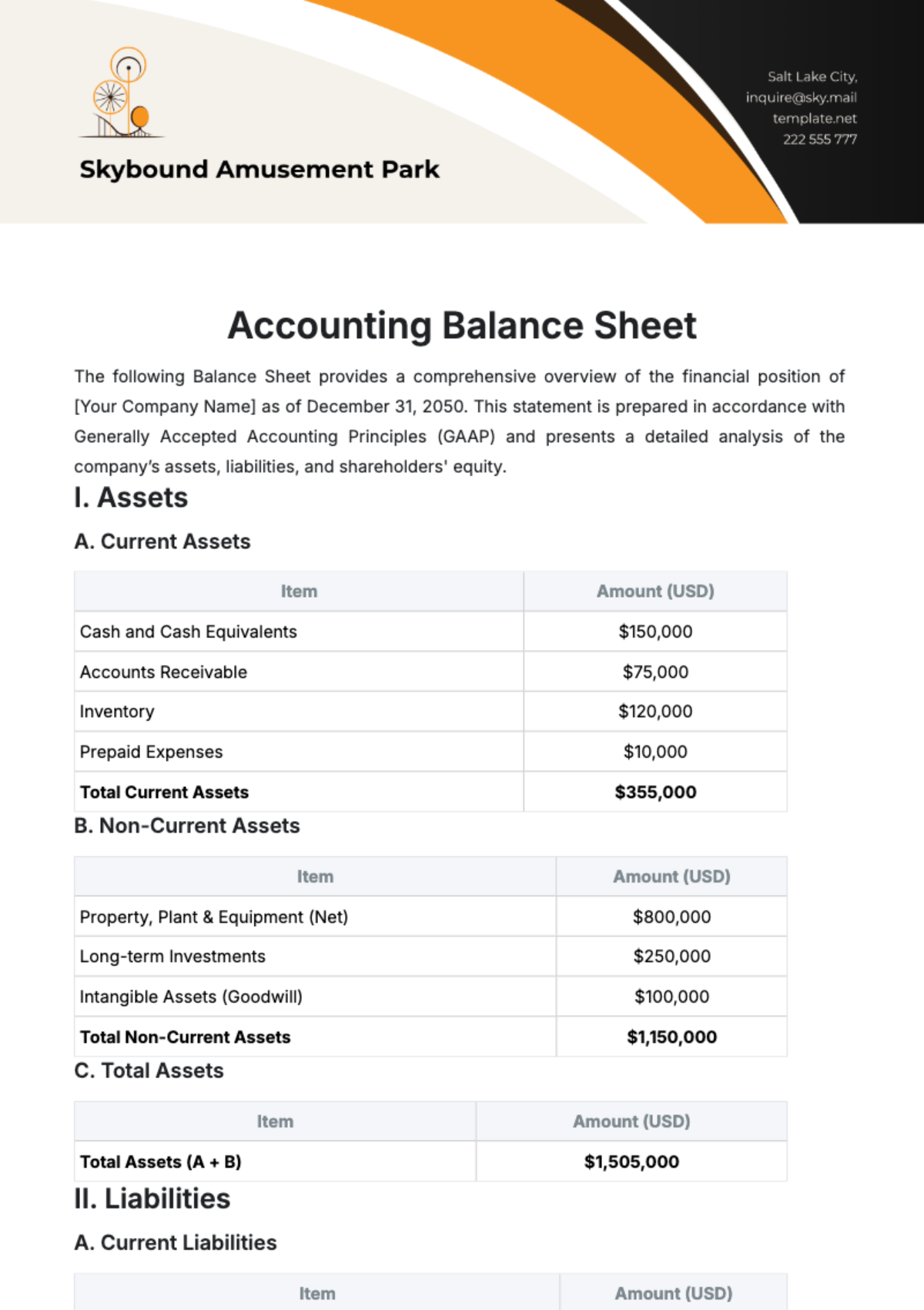

Accounting Balance Sheet

The following Balance Sheet provides a comprehensive overview of the financial position of [Your Company Name] as of December 31, 2050. This statement is prepared in accordance with Generally Accepted Accounting Principles (GAAP) and presents a detailed analysis of the company’s assets, liabilities, and shareholders' equity.

I. Assets

A. Current Assets

Item | Amount (USD) |

|---|---|

Cash and Cash Equivalents | $150,000 |

Accounts Receivable | $75,000 |

Inventory | $120,000 |

Prepaid Expenses | $10,000 |

Total Current Assets | $355,000 |

B. Non-Current Assets

Item | Amount (USD) |

|---|---|

Property, Plant & Equipment (Net) | $800,000 |

Long-term Investments | $250,000 |

Intangible Assets (Goodwill) | $100,000 |

Total Non-Current Assets | $1,150,000 |

C. Total Assets

Item | Amount (USD) |

|---|---|

Total Assets (A + B) | $1,505,000 |

II. Liabilities

A. Current Liabilities

Item | Amount (USD) |

|---|---|

Accounts Payable | $90,000 |

Short-term Loans | $50,000 |

Accrued Expenses | $15,000 |

Current Portion of Long-term Debt | $40,000 |

Total Current Liabilities | $195,000 |

B. Non-Current Liabilities

Item | Amount (USD) |

|---|---|

Long-term Debt | $300,000 |

Deferred Tax Liabilities | $25,000 |

Pension Liabilities | $35,000 |

Total Non-Current Liabilities | $360,000 |

C. Total Liabilities

Category | Amount (USD) |

|---|---|

Total Current Liabilities | $195,000 |

Total Non-Current Liabilities | $360,000 |

Total Liabilities | $555,000 |

III. Shareholders’ Equity

Item | Amount (USD) |

|---|---|

Common Stock | $200,000 |

Retained Earnings | $700,000 |

Additional Paid-in Capital | $50,000 |

Total Shareholders' Equity | $950,000 |

IV. Total Liabilities and Shareholders’ Equity

Category | Amount (USD) |

|---|---|

Total Liabilities | $555,000 |

Total Shareholders' Equity | $950,000 |

Total Liabilities & Equity | $1,505,000 |