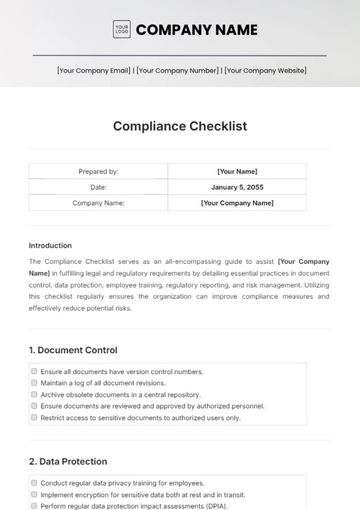

Free Bank Compliance Checklist

Date: September 25, 2050

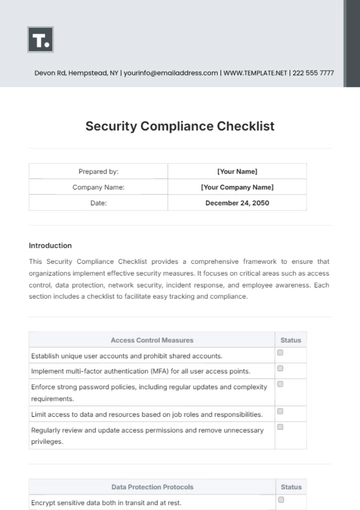

I. Regulatory Compliance

Licensing and Registration

Verify the bank's federal and state licenses.

Confirm that all licenses are current and renewed as required.

Anti-Money Laundering (AML)

Implement a robust AML program that includes:

Customer due diligence (CDD) policies.

Transaction monitoring systems.

Reporting of suspicious activities (SARs).

Conduct periodic training for employees on AML regulations and policies.

Know Your Customer (KYC)

Review KYC procedures for federal and state compliance.

Identification verification processes for new customers.

Ongoing monitoring of customer transactions.

II. Consumer Protection

Fair Lending

Ensure ECOA and FHA compliance.

Review lending policies to ensure non-discriminatory practices.

Conduct regular audits of loan files for compliance.

Truth in Lending Act (TILA)

Ensure TILA compliance for disclosures.

Ensure accurate APR and total cost disclosures on loan agreements.

Confirm that all promotional materials are clear and truthful.

Privacy Regulations

Review the bank's GLBA customer privacy policies.

Ensure customers are informed about their privacy rights.

Conduct regular assessments of data security measures.

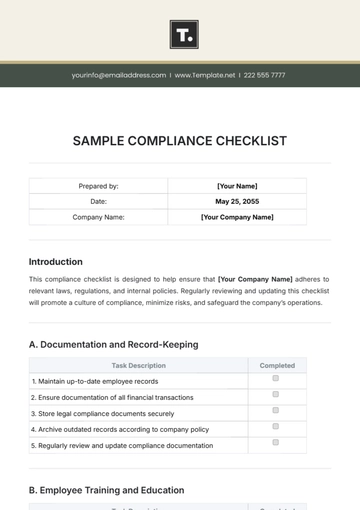

III. Operational Compliance

Internal Controls

Assess internal controls for fraud prevention and accurate reporting.

Regularly review and update internal policies and procedures.

Conduct independent audits to verify compliance with established controls.

Reporting Requirements

Confirm the bank meets all regulatory reporting requirements.

Submit Call Reports and CRA reports on time.

Review and verify the accuracy of reported data.

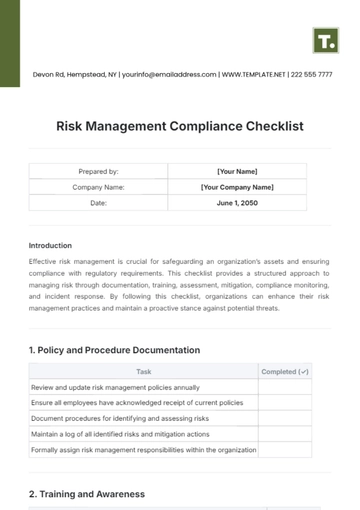

Risk Management

Assess the bank's risk management.

Identify potential risks in operations, lending, and investments.

Implement risk mitigation strategies and review effectiveness.

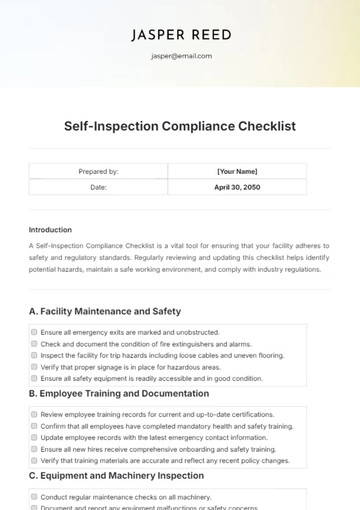

IV. Employee Training and Awareness

Compliance Training Programs

Provide regular compliance training for all employees.

Conduct training sessions on AML, KYC, and consumer protection laws.

Maintain records of training completion and effectiveness.

Whistleblower Policies

Review whistleblower policies to encourage reporting unethical behavior.

Ensure policies are communicated effectively to all employees.

Provide protection against retaliation for whistleblowers.

V. Signatory Section

This checklist has been prepared to ensure that [Your Company Name] adheres to all necessary compliance regulations.

[Your Name]

Company Secretary

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

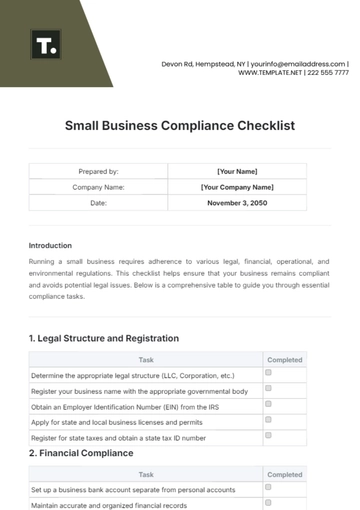

Streamline your banking operations with the Bank Compliance Checklist Template, offered by Template.net. This customizable, downloadable, and printable template is editable in our AI Editor Tool, enabling you to create a thorough checklist for compliance assessments. Ideal for financial institutions aiming to ensure adherence to regulations, mitigate risks, and maintain organized compliance documentation effectively.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

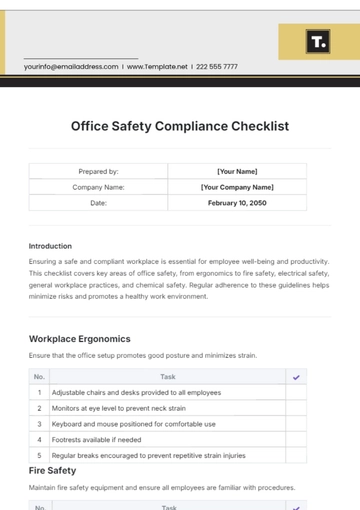

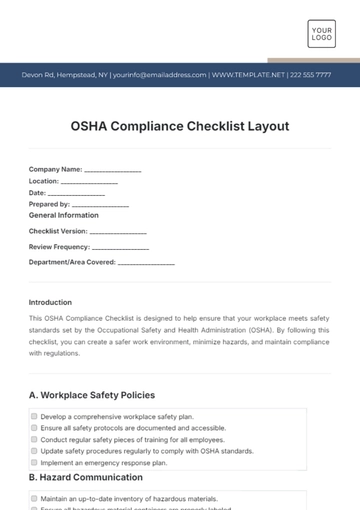

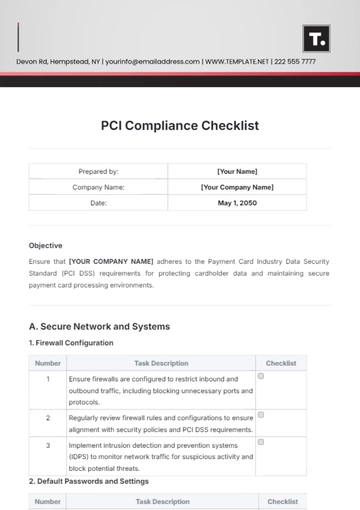

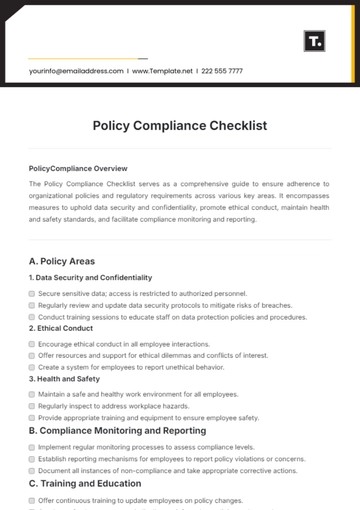

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

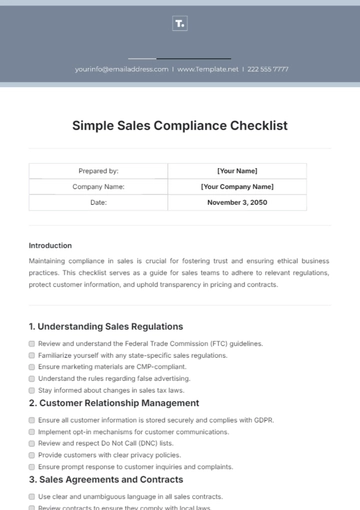

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

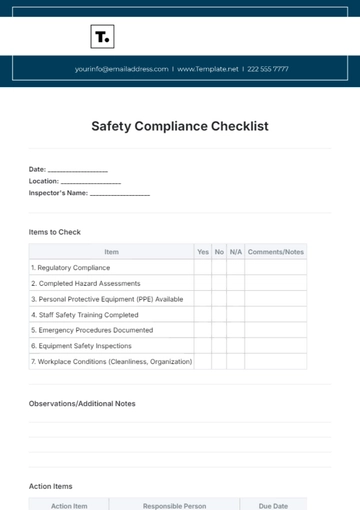

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

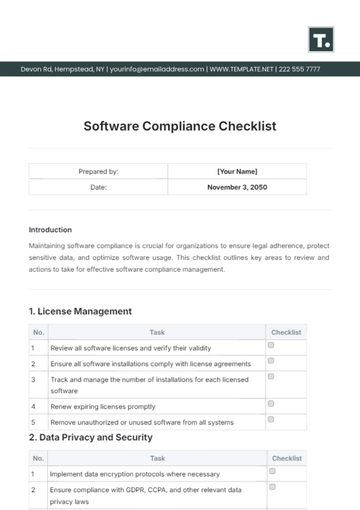

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

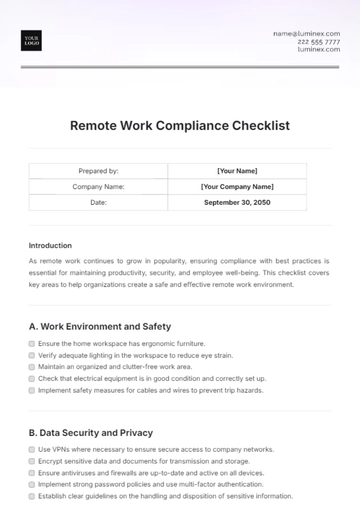

- Work From Home Checklist

- Student Checklist

- Application Checklist