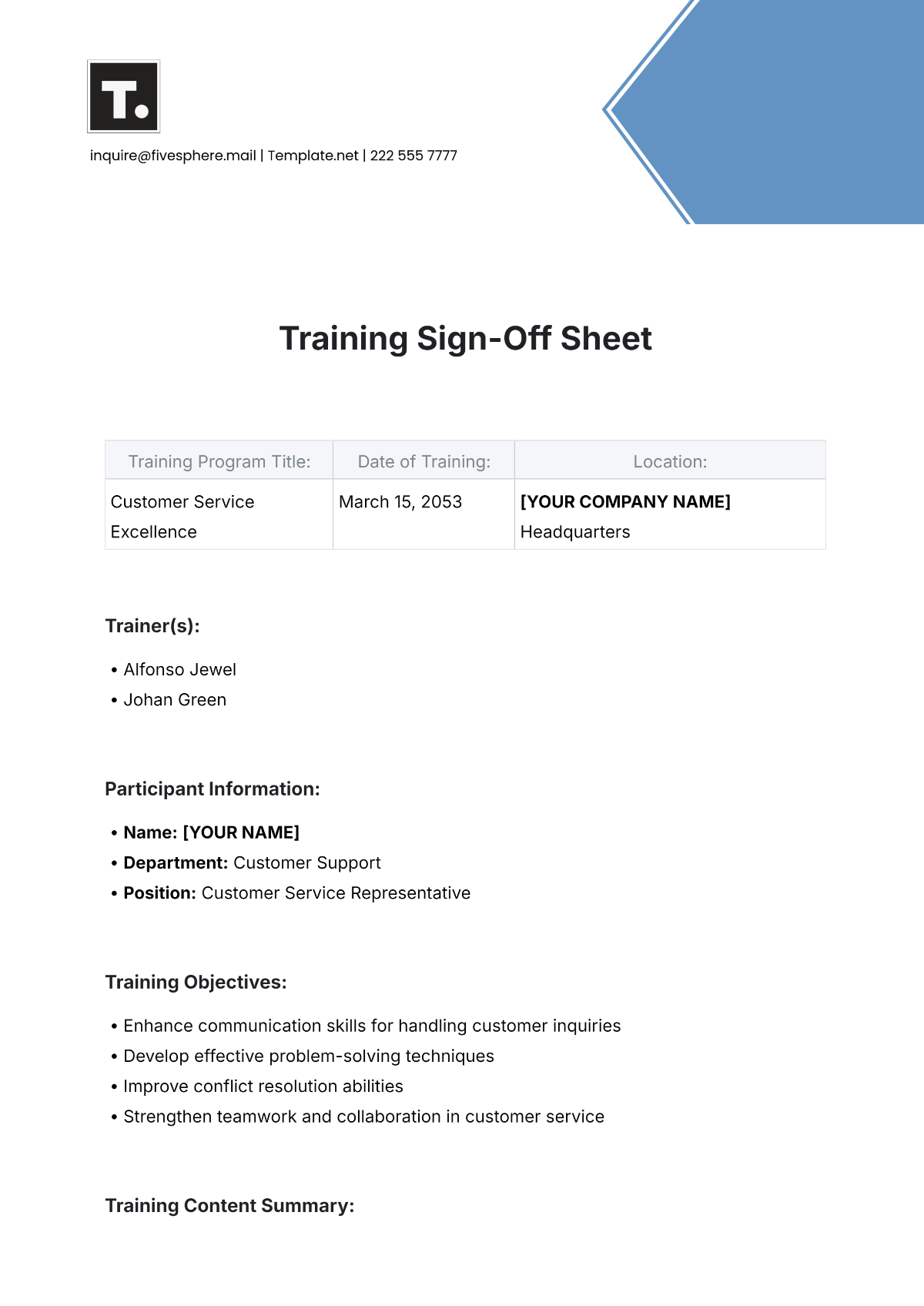

4. Responsibilities

Client Responsibilities:

Provision of accurate and complete financial records.

Timely submission of documents and information.

Cooperation with CPA Firm’s requests for additional information or clarification.

CPA Firm Responsibilities:

Performance of services in accordance with professional standards.

Timely delivery of reports and other deliverables.

Confidentiality of client information.

5. Term and Termination

Engagement Term: The term of this engagement will be from September 1, 2060, to August 31, 2061, unless terminated earlier by either party.

Termination: Either party may terminate this engagement with 30 days' written notice. In case of termination, the Client will be responsible for fees incurred up to the termination date.

6. Confidentiality

Both parties agree to maintain the confidentiality of all proprietary information and client data. The CPA Firm will not disclose any confidential information without the Client's prior written consent, except as required by law.

7. Dispute Resolution

Any disputes arising from this engagement will be resolved through arbitration in the state of California. Both parties agree to cooperate in good faith to resolve any disputes amicably.

8. Miscellaneous

Amendments: Any amendments to this Term Sheet must be made in writing and signed by both parties.

Governing Law: This Term Sheet will be governed by and construed in accordance with the laws of California.

Entire Agreement: This Term Sheet constitutes the entire agreement between the parties with respect to the subject matter and supersedes all prior agreements and understandings.

Signatures

For [YOUR COMPANY NAME]

Name: [YOUR NAME]

Title: Managing Partner

Date: August 30, 2060

For John Enterprises

Name: John Doe

Title: CEO

Date: August 30, 2060